Summary

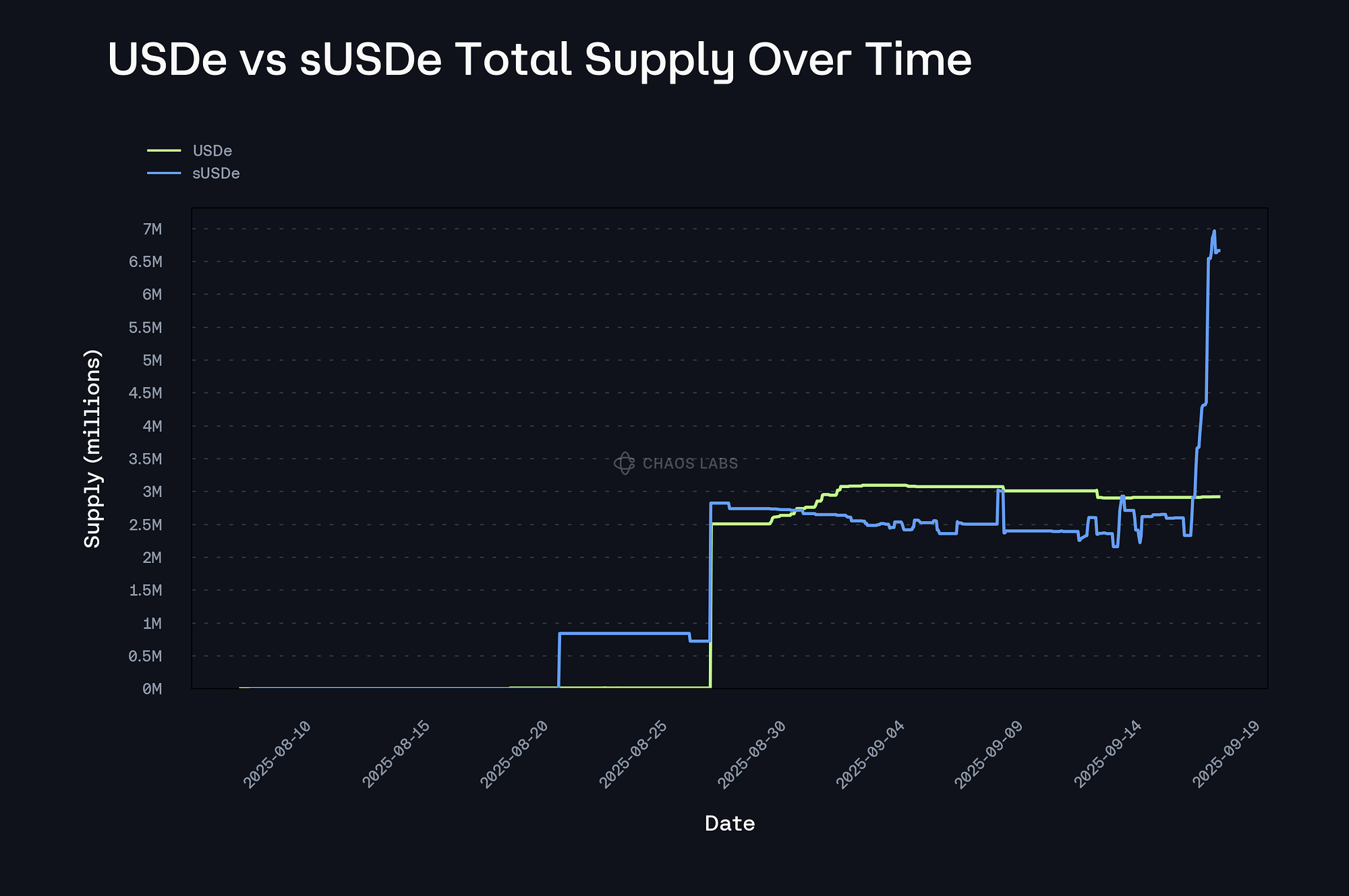

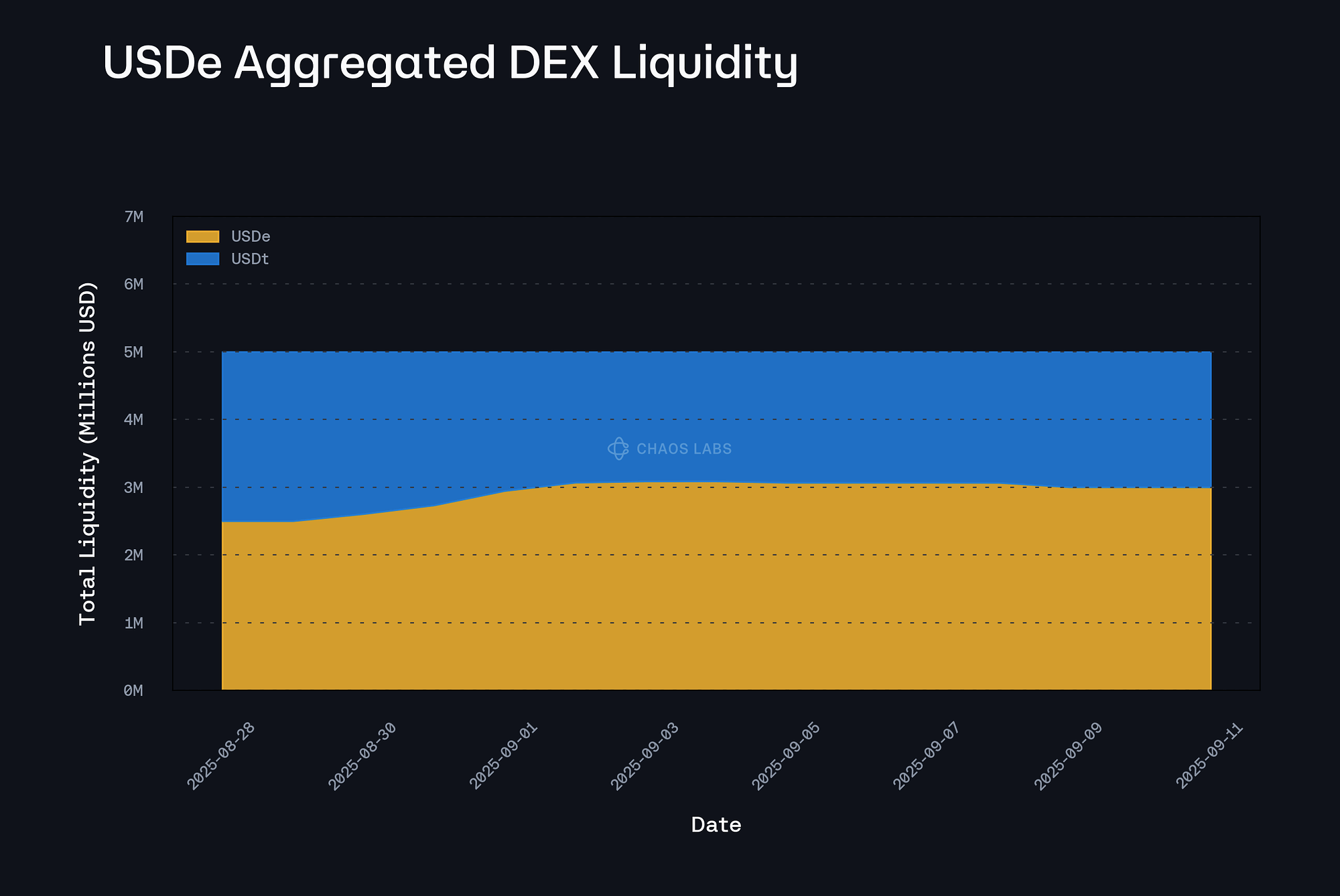

LlamaRisks supports the onboarding of sUSDe and USDe to the Avalanche instance, conditional on introducing a sUSDe/USDe price feed. Both assets are well known to Aave and have proven popular on the Core market with USDe and sUSDe representing $1.54B and $1.16B supplied, respectively. While liquidity is relatively low at ~2.4M USDe and ~3M sUSDe, incentives committed by Ava Labs (1000 AVAX per week) are likely to boost liquidity inflows soon after the assets deployment.

Given the recent bridge to Avalanche, the price history for both assets is limited. Liquidity venues at the time of writing are limited, with USDe having only 1 pool and sUSDe availability concentrated in 2 pools. Both contracts inherit LayerZero’s OFT standard, a standard utilized by other Aave-listed assets such as USDT0.

Both sUSDe and USDe are owned by a 5/10 multisig; sensitive functions such as ownership transfer and the ability to delegate admin functions that can affect transfer rates between chains represent the main access control risk considerations.

