Overview

Chaos Labs supports listing syrupUSDC on Aave V3’s Ethereum Core instance. Below is our analysis and risk parameter recommendations for the initial listing.

Protocol Overview

SyrupUSDC is Maple Finance’s liquid yielding dollar, a yield‑bearing stablecoin representing USDC deposits in Maple’s lending protocol. Depositors mint syrupUSDC by supplying USDC into Maple’s Syrup pool and receive an amount of syrupUSDC tokens according to the asset’s exchange rate. These tokens continuously accrue interest generated from Maple’s fixed‑rate, over‑collateralized loans to institutional borrowers. SyrupUSDC functions as an ERC‑4626 vault token representing a claim on the pool’s underlying USDC plus earned yield.

A delegate‑level management fee and a protocol fee are extracted from interest, and the pool can enforce a liquidity cap. There are no direct mint or redeem fees, and the pool is open access.

Maple Direct is the lending arm of Maple Finance, which conducts financial due diligence and agrees to terms with borrowers off chain. Maple Direct also manages the loan book, with a variety of alert and monitoring systems in place to promptly conduct margin calls and liquidations, discussed in more detail below.

Technical Implementation

The syrupUSDC token is implemented by an immutable MaplePool contract which stores the underlying asset address and a reference to a dedicated PoolManager. The PoolManager deploys liquidity into loans via LoanManager modules and coordinates withdrawals through a WithdrawalManager queue. MaplePool grants the manager an unlimited USDC allowance so that loan funding and withdrawal processing can transfer funds without additional approvals. Access control for every external call runs through the manager’s canCall hook, centralizing permission logic (liquidity cap checks, pause states, allowlist controls). All state‑mutating functions in MaplePool are made non‑reentrant.

Total pool value is tracked by the PoolManager as cash plus loan receivables minus unrealized losses. MaplePool’s totalAssets() simply forwards this value. Yield accrues by increasing the exchange rate between shares and assets; token balances themselves do not rebase. Two conversion rates exist: one for deposits (ignores unrealized losses) and one for withdrawals (deducts unrealized losses), preventing timing games around defaults. There are no unrealized losses in the pool, and thus the two values are currently equal. Interest payments arriving from loans first route delegate and protocol fees to their recipients, with the remainder raising totalAssets.

Additionally, when depositing, users are given the option to deposit USDC with no time commitment, a 3-month lockup (earning 1.5x Drips, Maple’s incentives), or a 6-month lockup (earning 3x Drips).

Mint and Redeem Mechanics

Minting

- A user calls either

deposit(assets, receiver)ormint(shares, receiver). - The manager confirms deposits are allowed, the liquidity cap is respected, and the pool is not paused.

MaplePoolcalculates the shares to mint from the current deposit exchange rate, performs the bootstrap‑mint safeguard if the pool was empty, mints the shares, and transfers in USDC from the sender.- The user receives syrupUSDC immediately; no lockup or fee applies.

Queued withdrawal

- The user calls

requestRedeem(shares, owner)to enter the queue. - The specified shares move to the

WithdrawalManagerescrow while continuing to earn yield. - The

PoolManagerservices queued requests FIFO whenever liquidity becomes available from loan repayments and new deposits, or uses liquidity from strategies like Aave or Sky, callingredeemon behalf of the escrow to deliver USDC to the user. - Users may cancel a pending request via

removeShares(shares, owner)if it has not been processed.

There is no fixed cooldown beyond the queue wait time; users can also trade syrupUSDC on secondary markets for immediate liquidity.

In practice, the vast majority of redemptions are completed in under one hour, as the chart below illustrates. The blue line indicates the aggregate value of redemptions that have been completed as hours elapsed increases, while the color of the individual redemptions indicates when they were processed — red indicates it was early in syrupUSDC’s history, green indicates it was a recent redemption.

