Overview

Chaos Labs recommends lowering the target borrow rate for major stablecoins from 5.50% to 5.00% through a coordinated adjustment to Slope 1 across Aave V3 markets. Recent market data indicate that stablecoin borrowing activity has continued to fail to meaningfully recover following the previous parameter reduction. Leveraged strategy yields remain structurally compressed, and demand for PT assets remains insufficient to catalyze a sustained rebound in borrowing demand.

Motivation

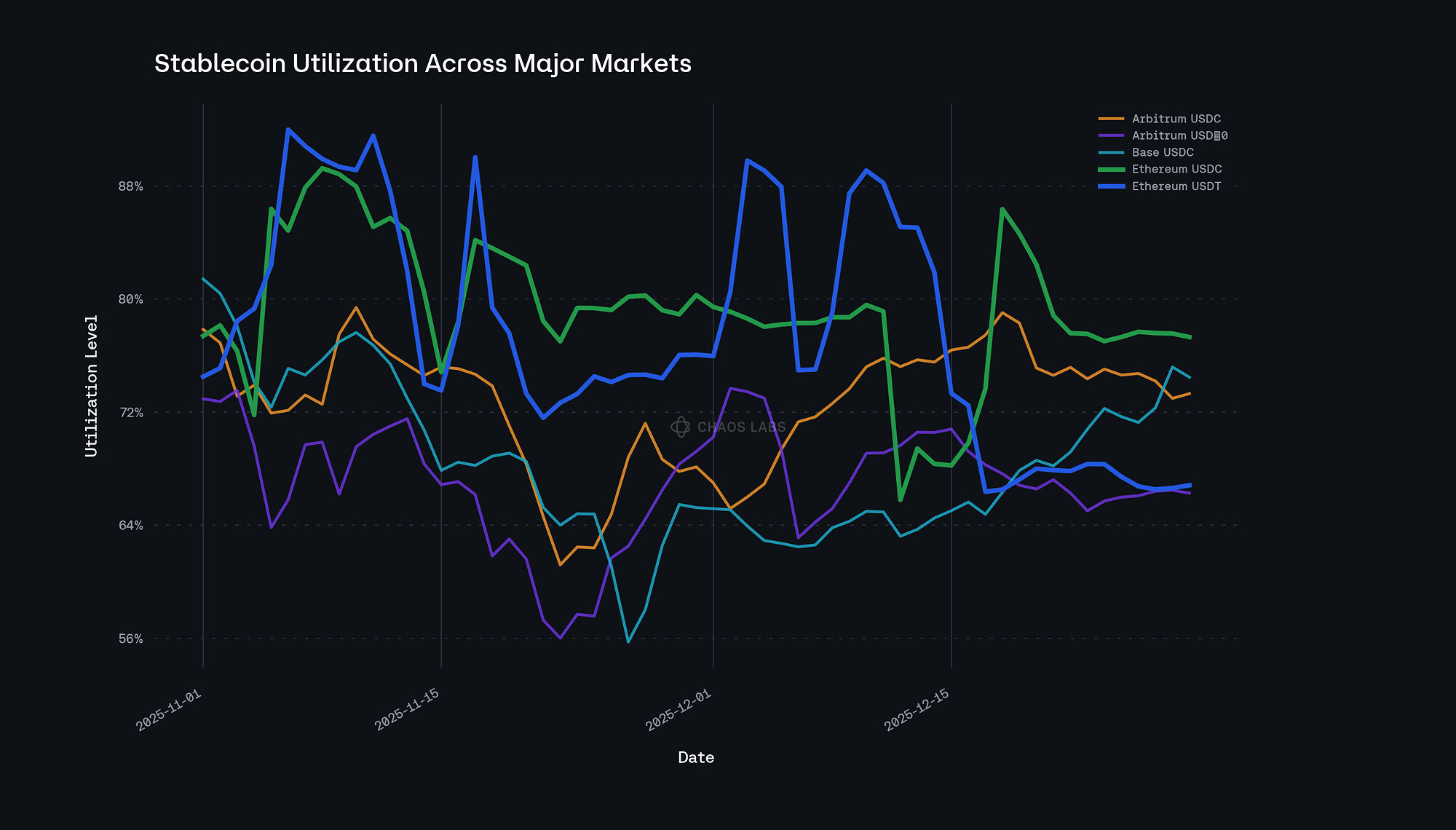

Over the past two months, utilization rates across major stablecoins have either declined or remained broadly flat. Most stablecoins have operated below the 80% utilization threshold, indicating persistently soft borrowing conditions. This dynamic has not materially improved following our interest rate reduction recommended in late November.

Focusing on the Ethereum instance, USDC utilization has averaged around 80%, with only brief spikes toward 88% that failed to persist. USDT exhibits a similar pattern: although utilization temporarily reached highs near 90%, it has largely hovered around 80% and declined further to below 70% over the final two weeks of 2025.

