Summary

This proposal recommends altering the implementation of the mUSD oracle on the Aave V3 Ethereum and Aave V3 Linea deployments from the current market price feed to a hardcoded value of 1. In parallel, we propose temporarily reducing the mUSD supply and borrow caps on both networks to 1 prior to the oracle migration. Upon AIP execution, the mUSD supply and borrow caps will be restored to economically meaningful levels.

This oracle change addresses observed short-lived but material negative deviations in the market feed, which are not aligned with the factual market value of mUSD and could enable opportunistic borrowing at artificially depressed prices. Given that mUSD is not enabled as collateral on these markets, the proposed change simplifies the oracle model, aligns it with mint/redeem parity, and materially reduces manipulation and mispricing risk for Aave, while preserving the protocol’s upside in adverse depeg scenarios.

Motivation

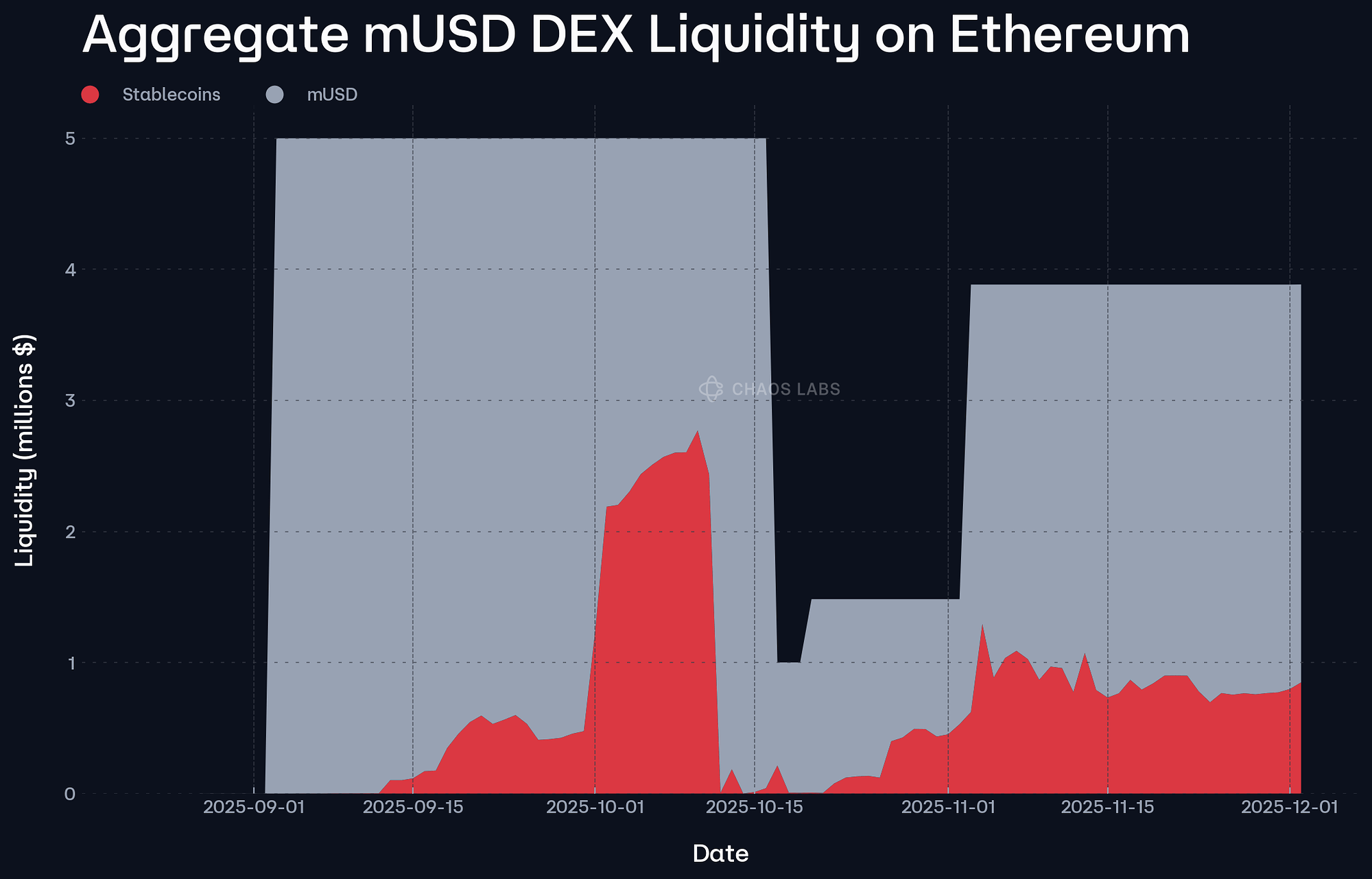

The core motivation for hardcoding mUSD to 1 USD stems from observed mismatches between mUSD’s reported on-chain price and its underlying economic value as a fully redeemable stablecoin, occurring against a backdrop of materially diminished mUSD liquidity. In particular, we have observed short-lived negative deviations in the mUSD/USD price feed on both Linea and Ethereum, even while broader on-chain markets with deeper liquidity continued to trade mUSD at or near parity.

These episodes seem consistent with the feed being skewed by low-volume venues, transient transaction-level distortions, or other opaque aggregation effects, rather than reflecting a true market-clearing price. As liquidity thins, even modest and temporary dislocations can generate oracle updates that are not representative of factual volume-weighted pricing.

From a risk perspective, it is essential to note that mUSD is not used as collateral in the relevant Aave deployments. As a result, negative market oracle moves do not produce liquidation shortfalls or threaten solvency through impaired collateral exits. Instead, the exposure is concentrated on the liability side: if the oracle were to briefly report a meaningfully sub-par price, the protocol is thus forced to treat transient, low-liquidity oracle prints as economically binding, even when they diverge from mUSD’s factual market value.

By hardcoding mUSD’s price to 1 USD, Aave explicitly encodes the assumption that mUSD remains redeemable at par in normal conditions and that short-horizon on-chain price noise is not relevant for risk management, given its non-collateral status. This removes the downside tail risk introduced by transient sub-par prints and prevents brief, low-depth price dislocations from translating into protocol-level accounting risk. The existing cap adapter ceiling already limits upside manipulation for stablecoins; moving to a static price effectively neutralizes oracle-driven tails on both sides, while remaining consistent with mUSD’s intended design as a par-redeemable asset.

