October 2025

This update highlights Chaos Labs’ activities and proposals in October.

Highlights

Deprecation of Low Demand Volatile Assets on Aave V3 Instances

Given the market disturbance on Oct 10, 2025, Chaos Labs identified systemic oracle dislocations and severe cross-chain asset volatility. At the same time, our revenue analysis showed that the affected long-tailed assets contribute negligible income relative to their risk. Therefore, we proposed the deprecation of these assets to safeguard Aave V3’s stability during future periods of heightened market stress.

Asset Listing Analysis for USDai & sUSDai

Chaos Labs has conducted a detailed analysis of USDai and sUSDai by analyzing their architecture, collateral composition, legal enforceability, liquidity, and redemption dynamics. Our analysis concludes that while USDai is fully backed by short-duration U.S. Treasuries via the M0 infrastructure, both USDai and sUSDai currently carry material peg, liquidity, and cross-jurisdictional enforcement risks, especially as GPU-backed credit exposure scales. In the end, we recommend deferring support for USDai listing on Arbitrum and Plasma until minting caps are lifted, supply–demand imbalances and redemption frictions are resolved, and the tokens demonstrate sustained peg stability and reliable primary-market liquidity.

Risk Oracles

Variable Rate Slope 2 Oracle

Since launch, the Slope 2 Risk Oracle has continued to function normally and executed two updates in late October, specifically on October 26 for USDe and WETH. These adjustments demonstrate that the oracle is operating as intended and responding appropriately to market conditions.