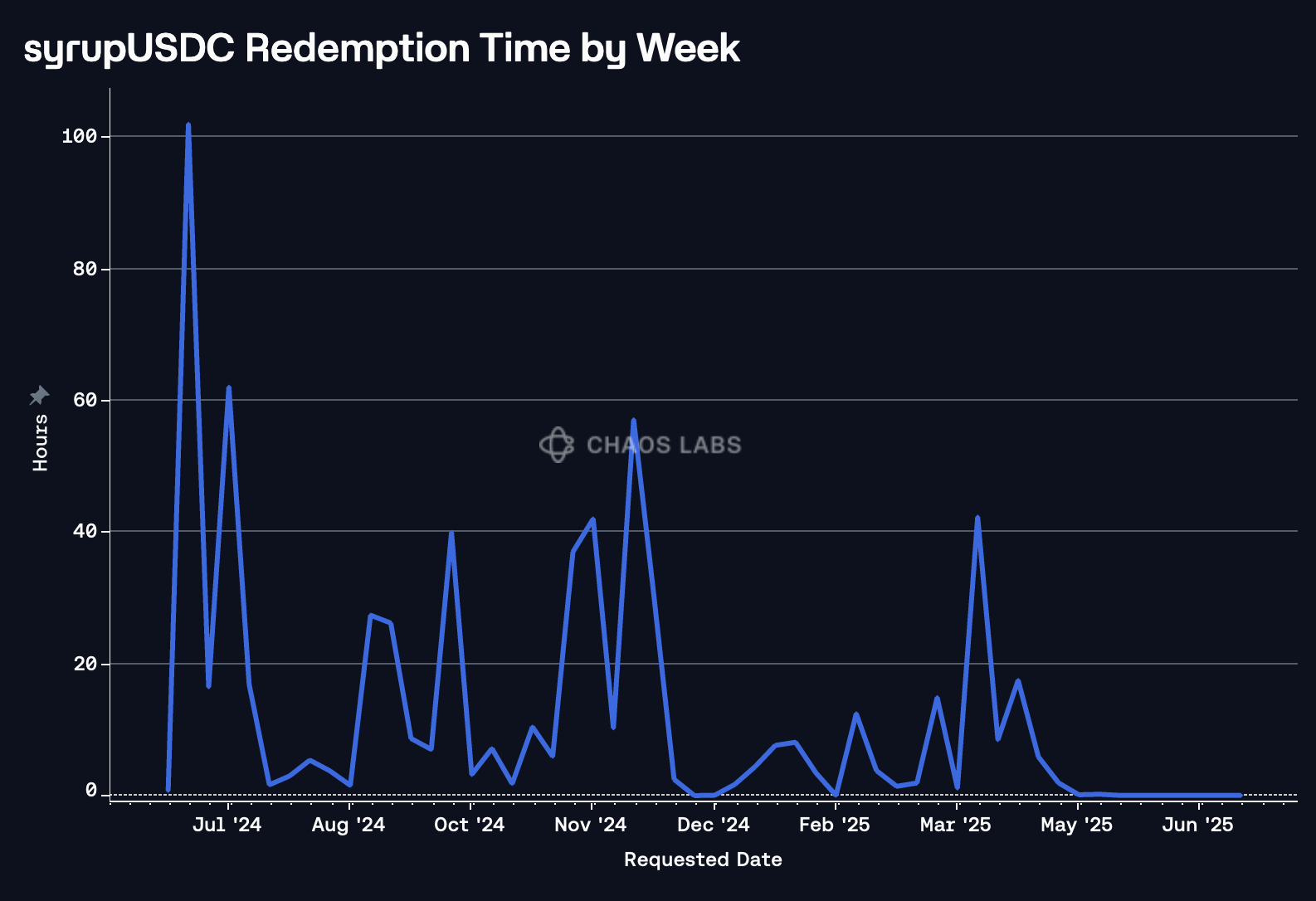

Displayed another way, with average redemption time (weighted by size of redemption) plotted over time, it is clear that syrupUSDC’s redemption time has improved significantly in recent weeks.

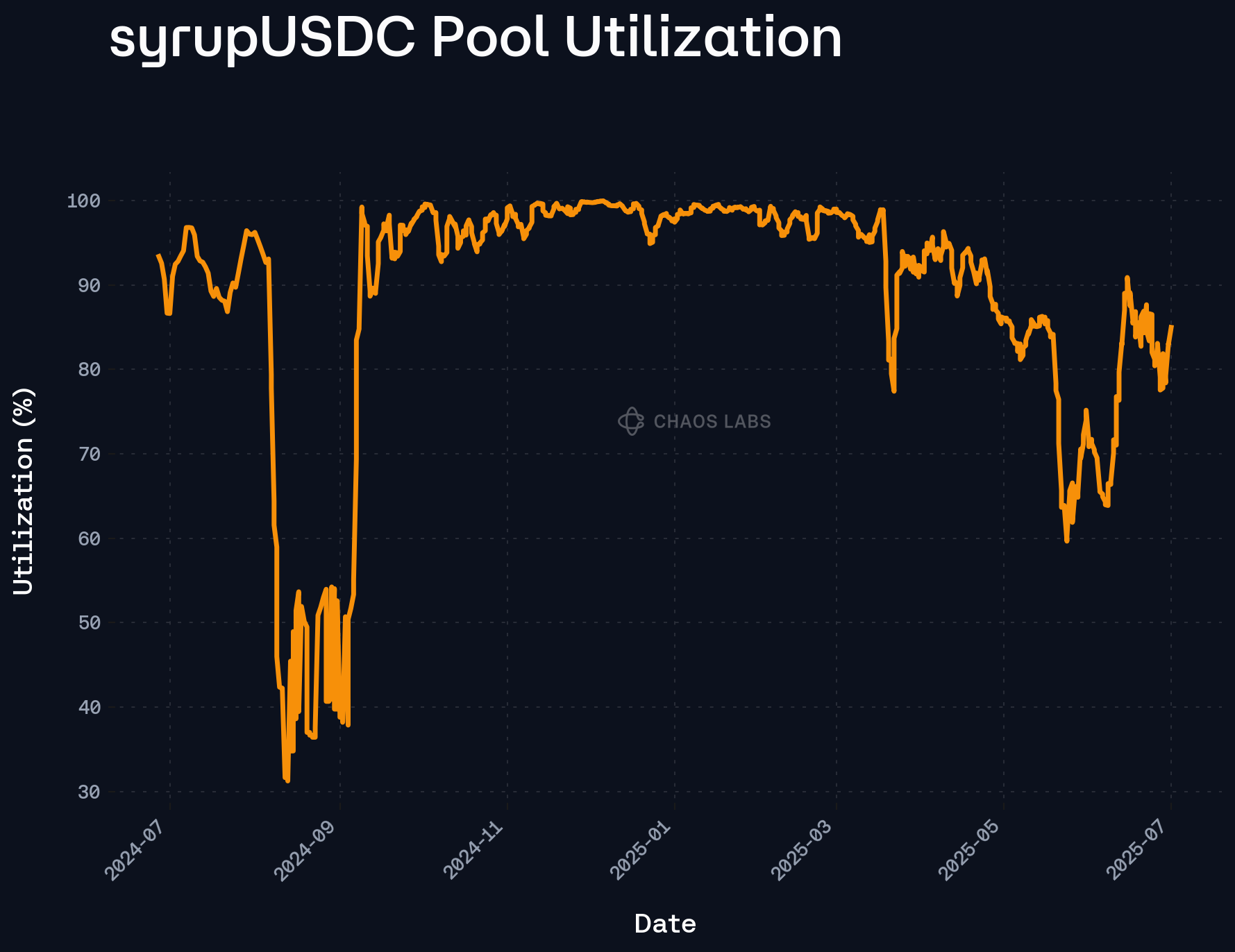

This faster redemption time has coincided with rapid new deposits, leading to a lower overall utilization of the pool, providing significantly more liquidity available for rapid withdrawals.

