Summary

LlamaRisk supports a provisional recommendation for Aave to deploy on Plasma pending a further analysis of the mainnet launch and the security features that will be implemented by the Plasma team.

At the time of writing, a testnet deployment is live with a mainnet launch scheduled later this month. While this testing phase has shown positive activity metrics, the full extent of the network is yet to be tested in an active market setting. This presents potentially technical, security, and market risks to AAVE that should be assessed post-deployment. Additionally, available documentation is largely theoretical and in practice only describes how the network is intended to work (or is still under development).

We will continue monitoring Plasma activity and provide revised asset recommendations as we move toward potential deployment.

1. Network Fundamental Characteristics

1.1 Network Overview

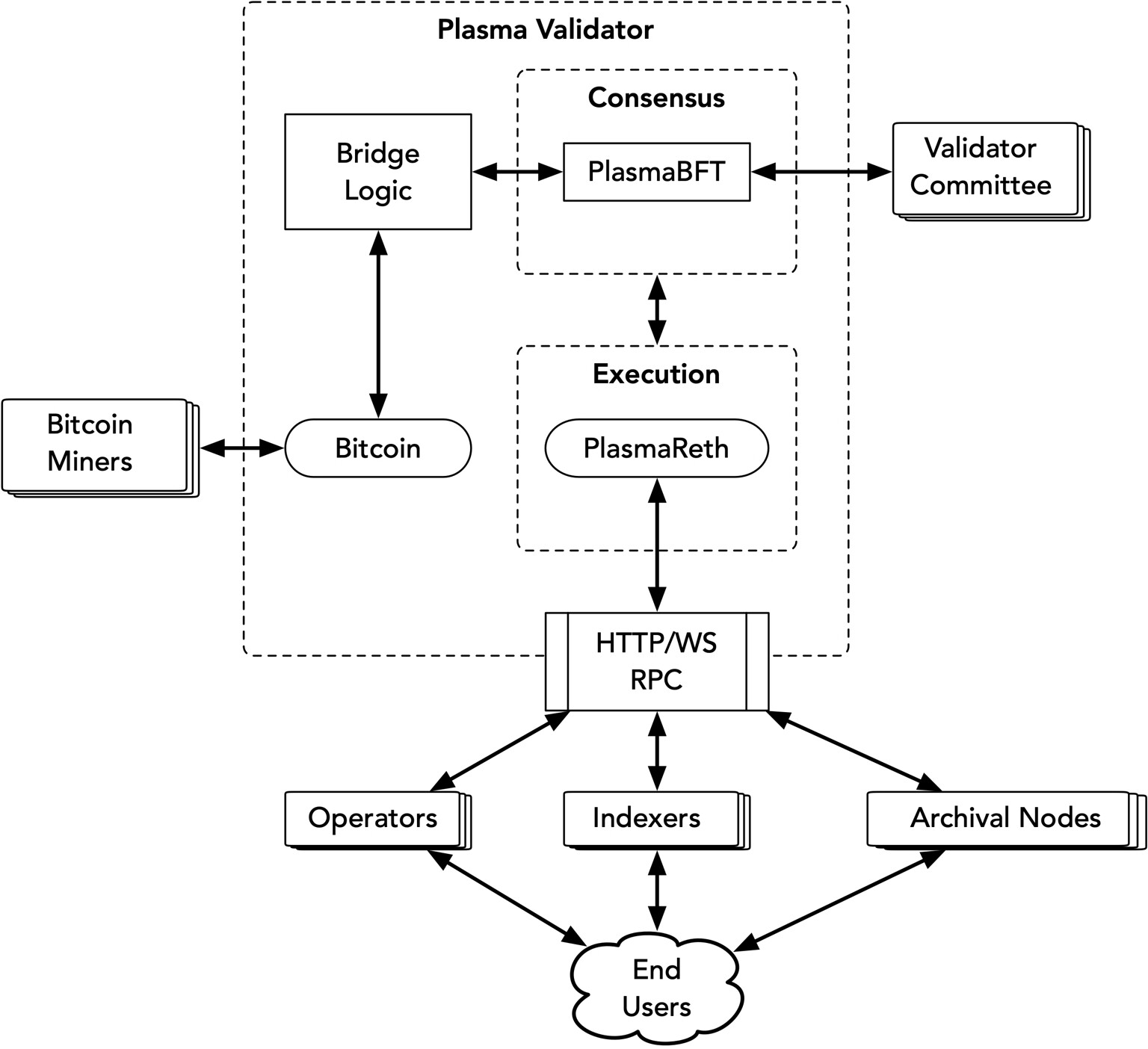

Source: Plasma architecture, Plasma documentation

Plasma is a novel, high-performance blockchain designed for stablecoin efficiency. It uses a custom consensus mechanism with Ethereum compatibility and settles to the Bitcoin network. At its core, it employs PlasmaBFT, a HotStuff-inspired consensus protocol optimized for rapid transaction finality and low latency.

This network’s execution layer is built on Reth, a Rust-based Ethereum Virtual Machine (EVM) node implementation. This enables full compatibility with Ethereum smart contracts. Plasma is a standalone Layer 1 blockchain that will be integrated with a trust-minimized Bitcoin Bridge, which will allow for the movement of BTC directly into Plasma without relying on centralized custodians. Plasma is billed towards facilitating fast and reliable stablecoin transfers, enabling zero-fee USD₮ transfers.

Network changes and updates are planned to be communicated with a 2-week window before changes take effect; however, emergency upgrades affecting liveness and security will be implemented immediately. The team informed us that the chain aims to follow a progressive decentralization model with governance details to be shared in the future.

XPL is intended to be the network’s native token, with a max supply of 10B. The token is intended to have transaction (gas), staking, and rewards utility on the network. Additional plans include a staked delegation mechanism for holders to delegate XPL to validators for a share of validation rewards.

Consensus Model

Plasma utilizes a Proof of Staking mechanism, with validators selected based on a stake-weighted random selection process. A small set of validators known as the Committee will initially secure the network at mainnet launch under the BFT consensus model, thereafter expanding.

Key features described that are related to validator operations:

-

Liveness failures are not penalized

-

Slashing will be levied on rewards rather than initial collateral

-

No-lock staking, with no withdrawal delay

