Summary

LlamaRisk supports the onboarding of wrsETH to the Avalanche instance. wrsETH’s architecture follows the same OFT design seen in rsETH on other L2s onboarded. Avalanche supply at the time of writing was approximately 6,723, with ~96% of onchain liquidity deposited in an Euler vault. DEX liquidity is highly concentrated in a single pool, which creates a singular liquidity dependency in the event of liquidations.

At the time of writing, we noted that 314 wrsETH (~$1.2M) could be swapped within a 7.5% price impact. In contrast to the near $26M onchain, this compounds the dependency risk associated with the single available pool. Therefore, we recommend onboarding rsETH with conservative parameters due to the lack of unallocated rsETH (required for liquidity migrations from Euler) and DEX availability.

1. Asset Fundamental Characteristics

1.1 Asset

wrsETH is the wrapped version of the liquid restaking token rsETH, backed by LSTs such as ETHx, stETH, and native ETH. Extensive analyses of rsETH have been conducted in the past, with previous reports detailing its design and risk considerations, including: Add rsETH to Aave V3 Ethereum, Onboard wrsETH to ZKsync V3 Instance, rsETH Collateral Risk Assessment, and Onboard wrsETH to Aave v3 Plasma Instance.

1.2 Architecture

rsETH is bridged through LayerZero infrastructure and utilizes the Omnichain Fungible Token (OFT) standard. Since OFTs are already present on Aave markets, the bridging mechanism poses little additional architectural risk.

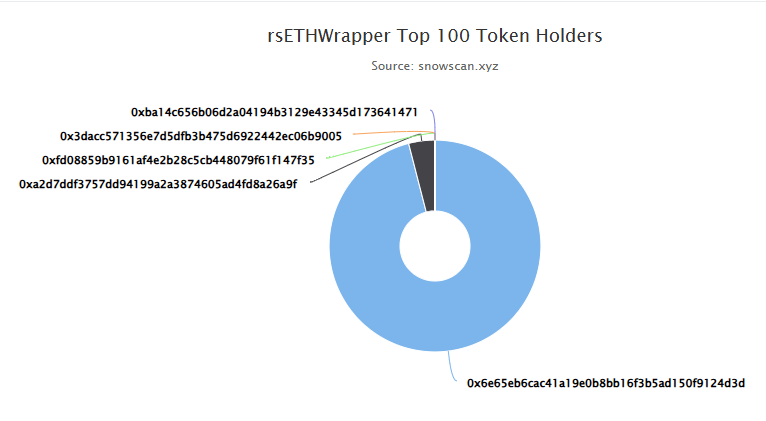

1.3 Token Holder Concentration

Source: wrsETH Holder Distribution, Snowscan, October 30th, 2025

A total of ~6,723 wrsETH (~$26M) is currently available circulating on Avalanche, with 119 accounts registered as holders. An Euler Vault holds ~96% of the onchain supply.

The remaining ~4% is in a Blackhole Algebra liquidity pool. Current onchain liquidity depth that isn’t allocated is shallow. As Euler represents a direct competitor, onboarding rsETH would require users to migrate liquidity to Aave. The incentives for users, therefore, would have to exceed what they currently receive from Euler; in turn, this may prompt Euler to increase incentives to retain liquidity.

2. Market Risk

2.1 Liquidity

Approximately 314 wrsETH worth ~$1.2M can be swapped within a 7.5% price impact.