Security Features

The pool’s loans are over‑collateralized, and a PoolDelegateCover theoretically supplies a first‑loss buffer. However, as stated in the documentation, the PoolDelegateCover is currently unused, as Maple Direct manages most pools and ensures collateralization levels.

MaplePool itself is immutable; PoolManager and supporting modules are upgradeable through time-locked, governed proxies. MapleDAO can invoke emergency pauses or parameter changes, while Pool Delegates manage individual pools under protocol‑level limits. Reentrancy guards, hardened token‑transfer helpers, and a one‑time bootstrap mint mitigate common smart‑contract attacks; the design has undergone multiple third‑party audits.

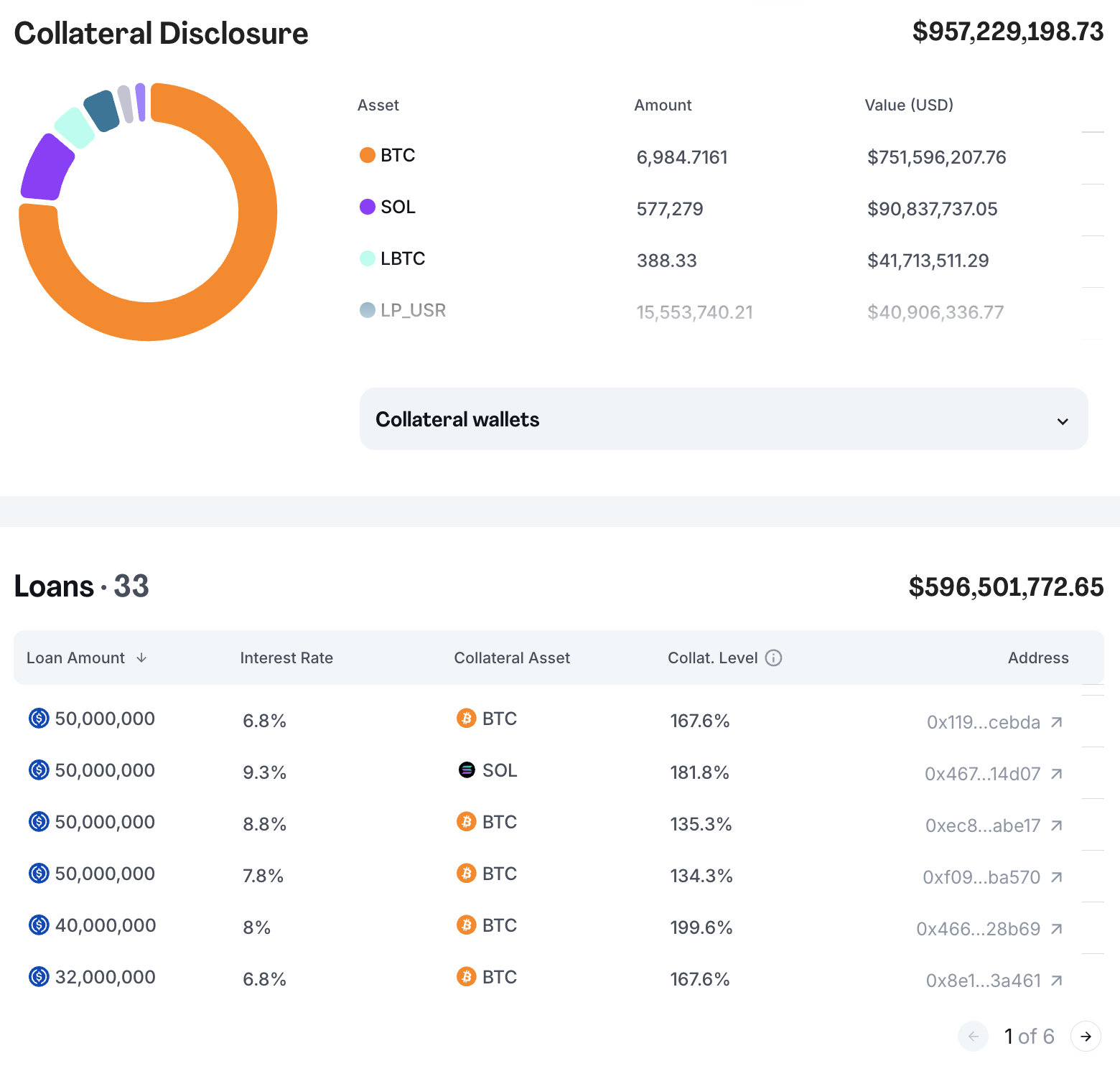

Underlying Assets

Collateral backing USDC and USDT loans on Maple currently total $957M, with $596M of stablecoins borrowed; this results in an overall collateralization ratio of 160% ($957M collateral supply/$596M borrowed). BTC represents the vast majority of collateral assets within the pool. Maple’s dashboard provides details on the loans provided and collateral wallets.

app.maple.finance/earn/details

Overall, BTC represents the vast majority of collateral on the book, followed by SOL. As expected, the average collateralization ratio for each collateral asset differs, with SOL’s slightly higher than BTC’s, while stablecoins have the lowest.

