Summary

This document provides an initial risk assessment and recommendation for deploying Aave on Plasma. Our analysis aims to explore key technical aspects of Plasma that are relevant to Aave’s security, efficiency, and overall ecosystem viability, as well as outline assets for initial listing and corresponding E-Modes.

Plasma Overview

Plasma is a high-performance EVM Layer 1 blockchain. Its stated purpose is to facilitate global stablecoin payments coupled with deep liquidity, which is supported by zero-fee USD₮ transfers and a native BTC bridge.

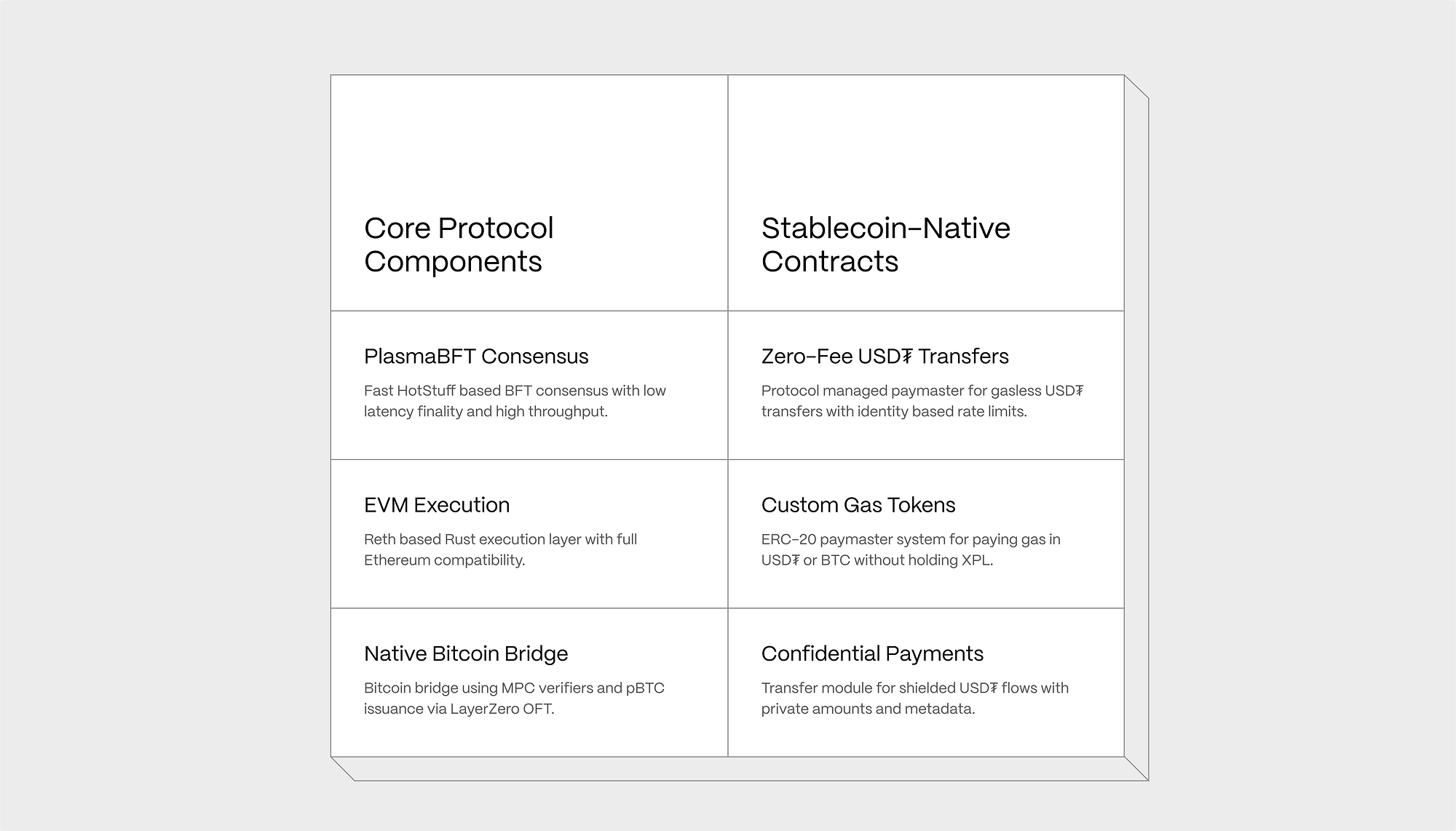

Technical Architecture

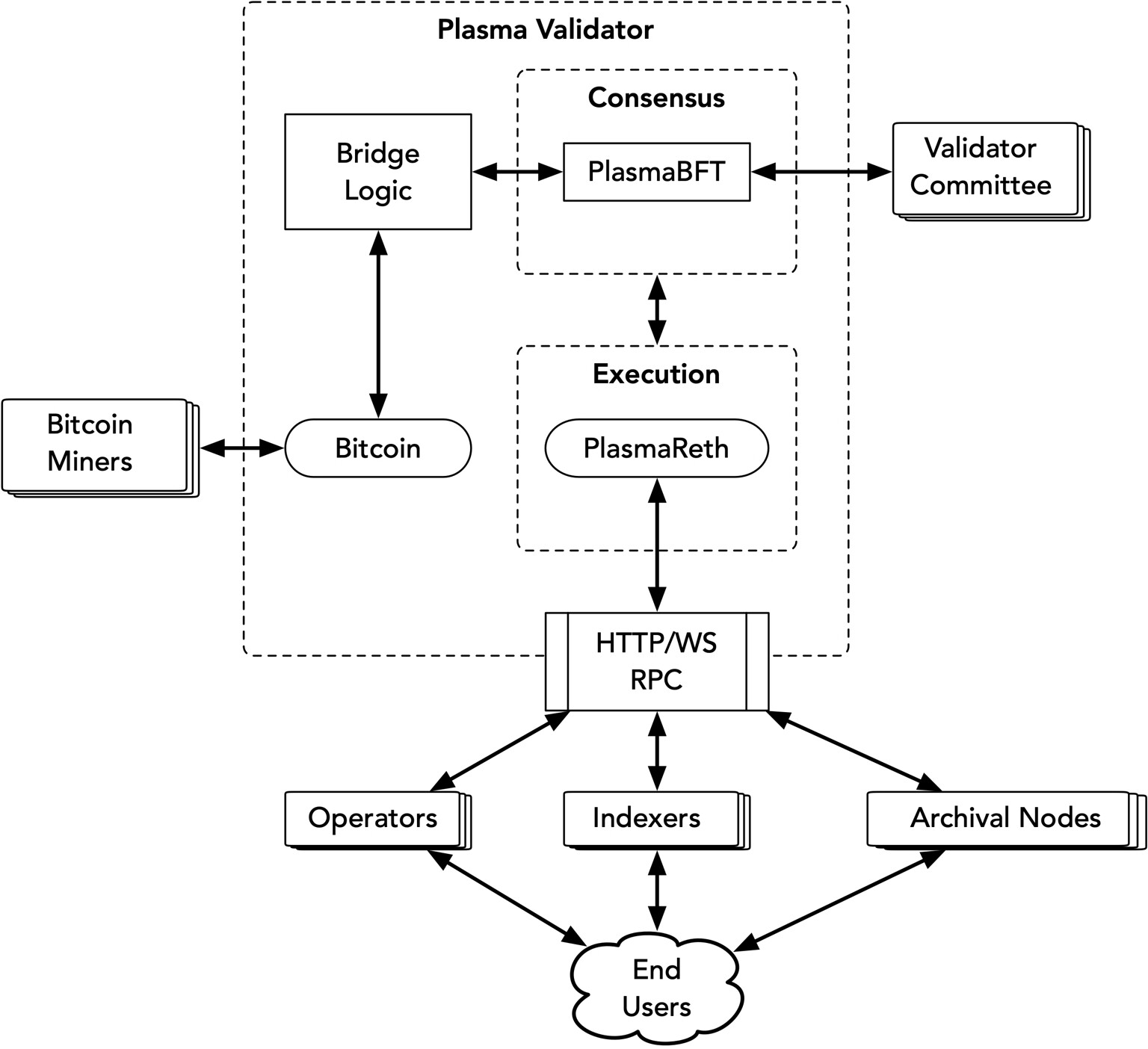

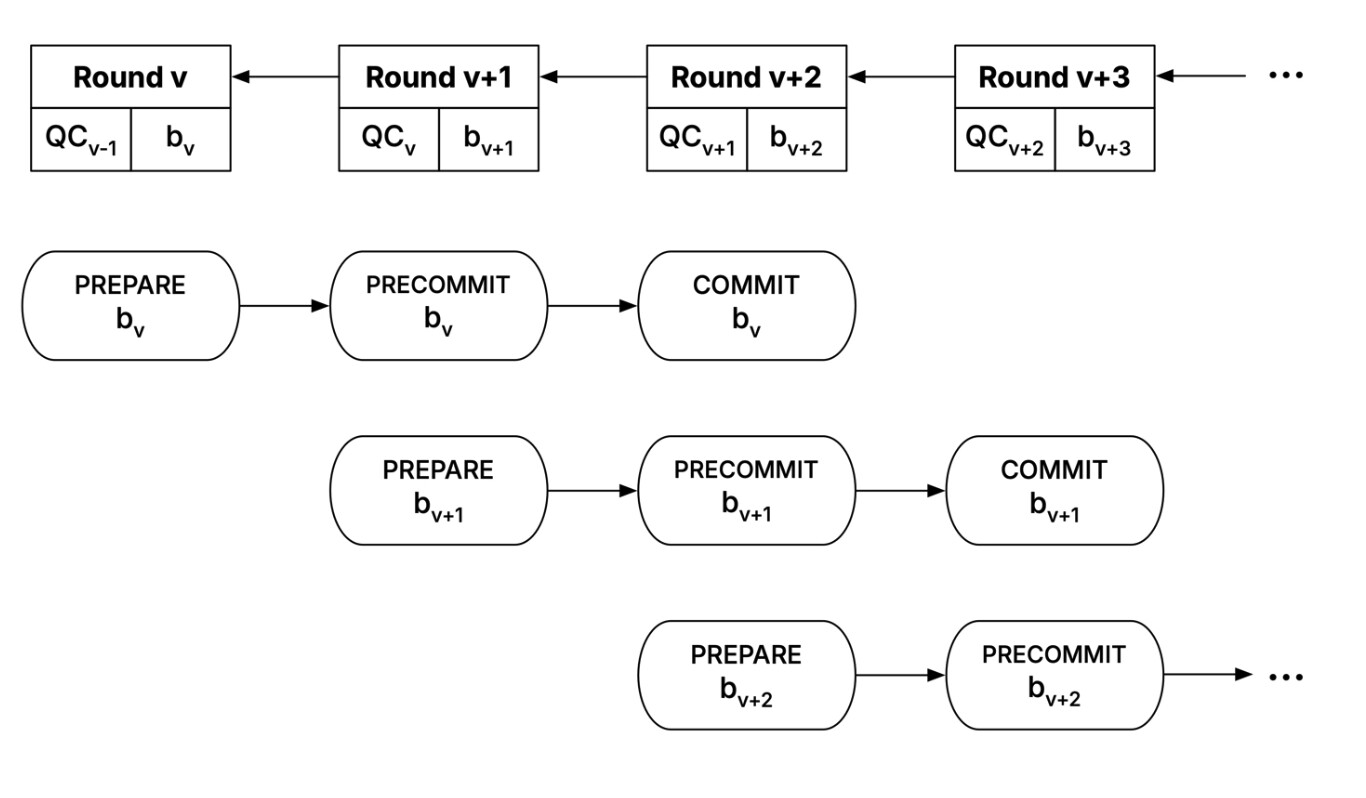

At its core, Plasma uses a loosely coupled architecture, where PlasmaBFT handles block sequencing and finality, while reth handles execution.

PlasmaBFT is a consensus mechanism for block sequencing and finality. While direct specifications of the consensus protocol are not available at the moment, documentation mentions that it follows a pipelined implementation of Fast HotStuff — a BFT consensus layer which, compared to HotStuff, eliminates the third consensus stage in most cases by asynchronously proposing the next block while the current block is being confirmed.

This implementation guarantees lower common-case latency while preserving worst-case safety requirements, as cited in the initial FastHotStuff paper.

