Overview

Chaos Labs conducted an extensive review of the USDai and sUSDai, analyzing their architecture, collateral composition, legal enforceability and liquidity mechanisms. The assessment covered the full operational lifecycle (from minting and staking to redemption, loan origination and default enforcement) as well as dependencies on the M0 infrastructure, cross-chain liquidity management, and the GPU-backed credit layer.

Following this comprehensive evaluation, Chaos Labs does not recommend supporting the listing of USDai or sUSDai at this time on either Arbitrum or Plasma, due to the outlined risks related to peg volatility, redemption liquidity, cross-jurisdictional collateral enforcement, and uncertainty surrounding secondary market demand and pricing resilience of GPUs. However, since USDai is fully backed by short-duration U.S. Treasuries through the M0 infrastructure, it may be reconsidered for listing once the current minting caps are lifted, the supply demand imbalance is resolved and the token demonstrates sustained peg stability.

Permian Labs

Permian Labs is the development team behind the USDai protocol. The company has positioned itself at the intersection of real world asset tokenization, AI, stablecoins and DeFi, with a focus on building legally enforceable credit infrastructure for AI infrastructure, particularly GPU financing.

In August 2025, Permian Labs announced a $13.4 million funding round led by Framework Ventures, with participation from Dragonfly, Arbitrum Foundation, Flowdesk, and other investors. The capital was directed toward building USDai and its supporting components, including CALIBER, FiLo, and QEV.

Permian Labs’ work on USDai builds on its earlier track record of designing financial infrastructure for digital collectables.

Metastreet

Before USDai, Permian Labs created Metastreet, an NFT financialization platform launched in 2021. Metastreet was designed as a lending marketplace for non-fungible tokens, allowing NFT holders to unlock liquidity against their assets.

The technical expertise developed through Metastreet informed the design of USDai. Several of the smart contract components originally built for Metastreet have been adapted and repurposed for the USDai protocol.

USDai Protocol

The USDai Protocol is a structured credit and stablecoin system designed to bridge DeFi with real-world asset financing, specifically the capitalization of AI infrastructure through GPU-backed loans. It integrates three primary frameworks (CALIBER, FiLo, and QEV) which together form a lifecycle of tokenization, collateralization, underwriting and liquidity management.

At a high level, USDai operates as a two-layered system:

- USDai: a base stablecoin layer, powered by the M0 Protocol, which provides fully collateralized, T-bill–backed liquidity.

- sUSDai: a GPU-backed, overcollateralized lend/borrow layer, where capital is deployed into tokenized GPU loans originated and structured through CALIBER and FiLo.

Integration with the M0 Protocol

USDai is issued as an Extension Token on top of M0, a stablecoin issuance infrastructure platform purpose-built for creating application specific stablecoins. M0 separates stablecoin design into two layers:

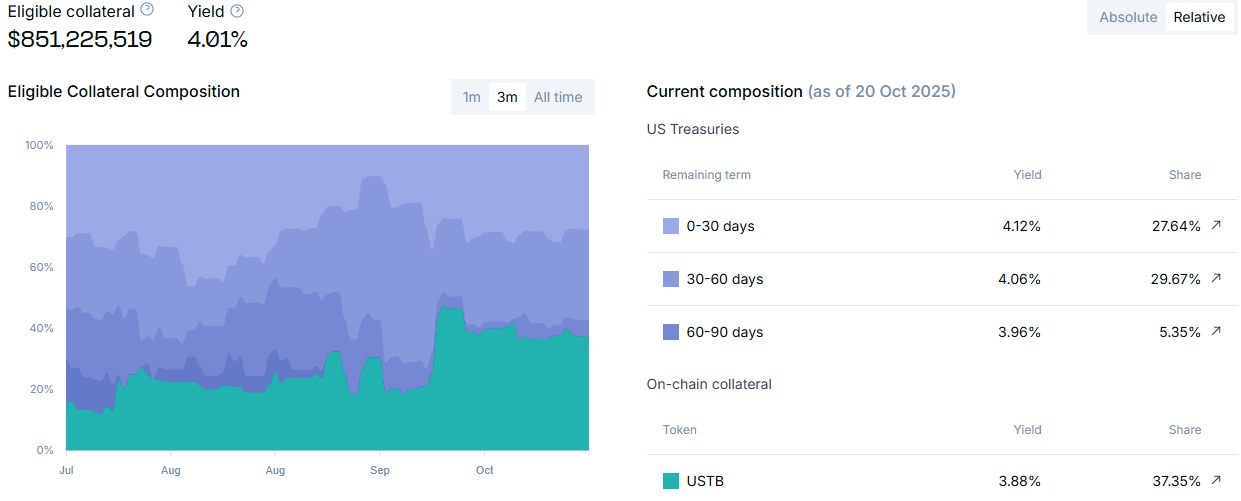

- Value Layer – $M Token: The foundational collateral layer of the M0 Protocol, where each $M token is fully backed 1:1 by eligible collateral such as short-duration U.S. Treasuries or tokenized equivalents like USTB.

- Application Layer – Extension Tokens: Custom ERC-20 stablecoins, such as USDai and mUSD, that wrap $M to inherit its collateralization, yield and compliance guarantees while adding protocol-specific logic and functionality.

The M0 system operates under a federated model with Minters, Validators, and SPV Operators, ensuring collateral custody and regulatory compliance. Minting and redemption of $M occur exclusively on Ethereum while Extension Tokens like USDai can operate across multiple chains.

A more detailed analysis of the M0 Protocol’s architecture and custody structure is available in Chaos Labs’ prior report, which can be accessed here.

USDai and sUSDai

Within the protocol, there are two key assets: USDai and sUSDai.

- USDai represents the base stablecoin, backed by tokenized short-duration U.S. Treasuries held through the M0 infrastructure.

- sUSDai represents the yield-bearing version of USDai. It is designed to generate yield from loans collateralized by GPUs through the CALIBER framework. These GPU-backed loans are originated and underwritten by FiLo Curators, who take first-loss exposure to align incentives.

At present, approximately 99% of sUSDai’s collateral remains allocated to T-bills, as the utilization of sUSDai capital in GPU-backed loans is below 1%. In practice, this means that less than 1% of the capital staked in sUSDai is currently being deployed toward GPU financing, while the vast majority remains in low-risk, yield-bearing Treasury instruments via the M0 infrastructure.

The long-term vision of the protocol is to progressively increase the share of sUSDai capital deployed into GPU-collateralized loans as origination capacity and participation expand. Over time, a greater portion of sUSDai’s backing is expected to consist of tokenized GPU loans rather than T-bills.

This evolution will transform sUSDai from a predominantly Treasury-backed yield instrument into an actively deployed capital vehicle that finances AI infrastructure through secured hardware lending. USDai, by contrast, will remain fully backed by T-bills at all times, serving as the stable, liquid base layer of the system.

Allo Points Program

To encourage participation and reward early adopters, the protocol has introduced the Allo Points Program, which serves as the incentive layer for both USDai and sUSDai holders. Points earned through the program determine user eligibility for upcoming token distributions, including allocations for the ICO and airdrop at the TGE.

- USDai holders earn points toward ICO allocations, which will account for 70% of the total token supply.

- sUSDai holders earn both the protocol APY (derived mainly from T-bill yields and partially from GPU-backed loans) as well as points toward the airdrop allocation, which represents 30% of the token supply to be distributed at TGE.

The program offers extra points for holding USDai, which has created an incentive that keeps the staking ratio for sUSDai relatively low. This reduced staking participation amplifies the effective yield for existing sUSDai holders, as T-bill rewards are distributed across a smaller capital base.

AutoUSDai and AutosUSDai

The protocol features two additional vault-based wrappers (autoUSDai and autosUSDai) designed to capital deployment and yield compounding while preserving users’ participation alignment in the Allo Points incentive program.

autoUSDai represents deposits of USDai allocated into the Auto strategy, a curated liquidity and market-making vault operated by Concrete, the protocol’s vault manager. Funds deposited into autoUSDai are automatically routed across a diversified set of strategies, including Uniswap, Balancer, Euler (on Plasma), Fluid, and Curve (on Arbitrum), with the majority of liquidity currently concentrated on the Plasma chain. Out of the total 85.6 million USDai deposited in autoUSDai, approximately 68 million resides on Plasma, with around 52 million held in idle USDai awaiting deployment. Participants in autoUSDai earn a 15× Allo Points multiplier.

autosUSDai functions analogously for sUSDai deposits. It enables auto-compounding of yield and reward accrual while maintaining users’ alignment with the Airdrop allocation under the Allo Points program. The autosUSDai vault, also managed by Concrete, operates primarily on Arbitrum and currently manages approximately 8 million sUSDai.

