August 2025

This update highlights Chaos Labs’ activities and proposals in August.

Highlights

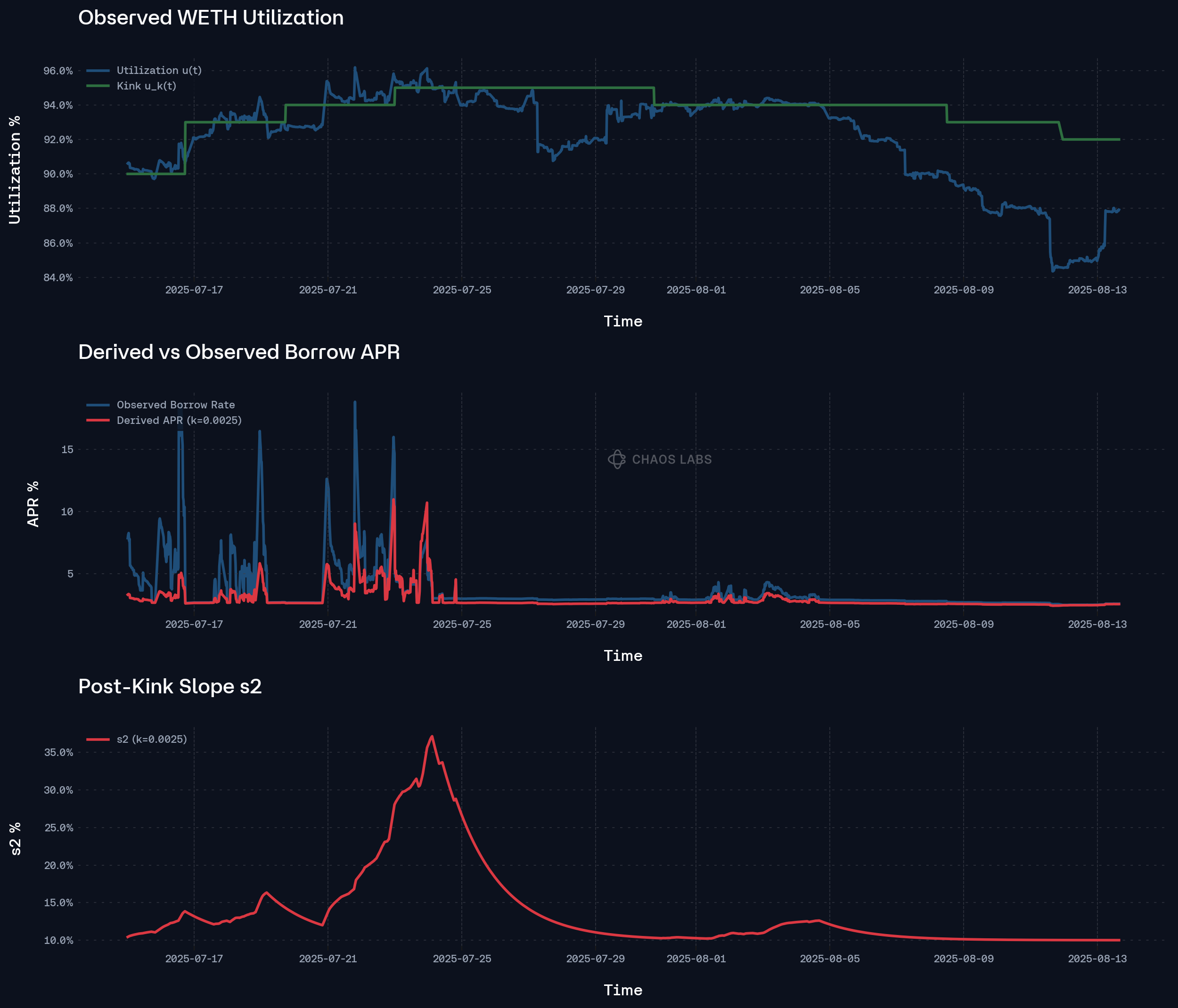

Automation of the Slope2 Parameter via Risk Oracles

We identify two key stressors in DeFi lending: large supplier exits and hyper-elastic borrower demand. Current linear rate models worsen shocks, producing APR spikes that accelerate deleveraging, lock liquidity, and heighten systemic risk across ETH, USDT, and USDe.