The execution layer is built using a modified reth, a fast implementation of the Ethereum protocol by Paradigm Research. As opposed to traditional Ethereum execution environments - reth is Rust-based, while geth is a Go-based execution layer. It’s important to note that using reth creates a unique risk since its first production-ready version was released in 2024, whereas geth has been in active use and development for over 10 years.

The separation of Consensus and Execution layers, along with a unique version of the consensus algorithm, enables Plasma to process multiple consensus steps in parallel, reducing latency and increasing throughput.

Transaction Fees

Plasma removes fee friction by letting whitelisted ERC-20 tokens effectively act as native gas tokens. For routine USD₮ transfers, a protocol‑run Paymaster sponsors the required XPL, so verified users send USD₮ without holding any gas token. For transfers with other tokens, the same paymaster accepts whitelisted ERC-20 tokens as gas payment by converting them to XPL at an oracle‑published rate and settling the validator’s cost within the block.

Additionally, the official documentation outlines that subsidized USD₮ transfers will be capped on a rolling basis per wallet to ensure uniform access.

BTC Bridge

Plasma’s Bitcoin bridge brings native BTC without using traditional custodians or chain-specific wrappers. Users deposit BTC to a Plasma-controlled address on the Bitcoin blockchain; a network of verifiers, running their own Bitcoin nodes, attest and verify the transaction, approving the minting of pBTC, an ERC-20 token, on Plasma. Since pBTC uses LayerZero’s Omnichain Fungible Token (OFT) standard, the asset can move between LayerZero’s supported networks freely without additional chain-specific wrapping.