The observed utilization behavior reflects a continued asymmetry between supply and borrowing dynamics. For USDT and USDC on Ethereum, total supply has remained stable to modestly increasing over the period, while total borrow balances have either trended lower or remained largely stagnant. This divergence is most pronounced for USDT in recent weeks, where borrowing activity has weakened further despite supply remaining stable to slightly increasing. As a result, utilization rates have drifted lower over time, reflecting that borrow-side demand is declining while supply liquidity remains generally intact. The persistence of flat-to-declining borrow balances alongside resilient supply points to a broader softening in leverage-driven activity.

This dynamic is primarily driven by persistently weak yields in Ethena-related strategies. Over the past two months, returns on sUSDe have remained subdued, consistently holding below 5%, which has in turn kept demand for the February PT series muted. This sustained yield compression has materially reduced the attractiveness of stablecoin-based leverage. Under the current rate structure, the diminished carry available from these strategies leaves limited incentive for borrowers to re-engage, effectively constraining any organic rebound in borrowing demand.

Recommendation

In light of the continued absence of a meaningful recovery in leverage-driven demand, we recommend a further downward recalibration of Slope 1 across the major stablecoin markets. Specifically, lowering the target variable borrow rate from 5.50% to 5.00% would better align protocol pricing with prevailing market carry conditions and the current demand environment. With Ethena-related yields remaining compressed and PT-related borrowing demand staying persistently weak, the existing rate configuration continues to sit above the clearing level required to support stable utilization. A further reduction would help stabilize borrowing demand at more sustainable levels and prevent utilization from continuing to drift lower under current market conditions.

For clarity, several stablecoin categories are intentionally excluded from this assessment, including GHO, bridged stablecoins, assets actively undergoing depreciation/offboarding, and other non-core or operationally constrained stablecoins.

Specification

| Protocol | Instance | Asset | Current Slope1 | Recommended Slope1 |

|---|---|---|---|---|

| Aave V3 | Ethereum Core | USDC | 5.50% | 5.00% |

| Aave V3 | Ethereum Core | USDT | 5.50% | 5.00% |

| Aave V3 | Ethereum Core | USDe | 5.75% | 5.25% |

| Aave V3 | Ethereum Core | USDtb | 5.50% | 5.00% |

| Aave V3 | Ethereum Core | DAI | 5.50% | 5.00% |

| Aave V3 | Ethereum Core | pyUSD | 5.50% | 5.00% |

| Aave V3 | Ethereum Core | LUSD | 5.50% | 5.00% |

| Aave V3 | Ethereum Core | EURC | 6.00% | 5.50% |

| Aave V3 | Arbitrum | DAI | 5.50% | 5.00% |

| Aave V3 | Arbitrum | USDT0 | 5.50% | 5.00% |

| Aave V3 | Arbitrum | USDC | 5.50% | 5.00% |

| Aave V3 | Optimism | DAI | 5.50% | 5.00% |

| Aave V3 | Optimism | USDT | 5.50% | 5.00% |

| Aave V3 | Optimism | USDC | 5.50% | 5.00% |

| Aave V3 | Base | USDC | 5.25% | 4.75% |

| Aave V3 | Base | EURc | 8.00% | 7.50% |

| Aave V3 | Avalanche | DAI.e | 5.50% | 5.00% |

| Aave V3 | Avalanche | USDC | 5.50% | 5.00% |

| Aave V3 | Avalanche | USDt | 5.50% | 5.00% |

| Aave V3 | Avalanche | AUSD | 5.50% | 5.00% |

| Aave V3 | Avalanche | EURC | 6.00% | 5.50% |

| Aave V3 | Gnosis | WXDAI | 5.50% | 5.00% |

| Aave V3 | Gnosis | EURe | 5.50% | 5.00% |

| Aave V3 | Gnosis | USDC.e | 5.50% | 5.00% |

| Aave V3 | BNB | USDC | 5.50% | 5.00% |

| Aave V3 | BNB | USDT | 5.50% | 5.00% |

| Aave V3 | Scroll | USDC | 5.50% | 5.00% |

| Aave V3 | ZkSync | USDC | 5.50% | 5.00% |

| Aave V3 | ZkSync | USDT | 5.50% | 5.00% |

| Aave V3 | Linea | USDC | 5.50% | 5.00% |

| Aave V3 | Linea | USDT | 5.50% | 5.00% |

| Aave V3 | Celo | USDT0 | 5.50% | 5.00% |

| Aave V3 | Celo | USDm | 5.50% | 5.00% |

| Aave V3 | Celo | USDC | 5.50% | 5.00% |

| Aave V3 | Celo | EURm | 5.50% | 5.00% |

| Aave V3 | Plasma | USDT0 | 5.50% | 5.00% |

| Aave V3 | Plasma | USDe | 5.75% | 5.25% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.