Summary

A proposal to:

- Increase the supply cap of PT-sUSDe-5FEB2026 on the Ethereum Core instance

- Increase the supply cap of PT-USDe-5FEB2026 on the Ethereum Core instance

- Increase the supply cap of wrsETH on the Avalanche instance

- Increase the supply and borrow caps of WETH on the Ethereum Core instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

PT-USDe-5FEB2026 & PT-sUSDe-5FEB2026 (Ethereum Core)

Both February-maturity PTs have been filled within 48 hours since the previous cap updates on the Ethereum Core instance, indicating continued demand to loop the assets on Aave.

Supply Distribution

The supply distributions of both assets are similarly concentrated, specifically:

- The top 3 users hold over 97.5% of the total PT-USDe-5FEB2026 supply, representing a substantial concentration of the supply. The largest supplier holds 76.5%, while the 2nd and 3rd largest wallets each account for approximately 10.6% of the market.

- In the case of PT-sUSDe-5FEB2026, the concentration risk is even higher, with the top user representing over 86.5% of the market, while the second-largest user holds approximately 13% of all supply.

Suppliers in both markets are using USDe and sUSDe PTs to collateralize stablecoin borrowing, primarily USDe. With implied APYs for the principal tokens ranging from 5% to 6% and USDe borrowing costs in the 2.5% to 2.75% range, users can earn a leveraged spread of approximately 3%. This can result in net APYs exceeding 20% with substantial recursive leverage. This dynamic explains the rapid exhaustion of supply caps and highly competitive positioning before expected cap raises, while indicating significant outstanding looping demand.