When users want to withdraw their BTC, they can burn pBTC on Plasma, which triggers the verifiers to attest the transaction and jointly produce a threshold-signed Bitcoin transaction that returns the BTC to the user’s chosen address on the Bitcoin network.

Decentralization

Plasma is following a progressive decentralization model, implying the following stages: (1) a centrally team-operated validator set in testnet for rapid iteration; (2) a small, whitelisted external validator set at mainnet; and (3) eventual permissionless participation backed by economic incentives and protocol-level safeguards.

This approach aims to prioritize stability and reliability during the network’s earlier stages of lifecycle, gradually transitioning to a more decentralized operational model over time.

Ecosystem

Plasma states that its ecosystem will have a significant number of dApps at launch, including but not limited to:

- Stablecoins: USD₮, Ethena, USD.AI, and Usual

- Yield: Ethena, Veda, Daylight, and others

- Dex: Curve and potentially other DEXs for volatile assets

- Bridges: LayerZero, Stargate, Jumper, and Relay

By securing commitments from leading projects in each category, Plasma ensures that the chain is operational and can provide a complete set of services on day one.

Tooling

Despite using a less conventional Ethereum executor, Plasma maintains a general-purpose EVM environment that offers:

- Full compatibility with EVM smart contracts

- Tool compatibility (Hardhat, Foundry)

- Interface compatibility (ABIs and libraries)

Currently, it offers all the expected developer/analytic tooling, including upcoming data on Dune, block explorers, LayerZero infrastructure for interoperability, and RPC providers. Reliable Oracle price feeds are expected to be available at launch.

Initial Asset Listings

USD₮

Technical Overview

USDT is the world’s most widely used stablecoin, issued by Tether on Ethereum. To extend its liquidity across multiple blockchains without modifying the original contract, Tether adopted LayerZero’s Omnichain Fungible Token (OFT) standard. The OFT model introduces USD₮, a cross-chain representation that uses a 1:1 lock-and-mint process: USDT is locked on Ethereum via an adapter, and an equal amount of USD₮ is minted on the target chain, like Plasma.

A typical deployment of USD₮ on a chain relies on the following smart contracts:

TetherTokenOFTExtension which exposes mint and burn functions on the destination chainOUpgradeable - LayerZero’s upgradable OFT module that handles cross-chain messaging, verification, and accounting- Source-side Adapter, which escrows the USDT on the source chain and initiates a cross-chain transfer

When a user bridges tokens, the adapter locks USDT and sends a LayerZero message to Plasma. OUpgradeable validates the payload; upon success, it calls TetherTokenOFTExtension to mint the exact amount of USD₮. By locking an equivalent amount of USDT on Ethereum for every USD₮ issued on Plasma, the system ensures that total circulating value remains fully collateralized, allowing native use of that capital within Plasma.

Price and Volatility

Since Plasma is not live now, we cannot provide the onchain volatility data. However, given the team’s significant liquidity commitments, we can expect USD₮ to exhibit price dynamics analogous to USDT on Ethereum.

As USD₮ is the largest stablecoin by market cap, its price is stable mainly in the 0.9995 — 1.0005 range, exhibiting strong peg performance.

USD₮’s 30-day rolling annualized volatility is typically extremely low, rarely exceeding 0.275%.

LTV, Liquidation Threshold, and Liquidation Bonus

We recommend aligning USD₮’s risk parameters closely with the Ethereum Core market. Given that USD₮ is expected to have sufficient liquidity across multiple AMM venues, we propose the following parameters: LTV 75%, LT 78%, and Liquidation Bonus 4.5%.

Supply and Borrow Caps

Based on Plasma’s liquidity commitment and USD₮’s ability to be rapidly bridged across networks with LayerZero, we recommend an initial supply cap of 2.2B and a borrow cap of 2B. These levels reflect the expectation of significant stablecoin liquidity on Plasma at launch, ensuring sufficient market depth to support both lending and borrowing activity.

IR Curve

We recommend reflecting USD₮’s deep market liquidity, long operational history, and dominant position among stablecoins on Plasma by setting the Uoptimal at 92%, a 2.5% base rate to support suppliers in the early stages of the market, slope1 at 4%, and slope2 at 20%. We believe its expected liquidity, low volatility profile, and consistently strong peg stability across various chains justify a higher utilization target while the introduction of a base rate ensures early supplier support as borrowing demand picks up, without significantly increasing liquidity risk.

Oracle/Pricing

We recommend pricing USD₮0 using the USDT/USD price feed. Additionally, we recommend wrapping the Oracle feed with a Capped Oracle, limiting the price of USDT to 1.04$ to minimize market deviations from USD₮0’s underlying value.

XAUT

Technical Overview

XAUt, or Tether Gold Token, is a digital asset issued by TG Commodities S.A. de C.V. that represents ownership of one fine troy ounce of physical gold per token. Each XAUt is backed by an identifiable gold bar that meets “London Good Delivery” standards set by the LBMA. Users verified through Tether Gold’s KYC process can purchase or redeem tokens via the primary market, with redemptions requiring whole gold bar denominations. Additionally, it’s important to note that XAUt is compatible with ERC-20 and LayerZero’s Omnichain Fungible Token (OFT), enabling native interoperability. Additionally, XAUt has already been analyzed in depth as part of the onboarding on the Ethereum Core instance; for reference, see the analysis.

Price and Volatility

While XAUt is not listed on Plasma, we can provide its price dynamics observed on Ethereum. XAUt’s price is tightly correlated with the price of gold. In the past 180 days, XAUt exhibited a decreasing volatility profile, reaching a 30-day rolling volatility of 10%.

Since XAUt represents tokenized gold, its on-chain price tracks the mark-to-market value of physical gold. Because global gold markets trade only during set hours, there are periods when off-chain prices remain static while XAUt continues trading, potentially creating short-term pricing discrepancies despite gold’s typically low volatility.

LTV, Liquidation Threshold, and Liquidation Bonus

Although XAUt’s reserve structure ensures a 1:1 physical gold backing, which underpins its fundamental stability, the observed volatility, particularly during off-market hours, warrants a conservative risk parameter configuration. Specifically, we recommend setting the Liquidation Bonus at 7.5%, the LTV ratio at 70%, and the LT at 75%.

Supply and Borrow Caps

We recommend an initial supply cap of 7,000 XAUt and not enabling it as a borrowable asset at launch.

Oracle

We recommend using the XAU oracle to price XAUt. Since gold trades only during set market hours, XAUt’s 24/7 trading can cause weekend price dislocations. As such, the XAU oracle will protect from upside deviations by underpricing the asset during these periods, while downside risks are rare and typically revert when markets reopen.

Isolation Mode and Debt Ceiling

We recommend listing XAUt in Isolation mode to prevent it from being used as collateral to borrow volatile assets. Significant price movements in the borrowed asset prices, combined with potential dislocations between XAUt’s secondary market price and XAU during off-market hours, could significantly elevate the risk of bad debt. We recommend an initial Debt Ceiling of 18,000,000 USD in order to support the complete utilization of the initial supply cap and we recommend initially including USDT as the only stable asset within the isolation mode.

