November 2025

This update highlights Chaos Labs’ activities and proposals in November.

Highlights

Chaos Risk Agent

Chaos Labs proposed the Risk Agent framework, which serves as a governance-aligned orchestration and validation middleware between Risk Oracles and the Aave protocol. The proposal of the Risk Agent framework is aimed to generalize and modularize risk-parameter ingestion, centralize validations, improve visibility, and isolate permissions while preserving full DAO ownership and control. It is expected to streamline configuration updates, eliminate redundant deployments, and support both generic and custom validation logic across Aave v3 and future systems.

Aave V4 New Features and Risk Parameters Analysis

Chaos Labs conducted a comprehensive feature examination on Aave v4, which introduces a modular Hub-and-Spoke architecture separating global liquidity and accounting at the Hub from market-level risk enforcement at the Spokes. This analysis is aimed to assess how new mechanisms such as dynamic liquidation mechanics, dynamic reserve configurations, and risk premiums reshape the protocol’s risk management and parameter update processes. In addition, it covered the full set of configurable risk parameters and the freezing and pausing functions across Hubs and Spokes that act as circuit breakers to contain risk during stress events.

Risk Oracles

Variable Rate Slope 2 Oracle

The Variable Rate Slope 2 Oracle continued to function as intended following its deployment. In November, updates occurred for USDC on Ethereum, USDC on Linea, USDT on Linea, WETH on Linea, and USDT on Ethereum. Among these assets, WETH on Linea saw the highest activity, as shown below, with a total of 60 updates throughout the month.

Supply and Borrow Cap Oracle

The supply and borrow cap risk oracles on Arbitrum, Avalanche, BNB, Gnosis, Polygon, Optimism, and Base have continued to operate efficiently, executing adjustments across numerous markets. As shown, a total of 13 supply cap updates and 42 borrow cap updates have been carried out. Among these, Avalanche experienced the highest frequency of adjustments, with 16 borrow cap updates.

