Summary

A proposal to:

- Increase CELO’s supply and borrow caps on the Celo instance.

- Increase USDT’s supply cap on the Celo instance.

- Increase USDC’s borrow cap on the BNB Chain instance.

- Decrease wstETH’s supply and borrow caps on the BNB Chain Instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

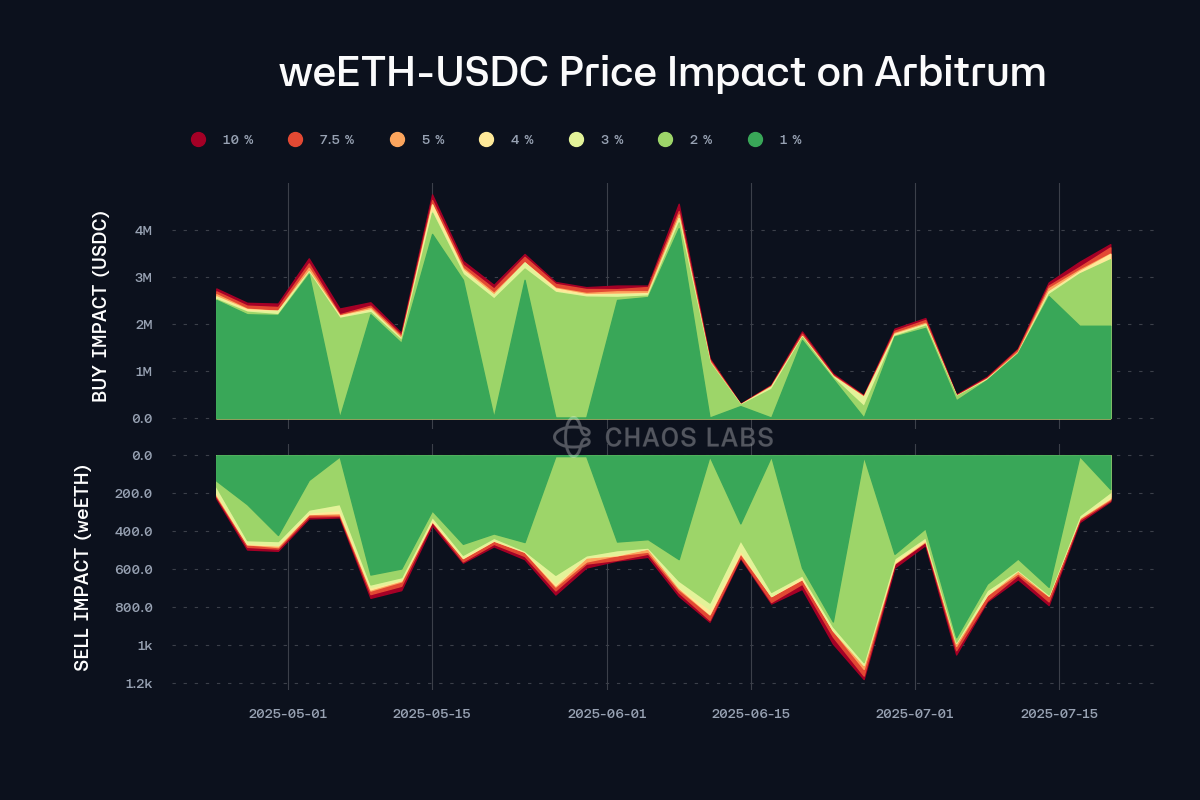

CELO (Celo)

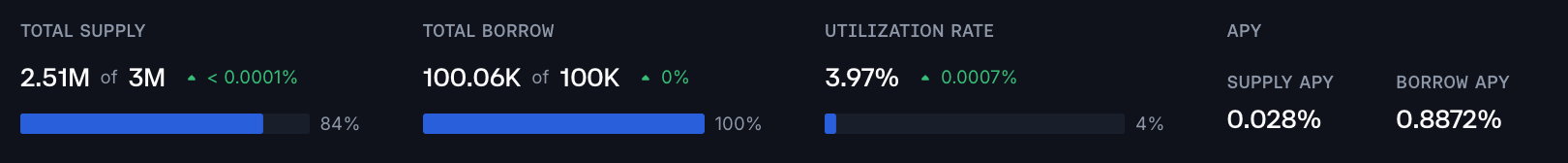

CELO has reached 84% supply cap and 100% borrow cap utilization following new activity in the market.

Supply Distribution

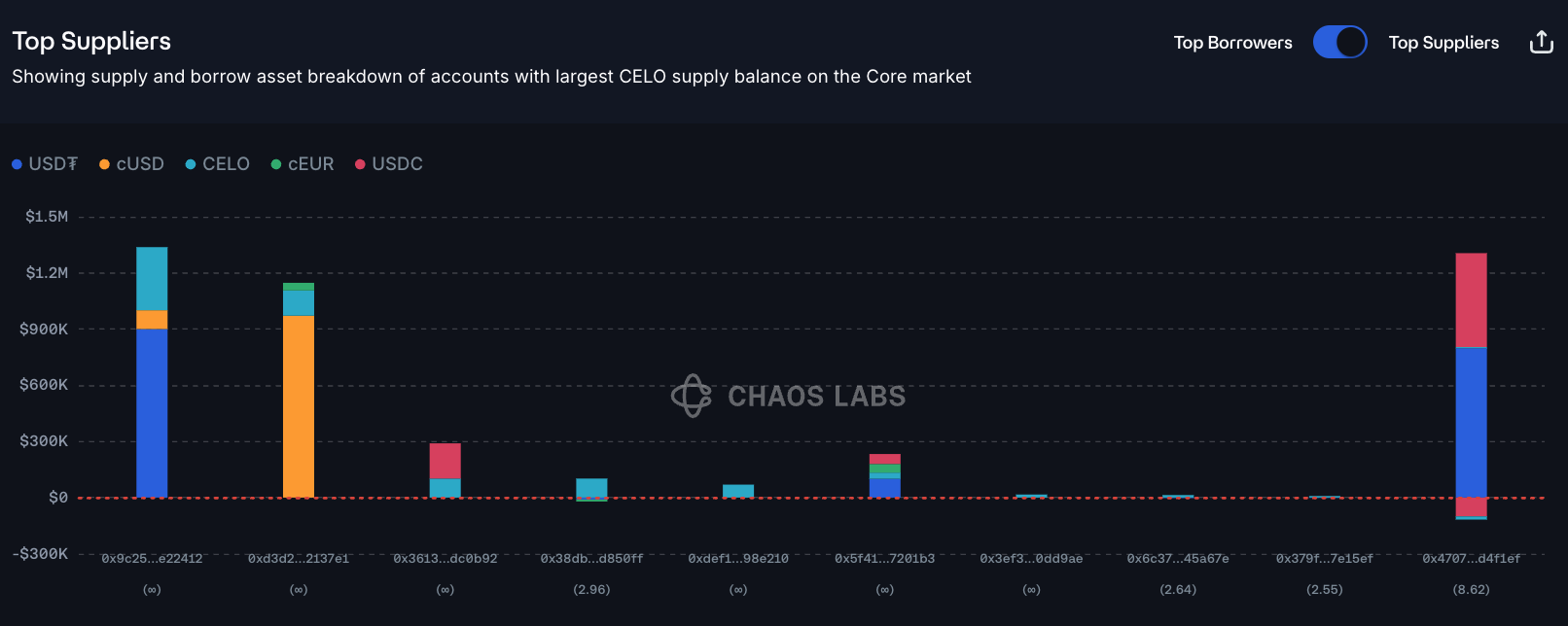

Supply is not highly concentrated and most of the largest suppliers are not borrowing against their positions.

The debt ceiling of $500K is just 6% utilized at the moment, creating a low-risk market from a supply-side perspective.

Borrow Distribution

Borrowing of CELO is limited in USD terms, at just over $33.5K borrowed; this is somewhat concentrated amongst the two largest borrowers, though neither presents a particularly risky profile.

