Summary

LlamaRisk supports Aave V3 deployment on X Layer. At this stage, the network has a comparatively low DeFi TVL of around $26 million and a total stablecoin market cap at $84.1 million, with usage still concentrated in early DEX activity and incentive-driven flows. X Layer is built with Polygon’s CDK and connected to the AggLayer, which provides cross-chain interoperability and unified bridging. The design runs on a single trusted sequencer with no fallback for forced inclusion, meaning ordering and liveness are centralized.

The gas token is OKB, whose supply has been fixed at 21 million following a one-time burn and contract upgrade in August 2025. All fees on the network are paid in this asset. Current issuance of stablecoins and other key tokens is through bridged variants rather than native deployments, which places reliance on bridge operators and external issuers.

While we initially support the list of assets proposed by @TokenLogic, we’ll be providing separate, asset-specific recommendations. This is due to the proposed onboarding of entirely new assets—OKB, xBTC, and USDG—onto Aave’s markets, which necessitates in-depth individual asset assessments. We will share these evaluations in due course in this same governance thread.

1. Network Fundamental Characteristics

1.1 Network Overview

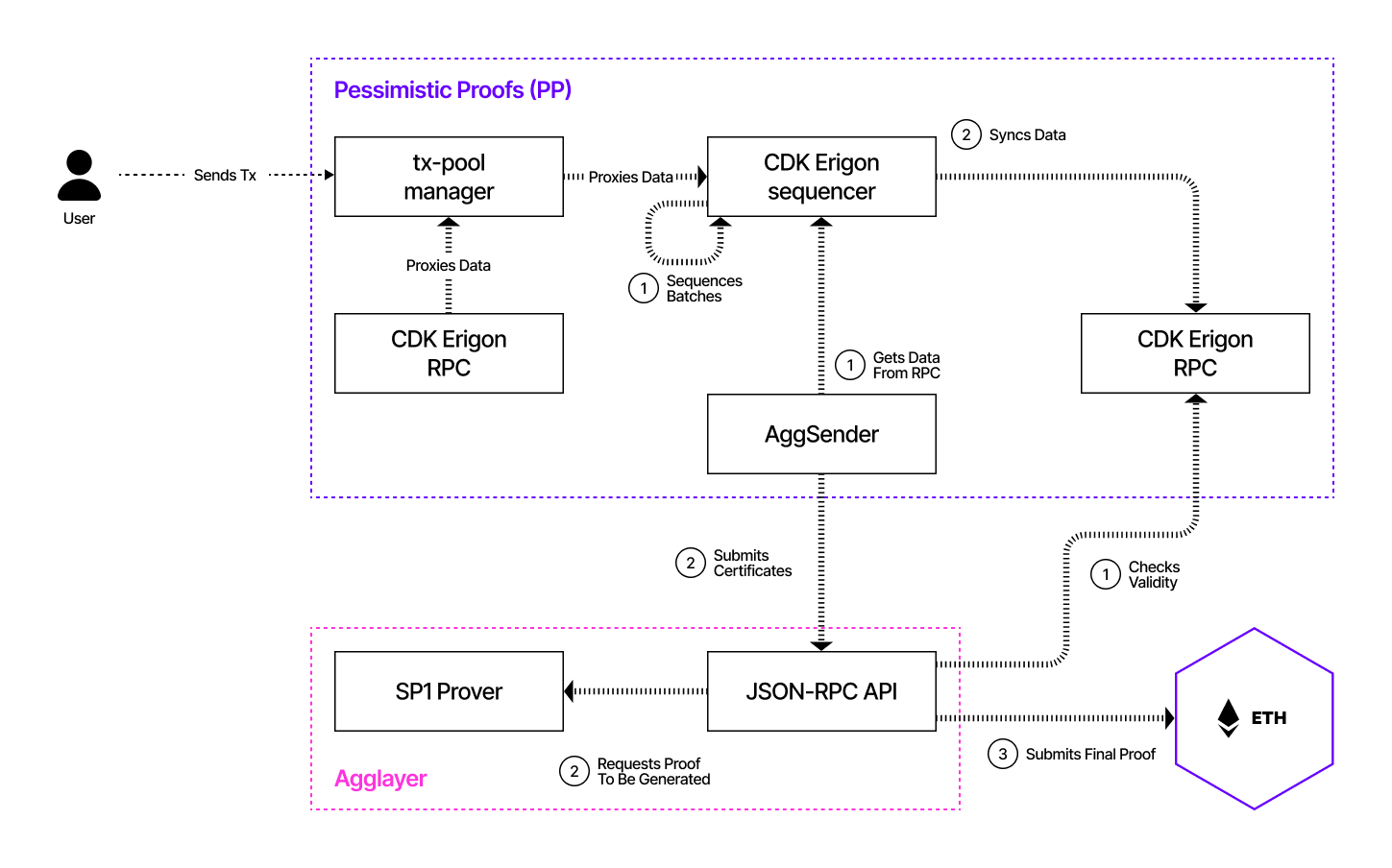

X Layer is a Zero-Knowledge (ZK) Ethereum Layer 2 (L2) and is built with the Polygon Chain Development Kit (CDK) as part of a strategic collaboration between OKX and Polygon Labs. Following the Pessimistic Proofs (PP) upgrade, completed on August 5, 2025, it offers full compatibility with the Ethereum Virtual Machine (EVM), enabling developers to deploy existing Ethereum applications.

X Layer processes transactions through an EVM, while its state and data are kept off-chain. Standard execution occurs natively on L2, while Polygon’s Pessimistic Proof mechanism is triggered only for bridging and cross-domain settlement to establish verifiable finality on Ethereum or other connected chains. This approach differs from ZK and Optimistic rollups, where data publication to L1 is embedded into the core protocol.

Source:

Polygon docs, September 30, 2025

X Layer architecture

The major components of X Layer are:

- Virtual Machine: EVM‑equivalent

- Consensus: Polygon Pessimistic Consensus

- Sequencer: Trusted

- Gas token: OKB (fixed supply at 21M post-burns/upgrades; L1 OKB phased out)

- Additional Features: AggSender for AggLayer interoperability, SP1 Prover for pessimistic proofs

