Overview

Chaos Labs supports listing syrupUSDT on Aave V3’s Plasma instance.

This asset is the sister product of syrupUSDC, issued by Maple Finance under the same protocol architecture, and thus shares its core design, minting, redemption, and accounting logic. We have provided a comprehensive technical overview of the system, which can be found here.

However, syrupUSDT exhibits distinct structural and backing characteristics that merit separate consideration, primarily stemming from its integration with Aave’s aethUSDT market and reserve composition.

Protocol Overview

Like syrupUSDC, syrupUSDT is a liquid yielding stablecoin built on top of Maple’s institutional lending platform.

It represents a claim on deposited USDT within Maple’s Syrup pool, accruing yield from over-collateralized loans extended to institutional borrowers. syrupUSDT conforms to the ERC-4626 vault standard, with share balances representing proportional claims on underlying assets. Meanwhile, syrupUSDT on Plasma leverages CCIP for its cross-chain infrastructure, which stems from its parent on Ethereum.

As syrupUSDT on Plasma represents a bridged version of its Ethereum counterpart, it cannot be natively minted or redeemed on the chain and might incur minimal price deviation. These deviations are expected to be quickly compensated for by cross-chain arbitrage.

All core features, including the immutable MaplePool, PoolManager governance layer, and WithdrawalManager queue system, remain identical to syrupUSDC. Depositors mint syrupUSDT by supplying USDT to the Syrup pool and receive yield-bearing tokens that appreciate over time via an increasing exchange rate.

As with syrupUSDC:

- No mint or redeem fees apply.

- Deposits and withdrawals are permissioned only by pause states and liquidity (cap) checks.

- Users can select flexible or locked deposits (3-month or 6-month) to earn boosted Drip incentives.

Market Performance and Liquidity

syrupUSDT has experienced rapid adoption over the past few weeks, particularly on Plasma, where deposits have surged in tandem with syrupUSDC. The asset now holds over $450 million in aggregate deposits, with approximately 85% effectively concentrated in Plasma.

