July 2025

This update highlights Chaos Labs’ activities and proposals in July.

Highlights

Stress Testing Ethena: A Quantitative Look at Protocol Stability

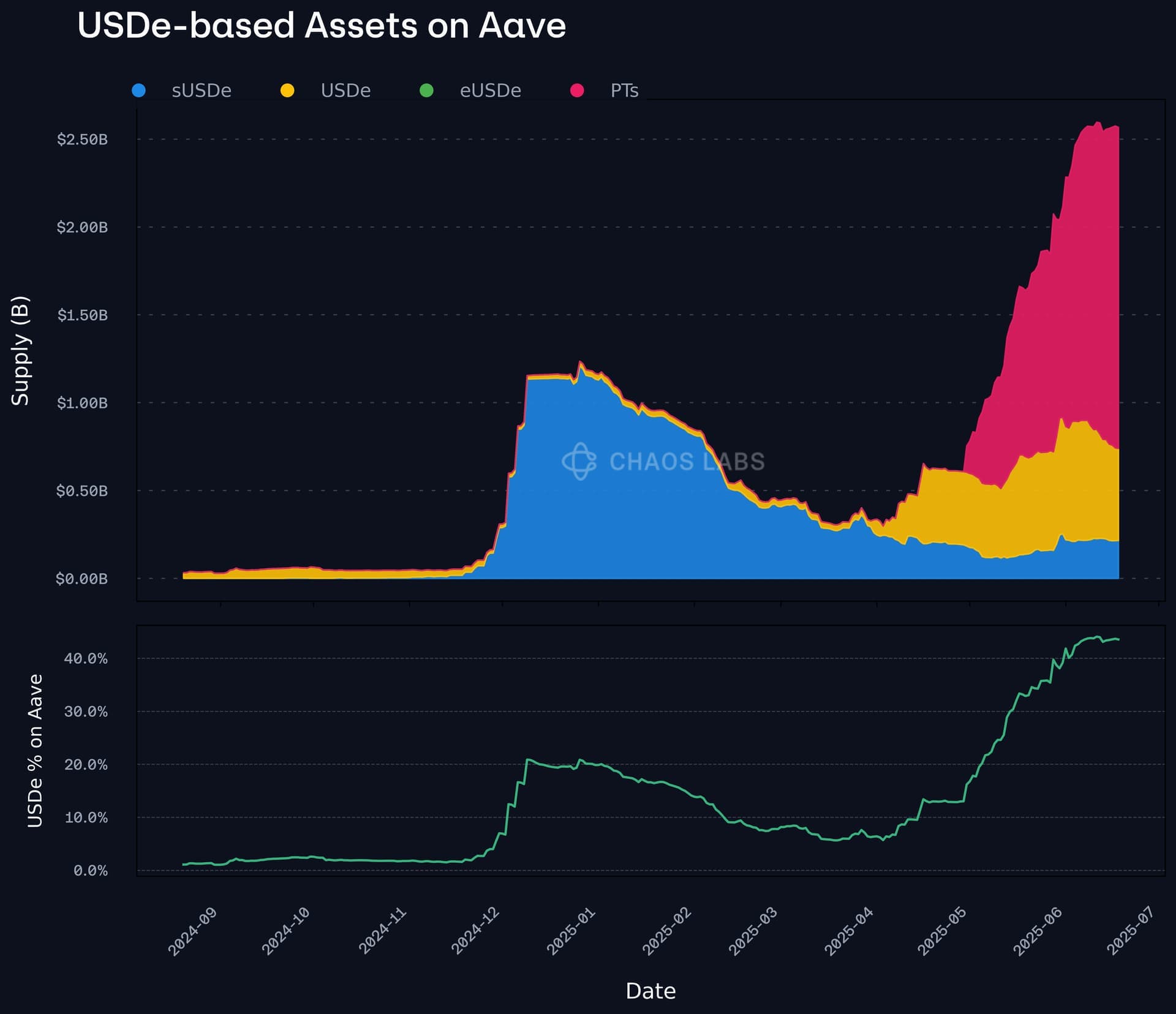

We published a detailed report outlining Aave’s increasing exposure to Ethena-linked assets, especially PT tokens, finding that nearly 50% of USDe is currently on Aave. Next, we examined the risks associated with the exposure, including PT token liquidity (mitigated using risk oracles), and USDe liquidity risk. This liquidity risk was further broken down into supply concentration risk, finding that two entities account for over 60% of the USDe on Aave, as well as USDe rehypothecation risk.