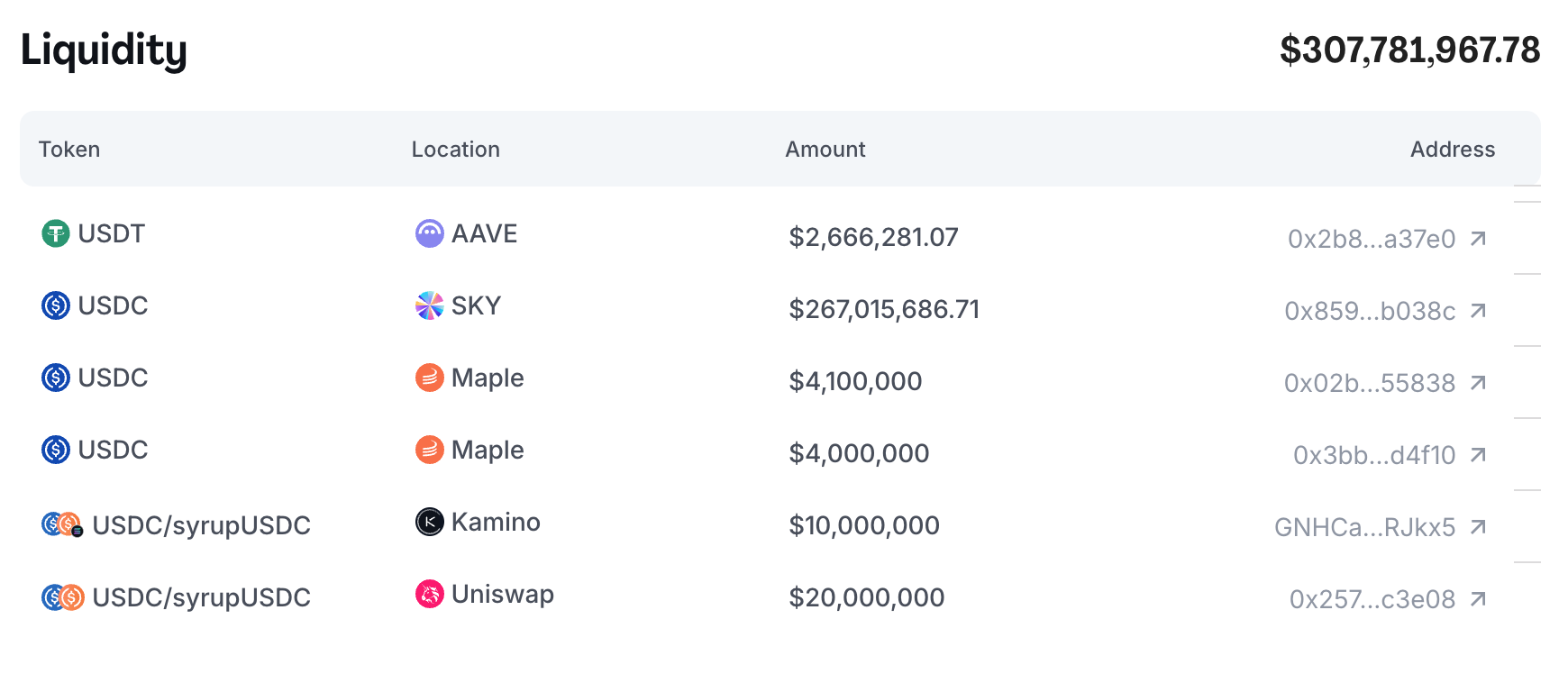

There is an additional $307M deposited across DeFi protocols, primarily SKY ($267M USDC), with additional deposits in liquidity pools and $2.67M USDT supplied on Aave.

Loan Contracts

Maple loans are instantiated as minimal proxy contracts created through the FixedTermLoanFactory or OpenTermLoanFactory (at this time there are only open term loans for syrupUSDC). Fixed Term loans, would set a defined date by which the loan must be repaid, whereas Open Term loans can be maintained in perpetuity.

At origination, the borrower provides core terms, including principal amount, interest rate, payment interval, and fee rates, which the factory records and then deploys a new proxy.

Funding occurs when the LoanManager calls fundLoan (fixed‑term) or fund (open‑term); this pulls USDC from the MaplePool into the loan contract and immediately transfers the proceeds to the borrower’s wallet via drawdownFunds. Once funded, the loan tracks state variables such as principal, interestRate, paymentInterval, andnextPaymentDueDate .

Repayments are made through makePayment: the borrower supplies USDC equal to scheduled principal plus interest. The function allocates the payment across principal, interest, and fees, updates principal and paymentsRemaining, and emits accounting events. If the borrower pays late, lateFeeRate and lateInterestPremiumRate automatically increase the owed amount from the original due date until payment.

Both fixed‑ and open‑term variants permit refinancing via proposeNewTerms/acceptNewTerms, enabling updated rates or schedules without deploying a new contract. Each loan proxy can be upgraded through migrate if Maple governance approves a new implementation, but critical economic parameters remain immutable after funding to protect both parties.

Liquidations and Principal Calls

When a loan fails to meet the designated payment due date, the borrower is notified and has a predetermined amount of time (referred to as the “grace period”, plotted below), generally 48 hours, to perform the payment, together with an incurred late payment fee. In the case in which the borrower does not meet the late payment within the grace period, and Maple Direct holds the belief that the borrower is insolvent, the Pool Delegate can liquidate the underlying collateral and repay the loan. In the unlikely case in which the collateral is not sufficient to cover the entirety of the debt, the Pool Delegate will call impairLoan (fixed‑term) or impair (open‑term) to initiate a default and the unrealizedLosses variable would be updated to reflect the lack of collateral.