Liquidity

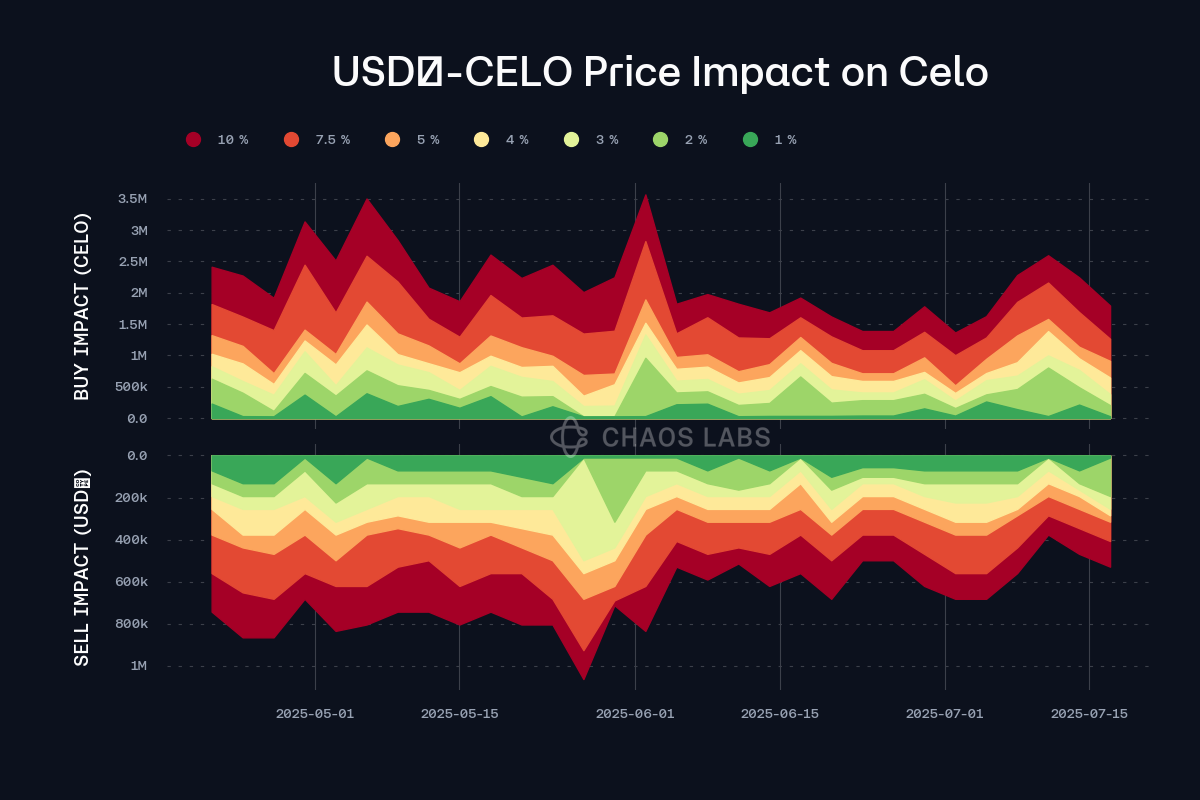

CELO’s liquidity has remained stable over the last few months, with a 2M CELO swap for USDT able to be completed at 10% price slippage.

Recommendation

Taking into account the low-risk user behavior and the asset’s stable liquidity, we recommend increasing its supply and borrow caps.

