Summary

A proposal to:

- Increase the supply cap of rsETH on the Arbitrum instance.

- Increase the supply and borrow caps of EURC on the Avalanche instance.

- Increase the supply cap of XPL on the Plasma instance.

- Reduce the supply cap of PT-USDe-25SEP on the Ethereum instance.

- Reduce the supply cap of PT-sUSDe-25SEP on the Ethereum instance.

- Reduce the supply and borrow caps of USDC on the Sonic instance.

- Reduce the supply and borrow caps of WETH on the Sonic instance.

- Reduce the supply and borrow caps of wS on the Sonic instance.

- Increase the base rate of BTC-correlated assets across Aave V3 instances.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

rsETH (Ethereum)

rsETH’s supply cap utilization has reached 100%.

Supply Distribution

99% of rsETH suppliers are currently borrowing highly correlated assets such as WETH and wstETH. The close relationship between the collateral and debt assets significantly reduces the likelihood of liquidation.

As shown, the two largest borrowed assets are WETH and wstETH, accounting for 85% and 14% of total borrows, respectively.

Recommendation

Given the safe user behavior, we recommend increasing the rsETH supply cap.

EURC (Avalanche)

EURC’s supply cap utilization has reached 100%, and its borrow cap utilization has reached 97%.

Supply Distribution

The supply distribution of EURC presents no concentration risk, as the top supplier accounts for less than 10% of total supply. All major suppliers either have no borrowing activity or are borrowing EURC itself or USDC, which significantly limits the likelihood of liquidations.

As shown, EURC, USDt, and USDC are the three largest borrowed assets against EURC, together accounting for 91.66% of total borrows.

Borrow Distribution

The borrow distribution of EURC also does not exhibit concentration risk, as the top borrower accounts for only 13% of total borrows. With one exception, all top borrowers either maintain a high health score or are borrowing against EURC itself, which significantly reduces liquidation risk.

There is currently one user with a health score of 1.06, with an outstanding borrow of approximately $367K in EURC. Although this account is exposed to potential liquidation, the user’s position is a EURC debt position against EURC and BTC.b collateral. As such, the net debt against volatile assets is greatly reduced, ensuring no liquidation risk.

Recommendation

Given the safe user behavior, we recommend increasing EURC’s supply and borrow caps.

PT-USDe-25SEP2025 & PT-sUSDe-25SEP2025 (Ethereum)

As both September Ethena PTs currently listed on Aave have reached expiry, and the majority of the outstanding users have withdrawn or migrated to the November expiry, this change aims to complete the deprecation of the assets in order to prevent future exposure.

PT-USDE-25SEP2025 current supply

PT-sUSDE-25SEP2025 current supply

Recommendation

Given the expiration of PT-USDe-25SEP2025 and PT-sUSDe-25SEP2025, we recommend setting their supply caps to 1.

USDC (Sonic)

USDC’s supply cap utilization stands at 5%, and its borrow cap utilization stands at 8%. Over the past month, no growth has been observed on either the supply or borrow side.

Recommendation

Given the lack of growth in supply and borrow activity, along with the very low utilization of both caps, we recommend lowering USDC’s supply and borrow caps.

WETH (Sonic)

WETH’s supply cap utilization currently stands at 14%, and its borrow cap utilization stands at 1%. Over the past month, WETH supply has shown no meaningful growth, and its borrow volume has trended downward during the same period.

Recommendation

Given the lack of growth in both supply and borrowing activity, we recommend lowering WETH’s supply and borrow caps. Should demand increase, we will reassess and adjust the caps as needed.

wS (Sonic)

wS’s supply cap utilization stands at 37%, and its borrow cap utilization stands at 57%. At the same time, both supply and borrow volumes have shown no meaningful progress over the past month.

Recommendation

Due to the sustained low utilization of the supply and borrow caps, as well as the absence of any upward trend in activity, we suggest reducing wS supply and borrow caps.

WXPL (Plasma)

On Plasma, WXPL’s supply cap utilization has reached 100%, hitting the 14M WXPL cap. This cap was reached within a single day after launch, indicating strong user demand.