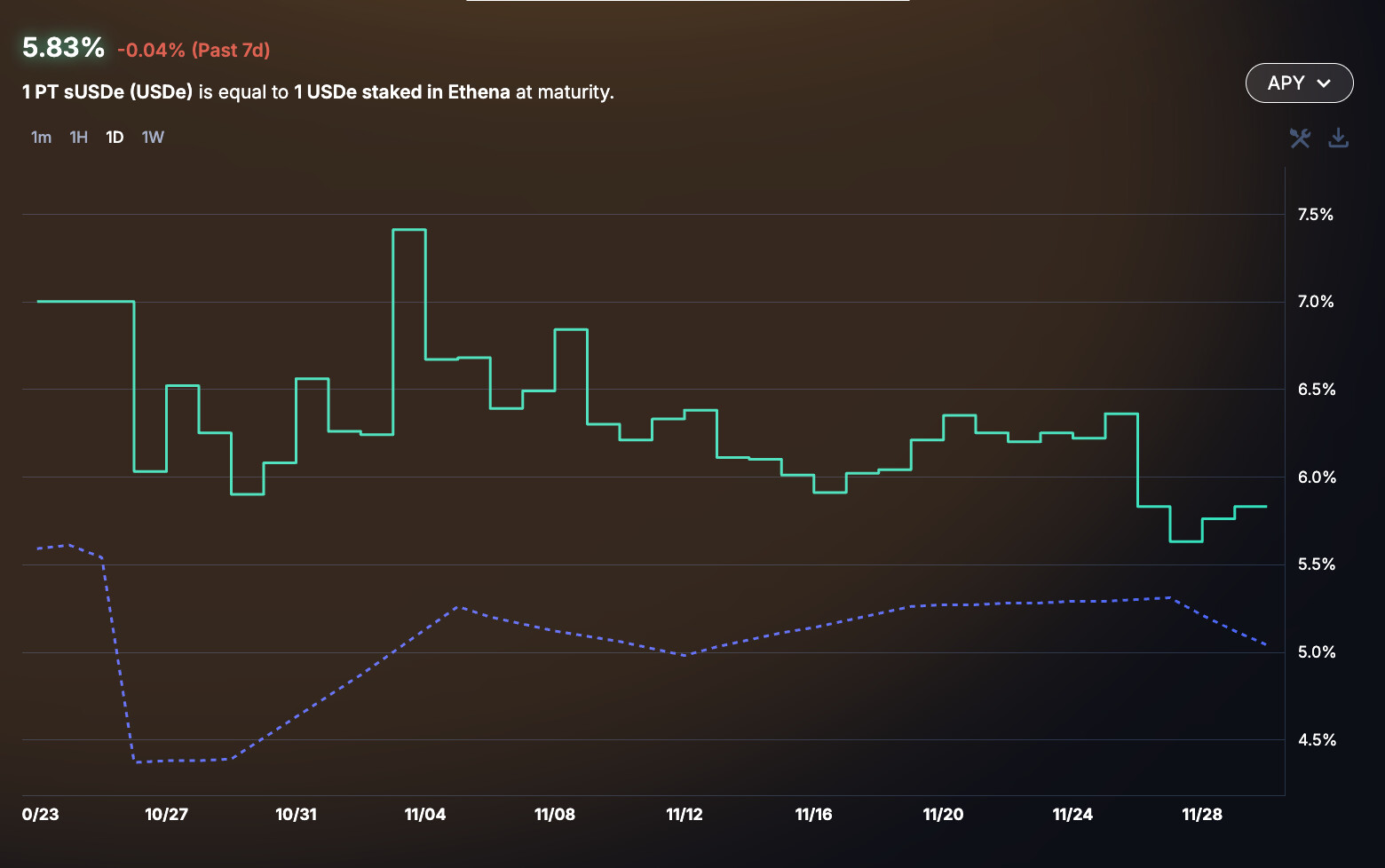

Implied Yields

PT-sUSDe’s implied yield has experienced a moderate decline in the recent week, dropping by approximately 50 basis points, currently standing at 5.83% implied yield.

Similar market dynamics can be observed in the PT-USDe market, where the implied yield has decreased by 40 basis points over the past week.

Given the current market dynamics and minimal fluctuations in the implied yield of the principal tokens, along with reduced USDe borrowing rates, we expect the looping demand to continue growing at substantial rates, prompting an increase in the supply caps of the assets.

Liquidity

Since the last recommendation, the liquidity landscape has shifted favorably as the depth of Pendle’s AMM pools has expanded. Specifically, the AMMs can facilitate:

- A swap of 2 million PT-USDe for USDe at 0.4% slippage, while the liquidity of the asset has expanded recently, future cap increases would be conditional on substantial growth in the depth of Pendle’s AMM pool liquidity

- A swap of 20 million PT-sUSDe for USDe at 1.3% slippage

Considering the high level of correlation between the debt and collateral markets in both PT markets, along with safe user behavior, the observed liquidity levels and estimated slippage support increases in the supply caps across the markets.

Recommendation

Given the on-chain liquidity, safe user behavior, and strong demand to loop these assets, we recommend increasing the supply caps for PT-sUSDe-5FEB2026 and PT-USDe-5FEB2026 on the Ethereum Core instance.

