Summary

A proposal to:

- Increase the supply cap of rsETH on the Arbitrum instance

- Increase the supply cap of PT-sUSDe-15JAN2026 on the Plasma instance

- Increase the borrow cap of USDe on the Plasma instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

rsETH (Arbitrum)

rsETH has reached 87% of its supply cap on the Arbitrum instance, following an inflow of over 6,000 tokens since October 14th, indicating growing demand to utilize the asset as collateral on the instance.

Supply Distribution

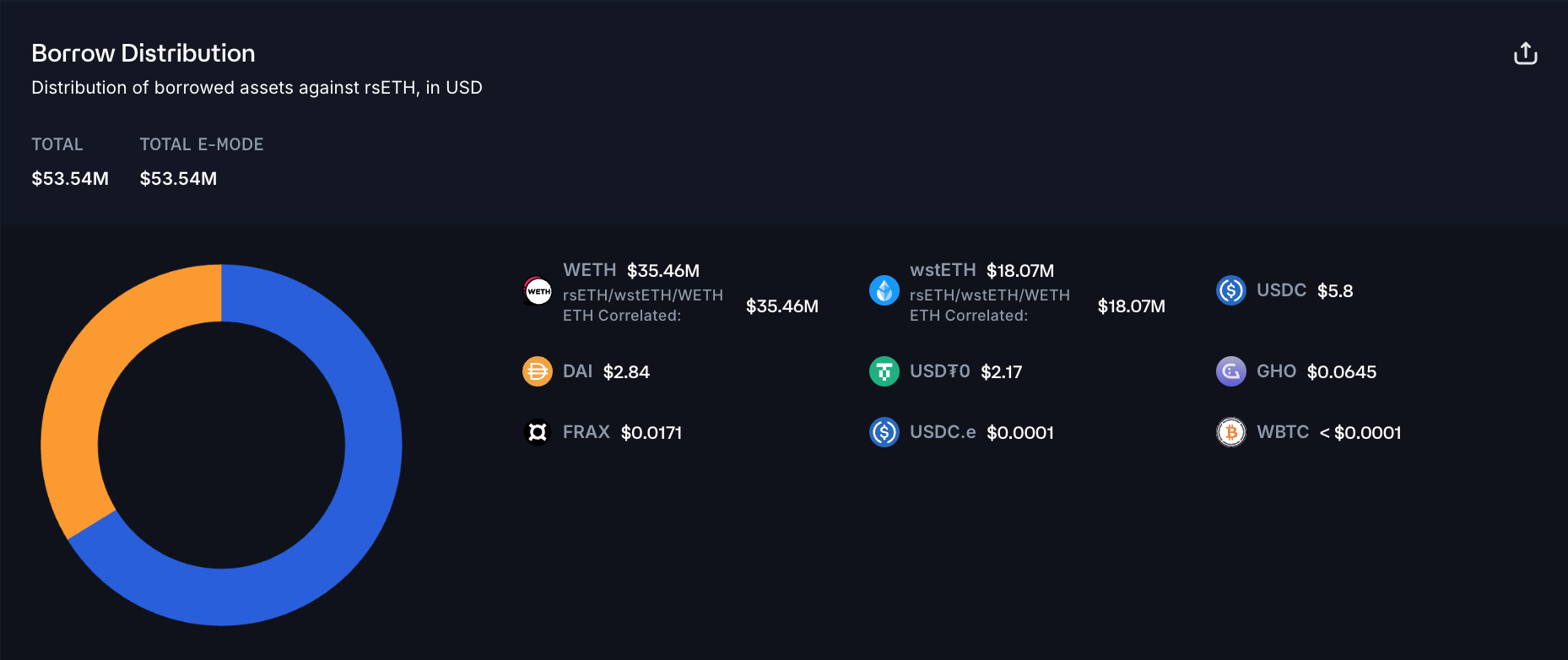

The supply distribution of rsETH is highly concentrated as the top supplier represents over 45% of the market, while top 2 users are accounting for over 82% of the total. We observe that the users are split between LRT and LST leveraged strategies as they are borrowing wstETH or WETH with rsETH collateral in order to capture spread between the staking yield and WETH borrow rate or restaking yield from rsETH and wstETH borrow costs. As is typical for such strategies, the health factors are tightly clustered in the 1.02 - 1.95 range, which, given the substantial correlation of debt and collateral prices, present minimal liquidation risk.

