Summary

A proposal to:

- Increase PT-USDe-31JUL2025’s supply cap on the Ethereum Core instance.

- Increase PT-sUSDe-25SEP2025’s supply cap on the Ethereum Core instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

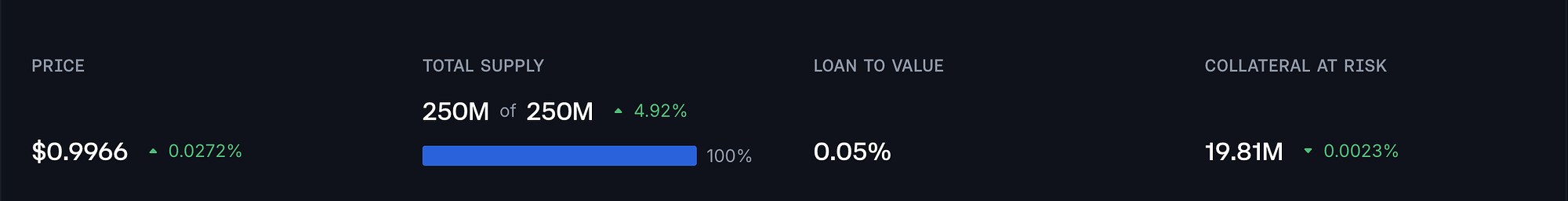

PT-USDe-31JUL2025 (Ethereum Core)

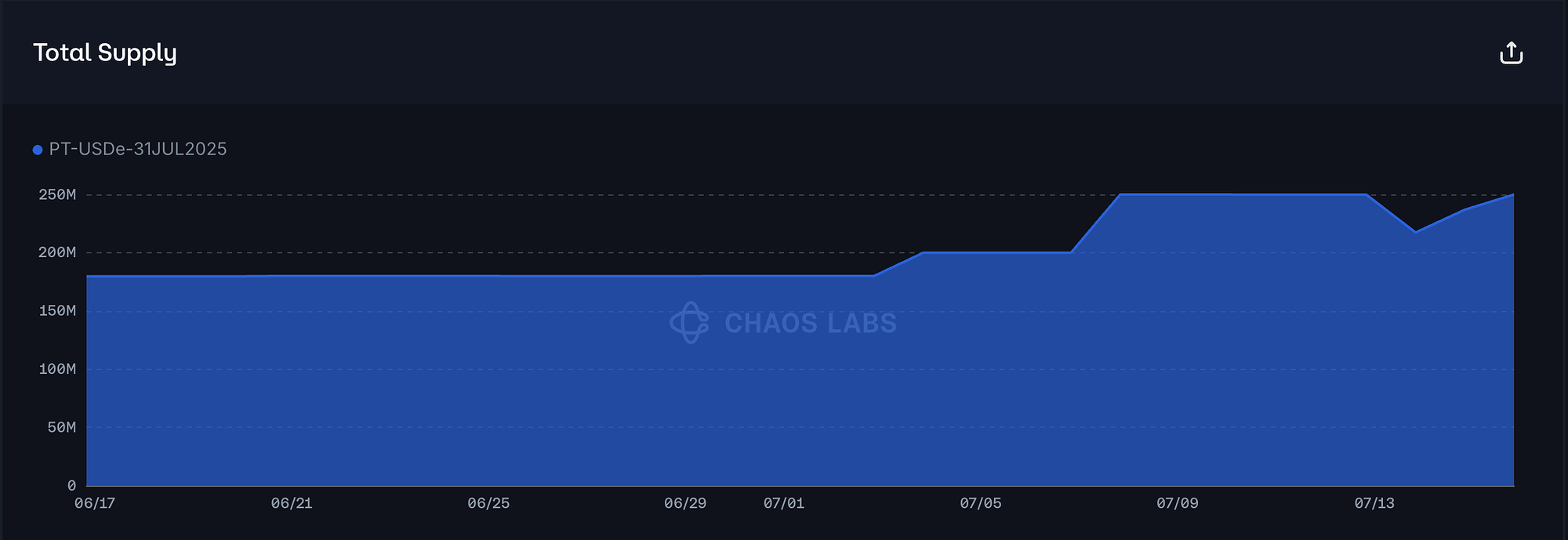

PT-USDe-31JUL2025 has reached 100% of its supply cap utilization.