Additionally, every loan agreement defines a margin call and a liquidation level. At the reach of the first level, the delegate will issue a margin call to the borrowers, requiring them to provide additional collateral or repay the loan within 12-24 hours from the notice.

Critically, suppose price moves cause LTV to reach the liquidation level. In that case, the delegate has the contractual right to bypass notice times and initiate an off-chain liquidation through market-maker agreements. In the case in which the collateral recovered is not sufficient to cover the entire debt, the Pool Delegate will once more use the proceeds to partially repay the loans and initiate an impairment on the remaining shortfalls, which would be reflected in unrealizedLosses.

This immediate liquidation provides an important backstop and prevents a scenario in which large price declines over 12-24 hours cause a position to accrue bad debt following a margin call.

Only one partial liquidation has been performed as of today of a BTC-backed loan; however, there have been no losses to syrupUSDC. The team has occasionally published reports after high volatility events, providing details on margin calls and liquidations; after mass liquidations on February 2, 2025, 35% of loans in the Syrup pool received margin calls and all margin-called borrowers supplied additional collateral to avoid liquidation.

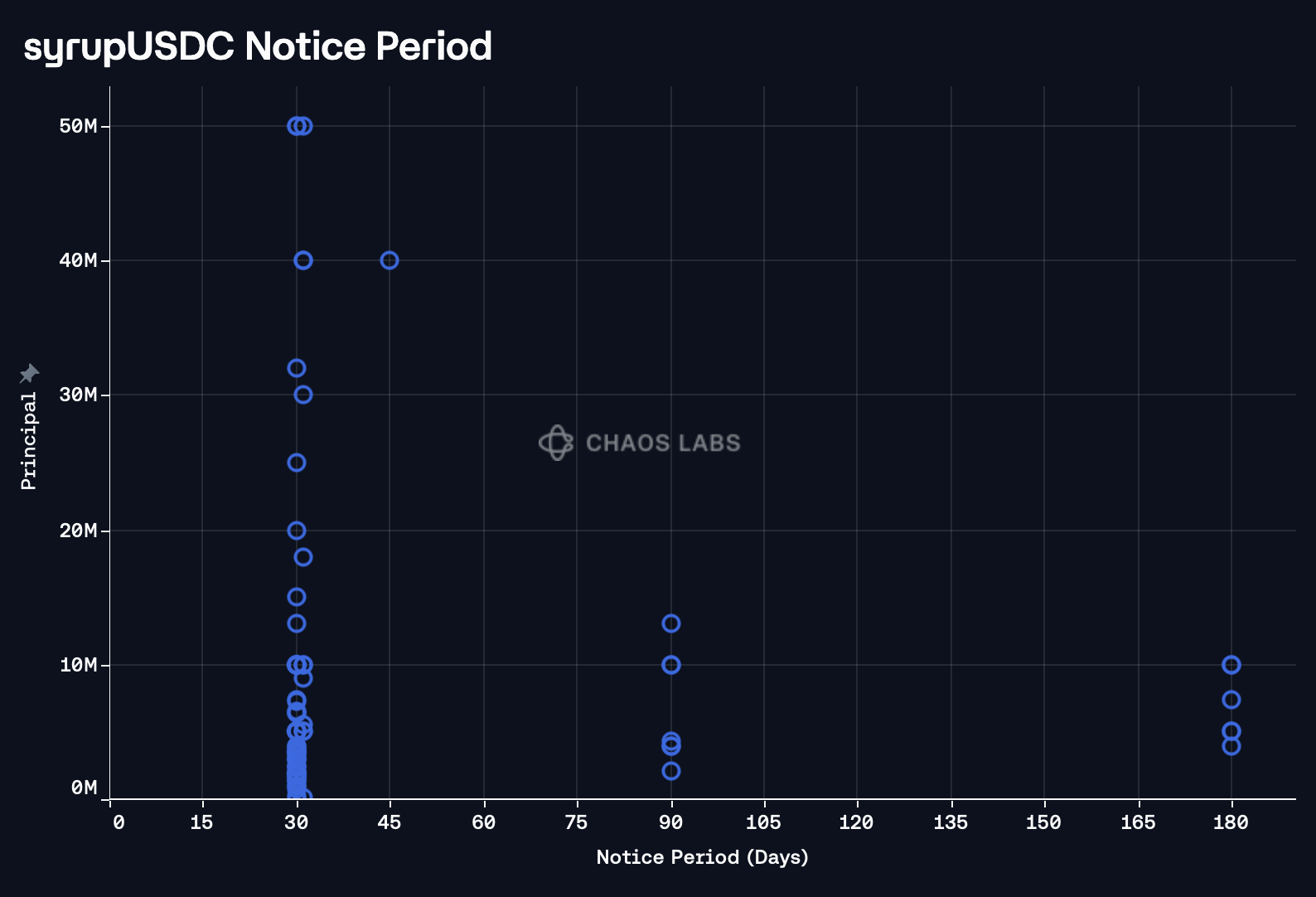

Additionally, open‑term loans support callPrincipal, letting the delegate demand partial repayment by a notice deadline. The amount of time a borrower has to repay their position after a call is dictated by the “notice period”; this value is set to 30 days or longer, however, it can be set to be as short as 2 days.

Unrealized Losses

As long as a loan is current and not impaired, the manager records no unrealized loss. When an impairment event occurs, either because a repayment deadline is missed after its grace period or because a margin call triggers liquidation, Maple first liquidates the posted collateral and applies the sale proceeds directly to the outstanding balance. Only the residual principal (including any accrued interest) that remains after this partial repayment is recognised as a shortfall and booked to unrealizedLosses. In other words, unrealizedLosses equals the difference between the original debt and the realised collateral proceeds, not the full notional of the loan.

