Summary

LlamaRisk does not support the onboarding of USDai and sUSDai at this time. Key risks surrounding these assets relate to asset categorization, GPU collateral liquidity uncertainty, peg instability, and legal design concerns. USDai is a synthetic dollar backed by U.S Treasury Bills, and sUSDai is a yield-bearing lending pool share token that generates yield from T-Bills and GPU loans, primarily targeted to the AI industry. While USDai falls into the category of reserve-backed stablecoins, we believe sUSDai would represent a new category of assets that needs to be pre-approved.

sUSDai’s model of financing GPUs presents liquidity concerns in the event of loan defaults. The 7-day liquidation window introduces greater liquidity constraints relative to other onboarded assets. USDai describes utilizing onchain and offchain components to manage liquidations, e.g., Primary and secondary resellers; however, critical elements to the process are yet to be finalized, which limit visibility on the resale value and possibilities of the underlying asset under live onchain conditions. At the time of writing, sUSDai is 99.8% collateralized by U.S. T-Bills and 0.2% by initial GPU loans. Additional loans are lined up for later this month.

USDai’s current supply cap also makes it an unfavorable asset to onboard due to the unstable peg borne from the supply cap set to ~$580M. Any future onboarding should be dependent on caps being removed to facilitate a more aligned peg to the Dollar. Lastly, the legal design of the USDAI protocol, while novel and coherent, lacks a track record of tested outcomes for us to support onboarding on these grounds.

1. Asset Fundamental Characteristics

1.1 Asset

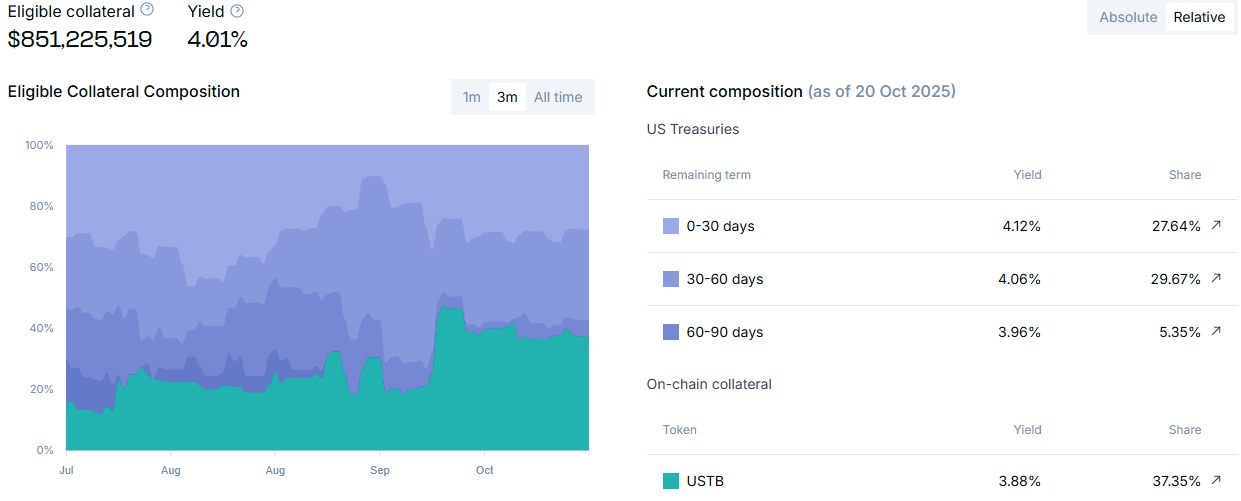

USDai is a non-yield bearing stablecoin backed by $M, an M0 protocol-issued token that U.S. Treasury Bills back. $M’s current reserve composition consists of U.S. Treasuries (up to 90 days) and Superstate’s USTB. wM is USDai’s base asset, $M’s non-rebasing wrapper.

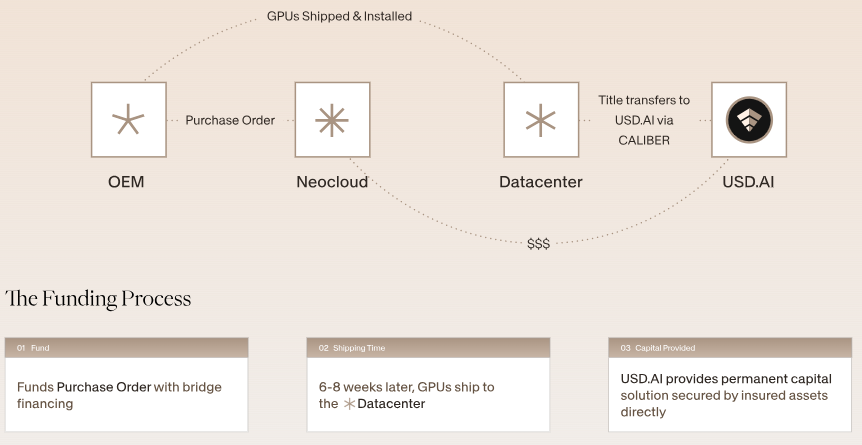

Staked USDai (sUSDai) is a yield-bearing ERC4626 token that earns yield from USDai M emissions and AI infrastructure loans - primarily GPUs. The funding of underlying assets involves a tokenization process that purchases GPUs and transfers title ownership to USD.AI until the loans are fully repaid. Loan terms are fixed to 3 years, and assets are ‘leased’ to borrowers for their operations.

Source: Loan funding process, USDai Docs

Yields accrue to sUSDai only, with yields currently sourced primarily from $M emissions. Currently, only 2 loans have been issued collectively worth $1.2M, making up less than 0.2% of reserve allocation, with an additional 5 loans expected, the first of which is scheduled to start on October 29th (labeled “closing” stage).

1.2 Architecture

5 core components enable the USD.AI protocol:

- CALIBER: an RWA tokenization framework

- FiLo: an underwriting and loan generation layer

- QEV: a market-based redemption queue management system

- Metastreet: Lending pool and auction layer protocol

- M0 Protocol: Extensions wrap/unwrap for underlying $M collateral for custom stablecoin deployments.