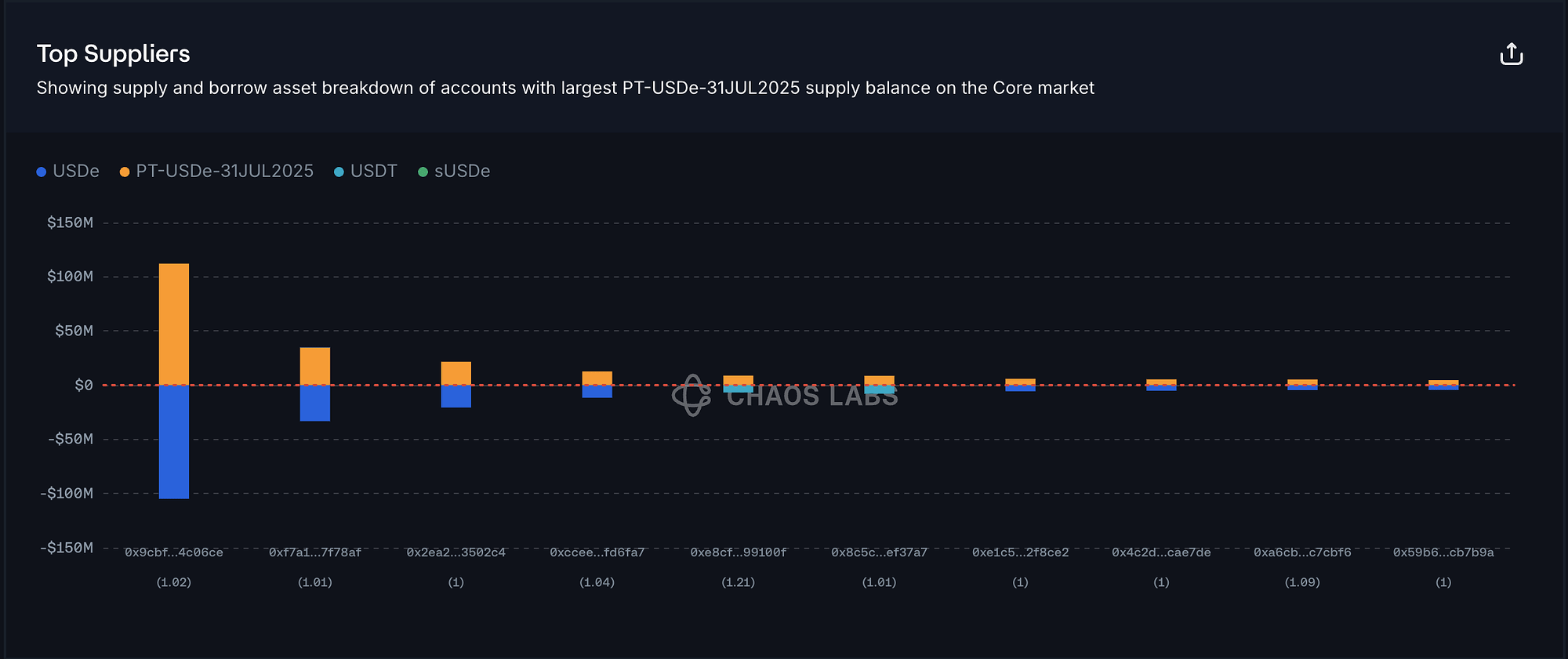

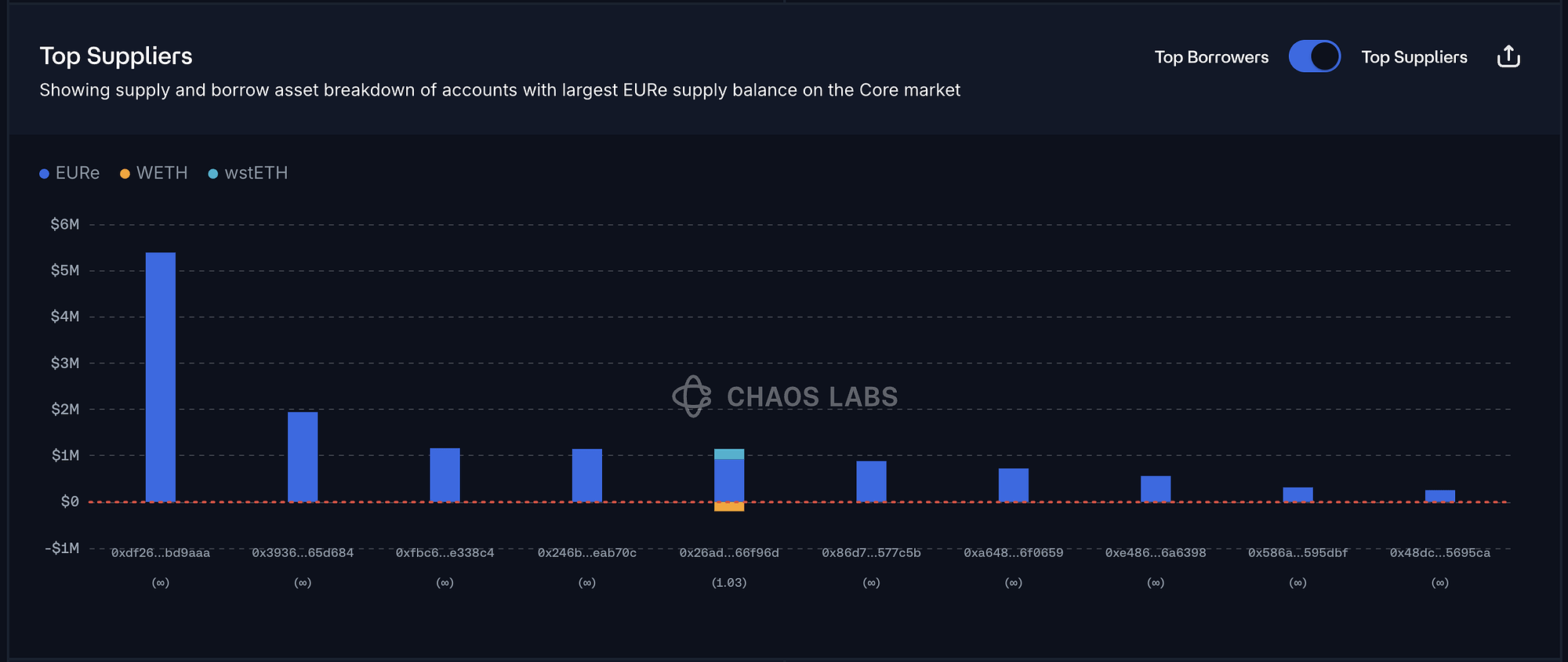

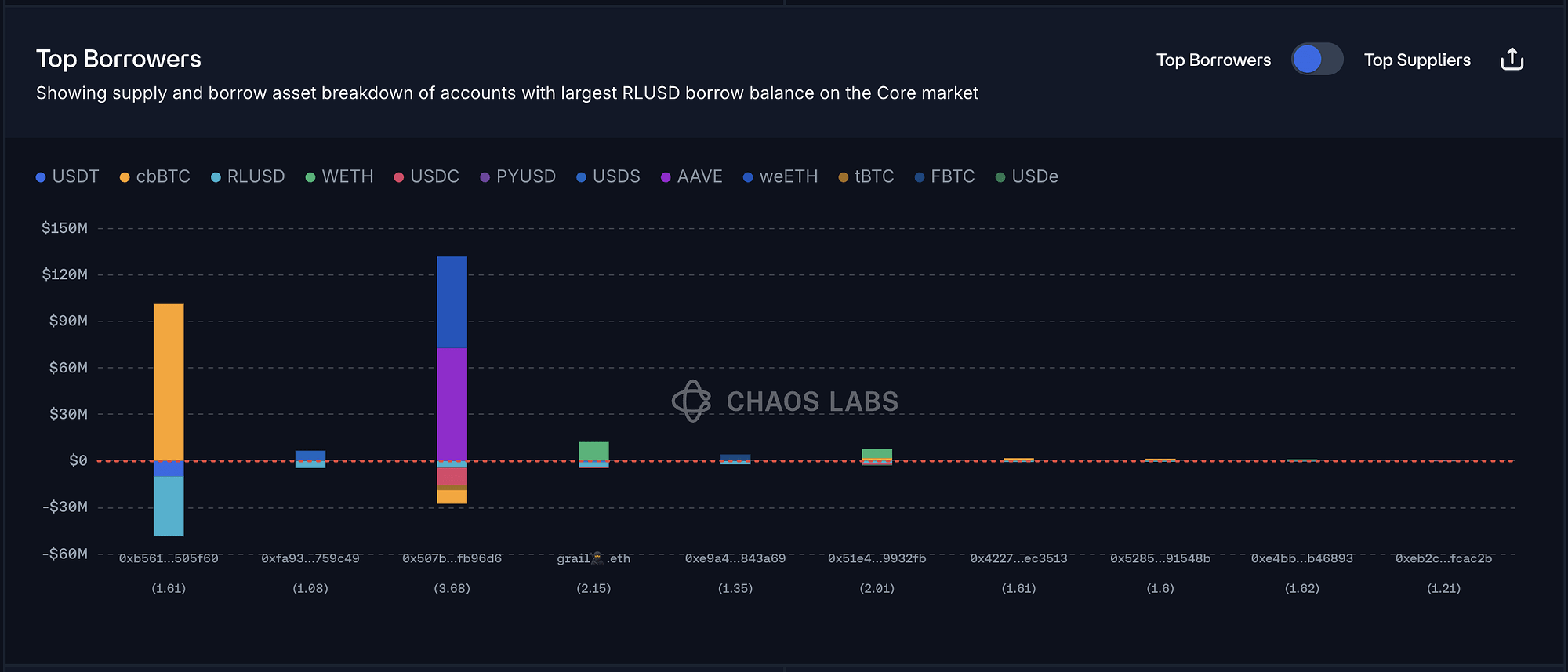

Supply Distribution

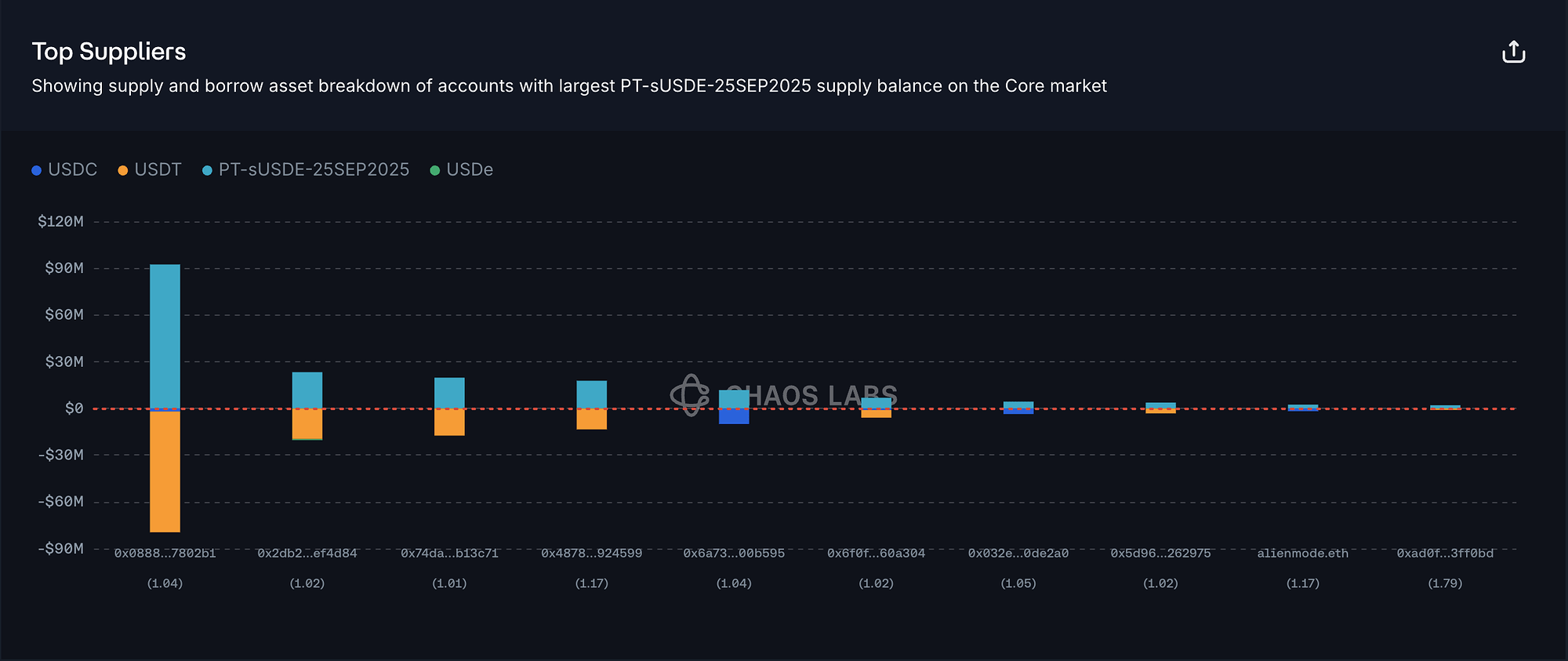

PT-USDe’s supply is concentrated, with the top supplier accounting for around 45% of the total distribution. However, since this user is borrowing USDe, the risk of liquidation is considered low. In addition, all other top suppliers are also borrowing USDe, USDT, or sUSDe, which significantly reduces the likelihood of liquidations.