Technical Overview

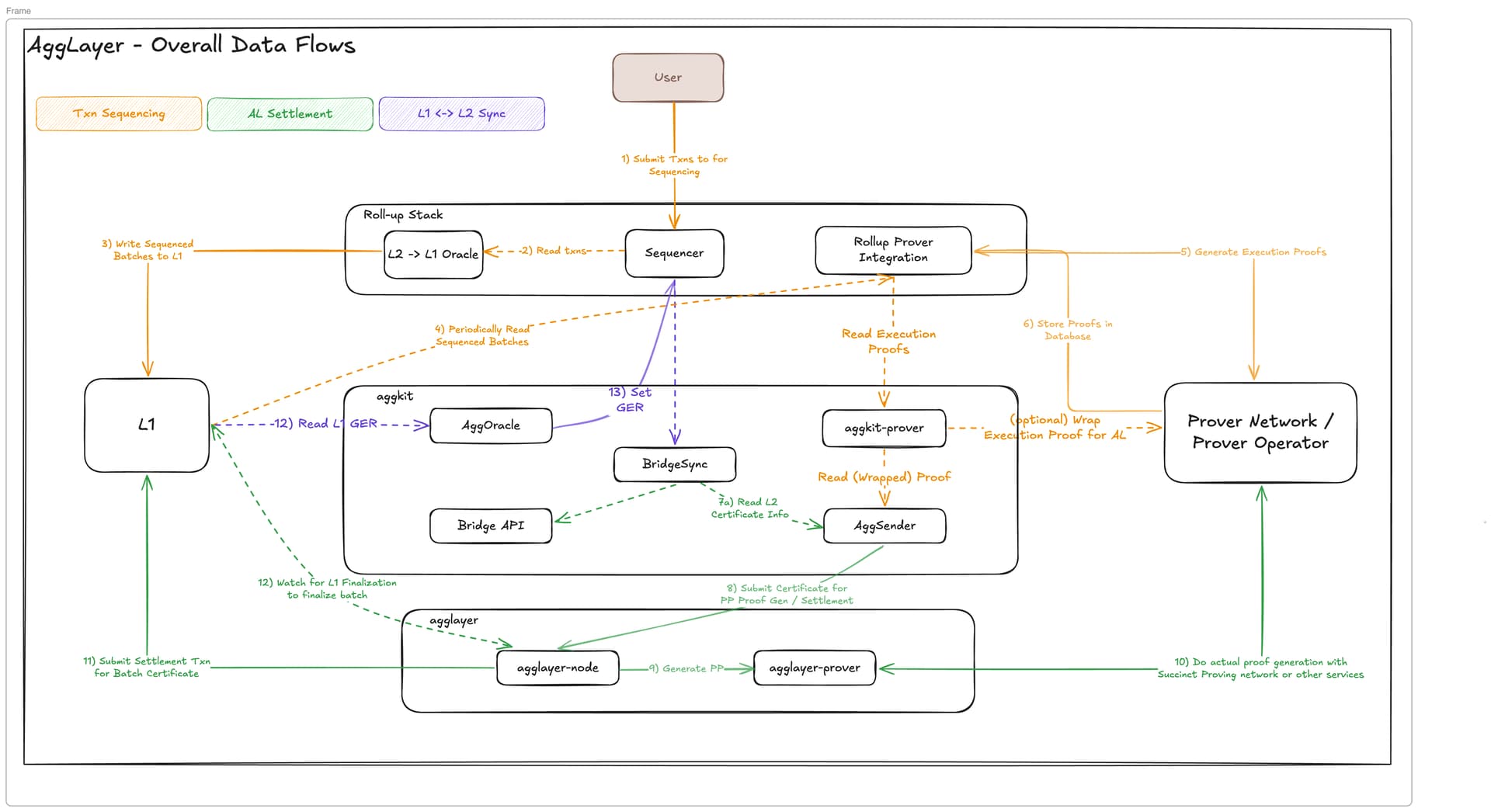

AggLayer is the coordination and settlement fabric that sits between many CDK chains and Ethereum. Its job is to police cross-chain value flows and to provide a common bridge. It tracks deposits and withdrawals across all connected chains through a unified accounting model. It accepts certificates from chains, verifies pessimistic proofs, and updates shared state on L1 so any chain can trust that another chain has not withdrawn more than it received.

Pessimistic proofs (PP) are the core of that safety model. Instead of re-proving every state transition, a chain proves that its withdrawals are backed by actual deposits recorded in the unified bridge. The proof is built in a zkVM prover pipeline and checked on L1. This closes the “bridge accounting” risk across the multi-chain set while avoiding the cost of full state proofs. It does not by itself validate the entire L2 state. Correctness inside a given L2 remains a function of the operator’s integrity and upgrade controls.

X Layer itself runs with a throughput of up to 5,000 TPS following the PP upgrade, positioning it to handle high-concurrency activity while relying on the AggLayer framework for settlement and cross-chain consistency.

Source:

AggLayer docs, September 30, 2025

On X Layer, the transaction path is straightforward. A user submits a transaction through an RPC endpoint hosted by the operator. The trusted sequencer orders transactions and executes them in an EVM-equivalent environment. The resulting batches and certificates are posted to the AggLayer through an AggSender component. The SP1 prover stack produces pessimistic proofs when cross-chain value must be settled. The AggLayer verifies these proofs and updates the unified bridge and global exit root on Ethereum. Once the L1 contracts reflect the updated state, withdrawals and cross-chain messages become claimable on destination chains.

The on-chain contract set follows the CDK pattern. A SystemConfig-style contract on L1 holds critical parameters such as the sequencer address and pointers to other L1 components. A proxy admin pattern governs upgradeability for the L1 contracts that anchor the rollup and its bridge. X Layer’s sequencer is operated by the team. Inclusion policy, fee parameters, and emergency actions are operational decisions by the operator. Data and access for public users are provided through centralized RPC and explorer infrastructure.

1.2 Decentralization and Legal Evaluation

X Layer is an EVM-compatible Layer 2 network designed to scale Ethereum applications. It operates using a single sequencer controlled by the X Layer team. Unlike validator-based models, there are no independent validators participating in block production. This design centralizes ordering power and network liveness in the sequencer. Public RPC endpoints are provided through official documentation and are hosted on AWS infrastructure, with operations based in Hong Kong.

Architecture and Control

The sequencing model places control of transaction inclusion, ordering, and censorship resistance entirely under the operator of the sequencer. If the sequencer halts or censors, users cannot force inclusion on their own. Bridge functionality and system configuration rely on smart contracts that can be upgraded through administrative multisigs held by the Polygon team.