USDe

Technical Overview

USDe is Ethena’s synthetic USD stablecoin. For every mint, the protocol opens an equal-sized short perpetual position on major exchanges while holding spot collateral in off-exchange custodians like Copper ClearLoop. Additionally, a significant portion of the reserves is allocated to highly liquid assets and stablecoins, which currently account for over 55% of the reserves. This delta-neutral strategy and use of custodians reduce counterparty risk and ensure USDe maintains its 1:1 backing. Any excess funding income accrues to staked USDe (sUSDe).

We assume that USDe’s deployment will follow the same pattern as its implementations on other EVM-compatible chains, such as Base, Arbitrum, and others. Therefore, USDe will be native to Plasma, reducing smart contract risk compared to the more complex and risky scenario of using secondary bridges.

Volatility

To estimate USDe’s onchain price performance, we can look at the USDe/USDC Uniswap pool on Ethereum. As can be observed, USDe’s DEX prices seldom exhibit minor deviations from the peg, predominantly limited by 20 bps; nevertheless, the price is primarily in the 0.999-1.002 range, typical for established stablecoins.

USDe exhibits a low volatility profile, with a 30-day volatility typically limited at under 0.6%. Occasional volatility spikes up to 0.8% are usually caused by the broader market dynamics.

LTV, Liquidation Threshold, and Liquidation Bonus

We recommend aligning USDe’s risk parameters closely with those used in the Core market. Hence, we recommend: LTV 72%, LT 75%, and LB 8.5%. Additionally, in the following sections, we introduce specialized E-Modes, which enable higher capital efficiency for USDe in particular strategies.

IR

We recommend setting USDe’s interest rate parameters to balance its strong peg stability with prudent risk management for Plasma’s early liquidity conditions. Specifically, we propose a Uoptimal of 85%, a 2.5% base rate to support suppliers in the early stages of the market, a slope1 at 5.0% and slope2 at 50%, alongside a Reserve Factor of 25%. This configuration reflects USDe’s lower expected liquidity depth relative to dominant stablecoins like USD₮, while still allowing for competitive borrowing costs under moderate utilization. The steeper slope2 ensures that interest rates respond aggressively when utilization exceeds the optimal point, mitigating liquidity risk during periods of heightened demand.

Supply and Borrow Caps

We recommend an initial supply cap of 500M USDe. The borrow cap should be set at 50M USDe, ensuring adequate on-chain liquidity for liquidations while Chaos Labs will consider expanding as demand grows.

Oracle

We recommend pricing USDe based on the USDT/USD oracle, consistent with the approach already used in the Ethereum Core market. This setup anchors USDe’s and reflects its substantial exposure to USDT as the dominant backing asset, rather than relying directly on USDe’s secondary market price. To minimize deviations, the oracle should be wrapped with a stable cap mechanism (e.g., $1.04 upper bound), ensuring protection against short-term dislocations while preserving consistency across the deployments.

sUSDe

Technical Overview

sUSDe is the staked version of Ethena’s synthetic stablecoin, USDe. When USDe is deposited into Ethena for staking, it is converted to sUSDe, representing a claim on the underlying USDe plus accrued yield, which is generated from Ethena’s delta-neutral strategy and is reflected in an increasing redemption rate of sUSDe/USDe. Redemption of sUSDe is subject to a 7-day withdrawal period and can only be facilitated directly on Ethereum.

Since sUSDe will be deployed natively on Plasma using LayerZero’s OFT standard, akin to other deployments (e.g., Base), integration risk remains limited, and smart contract risk is limited to Ethena’s audited contracts.

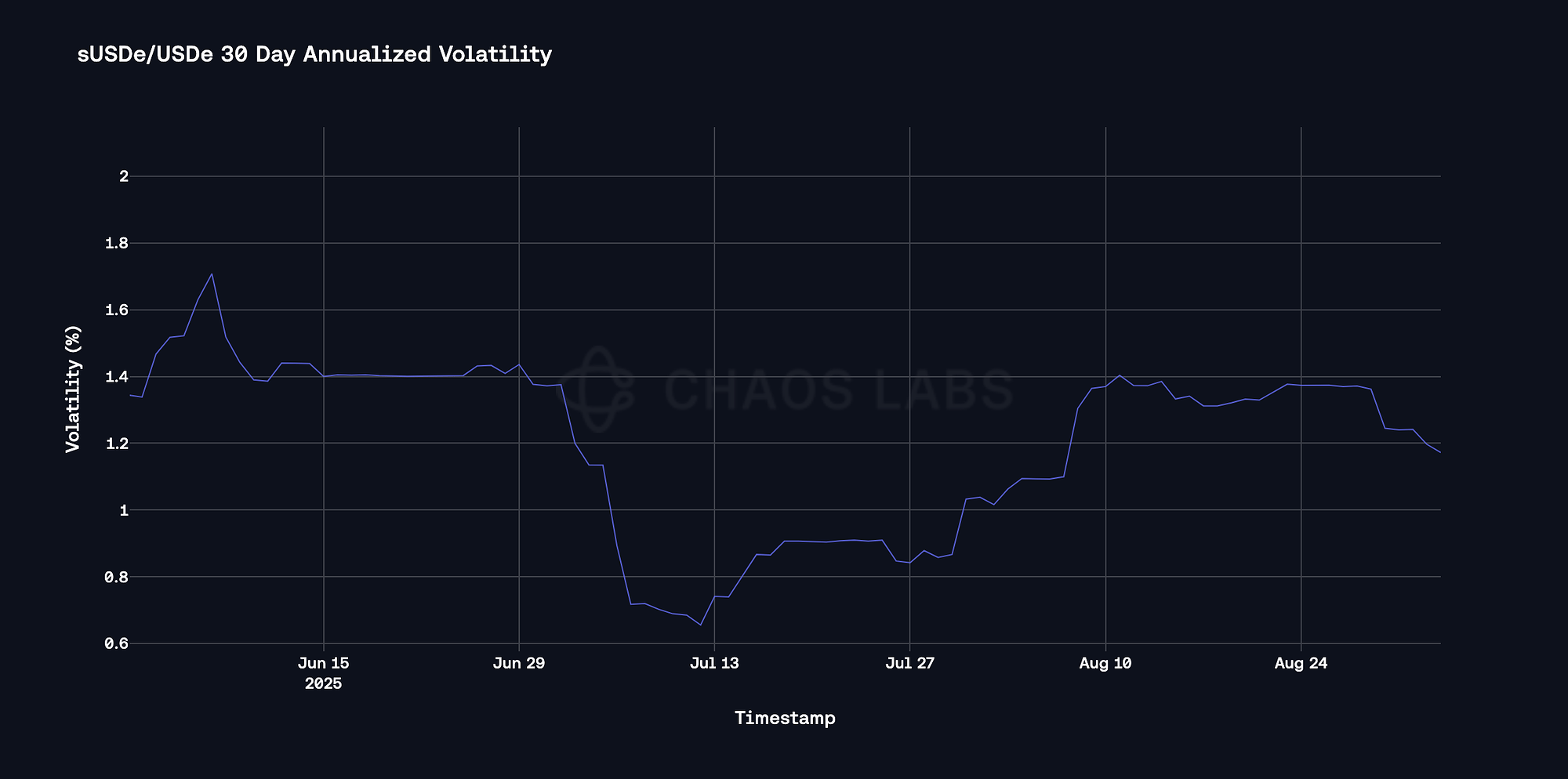

Volatility

As a yield-bearing derivative of USDe, sUSDe’s price is expected to track USDe closely, with a steadily growing premium reflecting accumulated yield.

