Summary

Chaos Labs supports updating ezETH and rsETH E-Modes on the Arbitrum Instance, additionally we recommend adjusting the wstETH/WETH E-Mode parameters to better align with current risk profiles.

LRT E-Modes Motivation

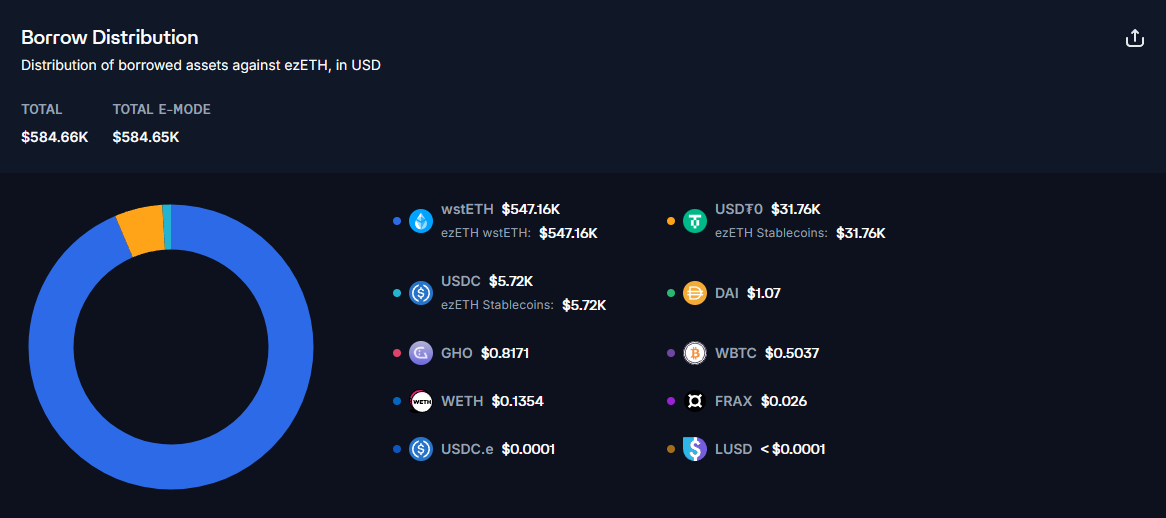

At the moment ezETH and rsETH are mostly utilized in looping strategies with wstETH. The nature of the strategy lies in the borrowing wstETH against an LRT in a recursive matter to year leveraged restaking returns.