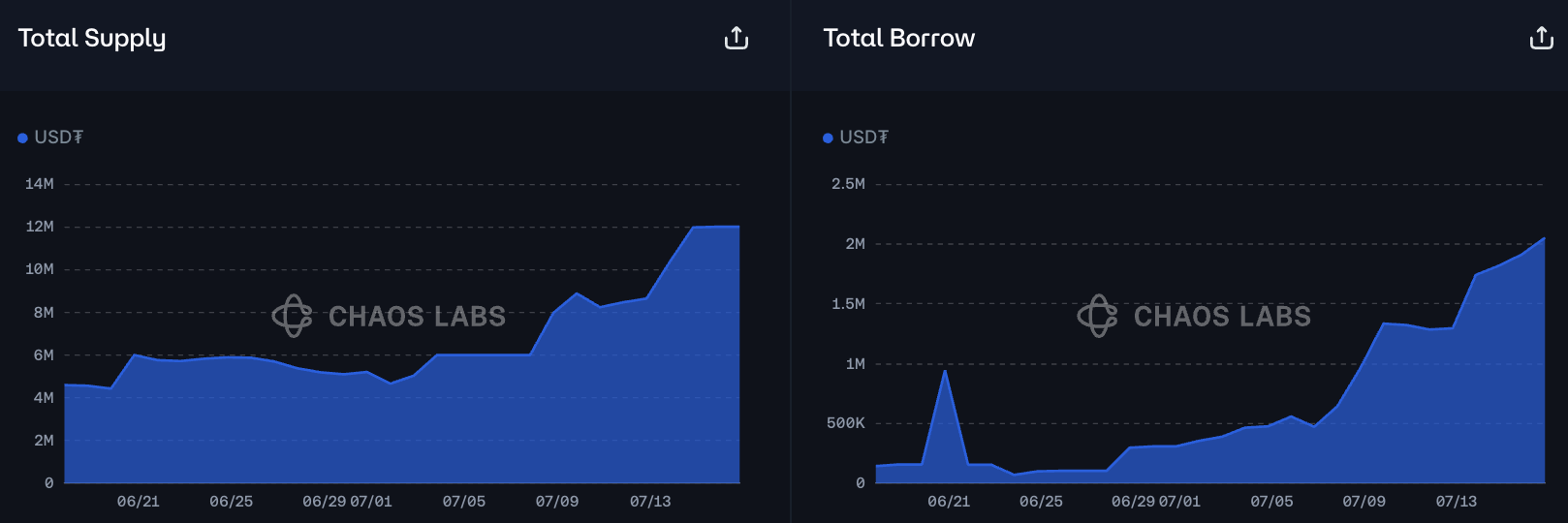

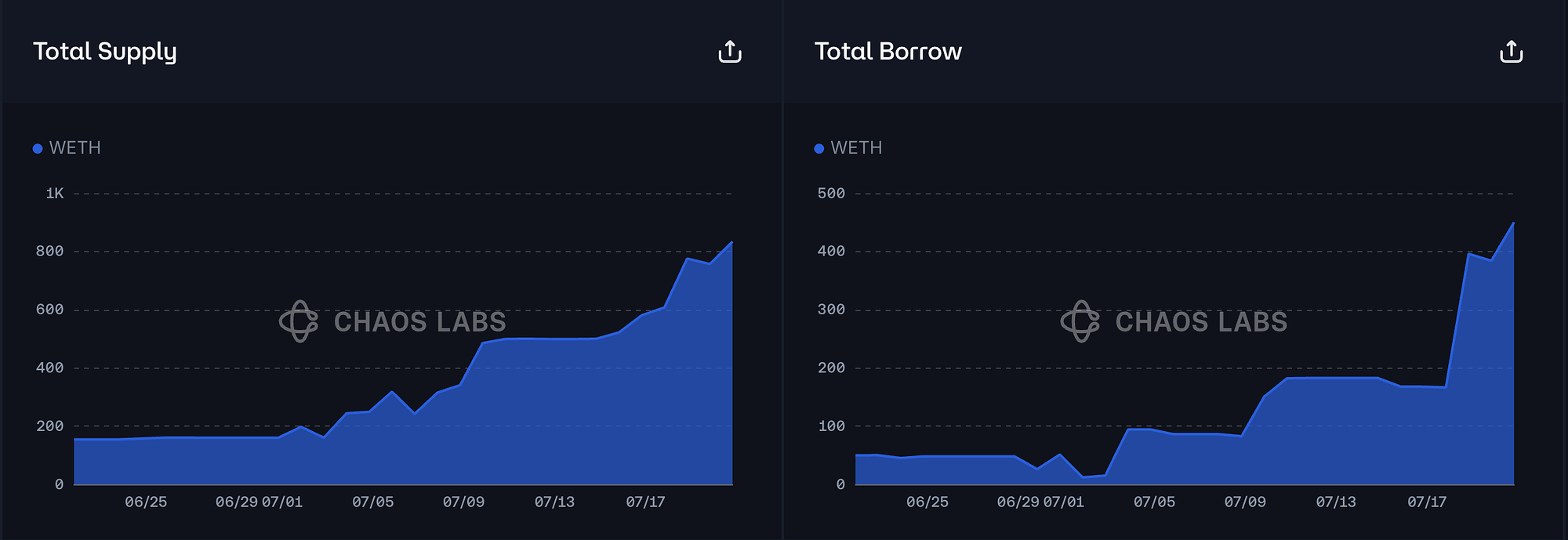

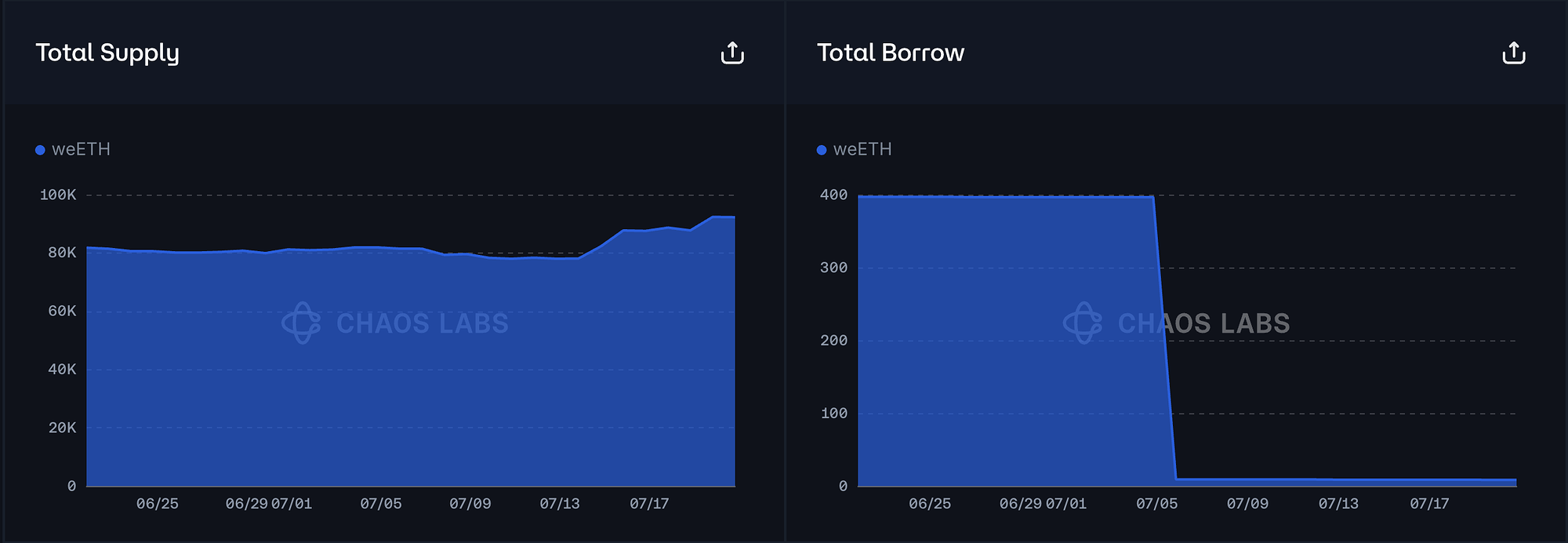

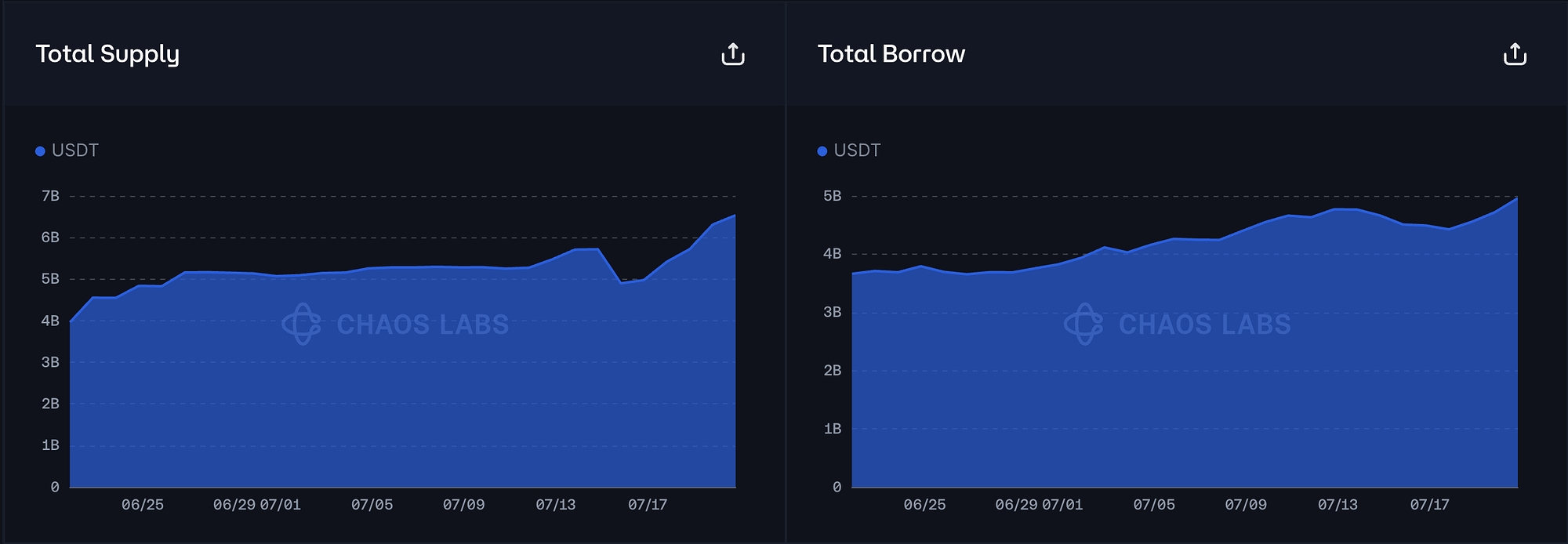

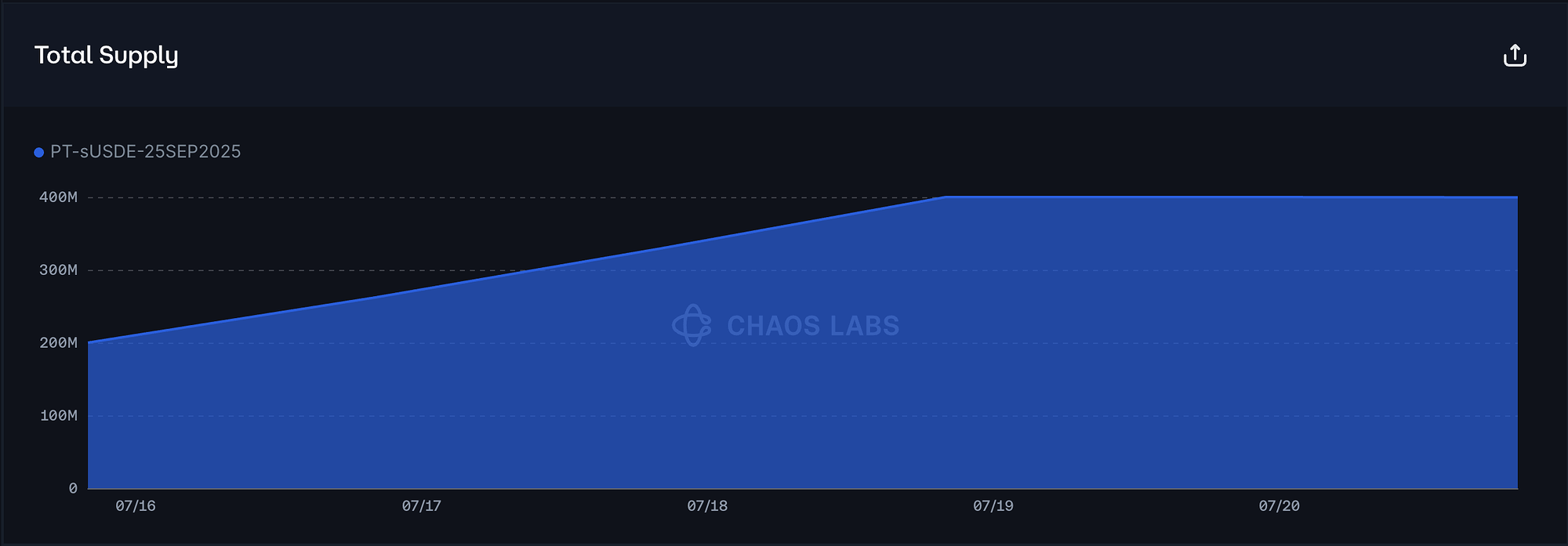

USDT (Celo)

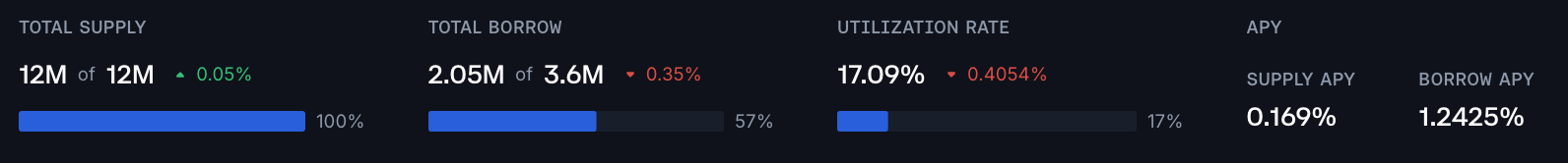

USDT has reached 100% supply cap utilization following new deposits in the market related to ongoing aCELO incentives for supplying.

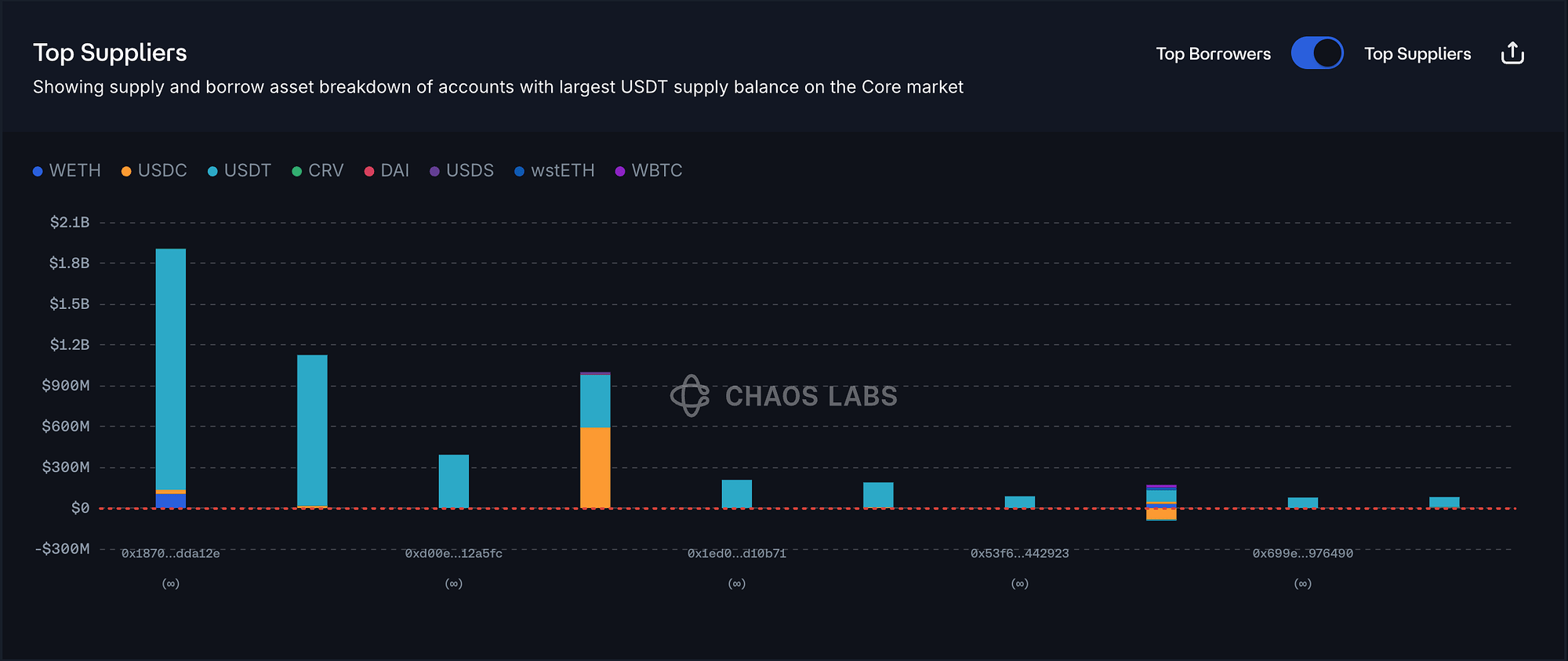

Supply Distribution

Supply in this market is highly distributed and does not pose a risk because most of the top users are supply-only, maintain a strong health score, or are looping USDT with itself.