Based on Ethereum DEX data, sUSDe has exhibited negligible daily volatility relative to USDe, with higher volatility periods coinciding with increased underlying yield and corresponding price increase of the token.

Supply and Borrow Caps

Given the absence of day-one liquidity data for sUSDe on Plasma and considering that it is a yield-bearing asset likely to be used primarily as collateral rather than for borrowing, we recommend an initial supply cap of 450M sUSDe. Consistent with the Core market, sUSDe should initially be enabled as collateral-only, as no significant borrowing use case is currently evident. These parameters can be revisited once liquidity depth and on-chain usage have matured.

LTV, Liquidation Threshold, and Liquidation Bonus

Considering the uncertainty regarding liquidity depth in the initial period after Plasma’s launch, we recommend limiting the utility of sUSDe as collateral outside of the designated E-Modes. Specifically, we recommend setting the following risk parameters: LTV 0.05%, LT 0.1%, and Liquidation Bonus 8.5%, effectively constraining the usage of sUSDe to the sUSDe Stablecoin E-Mode.

Oracle

We recommend pricing sUSDe using the sUSDe/USDe exchange rate together with the USDT/USD oracle, consistent with the pricing approach for USDe. This ensures the value reflects accrued yield while remaining anchored to a liquid stablecoin reference. A dynamic capped oracle (CAPO) should be applied to prevent excessive deviations from fundamental value.

CAPO

sUSDe’s yield is somewhat volatile; taking this into account, we recommend setting a Snapshot Delay of 14 days and setting the maxYearlyGrowthRatio to 15.19%.

WETH

Technical Overview

As of the time of writing, Plasma is not operational and, consequently, no bridging portals are active. However, it has been announced that a significant part of the assets will be bridged using LayerZero’s OFT standard, like the already mentioned XAUt and USD₮. Additionally, one of the OFT tokens will be WETH. Given the unified infrastructure for OFTs, no additional risk is assumed.

Volatility

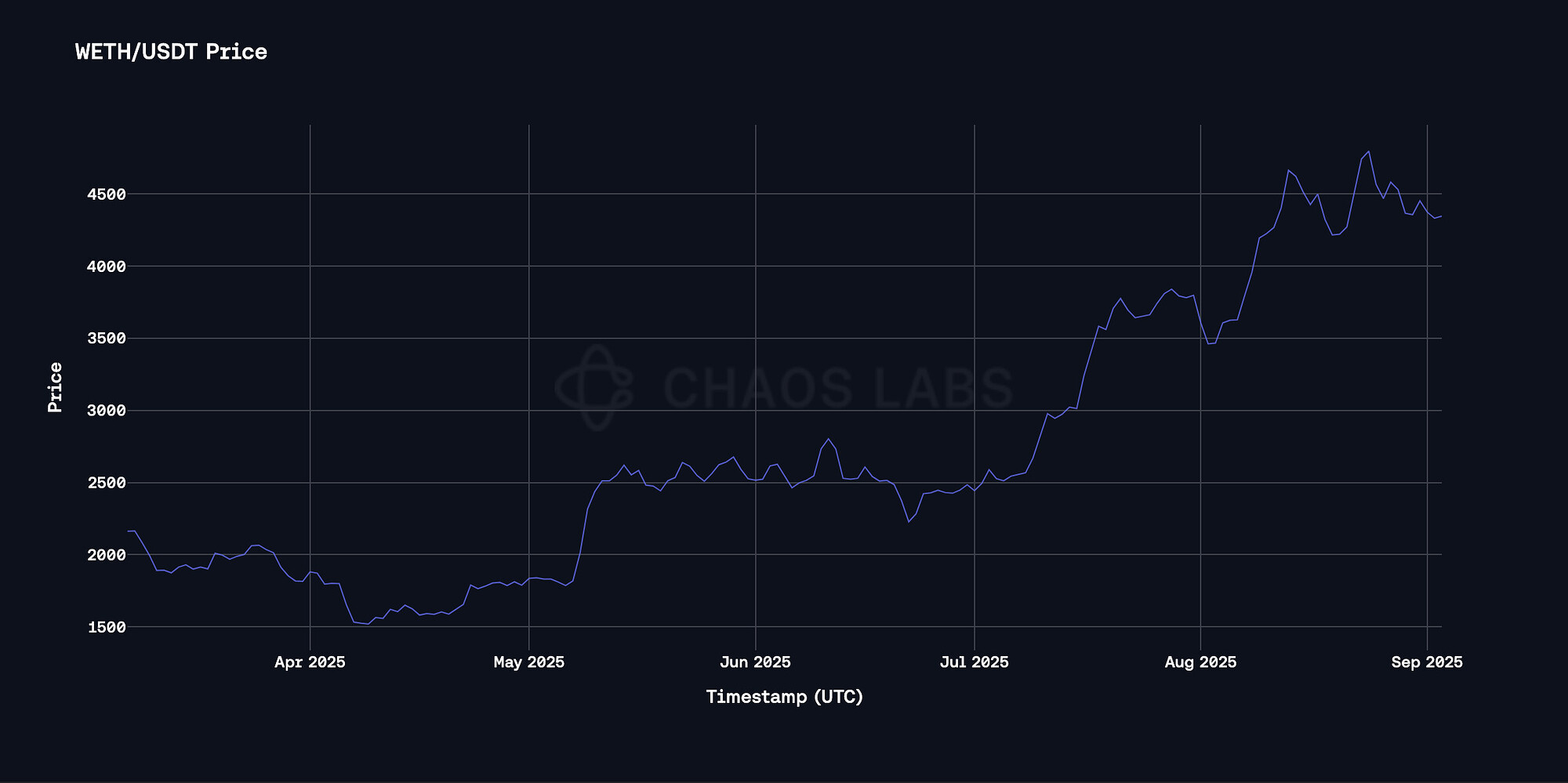

While there is no onchain data for WETH on Plasma at the moment, we can use Ethereum DEX trades data for this asset to approximate its price dynamics.

WETH has exhibited heightened volatility, peaking at 75% in June and converging to approximately 57.5% recently.

LTV, Liquidation Threshold, and Liquidation Bonus

WETH is one of the most widely adopted and liquid assets in crypto, making it a reliable collateral option. Hence, higher risk parameters could be justified. Specifically, we propose to align the market with Core by setting the LTV ratio at 80.5%, the LT at 83%, and the Liquidation Bonus at 5.5% to account for potential liquidity constraints on Plasma.

