Summary

Chaos Labs supports the launch of GHO on the Linea instance. The deployment has demonstrated rapid and sustained growth, with sharp increases in stablecoin borrowing, robust liquidity conditions, and persistent demand. These dynamics establish a favorable environment for scaling GHO supply while simultaneously strengthening protocol earnings.

Market Overview

In recent days, the Aave v3 instance on Linea has expanded by approximately $800 million in supplied assets, driven largely by inflows of WETH and stablecoins such as USDC and USDT.

Stablecoin borrowing demand has been particularly strong, with USDC and USDT accounting for approximately 40% of total outstanding debt. The introduction of GHO would allow this borrowing activity to be captured within the Aave ecosystem, deepening the utility of the Linea instance and reinforcing GHO’s position in the competitive stablecoin environment.

Stablecoin Borrowing

At the moment, the majority of stablecoin borrowing is facilitated by WETH collateral. The introduction of Native Yield, where bridged WETH earns staking yield, further increases the capital efficiency of similar strategies, implying additional demand for stablecoin borrowing.

Additionally, there is also evidence that a significant proportion of borrowers are using the assets to provide liquidity on Linea’s DEXs to capture elevated APYs. The availability of GHO on Linea would expand the set of stablecoins that can be deployed in these strategies, thereby facilitating additional borrowing activity. Participation is further reinforced by speculative positioning ahead of the anticipated Linea airdrop and the incentives expected to flow from the recently introduced Native Yield mechanism.

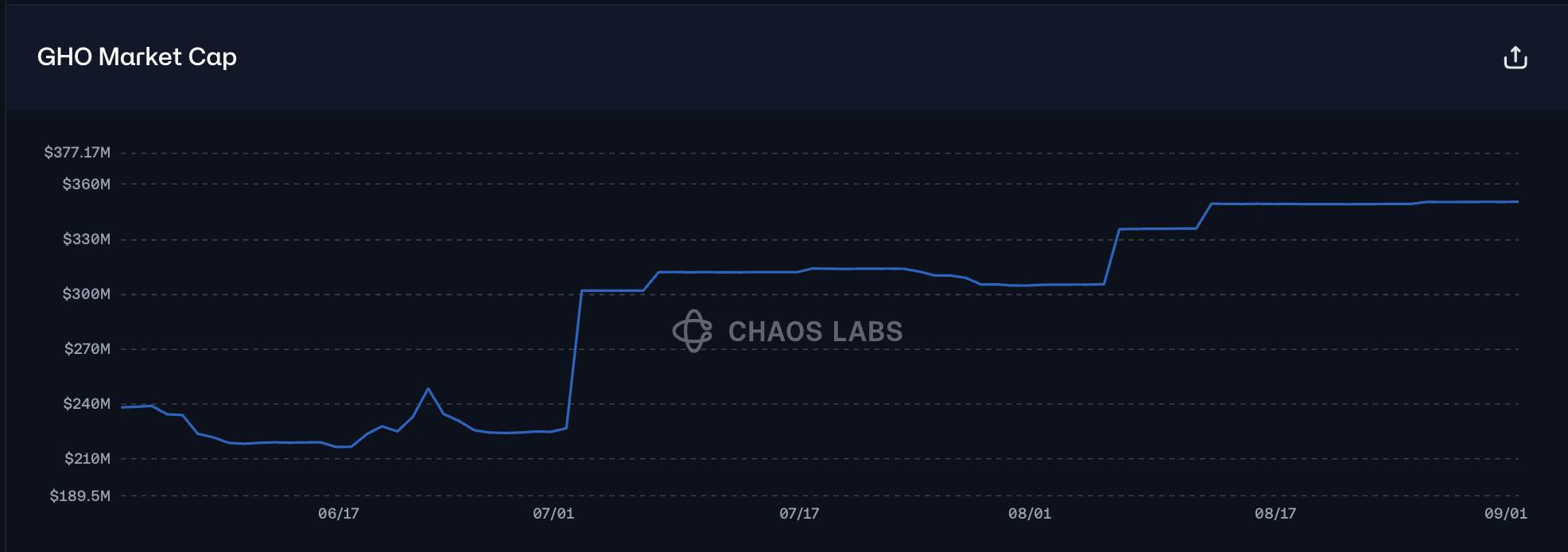

GHO Performance

In recent months, GHO’s market cap has grown by over $100 million, primarily due to increased demand for the Ethereum Prime instance.

While GHO has traded slightly below its peg, the dislocation has been minimal, averaging approximately 10 basis points with negligible variance.

GSM Implementation

We support the implementation of a stataUSDT0 GSM, we expect sufficient supply to be available at launch. With ample supply and market liquidity, stataUSDT0 is expected to be an effective stabilization asset for the GSM, capable of absorbing fluctuations around the GHO peg. Additionally, a large and more liquid USDT0 market will help keep interest rates for borrowing and lending USDT0 more stable and less prone to sudden spikes or drops.

Steward Authority Framework

The governance framework gives GHO Stewards the authority to adjust parameters within set boundaries, achieving a balance between flexibility and prudent risk management. This structure allows for timely updates to borrow caps, interest rates, supply caps, and GSM parameters within defined limits, enabling the system to respond quickly to changing market conditions while maintaining governance oversight. Experience from previous GHO deployments shows that this approach has effectively preserved stability during the early launch phase and supported growth.

Parameter Recommendations

Considering the rapid growth of the Linea instance, the structural demand for stablecoin borrowing, which is further enhanced by the introduction of Native Yield, and the demonstrated stability of GHO’s peg, we support listing GHO with the proposed parameters on the Linea instance to facilitate additional growth. Setting the initial supply cap at 5M and the borrow cap at 4.5M provides a balanced approach, limiting risk during the early adoption phase while maintaining sufficient liquidity.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0.