Summary

Chaos Labs supports launching GHO on the Plasma instance. Given the deployment’s strategic positioning for rapid expansion and Plasma’s focus on stablecoin activity, listing GHO at launch is well-timed to capture structural borrowing demand. We also support the proposed initial risk parameters, which mirror mature deployments such as Arbitrum and Base, and provide the necessary guardrails for listing on a new instance.

Motivation

Plasma is designed as a stablecoin-first, EVM-compatible blockchain; introducing GHO at launch positions it as one of the foundational stablecoins on Plasma. Given the recently proposed initial assets and substantial initial caps, listing GHO would provide additional utility to the deployment and position GHO for future expansion on the instance.

GHO Performance

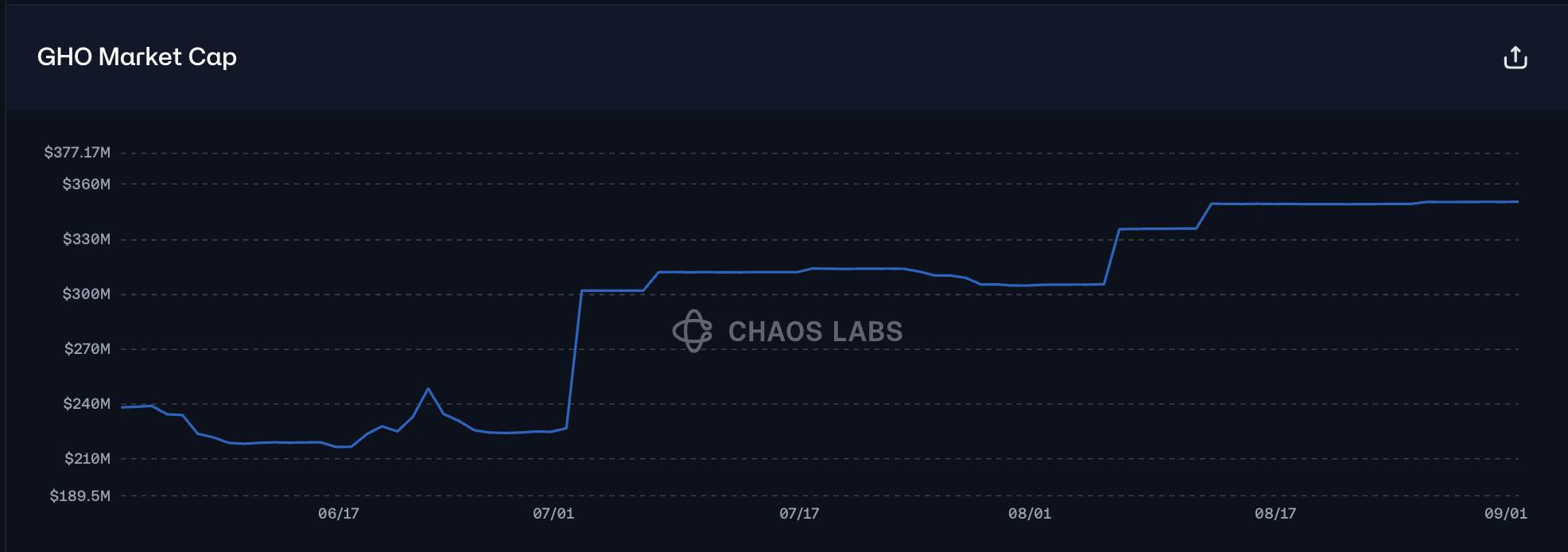

In recent months, GHO’s market capitalization has increased by over $100 million, driven primarily by demand in the Ethereum Prime instance.

Peg performance has been stable. Although GHO has traded slightly below par at times, the average dislocation has been modest—around 10 bps with limited variance—consistent with improving liquidity and adoption.

GSM Implementation

We support implementing a stataUSDT0-based GSM on Plasma and expect sufficient USDT0 supply to be available at launch. With ample supply and market liquidity, stataUSDT0 should be an effective stabilization asset for the GSM, capable of absorbing fluctuations around the GHO’s peg. Additionally, a larger and more liquid USDT0 market will help keep borrowing and lending rates more stable and less prone to sudden spikes or drops.

Steward Authority Framework

The governance framework gives GHO Stewards the authority to adjust parameters within set boundaries, achieving a balance between flexibility and risk management. This structure allows for timely updates to borrow caps, interest rates, supply caps, and GSM parameters within defined limits, enabling the system to respond quickly to changing market conditions while maintaining governance oversight. Experience from previous GHO deployments shows that this approach has effectively preserved stability during the early launch phase and supported orderly scaling.

IR

We additionally support the initial interest rate (IR) configuration, as it aligns with the broader stablecoin market, maintaining competitive pricing at Uoptimal, while being more sensitive to utilization changes before the kink than USDT0.

Recommendation

Given Plasma’s strategic positioning for rapid growth, the structural drivers of GHO borrowing, and the asset’s demonstrated peg stability, we support listing GHO at launch as it establishes GHO’s position in the ecosystem. The proposed interest-rate curve aligns with broader market conditions and other stablecoins, while the initial supply and borrow caps balance risk with growth opportunities—enabling meaningful early adoption with clear room to scale as demand accelerates.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.