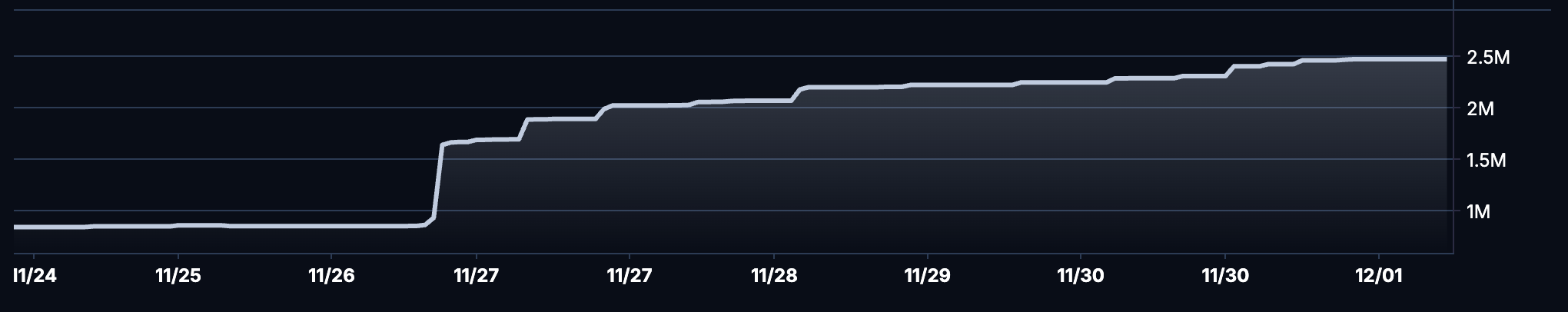

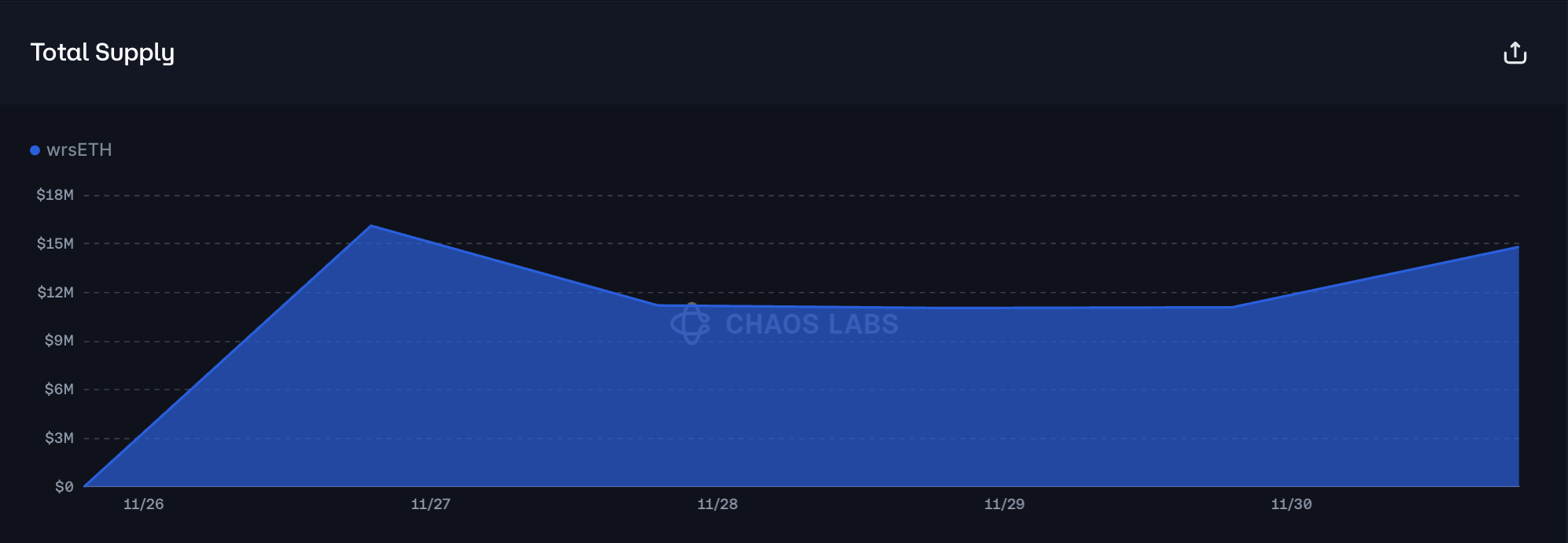

wrsETH (Avalanche)

wrsETH has reached its supply cap of 5,000 tokens shortly after listing on November 25th.

Supply Distribution

The supply of wrsETH is highly concentrated, with one user effectively representing the entire market. As expected for LRT suppliers, the user is utilizing wrsETH to recursively borrow and loop WETH, earning the spread between WETH borrowing costs and wrsETH’s underlying yield. With WETH borrowing currently inexpensive at 1.75%, the user is earning a substantial leveraged spread, which signals a potential for additional borrowing demand to be generated by the wrsETH suppliers.

The user’s health factor is currently at 1.03, presenting minimal risks due to the high correlation between collateral and debt assets, along with minimal rate volatility.

Liquidity

At the time of writing, Avalanche has one significant wrsETH/WETH pool with a net TVL of approximately $700,000, holding 207 wrsETH and 250 WETH. Additionally, a sell order of 230 wrsETH would incur approximately 0.22% slippage.

Recommendation

While the liquidity profile of the instance has shifted substantially after the Balancer V2 exploit, rsETH is predominantly used to borrow highly correlated assets, namely WETH and wstETH, which, given high market efficiency in pricing of the asset relative to the peg and conservative user behavior, allow for the expansion of the asset’s supply cap without increasing the risk exposure of the instance.

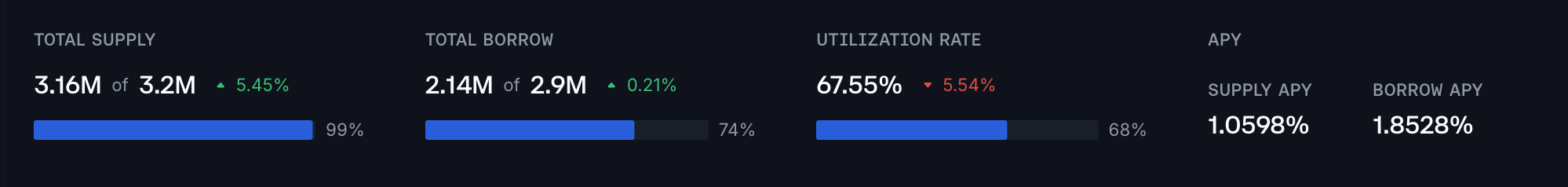

WETH (Ethereum Core)

WETH has reached its supply cap on the Ethereum Core instance, following an inflow of over 270,000 tokens since November 15th.