The most common asset borrowed against USDT is USDT itself, followed by other stablecoins, significantly reducing the risk of liquidations in this market.

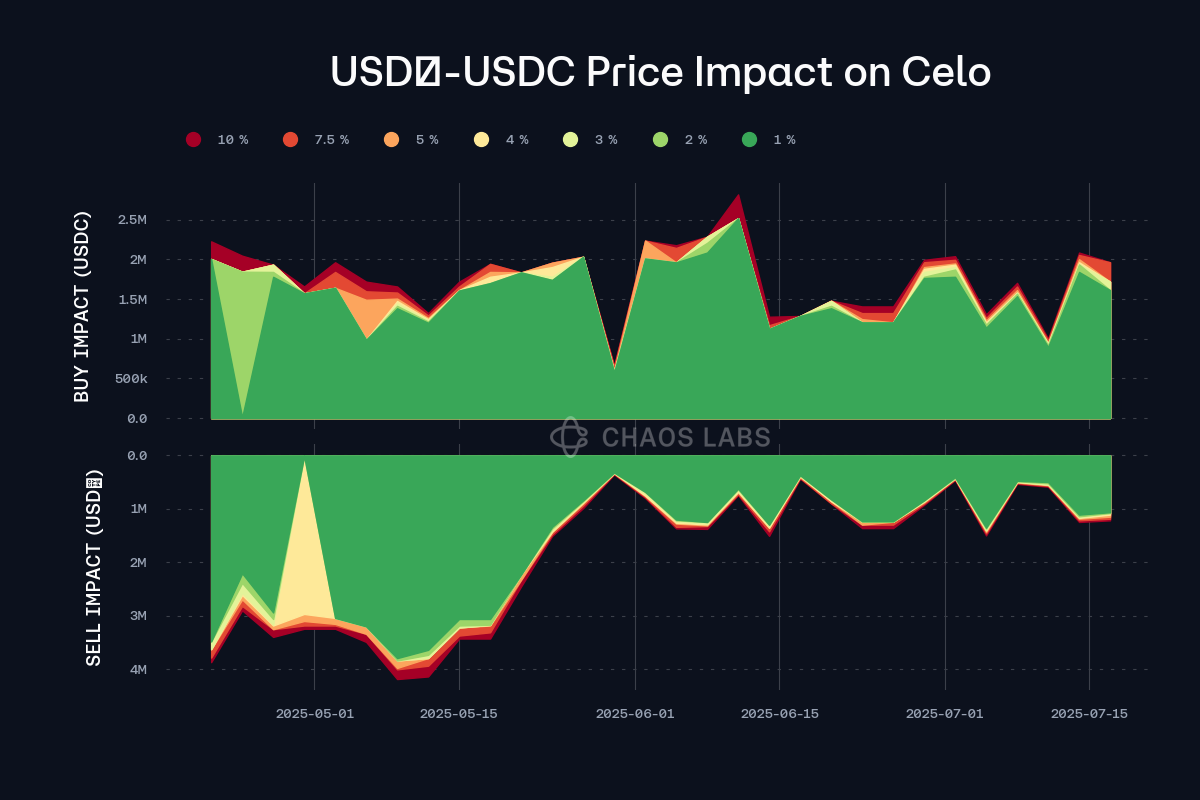

Liquidity

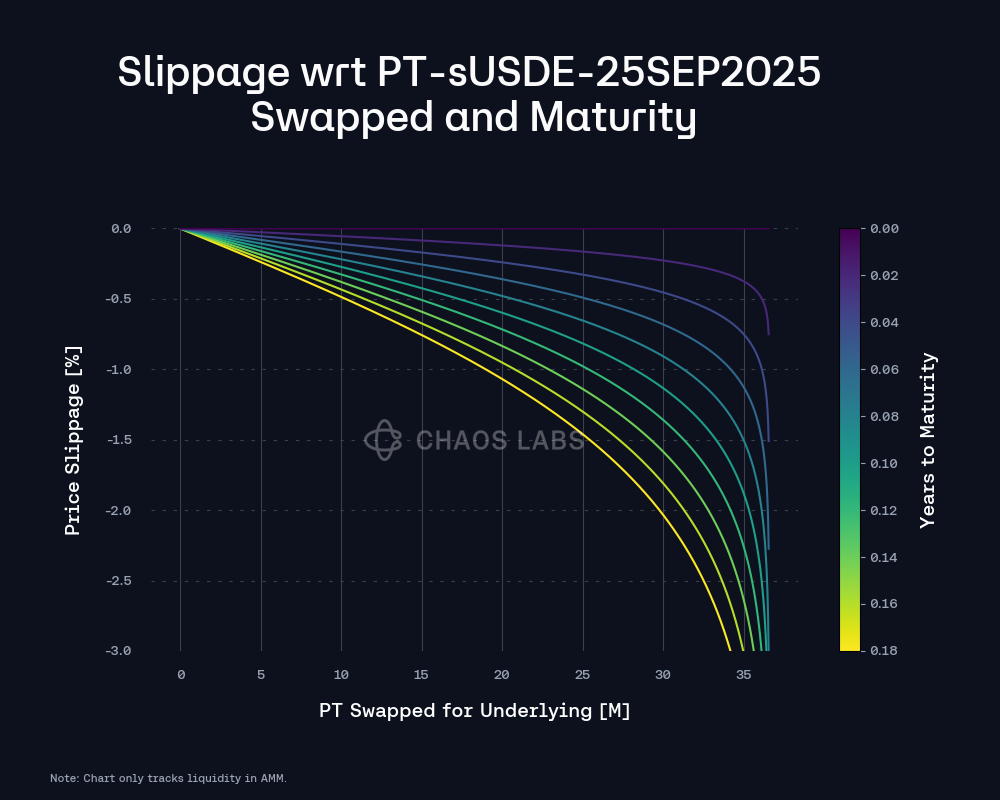

USDT’s liquidity against USDC has decreased somewhat since May, though it is still sufficient to recommend a supply cap increase for this market.

Recommendation

Given the asset’s low-risk usage, we recommend doubling its supply cap.

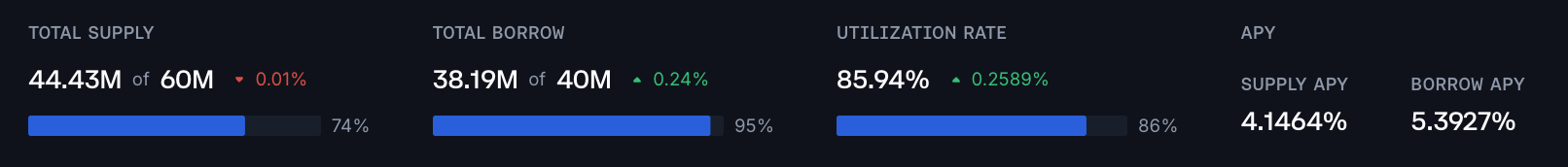

USDC (BNB Chain)

USDC’s supply and borrow caps are 74% and 95% utilized, respectively, following continued growth on both sides of the market.

