Summary

A proposal to:

- Increase WETH’s supply and borrow caps on the Sonic instance.

- Increase wS’s borrow cap on the Sonic instance.

- Increase cbBTC’s supply cap on the Ethereum Core instance.

- Increase WBTC’s supply cap on the Ethereum Core instance.

- Increase AUSD’s supply and borrow caps on the Avalanche instance.

- Increase WAVAX’s supply cap on Avalanche instance.

- Increase WBNB’s supply and borrow caps on BNB Core instance.

- Increase wstETH’s supply cap on BNB Core instance.

All increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

WETH (Sonic)

WETH’s supply cap and borrow cap utilization have both reached 100%.

Supply Distribution

The supply distribution of WETH shows some concentration, with the top supplier accounting for 29% of the total. However, this position maintains a solid health score of 1.42 and appears to be actively managed, mitigating any immediate risk concerns.

The largest borrowed asset against WETH is USDC.e, representing 87% of the total borrowed distribution.

Borrow Distribution

The borrow distribution of WETH presents limited concern at this time. While most top borrowers are using USDC.e as collateral to borrow WETH, all positions currently maintain relatively high health scores above 1.18, significantly reducing the risk of liquidation.

Liquidity

WETH’s liquidity has remained stable in recent periods, with a 2K WETH sell currently incurring less than 10% price slippage. This level of liquidity supports a potential increase in supply and borrow caps.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 22K and borrow cap to 14.3K

wS (Sonic)

The borrow cap utilization of wS has reached 100%, indicating full usage, while its supply cap utilization currently stands at 69%.

Supply Distribution

The supply of wS shows moderate concentration, with the top supplier holding 22% of the total distribution. However, as this supplier currently has no active borrowing positions, it poses no liquidation risk at this time.

The remaining top suppliers either have no borrowing activities or maintain a high health score. The only position currently with a health score near 1 is actively managing its exposure. In addition, given the relatively small size of this position, even in the event of liquidation, there is sufficient liquidity available to absorb the impact.

Borrow Distribution

The borrow distribution of wS presents limited liquidation risk, as all top borrowers are maintaining strong health scores, indicating well-collateralized positions.

The primary collateral asset used against wS is USDC.e, which accounts for 86% of the total distribution.

Liquidity

Currently, a 2.8M wS sell incurs less than 4% price slippage, supporting a borrow cap increase.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the borrow cap to 50M wS.

cbBTC (Ethereum-Core)

cbBTC’s supply cap utilization has reached 97%, while its borrow cap utilization stands at 52%.

Supply Distribution

The supply distribution of cbBTC presents minor concentration risk, with the top supplier accounting for 16% of the total distribution. However, as this user currently maintains a strong health score, it does not raise any significant concerns at this time.

The rest of the cbBTC suppliers are borrowing assets that are not strongly correlated with cbBTC, such as stablecoins and WETH. However, since all of these positions maintain strong health scores and appear to be actively managed, they do not present significant concerns at this time.

The largest borrowed asset against cbBTC is WETH, making up 39% of the total distribution, followed closely by USDC, which accounts for 37%.

Liquidity

cbBTC’s liquidity has fluctuated but remained generally stable over the past two months. Currently, a 1.2K cbBTC sell incurs less than 4% price slippage, which supports the case for a supply cap increase.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the supply cap to 14.3K cbBTC.

WBTC (Ethereum-Core)

WBTC’s supply cap utilization has reached 91%, while its borrow cap utilization stands at 15%.

Supply Distribution

WBTC’s supply is well-distributed, with the top supplier holding less than 5% of the total. The overall distribution presents limited risk, as all except one top suppliers maintain health scores above 1.4, significantly reducing the likelihood of liquidations.

The only position with a health score close to 1 has borrowed USDT and is actively managing its position. Additionally, given that WBTC and USDT are two of the most liquid assets on Ethereum, there is sufficient market liquidity to cover any potential liquidation, should it occur.

The largest borrowed assets against WBTC are USDT and USDC, accounting for 51% and 39% of the total distribution, respectively.

Liquidity

WBTC’s on-chain liquidity has remained generally stable over the past three months, with a current 800 WBTC sell incurring less than 10% price slippage.

Recommendation

Given the user behavior and liquidity, we recommend increasing the supply cap.

