Summary

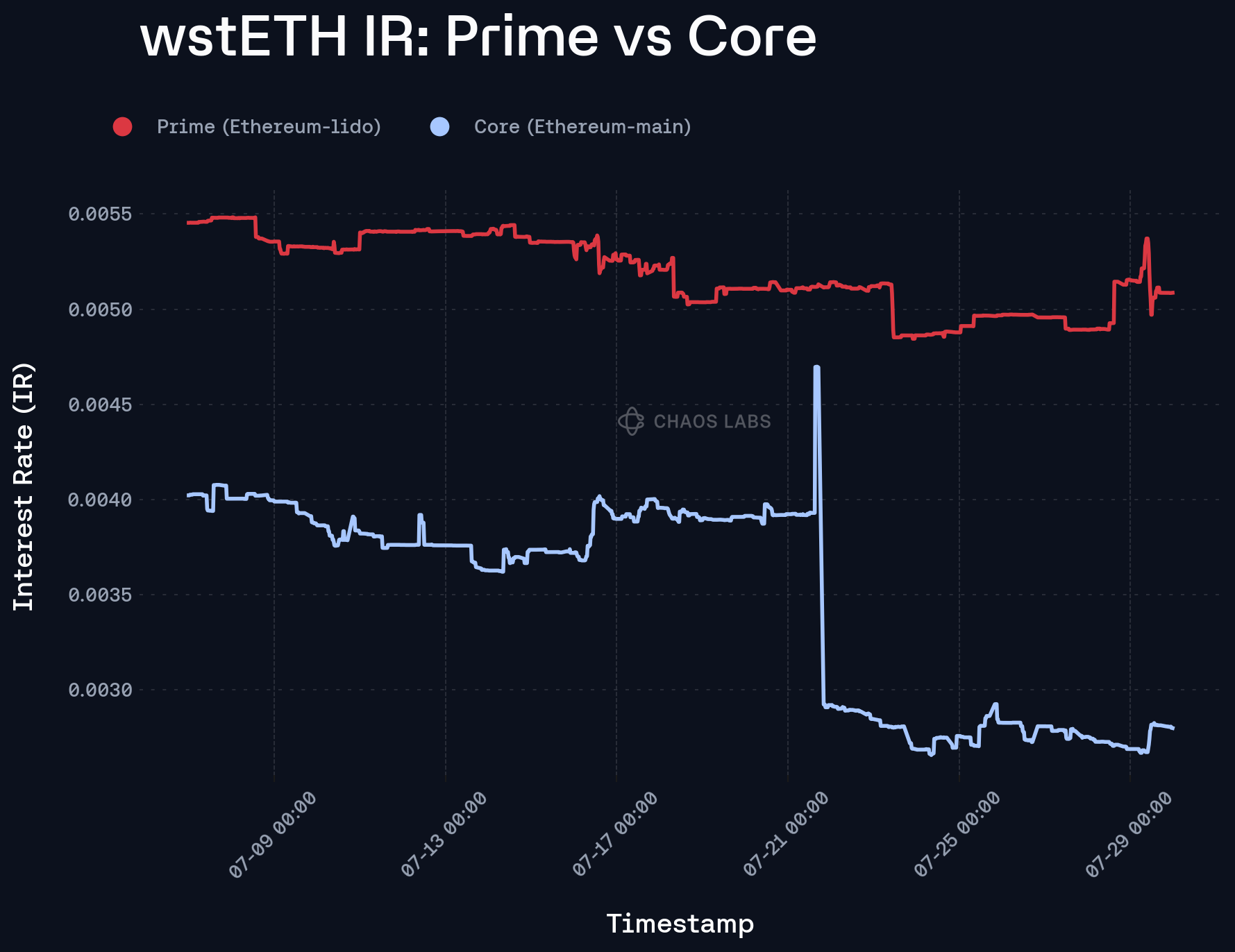

LlamaRisk supports the addition of ezETH to the Aave V3 Ethereum Core market. This integration would allow users to optimize their ezETH positions by benefiting from the lower wstETH borrow rates available on the Ethereum Core instance compared to the Prime market. While the overall risk profile of ezETH remains broadly consistent with our previous assessment, several improvements have been implemented that further strengthen its safety. The Immunefi bug bounty was increased from $250,000 to $500,000, enhancing incentives for responsible vulnerability disclosure. Additionally, four new smart contract audits were conducted, with all identified issues either resolved or acknowledged by the Renzo team.

