Overview

Chaos Labs supports the listing of USDG on the Aave v3 Core Instance as a borrow-only asset. The following post covers the details of the asset.

USDG

USDG (Global Dollar) is a fiat-backed stablecoin issued by Paxos Digital Singapore Pte. Ltd. (PDS), a subsidiary of Paxos, under the Monetary Authority of Singapore (MAS) stablecoin framework. It is structured as a single-currency stablecoin (SCS) fully backed 1:1 by U.S. dollars held in segregated reserve accounts comprising cash and cash-equivalent assets. USDG is fully redeemable from Paxos at a 1:1 ratio for USD.

Paxos operates as a regulated blockchain infrastructure and tokenization platform that issues multiple stablecoins across various jurisdictions through distinct legal entities. Paxos Digital Singapore Pte. Ltd. (PDS), licensed as a Major Payments Institution by MAS, is authorized to issue stablecoins in compliance with Singapore’s regulatory framework. Paxos Trust Company, LLC, a limited-purpose trust company regulated by the New York Department of Financial Services (NYDFS), issues Pax Dollar (USDP), PayPal USD (PYUSD), and Pax Gold (PAXG). Paxos Issuance MENA Ltd., regulated by the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM), issues Lift Dollar (USDL).

Paxos publishes monthly reserve reports and independent third-party attestation statements to verify that the total value of reserve assets meets or exceeds the circulating supply of the USDG token. These attestations are conducted by Enrome LLP, a Singapore-based accounting firm. As of August 30, 2025, the attestation report indicated that the total USDG in circulation was 553,678,623, while the fair value of the reserve assets was 555,580,297, representing a 0.34% surplus in reserve value, which confirms overcollateralization of USDG. As of the August report, the composition of the reserves is both short-term and highly liquid, with maturities ranging from September 4th to October 2nd; such composition of backing is expected to persist in the future.

Transparency reports and monthly attestations are available through the Paxos USDG Transparency Portal.

Smart Contract

The USDG contract implements a role-based permission framework to manage administrative functionality. The PAUSE_ROLE allows authorized entities to suspend all token transfers and approvals via the pause() function, which primarily functions as the primary safeguard in case of emergencies. Importantly, this control does not extend to minting or burning, which are governed separately. The ASSET_PROTECTION_ROLE can freeze and unfreeze specific wallet addresses and permanently remove balances from frozen accounts when necessary. The SUPPLY_CONTROLLER_MANAGER_ROLE oversees the assignment of the SUPPLY_CONTROLLER_ROLE within the external SupplyControl contract which regulates authorization and limits supply-related functionality. All these privileged actions are secured through multisig-controlled role addresses.

Minting

At the application layer, minting USDG is available exclusively to institutional clients onboarded through the Paxos platform. These entities undergo verification and are assigned operational permissions, including the management of whitelisted wallet addresses. Through the Paxos dashboard or API, users initiate minting by specifying the funding method (e.g., SWIFT, DBS-ACT), the token type (USDG or other Paxos-issued tokens), blockchain network, and destination address. Upon receipt of funds, Paxos automatically executes the corresponding on-chain mint and transfer transaction to the designated user address.

As mentioned previously, on-chain minting is restricted to addresses holding the SUPPLY_CONTROLLER_ROLE, as managed by the SupplyControl contract. When a mint transaction is initiated, the contract validates that (i) the availability of the recipient address, (ii) the caller is authorized to mint to the specified address, and (iii) the requested amount complies with predefined rate or volume constraints. Once verified, the recipient’s balance and the total token supply are incremented accordingly.

Redeeming

The redemption process of USDG follows similar operation control and execution logic to that of minting. Verified users initiate with the appropriate levels of permissions and initiate the redepmtions via the Paxos platform UI by linking and approving a fiat bank account. Once the account is approved by Paxos, the user can specify the source wallet address along with a corresponding chain, which prompts the transaction by a Paxos-controlled wallet address. Upon confirmation of token receipt, Paxos triggers the burn operation either via burn() or decreaseSupplyFromAddress() operation, depending on the type of destination wallet. The transactions decrease the supply of the token burned and emit logs Transfer and SupplyDecreased ensuring operational transparency. Upon the burn of the token, the fiat transfer to the user’s fiat bank account is initiated.

