Summary

LlamaRisk supports the proposed changes. Adding WETH to rsETH and ezETH E-Modes on Arbitrum poses minimal incremental risk and provides greater flexibility for users seeking ETH liquidity against these restaking assets. While the updated E-Modes broaden utility, they do not directly enable participation in the Arbitrum DRIP, which currently requires wstETH to be supplied as collateral, though this requirement may evolve in the future.

Market Risk

rsETH E-mode

The main use case for rsETH collateral on Arbitrum currently is LST yield leverage, where wstETH is borrowed. Currently, $18.4M rsETH is supplied on Arbitrum with $15.6M worth of wstETH borrowed against it, all by a single user operating at a health factor of 1.08. This concentrated usage pattern reflects a narrow collateral utility, which the proposed inclusion of WETH borrowing in the rsETH E-Mode would expand.

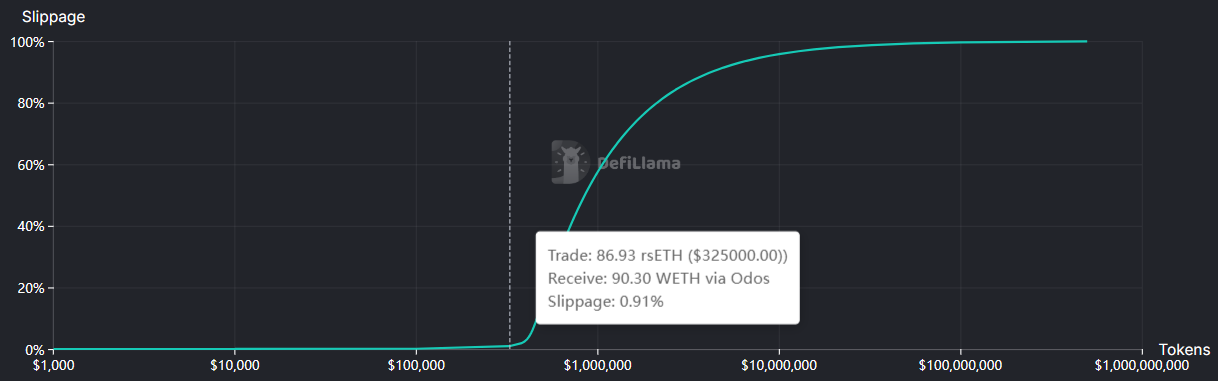

Source: rsETH/WETH Swap Liquidity, DeFiLlama, August 4, 2025

Users can currently swap 87 rsETH (worth $325K) for WETH on Arbitrum with just 1% price impact, which is relatively low considering rsETH’s current supply cap of 7.92K tokens ($30M).

ezETH E-mode

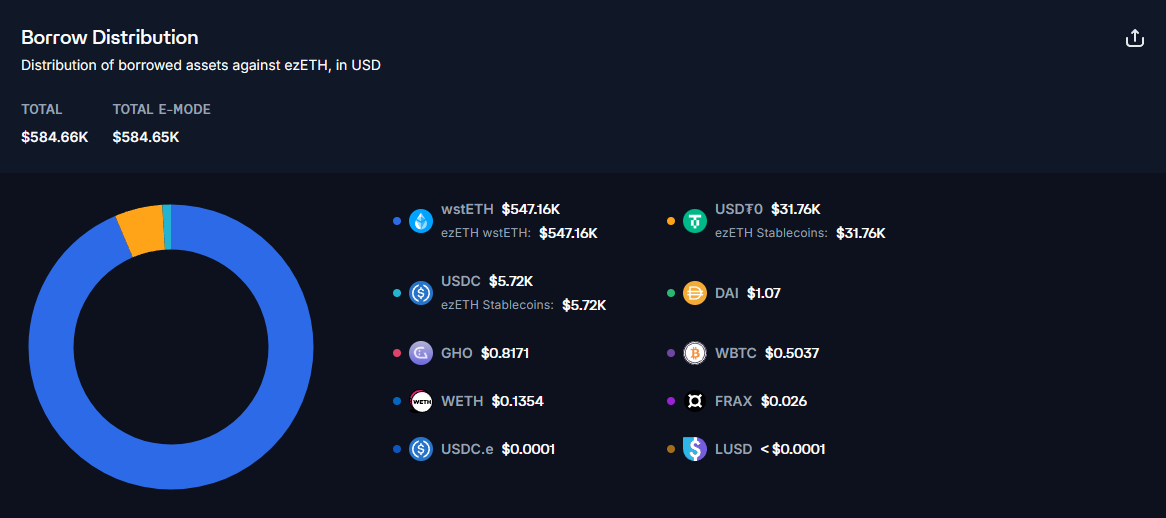

Source: ChaosLabs, August 4, 2025

Like rsETH, ezETH on Arbitrum is primarily used for wstETH-based LST yield leverage, with approximately $1.3M worth of ezETH currently supplied. The borrowing distribution of assets against ezETH can be seen above.

Source: ezETH/WETH Swap Liquidity, DeFiLlama, August 4, 2025

Notably, ezETH has significantly better secondary market liquidity than rsETH on Arbitrum; users can swap up to 530 ezETH (roughly $2M) for WETH with less than 1% price impact.

DRIP Farming

The Arbitrum DeFi Renaissance Incentive Program (DRIP) gives users 2% APR for supplying wstETH as collateral and borrowing ETH, USDC, or USDT on approved lending protocols. To qualify, users must maintain a minimum 15% LTV.

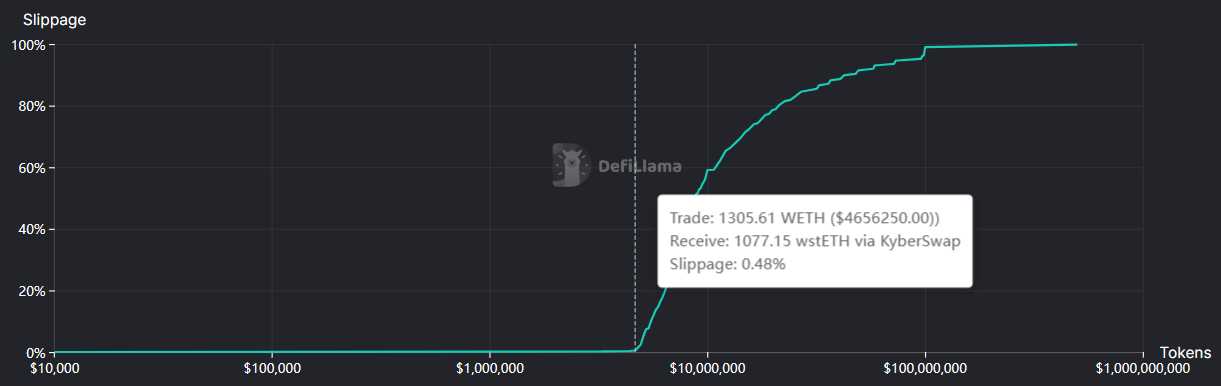

Source: WETH/wstETH Swap Liquidity, DeFiLlama, August 4, 2025

While the proposed rsETH or ezETH/WETH E-Modes alone do not make users eligible for DRIP rewards, since the program only incentivizes wstETH supplied as collateral, they can still be used to support DRIP participation indirectly. One option is to borrow wstETH via existing E-Modes and loop into DRIP. Alternatively, the new E-Modes allow borrowing WETH directly and swapping it for wstETH, though this is more complex and reliant on limited wstETH DEX liquidity (currently just under $5M).

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.