Governance and upgrade safety have also improved. The timelock controlling contract upgrades saw its minimum delay extended from 3 to 7 days, and it holds the DEFAULT_ADMIN_ROLE. The core administrative Safe multisig upgraded its threshold from a 3/5 to a 4/6 configuration, increasing operational security. Together, these measures lower ezETH’s overall risk profile.

Architecture

ezETH is a liquid restaking token (LRT) issued by Renzo Protocol, built on the EigenLayer framework. As of August 1, 2025, it offers an annual yield of approximately 3% APY. Users can mint ezETH by depositing ETH or stETH, with the latter currently subject to a restaking cap of 320,000 stETH. Renzo supports two withdrawal mechanisms for ezETH:

- Standard Withdrawal: A two-step process where the user’s ezETH is placed in a

WithdrawQueue. Funds can be claimed after a delay of up to two weeks. This method incurs no fees.

- Instant Withdrawal: Users can bypass the waiting period by tapping into Renzo’s withdrawal buffer. Depending on buffer availability, a fee ranging from 0.1% to 2% applies. As of August 1, 2025, Renzo’s withdrawal contract holds approximately 2,440 ETH ($8.7M) and 12,300 stETH ($44M) to support instant redemptions.

Additionally, Renzo charges a 10% fee on restaking rewards, which is split equally between the protocol treasury and Renzo node operators.

Market Risk

As of August 1, 2025, ezETH has a circulating supply of 312,000 tokens on Ethereum, with a market capitalization of approximately $1.18 billion. Of this, 175,500 ezETH (valued at $661 million) is supplied to the Aave V3 Prime market, accounting for nearly 60% of the total supply.

Liquidity

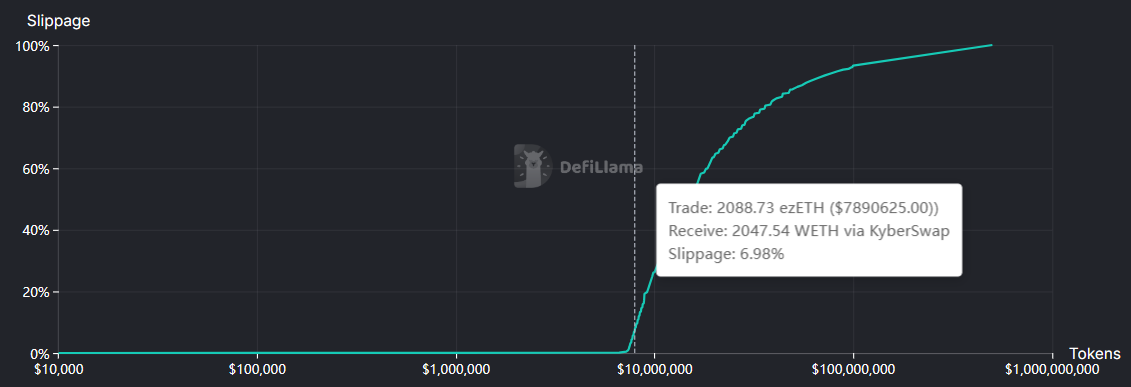

Source: ezETH/ETH Swap Liquidity, DeFiLlama, August 1, 2025

Users can swap 2090 ezETH worth up to $7.9M for ETH within a price impact of 7.5%. The onchain liquidity is mainly contributed by the $5.74M Balancer ezETH/WETH liquidity pool, followed by Curve ezETH/pzETH ($0.97M TVL) and Balancer weETH/ezETH/rswETH ($0.61M TVL) pools. ezETH is exclusively traded on DEXs and is not currently listed on any centralized exchange. Including Renzo’s withdrawal buffer and available DEX liquidity, ezETH has a total accessible liquidity of approximately $60.6M, equivalent to around 16,000 ezETH.