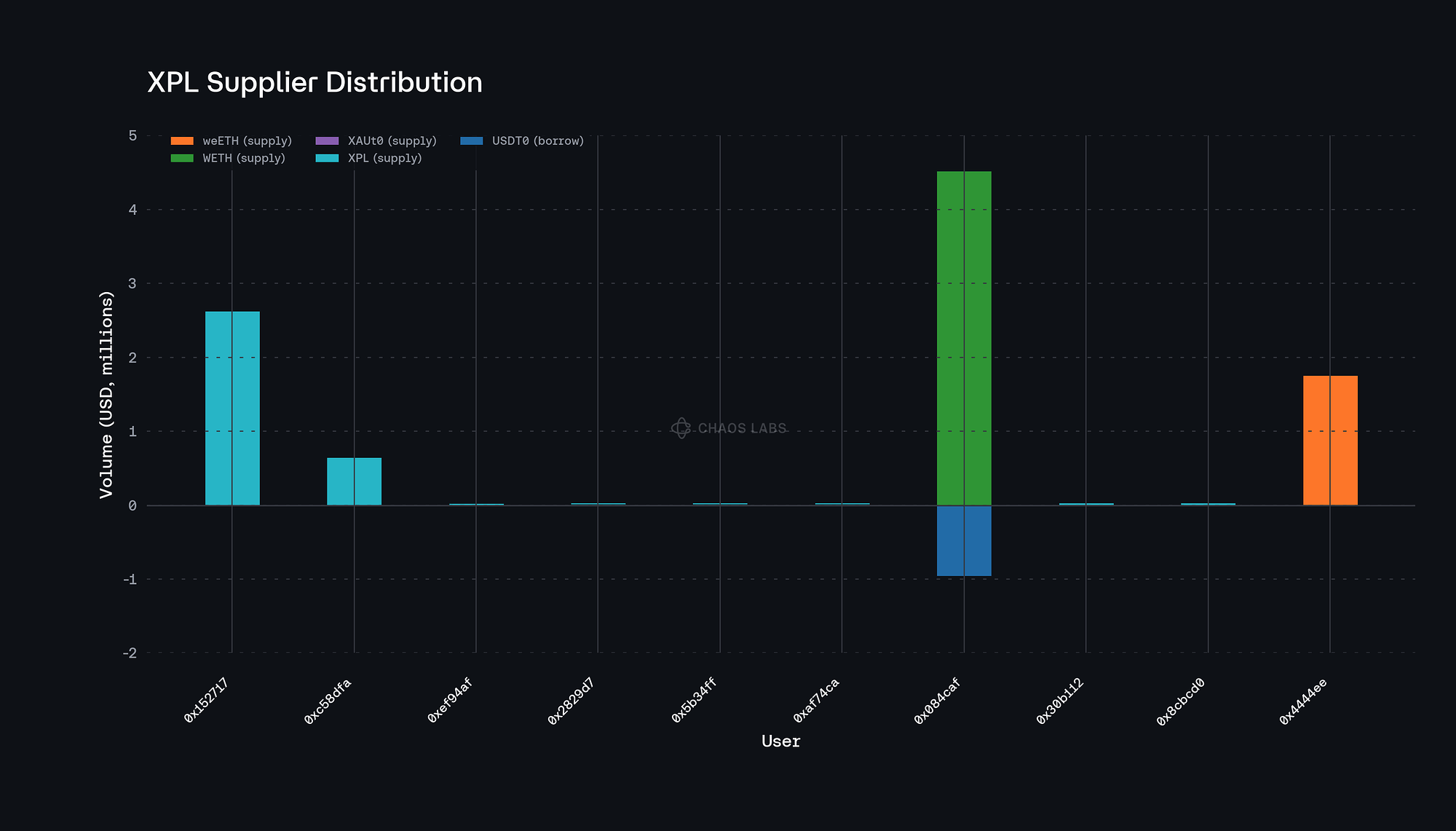

Supply Distribution

There are currently 12 WXPL suppliers, with 2 of them accounting for 98% of total supply, indicating concentration risk. However, we do not view this risk as material, as neither supplier has any borrowing activity, and therefore no liquidation risk exists at this time.

Liquidity

The majority of WXPL liquidity currently sits on Fluid. The available depth supports selling 2M WXPL with roughly 4% price slippage, which is sufficient to support a supply cap increase.

Recommendation

Given the strong demand, safe user behavior, and on-chain liquidity, we recommend increasing WXPL’s supply cap.

WBTC Interest Rate

Market Overview

At the time of writing, more than $8B of BTC-based assets are supplied on Aave V3, representing a substantial share of total protocol supply. While these assets account for approximately 15–17% of aggregate supply, their borrowing activity remains low.

At the moment, aggregate demand for BTC related assets is below $400M, representing a small fraction of the total supplied amount. This profile is consistent with expectations, as BTC is primarily used as collateral, either to increase BTC correlated exposure or to support BTC backed stablecoin borrowing to extract additional utility.

Borrow Activity

To further show the magnitude of the borrowing activity, we focus on BTC-related assets in instances where outstanding borrows exceed 10 BTC, approximately $1M at the time of writing. The plot below shows utilization across these markets. As observed, most exhibit very low utilization, averaging around 4%, with a few outliers such as cbBTC on Base, with an utilization of roughly 15%.

Such low utilization levels result in interest rates below 1%, in particular, several instances, including Avalanche, Ethereum, and Optimism, have rates below 0.5%, while cbBTC on Base is priced at 0.7% APY.

