Summary

Considering the evolved dynamics of the WETH reserves across multiple instances of Aave V3, Chaos Labs recommends adjusting the target borrow rate of WETH to 2.35%, effectively decreasing it by 15 basis points. The adjustment aims to restore healthier utilization dynamics by incentivizing additional borrower behavior, thereby achieving higher protocol capital efficiency.

Motivation

Following up on the previous analysis and recommendation to decrease the target borrow rate from 2.60% to 2.50% in November 2025, we have observed that the supply and demand dynamics have shifted materially due to a slight increase in overall WETH borrowing, primarily fueled by the expansion in the LRT markets. Nevertheless, the continued expansion of the supplied WETH on Aave has resulted in an outstanding supply of over 1 million, which signals both a desynchronization of supply and demand flows and the start of overpricing of WETH debt at current utilization levels.

Supply / Borrow Dynamics

WETH supply has increased by over 1 million tokens, while borrowing has remained largely range-bound with only incremental growth. This divergence has led to a steadily rising Outstanding Supply, confirming that additional supplied liquidity is not being absorbed by borrowers. In the absence of offsetting demand growth, this excess supply mechanically depresses utilization across the reserves.

Utilization Levels

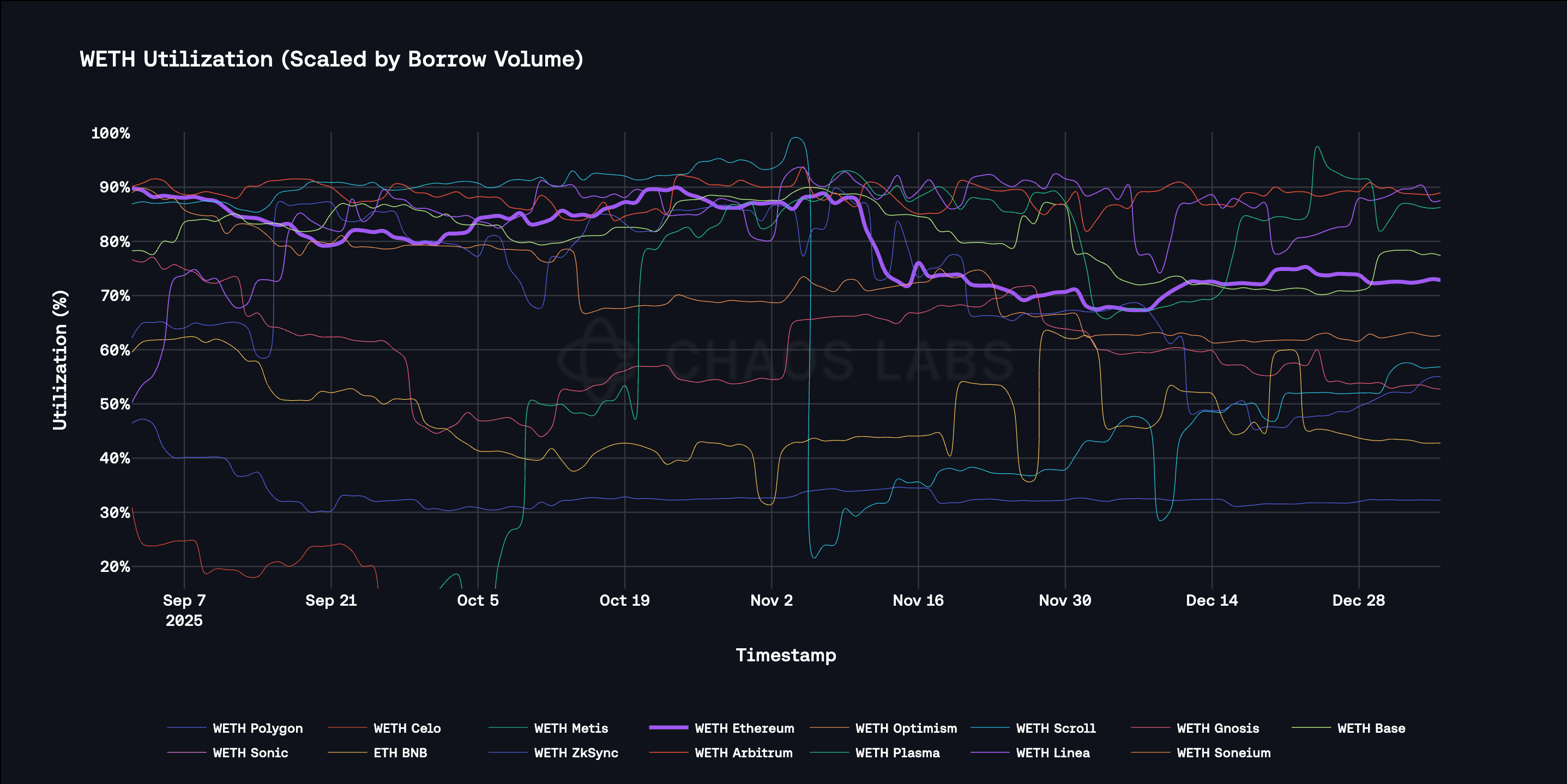

As can be observed below, the utilization has trended downward across multiple Aave V3 deployments. While the effect is most pronounced on Ethereum Core due to its larger absolute size, Optimism and Base have consistently operated in the 60–75% utilization range. This cross-chain consistency indicates that the observed underutilization is structural rather than instance-specific, and is primarily driven by excess supply rather than a deterioration in borrow demand.

Borrow Rates

Effective borrow rates have already drifted below the current target level of 2.50% following the prior adjustment, reflecting additional declining utilization driven by excess supply. Despite this downward pressure on rates, borrow demand has not been sufficient to absorb the expanding supply of WETH. This indicates that, at current parameters, even sub-target borrowing costs are not low enough to clear the market and restore utilization toward optimal levels.

In other words, supply growth has structurally outpaced demand growth, and the interest rate curve has reached a point where passive utilization-driven rate declines are no longer sufficient. Without a further downward adjustment to the target borrow rate, utilization is likely to remain suppressed, reinforcing capital inefficiency across the reserve as additional supply continues to enter the system.

Recommendation

Given the continued expansion of WETH supply, the resulting decline in utilization across Aave V3, and the inability of borrow demand to absorb excess liquidity even as effective rates drift below target, Chaos Labs recommends reducing the WETH target borrow rate by 15 bps, from 2.50% to 2.35%.

As shown in the proposed interest rate curves above, this adjustment lowers borrowing costs at prevailing utilization levels, improving demand elasticity where excess supply is concentrated, while preserving steep rate escalation at higher utilizations to disincentivize excessive borrowing. Additionally, this adjustment is scoped to the Ethereum Core instance, where excess WETH supply, declining utilization, and the economics of leverage strategies are most pronounced; changes to other deployments can be evaluated subsequently based on observed utilization responses and cross-instance migration of the assets.

Specification

| Instance | Asset | Current Slope 1 | Recommended Slope 1 |

|---|---|---|---|

| Ethereum Core | WETH | 2.50% | 2.35% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.