PlasmaBFT pipelines consensus, meaning a new block can be proposed while a previous block is still being committed. In the event of a leader failing to confirm a block, aggregated Quorum Certificates are used. A new leader aggregates the most recent QCs from other validators to create the highest known block.

Execution Layer

Plasma does not introduce a new virtual machine design, custom language, or compatibility layer.

Both these components have only recently been implemented through the testnet launch. Change models, security measures (such as audits or formal verification), or bug bounties are not yet documented. No public repository containing Plasma code is available.

Audits

3 audits have been completed on Plasma infrastructure, 2 by Spearbit and 1 by Zellic. No published audits are available yet, with additional audits planned before the public mainnet launch. Critically, the paymaster contract (which sponsors gas-free verified USD₮ transfers only) has not been audited, but will form part of future audits

A preliminary audit was shared with LlamaRisk, with 25 issues ranging from critical risk to information-related related that were identified, all issues were either fixed or acknowledged

Bug Bounty

No bug bounty is active, but an audit competition on the node software with a >$1M reward budget is planned before the public mainnet launch.

It is difficult to evaluate what level of risk this new network will pose to Aave, given that it is untested and novel. EVM-equivalence will reduce deployment friction, but nuances in the network (e.g., OPCodes) may result in unintended effects for the DAO and its protocol. A testnet environment has been launched, with the private mainnet and mainnet beta launches slated for August and September, respectively.

1.2 Decentralization and Legal Evaluation

No information is available at this time as to the location or number of nodes, given that the network is not yet live. One node implementation is noted, and it is based on Reth.

Legal Evaluation

Key authoritative information on Plasma and the XPL token is set out in Plasma’s MiCA whitepaper, which is linked from the official Plasma documentation. This whitepaper is the project’s regulated disclosure under the EU Markets in Crypto-Assets Regulation for a crypto-asset that is neither an ART nor an EMT, and it provides the legally operative summary of the offer and the network.

The entity responsible for the issuance, offering, and sale of the XPL token is Plasma Inc., a BVI business company registered on 25 April 2025 (company no. 2175392). The whitepaper states the parent is “Plasma Foundation,” and identifies Chain Technologies Research, an exempted company in the Cayman Islands, as the legal person involved in implementation. Disputes relating to XPL are governed by BVI law with exclusive jurisdiction in the BVI courts. The whitepaper also indicates a MiCA home Member State of Malta and a list of EU/EEA host Member States for passporting.