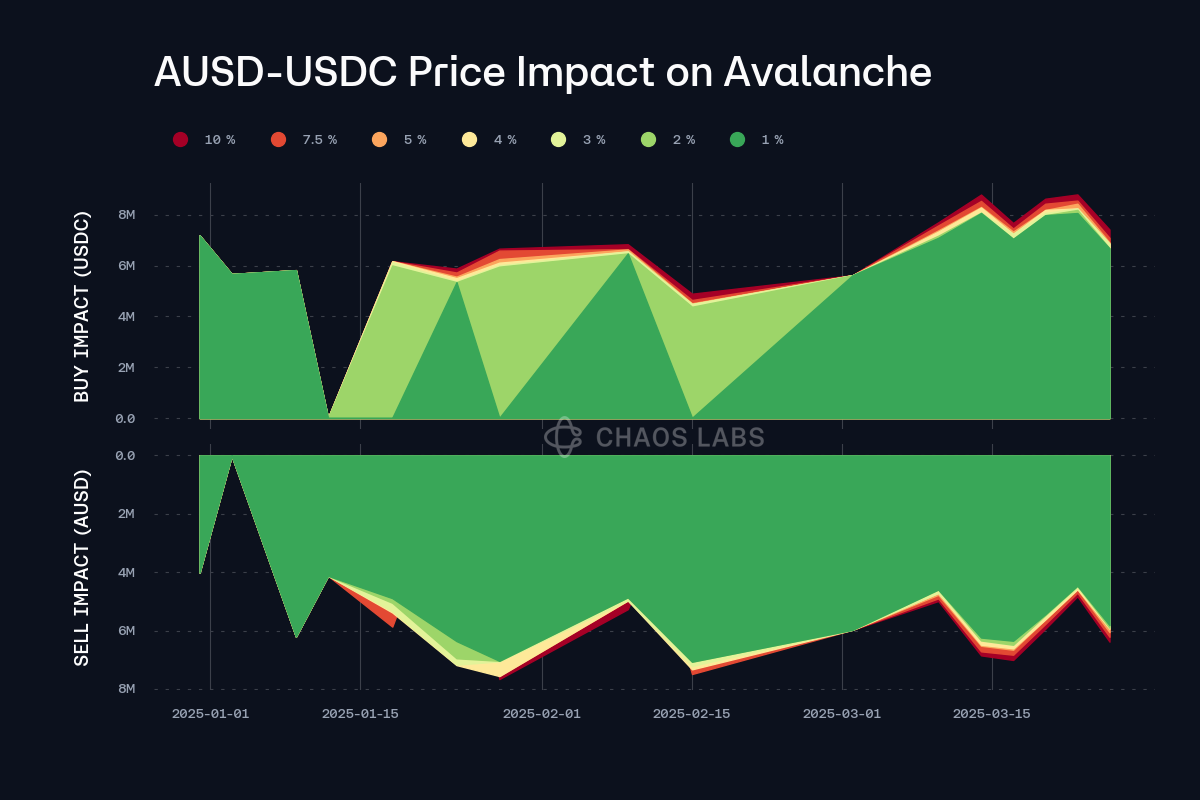

AUSD (Avalanche)

AUSD has reached 91% supply cap utilization and 73% borrow cap utilization

Supply Distribution

Virtually all of the value borrowed against AUSD is AUSD itself, with this looping representing the majority of the recent demand growth.

As a result, this market maintains a relatively low liquidation risk.

Liquidity

AUSD’s on-chain liquidity has remained stable in recent months and is sufficient to support cap increases.

Recommendation

Given liquidity and user behavior we recommend increasing the supply and borrow caps.

WBNB (BNB Chain)

WBNB has reached 83% supply cap and 100% borrow cap utilization.

Supply Distribution

WBNB’s supply is relatively concentrated, with one user supplying over $15M WBNB. They are borrowing USDT, maintaining a strong health score of 1.98.

USDT represents the vast majority of value borrowed against WBNB.

Borrow Distribution

Borrowing is also somewhat concentrated, with the two largest positions against BTCB. These do not represent a risk to the protocol given the liquidity of the assets involved.

Liquidity

WBNB’s on-chain liquidity has been consistent in recent months, allowing a 20,000 BNB sell to be performed with less than 5% price impact.

Recommendation

Given liquidity and user behavior we recommend increasing the asset’s supply and borrow caps.

wstETH (BNB Chain)

wstETH has hit 100% supply cap utilization on BNB Chain.

Supply Distribution

Its supply is somewhat concentrated, with the largest user borrowing WBNB against their collateral. However, given the high liquidity of WBNB this does not represent a liquidation risk.

Other users are borrowing ETH against their collateral and are thus at low risk of liquidation.

Liquidity

wstETH’s liquidity has been somewhat volatile but is sufficient to support a supply cap increase.

Recommendation

Given user activity and liquidity, we recommend increasing the supply cap.

WAVAX (Avalanche)

WAVAX has reached 82% supply cap utilization on Avalanche, while its borrow cap is currently 35% utilized.

Supply Distribution

The supply of WAVAX shows considerable concentration, with the top supplier holding 35% of the total supply. However, this supplier currently borrows WETH, hence maintaining a pair of highly liquid assets and a healthy score above 1.8. The remaining top suppliers maintain high health scores as well.

The majority of the value borrowed against WAVAX is represented by WETH.e, USDC, BTC.b and USDT.

Liquidity

WAVAX’s liquidity has been fairly stable over the last 3 months, and it remains sufficient to support a supply cap increase.

Recommendation

Given user activity and liquidity, we recommend increasing the supply cap.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Sonic | WETH | 20,000 | 22,000 | 11,000 | 14,300 |

| Sonic | wS | 192,000,000 | - | 26,000,000 | 50,000,000 |

| Ethereum Core | cbBTC | 13,000 | 14,300 | 720 | - |

| Ethereum Core | WBTC | 45,000 | 47,500 | 28,000 | - |

| Avalanche | AUSD | 19,000,000 | 22,000,000 | 17,400,000 | 19,000,000 |

| BNB | WBNB | 60,000 | 72,000 | 22,500 | 36,000 |

| BNB | wstETH | 1,900 | 3,800 | 190 | - |

| Avalanche | WAVAX | 10,000,000 | 12,000,000 | 7,200,000 | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0