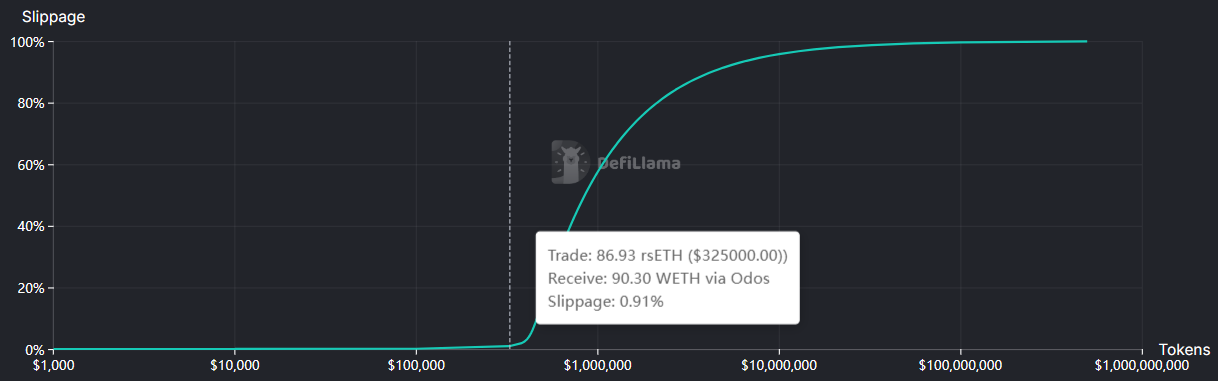

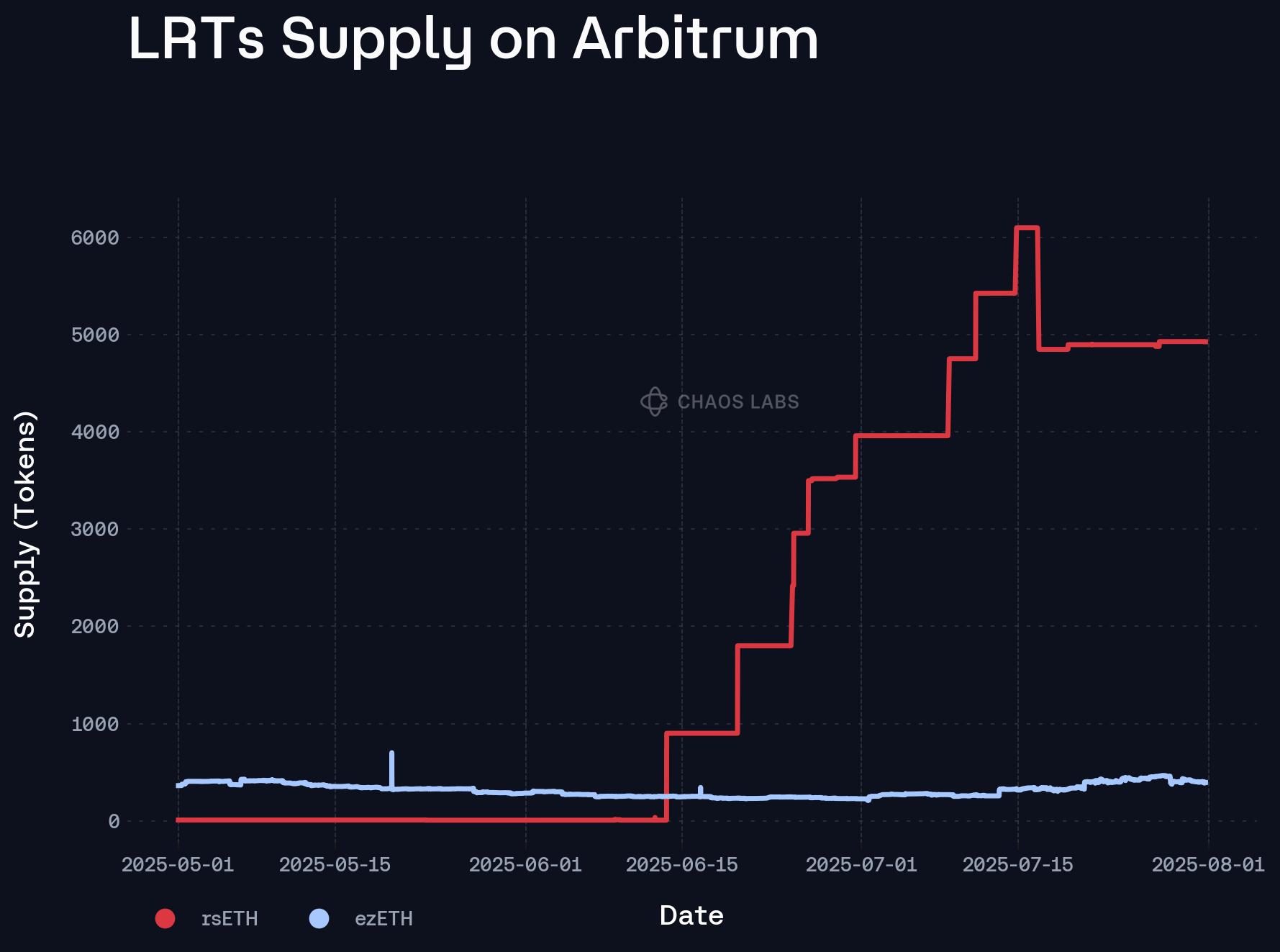

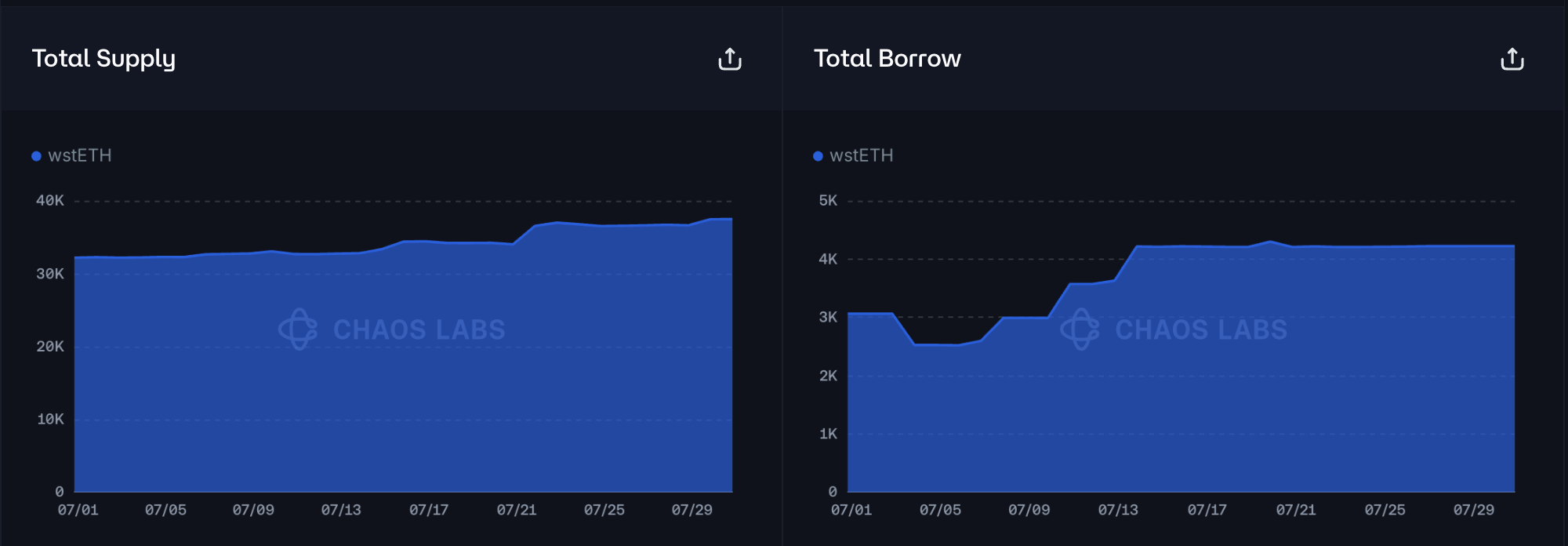

While this strategy would, in theory, significantly drive up the supply caps of ezETH and rsETH, their stagnant supply on Aave indicates that it has been relatively ineffective in the near term. Although the chart below shows a clear increase in rsETH’s supply cap utilization over the past three months, we also see that its supply has plateaued in the last two weeks. Given the nature of the looping strategy, we can deduce that profitability has stalled due to the low net yield between restaking returns and borrowing costs.

This phenomenon is additionally illustrated by the stagnant supply of rsETH and ezETH, along with a consistent borrow level of wstETH at 4,000 tokens.

The newly approved DRIP campaign, which will direct roughly 10M ARB in incentives toward WETH and stablecoin borrowing, offers an opportunity to revitalise demand. Incorporating WETH as a borrow asset in the existing ezETH/wstETH and rsETH/wstETH E-Modes will channel those incentives into fresh borrowing activity without displacing the current wstETH loops. This change preserves the established collateral parameters while giving users the flexibility to switch between wstETH and WETH loops as relative yields shift.

wstETH E-mode Motivation

wstETH is exposed only to Ethereum consensus-layer penalties, while LRTs such as rsETH and ezETH face additional risk of AVS slashing. Given the lower risk, wstETH can support higher LT and LTV without significantly increasing the protocol risk.

Our slashing simulations confirm: in the vast majority of validator-failure scenarios, Lido’s losses would remain below 0.10% of stake, well within the 1% liquidation penalty.