To address this, we propose a time-aware rate mechanism governed by a risk oracle. Instead of abrupt jumps, it escalates in three phases: gradual slope above the kink, exponential compounding under persistent stress, and predictable half-life decay once utilization normalizes. Backtests show smoother costs aligned with stress depth and duration, capped rates that prevent crises, and strict solvency protection. By embedding stress “memory,” the model sustains deterrence until liquidity recovers, creating orderly deleveraging and replacing governance actions with an autonomous, data-driven framework.

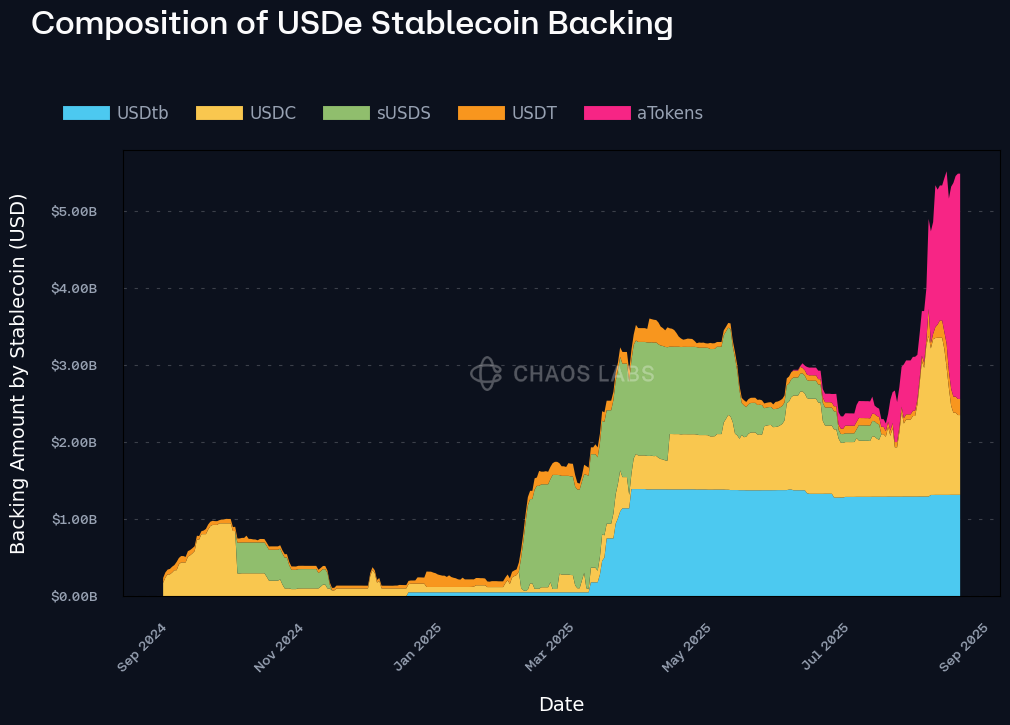

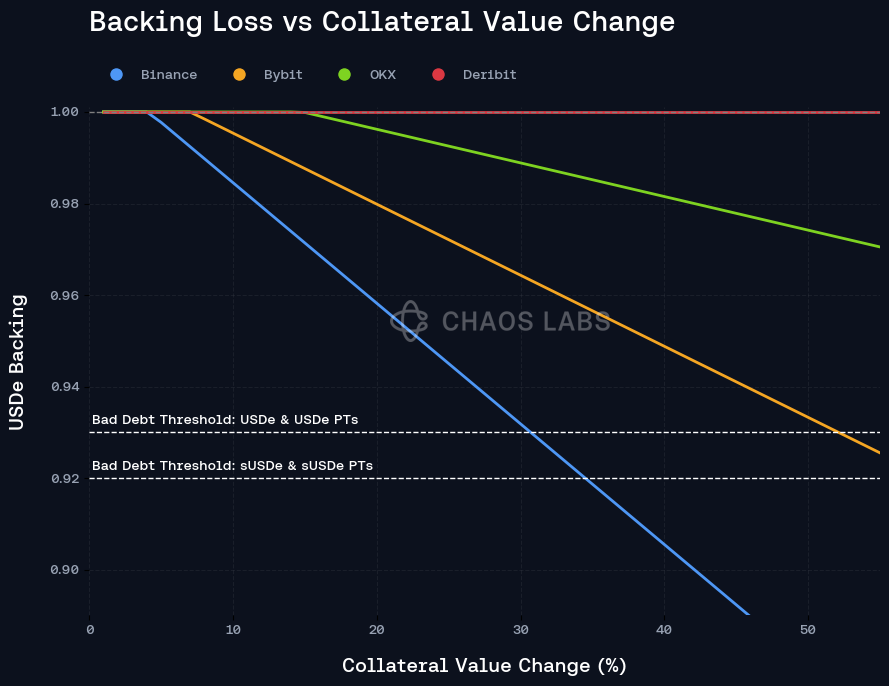

Strengthening Stability Between Aave and Ethena: Redemption Priority and Protocol Safeguards

Following our earlier research papers Stress Testing Ethena: A Quantitative Look at Protocol Stability and Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe, we identified that Ethena’s integration with Aave has deepened significantly. Nearly $7 billion in USDe-backed assets are now on Aave, about 60% of circulating supply, with Ethena depositing roughly $3 billion of its reserves (aUSDC, aUSDT). These deposits improve capital efficiency and lower borrow rates, supporting scalable loop strategies, but also create reflexivity: withdrawals in stress could spike rates, accelerate redemptions, and intensify contraction cycles.

In response, we have been collaborating with Ethena to implement targeted mitigation measures. A redemption ladder now prioritizes liquid stables and perpetual unwinds before touching Aave-based liquidity, ensuring aTokens are the last capital used. In addition, Aave will be whitelisted as a direct redeemer in Ethena’s contracts, allowing controlled redemptions of collateral in stress scenarios without relying on fragmented secondary markets. Together, these mechanisms anchor redemption flows, preserve stable borrowing conditions, and materially reduce systemic risk, resulting in a more resilient protocol-to-protocol integration that safeguards both Aave and Ethena while supporting continued USDe growth.