XPL has no protocol-level transfer restrictions and is designed to function as a standard, fully transferable on-chain token on the Plasma network. The whitepaper also cautions that off-chain intermediaries—centralized exchanges and other EU-regulated crypto-asset service providers—may overlay their own limits, for example, geo-blocking, min/max thresholds, KYC/AML requirements, whitelisting, and temporary administrative holds.

XPL bought by U.S. participants is subject to a 12-month lock-up from the close of the public sale, during which those tokens “cannot be transferred or traded,” expressly to address U.S. securities law risk. That is reiterated in Plasma’s own investor communications, which state that any U.S. offer relies on exemptions and is “subject to restrictions on transferability and resale.”

For the XPL sale, KYC and jurisdictional screening are done through Sonar by Echo. Echo documents that its stack uses Sumsub for KYC, and Sumsub’s documentation explains that AML screening covers sanctions, PEPs, and adverse media with ongoing monitoring. There is no public documentation from Plasma that speaks to travel-rule coverage for token transfers post-listing or to any ongoing wallet or transactional monitoring on-chain beyond Sonar’s “wallet association and transaction history checks” at sale time.

On financial capacity, the whitepaper says the entity is newly incorporated but “well-funded,” reporting approximately USD 24,000,000 in liquid assets, an estimated USD 500,000 for offer expenses, and ongoing operating costs “approximately USD 25,000 per month,” together implying more than 24 months of runway. It also attributes USD 24 million raised across Seed and Series A to rounds led by Framework Ventures and Bitfinex/USD₮0, and notes an additional strategic investment by Founders Fund.

Validators

The whitepaper projects, for sustainability reporting purposes, an eventual validator set in the range of roughly 150–300 validators in year one, with the estimate used to model energy consumption. The same section also sets minimum consensus hardware as “2 CPU cores, 4 GB RAM, SSD” for “basic validator operations,” which is a low bar by industry standards but only indicative at this stage. Plasma describes a staged decentralization: during testnet, all consensus nodes are run by Plasma; after mainnet launch, “a small group of external validators will join,” selected for reliability, operational readiness, and geographic distribution; over time, validator access opens permissionlessly.

Slashing

The whitepaper has internal inconsistencies on slashing. Part G.2 says “no-slashing policy” for downtime, while the sustainability section J.04–J.05 states that malicious behavior or extended downtime results in slashing. The technology section H.5 also says “validators earn … without slashing penalties.”

The analysis captures the current state of the network, with uncertainty remaining about the slashing implementation.

1.3 Activity Benchmarks

A public testnet was announced on July 15, 2025, enabling contract and network infrastructure testing in preparation for the mainnet beta launch.