Peg Stability

Below, we present USDG’s hourly close prices compared to other stablecoins with substantial market shares, namely USDT and USDC. As can be observed, on centralized venues, USDG is mostly traded within the same tight ranges, ranging from 0.9995 to 1.0005, typical for a fiat-backed stablecoin.

Like USDT, USDG exhibited a substantial depeg on October 10th. This period can be characterized as that of extremely high volatility, substantial liquidations, and record market stress. These factors, combined with malfunctions across a set of DEXs, have resulted in a number of minor depegs across stablecoins. For example, when USDT traded at 1.003, USDG was priced at under 0.97 on a number of CEXs, indicating pricing risk during periods of high stress.

USDG’s daily 7-day annualized volatility is on par with leading stablecoins such as USDT and USDC, currently at 0.20–0.25% annualized.

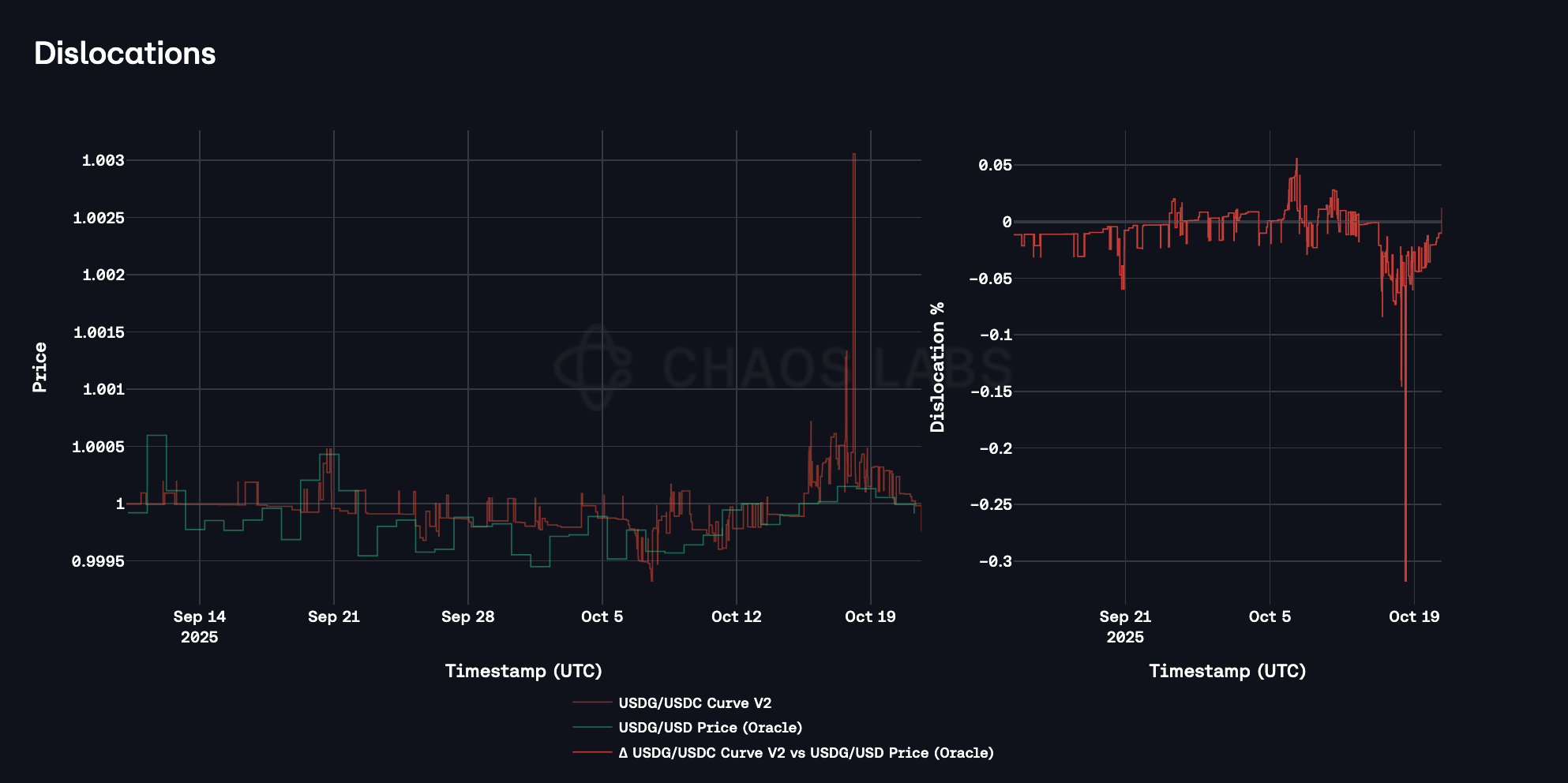

Dislocations

Similar to USDe, which has depegged by over 30% on some centralized exchanges but remained near peg on-chain, USDG exhibited comparable behavior but at a substantially milder extent. Its dislocation from peg was around 3% on centralized exchanges, while the on-chain dislocation in the Curve pool was 10x smaller in relative magnitude, reaching only 1.003.

Market Cap & Liquidity

USDG’s market cap on Ethereum is currently over $300 million. Aggregate DEX liquidity is approximately $14 million, split between two Curve pools:

As can be observed, the paired USDG and USDC liquidity has been stable over the past month, with minimal fluctuations.

At the time of writing, the liquidity is sufficient to limit slippage on a 3.5 million swap to a conservative 1%, which can provide a substantial liquidity absorption buffer in case of adverse collateral movements.

Distribution

At the time of writing, USDG has 1,223 unique holders. As expected, the distribution of balances across addresses follows an exponential distribution, with the majority of users holding minimal balances, while some addresses have significantly larger holdings. Specifically, we observe that an overwhelming majority of users have less than 128 USDG tokens; at the same time, the top 5 users account for over 54.47% of the total supply.