Together, the autoUSDai and autosUSDai vaults account for roughly 16% of the total USDai supply, representing the share of system liquidity under Concrete’s management for LP strategies.

CALIBER

CALIBER (Collateralized Asset Ledger: Insurance, Bailment, Evaluation, and Redemption) is a framework to enable the direct tokenization of physical assets, beginning with GPUs. It aims to create enforceable, on-chain ownership for real world assets that is legally recognized, bankruptcy-remote and operationally efficient.

Core Design

1. One-to-One Asset Representation

At the foundation of CALIBER is the principle of direct one-to-one representation of assets. Each GPU, is tokenized as a unique ERC-721 NFT, establishing a one-to-one correspondence between the physical hardware and its digital counterpart. The ERC-721 model ensures that each token embodies a distinct property right tied to an identifiable piece of hardware.

2. Bankruptcy Remote SPVs

To further strengthen collateral protection, CALIBER requires that borrowers contribute GPUs to a bankruptcy remote Special Purpose Vehicle (SPV). The SPV is legally structured and independently managed to ensure that the GPUs remain outside the reach of other creditors if the borrower enters insolvency proceedings. This separation guarantees that collateral pledged into the USDai protocol cannot be clawed back during bankruptcy.

3. Bailment and Custody Structure

Once contributed to the SPV, the GPUs are placed under the custody of datacenters through a Bailment Agreement. In this arrangement, the datacenter functions as Bailee, responsible for safeguarding the physical hardware, while the NFT holder acts as Bailor, retaining ownership rights. Permian Labs, acting as Tokenizing Agent, mints the NFTs that represent these GPUs on-chain. This creates a digital property right anchored in an enforceable custody structure, bridging traditional bailment law with blockchain-based asset management.

UCC Article 7: Legal Foundation

UCC Article 7 is a section of the Uniform Commercial Code, the body of standardized commercial laws that has been adopted across all U.S. states to govern trade and secured transactions. Article 7 specifically addresses documents of title, such as warehouse receipts and bills of lading, which serve as legal instruments proving ownership and the right to control goods in storage or transit. Although the UCC is a model code, its adoption by every state makes Article 7 legally enforceable nationwide within the United States.

UCC Article 7 provides the legal foundation for CALIBER by recognizing the enforceability of documents of title, including their electronic forms. Within this framework, each NFT minted for a GPU operates as an electronic document of title, certifying ownership and establishing enforceable rights over the underlying asset.

By structuring NFTs in this way, CALIBER ensures that holders possess a legally recognized property claim. In the event of default, the NFT holder has the right to repossess or liquidate the collateralized GPU, with enforcement carried out through on-chain auctions rather than protracted court proceedings. This alignment transforms the NFT from a digital representation into a legally binding property right, bridging traditional commercial law with blockchain-based collateralization.

FiLo: First Loss Curators

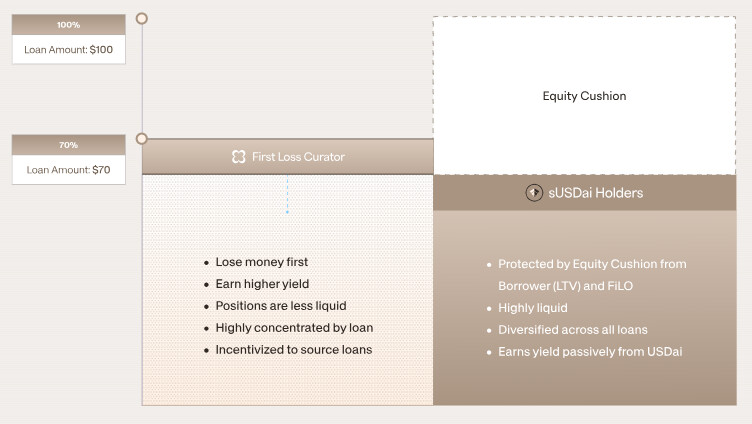

FiLo, short for First Loss Curators, is the risk-curation layer of the USDai protocol. While CALIBER provides the legal and technical framework for tokenizing GPUs and enforcing ownership, FiLo addresses the challenge of how loans are originated and underwritten. It require curators to take a first-loss position in every loan they originate or onboard. This creates an alignment of incentives: those who originate credit must also bear the highest tranche of risk.

FiLo Curators accept concentrated exposure in exchange for higher yields. Their position ensures that underwriting risk is absorbed first by the curator, protecting depositors and stakers from direct counterparty risk.

In practice, each loan is structured into two tranches: a senior sUSDai tranche covering up to 65% of collateral value, and a junior FiLo tranche extending the total LTV to 70%. This means curators supply roughly 7.1% of total loan principal, representing the top 5% of collateral value, the slice of exposure that takes the first hit if collateral prices fall or a borrower defaults.

By shouldering this 5% collateral risk, FiLo curators provide a built-in credit enhancement for the system, creating a protective buffer for sUSDai depositors while earning elevated returns (typically 20–30% APR) for bearing this subordinate risk.

Unlike traditional structured credit, where senior tranches are repaid first to maximize protection and increase credit enhancement over time, USDai employs pro-rata amortization. Both senior and junior tranches receive repayments proportionally as borrowers make payments, keeping the LTV ratio and first-loss buffer constant throughout the loan’s life. While this design preserves credit alignment and simplifies on-chain operations, it also forgoes the progressive de-risking seniors enjoy in traditional finance.

Risk Alignment and Safeguards

Each loan issued through FiLo includes multiple layers of protection. Borrowers contribute an equity cushion, curators contribute the first-loss tranche and the protocol enforces aggressive amortization schedules that front-load repayments. USDai applies a 3 year depreciation curve. As a result, an initial LTV ratio of 70% can fall to approximately 40% after just one year.

The capital stack resembles the rigid structure of commercial mortgage-backed securities (CMBS): equity from the borrower, a first-loss tranche from the curator and senior debt provided by sUSDai holders. Missed payments result in immediate forfeiture and recovery, without discretionary interventions.

Collateral valuation is supported by third-party appraisals from providers such as Evertas and Blockware, which supply secondary market pricing benchmarks. The semi-fungibility of high-end GPUs like the B200 and GB200 series allows for standardized valuation models across asset classes. Unlike tokenized DeFi collateral, live pricing oracles are not used. Instead, conservative amortization schedules, underwriter commitments and independent appraisals serve as the primary safeguards against collateral mispricing.

By requiring curators to take on first-loss risk, the protocol aligns incentives between originators and depositors. By embedding aggressive amortization, independent valuations and automated enforcement once a borrower misses a payment, it ensures that sUSDai remains a senior tranche.

QEV

Queue Extractable Value, or QEV, is a liquidity primitive introduced by USD.AI to solve one of the problems in finance: how to manage withdrawals against long-dated, illiquid collateral.

Most stablecoins promise instant liquidity, relying on collateral such as USDC or ETH that can be liquidated immediately. In contrast, USD.AI is backed by fixed-rate, amortizing GPU loans. These loans are safe in terms of repayment, but their cash flows are scheduled over time rather than instantly available.

In banking and DeFi alike, collapses often stem not from insolvency but from illiquidity. When more depositors ask for their money back than the system can immediately provide, confidence evaporates and tokens trade below par. For USD.AI, the challenge is monthly GPU loan repayments provide a steady stream of cash, but redemptions may spike unpredictably. The system needs a way to manage the sequencing of withdrawals without breaking fairness or stability.

How QEV Works

Each month, as borrowers repay principal and interest, the protocol knows in advance how much liquidity will be available for redemptions. This amount, denoted Δ, is released to service withdrawal requests of sUSDai. If redemption requests are smaller than Δ, all exits are honored in order and the queue clears. If requests exceed Δ, the queue transitions into an auction.

In these cases, sUSDai holders who wish to redeem bid privately for priority access. The sealed-bid system, powered by zero-knowledge proofs, prevents last-minute sniping. The higher the bid relative to others, the greater the share of Δ allocated to that redeemer. Importantly, the funds spent on bids are recycled back into the protocol, rewarding patient holders who wait their turn.

QEV is still in the design phase and has not yet been implemented on-chain. The current system instead uses a 30-day FIFO redemption queue, where withdrawal requests are processed sequentially at the redemption share price once the timelock expires. This indicates that QEV remains a planned future upgrade intended to replace the existing queue-based model with an auction-driven liquidity mechanism.

GPU Backed Overcollateralized Loans

The USDai protocol’s credit architecture is designed to finance real-world GPU infrastructure through a on-chain, legally enforceable and overcollateralized lending system. It connects three key layers: CALIBER for asset tokenization and legal structuring, FiLo for underwriting and risk alignment, and the USDai/sUSDai liquidity layer for capital provision.