Risk Oracles

Supply and Borrow Cap Oracles

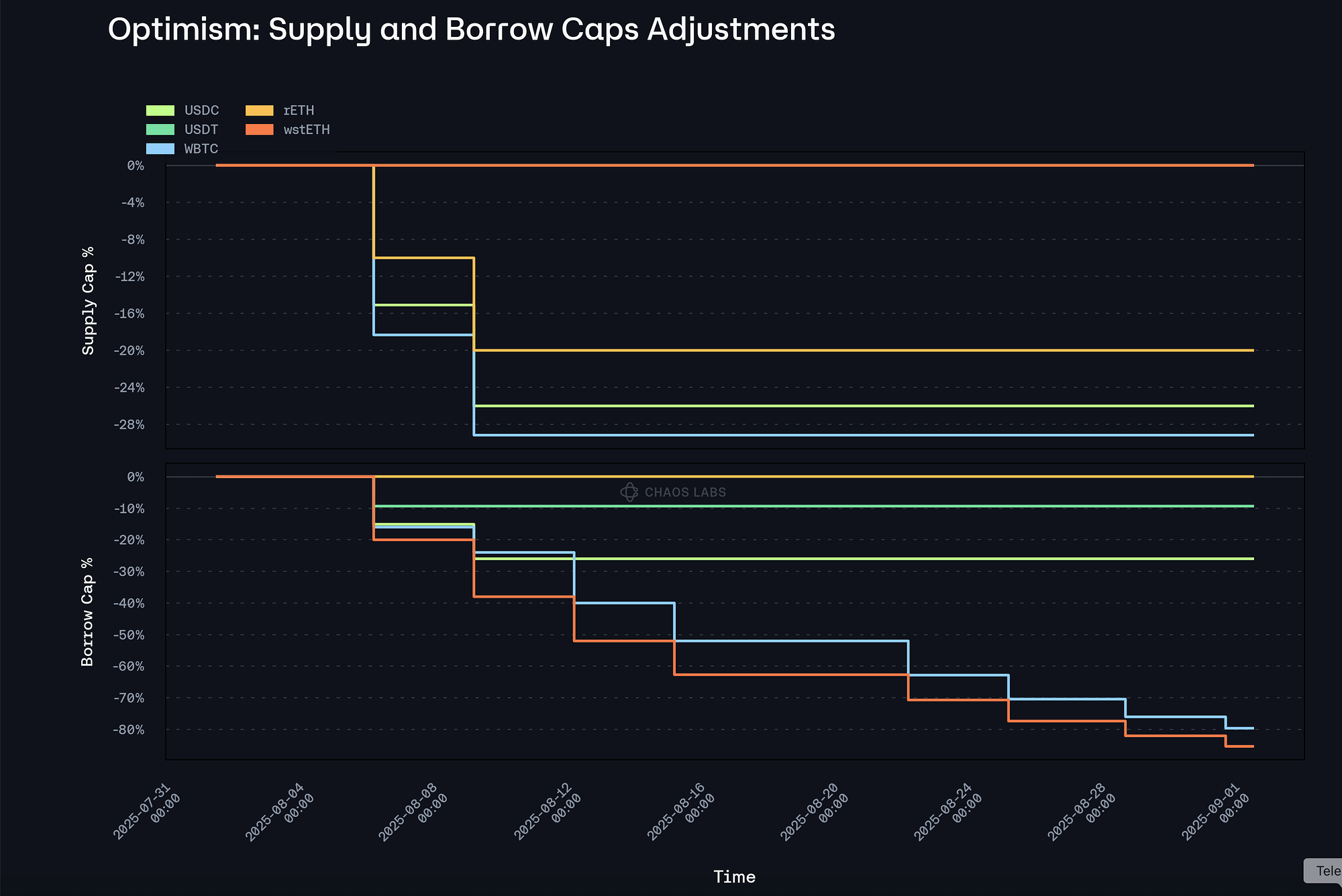

The supply and borrow cap risk oracles on Arbitrum, Avalanche, Polygon, Optimism, Gnosis, and Base have continued to function efficiently, executing adjustments across numerous markets.

Among them, the most frequent borrow cap adjustments occurred in the Optimism market, where the borrow caps for wstETH and WBTC were reduced by more than 70% within a month to align with real-time user behavior.