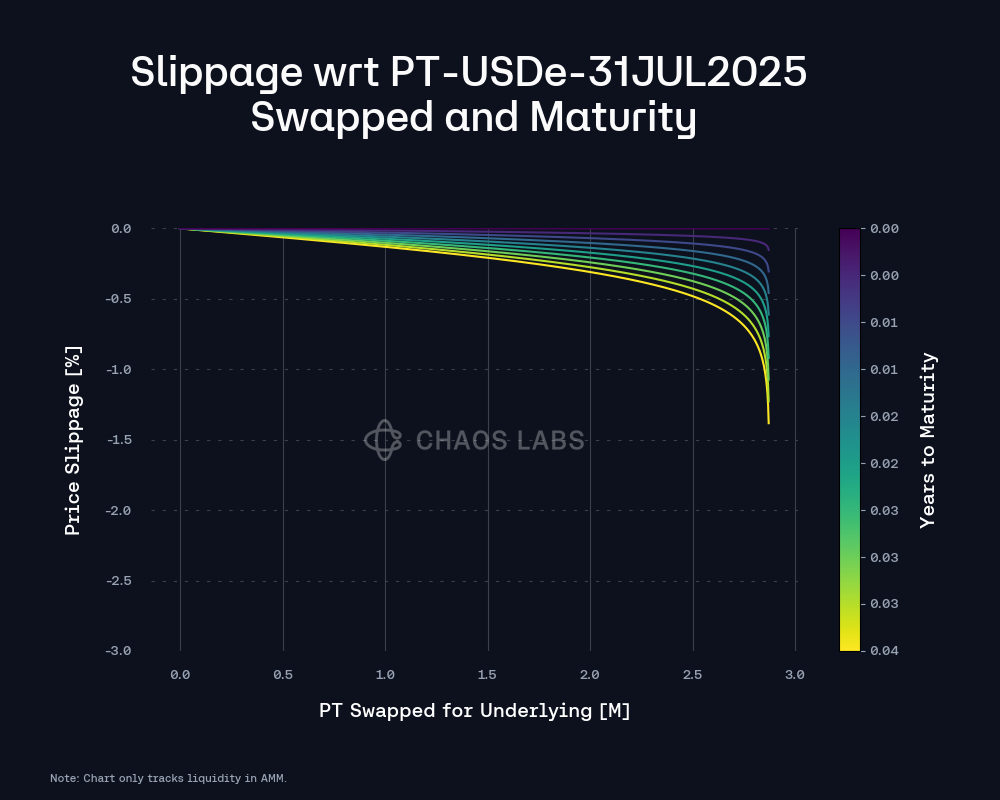

Liquidity and Market

PT-USDe-31JUL2025’s Pendle AMM liquidity has not shown a significant increase since our last recommendation. Currently, a 2.8M swap would incur less than 3% price slippage.

The asset’s on-chain liquidity has deteriorated slightly following a large drop roughly two months ago, with approximately 4M in SY liquidity and around 1M in PT liquidity.

There is more liquidity available in the asset’s order book, with nearly 10M worth of PT buys at 13% implied yield.

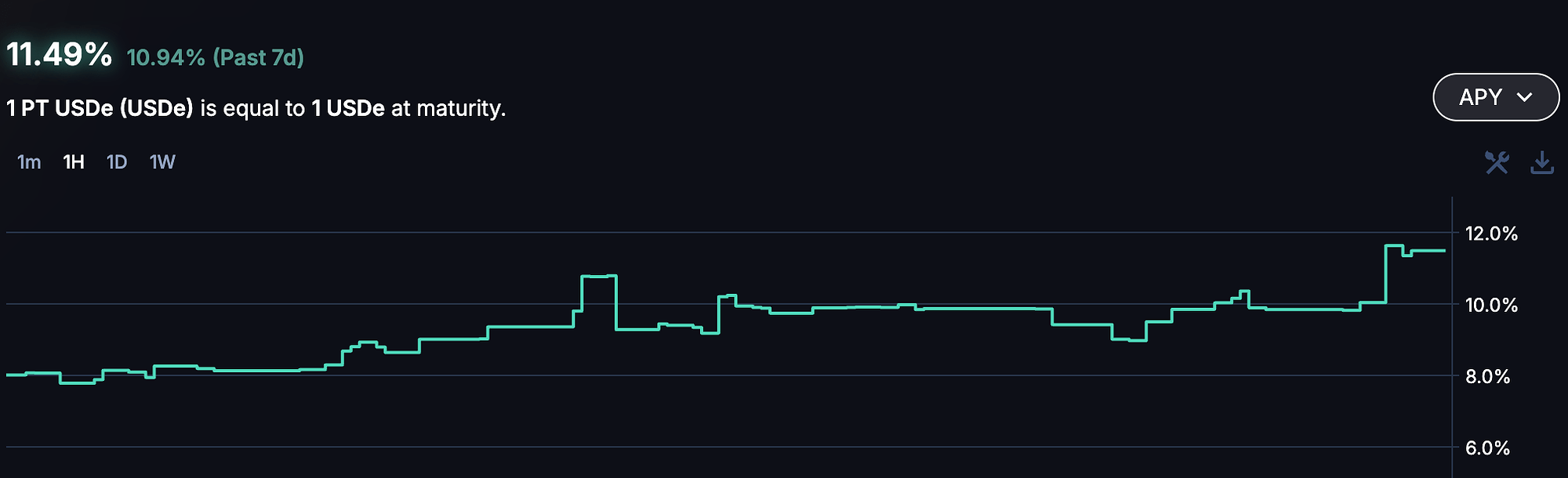

The PT-USDe-31JUL2025 market has shown an upward trend in yield over the past week, which aligns with the mechanics of PT tokens, because as the token approaches maturity, its price naturally converges toward par value, increasing the implied yield for holders.