In this section we bring these components together and explain, step by step, how the protocol operates end to end: from loan origination and collateral preparation, to on chain borrowing and monthly amortization, and through to default handling, repossession, and bankruptcy scenarios. Together, these elements form a closed loop that transforms physical GPUs into tokenized collateral capable of supporting decentralized credit issuance.

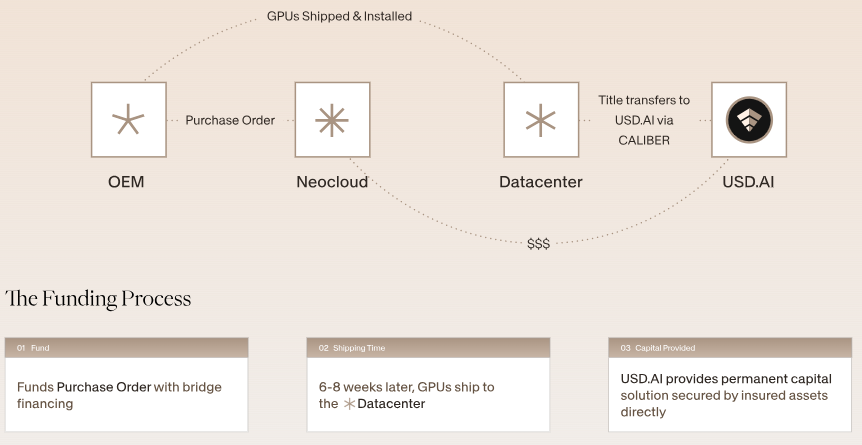

Loan Origination Process

- Purchase Order and Bridge Financing

The process begins when a borrower (e.g AI infrastructure company, datacenter operator, cloud provider) places a purchase order for GPUs from a manufacturer.

This purchase is initially financed through external short-term bridge capital, provided by traditional lenders or private financiers, not by the USDai protocol.

The purpose of this interim financing is to enable the borrower to secure and deploy the hardware without committing long-term capital at the procurement stage. Once the GPUs are delivered, installed and verified, the borrower transitions to permanent, on-chain financing through USDai.

- Shipment and Installation

Once manufactured, the GPUs are shipped and installed at an accredited data center, typically within six to eight weeks.

At this stage, the hardware becomes operational and begins generating verifiable economic output.

- SPV Formation

To qualify for borrowing through the USDai protocol, the borrower must establish a bankruptcy-remote SPV and contribute the GPUs to it.

The SPV serves as a legally segregated entity, distinct from the borrower’s corporate balance sheet, ensuring that the GPU assets remain outside the reach of other creditors in the event of borrower insolvency.

By transferring ownership to the SPV, the borrower effectively isolates the collateral, creating a clean and enforceable structure for the protocol to lend against.

- NFT Minting and Digital Title Creation

Permian Labs, acting as the Tokenizing Agent, mints ERC-721 NFTs that represent each GPU or batch of GPUs.

Each NFT functions as an electronic document of title under UCC Article 7, embedding enforceable property rights directly into the token.

These NFTs serve as the on-chain collateral representation and are the bridge between real-world legal title and digital financialization.

- Bailment Agreement with Data Center

The SPV enters into a Bailment Agreement with the data center that physically hosts the GPUs.

Under this agreement:

- The data center acts as the Bailee, responsible for the safekeeping, operation, and maintenance of the equipment.

- The NFT holder acts as the Bailor, retaining full legal ownership and control over the hardware through the electronic document of title.

This arrangement ensures that even though the GPUs are physically managed by the data center, legal ownership remains tied to the NFT itself, enabling enforceable claims, repossession, or transfer of ownership entirely on-chain.

- Underwriting by FiLo Curators

A FiLo Curator evaluates the borrower and the collateral.

Curators apply their domain expertise to assess borrower creditworthiness, operational capacity, and hardware valuation. They also determine whether the loan meets the protocol’s risk standards, ensuring that underwriting aligns with the protocol’s 70% LTV policy.

- Collateral Valuation by Third-Party Appraisers

Independent valuation firms such as Evertas and Blockware provide third-party appraisals of the GPU hardware.

Their assessments establish the fair market value used to calculate loan size and LTV ratios. The semi-fungibility of modern GPUs (e.g., NVIDIA B200, GB200) enables standardized pricing models and benchmarking across deals.

- On-Chain Loan Generation

Once the loan terms and collateral have been approved, the borrower initiates an on-chain borrow transaction through the protocol’s pool contract.

In this transaction, two actions occur:

- The NFT representing the GPU’s electronic document of title is transferred from the borrower to the

pool contract, which becomes the legal and technical custodian of the collateral for the duration of the loan.

- The borrower simultaneously receives USDC drawn from the pool, representing the disbursement of the overcollateralized loan.

This process formalizes the transfer of digital title under UCC Article 7, with the pool holding the NFT in escrow until full repayment or liquidation.

The loan is financed through a two-tranche capital structure:

- Senior Tranche (sUSDai Holders):

- Represents approximately 92.9% of total loan principal, covering up to 65% of collateral value (LTV).

- Capital originates from sUSDai holders, protocol supply liquidity by redeeming an equivalent amount of USDai from the staking contract.

- The redeemed USDai is unwrapped into $M tokens via the M0 protocol and converted into USDC, which funds the senior tranche of the pool.

- Junior Tranche (FiLo Curators):

- Represents approximately 7.1% of total loan principal, corresponding to the top 5% of collateral value.

- FiLo Curators deposit USDC directly into the pool as first-loss capital, absorbing any valuation shocks or default-related losses before they impact sUSDai depositors.

The borrow function executes both the collateral transfer and the loan disbursement in a single atomic call.

Upon completion, the pool contract holds the NFT as the custodian of the GPU’s digital title, while the borrower receives USDC liquidity. The NFT remains immobilized within the protocol until the borrower fully repays or a default triggers liquidation.

Loan Repayment Process

Once originated, each loan follows a 3 year amortization schedule designed to steadily reduce outstanding principal while maintaining full overcollateralization. Borrowers make monthly repayments that include both principal and interest, paid directly to the protocol’s pool contract.

Each loan is structured as a fully amortizing term loan with a 36 month duration and a fixed annual interest rate, currently around 15%, but adjustable over time based on market conditions and protocol risk parameters. Payments occur every 30 days, combining principal and interest in a single installment.

Repayments are front-loaded, meaning a larger portion of each payment goes toward principal during the early months of the loan term. For a standard three-year loan at 15% APR:

- Approximately 4% of principal is repaid in the first month.

- This gradually declines to around 2.8% by the final month as the interest component decreases.

All repayments are distributed pro-rata between the senior (sUSDai) and junior (FiLo) tranches based on their respective share of the total loan principal.

- FiLo Curators receive their portion of principal and interest directly in USDC, realizing higher returns that reflect their first-loss exposure.

- sUSDai holders benefit from the inflow of repayments, which replenish liquidity available for future GPU loans or support sUSDai redemptions.

Default, Repossession and Bankruptcy Scenarios

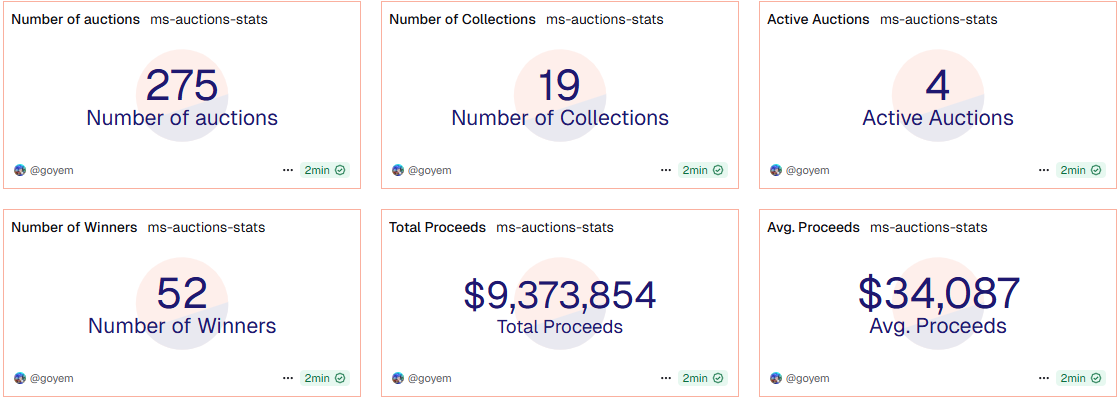

The USDai protocol enforces rules-based liquidation framework designed to preserve the solvency of the lending pool. Defaults are handled through an automated and legally enforceable process that integrates on-chain liquidation mechanisms with off-chain legal protections established under UCC Article 7.

A borrower is considered in default when a scheduled 30 day principal and interest payment is not made within the designated grace period. Once a default condition is triggered, the loan automatically transitions to a default state within the protocol’s pool contract, and liquidation is initiated without discretionary governance intervention.