Supply Distribution

The supply distribution of WETH exhibits substantial concentration risk, as the top two users account for approximately 11% of the total, while the top 10 users have a cumulative share of 31%. Most of the suppliers have debt posted against the collateral, which is primarily denominated in USDT and USDC. As can be observed on the plot below, the distribution of health factors is relatively broad and contained in the safe 1.5-7.51 range, limiting the probability of liquidations.

As mentioned previously, the majority of debt posted against WETH is denominated in USDT and USDC, which represent approximately 90% of all funds borrowed against WETH. Considering the safe distribution of the health factors, the supply side of the WETH market presents minimal liquidation risk.

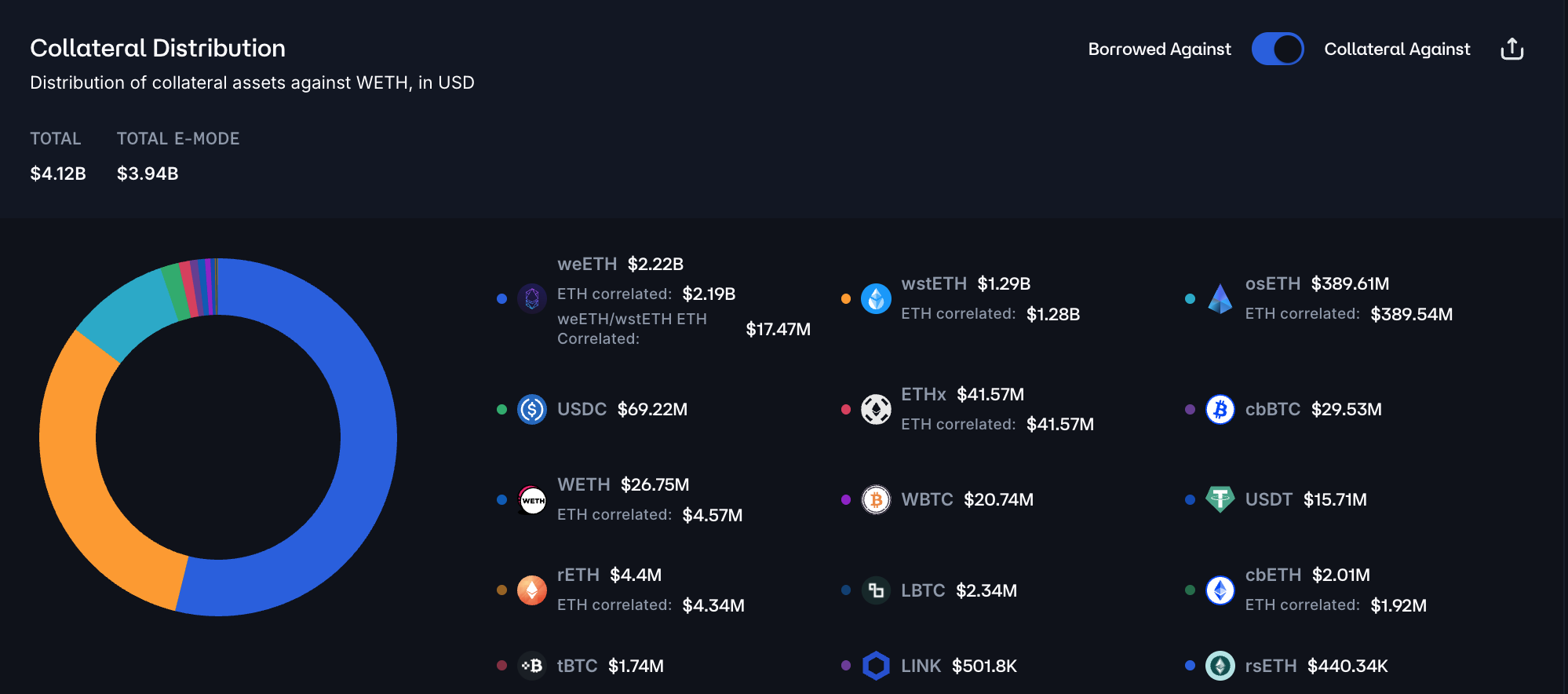

Borrow Distribution

Consistent with other WETH markets, borrowing activity is predominantly driven by LST/LRT collateral. Borrow positions are more concentrated than the supply side, with the largest borrower holding just over 25% of total outstanding debt and the top 5 accounts collectively representing around 33% of all borrowing. The distribution of health factors aligns with typical WETH leverage profiles. As users rely on ETH-correlated E-Mode configurations and operate at near maximum leverage, health factors cluster around 1.02. While this level of leverage would ordinarily be considered high risk, the strong correlation between collateral and debt significantly reduces the likelihood of liquidations.

