Summary

Should the community wish to list sfrxETH, Gauntlet recommends the following parameters. We give further color below.

Recap

In February, Gauntlet’s analysis indicated that listing sfrxETH may require higher levels of trust compared to stETH. We cautiously suggested delaying any action until frxETH v2’s release.

Following Ethereum’s Shapella upgrade in April 2023, which enabled token withdrawal for stakers, there has been great advancement in Protocols. By November 2023, the value of funds staked via Ethereum LSTs reached around 20 billion USD.

We provide a re-evaluation of the risk parameters for sfrxETH below from a market risk perspective.

Assessment

Market Share

sfrxETH has ~2.5% of the overall LST marketshare as of end of Nov, ranking it 5th by market share.

Liquidity

- sfrxETH has a circulating supply of 210k sfrxETH.

- The primary liquidity venues include two frxETH - ETH/WETH pools on Curve (~$136m TVL).

- A swap of 20k sfrxETH to WETH incurs ~2% slippage.

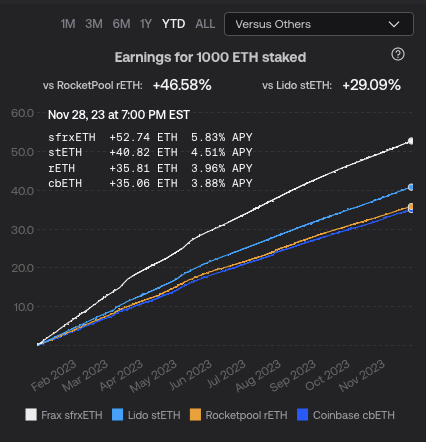

Staking yield

sfrxETH has realized yield of 5.83% over 2023, which has been more attractive than its competitors with yield below 5%. sfrxETH’s higher yield is achieved by its unique dual-token model and Frax’s strategy managing liquidity via Curve gauge incentives. The yield generated from all staked ETH by frxETH holders is allocated to sfrxETH holders. Frax’s governance stake and its AMO market-making strategy incentivizes liquidity for frxETH within the Curve platform.

Recommendations

Borrow and Supply Caps

Given its liquidity profile and expected WETH debt borrowed against sfrxETH, we recommend initial supply caps of 55k for sfrxETH, 25% of the circulating supply. Should the community wish to adopt a more conservative view towards sfrxETH due to trust related or other considerations, it may wish to adopt lower caps.

| Parameter | Recommendation |

|---|---|

| Isolation Mode | NO |

| Emode | ETH-correlated |

| Borrowable | YES |

| Borrowable in Isolation | NO |

| Collateral Enabled | YES |

| Stable Borrowing | NO |

| Supply Cap | 55,000 |

| Borrow Cap | 5,500 |

| Debt Ceiling | N/A |

| LTV | 71% |

| LT | 76% |

| Liquidation Bonus | 7.5% |

| Liquidation Protocol Fee | 10% |

| Reserve Factor | 15% |

| Base Variable Borrow Rate | 0 |

| Variable Slope 1 | 7% |

| Variable Slope 2 | 300% |

| Uoptimal | 45% |