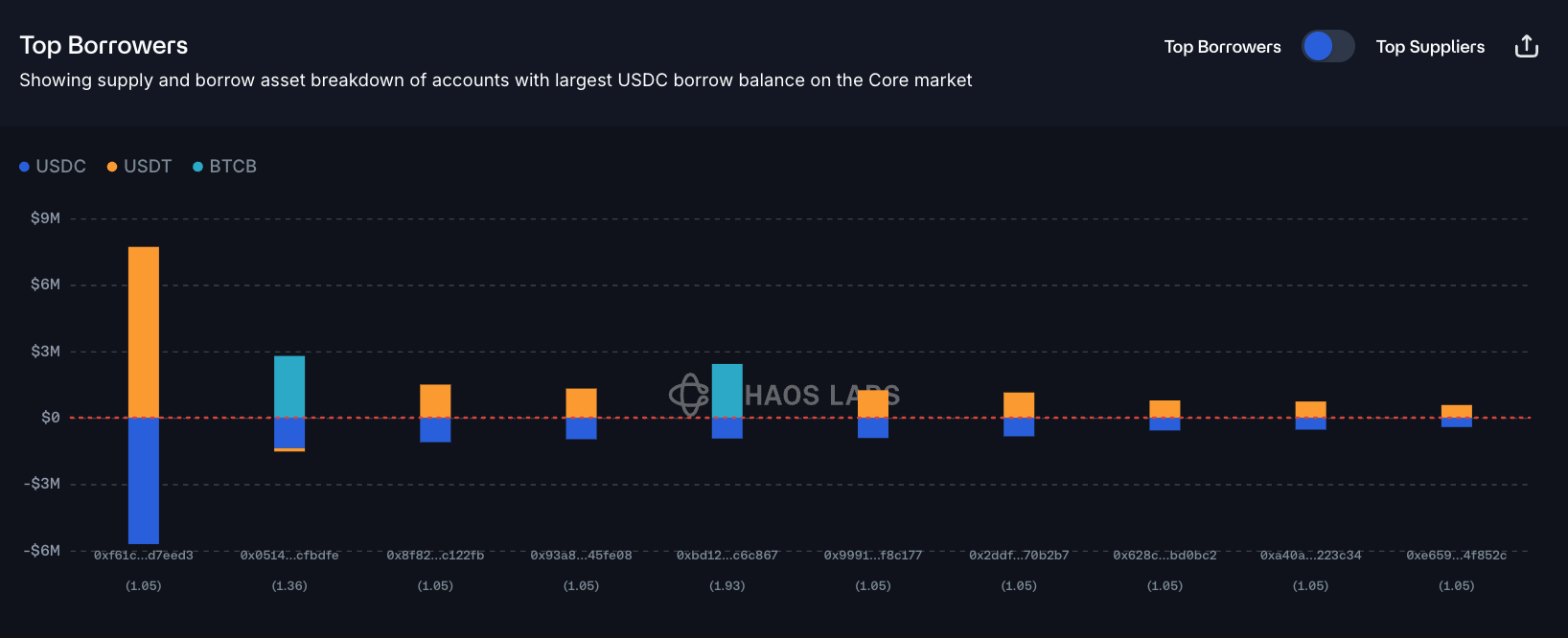

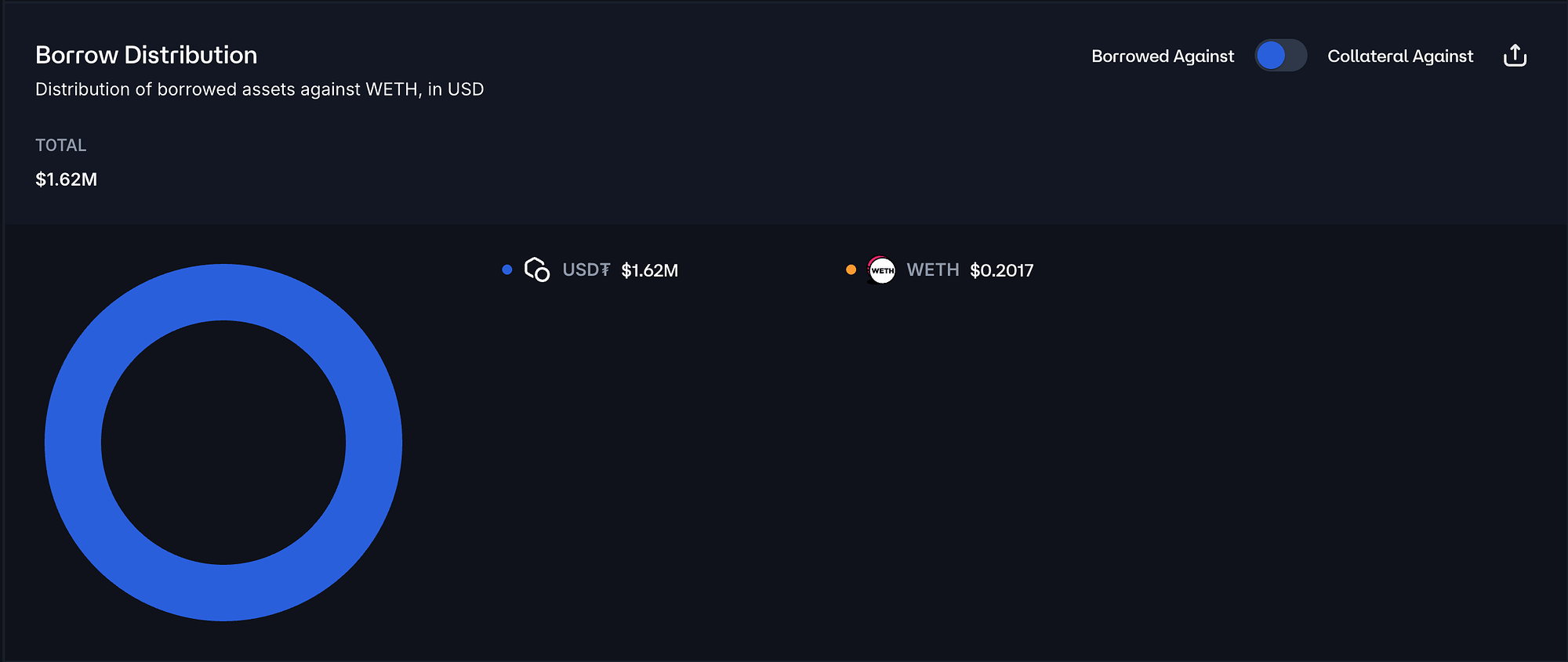

Borrow Distribution

Borrow positions are not highly concentrated, and the largest user is borrowing USDC against USDT, putting them at very low risk of liquidation.

Many other top borrowers share the same positional composition; there are only two in the top ten borrowers that are borrowing against an uncorrelated asset (BTCB). Overall, USDT is the most popular collateral asset, followed by BTCB and WBNB.

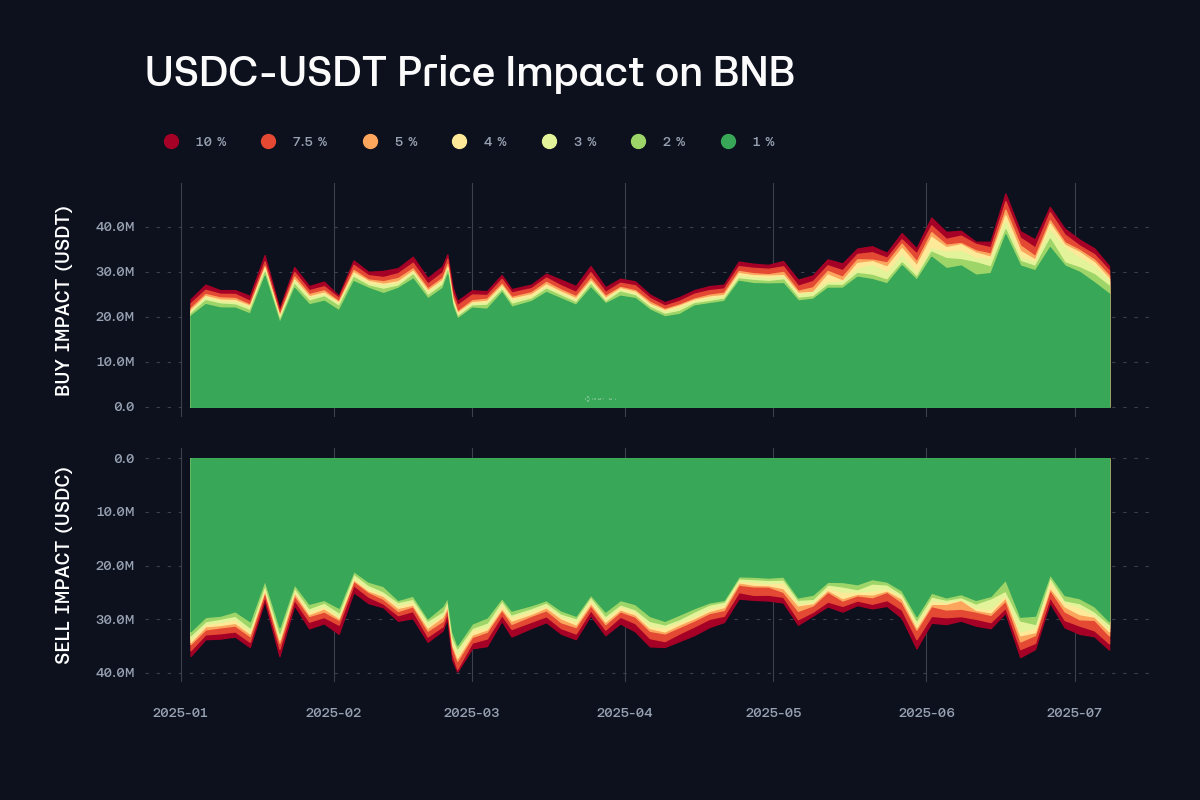

Liquidity

USDC’s liquidity has been stable in recent months, with a 30M swap to USDT able to be completed at less than 10% price slippage.

Recommendation

Considering user behavior and composition, as well as the asset’s stable liquidity, we recommend increasing USDC’s borrow cap.

wstETH (BNB Chain)

