title: [Direct-to-AIP] Add tETH to Core Instance Ethereum

author: @TokenLogic

created: 2024-07-29

Summary

This publication proposes onboarding tETH on the Core instance of Aave v3 on Ethereum.

Motivation

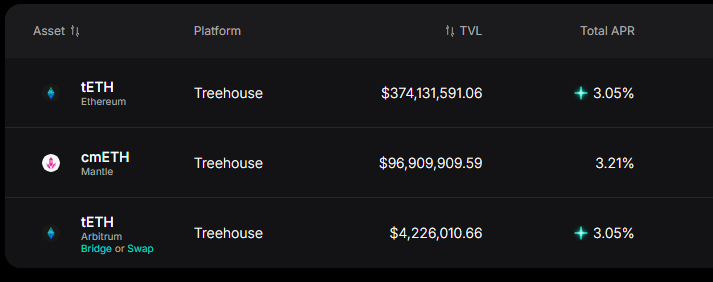

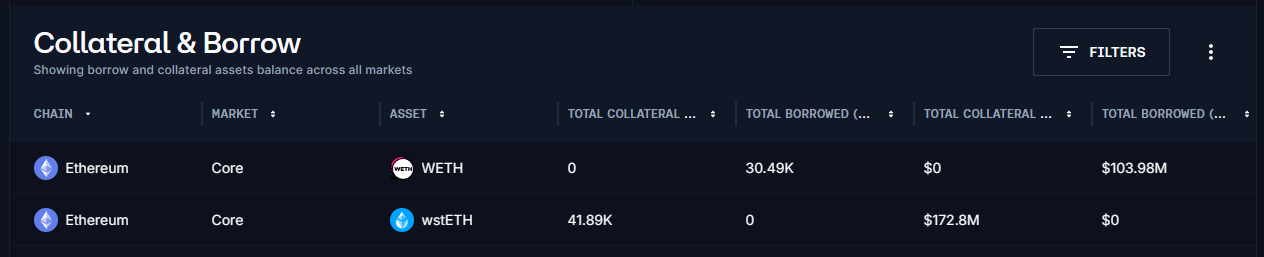

After successfully onboard tETH to the Prime instance this publication proposes enabling tETH collateral holders to borrow stablecoins via v3.2 Liquid eModes. tETH was listed on the Prime instance on the 28th June 2025 and since then has provided over 129M of User deposit, mostly from four unique addresses, and has been a significant wstETH liquidity consumer.

Source: Chaos Labs

Discussions with the TreeHouse team indicate there is strong demand for stablecoins. With insufficient stablecoin liquidity on Prime to support growing tETH, this publication proposes onboarding tETH to Core allow users access to stablecoin liquidity.

Subject to Risk Service providers approval, this publication propose enabling tETH users to access stablecoin liquidity on Core instance.

Specification

The following outlines the initial tETH onboarding parameters.

tETH Ethereum Address: 0xbf5495efe5db9ce00f80364c8b423567e58d2110

General Parameters

| Parameter | Value |

|---|---|

| Chain (instance) | Ethereum (Core) |

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap (ezETH) | 50,000 |

| Borrow Cap (ezETH) | 0 |

| Debt Ceiling | USD 0 |

| LTV | 0.05% |

| LT | 0.10% |

| Liquidation Bonus | 7.5% |

| Liquidation Protocol Fee | 10% |

| Reserve Factor | 15% |

| Base Variable Borrow Rate | - |

| Variable Slope 1 | - |

| Variable Slope 2 | - |

| Uoptimal | - |

| Stable Borrowing | DISABLED |

| Stable Slope1 | 0% |

| Stable Slope2 | 0% |

| Base Stable Rate Offset | 0% |

| Stable Rate Excess Offset | 0% |

| Optimal Stable To Total Debt Ratio | 0% |

| Flashloanable | ENABLED |

| Siloed Borrowing | DISABLED |

| Borrowable in Isolation | DISABLED |

| eMode Category | tETH/stablecoins |

Create new v3.2 liquid eMode

| Parameter | Value | Value | Value |

|---|---|---|---|

| Asset | tETH | USDT | USDC |

| Collateral | Yes | No | No |

| Borrowable | No | Yes | Yes |

| Max LTV | 72.00% | - | - |

| Liquidation Threshold | 75.00% | - | - |

| Liquidation Penalty | 7.50% | - | - |

Disclosure

TokenLogic does not receive any payment for this proposal.

Next Steps

- Gather feedback from the community.

- Using the Direct-to-AIP process, submit AIP for vote.

Copyright

Copyright and related rights waived via CC0.