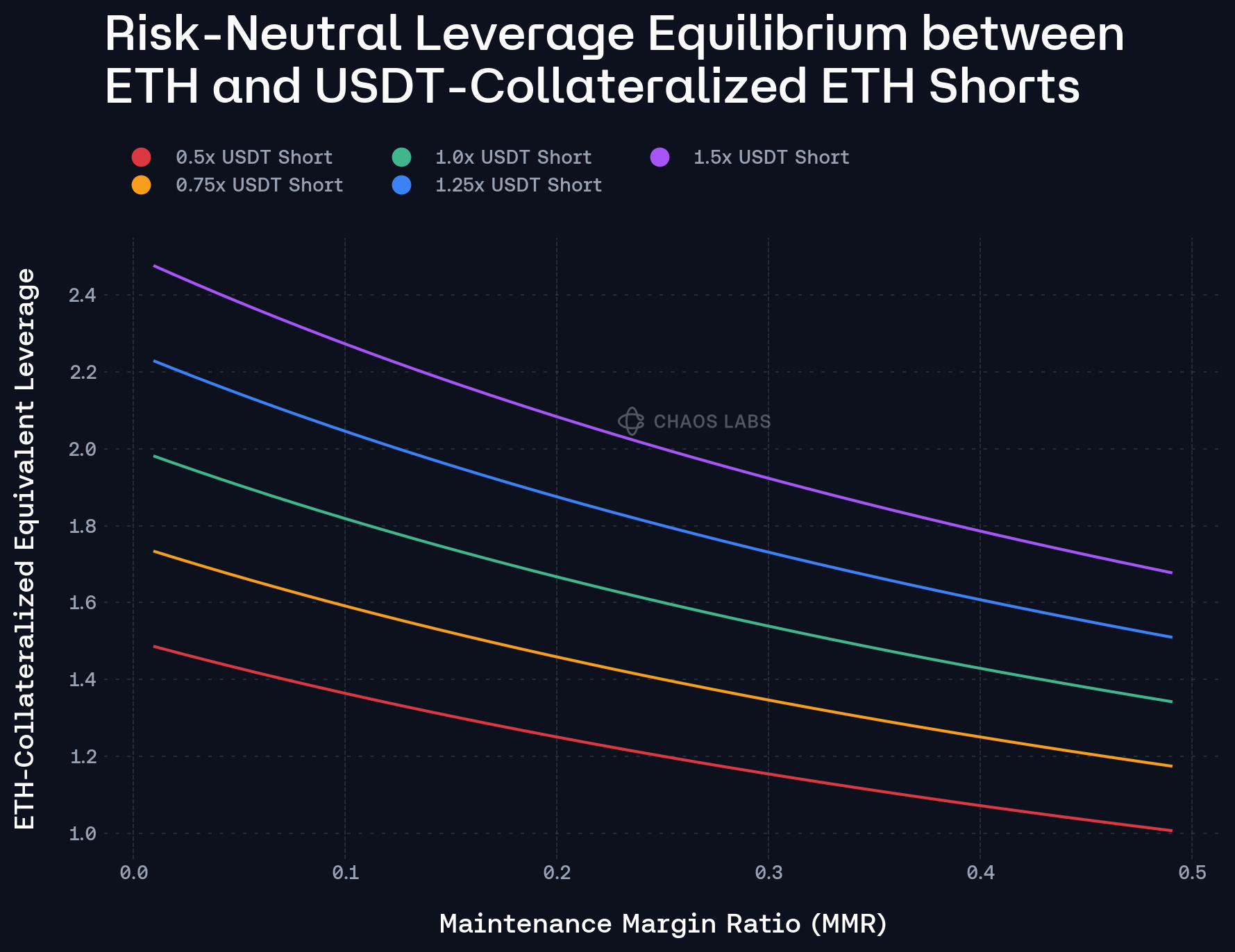

We found that to appropriately mitigate these liquidity risks, it is important to maintain a more conservative UOptimal for USDe relative to USDT and USDT, as well as to integrate USDe into PT stablecoin E-Modes to reduce frictions when utilizing Debt Swaps. Finally, we examined the risks posed by USDe’s backing, modeling numerous scenarios to determine risks (the chart below shows the quantitative assessment of Ethena hedging before an exchange failure is confirmed by a custodian), ultimately finding that Ethena’s hedging and collateral management systems are robust, and the probability of bad debt accruing to Aave is extremely low.