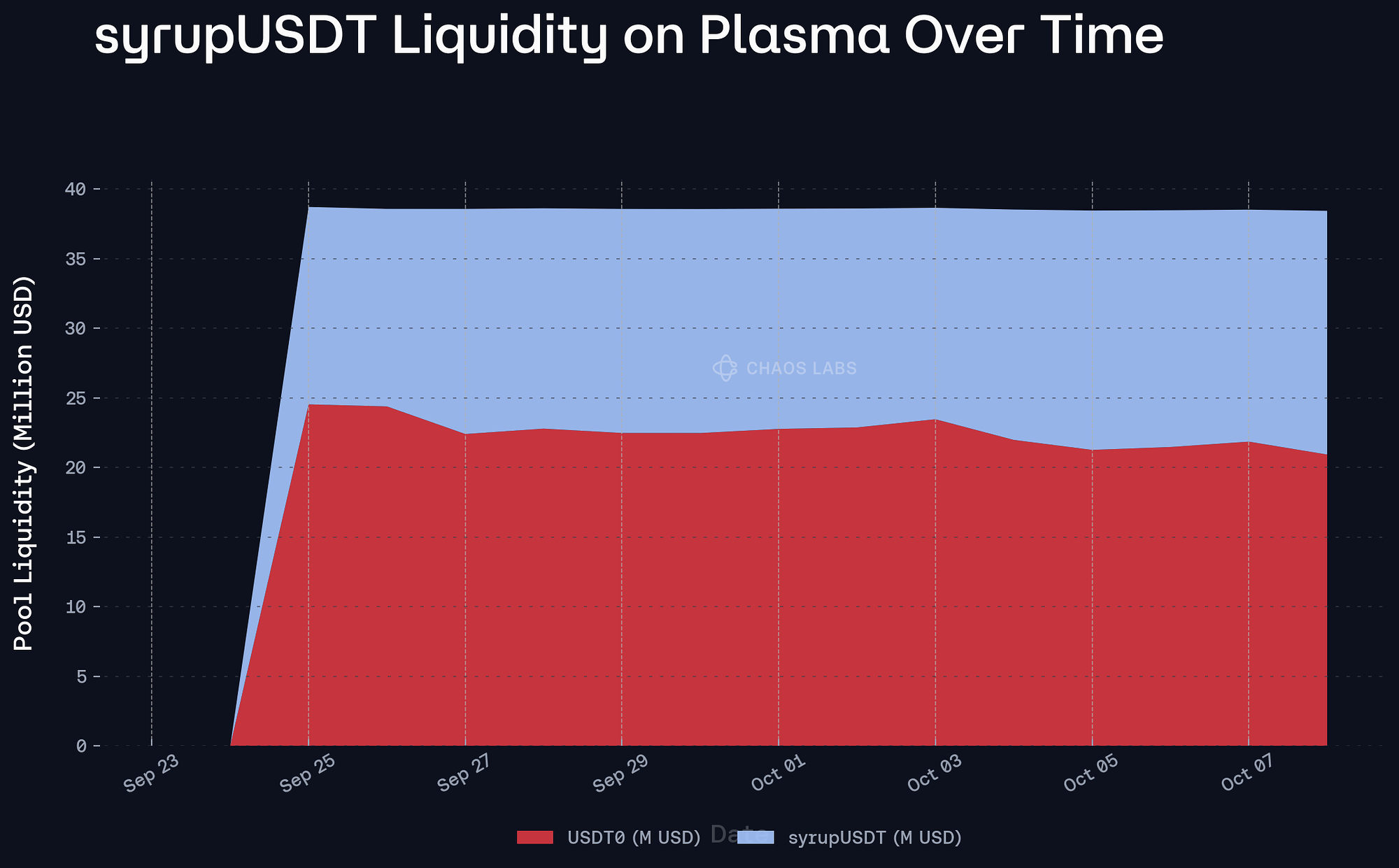

As of October 8, 2025, the total DEX liquidity for syrupUSDT on Plasma has stood at approximately $38.4 million, comprising around $20.9 million in USDT0 and $17.5 million in syrupUSDT-owned liquidity on Fluid. Over the observed period, liquidity levels have remained around such levels.

The asset has consistently traded at a slight premium to its peg, maintaining a range within approximately 10 basis points. This persistent premium reflects sustained and considerable market demand, which has supported price stability above the reference level despite normal fluctuations in liquidity and trading activity.

Key Differences in Backing and Liquidity Dynamics

aethUSDT as Primary Backing

Currently, roughly 42% of syrupUSDT’s effective reserves are deployed as aethUSDT, implying that syrupUSDT indirectly represents USDT deposited into Aave’s Ethereum Core market. This structure introduces a recursive element; a portion of syrupUSDT’s backing is itself yield-bearing Aave deposits, yet it also enhances liquidity and stabilizes redemption performance.