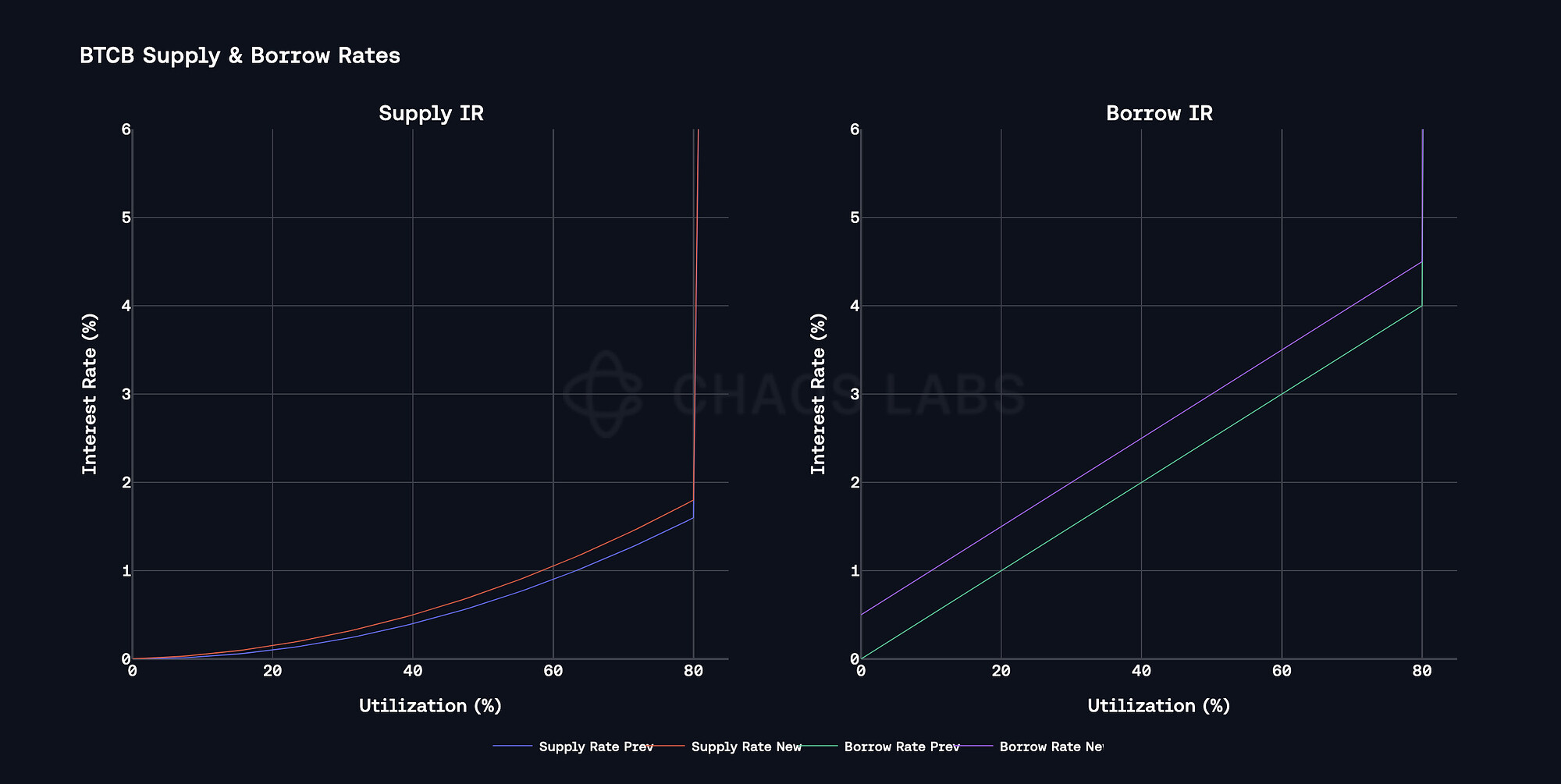

Proposed IR and Market Implication

As shown above, BTC borrowing rates are anchored by very low utilization. In this environment, adjustments to Slope 1 have little practical effect on realized borrowing costs because markets remain near the base of the utilization curve. To meaningfully influence pricing, we therefore propose an increase in the base rate between 0.25% and 0.5%, establishing a minimum borrowing cost for BTC-backed assets.

The impact of this change on market activity is expected to be limited. BTC-based assets are predominantly borrowed for shorting purposes, and as such the demand for the asset is inelastic to minimal changes in borrow cost. Since BTC already features some of the lowest borrowing rates on Aave, this modest uplift in the base rate is unlikely to materially reduce usage, while it enhances protocol revenue on the existing borrowed balances.