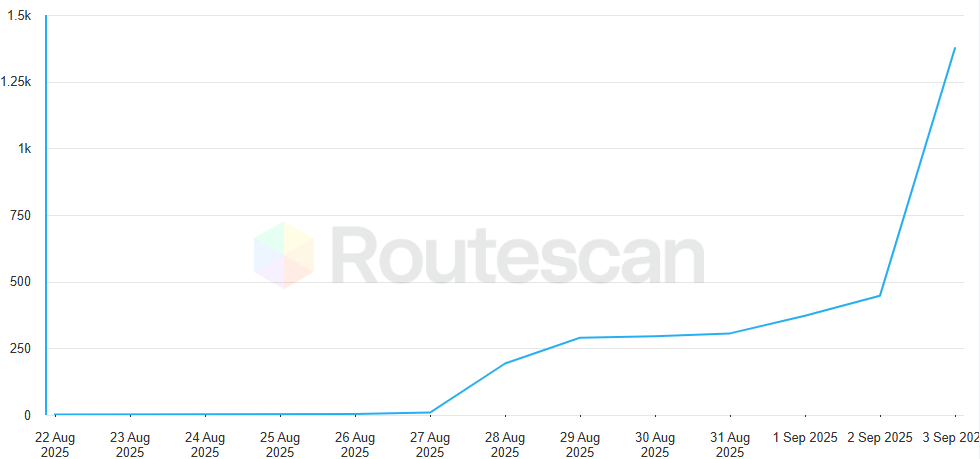

Source: Cumulative transactions, Plasmascan, September 3rd, 2025

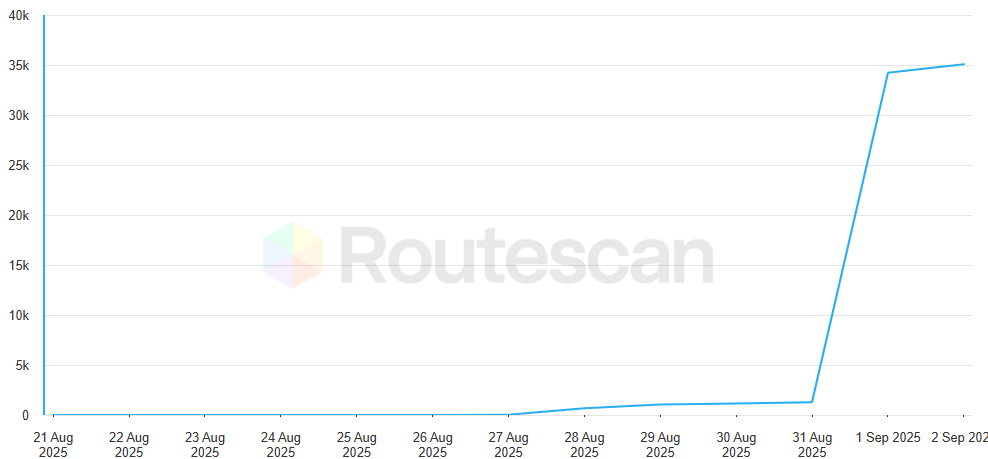

Source: Cumulative contracts, Plasmascan, September 3rd, 2025

Cumulative transactions and contracts have grown significantly since the testnet’s recent launch.

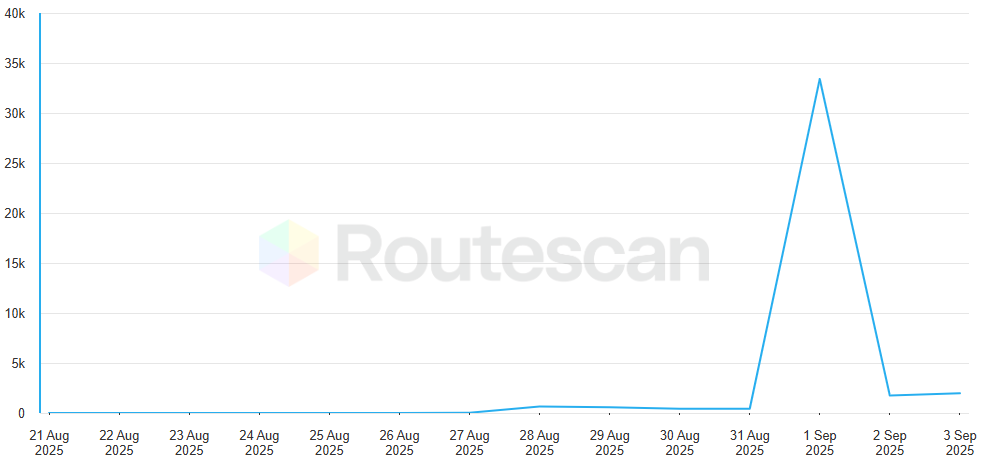

Source: Unique addresses, Plasmascan, September 3rd, 2025

Source: Active addresses, Plasmascan, September 3rd, 2025Early signs indicate that there is a strong interest in users engaging with the chain, as shown by unique addresses; however, a drop off can be seen in active addresses from September 1st.

It should be noted that the testnet environment is not an exact representation of what the mainnet activity will look like, and therefore serves as an early indicator of the network’s performance and interest.

2. Network Market Outlook

2.1 Market Infrastructure

With no mainnet network to evaluate, LlamaRisk cannot evaluate this network’s actual market infrastructure. Protocols that have committed to launch on Plasma mainnet include:

Lending: Aave, Fluid, Term Finance

DEXs: Uniswap, Curve, Fluid

Yield: Ethena, Pendle, Usual, Etherfi, Centrifuge, Daylight, Axis, Usd.AI

The Plasma team indicated that this is not an exhaustive list.