The majority of WETH debt is backed by weETH and wstETH, accounting for over 85% of all posted collateral. Given the high correlation of the assets, the liquidation risk is minimal.

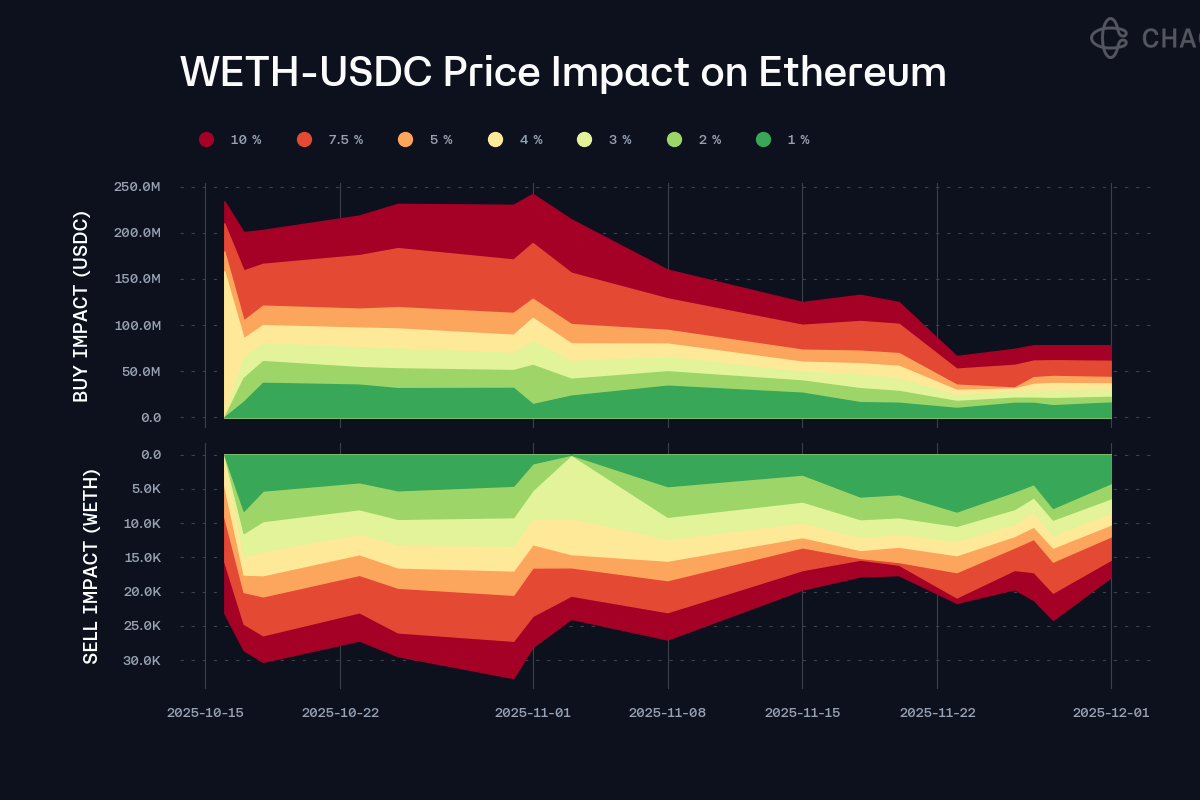

Liquidity

Given the limited risk on the borrow side of the WETH market, which is driven by the strong correlation between collateral and debt assets, the primary liquidity risk stems from USDC debt backed by WETH. At the time of writing, Ethereum’s liquidity profile supports swapping over 10,000 WETH for USDC with an estimated price impact of 3.5%.

Recommendation

Considering the increased demand to lend WETH and utilize it as collateral, along with safe user behavior and permissive liquidity levels, we recommend increasing the supply and borrow caps of the asset.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | PT-sUSDe-5FEB2026 | 60,000,000 | 120,000,000 | - | - |

| Ethereum Core | PT-USDe-5FEB2026 | 60,000,000 | 120,000,000 | - | - |

| Ethereum Core | WETH | 3,200,000 | 3,800,000 | 2,900,000 | 3,600,000 |

| Avalanche | wrsETH | 5,000 | 10,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.