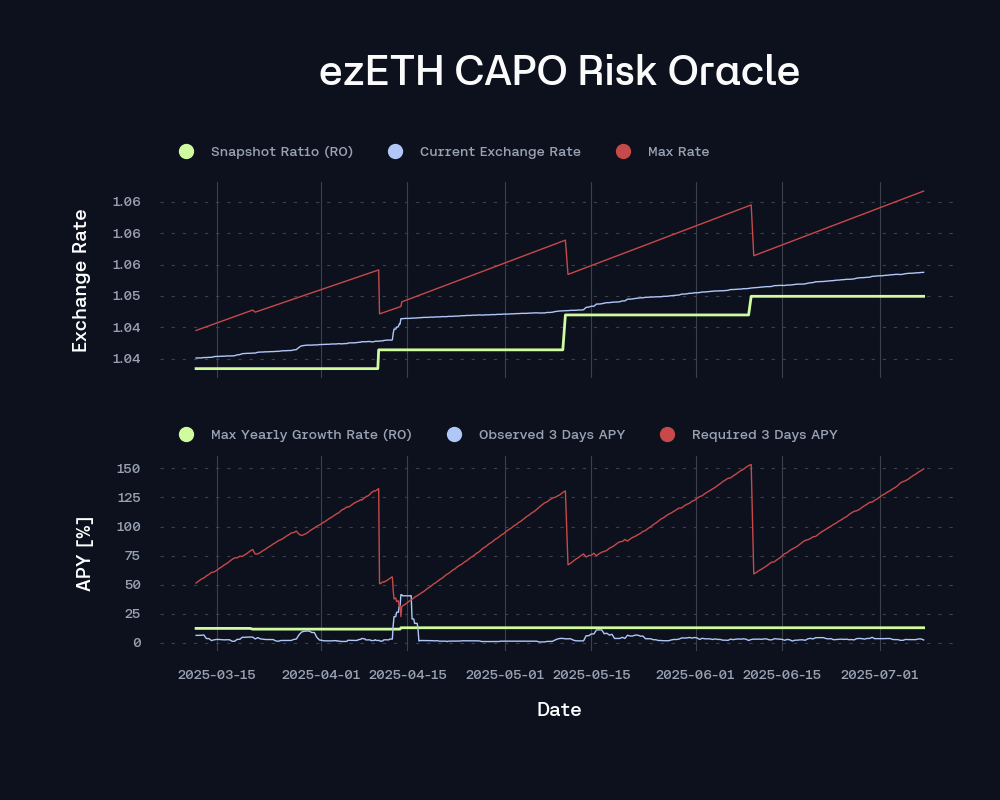

Dynamic Calibration of CAPO Parameters via Risk Oracles

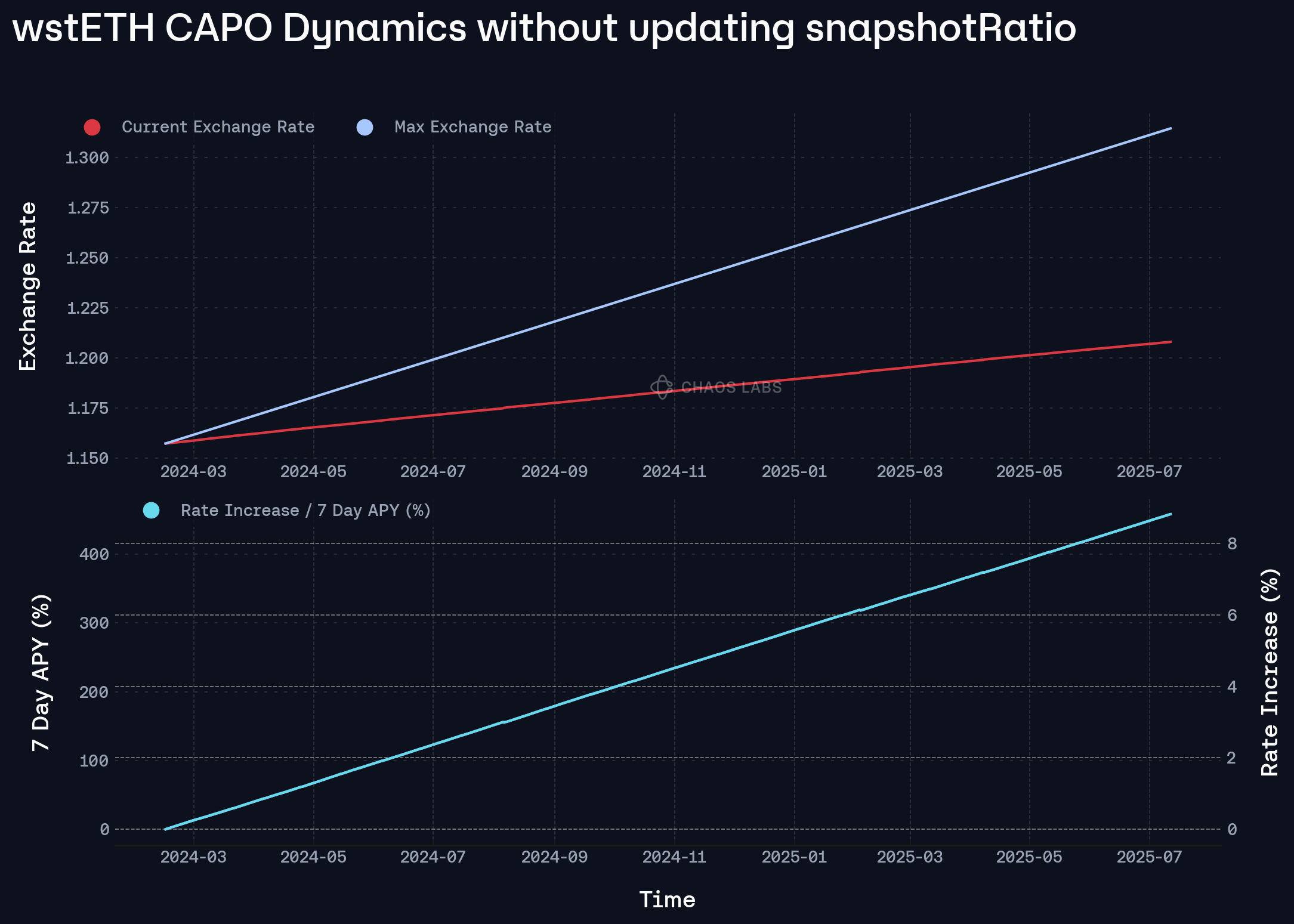

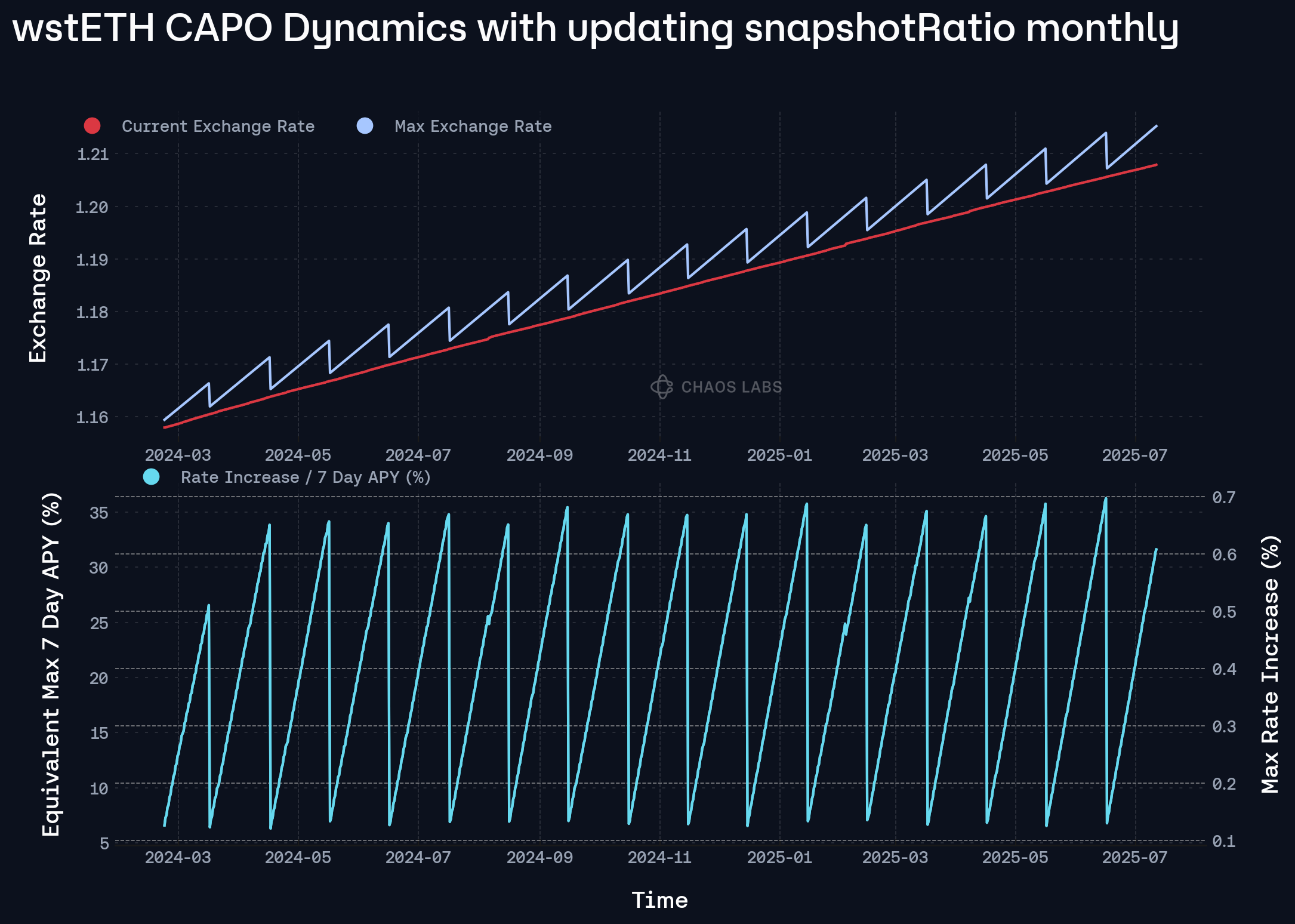

We proposed a formal framework for calibrating CAPO parameters using Risk Oracles, which would enforce a time-weighted upper bound on the permissible growth of a yield-bearing asset’s exchange rate relative to its base asset. Specifically, it is critical to refresh the snapshotRatio at a consistent cadence to ensure that the maxRatio is in line with real-world observations. When snapshotRatio is not refreshed, it leads a model with reduced responsiveness, as shown in the charts below. Taking this into account, we provided details on our proposed CAPO risk oracle, designed to improve the efficiency and risk mitigation properties of CAPO.