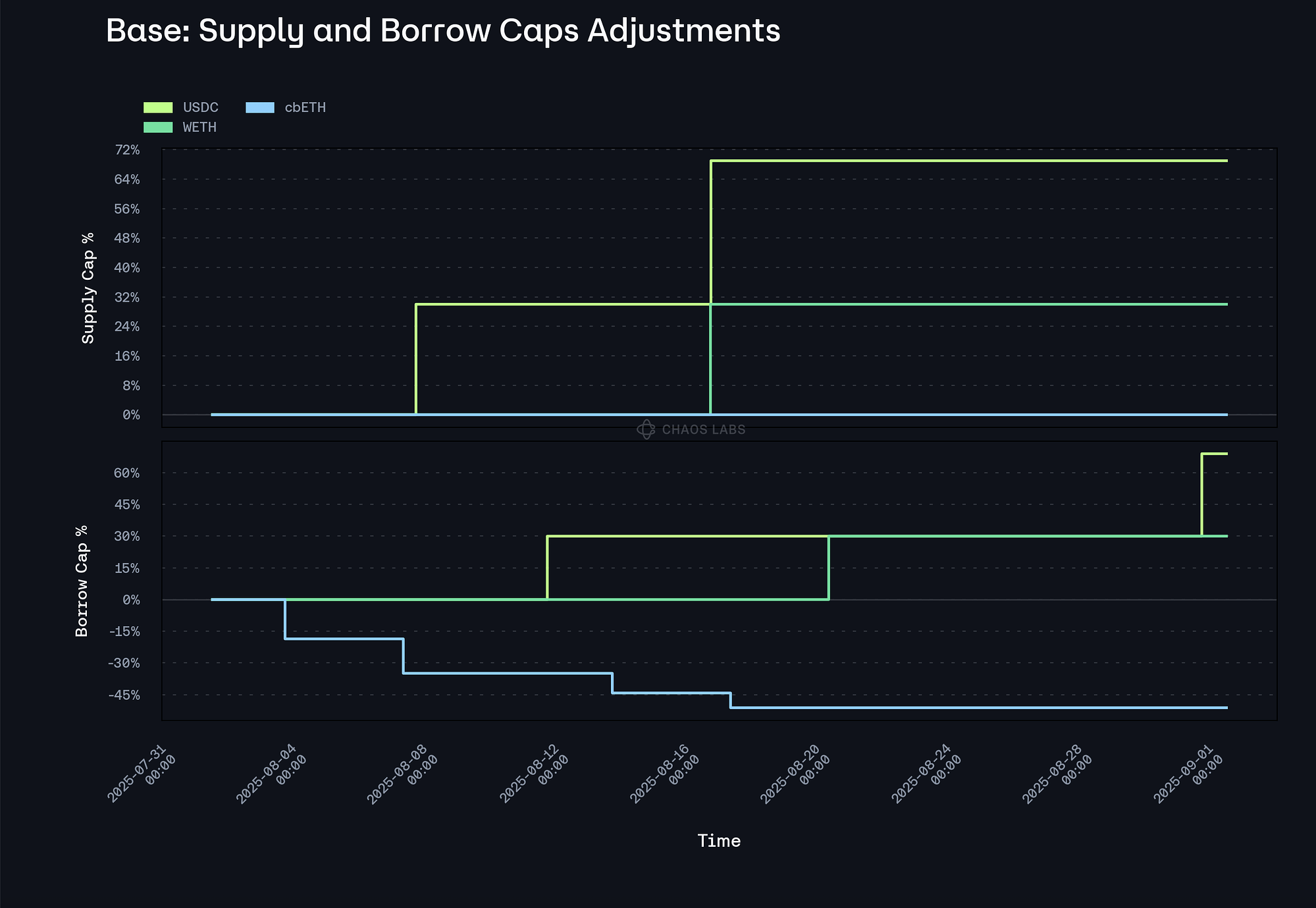

The most frequent supply cap increases occurred in the Base market, where USDC and WETH supply caps were raised by approximately 70% and 30%, respectively. Thanks to the timely supply cap increase, USDC and WETH deposits continued without disruption and utilization remained balanced in a risk-adjusted manner.