Additionally, USDG is being actively transferred across the Ethereum network, with a peak daily volume at 436 million tokens, likely coinciding with a large-scale mint event. The average transaction volume oscillates between 64 million and 32 million, indicating a substantial level of adoption on the Ethereum network.

Supply and Borrow Caps

Considering Curve’s substantial liquidity, we propose the initial supply and borrow caps of 30 and 26 million tokens, respectively.

IR Curve

We recommend setting the Uoptimal for USDG at 80% - slightly lower than the typical 90% used for USDT, to account for USDG’s recent launch and limited on-chain liquidity. Consistent with this conservative approach, we also propose a higher slope2 for USDG. This reflects its shorter track record and more aggressively mitigates utilization above the kink.

Oracle/Pricing

Given the recent behavior observed on other smaller stablecoin oracles such as mUSD, we recommend pricing USDG on Aave V3 Ethereum with a hardcoded price of 1 USD. In the current environment, a market oracle can produce temporary deviations that are not aligned with the asset’s backing, These deviations would open the risk of opportunistic borrowing at artificially depressed oracle levels prior to a return to backing value. Hardcoding the price to 1 USD removes this path, preventing its abuse and minimizing the asset’s risk.

This change does not introduce material additional risk as USDG is to be configured on the Aave Core instance exclusively as a borrowable asset and cannot be used as collateral. The oracle affects only the notional at which liabilities are recorded, not the valuation of collateral or the solvency profile of the protocol. In normal conditions, the hardcoded price neutralizes oracle-driven opportunities for underpriced borrowing. In a genuine depeg scenario, it is conservative for the protocol: USDG liabilities remain booked at 1 USD while the asset can be sourced below par by liquidators and borrowers alike, improving liquidation economics and reducing the probability of bad debt.

Specification

| Parameter | Value |

|---|---|

| Asset | USDG |

| Isolation Mode | No |

| Borrowable | Yes |

| Collateral Enabled | No |

| Supply Cap | 30,000,000 |

| Borrow Cap | 25,000,000 |

| Debt Ceiling | - |

| LTV | - |

| LT | - |

| Liquidation Bonus | - |

| Liquidation Protocol Fee | - |

| Variable Base | 0% |

| Variable Slope1 | 6.00% |

| Variable Slope2 | 50% |

| Uoptimal | 80% |

| Reserve Factor | 20% |

Disclosure

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0.