- Offchain Components

CALIBER

USD.AI utilizes its own system for collateralizing physical assets called CALIBER (Collateralized Asset Ledger: Insurance, Bailment, Evaluation, and Redemption), a tokenization model that is intended to improve collateral rights enforcement and risk management.

The framework follows Uniform Commercial Code Section 7 (Article 7). UCC compiles laws that govern commercial transactions in the U.S., which have been adopted and are enforceable across U.S. jurisdictions. Article 7 focuses on documents of title for property involved in commercial transactions. Under CALIBER, ownership of underlying assets (in this case, GPUs) is direct, and, given UCC 7 requirements, ownership is represented in a 1:1 ratio as ERC721s. This enables the enforcement of ownership, redemption, and embeds insurance.

Key differentiating features of CALIBER relative to traditional RWA frameworks:

| Feature | CALIBER | Traditional RWAs |

|---|---|---|

| Ownership | Direct, 1:1 asset ownership via an ERC-721 NFT. | No direct control via fungible ERC-20 tokens. |

| Enforcement | Onchain repossession and resale. | Legal processes, debt restructuring, and court involvement. |

| Insurance | Warehouse coverage. | Per-deal insurance onboarding. |

| Default Process | Onchain auctions within a 14-day redemption window. | Legal action is required, involving bankruptcy courts. |

Source: CALIBER, USD.AI docs

CALIBER GPU tokenization-to-loan process:

- A Borrower sets up a bankruptcy-remote SPV and transfers GPU ownership to the entity.

- The SPV enters into a Bailment Agreement with the Datacenter, where the GPUs are housed and maintained. Permian Labs (USD.AI) tokenizes the agreement (NFT), which represents the “Electronic Documents of Title”. GPUs remain operational for the borrower.

- Borrower deposits the NFT as collateral into USD.AI’s lending pool and borrows USDC up to 70% Loan-to-Value. Loans have a 3-year term, with repayments made every 30 days. Loans are exclusively for collateral only.

- LTVs are adjusted linearly as hardware ages.

Source: Loan Execution, USD.AI docs

FiLo

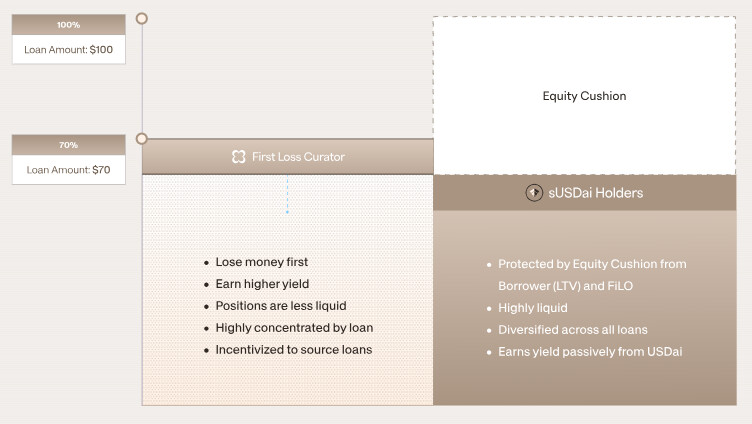

First Loss Curators (FiLo) are used to originate and verify loans for the USD.AI protocol, receiving an incentivized 3-10% admin fee for underwriting. Curators take first-loss positions in the event of defaults in exchange for higher yields. Curators are onboarded to a whitelist via a governance process before they can underwrite loans. Permian Labs is currently the only FiLo curator, with additional curators being vetted (USD.AI indicated to us that this would be disclosed in the future).

USD.AI uses Metastreet’s lending pool infrastructure to create loans and manage liquidations (see Metastreet section below). All loans issued are required to include a first-loss tranche (5% of the 70% LTV). Loans issued by the protocol have an equity cushion of 30%, with an additional 5% for non-FiLo lending pool participants. A small set of curators is planned initially, and loans are only issued for tokenized insured assets and not for other purposes, such as business loans or purchase orders.

Hardware loans are available for both new and used assets. New GPU prices are relatively standardized from OEMs with minimal variations. Secondary market prices are sourced from hardware partners, namely, Evertas, Blockware, and Procurri (see ‘Hardware Partners’ section below). Valuations of used GPUs present more price variability than new GPUs due to the introduction of additional factors, such as usage, condition, and model age.

Source: First Loss Curation Model, USD.AI docs

If a borrower defaults (i.e., misses a payment and one 30-day grace period)

- The deposited NFT is sold via the lending pool’s permissionless auction contract.

- The new holder of the document of title can claim the GPUs or enter into a new colocation agreement with the datacenter.

Collateral from defaults enters a 7-day English auction (highest bidder). Post settlement, NFT redemptions from datacenters require a 14-day notice period, with holders being required to pass independent KYCs. Hardware partners and FiLo curators are intended to facilitate the resale process, participating directly and indirectly in the resale process. The USD.AI team informed us that they plan on creating a GPU market maker for a more aligned resale process post-ICO.

USD.AI states that they are currently onboarding hardware partners for the resale process of GPUs, with FiLo curators to provide initial bids. GPUs are not appraised before being liquidated, and market prices are provided by USD.AI’s hardware partners, with proceeds going to sUSDai’s NAV. Additionally, an ICO is planned for the USD.AI protocol, with funds generated used as buffer reserves to fund purchases of defaulted loans for short-dated holding periods. The funds will be used in a revolving credit facility to amplify reserves; the status and value of the ICO is still in development, with the Allo Points program determining access and allocation to the ICO underway (the team has communicated that arrangements are being made with counterparties).

At the time of writing, 99% of deployed funds are currently invested in US T-Bills (via $M underlying collateral), with GPU loans accounting for a marginal percentage of deployed funds (0.2%). GPU auctions, therefore, are yet to be demonstrated as presented by USD.AI.

QEV

Queue Extractable Value (QEV) is a dynamic pricing mechanism that will manage access to available liquidity and withdrawal queues, ordering redemptions through an auction-based model. The aim of this is to address the challenge that illiquid assets, such as RWAs, pose when holders want to redeem but are hindered by liquidity constraints due to the rigid redemption cycles of these assets.