Censorship and Policy

There are no public records of enforced blacklisting of contracts or tokens. However, the architecture allows for censorship through the sequencer or restrictions at the RPC and explorer layers. This creates the technical capacity to block or limit access to specific contracts if policy requires it.

Economic and Market Conduct

Gas on the network is paid in OKB. With the sequencer centrally operated, policies for transaction ordering and MEV handling are set by the operator. This creates potential conflicts of interest where affiliates of the operator are active in trading, routing, or liquidity provision on the network.

Slashing

X Layer does not implement slashing. The network relies on a single sequencer and doesn’t have a public validator set. Operator behavior and system reliability are managed through access controls and administrative authority.

Legal Evaluation

Our legal analysis pertains to the X Layer Terms of Service, which serve as the publicly accessible and operative contractual framework governing the network. These terms are presented as a binding legal agreement between XLAYER TECHNOLOGY COMPANY LIMITED (referred to as “X Layer Foundation “) and each individual user. Nevertheless, the Terms do not specify the jurisdiction of incorporation for the company. During our comprehensive due diligence, the X Layer team has clarified that the entity is registered in Seychelles; however, no additional corporate identification or statutory particulars have been furnished.

With respect to limitations of liability, although the relevant disclaimers are notably comprehensive, it is important to recognize that many jurisdictions restrict or prohibit the exclusion of liability for certain consumer or statutory entitlements—particularly in regions such as the European Union, the United Kingdom, Australia, and various states across the United States. While the terms provide exclusions for gross negligence and fraud, the language, as currently drafted, fails to reference critical consumer protection statutes or those rights that cannot be lawfully excluded or waived.

The indemnification provision affords X Layer Foundation unfettered and unilateral authority to direct the defense and resolution of any relevant claim or proceeding, granting it “sole and absolute discretion” in such matters. This degree of discretionary control may invite scrutiny, as it departs from the more balanced standards often expected in contractual relationships, especially where indemnity is involved.

Regarding representations and warranties, the Terms unequivocally state that X Layer is offered strictly on an “as-is” and “as available” basis, with users assuming all associated risks. No form of representation or warranty—be it express, implied, or statutory—is provided. To the fullest extent permitted by applicable laws and regulations, X Layer explicitly disclaims, and users expressly renounce, any and all warranties or assurances of any nature, whether arising from law, custom, or the course of dealing.

The Eligibility provisions articulated in the Terms of Service delineate the baseline qualifications for users seeking access to the X Layer network. Natural persons are required to be at least eighteen years of age and must not be restricted, either by law or pursuant to the Terms, from accessing the Services. For institutional or organizational users, the Terms mandate that such entities be duly constituted under the laws of their respective jurisdictions and that the individual acting on the entity’s behalf possess formal authorization to bind the entity in legal agreements.

Notably, the Terms incorporate explicit prohibitions relevant to both “Restricted Persons” and “Restricted Locations.” Persons or entities who are citizens, residents, or physically situated in jurisdictions subject to comprehensive economic sanctions—such as Cuba, Iran, North Korea, Syria, Crimea, Donetsk, and Luhansk—are expressly barred from accessing the network. This exclusion extends to any party subject to penalties administered by international or national regulatory bodies, including the U.S. Office of Foreign Assets Control (OFAC), the European Union, the United Kingdom, and other global authorities. Furthermore, users are affirmatively required to certify, upon request, compliance with these requirements. These restrictive provisions are consistent with prevailing industry standards for blockchain and fintech platforms, reflecting efforts to mitigate exposure to global sanctions risk and reinforce compliance with anti-money laundering and counter-terrorist financing frameworks.

The Terms describe X Layer as an open-source, permissionless, layer 2 blockchain ecosystem that aggregates developer tools, distributed applications (DApps), digital assets, and relevant third-party interfaces. The Foundation explicitly denies any ongoing custodial relationship or direct control over assets, DApps, or third-party material, present or future, accessible through the X Layer network or its associated website.