After impairment, Maple seeks voluntary repayment from the borrower. If the borrower covers the shortfall unrealizedLosses is reversed in full, and the two exchange-rate paths (convertToAssets and convertToExitAssets) reconverge.

Failing swift settlement, Maple initiates formal legal recovery, a process that can span several months. In this instance the losses get realized and the two exchanges align to the lowest value between the two. Any recovery obtained later is injected back into the pool and offset the realised loss retroactively.

Because unrealizedLosses is calculated only on the net deficit after collateral realisation, it provides a close approximation of potentially unbacked exposure to the borrower. Nevertheless, during the legal-recovery phase, the variable can still overstate final losses if subsequent recoveries are expected, so its inclusion in external risk metrics such as Aave’s convertToExitAssets versus convertToAssets still warrants caution.

Comparison to Aave

The chart below displays USDC borrow rates on Aave V3 Ethereum Core, with dots overlayed representing newly initialized loans on Maple (size corresponds to principal amount).

The fixed rate dynamic of Maple carries with it a relatively significant premium, in which borrowers are routinely paying roughly double USDC’s borrow on Aave. This premium is likely caused by a combination of the borrower’s legal bounds, which impair them from accessing DeFi lending markets such as Aave, or the inability to wrap native assets. The collateralization levels of loans are similar to Aave; the lowest BTC-collateralized loan on Maple currently stands at an LTV of just under 77%, below Aave’s LT of 78%.

Market Cap and Liquidity

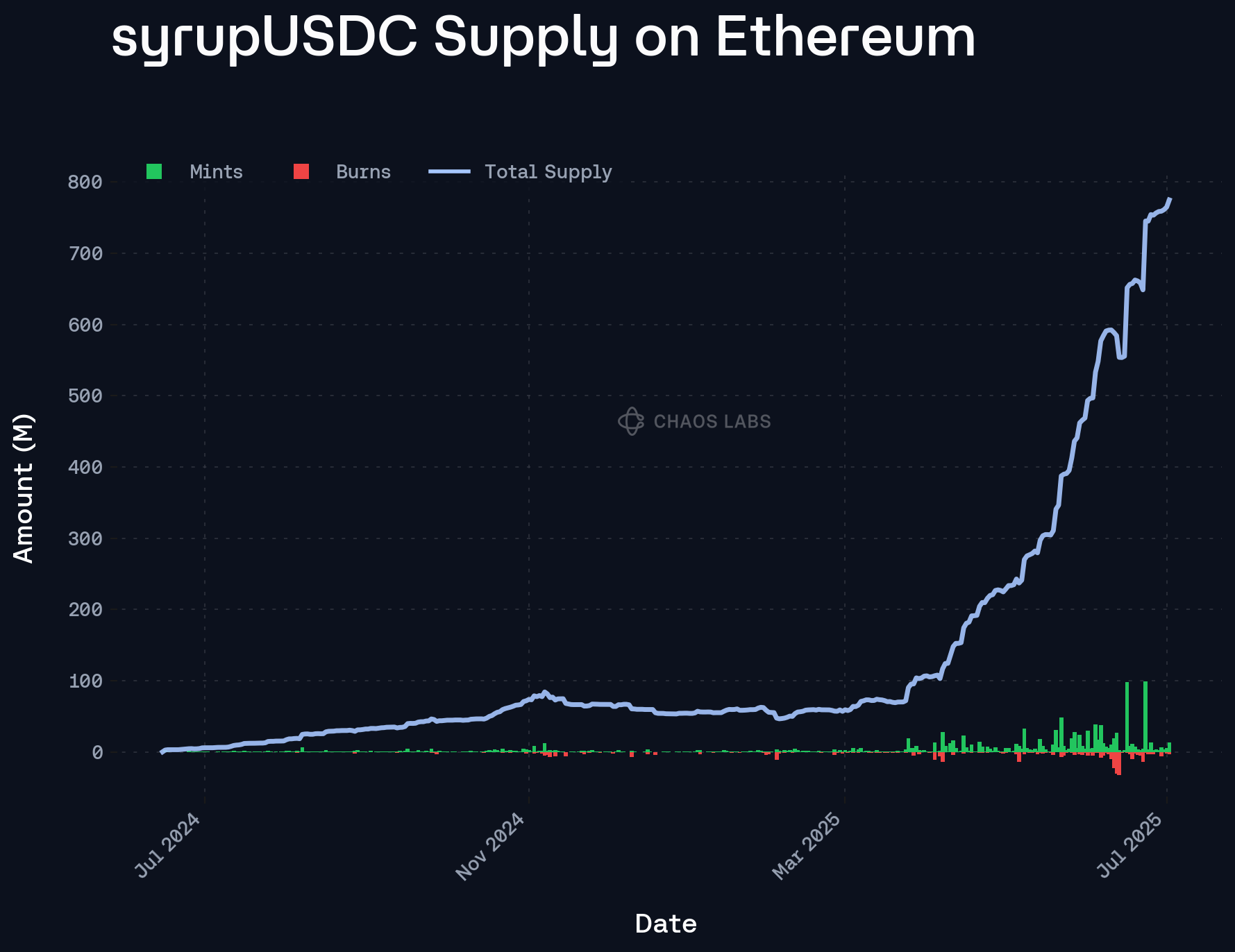

syrupUSDC’s supply has surged in recent months and is currently approaching 800M. There is an additional 58M on Solana.