Given the predefined repayments of USD.AI loans, withdrawals are scheduled incrementally in sync with amortization schedules. QEV sums distributions based on a 30-day cycle until an auction, creating visibility on predefined liquidity flows. Redemption slots are dynamically priced and tradeable.

QEV will be synchronized to 30-day intervals that sum all the distributions (inflows and outflows) between auction periods, managing liquidity for repayments and withdrawals based on a 30-day epoch. Limited redemption liquidity is prioritized via a bidding process. If no bids are made in an epoch, then queuing works on a FIFO ordering system. If no redemptions are logged, then liquidity is reinvested into new loans or T-Bills.

Source: QEV Redemption Queue, USD.AI docs

This process structures sUSDai withdrawals on fixed intervals, making direct instant withdrawals unavailable as a possible venue for Aave liquidations. QEV is not yet active.

Metastreet

Loans are enabled by Metastreet’s Automatic Tranche Maker (ATM), a permissionless lending protocol, allowing USD.AI to create lending pools against NFT collateral. Pools can be exposed to more than 1 NFT (bundled wrappers), with lender positions/shares in each pool represented by Liquid Credit Tokens (LCTs), liquid ERC20 tokens.

The lending pool infrastructure allows USD.AI to determine pool parameters, such as the maximum loan limits (LTV), loan durations, and interest rates. At the time of writing, 2 USDAI loan pools are currently active on Metastreet markets (USDAITH / USDC 1 and USDAI-TH/USDC 2).

- Repayments

Onchain loans are structured as zero-coupon loans that are repaid and rolled over every 30 days with protocol-facilitated flashloans. The fixed term of the loan is maintained as loans are paid off and periodic new loans are initiated with refinanced conditions representing the balance of the loan. Repayments that periodically service loans call the refinance function in the lending pool contract, updating loan terms and debt position remains open (see a transaction example here). In contrast, repay calls close the loan and return collateral.

- Defaults

Overdue loans can be liquidated by anyone after a single grace period, and the collateral of defaulted loans is transferred to an auction liquidator contract. Onchain liquidations follow English auctions.

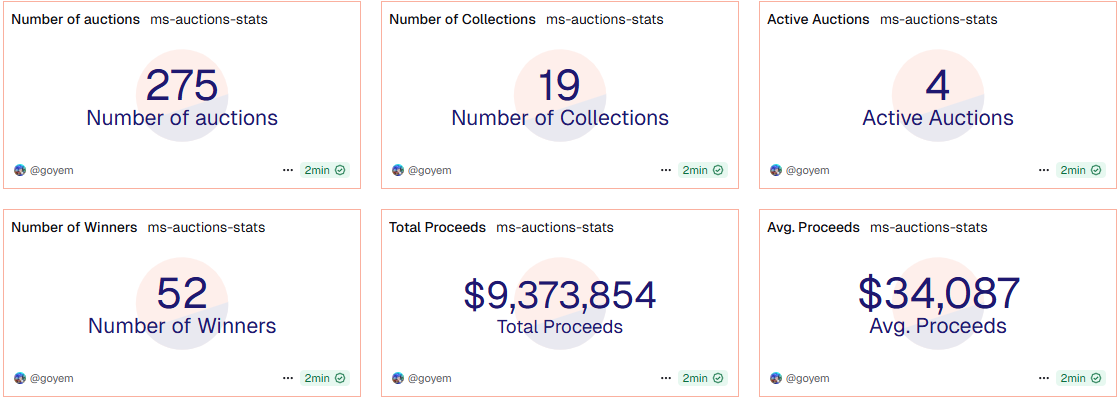

To date, no USD.AI loans have been liquidated. Metastreet auction history indicates varying default rates and auction profits, i.e., proceeds less outstanding debt (recent auction profits ranged between -99% and +261% but have largely seen positive returns).

Source: Metastreet, Dune, October 15th, 2025

M0 Protocol

USDai forms part of M0 protocol custom stablecoins, which are built using M0 Extensions. Extension architecture involves wrapping $M to collateralize USDai and unwrapping in a 1:1 atomic conversion process. Extensions inherit the security and yield properties of $M tokens while allowing projects to add their own features, branding, and business logic. For a more extensive analysis of the M0 protocol, see our onboarding assessment of mUSD here.

Offchain Components

USD.AI relies on several offchain/real-world components to enable sUSDai:

- Datacenters: Tokenized GPUs are required to be colocated in datacenters that are compliant with USD.AI’s insurance policy with their insurance provider Evertas. Tier 3 or Tier 4.) datacenters are automatically approved, while Tier 1 and 2 datacenters require a site visit and an insurance policy from Evertas.

- Hardware Partners: This consists of offchain organisations that USD.AI engages with in relation to GPUs.

-

- Original Equipment Manufacturers (OEMS): facilitate procurement of hardware, e.g., NVIDIA, SuperMicro, and Dell.

- Brokers: Supports the origination of loans and sourcing hardware, e.g., Hydrahost

- Insurance Services: Physical insurance coverage provider, e.g., Evertas

- Primary Resale Purchasers: Participate in default auctions, e.g., cloud server marketplaces.

- Intermediaries Market Makers: providing resale pricing and market-making services, operating as outright buyers of used GPUs and on consignment with an economic partner. E.g., Blockware, Procurri, FarmGPU, and Dataslayer.

Risk Profiles

USDai and sUSDai represent differing risk profiles, with USDai functioning more akin to a fiat-pegged, reserve-backed stablecoin. sUSDai, in contrast, functions as a lending pool share token, collateralized by RWA loans. sUSDai stands out as an asset that falls outside of the Aaca categories; initial approval of this type of asset should be determined.