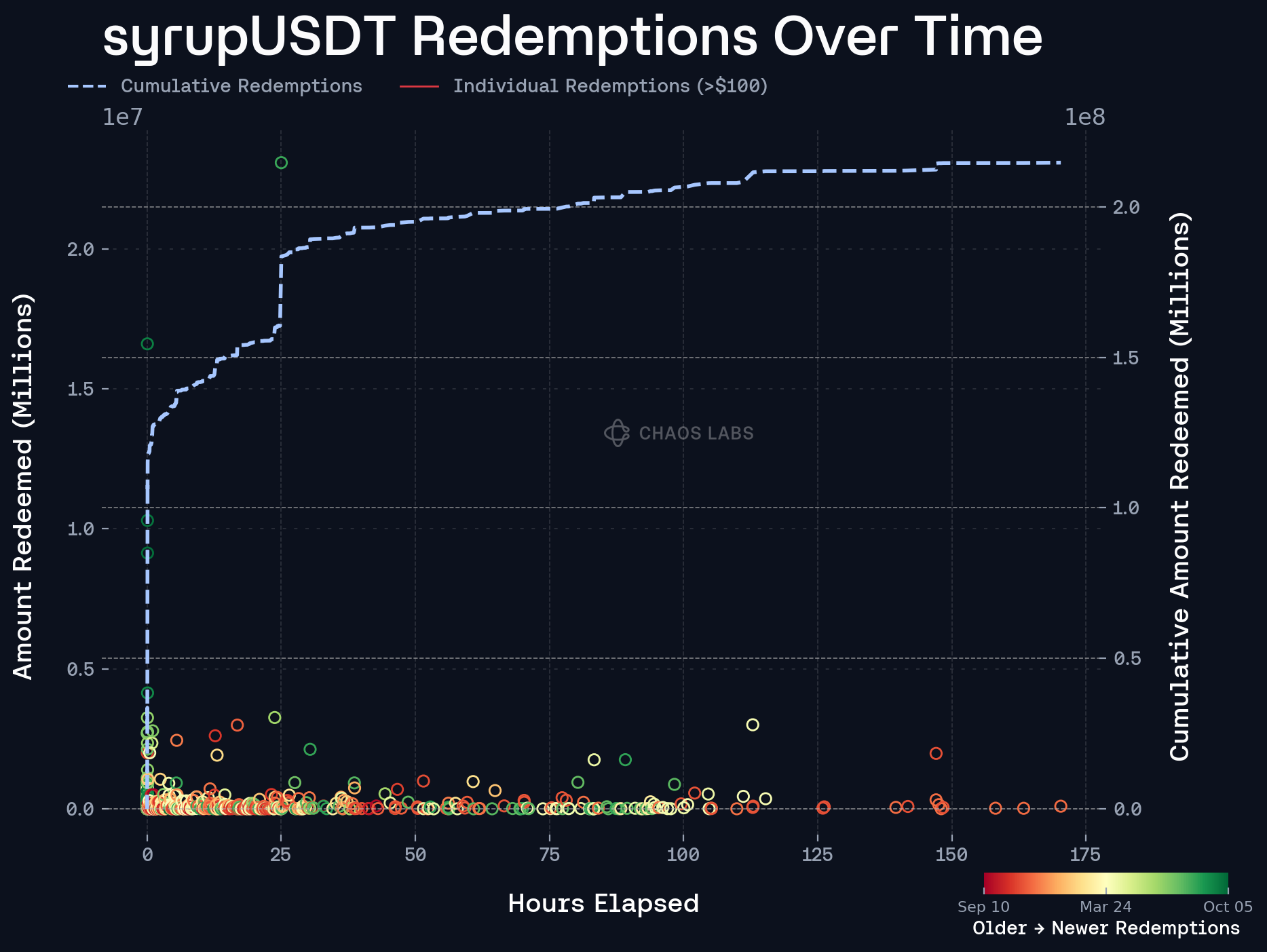

Empirically, redemption requests are processed near-instantaneously in expectation, as Maple can pull liquidity directly from Aave rather than relying solely on slower fixed loan repayments. For instance, the historical median redemption time is just 3.6 minutes, while 75% of redemption volume has been credited in a day.

Unlike Ethena’s liquid model, Maple does not maintain large additional liquid stablecoin reserves for redemption crediting. Instead, redemptions are funded primarily through the aethUSDT reserve layer, dynamically managed to ensure short settlement times. In the plot below, this is illustrated, whereby the time delta between redemption requests being created RequestCreated , followed by a withdrawal in the underlying aEthUSDT strategy StrategyWithdrawal , followed by the crediting of the redemption request RequestProcessed.

On average, the time between a RequestCreated and the corresponding StrategyWithdrawal is just 3 minutes, or 15 blocks. Following that, the time between a StrategyWithdrawal and a RequestProcessed averages just three blocks, or 36 seconds, indicating that once the withdrawal occurs, processing typically completes almost immediately.

A key concern in this recursive setup is that mass syrupUSDT redemptions could induce outflows from Aave’s Ethereum USDT market, potentially impacting rates and liquidity. However, the integration of our Slope2 Risk Oracle, mitigates this risk by:

- Gradually scaling the variable rate slope2 in response to deviations from the optimal utilization rate.

- Dampening artificial spikes in borrow rates caused by sudden supplier withdrawals.

- Stabilizing utilization volatility, preventing feedback loops between syrupUSDT redemptions and Aave’s interest rate model.

Additionally, the Umbrella Reserve on the aethUSDT market acts as a systemic buffer, minimizing outstanding risk exposure stemming from syrupUSDT; a hypothetical shortfall would remain contained, subject to nominal umbrella deposits (~$120M). Given that the aethUSDT market is dominated by a few large entities (e.g., Huobi, Ethena), the introduction of an additional entity via a combination of scaling and reserve mechanisms counterintuitively reduces concentration risk by smoothing withdrawal impact across time. Nonetheless, Chaos Labs will closely monitor the share of syrupUSDT’s total backing allocated to aethUSDT to ensure the structure remains sustainable and uncorrelated to other large market actors.