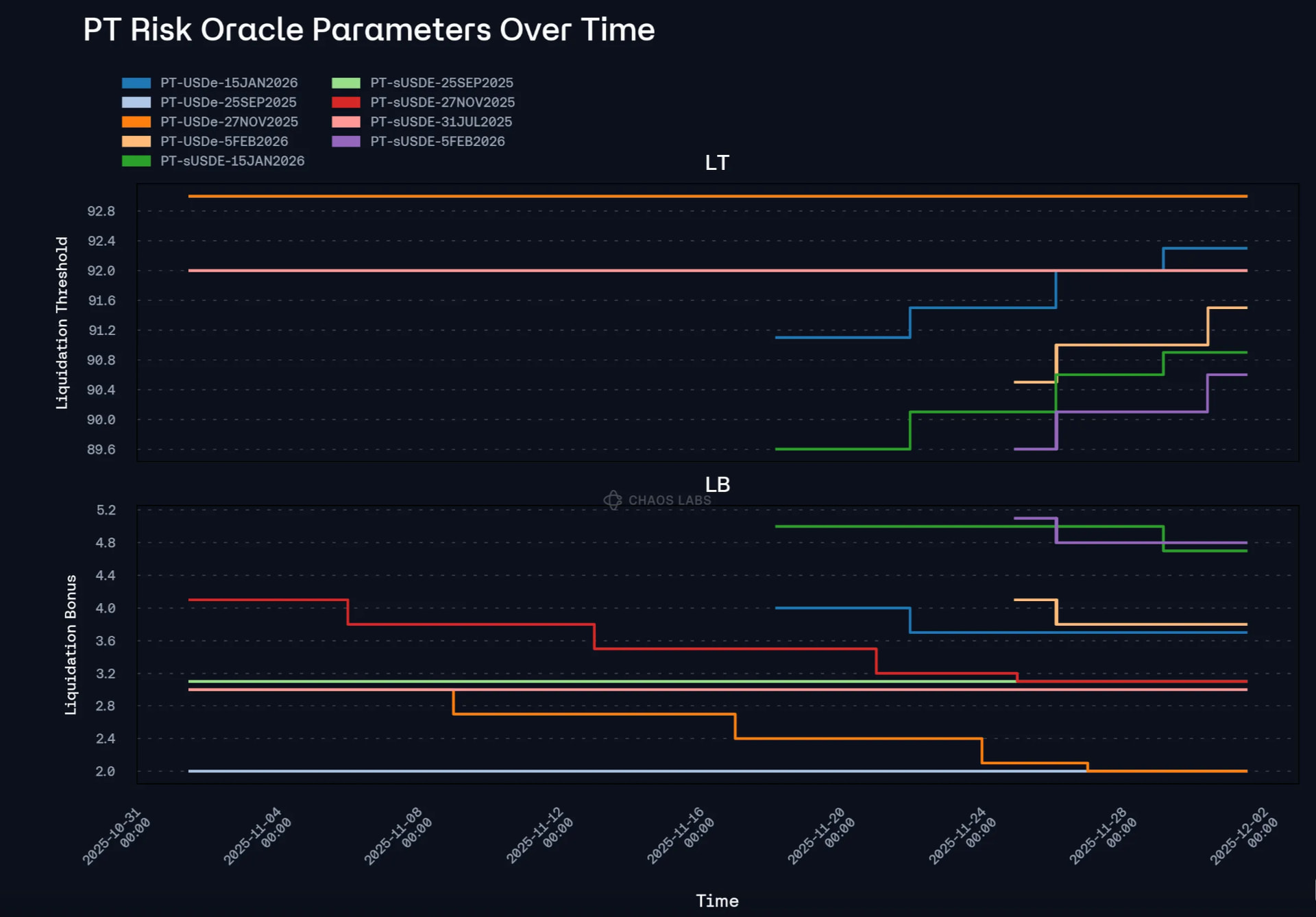

PT Risk Oracle

The value of assets utilizing the PT Risk Oracle averaged approximately $1.8B in November 2025. As shown in the chart, PT-sUSDe-27NOV2025 and PT-USDe-27NOV2025 were the two largest PT tokens in the market. Due to their expiration, both assets saw a decline in supply toward the end of November. However, we expect the migration into PT-sUSDe-5FEB2026 and PT-USDe-5FEB2026 to follow accordingly.

Additionally, the PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 series on Plasma, launched at the end of November, have also accumulated considerable supply. As of this writing, PT-USDe-15JAN2026 has a supply of 127M, while PT-sUSDe-15JAN2026 stands at 641M.

At the same time, as shown, as these PTs approach shorter remaining durations, the oracle dynamically adjusts the LT and LB parameters to reflect the declining time-to-maturity risk.

Forum Activity

We published the following proposals, updates, and analyses, including risk parameter updates:

- Chaos Labs Risk Stewards - Decrease Supply Caps on Aave V3 - 11.03.25

- Chaos Labs Risk Stewards - Adjust Supply, Borrow Caps and IR Curves on Aave V3 - 11.13.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 11.20.25

- Chaos Labs Risk Stewards - Stablecoins Interest Rate Adjustment on Aave V3 - 25.11.25

- Chaos Labs Risk Stewards - WETH Interest Rate Adjustment on Aave V3 - 25.11.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 11.25.25

Additionally, we provided analysis regarding the following proposals and discussions:

- [Direct to AIP] Onboard XPL on Aave V3 Plasma Instance

- [ARFC] Onboard USDG to Aave V3 Core Instance

- [Direct to AIP] Reinstate Supply and Borrow Caps on Aave V3 Gnosis Instance

- Proof of Reserve Feeds as Foundational Risk Infrastructure

- [Direct to AIP] weETH E-Mode Risk Parameter Adjustment on Aave V3 Plasma Instance

- [Direct to AIP] Onboard rsETH to Aave V3 Avalanche Instance

- [ARFC] Onboard stAVAX to Aave V3 Avalanche Instance

- Aave v4: New Features and Risk Parameter Analysis

- [Direct to AIP] Onboard syrupUSDT to Aave V3 Core Instance

- [Direct to AIP] Onboard USDe & sUSDe February expiry PT tokens on Aave V3 Core Instance

- [ARFC] Chaos Risk Agents

- [Direct to AIP] XAUt Supply Cap and Debt Ceiling Adjustment on Aave V3 Core Instance

- [ARFC] Ethena USDe Risk Oracle and Automated Freeze Guardian

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

- Supply and borrow cap risk oracle integration across additional chains leveraging Edge infrastructure

- Ongoing monitoring of SVR and related parameterization

- Pendle Dynamic Risk Oracle deployment for each PT asset

- CAPO Risk Oracle integration

- Preparation for the launch of Aave V4