When evaluating the regulatory status and posture of the X Layer network, it is noteworthy that, in response to our written inquiry, the X Layer team communicated that X Layer, functioning as a permissionless and decentralized blockchain protocol, is not classified as a regulated entity under the current legal and regulatory frameworks of major jurisdictions (i.e., the United States, European Union, United Kingdom, Singapore, and Hong Kong). However, it should be noted that nothing in our correspondence references, summarizes, or makes available the substance of X Layer’s legal analyses or counsel regarding the network’s regulatory exposure.

The Terms of Service specify that the agreement is governed by, and must be interpreted under, the laws of Singapore, without regard to any principles of conflict of laws. This choice of law provision is standard for entities operating within or seeking regulatory certainty with respect to Singapore’s recognized legal environment, especially given Singapore’s status as a leading global hub for fintech and digital asset innovation. The selection of Singaporean law confers predictability and the benefit of a relatively business-friendly statutory and common law tradition; however, the global accessibility of the network means that mandatory consumer protections or public policy laws of other jurisdictions may nonetheless apply as overriding statutes, particularly for users outside Singapore.

The Terms adopt a multi-tiered dispute resolution structure. In the event of a controversy or claim, parties are first directed to pursue resolution through mediation administered by the Singapore International Mediation Centre, in accordance with its procedural rules. Should mediation fail to yield a resolution within ninety days, all disputes are to be referred to binding, confidential arbitration administered by the Singapore International Arbitration Centre under its prevailing rules. The arbitral seat is Singapore, proceedings are conducted in English, and the panel is to be composed of three arbitrators, each party appointing one and a third being selected by the SIAC President.

1.3 Activity Benchmarks

X Layer went live in April 2024. X Layer currently holds around $26.7 million in total value locked, after spending much of the year closer to the 5 to 10 million range. Activity has expanded sharply in recent months, with temporary peaks above 30 million. The sharp pickup in DEX volumes from September reflects stacked catalysts that landed in August 2025: the PP upgrade that raised throughput and cut costs, with chain-specific incentives including a 100 million dollar ecosystem fund as well as launch of a memecoin acceleration program by PotatoSwap. Alongside this growth, trading volumes accelerated to over 60 million at their highest point before easing back toward the 50 million range.

Source:

DefiLlama, September 30, 2025

Daily metrics: X Layer L2

Polygon-based X Layer chain activity shows mostly steady day counts in the tens to low hundreds, with USD volume arriving in short bursts. Activity dipped through late 2024, then improved into mid and late 2025 with more consistent throughput.

Source:

Dune, September 30, 2025

Daily metrics: Ethereum L1

The X Layer official bridge on Ethereum shows heavy use in early 2024, a cooling phase into late 2024 and early 2025, and then a clear pickup from mid-2025 with rising daily transactions and several sharp value spikes. That pattern fits renewed bridging and liquidity shifts, with more users moving assets and a few high-value days driving the USD peaks.

Source:

Dune, September 30, 2025

1.4 Security

X Layer inherits the audited Polygon CDK (formerly zkEVM) stack and benefits from Polygon’s AggLayer, combining security from both the underlying technology and the aggregated verification layer.

Polygon CDK audits:

- Spearbit (March, 2023): 1 critical and 1 informational

- Spearbit-2 (March 27, 2023): 3 critical, 4 incompatibility, 2 low and 21 informational

- Spearbit-1 (March 27, 2023): 7 critical, 1 incompatibility, 1 high, 1 medium and 22 informational

- Spearbit (August 21, 2023): 1 low and 5 informational

- Spearbit (June 20, 2023): 2 high, 1 low and 5 informational

- Verichains (March 19, 2024): 2 critical, 1 medium, 1 low, and 15 informational

- Hexens (December 23, 2024): 2 informational

- Hexens (February 27, 2023): 4 critical, 1 high, 1 medium, 3 low and 7 informational

AggLayer audits:

- Spearbit (March, 2023): 4 mid, 16 low, and 30 informational

- Hexens (February, 2023): 4 critical, 1 high, 1 medium, 3 low and 7 informational

- Sigma Prime (January, 2024): 2 medium, 1 low and 3 informational

- Sigma Prime (February, 2024): 7 medium, 4 low and 9 informational

- Sigma Prime (June, 2024): 1 high, 1 medium, 1 low and 4 informational

Bug Bounty

X Layer participates in the OKX bug bounty program on HackerOne. Researchers can submit security findings related to the network, with rewards scaling by severity and payouts reaching up to 1,000,000 USD for critical issues.