The liquidation process is executed through the EnglishAuctionCollateralLiquidator contract. The defaulted NFT is transferred from the pool contract to the liquidator, and a seven-day auction begins. Bids are placed and the winning bidder acquires full legal ownership of the NFT and, by extension, the underlying hardware. In most cases, a FiLo curator expected to act as a stalking horse bidder, setting a minimum price for auctioned GPUs. The data center, acting as Bailee, is legally expected to follow the instructions of the NFT’s new holder, either maintaining the GPUs under existing hosting terms or preparing them for delivery.

If a borrower’s parent entity enters bankruptcy, the bankruptcy-remote SPV structure prevents contagion by isolating collateral ownership from the borrower’s general liabilities. The GPUs, which are legally held by the SPV, are not part of the borrower’s bankruptcy estate and cannot be claimed by other creditors. The NFTs representing these GPUs remain immobilized within the USDai protocol, enabling liquidation and repayment to continue uninterrupted regardless of external insolvency proceedings. This separation make sure that all hardware pledged to the protocol remains available for enforcement and that lender rights are preserved.

USDai

USDai is an ERC-20 stablecoin fully backed by short-duration U.S. Treasuries through the M0 Protocol infrastructure.

It is currently live on Arbitrum and Plasma, with minting and redemption operations exclusively supported on Arbitrum.

The token’s supply is capped at 500 million, a limit that has already been reached, contributing to its consistent secondary market premium, further amplified by incentives from the Allo Points Program.

Under the hood, USDai is backed by M0’s $M tokens, which represent fully collateralized digital dollars redeemable 1:1 against tokenized U.S. Treasury holdings.

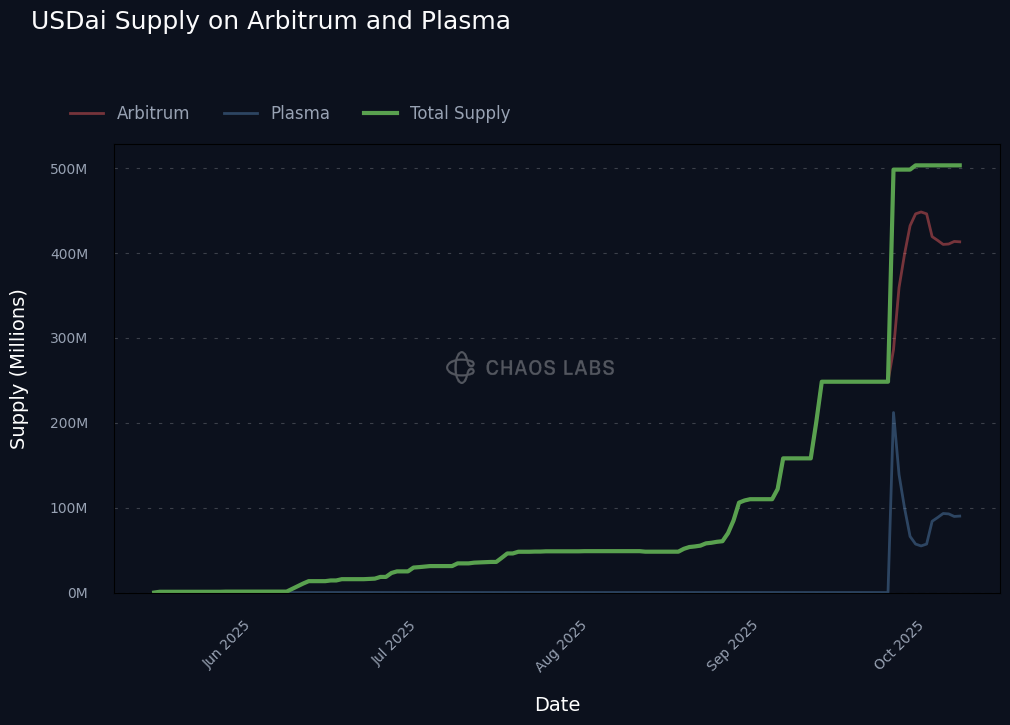

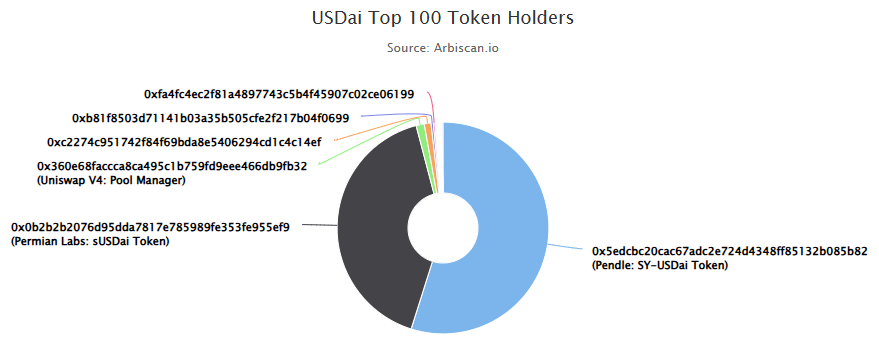

Market Capitalization

USDai’s total market capitalization currently stands at approximately 500 million, the maximum supply permitted under its current minting cap.

The majority of circulating supply (around 410 million, or more than 80%) resides on Arbitrum, which serves as the primary network for minting and redemption operations. Within Arbitrum, roughly 55% of USDai supply is deployed across Pendle PT markets, while approximately 40% is locked in the sUSDai staking contract, contributing to the protocol’s lending liquidity for GPU financing.

Following the recent launch of Plasma, USDai has become a multichain asset, extending beyond Arbitrum. Approximately 90 million of the total supply now circulates on Plasma.

Liquidity

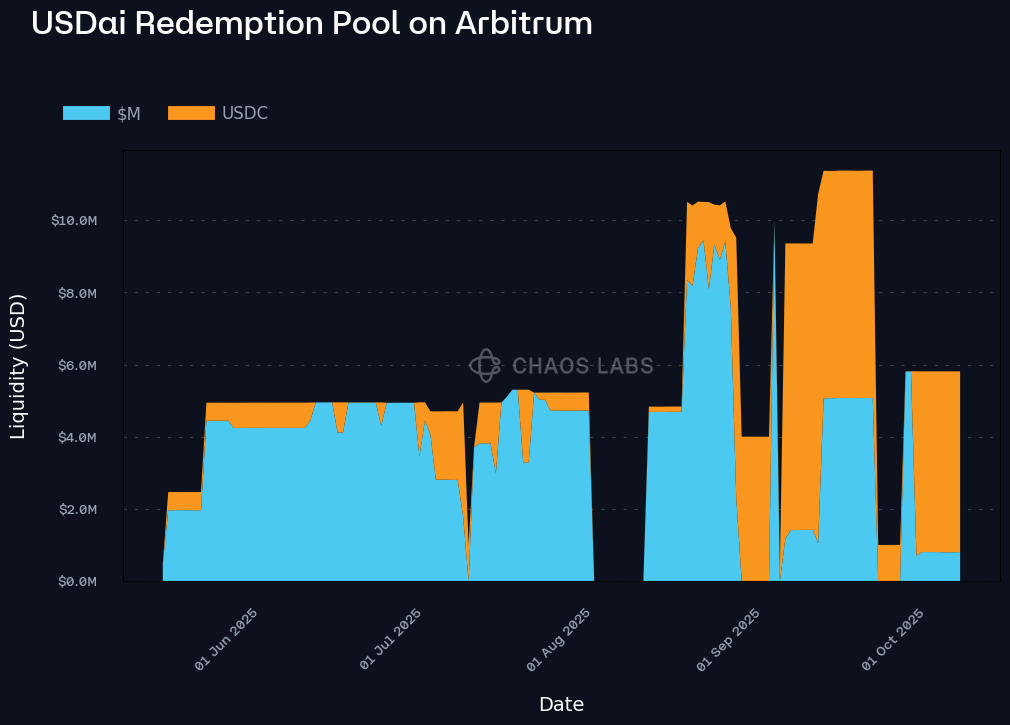

Total on-chain liquidity for USDai on Arbitrum is approximately $32 million, distributed across several decentralized exchanges. However, the composition of this liquidity is highly imbalanced, with the vast majority of depth concentrated on the USDC side of trading pairs, reflecting persistent secondary market demand and USDai’s premium relative to parity.

Most available pools pair USDai against USDC, spanning multiple venues. On Uniswap v3, there are four active pools across different fee tiers, though each displays limited USDai-side depth due to concentrated liquidity positioning. On Curve, a single pool holds around $7.5 million, but its composition is also highly imbalanced, with the majority of assets held in USDC rather than USDai. The largest nominal liquidity resides on Fluid, with approximately $20.5 million in total pool size, yet over 99% of this liquidity consists of USDC, as USDai’s premium discourages two-sided market-making. Additionally, PancakeSwap hosts a small USDai–USDC pool with roughly $270,000 in liquidity.