PT Risk Oracle

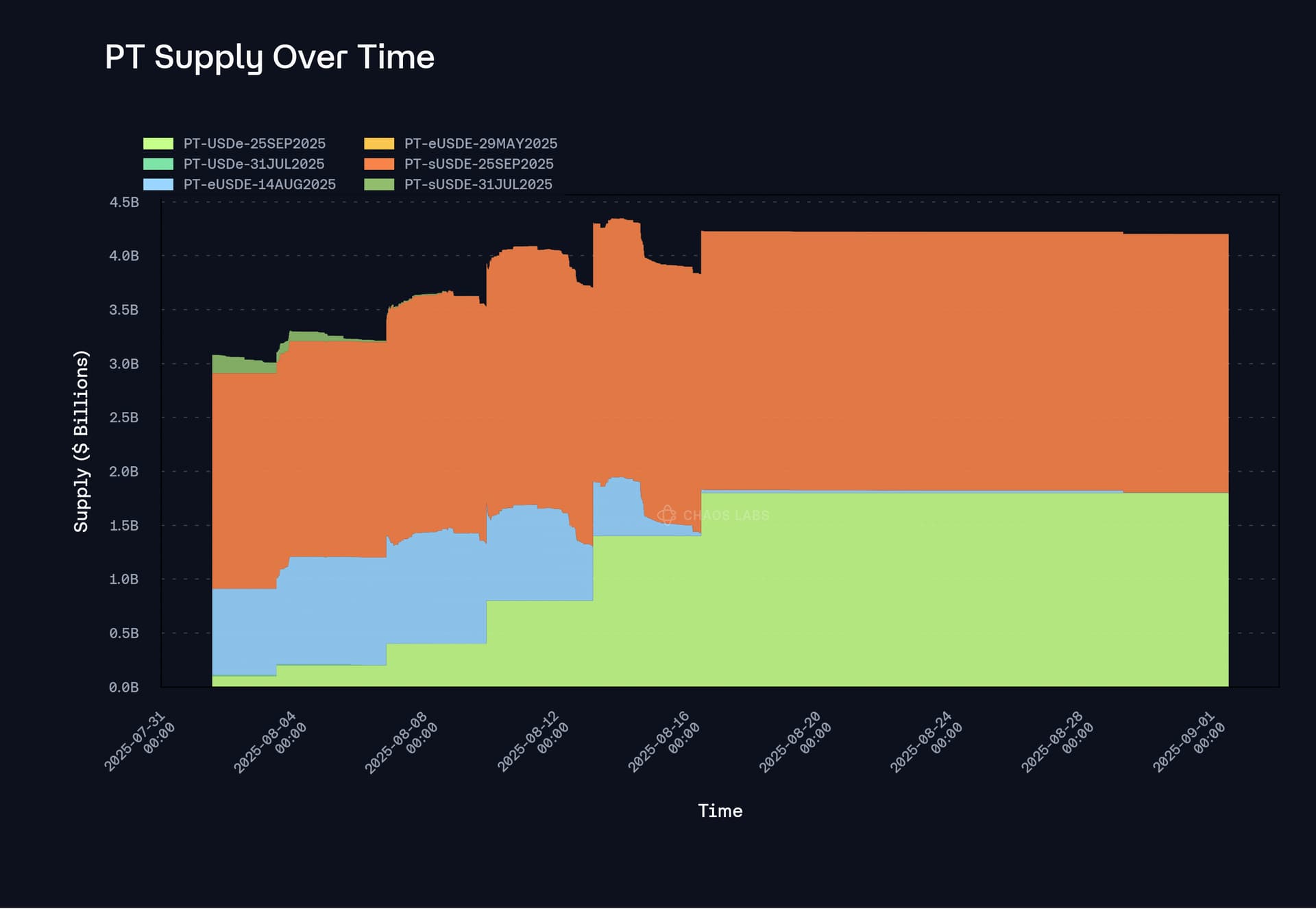

The value of assets utilizing the PT risk oracle has accumulated to $4.2B. As shown in the chart, PT-USDe-25SEP2025 and PT-sUSDe-25SEP2025 are currently the two largest PT tokens in the market, with supplies of 1.8B and 2.4B respectively, as of this writing.