As mentioned previously, users are mainly using rsETH collateral to borrow WETH and wstETH, with distribution of debt assets as follows: WETH - 66%, wstETH - 33%. Given the significant correlation of the assets the liquidation risk in this market is negligible.

Liquidity

At the time of writing, a sell order of over 150 rsETH would be subject to a conservative 1% slippage, supporting an increase in the supply cap of the asset.

Recommendation

Considering the substantial demand to use rsETH in leveraged staking and restaking strategies, conservative user behavior we recommend to double the supply cap of rsETH on the Arbitrum instance. The increase is expected to expand protocol revenue by creating additional wstETH and WETH borrowing demand with minimal changes to the protocol’s risk profile.

PT-sUSDe-15JAN2026 (Plasma)

The staked USDe Pendle principal token has reached its supply cap on the Plasma instance at 200 million within 24 hours of listing, indicating substantial demand to use the asset as collateral. The parameters proposed further were achieved in close collaboration with the Plasma team, aiming to optimize collateral distribution, asset utilization, and enhance user retention.

Supply Distribution

The supply distribution of PT-sUSDe-15JAN2026 is highly concentrated as the top user represents over 67% of the supply. As can be observed on the plot below, the users are using PT-sUSDe-15JAN2026 primarily to collateralize USDT0 debt, as they are participating in a looping strategy earning spread between the fixed implied rate of sUSDe and USDT0 borrowing rate.

The distribution of health factors is currently centered around 1.03, typical for this kind of leveraged strategies. Given the high correlation of debt and collateral assets, the liquidation risk in the market is minimal.

Market and Liquidity

Pendle’s AMM currently holds over $40 million of liquidity, limiting the slippage on a $30 million sell order to 3% — sufficient to limit risk and support further expansion of the asset’s supply caps. Additionally, the underlying mechanism of Pendle’s AMM ensures that slippage decays over time reducing asset’s liquidity risk with maturity.

The implied rate for January-expiry sUSDe principal token has exhibited minimal volatility with limited oscillations in the 7.15% - 7.95% range.

Recommendation

Given the historical performance of sUSDe principal tokens in terms of revenue generation for the protocol, high correlation of the PT’s price to borrowed assets, and deep on-chain liquidity, we recommend doubling the supply cap.

USDe (Plasma)

USDe has reached its borrow cap on the Plasma instance, following a spike in activity associated with the listing of Ethena-based principal tokens.