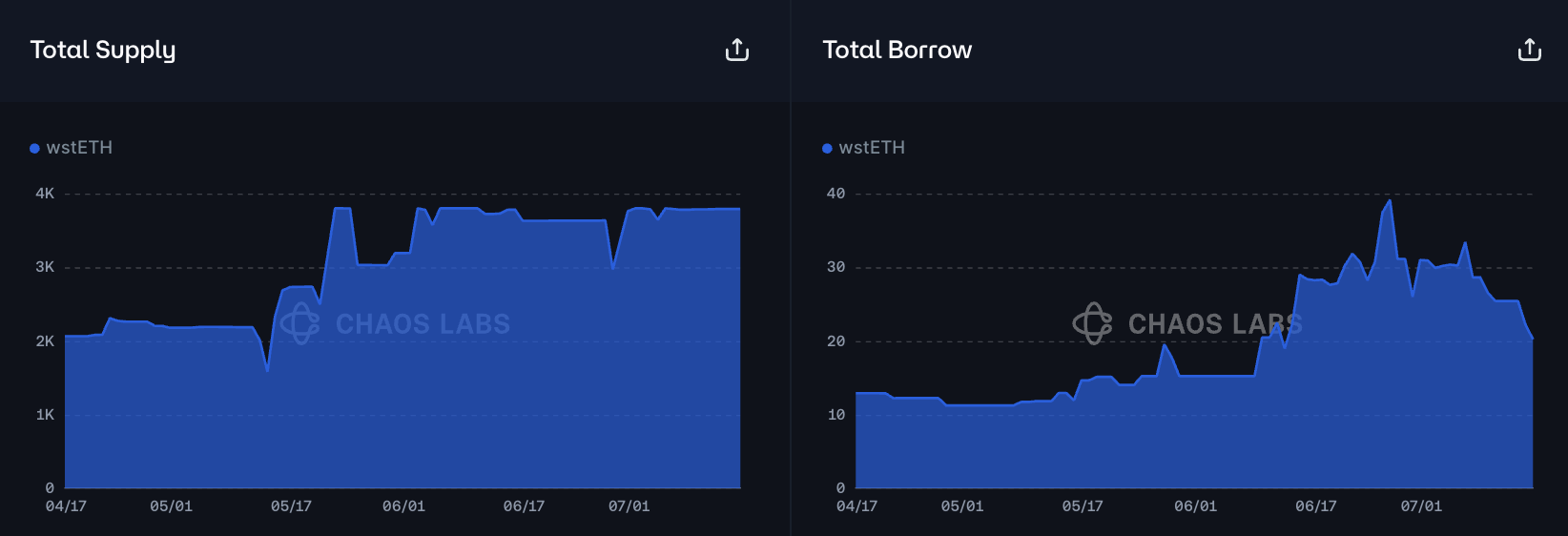

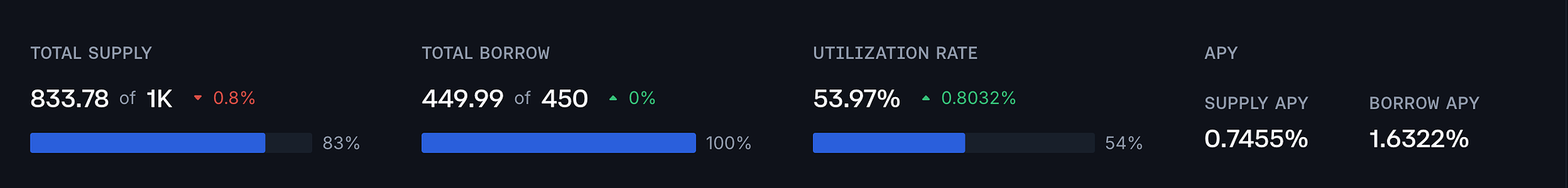

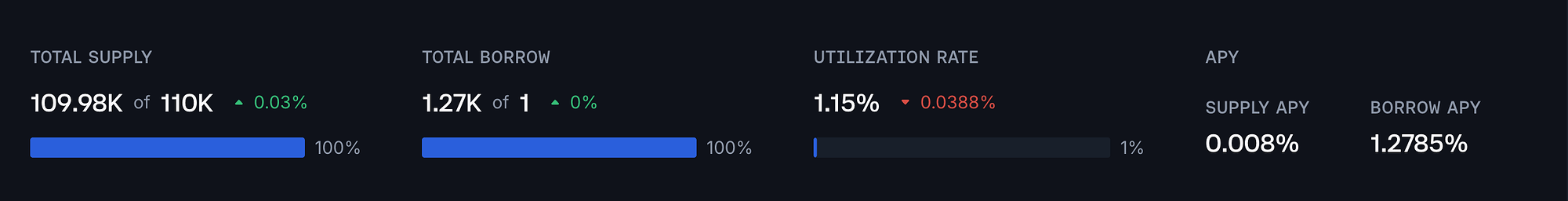

wstETH has reached its supply cap, while borrowing activity of the asset is relatively minimal.