1.3 Tokenomics

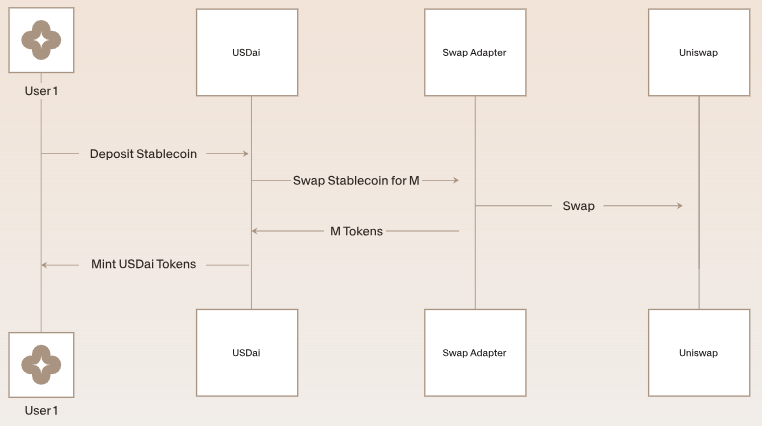

USDai is minted when supported stablecoins (e.g., USDC, USDT) are deposited and swapped for the base token $M. Swaps through Uniswap are facilitated by the SwapAdapter contract. Redemptions function similarly, with USDai being deposited, burned, and $M swapped for USDC/USDT. Conversions occur on an instant 1:1 basis; however, during high withdrawal periods, liquidity will be made available within 24 business hours through M0.

USDai currently has a deposit cap of $581.2M which has been filled. The USD.AI notified us that the cap would be lifted post the expiry of the 20Nov2025 Pendle pool.

Source: Minting USDai, USDai docs

sUSDai is minted when USDai is staked at a quoted deposit share price. Deposited USDai is burned for underlying M tokens, which are then swapped for the lending pool’s base token. Redemptions unstake sUSDai for USDai at the prevailing redemption share price following a 30-day timelock.

Redemptions are currently on a FIFO basis, but will change to an auction system as loans are introduced (as described in the QEV section).

Source: Minting sUSDai, USDai docs

USDai and sUSDai are issued on Arbitrum, with bridged deployments available on Plasma. The LayerZero OFT standard is used as a bridging mechanism, which represents an established standard accepted by Aave.

NAV and Share Pricing

The Net Asset Value (NAV) of sUSDai is the combined value of unallocated USDai and the total value of debt positions. Lending pool debt positions are estimated conservatively or optimistically.

- Conservative: estimates only include the principal of loans, in the case of default and liquidation.

- Optimistic: estimates principal plus real-time accrued interest of loans, in the case of repaymen.t

Realized interest is compounded back into the lending pool for new loan principals. The deposit share price quotes the optimistic NAV, while the redemption share price quotes the conservative NAV. Generally, the deposit share price is equal to or greater than the redemption share price. If there are no active lending positions, they are equal. This approach protects and incentivizes long-term investors, as they remain exposed to default risk, and prevents potential runs on pool liquidity.

Yield Accrual

Position Managers - BasePositionManager and PoolPositionManager - are responsible for harvesting M emissions from USDai and managing lending pool positions. sUSDai yield accruals are represented as the NAV increases less admin fee (yield is converted into sUSDai’s base asset USDai).

Admin fees

Lending admin fees are charged on loan repayments, based on a fixed percentage of the total interest on a loan. The current admin fee rate is set to 13.73%. In the event of a loan default, the admin fees are used to offset liquidation losses. Lending pool fees accrue to the Metastreet. A fee share of 36.4%, which splits a portion of the admin fee, is currently attributed to a Permian Labs-linked EOA.

A 10% sUSDai admin fee is charged for yields generated, with fees directed to a Multisig - 841F.

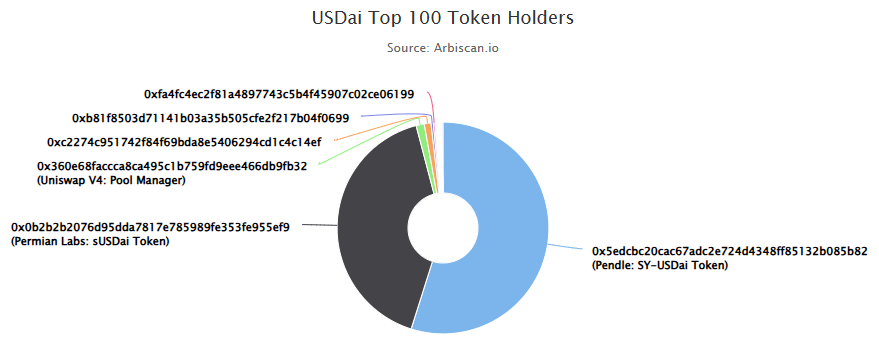

1.3.1 Token Holder Concentration

- USDai

418.7M USDai is currently available on Arbitrum with 2,688 total holders. Supply is concentrated in a Pendle SY-USDai contract (~54%) and staked in sUSDai (~41%). The highest EOA holds ~0.3%.

Source: USDai holders, Arbiscan, October 16th, 2025

159.2M USDai is currently available on Plasma with 1,373 holders. Supply is concentrated in a Pendle SY-USDai contract (~54%). The second and third highest holders represent ~18% (2/5 Multisig) and ~13% (Uniswap USDai/USDT0 pool), while the highest EOA holds ~1.2%.

Source: USDai holders, Plasmascan, October 16th, 2025

- sUSDai

136.5M sUSDai is currently available on Arbitrum with 2,462 holders. Supply is concentrated in a Pendle SY-sUSDai contract (~82%). The second and third highest holders represent ~2% each, while the highest EOA holds ~1.6%.

Source: sUSDai holders, Arbiscan, October 16th, 2025

30.4M sUSDai is currently available on Plasma with 996 holders. Supply is concentrated in a Pendle SY-USDai contract (~63%). The second and third highest holders represent ~19% (Euler Vault) and ~6% (EOA).