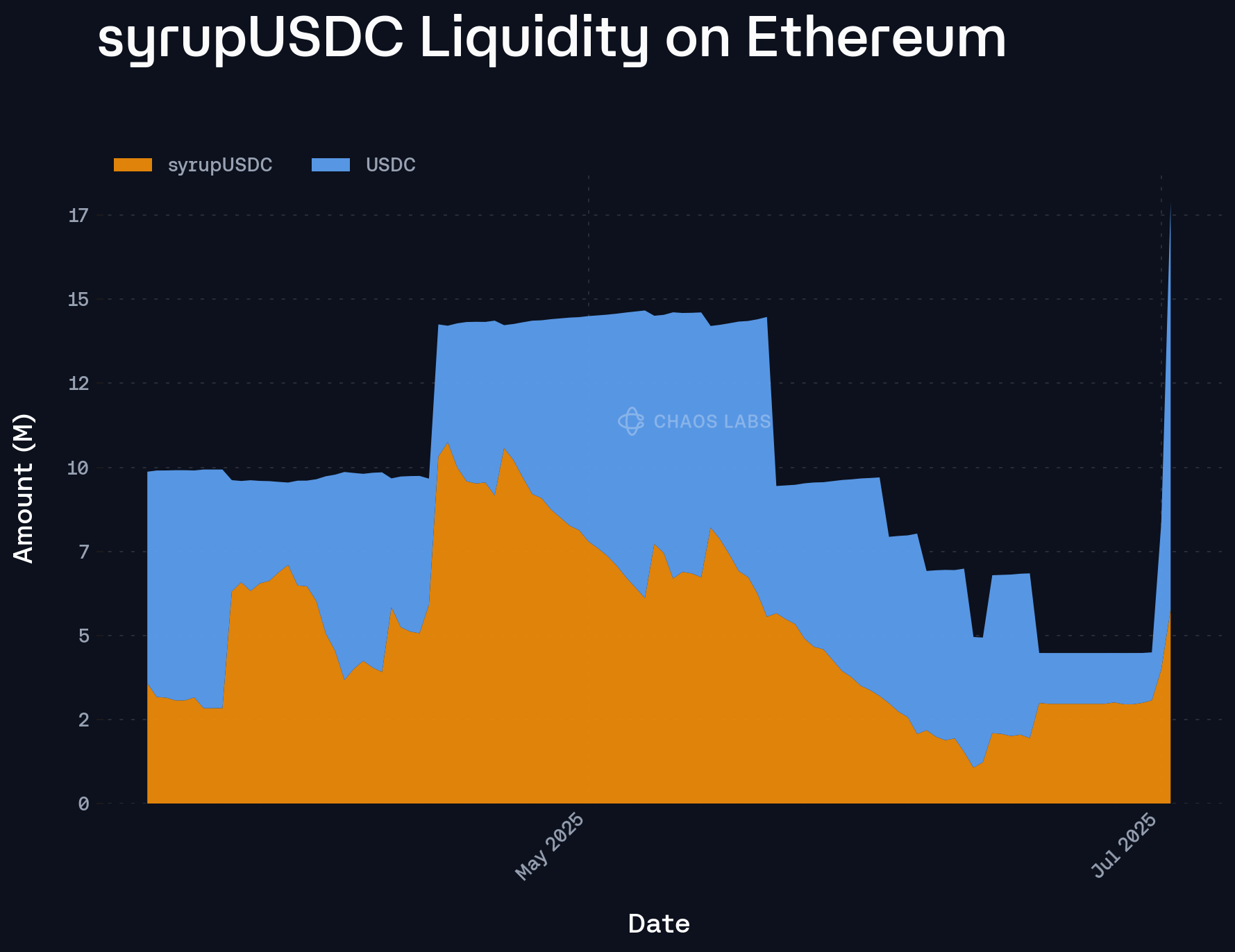

The asset’s on-chain liquidity has been somewhat limited and volatile, though it recently improved significantly with the funding of a new Uniswap V4 pool.

The asset’s on-chain liquidity is sufficient to support a listing, especially when considering its rapid redemption time. This timeliness has also helped support the asset’s on-chain market price, which has displayed no significant and persistent depegs from the asset’s exchange rate.

Risks

The primary economic risk associated with syrupUSDC is that redemptions in a short period of time exceed the amount of relatively liquid assets held as underlying (such as deposits in Aave and Sky), currently just under $300M when excluding DEX liquidity pools containing syrupUSDC and USDC. In this event, Maple would be required to facilitate redemptions by calling principal, in essence notifying borrowers that their otherwise healthy positions will be closed. In this hypothetical event, Maple would have access to significant liquidity after 30 days, and likely much sooner, when borrowers either repay their position or are closed out.

Parameter Recommendations

Liquidation Threshold and Bonus

The asset’s strong peg, robust controls, and over-collateralization indicate that it is appropriate to list the asset with a relatively high LT. However, taking into account that it yield-bearing stablecoin, and thus will primarily be used as collateral for other stablecoins, we recommend limiting its general LT, while selectively creating E-Modes that allow for this use case. Outside of E-Mode, we recommend a 78% LT and 6% LB.

E-Mode

We recommend listing the asset in an E-Mode with major stablecoins, allowing for users to efficiently leverage the asset and generate yield. The parameters for this E-Mode are provided below and are determined using syrupUSDC’s observed deviations from its exchange rate.

Supply and Borrow Cap

Taking into account the on-chain distribution of syrupUSDC liquidity, we recommend listing with an initial supply cap of 50M. Additionally, given the asset’s characteristics, we do not recommend allowing the asset to be borrowed.