Access Control

On Ethereum mainnet, the PolygonPessimisticConsensus contract is the consensus anchor for X Layer’s pessimistic proof mode, and it exposes an admin address. The admin can transfer and accept the admin role and can set the trusted sequencer identity and its URL.

- The L1/L2 contracts are managed by Polygon team using Safe 5/12 PolygonAdminMultisig:

- The Safe 6/8 PolygonSecurityCouncil multisig is used to activate an emergency state in both the manager and the shared bridge, pausing all connected projects and allowing system contracts to be upgraded immediately.

- The Safe 3/8 PolygonCreateRollupMultisig can interact with the PolygonRollupManager to deploy new projects based on predefined rollup implementations and connect them or other AggLayer chains to the manager.

- EOA 1

- Can interact with PolygonPessimisticConsensus

- sole address that can force batches

- EOA 2

- Can interact with PolygonPessimisticConsensus

- must provide a signature for each pessimistic proof, attesting to a valid state transition

- EOA 3

- Can interact with PolygonPessimisticConsensus and set the trusted sequencer address

Smart Contracts

-

PolygonPessimisticConsensus: Admin Address

System contract defining the X Layer logic. It only enforces bridge accounting (pessimistic) proofs and is otherwise kept minimal as the Layer 2 state transitions are not proven.

- Roles:

- admin: EOA 3

- forceBatchAddress: EOA 1

- trustedSequencer: EOA 2

-

AggLayerGateway: Admin Address

A verifier gateway for pessimistic proofs. Manages a map of chains and their verifier keys and is used to route proofs based on the first 4 bytes of proofBytes data in a proof submission. The SP1 verifier is used for all proofs.

- Roles:

- addPpRoute: Timelock; ultimately PolygonAdminMultisig

- admin: SharedProxyAdmin; ultimately PolygonAdminMultisig

- aggchainDefaultVKey: PolygonAdminMultisig

- freezePpRoute: PolygonAdminMultisig

Can be upgraded by: PolygonAdminMultisig with 3 day delay

-

PolygonSharedBridge: Admin Address

The shared bridge contract, escrowing user funds sent to Agglayer participants. It is usually mirrored on each chain and can be used to transfer both ERC20 assets and arbitrary messages.

- Roles:

- admin: SharedProxyAdmin; ultimately PolygonAdminMultisig

- proxiedTokensManager: Timelock; ultimately PolygonAdminMultisig

Can be upgraded by: PolygonAdminMultisig with 3 day delay

-

PolygonRollupManager: Admin Address

The central shared managing contract for Polygon Agglayer chains. This contract coordinates chain deployments and proof validation. All connected Layer 2s can be globally paused by activating the ‘Emergency State’. This can be done by the PolygonSecurityCouncil or by anyone after 1 week of inactive verifiers.

- Roles:

- admin: SharedProxyAdmin; ultimately PolygonAdminMultisig

- createRollup: PolygonAdminMultisig, PolygonCreateRollupMultisig

- defaultAdmin: Timelock; ultimately PolygonAdminMultisig

- emergencyCouncilAdmin: PolygonSecurityCouncil

- trustedAggregator: EOA 4, EOA 5

- tweakParameters: PolygonAdminMultisig

Can be upgraded by: PolygonAdminMultisig with 3 day delay

-

PolygonGlobalExitRootV: Admin Address

A merkle tree storage contract aggregating state roots of each participating Layer 2, thus creating a single global merkle root representing the global state of the Agglayer, the ‘global exit root’. The global exit root is synchronized to all connected Layer 2s to help with their interoperability.

- Roles:

- admin: SharedProxyAdmin; ultimately PolygonAdminMultisig

Can be upgraded by: PolygonAdminMultisig with 3 day delay

-

Timelock

A timelock with access control. In the case of an activated emergency state in the PolygonRollupManager, all transactions through this timelock are immediately executable. The current minimum delay is 3d.

- Roles:

- timelockAdmin: PolygonAdminMultisig (no delay if in emergency state), Timelock (no delay if in emergency state); ultimately PolygonAdminMultisig (no delay if in emergency state)

-

SP1Verifier

Verifier contract for SP1 proofs (v5.0.0).