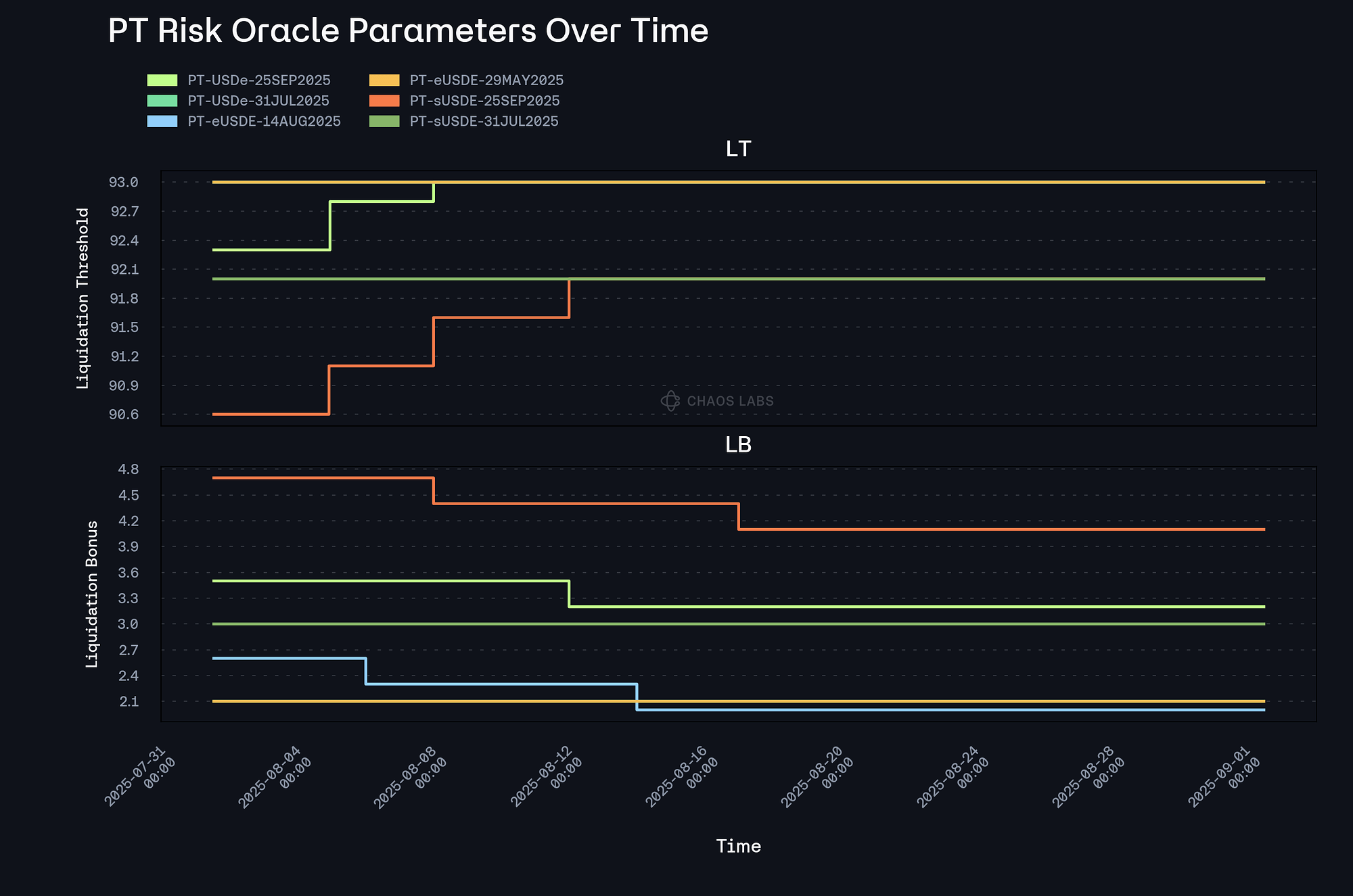

As observed, the LT for both PT-USDe-25SEP2025 and PT-sUSDe-25SEP2025 was raised in August 2025. Since risk naturally declines as PTs approach maturity, applying gradually less conservative risk parameters over time is justified. Similarly, the LB for PT-USDe-25SEP2025, PT-sUSDe-25SEP2025, and PT-eUSDE-14-AUG2025 was lowered in August 2025. The oracle continues to function optimally and has allowed for significant, responsible growth in these assets.

Forum Activity

- We published the following proposals, updates, and analyses, including risk parameter updates:

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.03.25

- [Direct to AIP] LBTC Oracle and CAPO implementation Update

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.05.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.08.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 Linea - 08.11.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.12.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.14.25

- Chaos Labs Risk Stewards - Stablecoin Interest Rate Adjustment on Aave V3 - 08.14.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.15.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.19.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.22.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.24.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.25.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 08.26.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 Linea Instance- 08.29.25