Supply and Borrow Caps

We recommend setting the supply cap at 80,000 WETH, while constraining the borrow cap at 10,000 WETH.

IR Curve

We recommend setting WETH’s Uoptimal at 92%, with a slope1 of 2.7% and a slope2 of 20%. Given WETH’s established presence in DeFi and widespread integration across protocols, the reserve can safely handle higher utilization levels without creating significant liquidity risk.

Oracle/Pricing

We recommend pricing WETH using the ETH/USD price feed.

weETH

Technical Overview

weETH is a wrapped, non-rebasing version of Ether.fi’s LST, eETH, which represents ETH staked with Ether.fi. Wrapping eETH into weETH fixes the token balance, while accrued yield is reflected in an increasing redemption rate back to eETH. Additionally, the deployment of weETH on Plasma is going to be facilitated using LayerZero’s bridging infrastructure, given that this is the case for most of the assets, no additional risk is assumed.

Volatility and Dislocations

weETH’s price correlates closely with ETH, maintaining a small, steadily growing premium from accumulated staking rewards. However, weETH’s secondary market price may diverge from its redemption rate during market stress, such as extended withdrawal queues, as can be observed at the moment. These dislocations are modest, typically reaching maximum values of 0.6% and averaging less than 0.3% in magnitude.

LTV, Liquidation Threshold, and Liquidation Bonus

In order to limit the protocol’s exposure to liquidity and volatility risks we recommend to conservative risk parameters for weETH. Specifically, we propose setting the LTV at 0.05%, the LT at 0.1%, and the Liquidation Bonus at 7% effectively minimizing the utility of weETH as collateral outside of the dedicated weETH/WETH E-Mode.

Supply and Borrow Caps

While Ether.fi’s staking base suggests significant liquidity potential, we recommend an initial supply cap of 10,000 weETH to limit risk until Plasma’s liquidity profile is established. Borrowing will be disabled at launch, as there are no clear use cases for borrowing weETH.

Oracle

We recommend pricing weETH via the ETH/USD price feed adjusted for the current weETH/eETH redemption rate, which ensures an accurate valuation of the accrued staking yield.

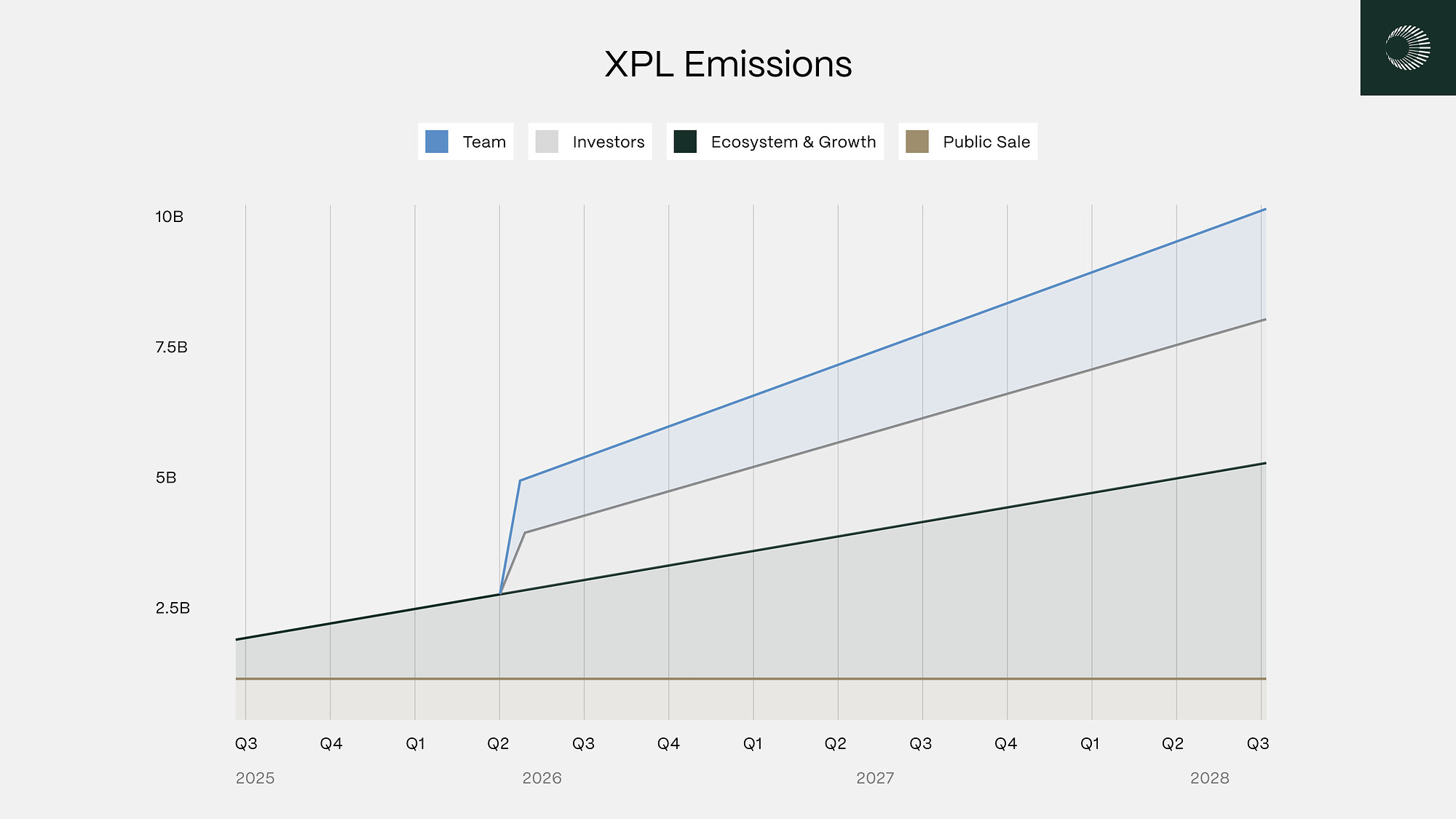

XPL

Overview

XPL is Plasma’s utility token, primarily used for transaction fees and staking. Unlike bridged assets, XPL is issued natively by Plasma and underpins the network’s security and economic alignment. While Plasma offers gas abstraction through Paymasters and whitelisted ERC-20 tokens (e.g., USD₮), XPL remains the fundamental gas and validator incentive token.

LTV, Liquidation Threshold, and Liquidation Bonus

We expect XPL to exhibit increased volatility at launch; hence, we recommend conservative risk parameters to mitigate the potential impact on the protocol. Specifically, we propose setting the LTV at 0%, the Liquidation Threshold at 0.1%, and the Liquidation Bonus at 8%. This ensures XPL cannot be used to collateralize debt, fully containing risk during the initial rollout. Once a reliable price feed is available and liquidity stabilizes, we recommend revisiting these parameters in a subsequent AIP, introducing risk parameters aligned with observed liquidity and market dynamics.