Recommendation

Given user behavior and the market’s close proximity to maturity, we recommend increasing the supply cap to 300M.

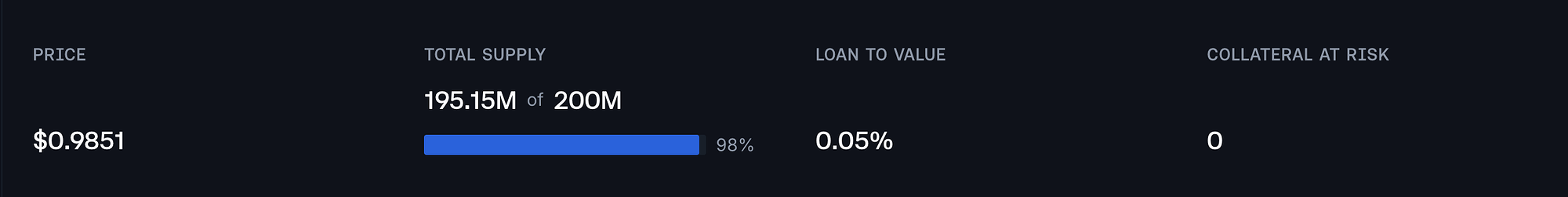

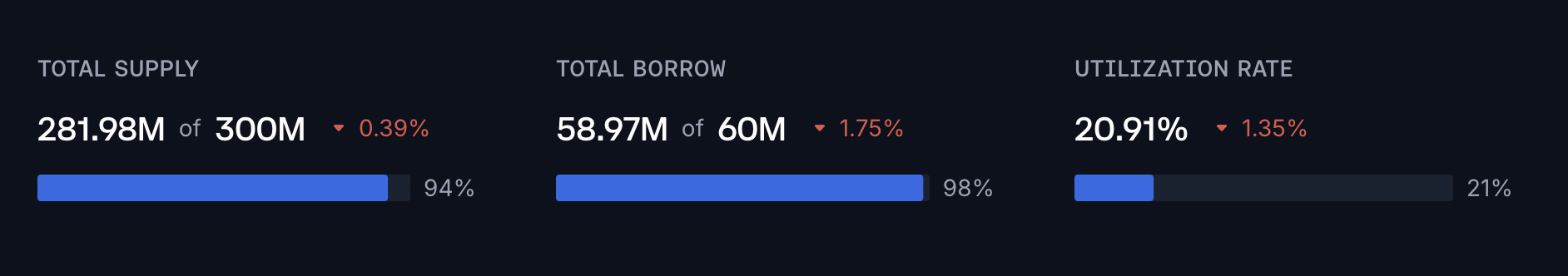

PT-sUSDe-25SEP2025 (Ethereum Core)