USDai’s deployment on Plasma has introduced substantial nominal liquidity, with total depth across USDai–USDT0 pairs reaching approximately $182 million. Despite this headline figure, the liquidity composition mirrors the imbalance observed on Arbitrum, only about 3% of the TVL is in USDai, with the remaining 97% is in USDT0. This skew reflects USDai’s persistent premium and the limited supply available due to the protocol’s 500 million mint cap.

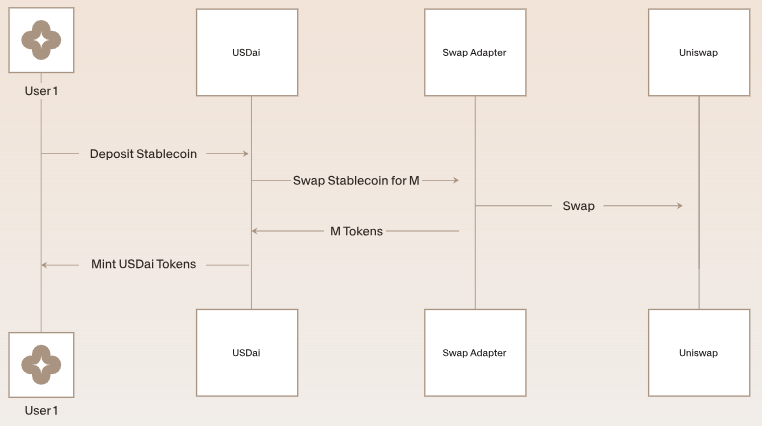

Mint and Redemption

USDai minting and redemption occur exclusively on Arbitrum. Both operations are atomic. To facilitate issuance on M0 infrastructure, the team maintains a dedicated Uniswap v3 USDC–$M 0.01% redemption pool on Arbitrum. When a user mints USDai with USDC, the flow swaps USDC for $M in that pool, and the acquired $M is then used within the same call to mint USDai.

Under the hood, the USDai contract relies on a SwapAdapter that routes between USDC and M0’s base asset ($M). USDai is minted only after the adapter has delivered the base token to the USDai contract. Likewise, redemptions burn USDai and route back through the adapter to return the requested asset to the user.

Liquidity Management for Mint and Redemption

The USDai team is the sole liquidity provider in the USDC–$M 0.01% redemption pool, maintaining tight operational control over the mint and redemption pipeline.

As minting activity dominates (given that redemptions are rare due to USDai’s persistent secondary market premium), the pool’s balance naturally skews toward excess USDC and depleted $M liquidity. This occurs because users continuously swap USDC for $M to mint new USDai, drawing down the available $M reserves in the pool.

To rebalance liquidity, the team periodically withdraws excess USDC from the pool on Arbitrum and bridges it to Ethereum mainnet, where M0’s core contracts reside.

On mainnet, the USDC is used to acquire $M tokens directly through the M0 protocol, the only network where $M creation and redemption are supported.

Acquired $M tokens are then bridged back to Arbitrum and redeposited into the Uniswap v3 pool, restoring equilibrium between USDC and $M liquidity.

It also underscores that liquidity synchronization with M0’s mainnet infrastructure remains operationally managed by the team.

Mint Flow

Below is the on chain sequence for minting USDai, centered on the USDai contract:

- User calls

deposit on USDai contract. This is the primary entry point for minting.

- USDai pulls the input asset from the user. The contract transfers

depositAmount of depositToken from msg.sender to itself using SafeERC20.safeTransferFrom.

- If the input asset is not the base token ($M), USDai swaps into the base token via the Uniswap v3

SwapAdapter. Most of the cases, depositToken is USDC and the adapter routes through the Uniswap v3 USDC–$M pool to acquire $M.

- The pool operates on a 0.01% fee tier, meaning each swap incurs a trading fee.

- The amount of $M received depends on current pool depth and execution price, so the final USDai minted reflects the effective post fee and post price impact amount of $M obtained.

- If the input is already the base token ($M), the contract skips the swap entirely and mints USDai on a 1:1 basis.

- The acquired $M becomes the underlying collateral recorded on the contract balance. This $M will remain in custody of the USDai contract until redemption occurs.

- Checks that the supply cap is not exceeded, and prepares the USDai amount to mint. The cap enforcement is applied unless the caller has the

DEPOSIT_ADMIN_ROLE.

- The contract calls

_mint and emits a Deposited event. The entire path from user call to mint is atomic. If any step fails, the transaction reverts.

Redemption Flow

Below is the on chain sequence for redeeming USDai, centered on the USDai contract:

- User calls

withdraw on USDai, this is the primary entry point for redeeming USDai back into supported stablecoin i.e USDC.

- The contract calls

_burn(msg.sender, usdaiAmount) to remove the tokens from circulation, reducing total supply proportionally.

- If the output asset is not $M, USDai swaps out via the Uniswap v3

SwapAdapter.

- The contract withdraws an equivalent amount of $M from its own holdings.

- It approves the

SwapAdapter to perform a swap from $M to USDC via the Uniswap v3 $M–USDC pool.

- The swap is subject to the same 0.01% fee tier and any price impact.

- After completing the swap, the contract sends the resulting USDC to the user and emits a

Withdrawn event.

The entire burn, swap and transfer sequence executes atomically. The USDai contract first withdraws $M from its holdings, swaps it for USDC and transfers it to the user, all within one transaction.

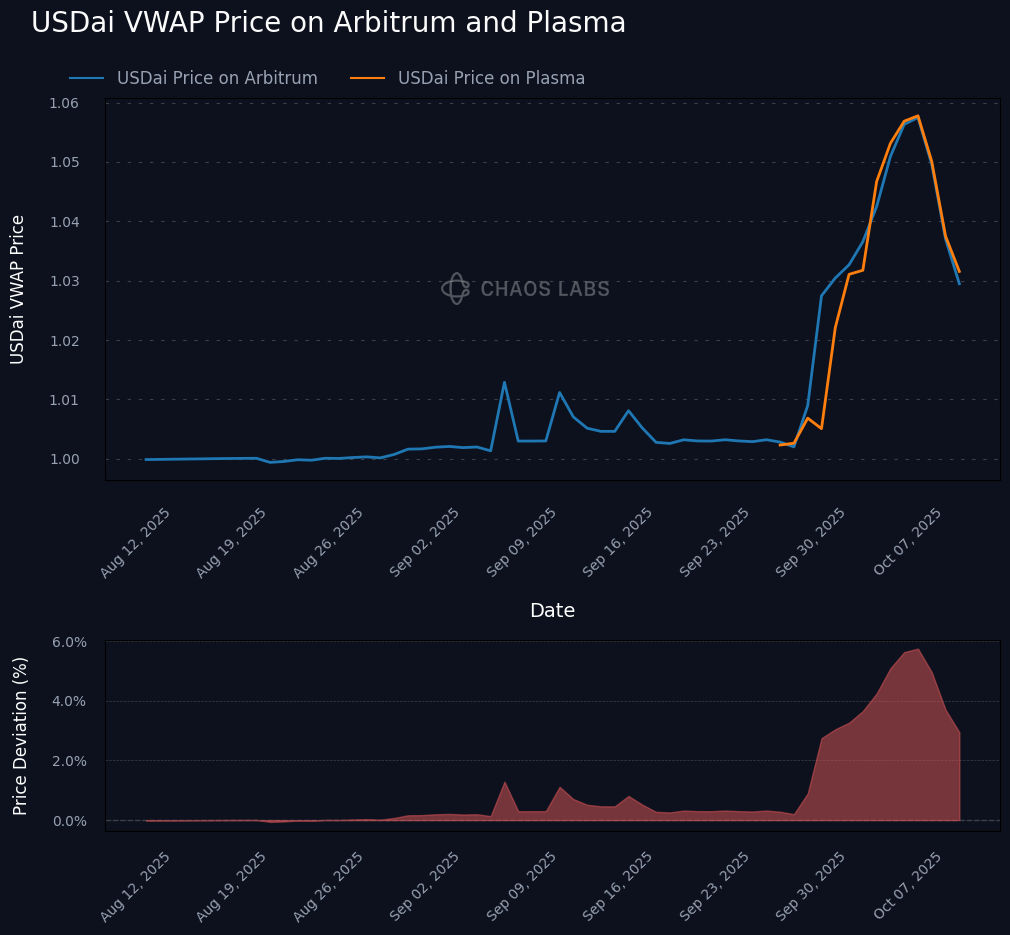

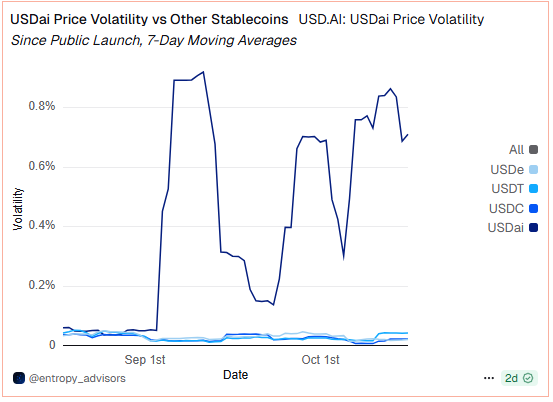

Peg Performance

Since mid-August, USDai has consistently traded above its intended $1.00 peg, reflecting excess market demand relative to its fixed minting cap. The premium first appeared as the cap was reached on Arbitrum, but it intensified following the launch of USDai on Plasma, where additional incentive programs accelerated capital inflows.