Source: USDai holders, Plasmascan, October 16th, 2025

2. Market Risk

2.1 Liquidity

2.1.1 Liquidity Venue Concentration

USDai liquidity on Plasma is concentrated in a single Balancer pool, with over $40M in TVL, while Arbitrum liquidity is spread between Curve, Fluid, and Uniswap pools.

| Token | Network | Venue | Pair | TVL |

|---|---|---|---|---|

| USDai | Plasma | Balancer | USDai/USDT0 | $41.72M |

| Arbitrum | Fluid | USDai/USDC | $20.9m | |

| Uniswap | USDai/USDC | $5.34M | ||

| Curve | USDai/USDC | $5.15M | ||

| Uniswap | USDai/USDC | $766K |

Source: USDai liquidity pools, GeckoTerminal, October 17th, 2025

sUSDai exhibits a similar pattern for venue distribution on Plasma and Arbitrum, as shown for USDai

| Token | Network | Venue | Pair | TVL |

|---|---|---|---|---|

| sUSDai | Plasma | Balancer | sUSDai/USDT | $2.44M |

| Arbitrum | Curve | sUSDai/USDC | $12.8M | |

| Fluid | sUSDai/USDC | $2.79M | ||

| Uniswap | sUSDai/USDT | $1.66M |

Source: sUSDai liquidity pools, GeckoTerminal, October 17th, 2025

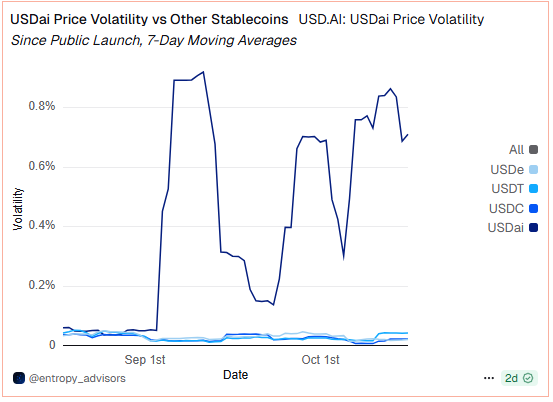

2.2 Volatility

USDai

Since September 2025, USDai has consistently traded at a premium on both Arbitrum and Plasma. The lack of stability around the Dollar peg would represent onboarding an asset with a high-risk market feed, given its volatility.

Source: USDai/USDC (Arbitrum), Geckoterminal, October 18th 2025

Source: USDai/USDT (Plasma), GeckoTerminal, October 18th, 2025

Source: USDai Price Volatility vs Other Stablecoins, Entropy Advisors - Dune, October 18th, 2025

sUSDai

sUSDai appreciated in line with its internal yield accrual mechanism initially; however, October has seen more divergent fluctuations less in line with sUSDai’s underlying yield accrual.

Source: sUSDai/USDT (Arbitrum), GeckoTerminal, October 18th, 2025

Source: sUSDai/USDT (Plasma), GeckoTerminal, October 18th, 2025

2.3 Exchanges

Neither USDai nor sUSDai is currently available on centralized exchanges.

2.4 Growth

USDai has seen significant growth over the last 3 months, representing over $570M across Plasma and Arbitrum.

Source: USDai Circulating Supply, Entropy Advisors - Dune, October 18th, 2025

Current Staked USDai represents a 29% staking ratio and an expected utilization of 23% (upcoming loans). The team indicated that they have set an initial utilization of 50%, with a long-term target of 80% post-TGE.

3. Technological Risk

3.1 Smart Contract Risk

2 audits have been completed for USD.AI protocol. The following issue findings are summarized below:

- Kais Tlili - Independent Auditor (May 14, 2025): 1 medium, 1 low, 2 informational

- Cantina (May 12, 2025): 1 medium, 8 low, 1 gas optimization, and 10 informational

Metastreet audits:

- Cantina (June 22, 2023): 6 medium, 7 low, 14 gas optimization, 16 informational

- Cantina (October 3, 2023): 1 low, 2 gas optimization, 7 informational

- Cantina (November 25, 2023): 1 low, 2 gas optimization, 7 informational

- Cantina (April 30, 2024): 1 high, 2 low, 10 informational

M0 Protocol has undergone extensive audits, relevant audits to USDai, and their findings include:

- M0 Protocol and TTG

-

- Quantstamp (January 29, 2024): 1 medium, 9 low, and 11 informational

- Three Sigma (February 2, 2024): 2 high, 2 medium, 11 low, and 17 informational

- OpenZeppelin (February 15, 2024): 1 high, 6 medium, 7 low, and 8 informational

- Prototech Labs (March 8, 2024): 3 critical, 4 high, 5 medium, 9 low, and 11 informational

- Kirill Fedoseev (March 8, 2024): 1 high, 2 medium, 4 low, and 10 informational

- Sherlock (March 27, 2024): 3 medium

- Certora (April 2024): 2 critical, 1 high, 2 low, and 8 informational

- ChainSecurity (April 24, 2024): 6 medium and 22 low

- EVM M0 Extensions

-

- Certora (July 2025): 2 high, 2 medium, 5 low, and 5 informational

- ChainSecurity (July 21, 2025): 1 high, 4 medium, and 5 low

- Guardian (August 5, 2025): 1 high, 4 medium, and 33 low

All issues were either fixed or acknowledged.

3.2 Bug Bounty Program

A Cantina-hosted bug bounty is active for USDai, with a max bounty of $100,000. Additionally, a MetaStreet bounty program with a max bounty of $50,000 is also available on Immunefi. M0 protocol currently does not have a bug bounty.

3.3 Price Feed Risk

USDai has a Chainlink USDAI / USD price feed on both Arbitrum and Plasma, while sUSDai only has an SUSDAI/USDAI exchange feed on Plasma.

USDai: Peg Stability Concerns

USDai’s deposit cap and utilization in sUSDai make the asset’s dollar peg potentially unstable. Since supply is capped, USDAI’s ability to restabilize through mint and redemption mechanisms is limited. As shown in section 2.2, USDai has persistently traded at a premium despite its underlying Dollar peg. The imposed supply cap prohibits the minting of new USDai, which would enable arbitrage opportunities that would help stabilize USDai on the open market. Inversely, should USDai trade at a discount, the assets redemption mechanism may be limited if USDai utilization in sUSDai loans is excessively high and during high liquidity demands.

sUSDai: Liquidation Concerns

Given that sUSDai’s NAV is the combined value of unallocated USDai and the total value of debt positions, should loans default and collateral sell below valuations, the drop in NAV once updated could lead to a series of sudden bad debt positions for Aave. This design introduces some uncertainty, given the time lag associated with repayments and 7-day liquidations.

