Summary

A proposal to:

- Increase the supply cap of ezETH on the Ethereum Core instance

- Increase the supply cap of weETH on the Plasma instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

ezETH (Ethereum Core)

ezETH has reached its supply cap on the Ethereum Core instance at 75 thousand tokens, following a gain of over 50% during the last 7 days, indicating substantial demand to use the asset as collateral.

Supply Distribution

The supply distribution of the asset is highly concentrated as the top user accounts for over 67% of the market, while top 15 users represent the whole market. As can be observed from the plot, the users are collateralizing wstETH debt with ezETH, leveraging the restaking yield. The distribution of health factors is narrow (1.05 - 1.07), as users maximize their leverage.

As mentioned previously, the majority of debt is concentrated in wstETH, which represents over 98% of the borrowed funds. While the positions have low health factors, the liquidation risk in the market is minimal due to the high correlation of the asset prices, given that ezETH represents a restaked version of wstETH.

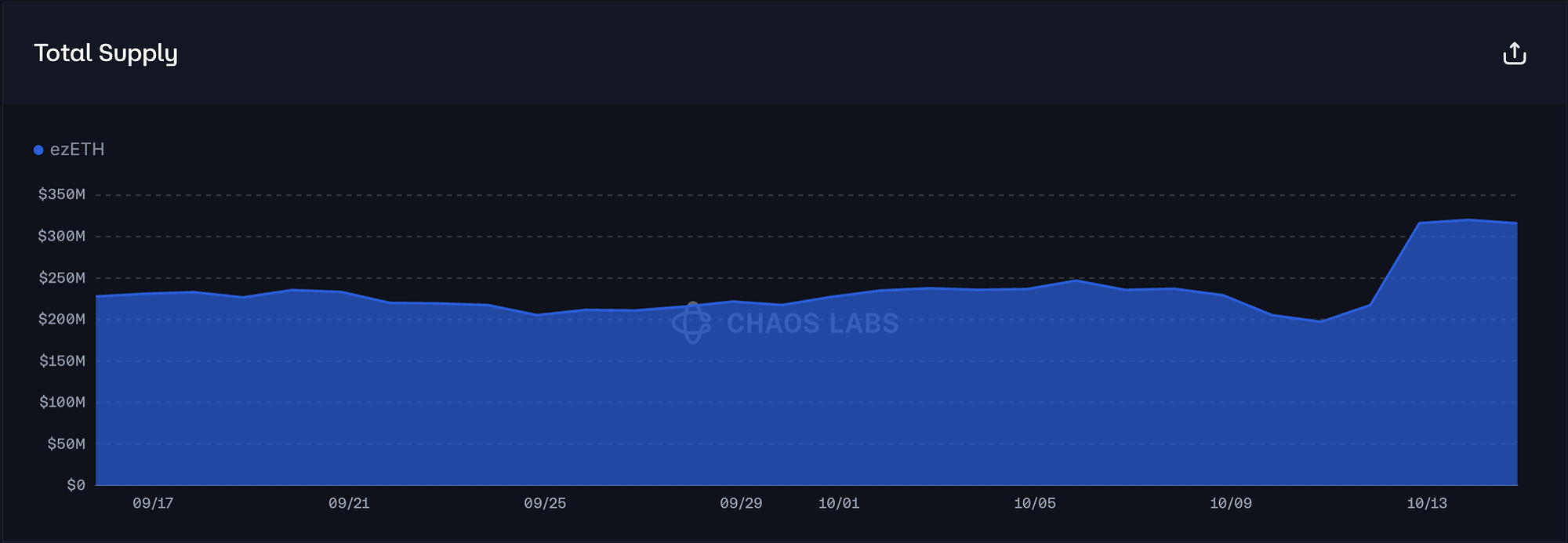

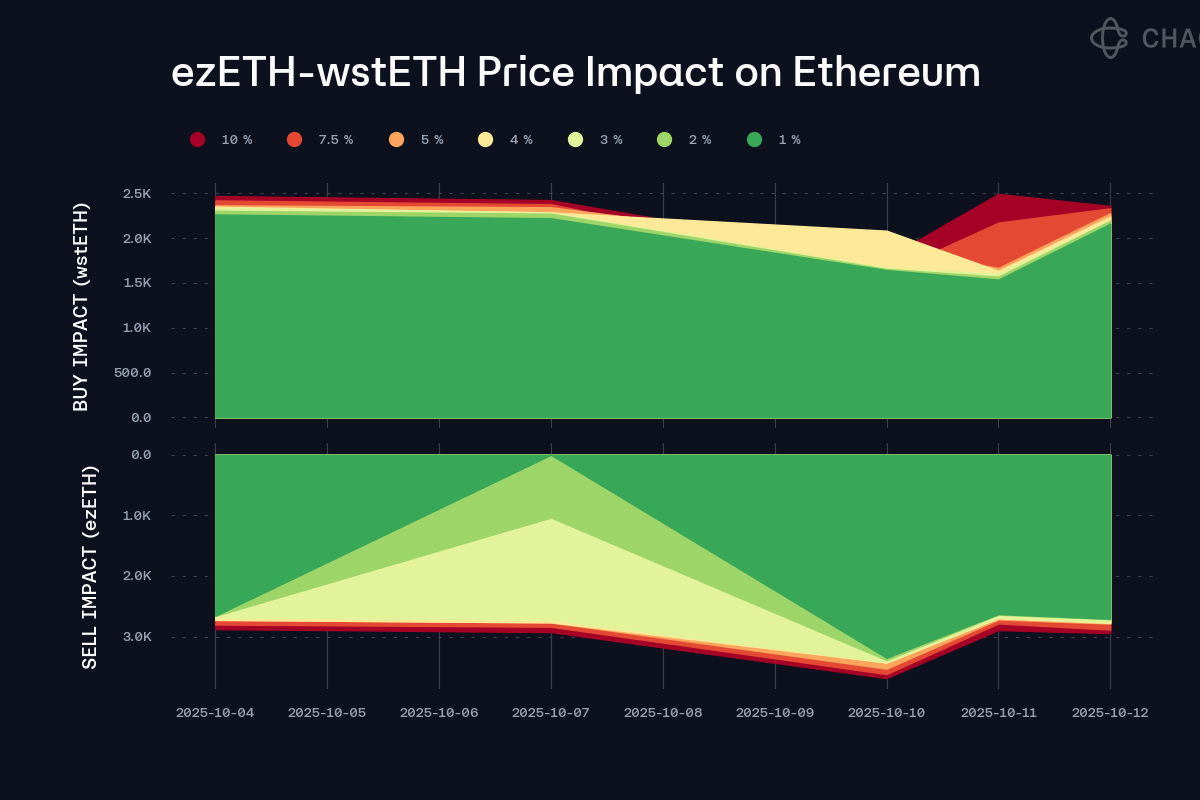

Liquidity

Currently, ezETH liquidity on Ethereum is sufficient to limit the price impact of a 2,500 ezETH sell order to 1%, supporting an increase in the supply cap.

Recommendation

Given the substantial demand for using ezETH as collateral in tightly correlated leveraged restaking strategies, along with safe user behavior and deep on-chain liquidity, we recommend increasing the supply cap of the asset.

weETH (Plasma)