-

SharedProxyAdmin

Concerns arise around the use of EOAs for the admin, forceBatchAddress, and trustedSequencer roles in the PolygonPessimisticConsensus contract, given the level of influence this contract has on the chain, the absence of state validation, and the lack of any upgrade delay if one of these keys were compromised.

Sequencer

The Sequencer’s private key is managed and protected by a dedicated address owned by X Layer Asset Security Team.

The address deployed on: 0x610de9141a2c51a9a9624278aa97fbe54b27c102

2. Network Market Outlook

2.1 Market Infrastructure

Bridge

X Layer can be accessed through third-party liquidity bridges such as RetroBridge, Rhino.fi, Meson, XY Finance, Owlto, and Orbiter, along with Polygon’s portal integration. Users should confirm official interfaces and contract addresses before moving assets and limit transfer sizes to manage exposure.

DEXs

Currently, there are 10 DEX protocols on X Layer, with the overall trading volume leaning towards PotatoSwap with around $18m USD volume. The list of existing DEXs includes:

- PotatoSwap ($14.39m), Curve Finance ($5m), DyorSwap ($4.76m), OkieSwap ($874,034), AbstraDEX ($637,929), LFGSwap ($521,554), iZUMi Finance ($227,871), Quickswap ($99,276), Revoswap ($69,370), JaceSwap ($41,401)

Lending

A few lending protocols are deployed on X Layer:

Tooling

- Bridging/Interoperability Protocols: 7 bridging/interoperability protocols support X Layer

- Cross-Chain: For cross-chain communication and messaging X Layer uses LayerZero and Connext

- RPC Node Services: RPC node services on X Layer include QuickNode, Blockdaemon, ZAN and Ankr

- Oracles/Data Services: Oracles and data services include Chainlink, API3, RedStone and SupraOracles.

CEXs

Currently, OKX appears to be the only major CEX with direct, native X Layer network support for deposits and withdrawals. Other exchanges may add support as the network grows in adoption and liquidity.

2.2 Liquidity Landscape

X Layer DEX liquidity is highly fragmented across several AMMs and routing aggregators. Depth shifts with mercenary TVL, so large trades are often split across multiple pools, which increases slippage and fee drag. The current list includes:

The team is preparing to seed $5 million of liquidity into X Layer DEX pools, targeting execution within a 5–8% slippage tolerance, following LlamaRisk recommendations. This increase is intended to support larger trades without destabilizing pricing, with the expectation that incentive programs associated with an Aave market launch will further deepen DEX liquidity.

Incentive program

The Pay rewards program on X Layer credits yield for holding USDC or USDT in the Pay balance. Accrual is automatic with monthly distribution and the reward rate can change or stop at the platform’s discretion. Eligibility requires keeping assets inside the Pay account on X Layer.

In addition, incentive programs are active for USDG with an advertised yield of around 4.1% APY, as well as for ETH/USD and xBTC/USD DEX LP tokens.

Fee structure

X Layer uses OKB as the gas token. Transaction fees are paid in OKB and are calculated on L2 as gas used multiplied by the gas price, with execution and fee enforcement occurring on the L2 sequenced chain. State and data are kept off chain in “Pessimistic Proof” (PP) mode, so routine user transactions do not include a separate Ethereum L1 data fee component.

There is no separate per-transaction Ethereum L1 blob fee in this configuration because X Layer runs on Polygon CDK’s Pessimistic Proof mode with external data availability. Routine transaction data is not posted to Ethereum L1, and the pessimistic proof mechanism is focused on securing the bridge’s accounting. Cross-chain actions such as withdrawals are settled on Ethereum through bridge contracts, and any L1 verification costs appear as bridge fees rather than as an additional charge on every L2 transaction.

2.3 Ecosystem Resilience

Grant program

As of today, OKX has active chain-specific incentives for X Layer, most notably a $100M “X Layer Ecosystem Fund” aimed at builders, along with liquidity incentives to attract projects. The fund was announced in late August and reiterated in OKX’s upgrade notes in mid-August, which also highlighted liquidity programs connected to the X Layer rollout.

Liquidity depth

Liquidity on X Layer is not yet deep at the ecosystem level. Depth is fragmented across many long-tail tokens, with limited concentration in high-quality base assets, which increases slippage and execution risk for institutional-sized orders until larger market makers, incentives, or cross-chain liquidity connectors scale up.