In a true fundamental depeg scenario, where mUSD’s backing is impaired and its market price trades below $1 for a sustained period, the static oracle maintains a conservative posture for the protocol. Debt continues to be booked at 1 USD while the asset’s market value falls. From the protocol’s perspective, this improves resilience: liquidators can source mUSD more cheaply to repay a 1 USD unit of debt, increasing liquidation profitability and reducing the likelihood of bad debt. Borrowers are effectively “overcharged” relative to spot during a depeg, but that asymmetry is protective for the protocol compared to a dynamic oracle that would mark liabilities down in line with distressed, low-liquidity pricing.

Specification & Recommendation

We recommend a two-step implementation path.

First (immediate, strictly temporary mitigation): the Aave Risk Steward will reduce the mUSD supply and borrow caps on both the Ethereum and Linea deployments to 1 unit. This is an intentionally short-lived circuit breaker meant only to cover the brief window until the AIP executes the new oracle configuration. It freezes the effective growth of new mUSD liabilities while leaving existing positions untouched, with $3,500 in supply and $1,200 in borrows on Linea, and $155 in supply and $100 in borrows on Ethereum Core. This prevents opportunistic borrow expansion during the AIP’s voting and timelock period.

Second (at AIP execution): When the AIP is executed, the payload should (i) update the oracle configuration for mUSD on Aave V3 Ethereum and Aave V3 Linea to use a static 1 USD price source, implemented via the standard Aave price-oracle adapter mechanism, and (ii) raise the mUSD supply and borrow caps back up from 1 unit to a more conservative level than today’s pre-steward settings, reflecting the still-thin liquidity backdrop even after the oracle hardening. No other risk parameters for mUSD change under this proposal.

Chaos Labs will continue to monitor mUSD liquidity, peg stability, and user behavior across both deployments and will return to governance with further recommendations if either market structure or the stablecoin’s fundamental design changes in a way that warrants revisiting the 1 USD hardcoding assumption.

Current, via Steward

| Instance | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|

| Ethereum Core | 10,000,000 | 1 | 8,000,000 | 1 |

| Linea | 70,000,000 | 1 | 60,000,000 | 1 |

AIP Specification

| Instance | Current Expected Supply Cap | Recommended Supply Cap | Current Expected Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|

| Ethereum Core | 1 | 5,000,000 | 1 | 4,500,000 |

| Linea | 1 | 20,000,000 | 1 | 18,000,000 |

Next Steps

We will move forward and implement the relevant updates via the Risk Steward process. AIP will follow shortly after.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.