Our framework accommodates assets with either regular or irregular yield distributions, stressed via backtesting. In the case of ezETH, its March distribution of EIGEN rewards into its exchange rate provided an important test. Under backtesting, the rate-setting algorithm executed a parameter recalibration in response to the updated reward trajectory. Importantly, the required minimum 3-day MA of APY, used as a guardrail to prevent excessive rate increases, converged below the observed 3-day APY. This meant the new max rate was deemed within the bounds, increasing the associated maxYearlyGrowthPercent.

Adjust USDT and WETH IR Curves

We continued to monitor and frequently update the IR curves of both WETH and USDT in response to large withdrawals by the HTX account from Aave V3. The WETH withdrawals in particular created ripple effects, as users who were leveraging LSTs and LRTs were faced with unprofitable positions, and unwinding caused minor peg deviations in these assets. To address this, we temporarily lowered Slope2 and increased UOptimal; similar actions were taken in the USDT market, where large withdrawals caused a spike in borrow rates.

Risk Oracles

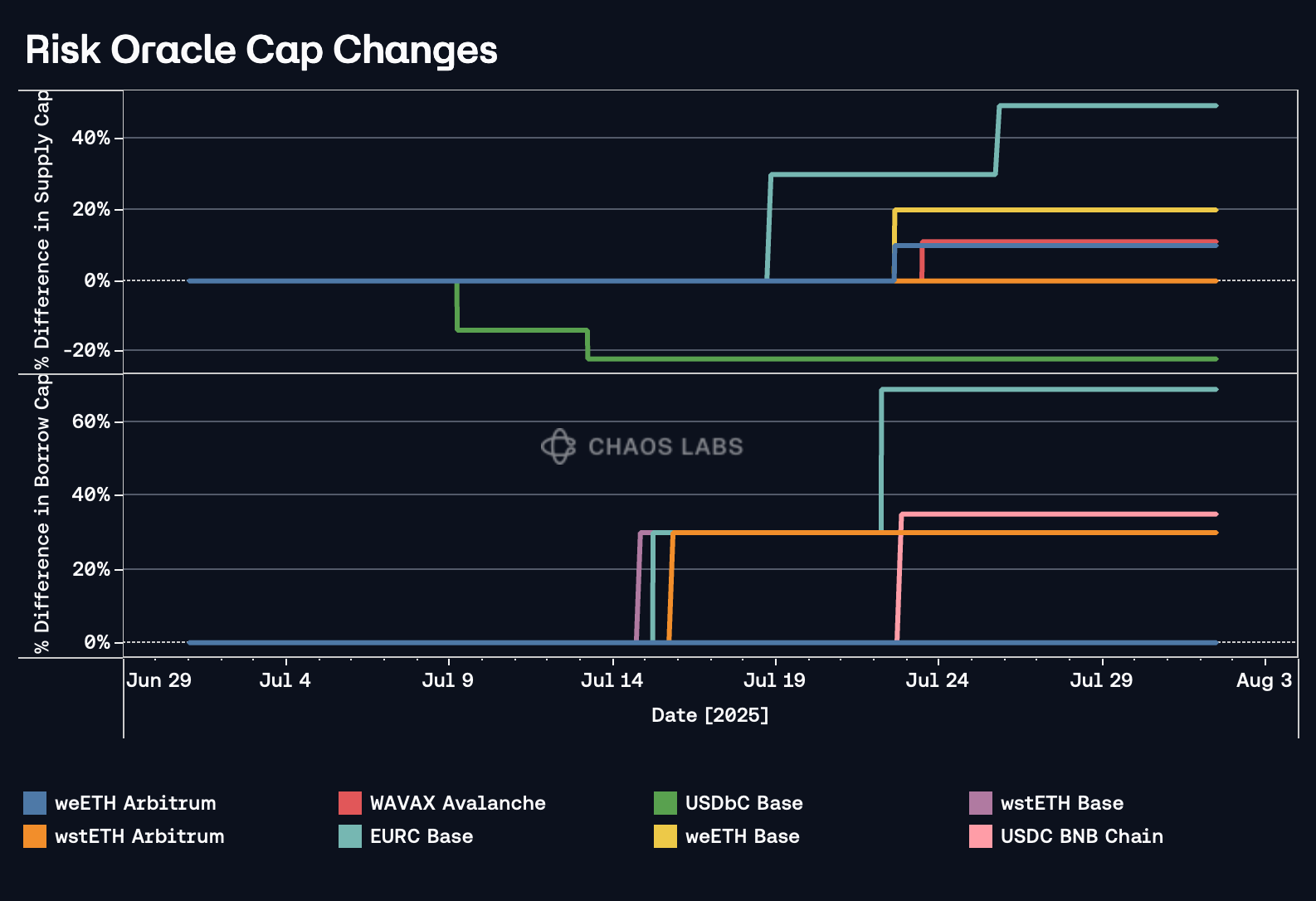

Supply and Borrow Cap Oracles

The supply and borrow cap risk oracles on Arbitrum, Avalanche, and Base continued to function efficiently, executing changes on numerous markets. The most significant changes came on Base’s EURC market, where the oracle recommended multiple supply and borrow cap increases.

This allowed for a frictionless rise in EURC utilization on Base, in part because of increased borrowing against cbBTC.