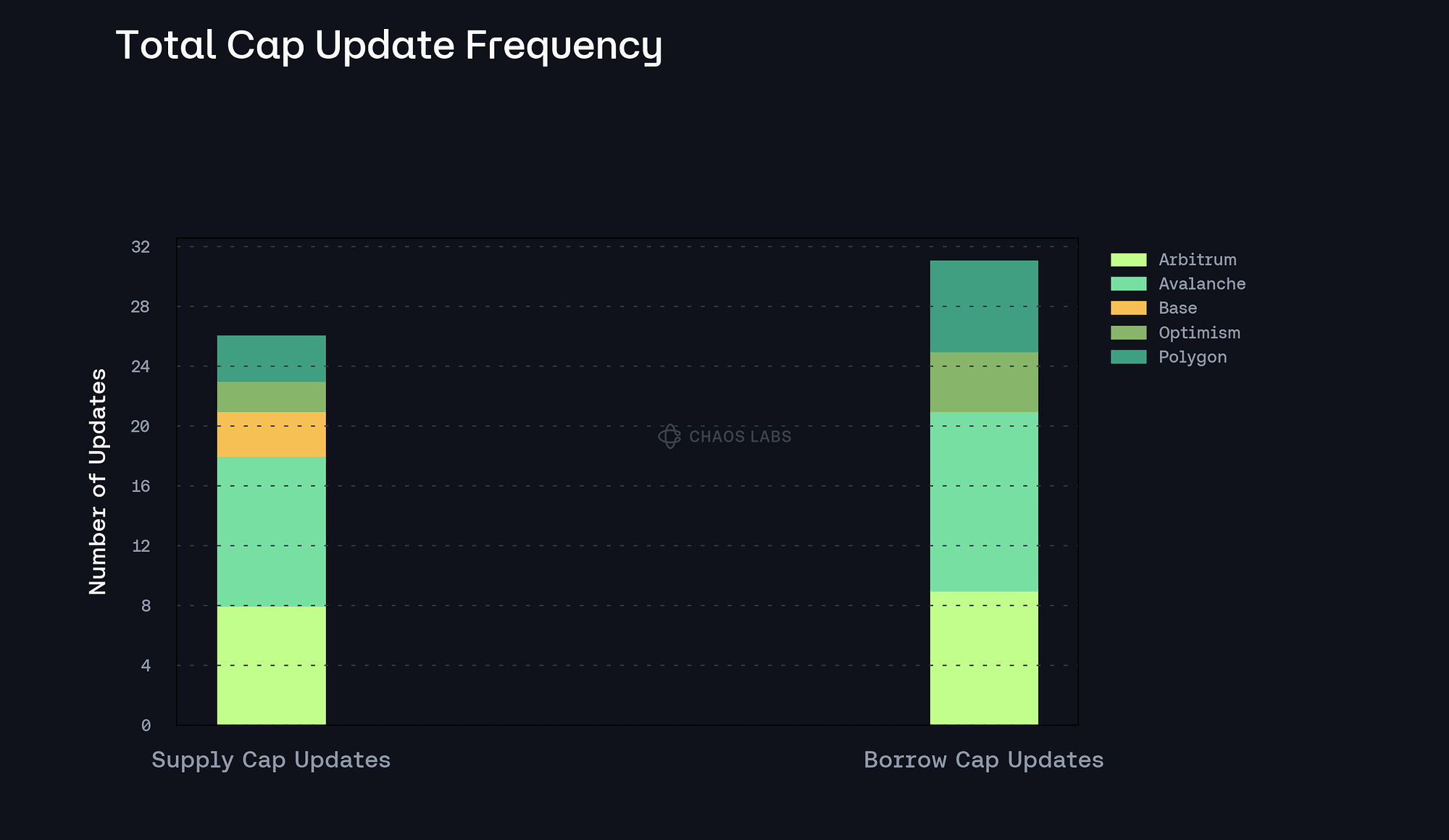

Supply and Borrow Cap Oracle

The supply and borrow cap risk oracles on Arbitrum, Avalanche, Polygon, Optimism, and Base have continued to operate efficiently, executing adjustments across numerous markets. As shown, a total of 26 supply cap updates and 31 borrow cap updates have been carried out. Among these, Avalanche experienced the highest frequency of adjustments, with 10 supply cap updates and 12 borrow cap updates.

PT Risk Oracle

The value of assets utilizing the PT Risk Oracle averaged approximately $2B in October 2025. As shown in the chart, PT-sUSDe-27NOV2025 and PT-USDe-27NOV2025 are currently the two largest PT tokens in the market, with supplies of 1.3B and 340M respectively, as of this writing. As noted in our September monthly update, the reduction in size from the November PTs compared to their September counterparts stems from the significantly lower implied yield of PT-USDe November relative to the September series.

At the same time, as shown, as these PTs approach shorter remaining durations, the oracle dynamically adjusts the LT and LB parameters to reflect the declining time-to-maturity risk.

Forum Activity

We published the following proposals, updates, and analyses, including risk parameter updates:

- Chaos Labs Risk Stewards - Adjust Supply Caps and Borrow Caps on Aave V3 Plasma Instance - 10.02.25

- Chaos Labs Risk Stewards - Slope2 Parameter Adjustments for Risk Oracle Deployment

- Chaos Labs Risk Stewards - Adjust Supply Caps and Borrow Caps on Aave V3 - 10.06.25

- Chaos Labs Risk Stewards - Adjust Supply Caps and Borrow Caps on Aave V3 - 10.16.25

- Chaos Labs Risk Stewards - Adjust Supply Caps and Borrow Caps on Aave V3 - 10.20.25

- Chaos Labs Risk Stewards - Stablecoins Interest Rate Adjustment on Aave V3 - 25.10.25

- Chaos Labs Risk Stewards - Adjust Supply Caps and Borrow Caps on Aave V3 - 10.27.25

- Chaos Labs Risk Stewards - Adjust Supply Cap on Aave V3 - 10.28.25

- Chaos Labs Risk Stewards - Adjust Supply and Borrow Caps on Aave V3 - 10.30.25

Additionally, we provided analysis regarding the following proposals and discussions:

- [Direct-to-AIP] Onboard wrsETH to Aave v3 Plasma Instance

- [Direct-to-AIP] Onboard wstETH to Aave v3 Plasma Instance

- [Direct-to-AIP] Full Deprecation of DPI Across Aave Deployments

- [Direct to AIP] Onboard sUSDe and USDe January expiry PT tokens on Aave V3 Plasma Instance

- [Direct to AIP] Enable pyUSD as collateral on Aave V3 Core Instance

- [Direct to AIP] Onboard syrupUSDT to Aave V3 Plasma Instance

- Chaos Labs Risk Report: Insights from Recent Market Events - 10/11/25

- [ARFC] Onboard USDai & sUSDai to Aave V3 Arbitrum Instance

- [ARFC] USDC (old) deprecation on Gnosis Chain Instance

- [ARFC] Deprecation of Low Demand Volatile Assets on Aave V3 Instances

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

- Supply and borrow cap risk oracle integration across additional chains leveraging Edge infrastructure

- Ongoing monitoring of SVR and related parameterization

- Pendle Dynamic Risk Oracle deployment for each PT asset

- CAPO Risk Oracle integration

- Preparation for the launch of Aave V4