USD.AI sources secondary market prices from hardware partners; however, price discovery visibility is limited for potential external liquidators without transparent marketplaces. This information asymmetry may hinder effective liquidations, limiting sUSDai to a limited set of liquidators.

3.4 Dependency Risk

Metastreet

sUSDai relies on Metastreets lending pool smart contracts for proper accounting and securing positions. Loan repayments are a critical part of ensuring that funds remain collateralized and yields are accrued. Failure to account for repayments, loan disbursements, or acceptance of incorrect collateral would increase counterparty risk and affect returns.

M0 Protocol

Like in our findings for mUSD, we note similar dependencies for M0. USDai inherits both the regulatory posture and technical architecture of the protocol. Consequently, any changes to M0 governance, particularly those affecting the $M token, which underpins USDai’s base liquidity and collateral structure, can directly impact USDai’s stability and functionality. M0-approved Minters (Bridge) and Validators (Chronicle) are trusted to operate cohesively, minting $M only with approved collateral, which directly affects USDai’s backing.

Source: M0, October 20th, 2025

According to the M0 dashboard, ~$10.3M USDai is held as reserve liquidity (a 2% over-collateralization buffer).

Superstate

A key dependency risk arises from Superstate’s USTB, which currently comprises around 41% of the $M reserves. The health of $M, and by extension USDai and other M0 Extensions, relies heavily on the operational and regulatory soundness of Superstate’s product.

Source: Superstate USTB Holdings, October 10th, 2025

LayerZero

Bridged USDai and sUSDai utilize LayerZero Omnichain Adapters to enable the cross-chain transfers as OFTs. OAdapters use a mint and burn system, utilizing LayerZero endpoints for cross-chain messaging. Bridging relies on the efficient operations of _debit (sender) and _credit (receiver) function calls through LayerZero infrastructure.

Datacenters

Organizations that assign tiers to datacenters, such as the Uptime Institute, determine the grade that datacenters are given based on several factors, such as redundancy, uptime, and sustainability. Should datacenters fall below the Tier 3 or 4 rankings required by USD.AI, then insured collateral may lose its coverage, potentially affecting the asset’s value and security.

Hardware Partners

USD.AI relies on external organizations in its offchain processes; in many instances, these dependencies are layered, form critical parts of USD.AI’s operations (e.g., pricing and resale service providers), and in one instance contingent (e.g., securing funds for revolving credit). Should a partner fail to perform liquidations effectively or discontinue the arrangement with USD.AI, this would severely impact the protocol’s ability to operate as designed.

4. Counterparty Risk

4.1 Governance and Regulatory Risk

USD.AI’s governance process is not fully defined in their documentation; however, sections indicate that governance may influence liquidity allocation, underwriting, interest rate controls, and sUSDai utilization caps.

ToS Review

USDai’s formally operative end-user instrument is its Terms of Service. The Terms select Delaware law as the governing law and, subject to matters preempted by the Federal Arbitration Act, designate Delaware as the forum for disputes. They regulate user access to and use of the USD.ai online services, website, software, and accompanying documentation provided in connection with the platform (collectively, the “Service”). Operationally, the protocol and front end are described as being operated and maintained by Permian Labs DBA “USD.AI.”

The Terms do not expressly characterize USDai as a security, e-money, or any other regulated financial instrument. Instead, they deploy broad disclaimers, waivers, and limitations of liability—an approach consistent with avoiding treatment as a regulated securities or e-money offering under U.S. law—while carefully framing the relationship as access to a software service rather than participation in an issuer-backed financial product.

Functionally, USDai is positioned as a “fully-backed synthetic dollar” designed for “instant” redemption at all times, while being deliberately distinguished from fiat-referenced stablecoins. Yield is not distributed at the USDai layer; rather, it is concentrated in a separate staked token, sUSDai. The public materials describe idle capital as being held in T-bills and lower-risk stablecoins, with sUSDai returns sourced from loans secured by tokenized hard assets used in AI/DePIN infrastructure. The off-chain collateralization and enforceability stack is framed under “CALIBER,” a UCC Article 7-style bailment and warehouse-receipt regime in which hardware is tokenized via NFTs (for example, negotiable warehouse-receipt tokens for GPUs) and structured to be bankruptcy-remote at the borrower level. Those CALIBER mechanics secure loans made to borrowers; they do not confer direct, off-chain property rights in such collateral on USDai or sUSDai holders.

Under the Terms, users are granted a limited, non-exclusive, non-transferable, and revocable license to access and use the Service. Access is conditioned on continued compliance and may be limited, suspended, or withdrawn by USD.AI in its discretion. No proprietary rights in the platform, its software, or its content are conveyed to users, and the Terms do not create any specific property interest or claim over particular assets, over USDai tokens themselves, or over any underlying reserve.

There is no clause granting users a contractual right, vis-à-vis the operator, to mint or redeem USDai on demand. The Terms are silent on hard reserve-maintenance obligations, on a binding 1:1 redemption covenant, and on any formal mechanism to convert USDai into fiat or other assets directly through the operator pursuant to an off-chain promise.

Likewise, the Terms contain no express representation that USDai will be maintained at a fixed U.S. dollar peg or that any particular reserve methodology will be upheld. While they acknowledge market volatility, potential protocol upgrades, and chain forks, they stop short of imposing an obligation to defend a peg or to provide specific reserves. As drafted, users have no operator-level right to redemption and no contractual claim against USD.AI or Permian Labs for delivery of fiat, collateral, or other backing assets.

In practice, USDai holders rely on in-protocol. These smart-contract mechanics reflect an on-chain claim to the protocol’s pooled stablecoin reserves, typically expressed as the ability to redeem USDai for approved deposit currencies via the contracts. That entitlement functions economically like a bearer-style redemption right within the code environment. The Terms of Service, however, do not create an additional, off-chain undertaking by the operator to redeem or to make holders whole outside the protocol.