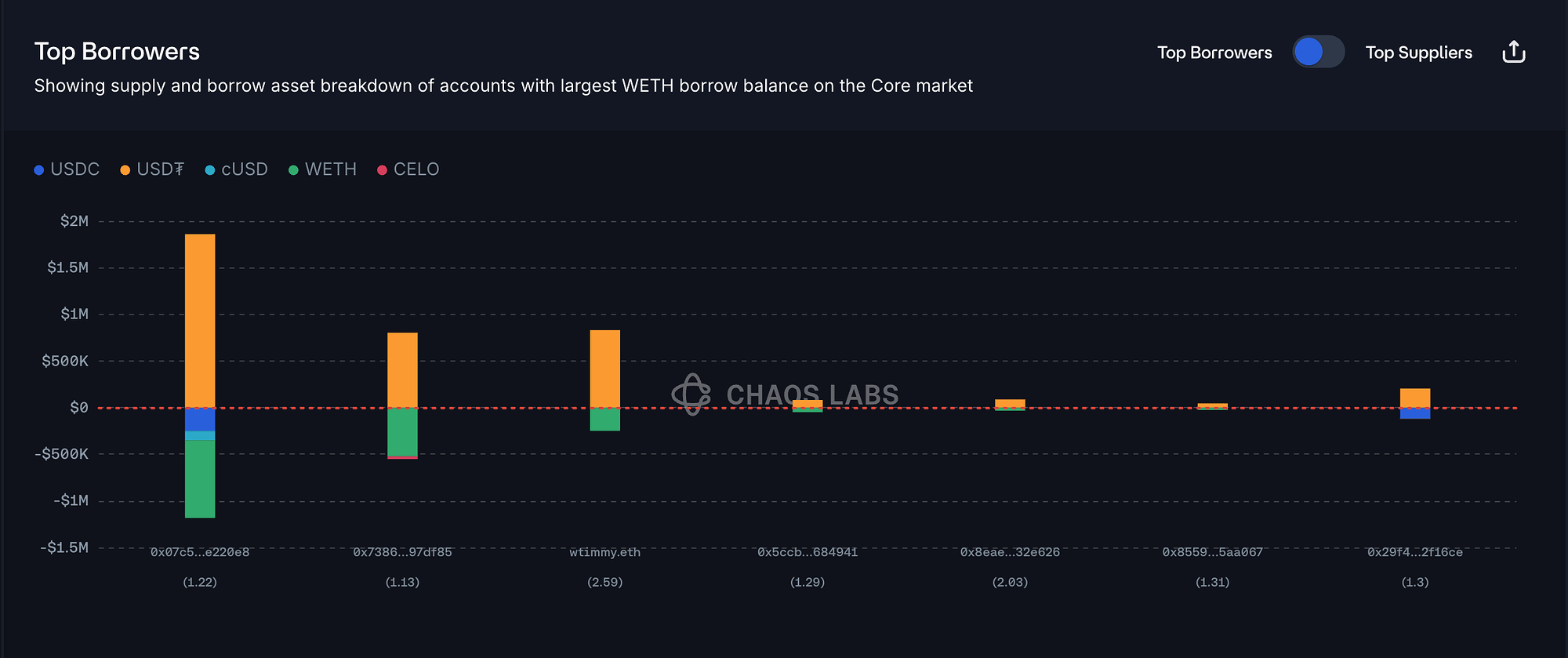

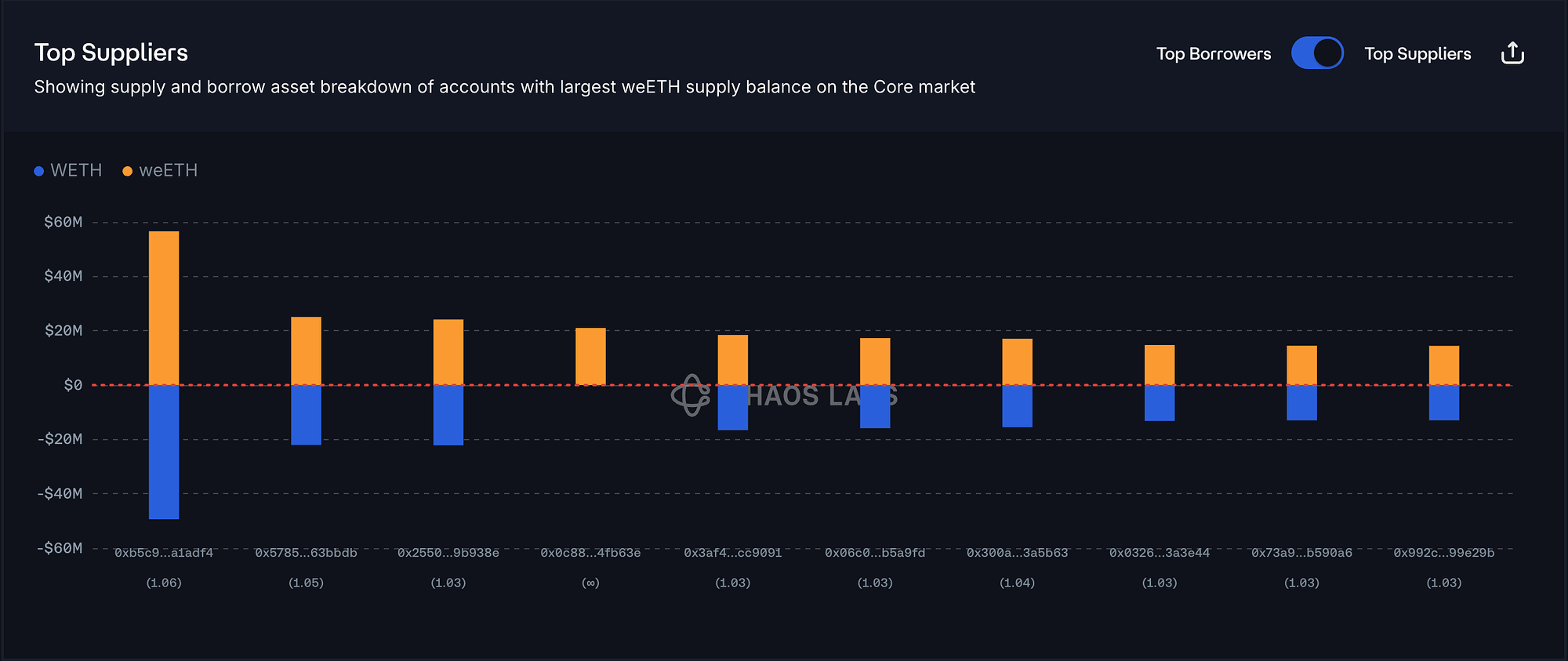

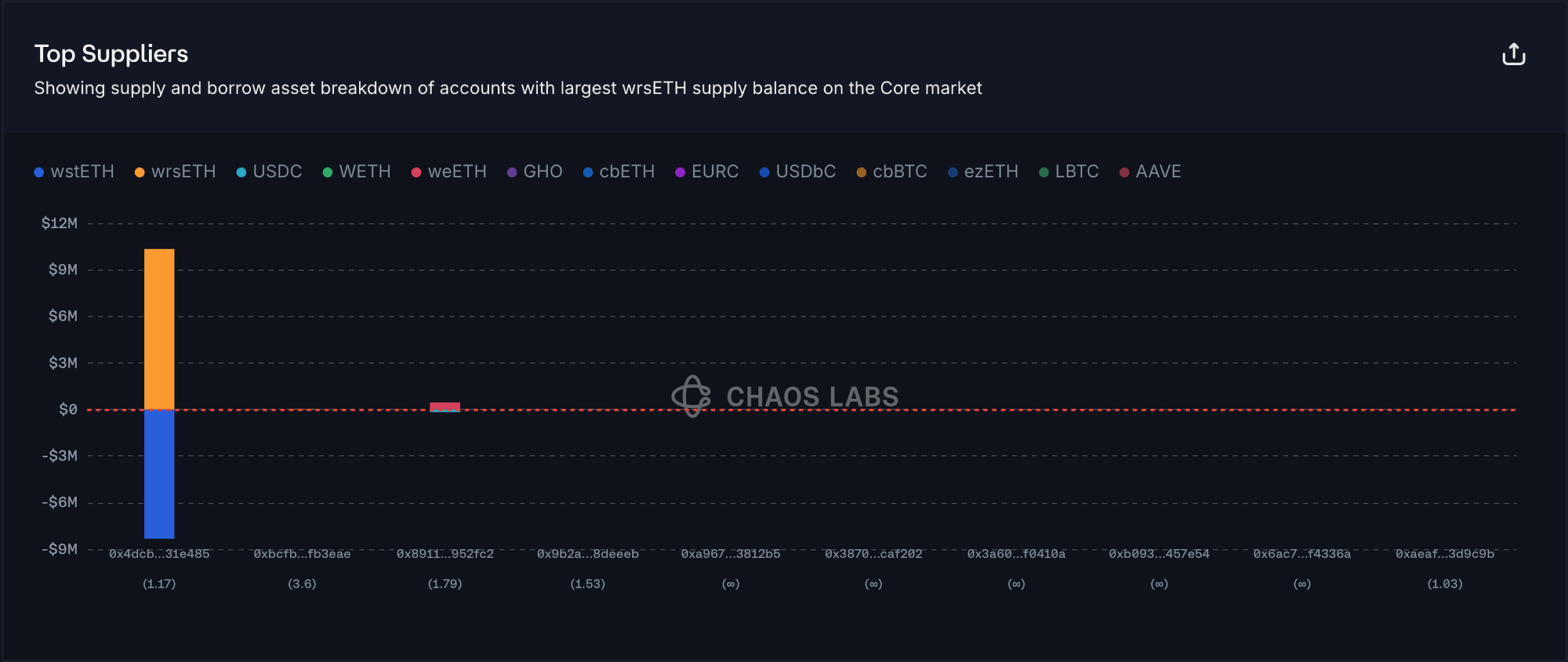

Supply Distribution

The increase in supply has led to an increase in ETH borrowed, maintaining the market’s lower risk of widespread liquidations.

The market is somewhat concentrated, with the largest user accounting for more than 50% of the total supply; they are borrowing ETH and thus at lower risk of liquidation. However, the second-largest user is borrowing WBNB against USDC and ETH with a health score of 1.15, presenting a moderate risk of liquidation.

This user has been somewhat active, repaying some of their WBNB debt on July 5; this suggests they are actively monitoring their position and may repay some debt should they approach liquidation.