Supply and Borrow Caps

We recommend setting the Supply Cap at 50M XPL and making the token unborrowable. This allows deposits to be supported without introducing pricing risk. As the asset matures, both caps and borrowability should be reassessed and scaled in line with market liquidity and demand.

Oracle

At launch, no spot market exists for XPL, so we recommend anchoring its price to the presale at 0.05$. This temporary pricing measure will not affect the market since XPL will be neither borrowable nor effectively usable as collateral during this period. After the initial price discovery and the introduction of liquid trading venues, we recommend switching to a market-price oracle anchored to deep spot pairs on major CEXs.

E-Mode Configurations

USDe Stablecoin E-Mode

To strengthen capital efficiency on Plasma, a dedicated USDe E-Mode should be introduced. This configuration would enable users to post USDe as collateral while borrowing USD₮ in a more capital-efficient manner than under the standard risk parameters of USDe. Given the recommendation to price USDe using USDT/USD price feeds, this E-Mode ensures that borrowing and collateral values remain tightly anchored, facilitating highly efficient stablecoin leverage while reducing exposure to volatility.

By anchoring borrowing against USD₮ while using USDe as collateral, the model preserves stability and low liquidation risk while enabling leveraged strategies that cycle USDe through borrowing and reinvestment to support user demand and liquidity growth.

sUSDe Stablecoin E-Mode

We propose creating a sUSDe stablecoin E-Mode category that aligns with the Ethereum Core market configuration to enhance capital efficiency and enable Liquid Leverage strategies on Plasma. This category would let users utilize USDe and sUSDe as collateral, with USD₮ serving as the debt asset.

Motivation

Ethena’s Liquid Leverage model on Aave solves the typical 7-day unstaking lock for sUSDe by pairing it with liquid USDe - providing immediate capital access while sUSDe continues accruing yield.