- Chaos Labs Risk Stewards - Adjust USDT Interest Rate Curve on Aave V3 - 06.05.25

- Additionally, we provided analysis regarding the following proposals and discussions:

- [Direct-to-AIP] Add ezETH to Aave v3 Core Instance

- [ARFC] Launch GHO on Ink & set ACI as Emissions Manager for Rewards

- [Direct-to-AIP] Add tETH to Core Instance Ethereum

- [ARFC] Onboard USD1 to Aave V3 Core and BNB Instance

- [Direct to AIP] Onboard wBTC to Sonic V3 Instance

- [Direct-to-AIP] Parameter Updates - zkSync, Scroll and Sonic

- [Direct-to-AIP] Arbitrum eMode Update - rsETH and ezETH

- [ARFC] Add sUSDE to Aave V3 Base Instance

- [Direct to AIP] Onboard sUSDe November expiry PT tokens on Aave V3 Core Instance

- [ARFC] Add EURC to Avalanche V3 Instance

- [ARFC] Onboard tBTC to Aave v3 on Base

- [ARFC] Deploy Aave v3 on BOB

- [Direct to AIP] Onboard USDe November expiry PT tokens on Aave V3 Core Instance

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

- Supply and Borrow Cap Risk Oracle integration on additional Chains leveraging Edge infrastructure.

- Continuous monitoring of SVR and associated parameterization

- Pendle Dynamic Risk Oracle for each PT asset deployment

- Risk Oracle integration for automated interest rate curve adjustments in response to demand

- CAPO Risk oracle integration

- Preperation for the launch of Aave V4

- Collaboration with BGD on automated techniques for offloading Ethena-related assets in the event of an adverse scenario, leveraging Aave’s status as a whitelisted redeemer