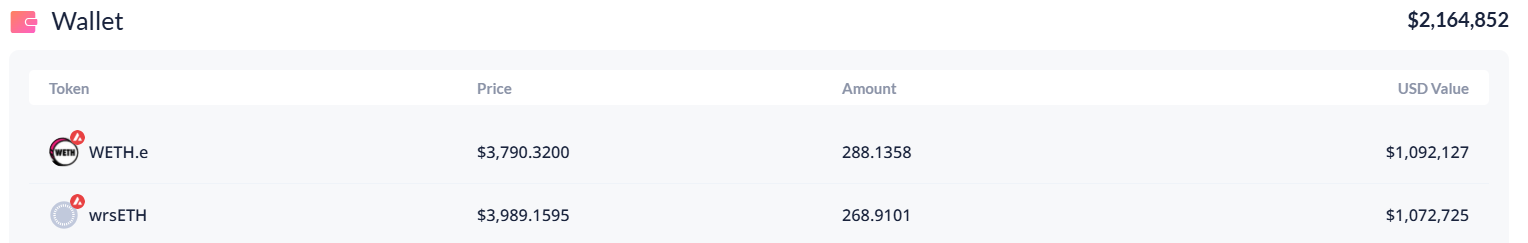

Source: wrsETH/WETH swap, Kyberswap, October 30th, 2025

Liquidity on Avalanche is limited to a single wrsETH/WETH.e pool. Relative to the ~$26M TVL, DEX liquidity is notably limited and reliant on a single venue. The pool currently has a TVL of $2M.

Source: wrsETH Liquidity Pools, GeckoTerminal, October 30th, 2025

Source: wrsETH/WETH Blackhole pool TVL, Debank, October 30th, 2025

Analyzing the pool’s LP deposits, a single EOA supplies a large proportion of the pool’s TVL (Arkham has currently only priced WETH). In the event that liquidity is withdrawn from this pool, Aave would be exposed to liquidations being constrained.

Source: Blackhole wrsETH/WETH pool, Arkham Intelligence, October 29th, 2025

2.2 Volatility

The price history for wrsETH on Avalanche is limited, with the single pool being a little over a month old.

Source: wrsETH/WETH pool, Dexscreener, October 29th, 2025

3. Technological Risk

3.1 Smart Contract Risk

5 audits have been completed on rsETH’s codebase. We have previously covered audit details, and descriptions can be found here (for SigmaPrime, Code4rena, and MixBytes) and [here](https://Smart Contract Risk) (for the most recent SigmaPrime audits)

3.2 Bug Bounty Program

Layerzero and Kelp DAO bug bounties have max bounties worth $15.5M and $250K, respectively.