The testnet release includes:

-

A protocol-managed paymaster that facilitates zero-fee transfers of USDT (allows verified users to send USD₮ without holding XPL)

-

Enabling the use of whitelisted ERC-20 tokens as a custom gas token

-

A native BTC bridge using an MPC-based design

Plasma note that these details and others to be implemented are subject to change for performance, security, or compatibility reasons.

A total of 20 unique toolings are currently integrated or in development on the Plasma testnet:

Account Abstraction (e.g., wallets and bundlers): Gelato Relay, Protofire Safe, Thirdweb, Privy, and Turnkey

Analytics: Dune

Block Explorers: Routescan, Gas.zip, and Arkham

Cross-Chain: Debridge, Hyperlane, Jumper, LayerZero, Relay, and Stargate

Testnet Faucets: Gas.zip and Quicknode

Indexers: Goldsky, Arkham, Quicknode, thirdweb, and Zerion

Oracles: Chainlink, Blocksense

RPC Providers: Tenderly, thirdweb, and QuickNode

It is expected that these toolings will also be deployed on the mainnet.

2.2 Liquidity Landscape

The following liquidity venues and pairs are planned for the mainnet launch:

| Protocol | Pairs |

|---|---|

| Uniswap V3 | USDT0/XPL, eETH/XPL, XAUT0/XPL, ETH/XPL |

| Fluid | USDE/USDT, USDai/USDT, USDR/USDT, AXIS.USDT, FraxUSD/USDT, GHO/USDT, USDO/USDT, Resolv/USDT |

| Curve | USDE/USDT, USDai/USDT, USDR/USDT, AXIS.USDT, FraxUSD/USDT, GHO/USDT, USDO/USD, Resolv/USDT |

2.3 Ecosystem Resilience

The introduction of the testnet also initiated ecosystem development efforts with Plasma, encouraging builders in areas such as wallets, payment apps, and remittance tools to join their Discord channel.

This strategy aims to create a developer-focused space for support, feedback, and integration into the network. This ecosystem growth strategy is currently relatively informal and is likely to become more formalized in the future with the mainnet launch. A developer’s guide is also available in their docs.

2.4 Major and Native Asset Outlook

Plasma will focus on two assets: USDT0 and BTC. This is highly encouraging for Aave: USDT0 is already onboarded to Aave (see LlamaRisk’s report on the topic) and is a major driver of revenue on Core. Clarity on the specific Bitcoin wrapper to be used is needed, but this is an asset class that is already widely used on Aave.

Pending details, these two major asset types should pose no incremental risk.

Source: XPL Allocation, Plasma DocsXPL is the network’s native token, facilitating transactions, staking, and rewards for validators. Outside of these functions, no additional use cases have been indicated. Distribution for XPL is split: 25% investors, 25% team, 40% ecosystem and growth, and 10% to the public sale.