Source: ezETH Liquidity Pools on Ethereum, GeckoTerminal, August 1, 2025

The majority of ezETH’s DEX liquidity, almost 72% is supplied by Aura Finance, and 56.1% of their deposits are made by a single Multisig, making ezETH’s liquidity on Ethereum moderately concentrated.

Volatility

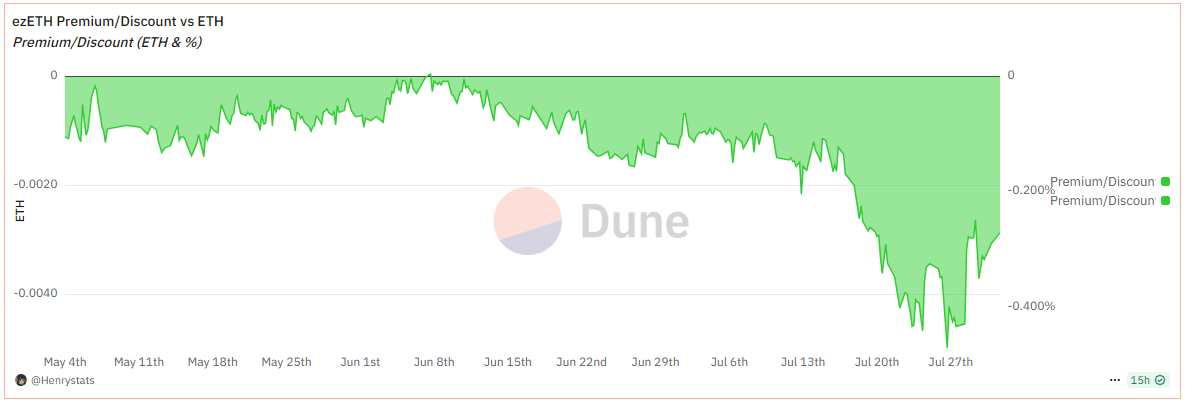

Source: ezETH Exchange Rate vs Market Rate, Dune, August 1, 2025

Over the past three months, ezETH’s secondary market price has generally traded within a 0.2% deviation from its oracle exchange rate. However, in the past two weeks, increased demand for native ETH combined with a prolonged validator exit queue, averaging 11 days over the past week, led to a slight depeg, with ezETH trading at approximately 0.45% below its exchange rate.

Technological & Counterparty Risk

Since our previous assessment in August 2024, the technological and counterparty risk profile of the protocol remains largely unchanged. However, several notable improvements have been made. The Immunefi bug bounty has been doubled to $500,000, enhancing incentives for responsible disclosure. Additionally, the protocol underwent four new security audits, with all identified findings either resolved or formally acknowledged by the team:

- Halborn (September 16, 2024) for EzRVaults: 2 critical and 11 informational

- Nethermind (April 14, 2025) for Renzo: 2 high, 1 medium, 3 low, and 3 informational

- Nethermind (May 1, 2025) for Renzo Bridge: 4 informational

- Halborn (June 11, 2025) for EzRVaults: 2 informational

The timelock contract responsible for controlling protocol upgrades has had its minimum delay extended from 3 days to 7 days and currently holds the DEFAULT_ADMIN_ROLE. Meanwhile, the Safe Multisig A continues to retain major administrative control across various Renzo contracts, including serving as the timelock admin. Its configuration was recently strengthened, with the approval threshold increased from 3-of-5 to 4-of-6 signers.

E-Mode

Under the proposed ezETH/wstETH E-Mode parameters on the Ethereum Core market, the maximum achievable leverage for ezETH is approximately 14.29x. A narrow 2% buffer between the LTV and the LT is the critical safeguard against depeg risk. Notably, even a 14 bps deviation in the exchange rates, where wstETH temporarily outpaces ezETH, can trigger liquidation at maximum leverage. However, this risk remains low in practice. As an LRT, ezETH accrues yield faster than wstETH, causing its oracle rate to increase faster. Over time, this improves health factors for looped positions, making them progressively safer. The same remains true for ezETH/stablecoin E-Modes.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.