By contrast, sUSDai holders obtain a smart-contract claim on the loan portfolio’s pooled economics and cash flows, subject to the defined unstaking period, the Queue Extractable Value (QEV) priority process, and the stated loss waterfall, which places borrower equity and first-loss curator capital ahead of stakers in absorbing losses. There is no direct, individualized property interest in collateralized GPUs or other hardware in favor of sUSDai holders; remedies on borrower default are pursued through the CALIBER framework and the designated underwriters or agents, not through direct enforcement actions by retail stakers.

CALIBER framework

As reflected in the privately shared document kit, CALIBER collateralization proceeds through a title-and-bailment sequence. An SPV LLC operating agreement establishes a Delaware single-purpose, bankruptcy-remote vehicle intended to hold title to the GPUs and interface with the USD.AI protocol. The borrower’s operating company effects a true sale of the GPUs to this SPV under a Sale and Contribution Agreement that expressly states absolute transfer intent, while installing a precautionary, first-priority UCC Article 9 security interest should any court recharacterize the conveyance as secured financing, coupled with segregation of collections into a designated account. This combination moves the assets off the operating company’s balance sheet and ring-fences them for financing within the SPV.

Once the SPV holds record title, the datacenter issues a negotiable Electronic Warehouse Receipt naming itself as bailee and acknowledging physical possession at the specified premises. The receipt designates the Arbitrum mint address as the authoritative copy and links “control” to UCC § 7-106, so that the on-chain controller is the “Bearer” entitled to demand delivery. The instrument also pre-wires the protocol’s enforcement pathway: a transfer executed via the USD.AI Vault Contract’s liquidate() function constitutes a transfer of the receipt, automatically vesting Bearer status in the transferee. New York law and forum are selected to govern the receipt, and the paper sets operational terms—fourteen-day delivery procedures, prohibitions on relocation absent Bearer consent, storage-charge mechanics, and a bailee warranty/liability cap—consistent with UCC Article 7 practice.

Under the Permian Customer Agreement, Permian mints the receipt-token, coordinates SPV formation and independent-manager onboarding, and supports deposit of the token into the USD.AI protocol to draw proceeds. Following funding, the SPV is obligated to make 30-day fixed payments plus variable components; it retains the right to reclaim the token upon payment in full of all accrued and unpaid amounts, but a missed installment opens a 30-day grace window, after which the token is liquidated under protocol rules and the reclamation right terminates. The protocol architecture is intended to prevent the token from leaving controlled custody except in two cases: (i) full payoff and return to the SPV, or (ii) liquidation transfer to the enforcement transferee.

The borrower’s obligations are split between financing covenants at the SPV level and duties under the warehouse bailment. On the financing side, the Customer Agreement requires a valid SPV organization, perfected transfer of title into the SPV, satisfactory warehousing that yields a tokenized document of title, completion of KYC, representations of good and unencumbered title (with a covenant to clear any liens from protocol proceeds), and indemnities favoring Permian and the independent manager. On the bailment side, the Bearer must pay storage and ancillary charges, maintain full-replacement-value insurance on a primary, non-contributory basis with a waiver of subrogation against the bailee, keep the goods at the contracted premises absent Bearer-approved relocation, and comply with the stated delivery procedure when demanding release.

Defaults and liquidations follow a mechanical, pre-agreed sequence. Failure to make a required 30-day payment triggers a 30-day grace period at an increased variable rate; failure to cure by its expiry authorizes liquidation “according to the Protocol rules,” permanently extinguishing the SPV’s right to reclaim. The liquidation call transfers on-chain control of the negotiable receipt; by the receipt’s express terms, the transferee becomes Bearer and may instruct the bailee to deliver the equipment or dispose of it for value. In effect, on-chain default logic is translated into an off-chain delivery entitlement under UCC Article 7 without a separate court process to perfect or foreclose.

Where the borrower is a non-U.S. entity, the structure remains viable provided two conflict-of-laws pivots are respected. First, the goods and the bailment relationship must be sited in the United States so the warehouse receipt sits squarely within UCC Article 7, ensuring New York law governs possession, negotiability, lien priority, and delivery rights against third parties. Second, the sale by the foreign seller into the Delaware SPV must constitute a “true sale” both under U.S. bankruptcy jurisprudence (as reflected in the Sale & Contribution Agreement) and under the seller’s home property and insolvency law; in practice, that requires bailee attornment to the SPV and any local perfection or notice steps needed to resist claw-back by a foreign insolvency officeholder.

Two frictions in the current forms limit the degree of protection until they are completed:

- The warehouse receipt preserves the bailee’s statutory warehouse lien and authorizes a public sale after sixty days of non-payment; without a negotiated lien waiver or subordination in favor of the secured claim, together with lender’s loss-payable endorsements on the required insurance, that senior statutory lien can erode recoveries that would otherwise support the 1:1 collateralization story.

- The control before default is not yet fully specified. The receipt ties “control” to UCC § 7-106 and recognizes that liquidate() effects a transfer, but the papers do not appoint a collateral agent as the “person in control” of the authoritative electronic copy while pledged, nor do they append a technical annex mapping the protocol’s control mechanics to § 7-106’s reliability criteria. A further purity concern arises if the datacenter functions as more than a storer: the receipt obliges the bailee to “provide access … for the use of the Property,” and the LLC agreement contemplates separate “Usage Agreements.” The more the bailee or third parties “use” the equipment under warehouse paper, the greater the risk to a clean UCC Article 7 characterization. If operational use is contemplated, it should be housed in stand-alone use agreements with rent streams payable to the SPV. At the same time, the warehouse receipt remains a pure document of title and the bailee acts strictly as bailee. Until these completions are documented—and, ideally, supported by a focused legal opinion—the perfection and priority narrative rests more on design intent than on a fully tested control arrangement.

