Summary

A proposal to:

- Increase USDT’s supply cap on the Celo instance.

- Increase WETH’s supply and borrow caps on the Sonic instance.

- Increase USDC.e’s supply cap on the Sonic instance.

- Increase wstETH’s borrow cap on the Base instance.

USDT (Celo)

USDT’s supply cap utilization has reached 94%, while its supply cap utilization stands at 4%.

Supply Distribution

The supply of USDT presents limited liquidation risk at this time, as all but two of the top suppliers currently have no borrowing activity. The two borrowers maintain relatively strong health scores, reducing the chance of large liquidations in this market.

Recommendation

Given user behavior and the low risk of liquidations, we recommend increasing the supply cap to 6M USDT.

WETH (Sonic)

WETH has reached 93% supply cap utilization and 100% borrow cap utilization.

Supply Distribution

All but one of the top WETH suppliers are borrowing against their collateral, with most borrowing USDC.e. The users borrowing USDC.e are at risk of liquidation should WETH’s price fall, though most maintain relatively strong health scores.

USDC.e represents the majority of debt against WETH collateral, with wS in a distant second place.

Borrow Distribution

The top borrow positions of WETH are entirely collateralized by USDC.e, putting them at risk of liquidation should WETH’s price increase.

This is reflected in the collateral against distribution chart below, which shows that USDC.e is increasingly being used as collateral for WETH borrows.

Liquidity

On-chain liquidity has remained relatively stable, with a 2K WETH for USDC.e swap able to be completed at less than 10% price slippage.

Recommendation

Given user behavior and on-chain liquidity we recommend increasing the supply and borrow caps. These increases are limited by on-chain supply, though we are able to recommend slightly more aggressive parameters because Sonic has shown consistent supply growth.

USDC.e (Sonic)

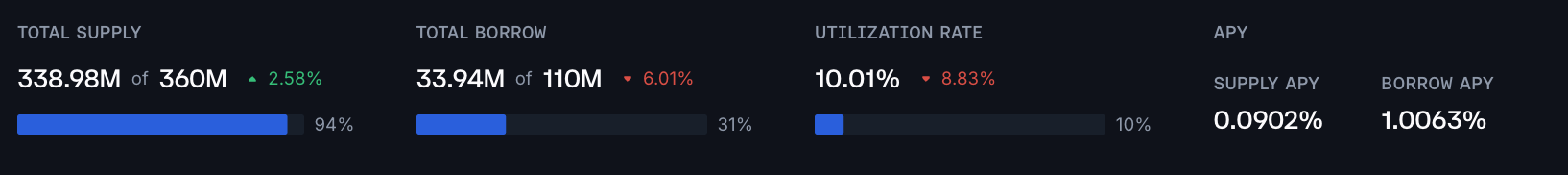

USDC.e has reached 94% supply cap utilization while its borrow cap remains lightly utilized.

Supply Distribution

Its supply is well distributed, with the largest supplier accounting for only 16% of the total. Additionally, most top suppliers are not borrowing against their USDC.e.

The borrows that do exist are a mix of WETH, USDC.e, and wS, reducing the risk of large-scale liquidations should any asset increase in price.

Liquidity

Recommendation

Given user behavior and on-chain liquidity we recommend increasing USDC.e’s supply cap. Again, this increase is limited by on-chain supply, though we are able to be more aggressive because of Sonic’s growth.

wstETH (Base)

wstETH has reached 100% borrow cap utilization on Base; its supply cap is 59% utilized.

Borrow Distribution

New borrowing demand has primarily been driven by WETH collateral, though weETH collateral has also grown. ezETH has been a consistent source of borrowing demand.

The three largest wstETH borrowers are borrowing against WETH, along with USDC and ezETH. These positions do not present a risk to the market given the correlation between the ETH derivatives.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing the borrow cap.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Celo | USDT | 3,000,000 | 6,000,000 | 1,800,000 | - |

| Sonic | WETH | 22,000 | 25,000 | 14,300 | 22,000 |

| Sonic | USDC.e | 360,000,000 | 400,000,000 | 110,000,000 | - |

| Base | wstETH | 18,000 | - | 5,200 | 10,400 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0