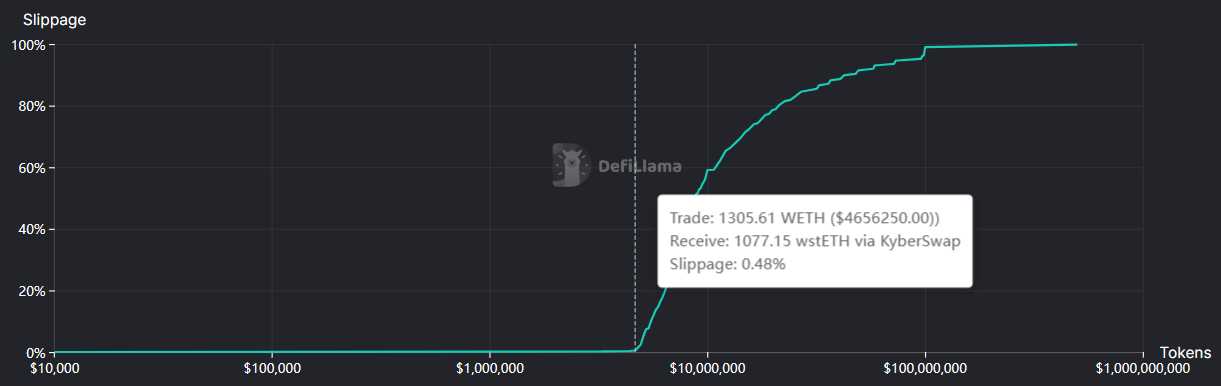

We propose creating an additional wstETH E-Mode with improved parameters of 94% Max LTV and a 96% Liquidation Threshold, while maintaining the 1% liquidation penalty. These adjustments preserve the protocol’s safety margin while ensuring that wstETH/WETH loop stays competitive with the LRT-based strategies.

weETH/wstETH Borrow Access on Ethereum Core

In parallel, we recommend enabling wstETH borrowing against weETH collateral within the Ethereum Core market, restoring a degree of flexibility that existed in earlier iterations of E-Mode (pre–v3.2 and the introduction of liquid E-Modes), where all ETH-correlated assets were both collateralizable and borrowable against each other.

The motivation for this change stems from recent episodes of significant ETH liquidity crunches, during which ETH borrow rates have spiked to highly unprofitable levels for leveraged looping strategies. In such scenarios, weETH loopers can execute a debt swap from WETH to wstETH, effectively purchasing wstETH at a discount to market in the process (due to the widened spread between spot and fundamental prices). This maneuver can temporarily neutralize some of the looping losses before eventually swapping back to WETH or unwinding positions.

Including WETH as a borrowable asset in the E-Mode also facilitates efficient migration into the configuration, allowing users to enter the E-Mode, borrow WETH, and then swap or adjust positions without leaving the optimal collateral/borrow framework.

This change is not introducing new functionality, as it simply extends to weETH the same wstETH borrowing capability that ezETH and rsETH already have, while adding WETH for migration efficiency. The proposed change has been discussed with TokenLogic and will be incorporated into the scope of this AIP.

Recommendation

Given the behavior of market participants and expected growth of borrowing demand for WETH market, we recommend including WETH into the E-Modes for rsETH and ezETH. Additionally, in order to align the risk profiles of LRTs and wstETH we recommend creating the wstETH/WETH E-Mode.

Specification

Update rsETH/WETH E-Mode

| Parameter |

Value |

Value |

Value |

| Asset |

rsETH |

wstETH |

wETH |

| Collateral |

Yes |

No |

No |

| Borrowable |

No |

Yes |

Yes |

| Max LTV |

93.00% |

- |

- |

| Liquidation Threshold |

95.00% |

- |

- |

| Liquidation Penalty |

1.00% |

- |

- |

Update ezETH/WETH E-mode

| Parameter |

Value |

Value |

Value |

| Asset |

ezETH |

wstETH |

wETH |

| Collateral |

Yes |

No |

No |

| Borrowable |

No |

Yes |

Yes |

| Max LTV |

93.00% |

- |

- |

| Liquidation Threshold |

95.00% |

- |

- |

| Liquidation Penalty |

1.00% |

- |

- |

wstETH/WETH Correlated E-Mode

| Parameter |

Value |

Value |

| Asset |

wstETH |

wETH |

| Collateral |

Yes |

No |

| Borrowable |

No |

Yes |

| Max LTV |

94.00% |

- |

| Liquidation Threshold |

96.00% |

- |

| Liquidation Penalty |

1.00% |

- |

weETH/wstETH E-Mode on Core

| Parameter |

weETH |

wstETH |

wETH |

| Collateral |

Yes |

No |

No |

| Borrowable |

No |

Yes |

Yes |

| Max LTV |

93.00% |

- |

- |

| Liquidation Threshold |

95.00% |

- |

- |

| Liquidation Penalty |

1.00% |

- |

- |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0