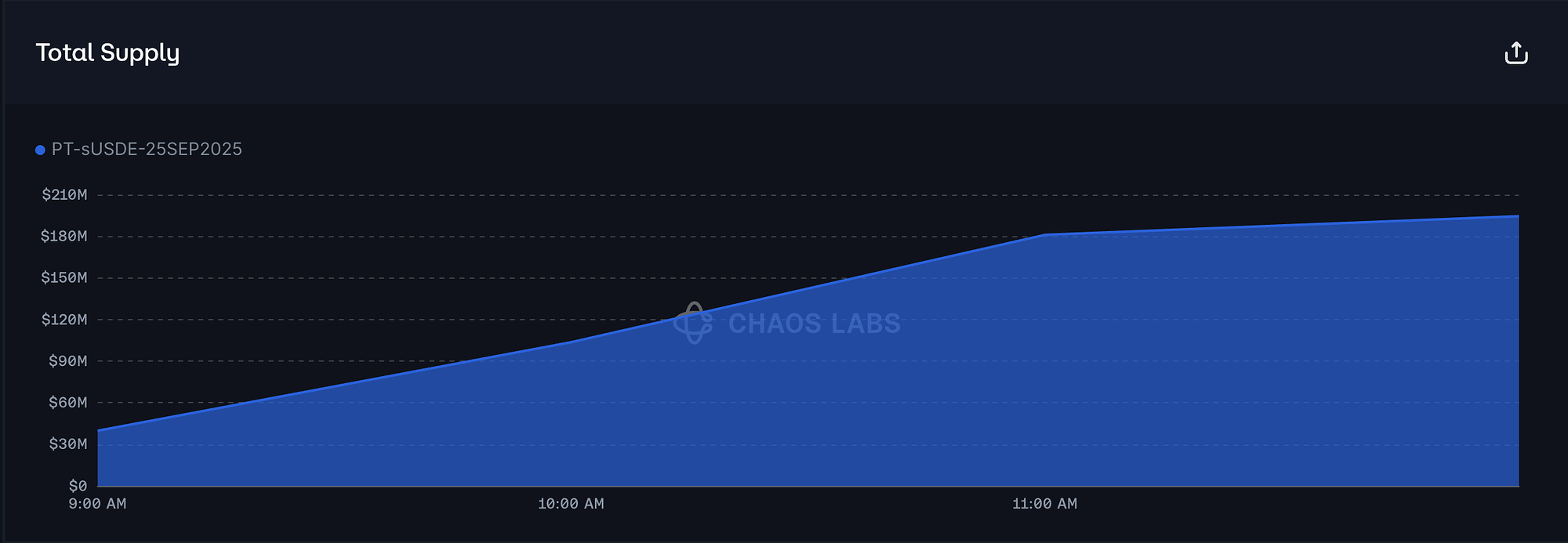

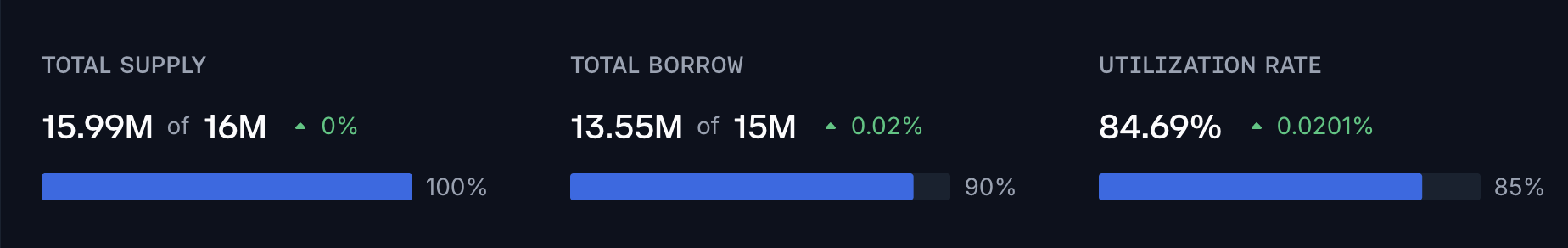

PT-sUSDe-25SEP2025 has reached 98% supply cap utilization, rising from 30M to 195M within 24 hours.

