Summary

A proposal to:

- Increase ETHx’s supply cap on the Ethereum Core instance.

- Increase LBTC’s supply cap on the Ethereum Core instance.

- Increase eBTC’s supply cap on the Ethereum Core instance.

All increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

ETHx (Ethereum Core)

ETHx has reached 95% supply cap utilization following new deposits in the market.

Supply Distribution

Supply is highly concentrated, with the top supplier accounting for nearly 90% of the total supply.

This account is operated by the Enzyme protocol, which targets a leverage range of 9 to 10x on ETHx. This account has a low liquidation risk because of the correlation between ETHx and WETH.

Liquidity

ETHx’s liquidity on Ethereum has been relatively stable and is sufficient to support increasing the supply cap.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing ETHx’s supply cap.

LBTC (Ethereum Core)

LBTC has reached its supply cap following new deposits in the market.

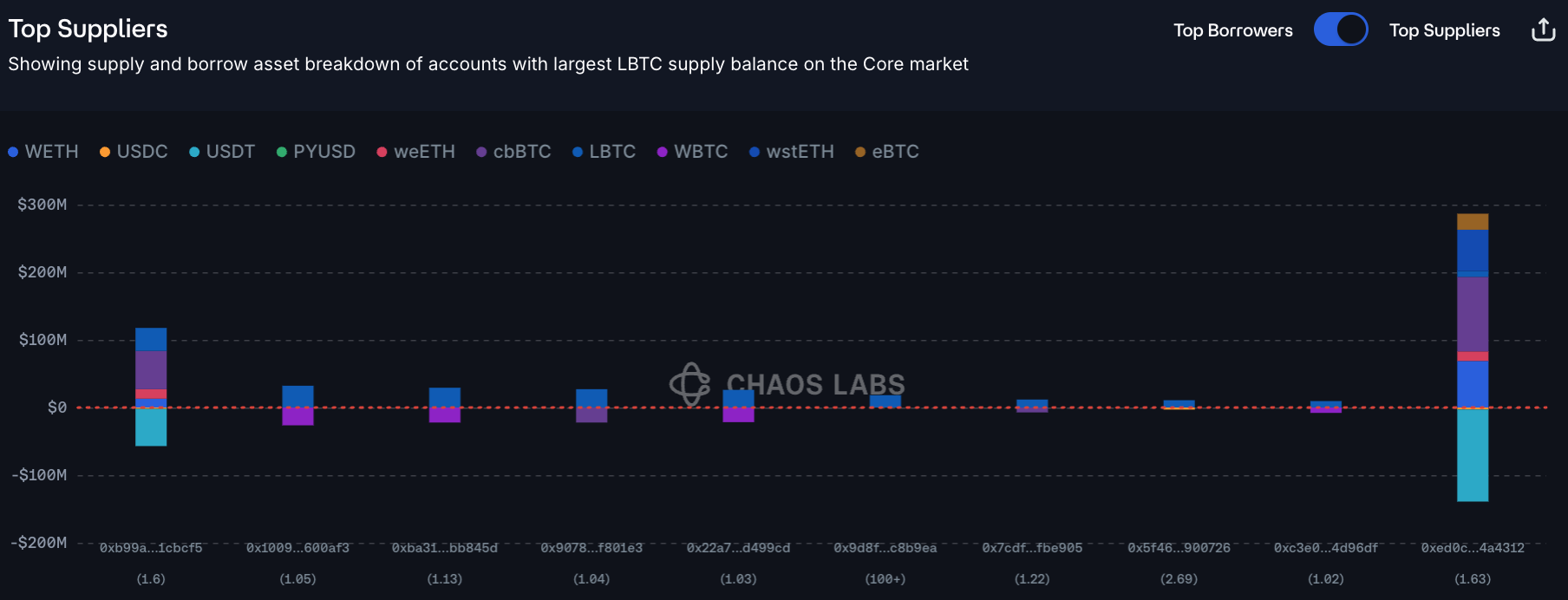

Supply Distribution

Supply in the market is highly distributed, with the top four suppliers accounting for just over 40% of the total supply. Most of the top suppliers borrow BTC-correlated assets against LBTC, reducing their likelihood of liquidation. The largest user, however, is borrowing USDT.

WBTC has been the most popular asset borrowed against LBTC, reducing liquidation risk in the market.

Liquidity

LBTC’s liquidity is somewhat limited, though it has remained steady over the last month.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing LBTC’s supply cap.

eBTC (Ethereum Core)

eBTC has reached 92% supply cap utilization following a large deposit of 148 eBTC on April 18.

Supply Distribution

Supply is not highly concentrated, as the largest supplier represents under 30% of the market.

There is a variety of borrowing activity against eBTC, reducing the risk of widespread liquidation events. While USDC was formerly the largest debt asset against eBTC, recent cbBTC borrowing has put it first.

WBTC and cbBTC, both BTC-correlated assets, represent the majority of value borrowed against eBTC, reducing liquidation risk.

Liquidity

eBTC liquidity has surged in recent days, though it remains somewhat thin. However, given that most of the eBTC on Aave is backing debt of correlated assets, this does not present a significant risk.

Recommendation

Given user behavior, we recommend increasing eBTC’s supply cap.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | ETHx | 20,000 | 40,000 | 1 | - |

| Ethereum Core | LBTC | 3,200 | 5,700 | 1 | - |

| Ethereum Core | eBTC | 1,100 | 1,500 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0