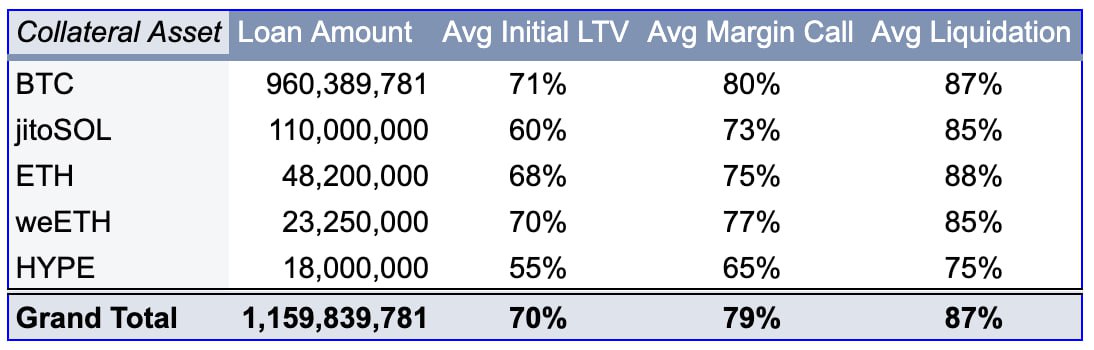

Aggregate USDT Debt Collateral Distribution and Underlying Risk Parameter Configuration

As the Maple Loan book effectively operates as overcollateralized Credit Lending, backstopped via an efficient internal liquidation mechanism in the event that the loan-to-value ratio of a respective debt position scales above specified thresholds, in addition to reputational exposure stemming from such entities, the protocol enables varying risk parameters in accordance with the underlying collateral asset as well as the entity. As sourced from the Maple team, the table below presents the aggregate debt positions for both syrupUSDC and syrupUSDT, along with their respective collateral assets and underlying risk parameters, on average, indicating a relatively healthy buffer.

While such variance exists based on the entity, the following maximally defined risk parameters within the Maple protocol are presented below:

| Collateral Asset | Max Initial LTV | Max Margin Call Threshold | Max Liquidation Threshold |

|---|---|---|---|

| BTC | 80% | 87% | 90.9% |

| jitoSOL | 60% | 73% | 85% |

| ETH | 75% | 85% | 90% |

| weETH | 70% | 77% | 85% |

| HYPE | 55% | 65% | 75% |

Cross-Pool Backing and Contingency Behavior

While syrupUSDT and syrupUSDC operate as distinct Maple pools, their systemic proximity warrants mention. Each token’s backing derives from separate lending pools and associated collateral structures; USDT-based loans for syrupUSDT and USDC-based loans for syrupUSDC, yet both sit under the same governance umbrella. As discussed with the Maple team:

- Under normal operation, pools are entirely independent, with no comingled assets.

- In a stress event, the Maple community could hypothetically vote to utilize backing from one pool to service redemptions in the other, effectively cross-collateralizing the two Syrup tokens.

- Any such action would remain exceptional, and a first-loss equity tranche stemming from the team’s internal coverage buffer would trigger first.