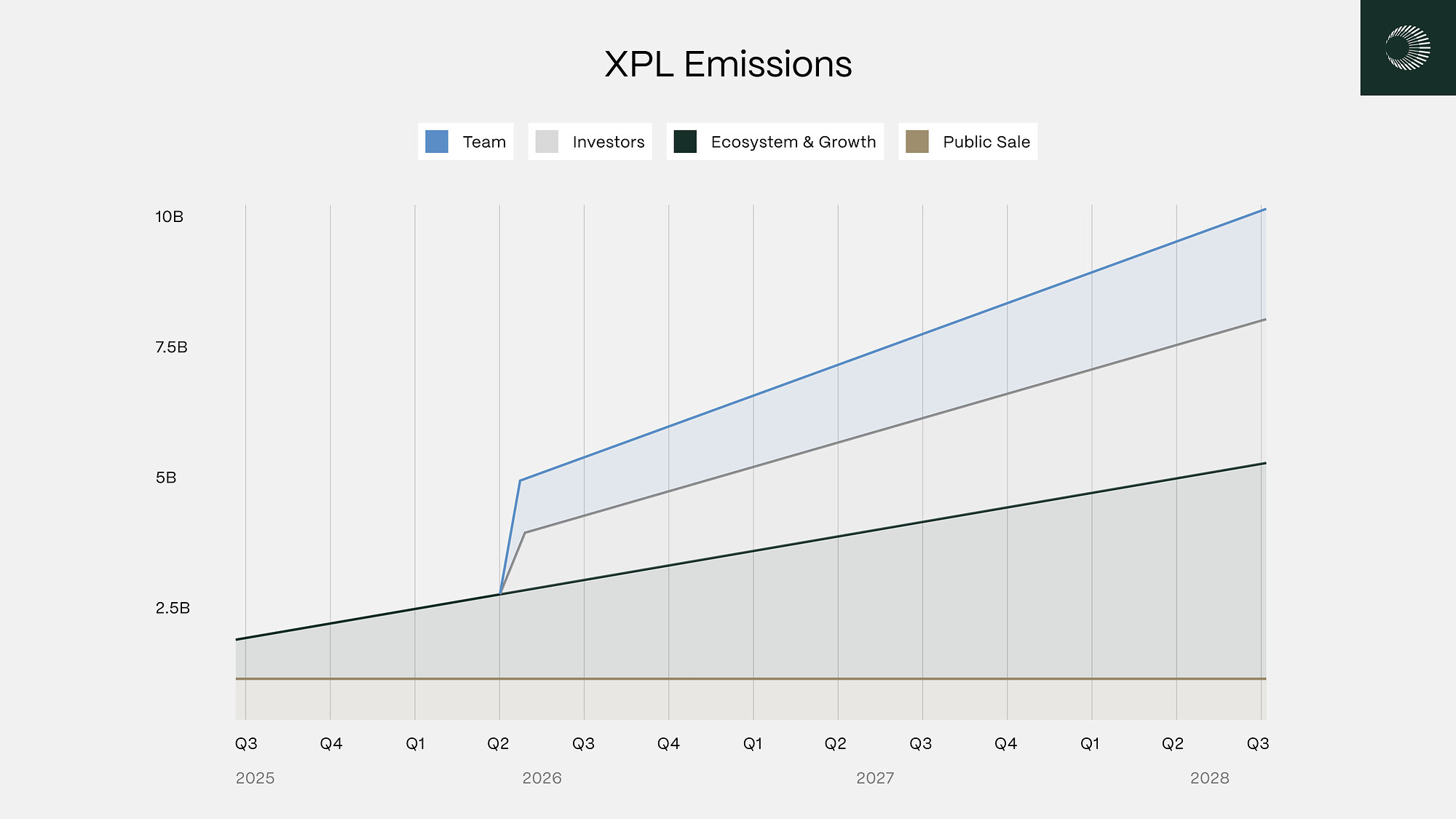

Source: XPL Emissions, Plasma DocsThe planned unlock schedule for XPL that is not immediately made available at mainnet launch includes:

-

XPL, purchased by US investors, is subject to a 12-month lockup

-

80% ecosystem and growth allocation (32% of the 40%) unlocks monthly over 3 years

-

⅓ of the team and investor allocations are subject to a 1-year cliff, and the remaining ⅔ unlock monthly over 2 years

Should XPL have additional future governance utility, then the planned allocation would give the team and investors an initial 50% control over the network, which presents significant centralization risk. Network changes could be enacted almost unilaterally.

3. Onchain discoverability

As mentioned in section 2.1, 3 block explorers are currently supported for testnet: Routescan, Gas.zip, and Arkham.

4. Impact of AAVE Deployment

It is not yet possible to gauge the impact of Aave’s deployment to Plasma as the network has only recently launched a testnet. This presents a level of risk uncertainty, as the exact mainnet launch is under development.

5. Asset suggestions

LlamaRisk is favourable to recommending WETH, XAUT, USDT0, sUSDe, USDe, GHO, weETH, and XPL as the initial assets to onboard. These assets will provide the basic functionality of the new instance, with additional assets expanding use cases on the chain. To date, WETH, XAUT, USDT0, sUSDe, USDe, GHO, and weETH have been reviewed to some extent and frequency, while the native token XPL will need to be reviewed once the mainnet contracts have been deployed. Given the tokens’ inherent importance to network operations, a deployment of a Plasma instance is in part an endorsement of the asset to AAVE. Therefore, to provide sufficiently optimized parameters, we recommend a separate risk assessment with live conditions.

Aave V3 Specific Parameters

Will be presented jointly with @ChaosLabs.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.