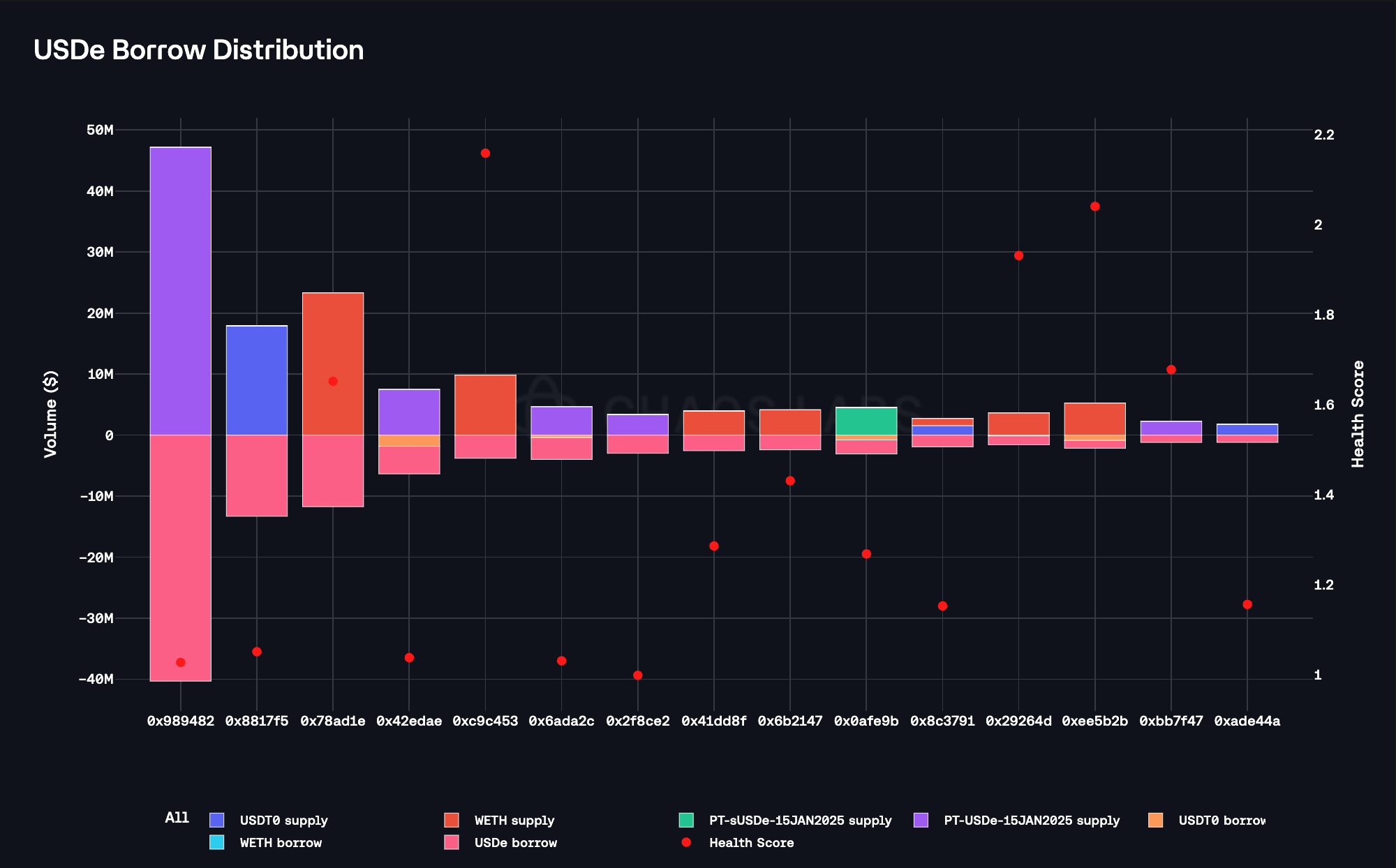

Borrow Distribution

USDe’s borrow distribution is moderately concentrated as the top user accounts for over 40%, while top 5 represent approximately 72%. Borrow behavior is highly variable, as some users use volatile assets like WETH to collateralize USDe debt, while others use USDT0 or PT-USDe-15JAN2026 principal token. For each respective position from the top 15 the health factors are safe for the given strategy as with correlated assets collateral the positions health factors are clustered at approximately 1.05, while WETH-collateral positions are in a broader 1.5 - 2.1 range. Hence the market currently presents minimal liquidation risk.

Liquidity

Plasma’s USDe liquidity has sufficient depth, with the Curve and Balancer USDe/USDT0 pools having a cumulative TVL of over $20 million, with additional liquidity on Fluid. At the time of writing a sell order of 30 million USDe would result in a conservative 2.5% slippage.

Recommendation

Considering the increased demand for USDe borrowing, safe user behavior and substantial on-chain liquidity, we recommend to increase the borrow cap of the asset. Specifically, we recommend aligning this adjustment with the increase of the supply caps of USDe-based PTs as this configuration will additionally contain the risks related to principal token looping strategies while allowing for higher capital efficiency.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Arbitrum | rsETH | 15,840 | 31,680 | - | - |

| Plasma | PT-sUSDe-15JAN2026 | 200,000,000 | 400,000,000 | - | - |

| Plasma | USDe | 1,750,000,000 | - | 100,000,000 | 200,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.