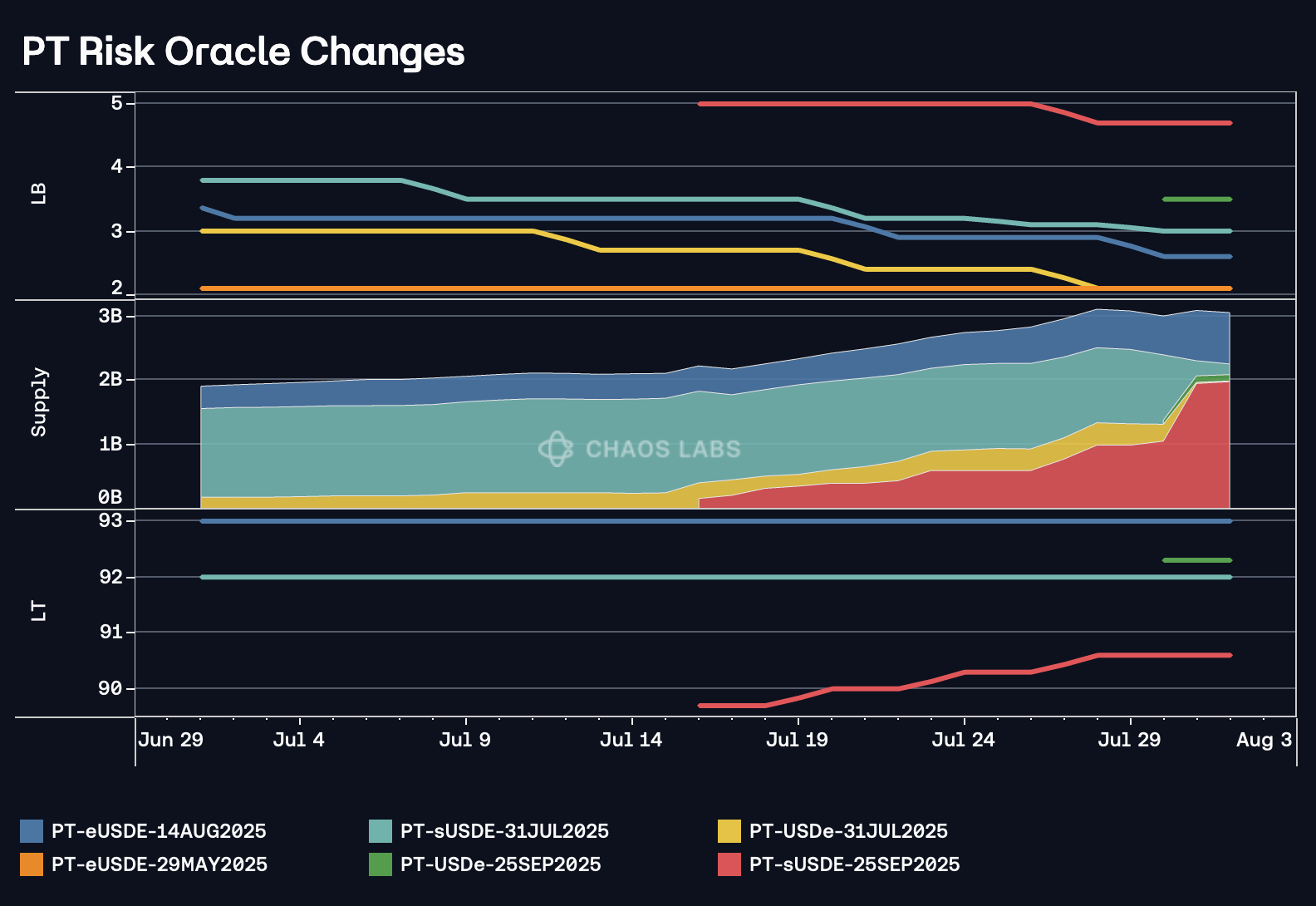

PT Risk Oracle

The value of assets utilizing the PT risk oracle has eclipsed $3B. The chart below shows two of the three parameters dictated by risk oracles: Liquidation Bonus and Liquidation Threshold, as well as total supply in USD terms.

PT-sUSDE-31JUL2025’s LT remained steady while its LB decreased, reflecting its approaching maturity at the end of July. Meanwhile, the LT of PT-sUSDE-25SEP2025 has been consistently increasing since listing, while its LB has decreased slightly. The oracle continues to function optimally and has allowed for significant, responsible growth in these assets.

Forum Activity

-

We published the following proposals, updates, and analyses, including risk parameter updates:

-

Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 07.03.25

-

Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 07.08.25

-

Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 07.10.25

-

Stress Testing Ethena: A Quantitative Look at Protocol Stability

-

Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 07.15.25

-

[ARFC] Dynamic Calibration of CAPO Parameters via Risk Oracles

-

Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 07.17.25

-

[Direct to AIP] Adjustment of PT sUSDe September E-Mode and USDtb IR Curve

-

Chaos Labs Risk Stewards - Adjust Supply and Borrow Caps on Aave V3 - 07.21.25

-

Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 07.23.25

-

Chaos Labs Risk Stewards - USDC IR Adjustment on Aave V3 Base Instance- 07.25.25

-

Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 07.26.25

-

Chaos Labs Risk Stewards - Adjustment of Caps and Interest Rate on Aave V3 - 07.29.25

-

Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 07.30.25

-

-

Additionally, we provided analysis regarding the following proposals and discussions:

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

-

Supply and Borrow Cap Risk Oracle integration on additional Chains leveraging Edge infrastructure.

-

Continuous monitoring of SVR and associated parameterization

-

Pendle Dynamic Risk Oracle for each PT asset deployment

-

Risk Oracle integration for automated interest rate curve adjustments in response to demand

-

Circuit Breaker for LSTs and LRTs

-

Umbrella parameterization and methodology

-

GHO: ongoing recommendations, including a comprehensive quantitative framework for the GHO savings rate.

-

Continuous optimization of risk parameters on all V3 deployments.

-

Parameterization for new Liquid E-Modes.

-

Analysis and parameter recommendations for new assets and markets.