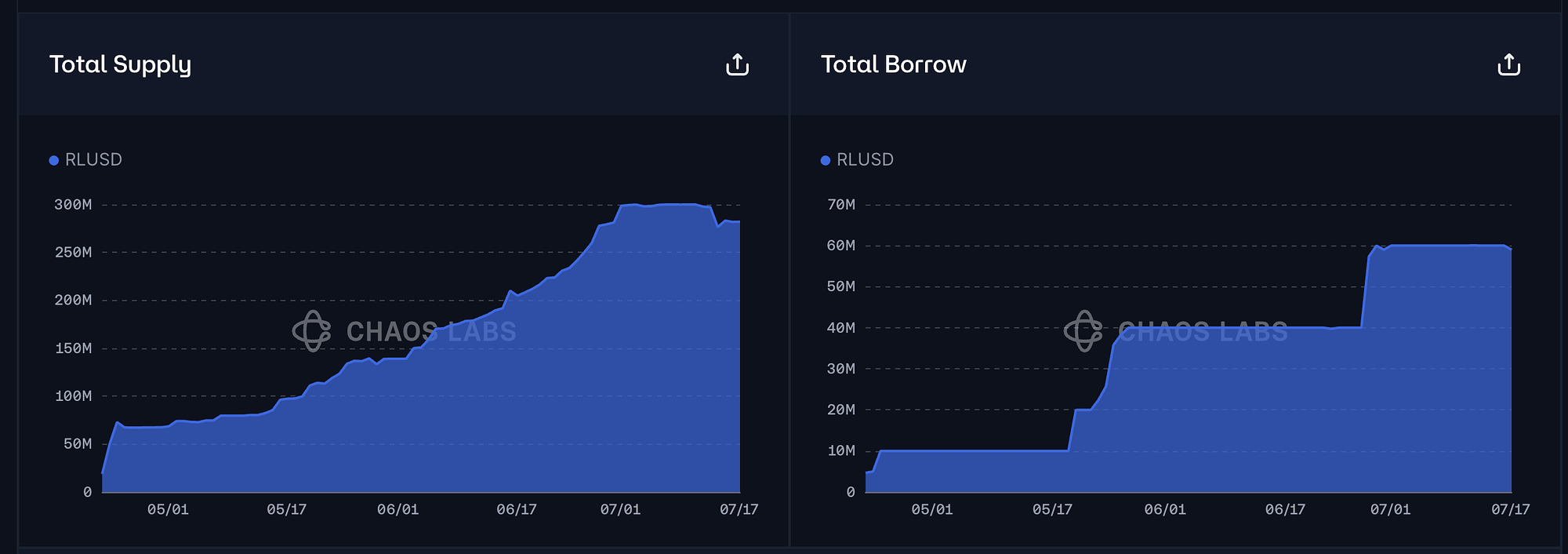

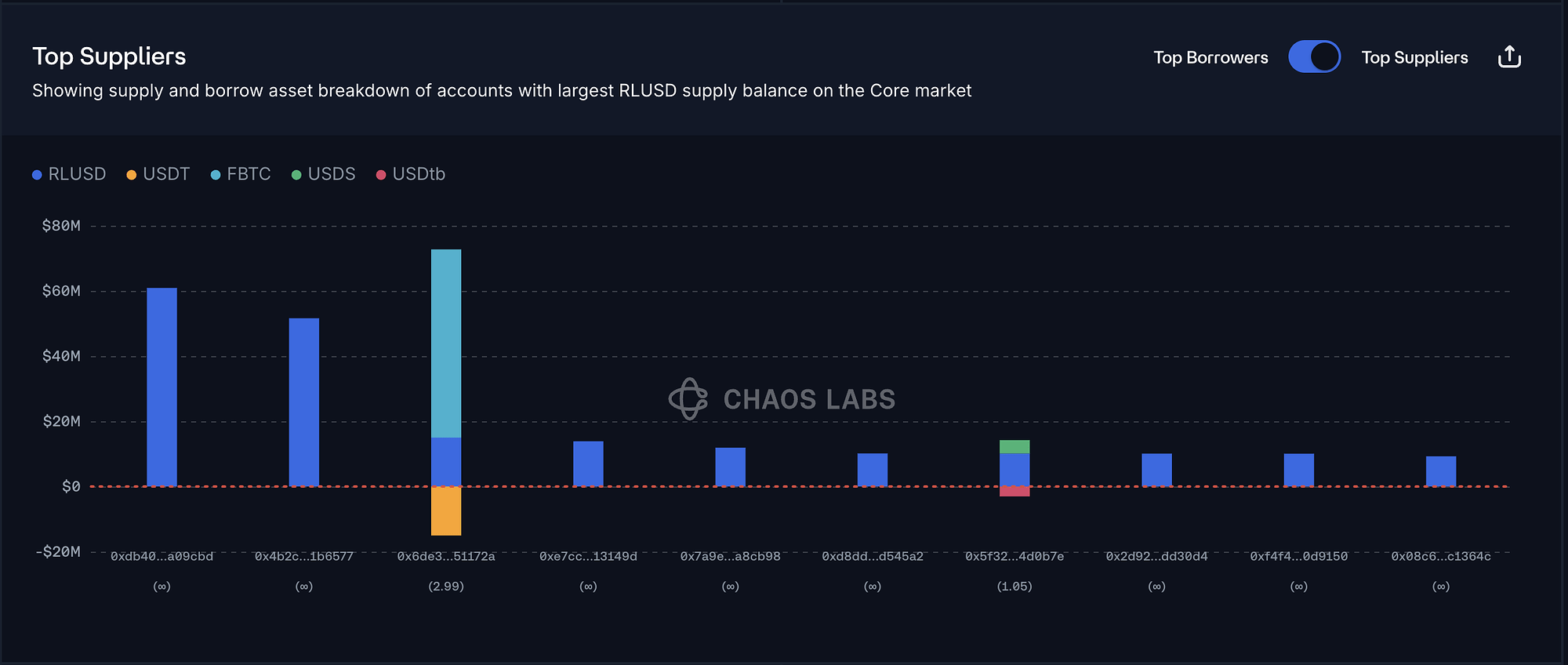

Supply Distribution

The PT-sUSDe supply distribution is concentrated, with the top supplier accounting for 46% of the total. However, because this user is borrowing USDT, they do not pose a significant liquidation risk. Additionally, all other top suppliers are borrowing USDT, USC, or USDe, which reduces the chance of liquidation.

Liquidity and Market

PT-sUSDe-25SEP2025’s Pendle AMM liquidity currently supports a 38M swap with less than 3% price slippage.

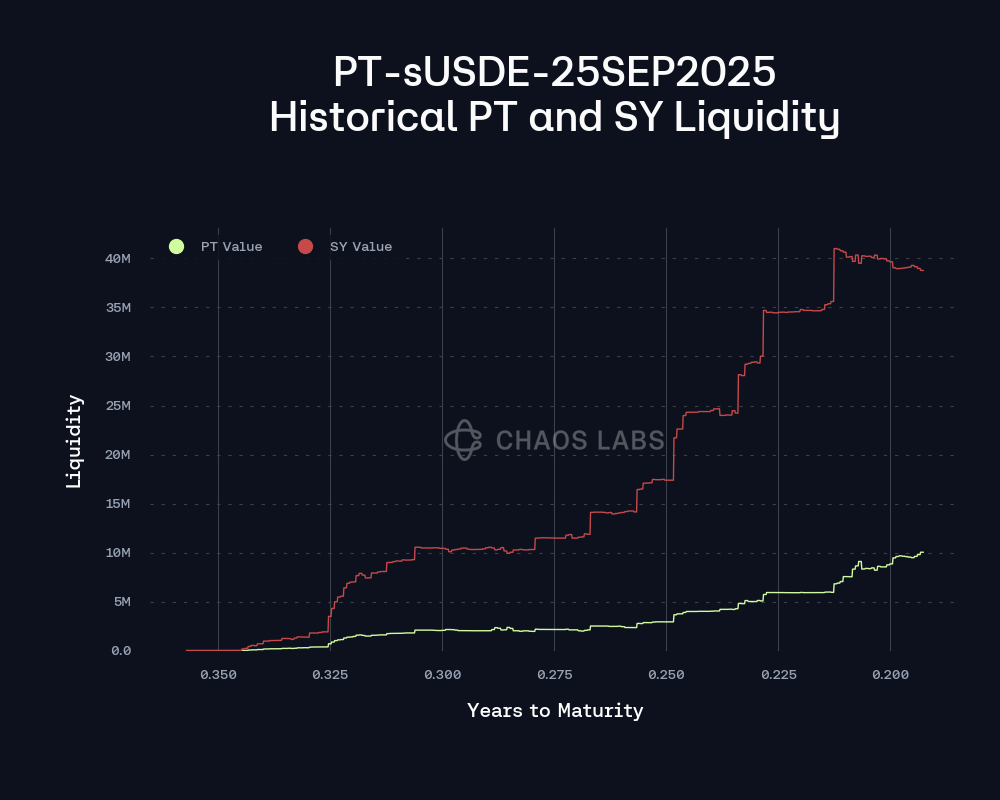

The asset’s on-chain liquidity has displayed a consistent upwards trend, with SY liquidity reaching 40M and PT liquidity reaching 10M.

