Overview

Chaos Labs supports the proposal to list tETH on Aave’s Ethereum Core instance. Below, we present our analysis along with initial risk parameter recommendations.

Motivation

tETH is an LST that aims to capture the spread between ETH borrow rates and POS rewards. This is achieved by borrowing ETH on lending markets like Aave using wstETH deposited by users, then staking the borrowed ETH. The protocol continues this recursive looping strategy until it reaches the desired LTV and risk parameters.

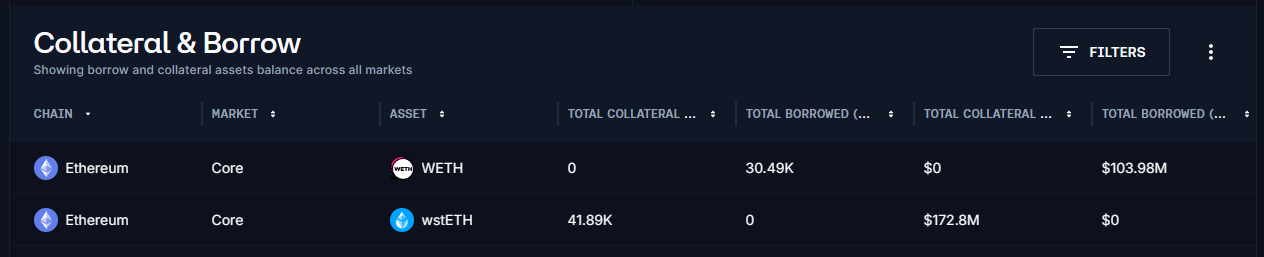

At the moment, Treehouse has over $172M wstETH as collateral and $103M WETH as debt.

Following recent WETH withdrawals, borrow utilization has reached 94.5%. As a result, the interest rate is now 2.99% while Lido’s yield stands at 2.60%. This creates a negative yield of -0.40% on Treehouse’s ETH strategy, reducing tETH’s returns and in some cases causing losses. In order to mitigate this risk Treehouse monitors the utilization and, according to the docs, will deleverage if net yield stays negative for 2+ days, reducing the risk of losses.

Given tETH’s sustained demand on the Prime instance and its active management of the leveraged positions, we find the asset sufficiently reliable to support its listing on the Core instance. This listing will allow tETH suppliers to access deep stablecoin liquidity to take non-correlated asset debt.

Market Cap & Liquidity

tETH’s total supply has experienced some fluctuations over the past three months, with a notable decline in June 2025 followed by a rebound in July, reaching a peak of 100K. As of this writing, tETH’s total supply stands at 88.5K, corresponding to a TVL of $390.9M.

tETH’s liquidity is currently concentrated in the wstETH/tETH Balancer V2 Stable Liquidity Pool with a TVL of $5.85M, the wstETH/tETH Balancer V3 Liquidity Pool with a TVL of $2.64M, the tETH/weETH Curve Liquidity Pool with a TVL of $2.1M, and the tETH/wstETH Curve Liquidity Pool with a TVL of $1.39M. As shown in the chart, tETH’s liquidity has generally remained stable above the 10M range. As of this writing, its total on-chain liquidity is around 12M.

Volatility

Over the past month, the conversion rate between tETH and its underlying asset, wstETH, in the secondary market has maintained a relatively stable peg with the internal conversion rate. Most of the time, fluctuations have remained within 50 bps, with the largest observed depeg being around 90 bps during the recent WETH liquidity crunch stemming from large withdrawals on Aave.

Recommendation

Chaos Labs agrees with the proposed parameters. The purpose of E‑mode is to limit its use to highly liquid stablecoin assets and prevent its use as collateral for volatile assets within the Core instance. Since tETH and stablecoins are not correlated, setting the LTV at 72%, LT at 75%, and LB at 7.5% provides a prudent balance, controlling risk while still leaving room for potential borrowing demand. However, prolonged instances of negative yields stemming from the wstETH carry trade, akin to the observed dynamics a few weeks ago, can lead to a liquidity crunch, necessitating more prudent supply caps in current market conditions, coupled with the limited on-chain liquidity availability while collateralizing stablecoin debt.

Specification

Market Configuration:

| Parameter | Value |

|---|---|

| Asset | tETH |

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 10,000 |

| Borrow Cap | - |

| Debt Ceiling | - |

| LTV | 0.05% |

| LT | 0.1% |

| Liquidation Penalty | 7.5% |

| Liquidation Protocol Fee | 10% |

| Variable Base | - |

| Variable Slope1 | - |

| Variable Slope2 | - |

| Uoptimal | - |

| Reserve Factor | - |

| Stable Borrowing | Disabled |

| Flashloanable | Yes |

| Siloed Borrowing | No |

| Borrowable in Isolation | No |

| E-Mode Category | tETH/Stablecoins |

tETH/Stablecoins Liquid E-mode Configuration:

| Parameter | Value | Value | Value |

|---|---|---|---|

| Asset | tETH | USDT | USDC |

| Collateral | Yes | No | No |

| Borrowable | No | Yes | Yes |

| Max LTV | 72% | - | |

| Liquidation Threshold | 75% | - | |

| Liquidation Bonus | 7.5% | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0