Specifically, the proposed base rate adjustment produces a measurable increase in annualized protocol revenue. With approximately $8B in BTC liquidity and an average utilization rate of around 4%, about $300M is actively borrowed. Under current conditions, annualized borrow revenue is approximately $398K, or 3.93 BTC. Following a 50 bps base rate increase, total borrow revenue is projected to rise to roughly $470K, or 4.67 BTC. This adjustment converts underutilized BTC liquidity into a more productive revenue source without introducing material borrower friction.

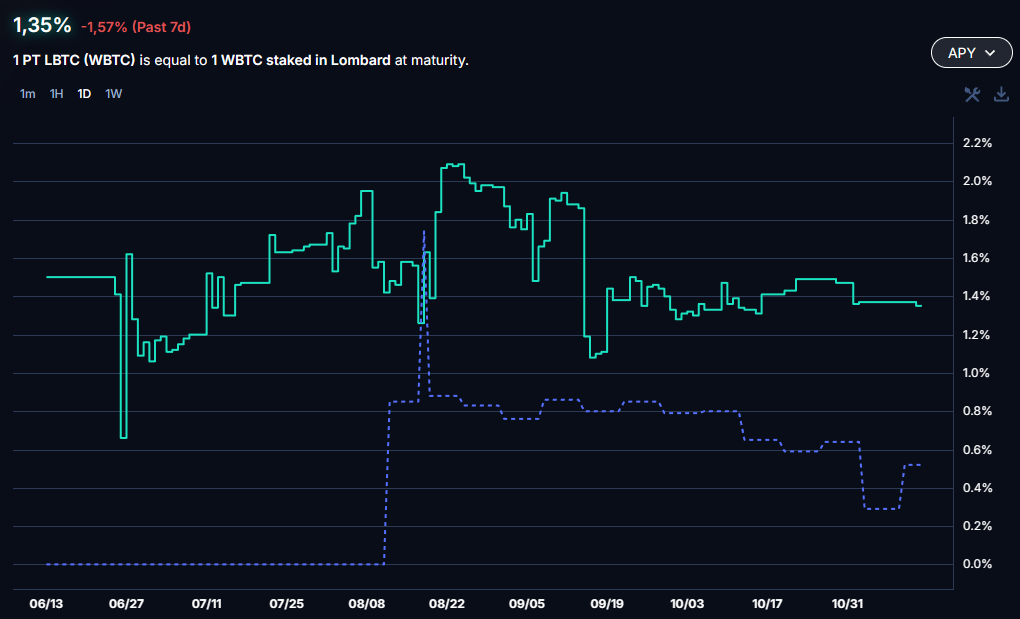

However, borrowing activity for several BTC related assets on the Ethereum instance is primarily driven by leverage looping behavior, where users supply yield-bearing BTC and then borrow BTC against it. The underlying yield on these yield-bearing BTC assets is currently around 0.5%, with its implied yield currently being 1.3%. In this context, raising the base rate to 0.5% is not appropriate, as it would likely compress or eliminate the yield spread and cause these positions to unwind, reducing borrowing demand.

For example, the chart below shows the collateral backing WBTC borrows on the Ethereum instance. LBTC accounts for 34.5% of the borrowed assets distribution, indicating that WBTC on Ethereum is heavily used for leverage looping.

For these assets, we therefore recommend a more conservative adjustment, increasing the base borrow rate by only 0.25%.

Specification

Supply & Borrow Caps

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Arbitrum | rsETH | 31,680 | 60,000 | - | - |

| Avalanche | EURC | 3,000,000 | 6,000,000 | 2,800,000 | 5,600,000 |

| Ethereum | PT-USDe-25SEP2025 | 1,800,000,000 | 1 | - | - |

| Ethereum | PT-sUSDe-25SEP2025 | 2,400,000,000 | 1 | - | - |

| Sonic | USDC | 560,000,000 | 50,000,000 | 110,000,000 | 20,000,000 |

| Sonic | WETH | 30,000 | 10,000 | 26,400 | 8,800 |

| Sonic | wS | 420,000,000 | 300,000,000 | 200,000,000 | 130,000,000 |

| Plasma | WXPL | 14,000,000 | 28,000,000 | - | - |

BTC Interest Rate

| Instance | Asset | Current Base Rate | Proposed Base Rate |

|---|---|---|---|

| Arbitrum | WBTC | 0% | 0.5% |

| Avalanche | BTC.b | 0% | 0.5% |

| Base | cbBTC | 0% | 0.5% |

| Base | tBTC | 0% | 0.5% |

| BNB | BTCB | 0% | 0.5% |

| Linea | WBTC | 0% | 0.5% |

| Optimism | WBTC | 0% | 0.5% |

| Polygon | WBTC | 0% | 0.5% |

| Ethereum Core | FBTC | 0% | 0.5% |

| Ethereum Core | cbBTC | 0% | 0.25% |

| Ethereum Core | WBTC | 0% | 0.25% |

| Ethereum Core | tBTC | 0% | 0.25% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.