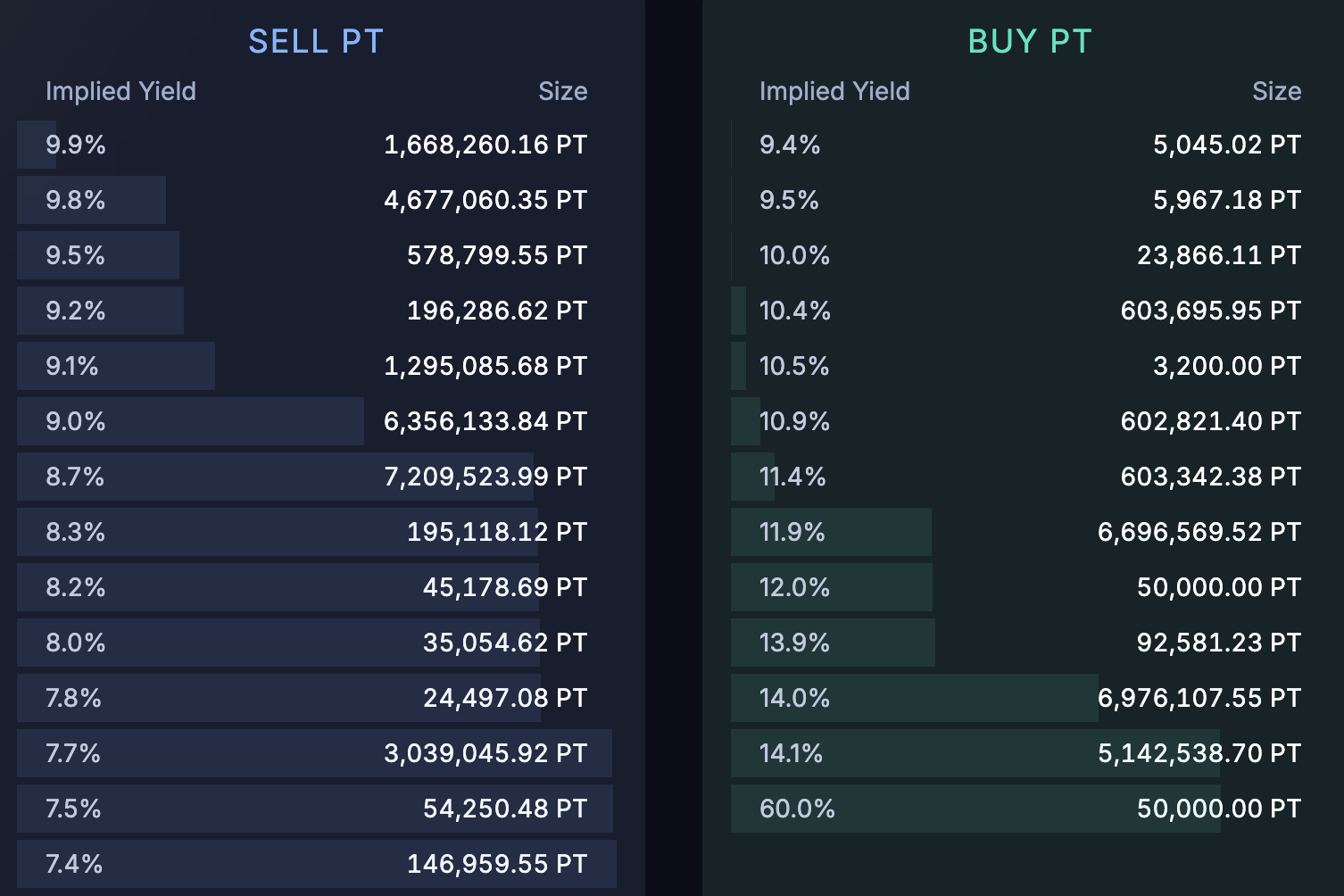

There is additionally more than 8M worth of PT buy orders before 12% implied yield.

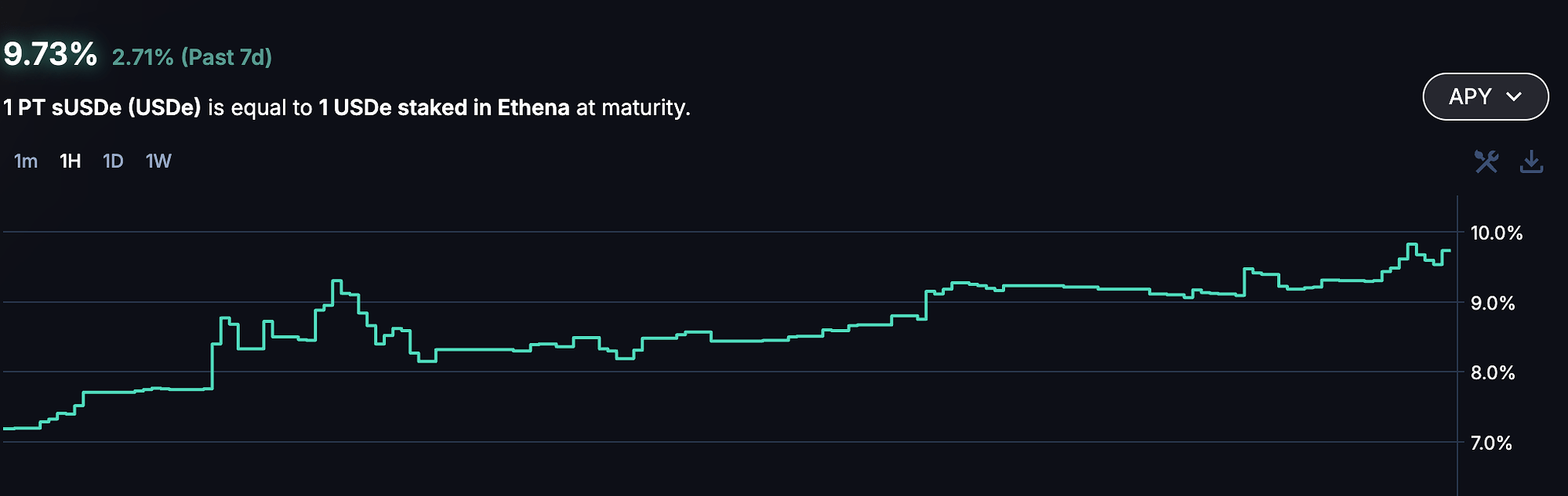

The PT-sUSDe-25SEP2025 market has shown a relatively stable upward trend in yield over the past week, primarily staying within the 8% to 10% range.

Recommendation

Given user behavior, the market’s liquidity, and strong market demand, we recommend increasing the supply cap to 400M.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | PT-USDe-31JUL2025 | 250,000,000 | 300,000,000 | - | - |

| Ethereum Core | PT-sUSDe-25SEP2025 | 200,000,000 | 400,000,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0