Source:

GeckoTerminal, September 29, 2025

2.4 Ecosystem Growth Potential

X Layer is developed by OKX as a payments-first L2 built on Polygon CDK. Its positioning centers on converting OKX exchange and wallet flows into on-chain settlement for everyday transfers and commerce. OKB functions as the gas asset, and OKX Pay routes stablecoin activity through X Layer, aligning the chain with a payments and settlements use case rather than yield-first DeFi.

This focus reflects an adoption path that connects existing OKX products with on-chain rails across retail and merchant scenarios. The emphasis is on low fees, high throughput, and tight wallet integration so that stablecoin movement and basic financial primitives can operate with minimal friction in the OKX environment.

X Layer integrates the Polygon CDK stack and connects to AggLayer for interoperability and shared verification. The OKX distribution surface, including the exchange, wallet, and Pay, provides an installed base that can seed liquidity and transactions. Ecosystem growth is expected to come from anchor integrations in payments, simple credit, and selected DeFi venues, supported by targeted funding and rewards that are builder- and utility-oriented.

2.5 Major and Native Asset Outlook

Source:

X Layer docs, September 30, 2025

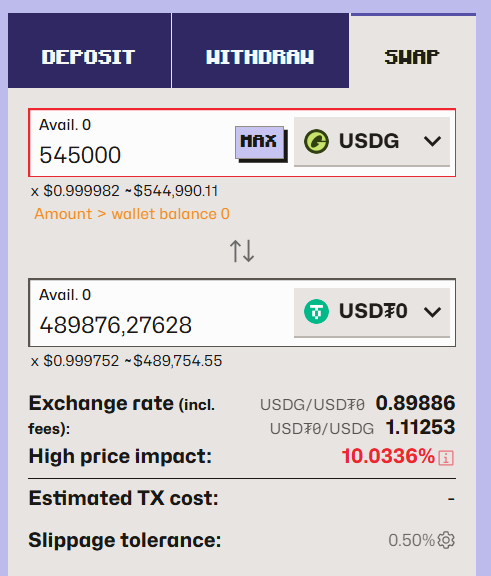

The list of major assets deployed on X Layer includes Wrapped OKB, Wrapped ETH, Wrapped BTC, xBTC, USDT, USD₮0, USDC, USDG, Bridged USDC.e and DAI. With USD₮0 being the biggest asset with $53.3m fully diluted market cap. The stablecoins total suppy is estimated at $84.1m, with 196k on DAI, 6.89m on USDC, 12.4m on USDT, 9m on USDG and 53.3m on USD₮0.

2.6 Tokenomics

OKB total supply is fixed at 21,000,000 following a single-instance burn of 65,256,712.097 OKB sourced from historical repurchases and treasury reserves that was executed on Aug 15, 2025, and a contract upgrade on Aug 18, 2025, that removed mint and burn functions on the L1 ERC-20 proxy. Implementation currently resolves to 0x81A4…E094 on Ethereum. X Layer uses OKB for gas via its L2 representation.

3. Onchain discoverability

Activity dashboards for X Layer are available on TokenTerminal and DefiLlama. Also there is an available subgraph for X Layer on TheGraph. DEX liquidity can be viewed through Geckoterminal. There is also available a Dune dashboard for general metrics about X Layer and Ethereum L1:

The OKX also developed and maintains a blockchain explorer for X Layer.

4. Impact of Aave Deployment

At present there is no competitive lending market on X Layer. Existing deployments such as ZeroLend, Dolomite, and Timeswap have very limited liquidity, with aggregate TVL in the tens of thousands, far below thresholds needed to support meaningful credit creation. This leaves most stablecoin and asset balances idle and constrains secondary markets.

An Aave v3 deployment would represent the first institutional-grade lending venue on the chain, setting the baseline for collateral standards, risk parameters, and market depth. Its arrival could anchor credit formation and provide the liquidity foundation for other protocols to build against.

Current activity levels on X Layer remain limited, and the chain itself is still early in its lifecycle. This raises concerns about whether liquidity, user adoption, and transaction flow will reach sustainable levels in the near term, as low activity could constrain lending demand and reduce the effectiveness of an early deployment.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.