During early October, the over-peg reached levels of up to 6% on both Arbitrum and Plasma, with USDai frequently trading between $1.03 and $1.06 across DEXs. This sustained premium created secondary effects in lending markets that integrated USDai as a borrowable asset.

In response, a lending protocol coordinated with the USDai team to adjust parameters and announce a forthcoming increase to the protocol’s minting cap, as referenced in USDai’s public communication. Following this announcement, USDai’s premium began to moderate, declining from 6% to approximately 3% above peg.

As of the latest observations, USDai continues to trade around $1.03, maintaining a moderate over-peg due to persistent demand and the still-active supply cap. The token is not expected to fully revert to par until additional mint capacity is introduced.

sUSDai

sUSDai is the yield-bearing version of USDai, functioning as the capital deployment layer of the USDai ecosystem. While USDai serves as the fully collateralized, liquid base stablecoin, sUSDai represents staked USDai that is actively utilized to generate yield from both GPU-backed credit issuance and Treasury bill–backed reserves.

When users stake USDai into the sUSDai contract on Arbitrum, the tokens are locked and become part of the protocol’s lending liquidity. Although sUSDai is live on Plasma, all staking and unstaking operations occur exclusively on Arbitrum, where the underlying USDai collateral is managed. The USDai staked in the contract serves as the primary source of capital for GPU-backed loans originated through the USDai protocol.

In return for providing this capital, sUSDai holders are entitled to the protocol’s aggregate yield, which is composed of two income streams:

- T-bill yield from the underlying USDai collateral held through the M0 infrastructure, and

- Interest repayments from active GPU-backed loans, which are overcollateralized through the CALIBER and FiLo frameworks.

While USDai is designed to maintain a stable, low-risk profile, sUSDai carries a more dynamic and risk-sensitive exposure. Its yield potential scales with the proportion of total capital deployed into GPU financing, but so does its risk, since defaults or collateral depreciation in GPU-backed loans could impact sUSDai’s backing and redemption liquidity.

At present, approximately 30% of total USDai supply is staked in the sUSDai contract.

Of this amount, only 0.9% of the backing is currently deployed toward active GPU loans, while the remaining 99% remains passively held as USDai. However, this utilization ratio is expected to rise sharply as additional GPU loan facilities are onboarded. The protocol anticipates utilization to increase from 0.9% to over 20% by October, reflecting the next phase of capital deployment.

The long-term vision for sUSDai is to transition from a predominantly T-bill–backed instrument into one where GPU-backed loans constitute the majority of yield generation. This transition is expected to enhance overall returns for stakers but also introduces structural challenges. As a greater share of staked USDai is lent out for 3 year GPU financing, the available liquidity for sUSDai redemptions will decrease.

Although the protocol currently enforces a 30-day unstaking cooldown period, sustained increases in loan utilization will naturally make it progressively harder to service all redemptions within that window. This could result in temporary liquidity imbalances or market depegs on secondary venues during periods of high redemption demand.

Active GPU-Backed Loans

As of October 2025, two GPU-backed loan positions are active within the USDai ecosystem, representing the first real-world deployments of the protocol’s CALIBER framework. Together, they total approximately $1.27 million in principal exposure. Both positions are structured as Equipment Purchase and Sale Agreements (PSAs) between Permian Labs, Inc. and the respective GPU operators (Tactical Compute Holding Ltd and Compute Labs Inc), using blockchain-based Electronic Documents of Title compliant with UCC Article 7.

1. Tactical Compute Holding Limited

- Jurisdiction: Abu Dhabi Global Market (ADGM), UAE

- Loan Size (Protocol Proceeds): $620,243.86 USDC

- Fixed Payments: $17,229.00 per 30 days for 36 months

- Variable Payments: ~1.23% monthly (≈ 15% annualized)

Business and relationship context:

Tactical Compute is not an unrelated borrower, it is a joint venture between Aethir, Beam Foundation and MetaStreet (Permian Labs). The venture operates as a $40 million AI compute initiative, aiming to finance and deploy GPU-based compute infrastructure for Web3 and AI applications. Tactical Compute acts as a bridge between Aethir’s decentralized GPU network (43,000+ GPUs across North America, Europe, and Asia) and Permian’s credit structuring layer, using USDai as the financing medium.

Risk considerations:

While counterparty creditworthiness benefits from the backing of entities (Aethir, Beam, MetaStreet), the loan carries cross-jurisdictional enforcement risk, since the GPUs are physically located outside the U.S. and the bailee operates under ADGM law. If Tactical Compute defaulted, enforcing title recovery under UCC Article 7 may be challenging in foreign courts.

2. Compute Labs, Inc.

- Jurisdiction: Delaware, United States

- Loan Size (Protocol Proceeds): $649,600 USDC

- Fixed Payments: $18,044.44 per 30 days for 36 months

- Variable Payments: ~1.23 % monthly (≈ 15 % annualized)

Business and credit profile:

Compute Labs is a U.S. based AI-infrastructure company focused on tokenizing and financing GPU hardware through blockchain. The firm develops compute-backed financing solutions that enable investors to gain exposure to real-world compute capacity. It operates under Delaware jurisdiction.

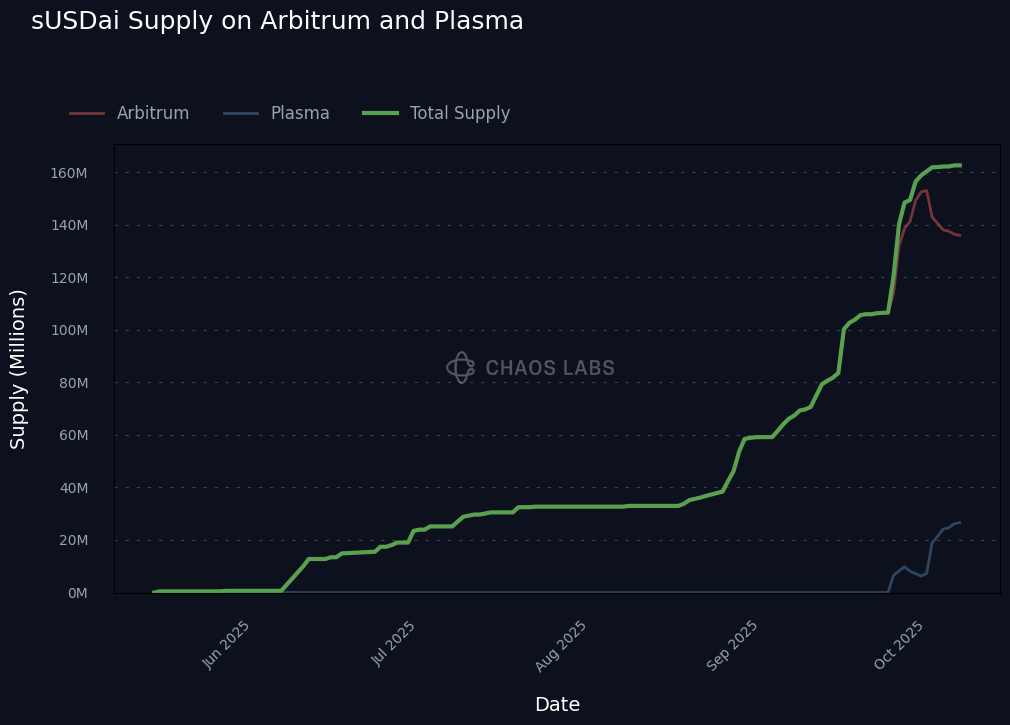

Market Capitalization

The total supply of sUSDai has reached over 160 million, representing approximately 30% of all circulating USDai currently staked in the protocol’s yield-bearing contract.

The majority of this supply (around 135 million sUSDai, or 85% of the total) resides on Arbitrum, which serves as the primary network for staking and redemption operations. The remaining 25 million is deployed on Plasma.