3.3 Price Feed Risk

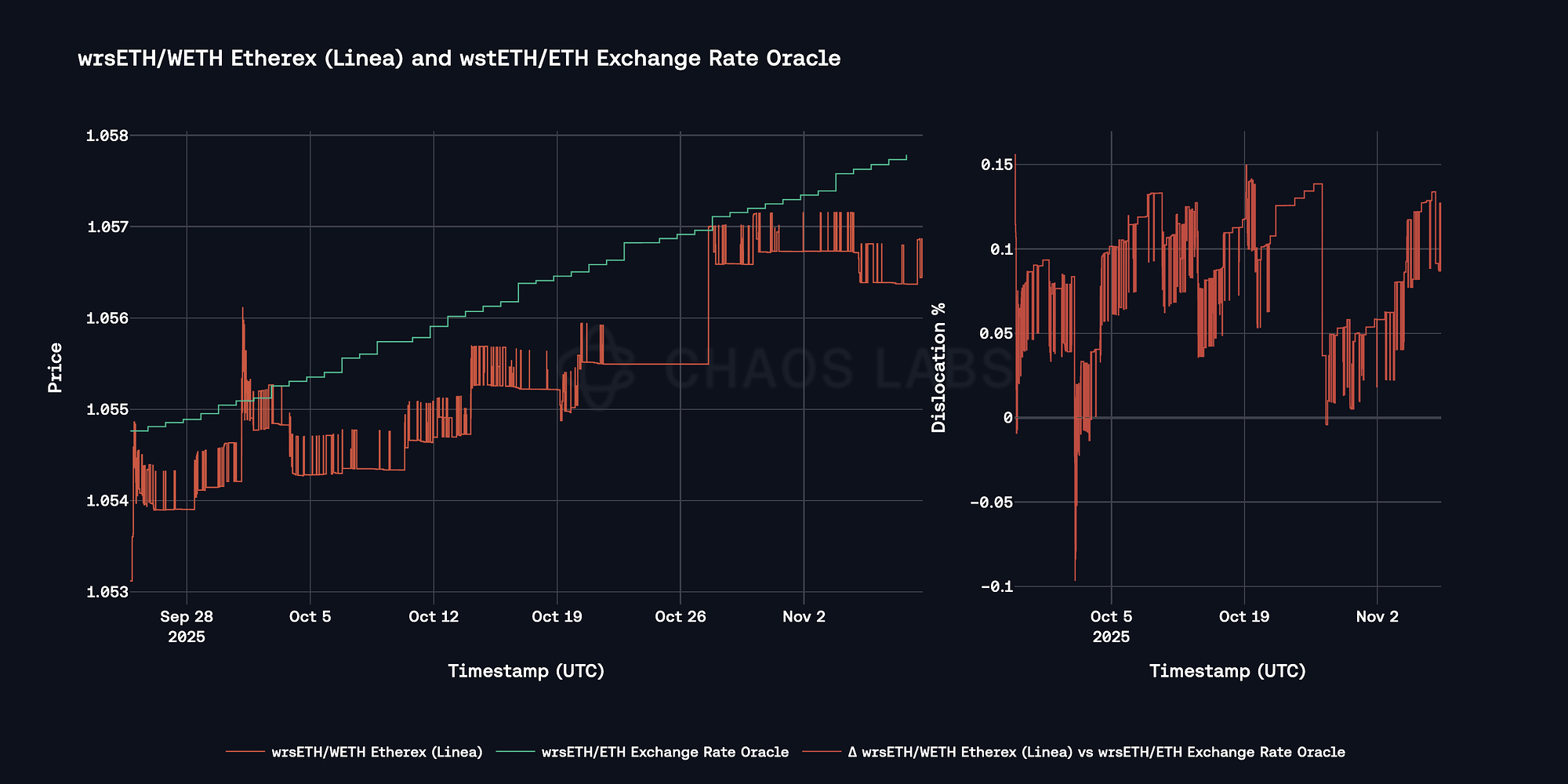

A Chainlink wrsETH/ETH exchange rate price feed is available on Avalanche. The custom feed has a deviation threshold of 0.05% and a 24-hour heartbeat.