Legal Design Concerns

Based on the documents and architecture reviewed, our view is that several headline assertions are directionally credible yet legally under-specified. The materials at points conflate “on-chain functionality” with “off-chain enforceability,” which are distinct questions and must be addressed separately. This gap gives rise to the legal concerns set out below.

- Positioning USDai and sUSDai as “permissionless” and “decentralized” does not resolve the threshold issues of legal characterization. A compliant posture requires a clear statement of what each instrument is as a matter of law, which body of law governs holder rights and remedies, and where—if anywhere—off-chain obligations are undertaken by an identifiable legal person. The absence of a reasoned U.S. securities/commodities and money-transmission analysis for USDai and sUSDai leaves regulatory risk unmitigated.

- The lack of targeted legal opinions on the CALIBER construct is understandable for a nascent deployment, but leaves material risks unaddressed. For a structure that explicitly relies on UCC negotiability and an authoritative electronic copy, market practice is to obtain a relevant opinion. Without such, the distinction between commercial appetite and legal resilience remains unproven.

- Dependence on wM (M0) for undeployed capital introduces a second-order legal and operational dependency that requires explicit, granular disclosure. If wM evidences claims on T-bill custodial arrangements administered by third parties, reserve quality and liquidity for USDai are partly a function of M0’s governance, custody chain, licensing posture, gate/notice mechanics, and redemption terms. That dependency is not disqualifying, but it is a look-through risk that must be surfaced with precision in the Terms, user disclosures, etc. As of this review, the level of transparency regarding wM reliance is insufficient to substantiate the backing claim.

In conclusion, while we recognize the coherence and ambition of the legal architecture, its novelty and limited practical provenance (absence of tested outcomes or maturity), together with the deficiencies identified above, prevent us from endorsing onboarding at this time from a legal-risk perspective.

4.2 Access Control Risk

4.2.1 Contract Modification Options

The controlling wallets for USD.AI:

- 2/3 Multisig A: Default Admin

USDai and sUSDai are deployed behind ERC1967 Proxies that utilize a role-based access control system.

USDai roles:

- DEFAULT_ADMIN_ROLE: ability to grant/revoke all other roles, can adjust the total supply cap, and call other role functions.

- BRIDGE_ADMIN_ROLE: manages mint/burn bridging operations

- DEPOSIT_ADMIN_ROLE: privileges for deposit operations

sUSDai roles:

- DEFAULT_ADMIN_ROLE: ability to grant/revoke all other roles, call all role-protected functions, and control redemption timelock period.

- BLACKLIST_ADMIN_ROLE: blacklist/whitelist privileges

- STRATEGY_ADMIN_ROLE: manages redemption queue, and manages BasePositionManager and PoolPositionManager contracts

- PAUSE_ADMIN_ROLE: pause/unpause sUSDai contract

- BRIDGE_ADMIN_ROLE: mint/burn controls associated with the bridging process

Key contracts to USDai’s functionality

- USDai: ERC20

- SwapAdapter: swaps between whitelisted tokens (USDC & USDT) and $M tokens, using Uniswap pools. Managed by DEFAULT_ADMIN_ROLE.

Key contracts to sUSDai’s functionality

- sUSDai: ERC20

- BasePositionManager: harvests M emissions from the USDai contract.

- PoolPositionManager: manages Metastreet lending pool liquidity.

- PriceOracle: Chainlink price feed used to convert lending pool value denominated in USDC and USDT into USDai for NAV calculations (using the USDC / USD and USDT / USD price feeds). The DEFAULT_ADMIN_ROLE can add/remove price feeds.

USDai and sUSDai OAdapters are owned by Multisig A. The adapter manages token transfer limits between chains.

Key Metastreet contracts:

- WeightedRateGracePeriodRangedCollectionPool: NFT lending pools deployed as an ERC1967 BeaconProxy. Admin controls include managing whitelists, interest rate params, and accepted collateral. Admin is the PoolFactory contract.

- BundleCollateralWrapper: a bundle collateral wrapper that consolidates NFTs into a single wrapped token.

- SimpleSignedPriceOracle: verifies and stores NFT prices from trusted signers

- EnglishAuctionCollateralLiquidator: handles collateral liquidations through English auctions.

- PoolFactory: The admin contract for all pool contracts, able to modify parameters, withdraw fees, and pause pools. Owned by ⅔ Multisig A

4.2.2 Timelock Duration and Function

No timelock has been implemented for either USDai or sUSDai, indicating that admin changes and upgrades may be implemented without giving holders sufficient time to opt-out.

4.2.3 Multisig Threshold / Signer identity

Multisig A 2/3

0xe982B3F68981eFEA221F5B4F843757dEd2c0a69C

0x986868c921075f31514015E6ecdbB4A6526579b2

0xD1Affe275f09cD11bfDf38F3c9b85c016F47b75e

Contrasting GPU Outlook

GPU Lifespan and Market Value Concerns

GPUs used in AI experience high utilization, running under heavy computational loads and prolonged thermal stress. As a result of wear and tear, their performance and economic value decline over time. USD.AI cites an average lifespan of 5–7 years for top-tier GPUs. Other sources indicate that most datacenter GPUs have shorter lifespans, ranging from 1-3 years for peak performance and 3-5 years with lower utilization rates, before units are either used for less intensive work or replaced.

These alternative estimates indicate that the peak performance years for GPUs under high utilization are likely within the first 3 years. This would mean that USD.AI’s 3-year loan amortization schedule coincides with the optimal period for AI GPU performance and likely the steepest value declines during this period (i.e., a narrower margin of safety than proposed).

Other AI sector factors, such as the price impact that new models have on older models, should also be factored in. GPU performance and efficiency improvements have historically doubled approximately every 2.6 years, and compute usage in AI has doubled approximately every 6 months. AI GPUs face accelerated rates of obsolescence as benchmarks improve. This necessitates the replacement of legacy systems at a faster rate for businesses in this sector to remain competitive.

These considerations offer a dampened outlook on the secondary market demand and value of AI GPUs. In the event of a loan default, collateral may be sold at a lower market value relative to the expected value reported by USD.AI.

Aave V3 Specific Parameters

N/A

Price feed Recommendation

N/A

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.