This staked capital forms the core lending pool of the USDai ecosystem, liquidity that can be mobilized to finance GPU-backed loans originated through the protocol’s CALIBER and FiLo frameworks.

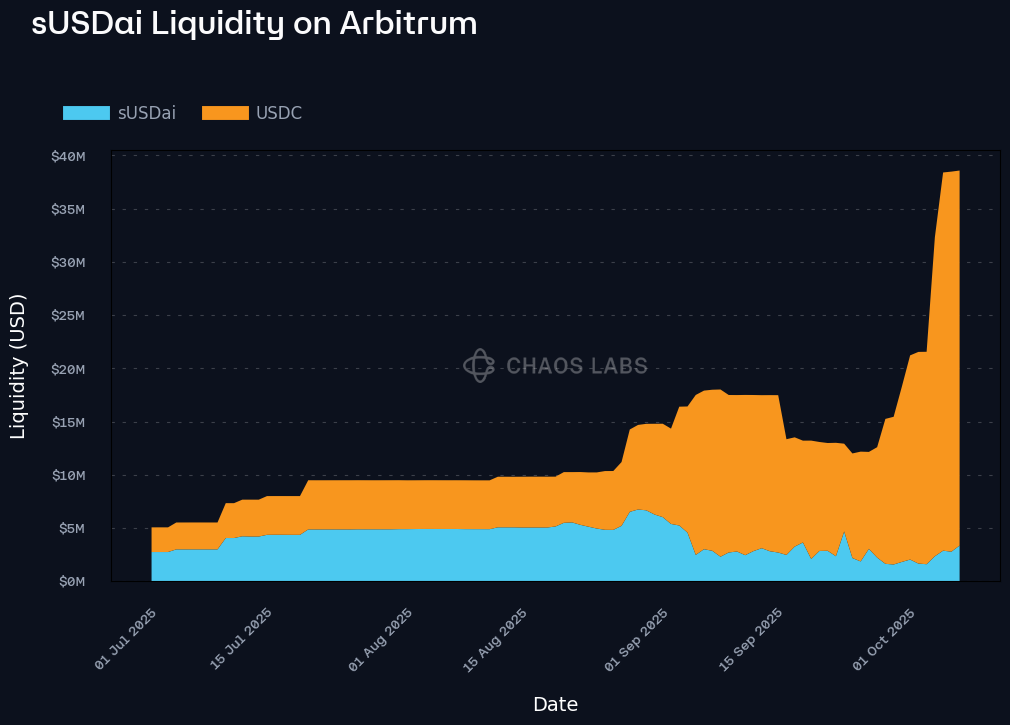

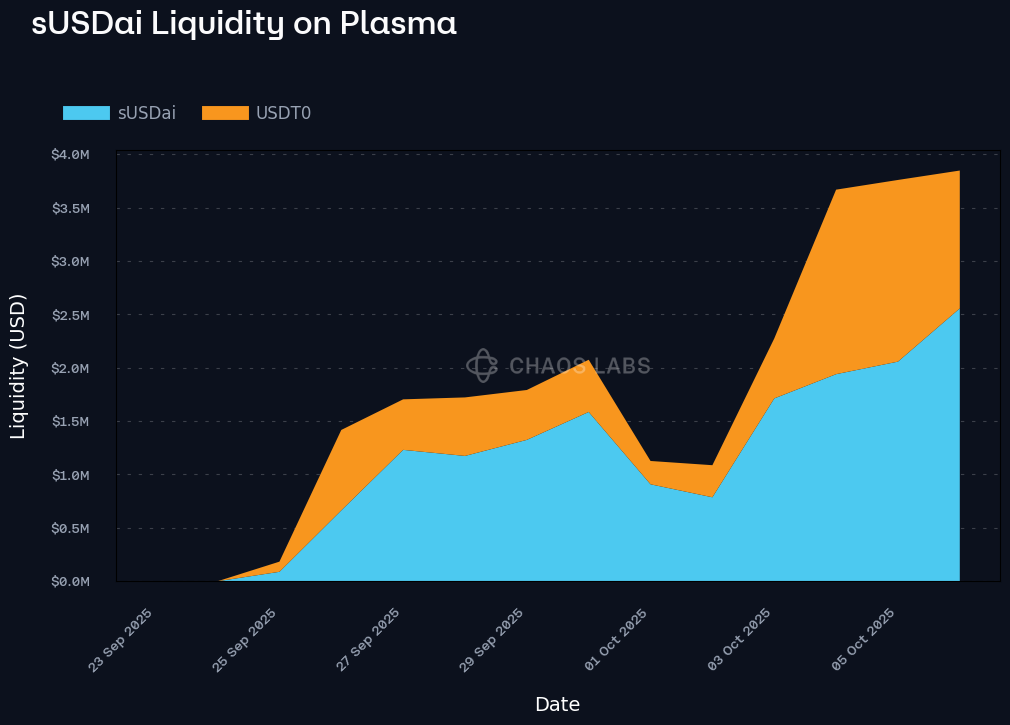

Liquidity

Total on-chain liquidity for sUSDai on Arbitrum stands at approximately $40 million, distributed across several DEXs.

The vast majority, around 80% of this liquidity, is concentrated in a Curve pool against USDC, which serves as the primary trading venue for sUSDai. While this pool provides the deepest market depth, its composition is notably imbalanced, with the majority of assets held in USDC rather than sUSDai, reflecting persistent secondary market demand and sUSDai’s recurring premium above parity.

This structural imbalance is consistent across other venues on Arbitrum, where liquidity provisioning remains skewed toward the stable side of the pair. As a result, only about 10% of the total DEX liquidity on Arbitrum is composed of sUSDai itself.

On Plasma, sUSDai liquidity remains comparatively limited, with approximately $4 million in total DEX depth. Nearly all of this liquidity is concentrated in a Balancer pool against USDT0, which serves as the primary market venue for the asset on the network.

Unlike on Arbitrum, the liquidity composition within this pool is more evenly balanced between sUSDai and USDT0, despite sUSDai also trading at a premium on Plasma.

Mint and Redemption

Minting sUSDai with USDai is an atomic operation, executed directly through the staking contract on Arbitrum. When users deposit USDai, the protocol immediately locks the tokens and issues an equivalent amount of sUSDai, representing a claim on the pooled capital that underpins both T-bill–backed reserves and GPU financing.

Redemption, by contrast, is subject to a 30-day cooldown period. This mechanism governs the process of converting sUSDai back into USDai, introducing a time buffer helps the protocol to manage liquidity between redemption demand and longer-term GPU-backed credit positions.

Importantly, the cooldown period does not guarantee redemption within 30 days. Since sUSDai’s backing is partially deployed into 3 year amortizing GPU loans, redemptions are fulfilled strictly from available liquidity at hand. The protocol does not liquidate active GPU loans to satisfy redemptions.

As a result, during periods of high redemption demand and/or elevated loan utilization, users may experience longer exit durations, with actual redemption timelines determined by the system’s liquidity composition and the maturity profile of outstanding loans.

Mint Flow

When a user decides to stake USDai to receive sUSDai, the process is executed atomically within the StakedUSDai contract on Arbitrum.

The sequence begins when the user calls the deposit() function on the StakedUSDai contract, specifying the amount of USDai to stake and the address that should receive the newly minted sUSDai.

Upon receiving the call, the contract first verifies that deposits are currently enabled. The contract calls its internal _sharePrice() function (via depositSharePrice()) to determine the current exchange rate between USDai and sUSDai.

This share price is computed as:

sharePrice = totalAssets / (totalSupply + bridgedSupply + pendingRedemptions)

Where,

totalSupply refers to the sUSDai circulating on Arbitrum,bridgedSupply represents the sUSDai bridged to Plasma (and future chains), andpendingRedemptions accounts for the tokens already submitted for withdrawal but still in the cooldown queue.

On the numerator side, totalAssets aggregates all USDai-equivalent value backing sUSDai shares:

totalAssets = basePositionAssets + poolPositionAssets + idleUsdaiBalance

Where,

basePositionAssets represents the yield accrued from the T-bill backed USDai reserves. It captures the ongoing income generated by the M0 layer, reflecting the realized T-bill yield.poolPositionAssets measures the capital actively deployed into GPU-backed loan pools managed through the protocol’s lending infrastructure. These assets include all outstanding loan principal, accrued interest and recovered amounts, representing the productive portion of sUSDai capital that finances real-world GPU infrastructure.idleUsdaiBalance denotes the unallocated USDai held directly by the StakedUSDai contract. This balance acts as an immediate liquidity buffer to facilitate redemptions and/or fund new loan allocations.

Once the share amount is determined, the contract transfers the user’s USDai from their wallet into the staking contract using SafeERC20.safeTransferFrom. The transferred USDai immediately becomes part of the pool’s total assets and is available for allocation to upcoming loan originations.