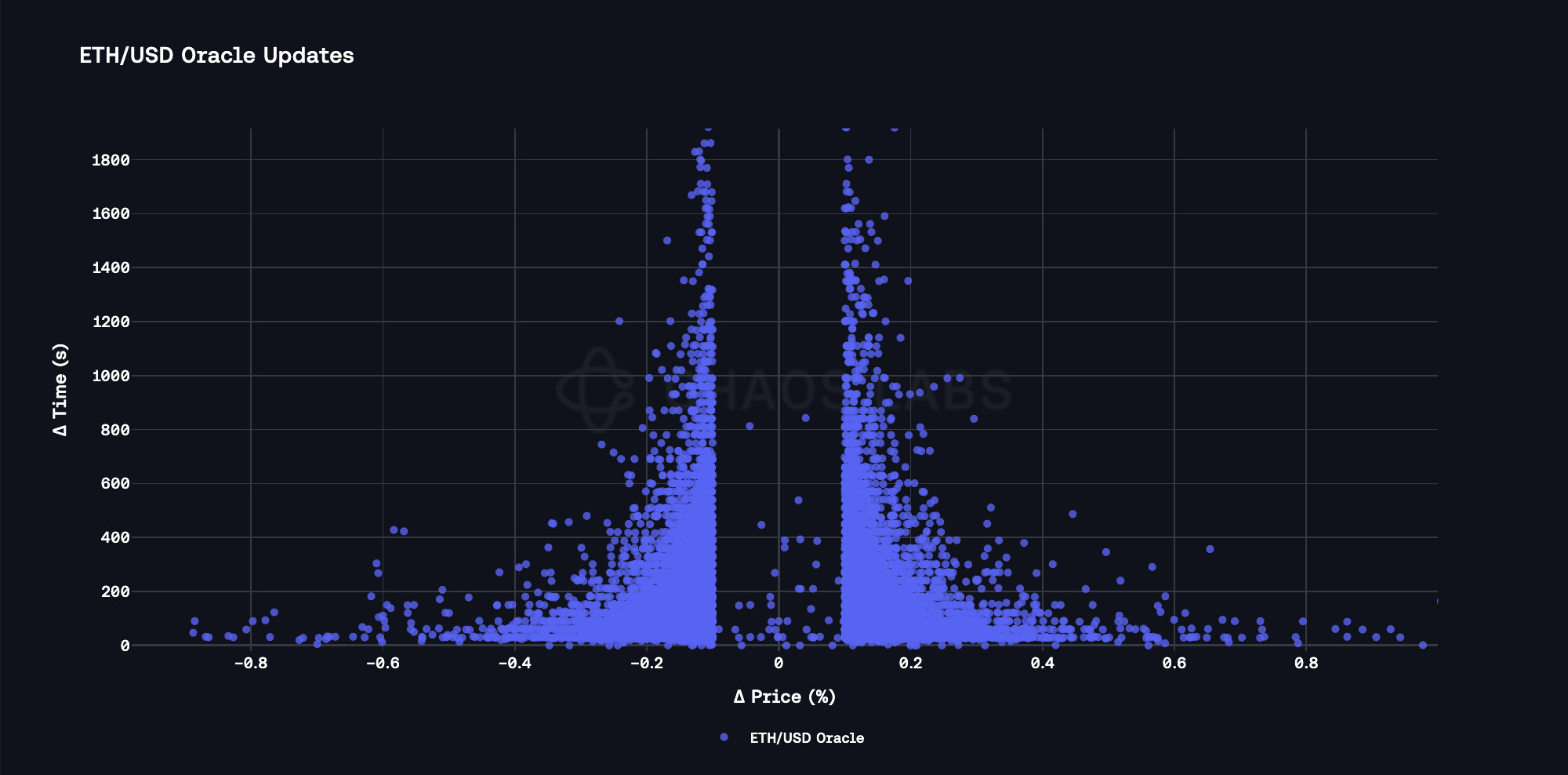

Additionally, an ETH/USD price feed is available that has a 0.1% deviation threshold and a 24-hour heartbeat.

4. Counterparty Risk

4.1 Access Control Risk

4.1.1 Contract Modification Options

Deployed Kelp DAO contracts on Avalanche:

RSETHPoolV3: the deposit pool for rsETH.

RSETH_OFT: LayerZero ERC20 contract for rsETH.

rsETHWrapper: is deployed behind a TransparentUpgradeableProxy contract.

RSETHRateReceiver: contract acts as RsETH’s oracle.

RSETH_OFT is owned by Multisig A. The owner has access to functions related to LayerZero’s OFT (e.g., cross-chain functionality, fees, and pause abilities) and OpenZeppelin’s Ownable (e.g., transfer ownership and renounce ownership) privileges.

rsETHWrapper has the following roles:

- DEFAULT_ADMIN_ROLE: can assign roles and unpause the contract. Assigned to Multisig A.

- BRIDGER_ROLE: deposits bridged rsETH from L1 to collateralize wrsETH on L2. Assigned to EOA A.

- MINTER_ROLE: allows the role holder to mint wrsETH. Not currently assigned (users can mint wrsETH via asset deposits).

- TIMELOCK_ROLE: can change supported assets. Not currently assigned

- MANAGER_ROLE: is defined but does not have assigned functions or accounts.

While the BRIDGER_ROLE is assigned to an EOA, the minting of wrsETH is limited by maxAmountToDepositBridgerAsset() check, which ensures 1:1 collateralization of deposited assets to prevent manipulation of backing ratios.

4.1.2 Timelock Duration and Function

No time locks are implemented directly in the wrsETH contract.

4.1.3 Multisig Threshold / Signer identity

Multisig A has a 3/ 6 threshold. Signers are comprised solely of the KelpDAO core team.

Signers include:

0xFCc1C98F887C93C38Deb5e38A6Fb820AD3fB9DFD

0x51C59785639CCa31c09D0833749e76A5D945C9F3

0x601767c4ba4134cc2E906ea7cf25EaB845152A7C

0x0e4B97563723eF7f0a7FDe4c7bD3B17a5bF63fBf

0x7AAd74b7f0d60D5867B59dbD377a71783425af47

0x1f7A03b70C5448DFd0a2C5a7865169253c2C769b

Note: This assessment follows the LLR-Aave Framework, a comprehensive methodology for asset onboarding and parameterization in Aave V3. This framework is continuously updated and can be accessed here.

Aave V3 Specific Parameters

Parameters will be presented jointly with Chaos Labs, including wrsETH/WETH and wrsETH/Stablecoins Emodes.

Price Feed Recommendation

We recommend using the internal exchange rate of rsETH together with CAPO, in conjunction with Chainlink ETH/USD price feed, as has been utilized for other rsETH markets

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.