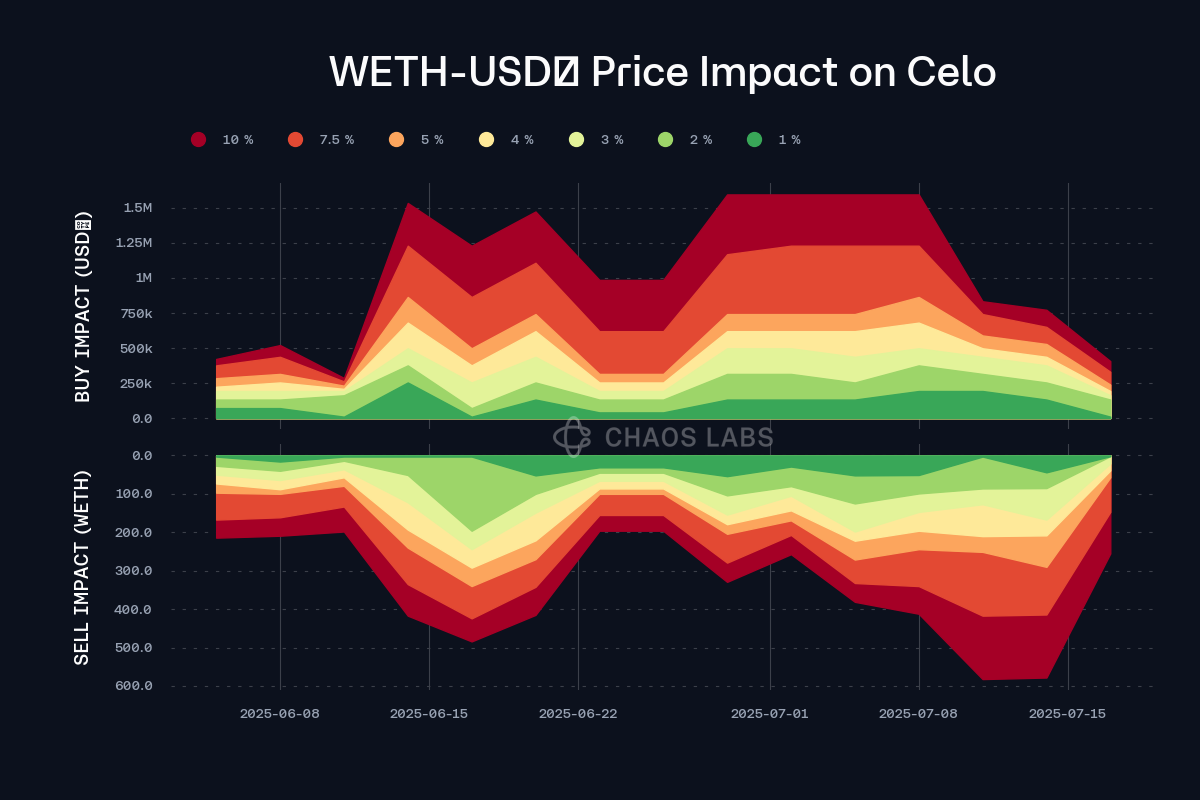

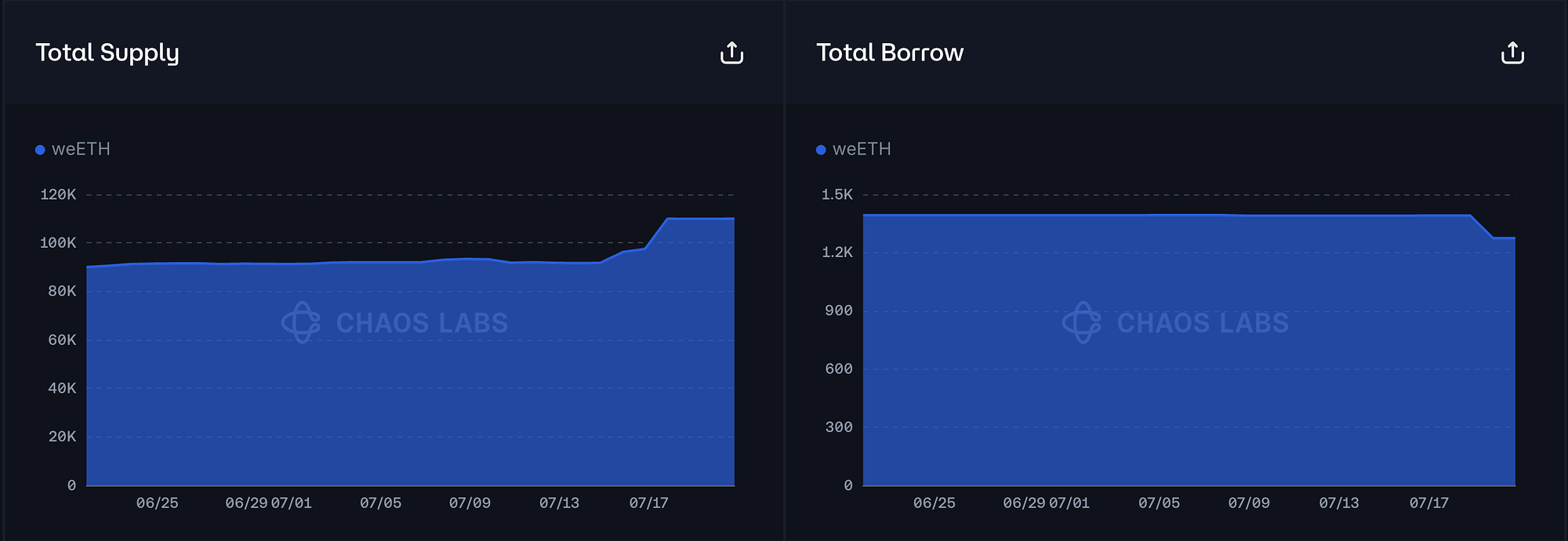

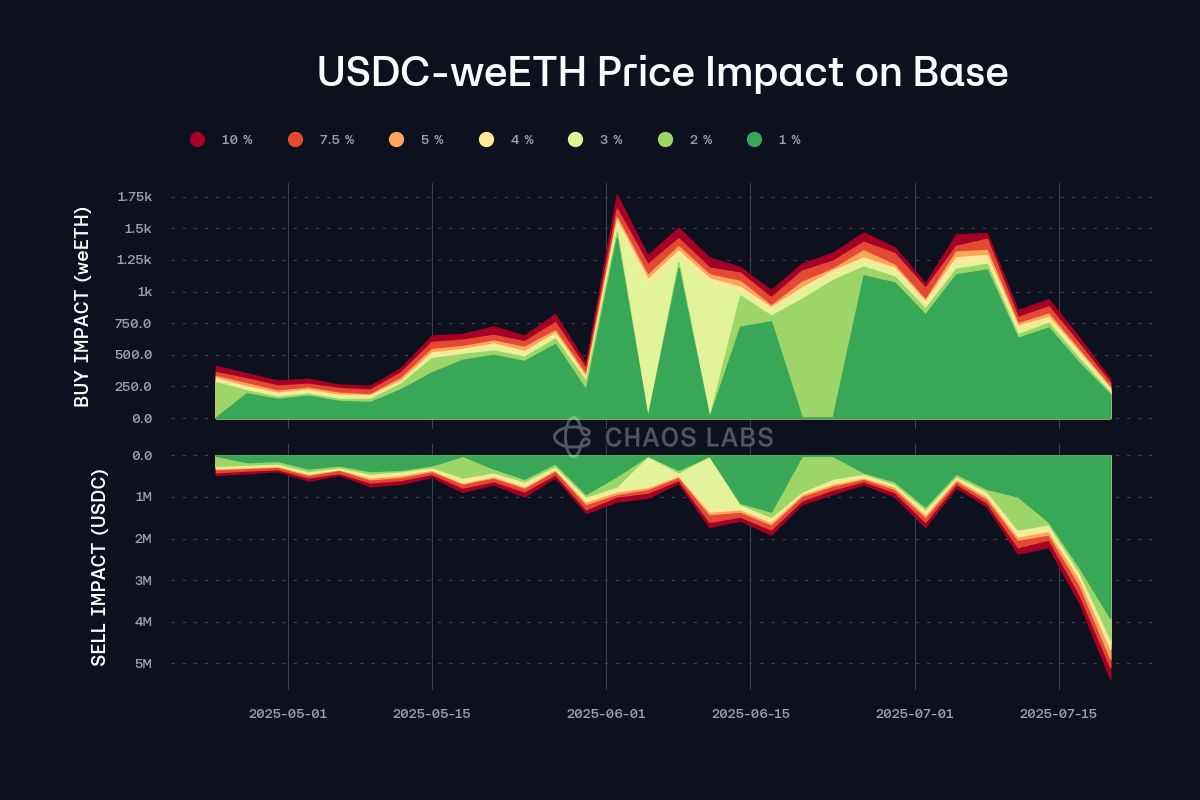

Liquidity

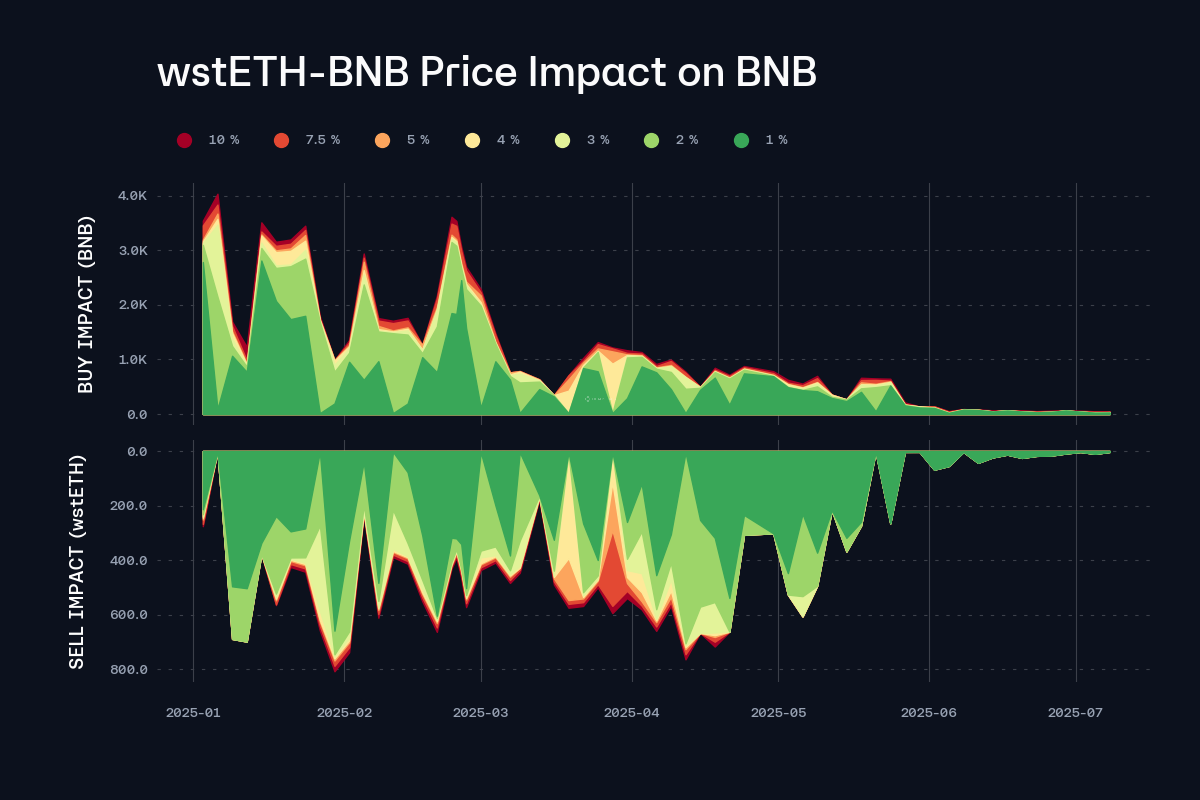

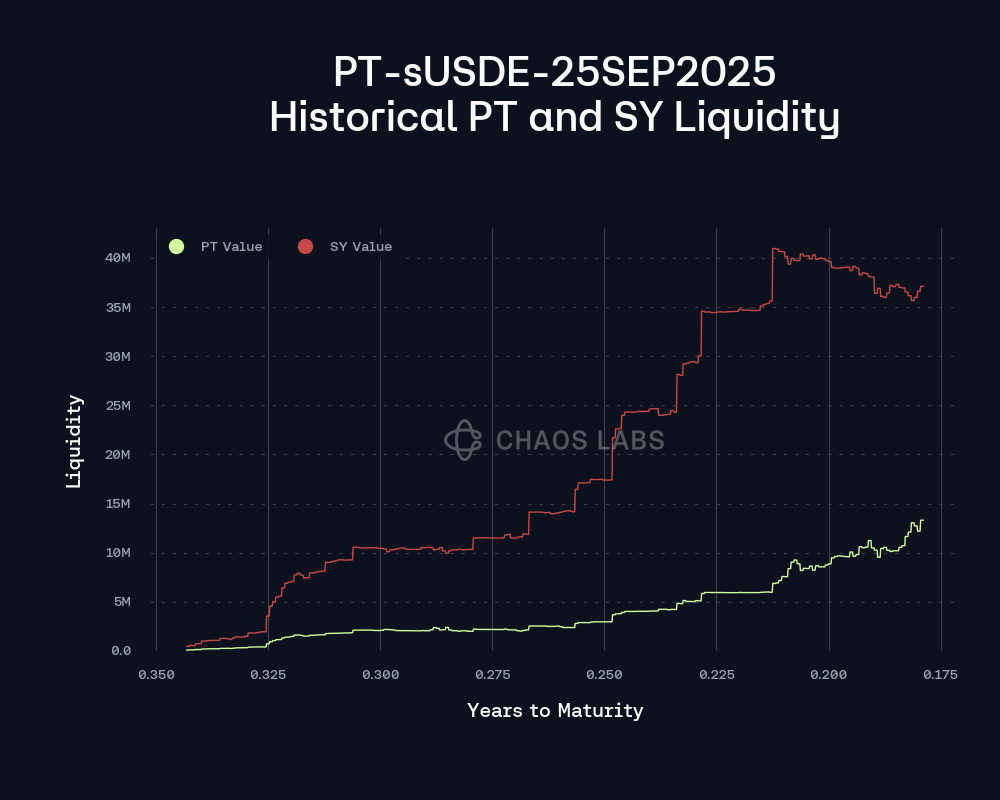

wstETH’s liquidity has seriously degraded over the past month, potentially posing a risk to the protocol should the above user’s position be allowed to grow. The Lido team has informed us that they have ceased liquidity support for the asset on BNB Chain.

Recommendation

As a result of the asset’s degraded liquidity, we recommend setting its supply and borrow caps to 1.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Celo | CELO | 3,000,000 | 4,500,000 | 100,000 | 200,000 |

| Celo | USDT | 12,000,000 | 24,000,000 | 3,600,000 | - |

| BNB Chain | USDC | 60,000,000 | - | 40,000,000 | 54,000,000 |

| BNB Chain | wstETH | 3,800 | 1 | 190 | 1 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0