After receiving the USDai, the contract mints the calculated number of sUSDai tokens to the specified receiver’s address.

The contract emits a Deposit event that logs the transaction details: the depositor’s address, receiver, deposit amount and minted share quantity.

The newly deposited USDai is now held within the StakedUSDai contract and can be allocated by the protocol’s liquidity management module PoolPositionManager toward into GPU-backed loans.

Redemption Flow

When a user decides to redeem sUSDai back into USDai, the process unfolds in two phases (a redemption request and a later withdrawal) coordinated through the RedemptionLogic module and the on-chain redemption queue.

The sequence begins when the user calls the requestRedeem() function on the StakedUSDai contract, specifying the amount of sUSDai shares to redeem. The user can submit the request directly or through an authorized operator set via setOperator().

Upon receiving the call, the contract validates that redemptions are enabled, verifies the user’s sUSDai balance and burns the specified shares from their wallet. The redemption request is then recorded in the on-chain queue through RedemptionLogic._requestRedeem().

Each request is assigned a unique redemption ID and timestamped with a cliff time, determined by the global timelock parameter (currently 30 days).

This timelock defines the minimum period a user must wait before their redemption becomes claimable. During this cooldown, the request is added to the queue and tracked as pending shares, included in the pendingRedemptions value that contributes to the share price calculation.

Once the cooldown period has expired and liquidity becomes available, the queued requests can be serviced.

Servicing is initiated by the protocol’s strategy admin, who calls serviceRedemptions() to process pending requests in the on-chain queue.

This triggers RedemptionLogic._processRedemptions(), which fulfills requests in strict FIFO order. There is no discretionary control over which redemptions are processed first until the previously discussed QEV mechanism is implemented.

Crucially, the serviceRedemptions() function includes an explicit safeguard to ensure that only redemptions that can be fully backed by available liquidity are processed:

if (amountProcessed > _usdaiBalance()) revert InsufficientBalance();

This means the strategy admin cannot process redemptions if the contract’s idle USDai balance is insufficient, even if some requests have completed their 30-day cooldown.

As a result, redemption servicing is entirely liquidity-dependent: if cash is not yet available from monthly GPU loan repayments, idle USDai balance or T-bill yield the queue remains paused until sufficient funds accumulate.

Once redemptions are processed and liquidity allocated, users can claim their USDai by calling redeem() . This functions internally invoke RedemptionLogic._redeem(), which transfer the corresponding USDai to the user’s wallet and emit a Withdraw event recording the transaction details.

Since launch, on-chain redemption activity has remained low. The strategy admin has serviced the queue once, on September 19, 2025, processing 83 redemption requests in a single batch. Of these, 38 requests have been claimed by users.

In total, 142 redemption requests have been submitted. The limited servicing frequency and low claim ratio reflect minimal reliance on the native redemption mechanism, largely because sUSDai has consistently traded at a premium, allowing users to exit through secondary markets instead of waiting for the cooldown period.

Peg Performance

sUSDai has consistently traded at a premium to its intended exchange rate with USDai.

At its highest point, the secondary market premium reached approximately 4.2%, before moderating to around 2%.

This behavior closely mirrors that of USDai, which itself trades above $1.00 due to its fixed minting cap. Because sUSDai can only be created by staking USDai, the two assets share the same supply limitations.

Risks

Both USDai and sUSDai introduce new design trade-offs relative to conventional stablecoins and yield-bearing assets.

While the system is fully collateralized and legally structured to minimize insolvency risk, it remains exposed to several categories of market, liquidity and operational risks.

1. Peg Volatility and Secondary Market Dynamics - USDai

The fixed 500 million minting cap creates an inherent supply bottleneck. As demand for USDai rises, the lack of new issuance pushes the token to trade at a premium above $1, a pattern already observed across both Arbitrum and Plasma. While this premium indicates strong demand, it introduces peg volatility that can disrupt integrations with lending protocols.

When USDai trades above par, liquidators are disincentivized to repay USDai-denominated debt, as they would need to repurchase USDai on the secondary market at a higher price than the protocol’s internal pricing, making liquidations economically less attractive.

This friction complicates USDai’s use as a borrowable asset in collateralized lending protocols.

2. Liquidity Management and Operational Risk – USDai

USDai’s mint and redemption pipeline relies on a Uniswap v3 USDC–$M pool on Arbitrum, which serves as the primary on-chain venue for converting between M0’s base asset ($M) and USDai’s deposit currency (USDC).

While the system is designed for atomic issuance and redemption, it introduces several operational dependencies that can affect liquidity availability and redemption timelines:

Liquidity Pool Dependence:

All redemptions route through the Uniswap v3 pool, where executions are subject to the prevailing pool depth, swap fees (0.01%) and price impact. Under conditions of thin $M liquidity, redemptions may experience slippage or temporarily limited capacity until liquidity is replenished.

Cross-Chain Liquidity Rebalancing:

The USDai team is the sole liquidity provider in this pool and manually manages its balance. When persistent minting activity depletes $M reserves, the team withdraws excess USDC, bridges it to Ethereum mainnet, mints new $M through the M0 protocol, and bridges the $M back to Arbitrum. This process introduces an operational reliance on manual cross-chain rebalancing.

In periods of high redemption demand or network congestion, cross-chain bridging delays or temporary bottlenecks in M0’s mainnet minting capacity could pause or slow USDai redemptions, breaking the assumption of atomic liquidity on Arbitrum.

Until the team completes a new liquidity cycle, redemption processing could temporarily stall.

These factors introduce a layer of operational and timing risk to USDai’s otherwise fully collateralized design.

While not solvency-related, such dependencies could create short-term redemption delays or localized slippage during peak on-chain activity or sustained imbalance between USDC and $M liquidity.

3. Liquidity and Redemption Risk - sUSDai

sUSDai’s redemption model is designed to prioritize long-term stability for borrowers rather than instant liquidity for lenders.

While only ~1% of the current collateral base is deployed into GPU-backed loans, the protocol expects utilization to rise substantially over time.

As utilization increases, a greater portion of sUSDai will be backed by illiquid, amortizing loans, which cannot be liquidated to service withdrawals if borrower is not defaulted.

Redemptions are expected to fulfilled solely through idle USDai balances and monthly loan repayments.

During periods of high redemption demand, the protocol may be able to service only a fraction of queued requests, extending withdrawal timelines well beyond the nominal 30 day cooldown.

This structural liquidity lag increases the likelihood that sUSDai could trade below its exchange rate to USDai during stress events.

4. Collateral Value and Depreciation Risk - sUSDai

As the protocol expands GPU-backed lending, sUSDai’s collateral composition will become increasingly sensitive to the market value of GPUs.

While GPUs are currently in high demand, their prices can decline sharply due to new model releases, technological obsolescence or reduced AI infrastructure spending.

If GPU valuations fall faster than expected, the protocol’s collateral coverage could weaken, reducing the effective backing of sUSDai and amplifying redemption pressure.

5. Credit and Counterparty Risk - sUSDai

The sUSDai system involves multiple counterparties whose collective performance determines credit quality:

- Borrowers may default or enter bankruptcy, triggering on-chain liquidations.

- FiLo Curators may extend credit to financially weak or speculative GPU purchasers whose cash flows are insufficient to service debt, resulting in poor underwriting quality and potential first-loss absorption that diminishes the protection of the senior sUSDai tranche.

- Data centers and SPVs introduce operational dependencies for custody, maintenance and legal enforcement. Although SPVs is structured to be bankruptcy-remote and enforceable under UCC Article 7, practical enforcement can become complex when counterparties or data centers operate outside U.S. jurisdiction. In such cases, the legal recognition of electronic documents of title and bailment agreements may not be uniformly upheld, potentially complicating repossession or collateral recovery.

Furthermore, because on-chain liquidation of physical GPU claims has no historical precedent, the secondary market for repossessed GPU NFTs remains untested and may exhibit limited liquidity in distressed scenarios. Although the team is in contact with GPU resellers for potential liquidation pathways, such mechanisms have yet to be validated in practice.

These factors collectively introduce material counterparty and enforcement risk that could affect recovery rates in the event of borrower default.

Conclusion

While the USDai protocol represents a sophisticated attempt to bridge DeFi liquidity with real-world compute infrastructure, the system’s reliance on GPU-backed lending introduces additional layers of liquidity, operational, and enforcement complexity. These challenges are further compounded by the limited visibility into secondary market demand and resale liquidity for GPUs, which could materially affect collateral recovery and loan performance under stress conditions.

Chaos Labs recommends deferring the listing of both USDai and sUSDai and reassessing at a later stage, once the ecosystem and GPU market dynamics have matured, the USDai minting caps are lifted and a reliable redemption mechanism is demonstrated.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0