Oracle Implementation

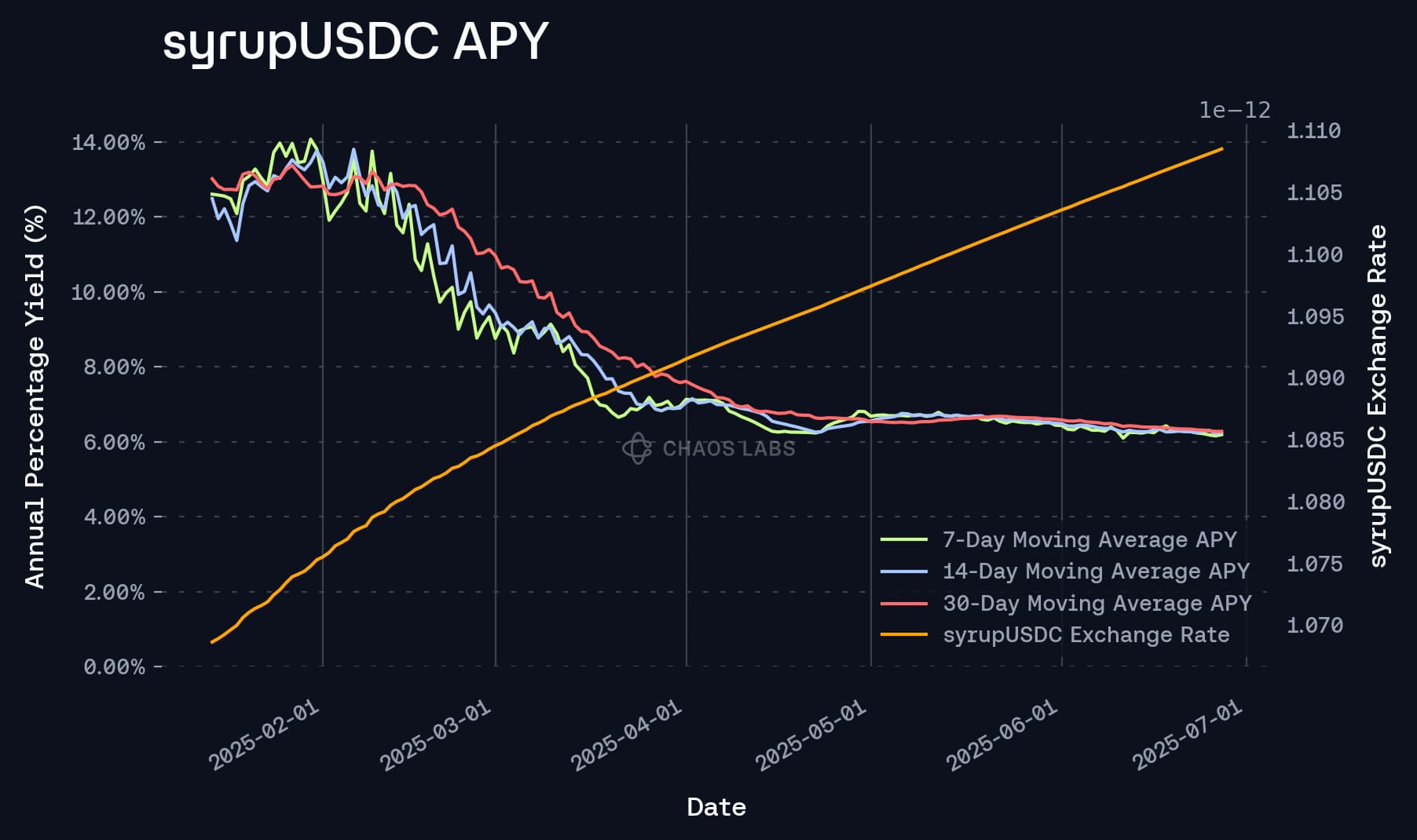

We recommend utilizing the USDC/USD oracle, augmented with the convertToExitAssets value in syrupUSDC’s contract. In the event of any practical deficit observed within any of the debt positions on Maple post-liquidation, this exchange rate will be altered to account for the underlying shortfall. This will additionally be protected using CAPO, with parameters provided below.

However, while convertToExitAssets does accurately represent the deficit of the syrupUSDC pool, the liquidation process may lead the market price of syrupUSDC to effectively anticipate the loss. This could lead to users speculating on the future loss by taking loans against syrupUSDC collateral prior to the exchange rate update. While an unlikely situation, given the distribution of collateral assets within Maple’s protocol, this poses a risk of bad debt.

Hence, moving forward, we aim to work in parallel with Maple in an effort to obtain relevant information about the state of the collateralized debt positions residing on the balance sheet and react accordingly in the context of risk parameterization.

Specification

| Parameter | Value |

|---|---|

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 50,000,000 |

| Borrow Cap | - |

| Debt Ceiling | - |

| LTV | 73% |

| LT | 78% |

| Liquidation Bonus | 6% |

| Liquidation Protocol Fee | 10% |

| Variable Base | - |

| Variable Slope1 | - |

| Variable Slope2 | - |

| Uoptimal | - |

| Reserve Factor | - |

E-Mode

| Parameter | Value | Value | Value | Value |

|---|---|---|---|---|

| Asset | syrupUSDC | USDC | USDT | USDS |

| Collateral | Yes | No | No | No |

| Borrowable | No | Yes | Yes | Yes |

| Max LTV | 90.00% | - | - | - |

| Liquidation Threshold | 92.00% | - | - | - |

| Liquidation Bonus | 4.00% | - | - | - |

CAPO

| maxYearlyRatioGrowthPercent | ratioReferenceTime | MINIMUM_SNAPSHOT_DELAY |

|---|---|---|

| 19.94% | monthly | 7 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0