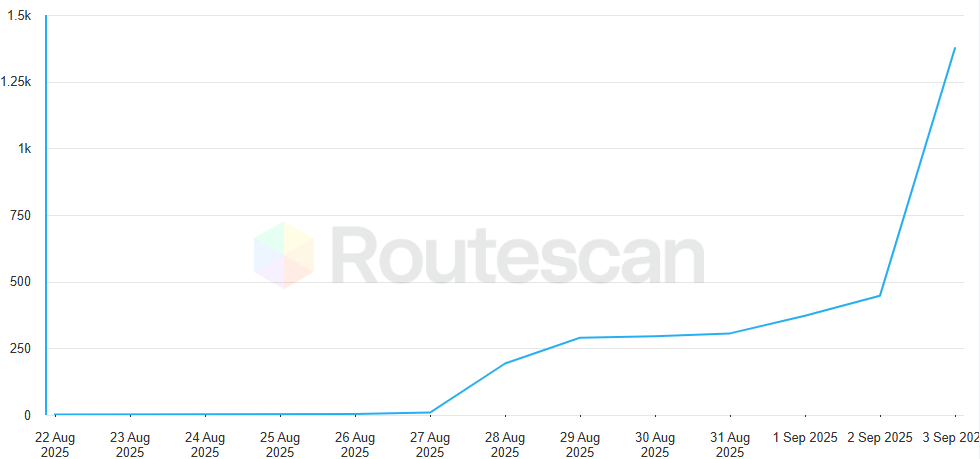

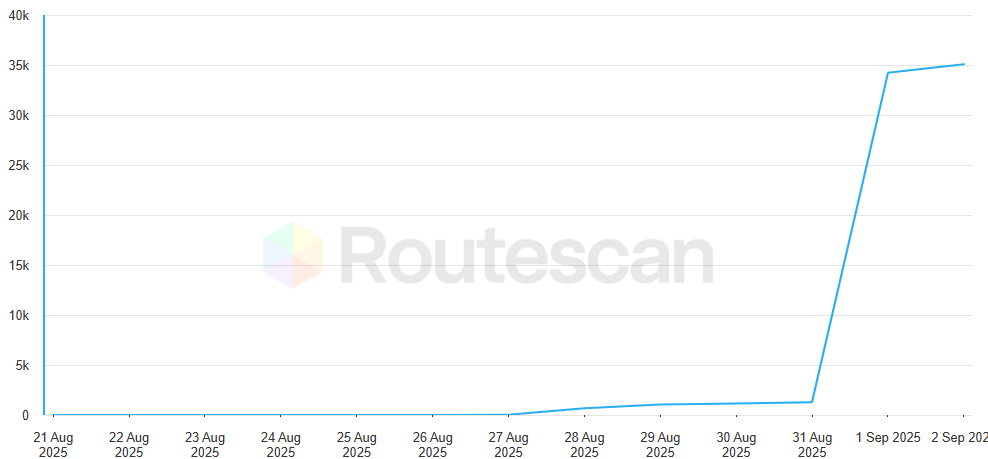

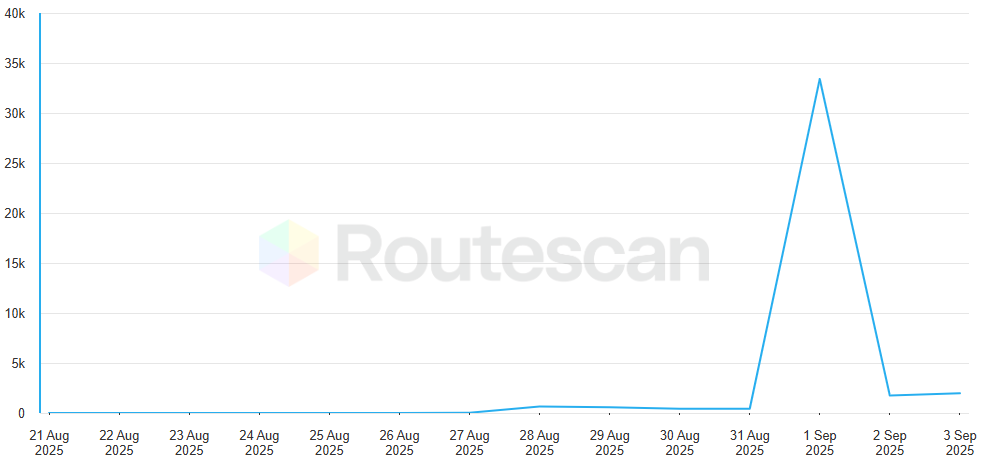

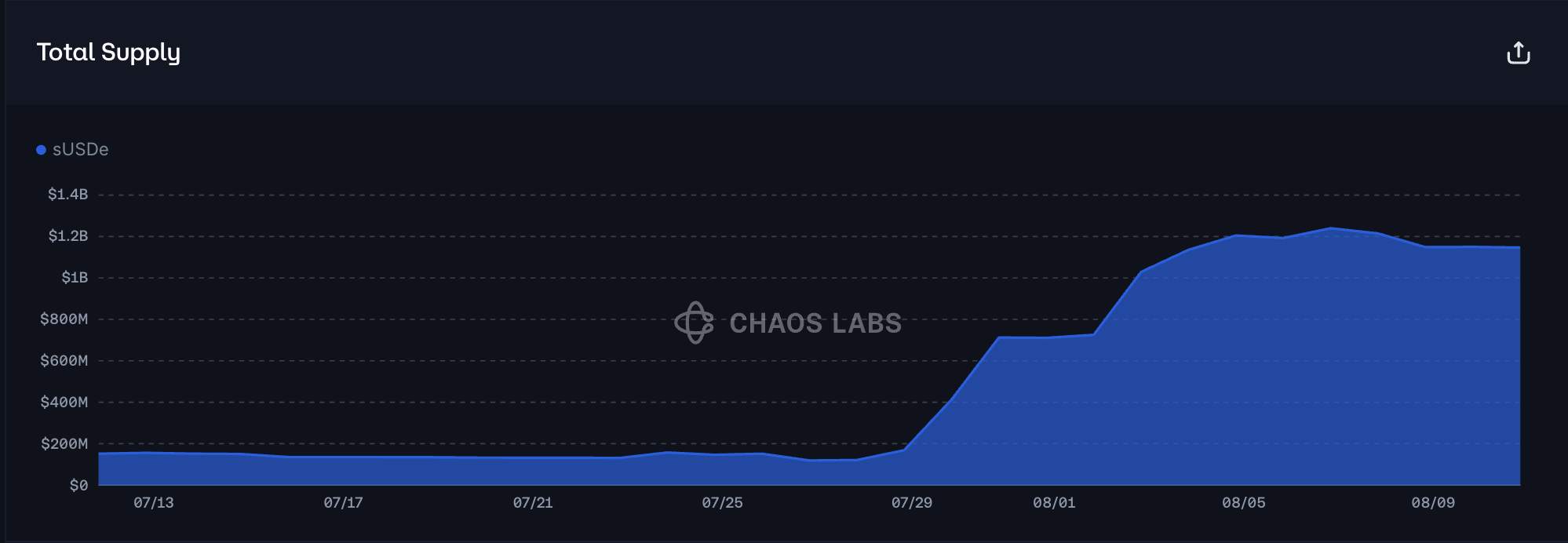

The incentive program has been highly effective, driving over $1.1 billion of sUSDe inflows within days of launch on Ethereum Core, boosting stablecoin borrowing—particularly USDT—and leading Aave to raise deposit limits. Incorporating USDe and sUSDe within sUSDe E-Mode would allow users to employ similar yield-enhancing strategies while maintaining strong risk parameters (90% LTV, 92% LT, 4% liquidation bonus). As these Ethena-related E-Modes mirror Ethereum Core’s configurations, see our risk analysis for in-depth research on the topic.

weETH WETH E-Mode

We recommend introducing a weETH WETH E-Mode, which traditionally enables users to borrow against staked or restaked ETH derivatives (e.g., weETH) at higher LT/LTV when collateral and debt assets are closely correlated in price. This substantially reduces liquidation risk from market volatility, as the debt and collateral prices are highly correlated.

Motivation

On Ethereum, Arbitrum, and Base, ETH-Correlated E-Modes are facilitating a significant share of total borrowing, providing high capital efficiency for strategies such as looping LSTs/LRTs for leveraged staking/restaking yield or accessing liquidity without fully exiting a staked position. These use cases attract retail and institutional participants, driving deposit growth and borrowing demand; hence, introducing the ETH Correlated E-Mode is expected to boost demand on the newly deployed Plasma instance.

weETH Stablecoin E-Mode

We also recommend creating a weETH/Stablecoin E-Mode. On Ethereum core, beyond its primary use case of looping, the main demand for weETH as collateral is borrowing USDT and USDC. Therefore, we believe this setup will enhance the capital efficiency of stablecoin borrowing and is expected to boost demand on the new instance.

Specification

| Parameter |

Value |

Value |

Value |

Value |

Value |

Value |

Value |

| Asset |

USD₮ |

USDe |

sUSDe |

XAUt |

WETH |

weETH |

XPL |

| Isolation Mode |

No |

No |

No |

Yes |

No |

No |

No |

| Borrowable |

Yes |

Yes |

No |

No |

Yes |

No |

No |

| Collateral Enabled |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Supply Cap |

2,200,000,000 |

500,000,000 |

450,000,000 |

7,000 |

80,000 |

10,000 |

50,000,000 |

| Borrow Cap |

2,000,000,000 |

50,000,000 |

- |

- |

10,000 |

- |

- |

| Debt Ceiling |

- |

- |

- |

18,000,000 |

- |

- |

- |

| LTV |

75% |

72% |

0.05% |

70% |

80.5% |

0.05% |

0.00% |

| LT |

78% |

75% |

0.1% |

75% |

83% |

0.1% |

0.1% |

| Liquidation Bonus |

4.50% |

8.50% |

8.50% |

7.50% |

5.5% |

7% |

8% |

| Liquidation Protocol Fee |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

| Variable Base |

2.5% |

2.5% |

- |

- |

0% |

- |

- |

| Variable Slope1 |

4.0% |

5.0% |

- |

- |

2.7% |

- |

- |

| Variable Slope2 |

20% |

50% |

- |

- |

20% |

- |

- |

| Uoptimal |

92% |

85% |

- |

- |

92% |

- |

- |

| Reserve Factor |

10% |

25% |

- |

- |

15% |

- |

- |

USDe Stablecoin E-Mode

| Parameter |

Value |

Value |

| Asset |

USDe |

USD₮ |

| Collateral |

Yes |

No |

| Borrowable |

No |

Yes |

| Max LTV |

90% |

- |

| Liquidation Threshold |

93% |

- |

| Liquidation Bonus |

2.0% |

- |

sUSDe Stablecoin E-Mode

| Parameter |

Value |

Value |

Value |

| Asset |

USDe |

sUSDe |

USD₮ |

| Collateral |

Yes |

Yes |

No |

| Borrowable |

No |

No |

Yes |

| Max LTV |

90% |

90% |

- |

| Liquidation Threshold |

92% |

92% |

- |

| Liquidation Bonus |

4.0% |

4.0% |

- |

weETH WETH E-Mode

| Parameter |

Value |

Value |

| Asset |

weETH |

WETH |

| Collateral |

Yes |

No |

| Borrowable |

No |

Yes |

| Max LTV |

93% |

- |

| Liquidation Threshold |

95% |

- |

| Liquidation Bonus |

1.00% |

- |

weETH Stablecoin E-Mode

| Parameter |

Value |

Value |

| Asset |

weETH |

USD₮ |

| Collateral |

Yes |

No |

| Borrowable |

No |

Yes |

| Max LTV |

75% |

- |

| Liquidation Threshold |

78% |

- |

| Liquidation Bonus |

7.50% |

- |

CAPO Parameters sUSDe

| Token |

Snapshot Delay |

maxYearlyGrowthRatio |

| sUSDe |

14 days |

15.19% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation. Our provision of risk-related data services to the Plasma Protocol bears no influence on the content or conclusions of this analysis.

Copyright

Copyright and related rights waived via CC0