Oracle and CAPO Configuration

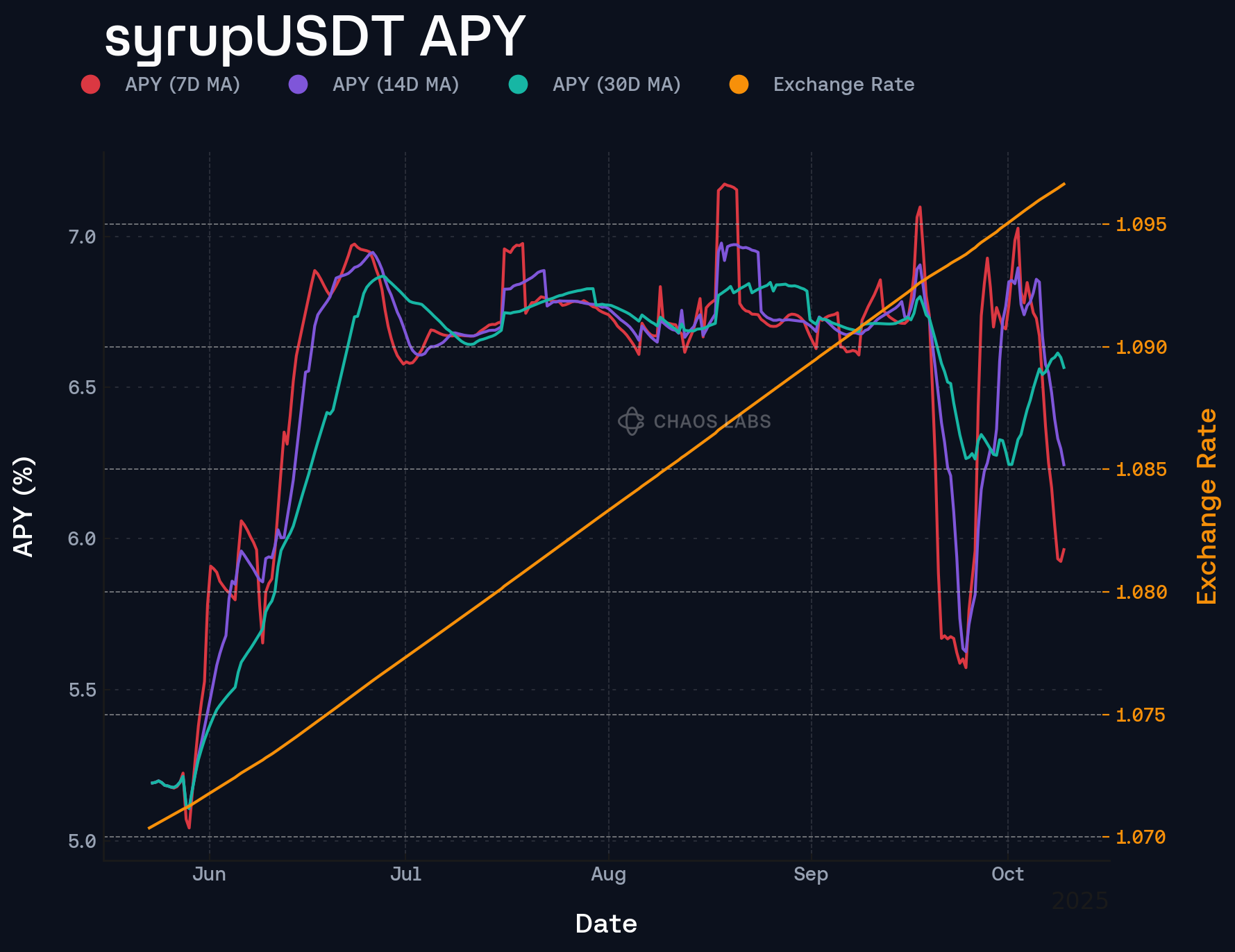

Akin to the proposed implementation of syrupUSDC, Chaos Labs recommends leveraging the USDT/USD Chainlink feed augmented with a cross-chain oracle representing the convertToExitAssets() value from the syrupUSDT contract. In the event of any practical deficit observed within any of the debt positions on Maple post-liquidation, this exchange rate will be altered to account for the underlying shortfall. This will additionally be protected using CAPO, with parameters provided below.

Specification

| Parameter | Value |

|---|---|

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 150,000,000 |

| Borrow Cap | - |

| Debt Ceiling | - |

| LTV | 0.05% |

| LT | 0.10% |

| Liquidation Bonus | 6% |

| Liquidation Protocol Fee | 10% |

E-Mode

| Parameter | Value | Value |

|---|---|---|

| Asset | syrupUSDT | USDT0 |

| Collateral | Yes | No |

| Borrowable | No | Yes |

| Max LTV | 90.00% | - |

| Liquidation Threshold | 92.00% | - |

| Liquidation Bonus | 4.00% | - |

This configuration mirrors syrupUSDC’s E-Mode stablecoin group, facilitating efficient leveraged stablecoin strategies while preserving strict containment outside of E-Mode.

CAPO

| maxYearlyRatioGrowthPercent | ratioReferenceTime | MINIMUM_SNAPSHOT_DELAY |

|---|---|---|

| 8.45% | monthly | 7 |

Disclosure

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0.