weETH on Plasma has reached its 160,000-token supply cap and is primarily used as collateral. The parameters proposed further were achieved in close collaboration with the Plasma team, aiming to optimize collateral distribution, asset utilization, and enhance user retention.

Supply Distribution

The supply distribution of weETH is moderately concentrated at the top user accounts, which account for 37% of the total supply, while the top 5 wallets represent over 90%. The users are primarily clustered into two distinct categories: those with USDT0 debt and WETH debt. USDT0 borrowers are likely using the debt for liquidity provision or incentive exposure maximization within the instance, due to the uncorrelated returns of weETH and USDT0, the users are maintaining high health factors in the 2.0-2.9 range. The other group of users is borrowing WETH with substantial leverage to maximize the captured spread between the underlying APY of weETH and WETH borrow rates.

Both clusters of users present minimal risks for either correlated asset lending strategies or high and consistently maintained health factors.

Liquidity

At the time of writing, the slippage on a 5,000 weETH sell order for WETH is limited to 3.5%, supporting an increase of the supply cap. Additionally, Plasma’s team has established a $300 million liquidation backstop to ensure timely execution of liquidations during periods of high market stress, which substantially reduces the risk of bad debt for the protocol.

Recommendation

Considering the substantial demand to use weETH as collateral on Plasma, favorable liquidity conditions, and safe user behavior, we recommend increasing the asset’s supply cap.

Specifications

| Instance | Asset | Current Supply Cap | Recommended Supply Cap |

|---|---|---|---|

| Ethereum Core | ezETH | 75,000 | 120,000 |

| Plasma | weETH | 160,000 | 240,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.