Title: [ARFC] Onboarding sfrxETH to Aave V3 Ethereum Market

Author: @0xTogbe - Aave Chan Initiative

Date: 2023-11-27

Summary

This ARFC proposes the addition of sfrxETH from Frax to Aave V3 Ethereum to enhance LST liquidity and asset diversity.

Motivation

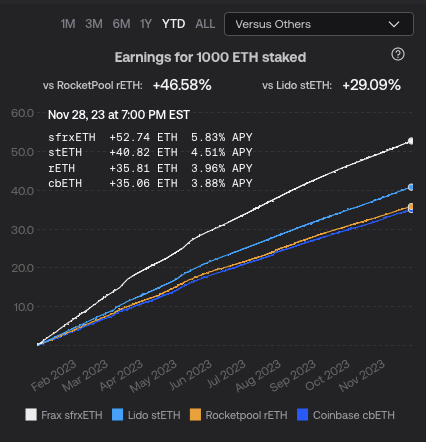

sFrxETH is the Staked version of FrxETH from the Frax Ecosystem. Users can freely mint frxETH in exchange for ETH deposits.

The Aave-Chan Initiative supports LST diversity in Aave V3 as shown with our historical support of cbETH, rETH, and, parallel to this proposal, our support for ETHx.

This proposal is a reboot of ARC Proposal: Onboarding sfrxETH from Frax Protocol to Aave V3 Ethereum Market 10 from January. More details for sFrxETH can be found in the first proposal.

Specification

- *Contract Address: sfrxETH : 0xac3e018457b222d93114458476f3e3416abbe38f 2

| Risk Parameter | Value |

|---|---|

| emode | Yes |

| Isolation Mode | No |

| Borrowable in Isolation | No |

| Stable Borrow | No |

| Enable Borrow | Yes |

| Enable Collateral | Yes |

| Loan To Value (LTV) | 71% |

| Liquidation Threshold | 76% |

| Liquidation Bonus | 8% |

| Reserve Factor | 15% |

| Liquidation Protocol Fee | 10% |

| Supply Cap | 80000 sfrxETH |

| Borrow Cap | 5000 sfrxETH |

| Debt Ceiling | N/A |

| uOptimal | 45% |

| Base | 0% |

| Slope1 | 7% |

| Slope2 | 300% |

Next Steps

- Solicit feedback from the Aave community.

- If community sentiment is favorable, proceed with the ARFC snapshot.

- Success in the snapshot leads to the development of an AIP.

Disclaimer

This proposal is powered by Skywards.

The Aave Chan Initiative is not directly affiliated with Frax Protocol and did not receive compensation for creation this proposal.

Copyright

Copyright and related rights waived via CC0.