1. Asset Fundamental Characteristics

1.1 Asset

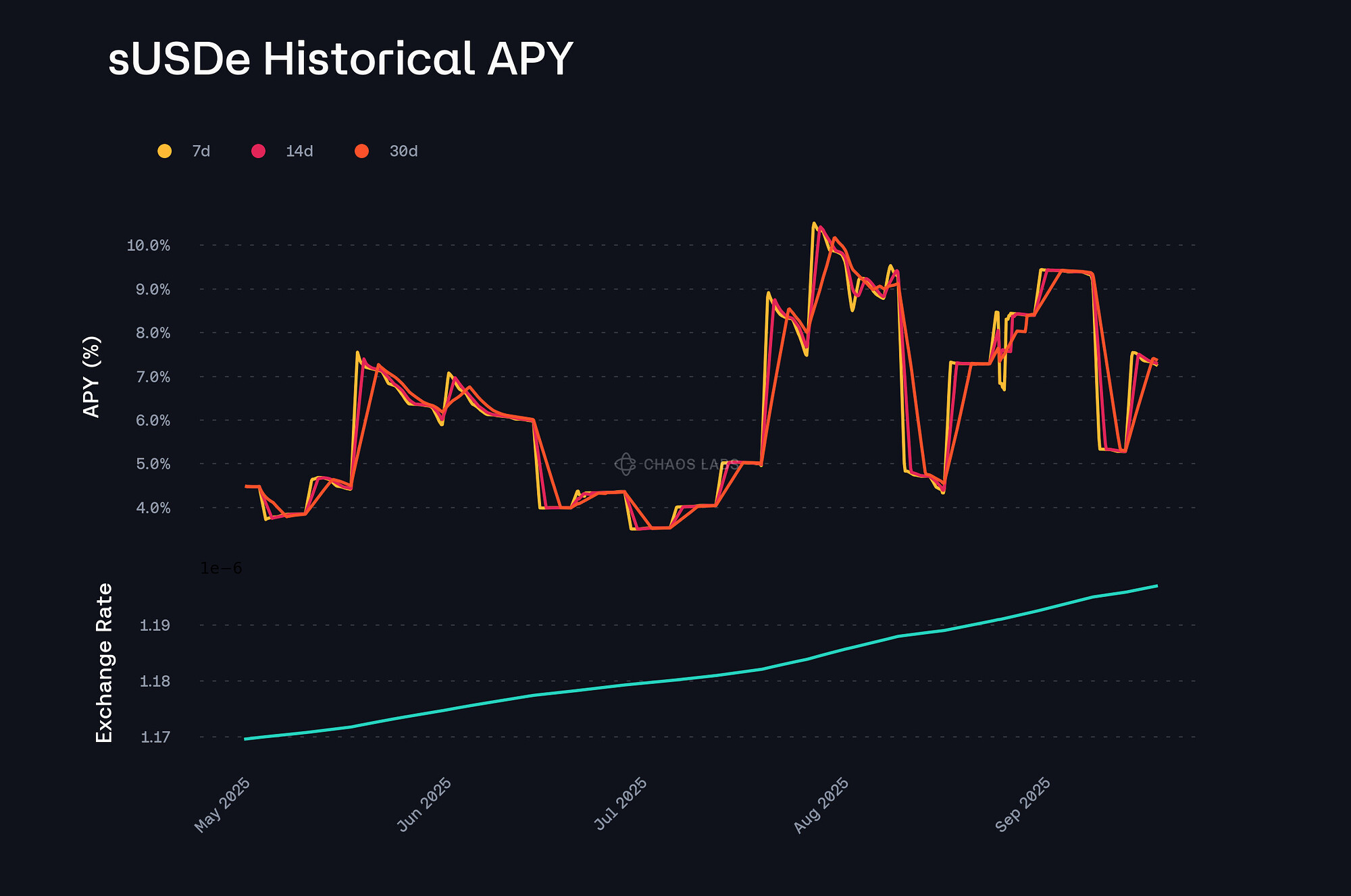

USDe is a dollar-pegged stablecoin, backed by delta-neutral positions and liquid stablecoins. sUSDe is the yield-accruing asset of staking USDe. Extensive analyses of USDe and sUSDe have been conducted in the past, with previous reports detailing their underlying design and risk considerations, including: Asset Risk Assessment of Ethena’s USDe/sUSDe, Onboarding USDe on Ethereum, and Onboarding sUSDe on Ethereum.

1.2 Architecture

sUSDe and USDe on Avalanche are bridged through LayerZero infrastructure and utilize the Omnichain Fungible Token (OFT) standard. Since OFTs are already present on Aave markets, introducing the bridging mechanism or the underlying asset poses little additional architectural risk, given their prior presence.

#1.3 Tokenomics

The OFT standard debits from the source chain and credits on the destination chain whenever an asset is bridged, maintaining canonical supply.

1.3.1 Token Holder Concentration

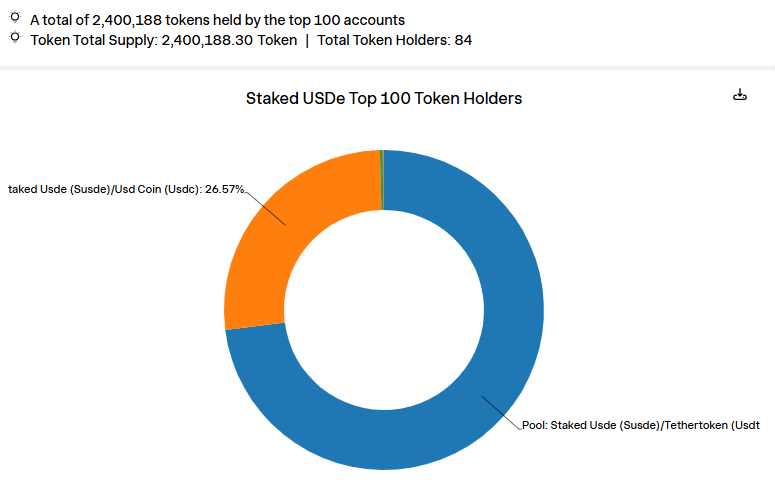

Source: sUSDe token holders, Snowtrace, September 9th, 2025

A total of 2.4M sUSDe is currently available on Avalanche; 2 accounts hold 99% of sUSDe’s supply, namely a Uniswap sUSDe/USDT pool and an LFJ sUSDe/USDC pair (formerly TraderJoe).

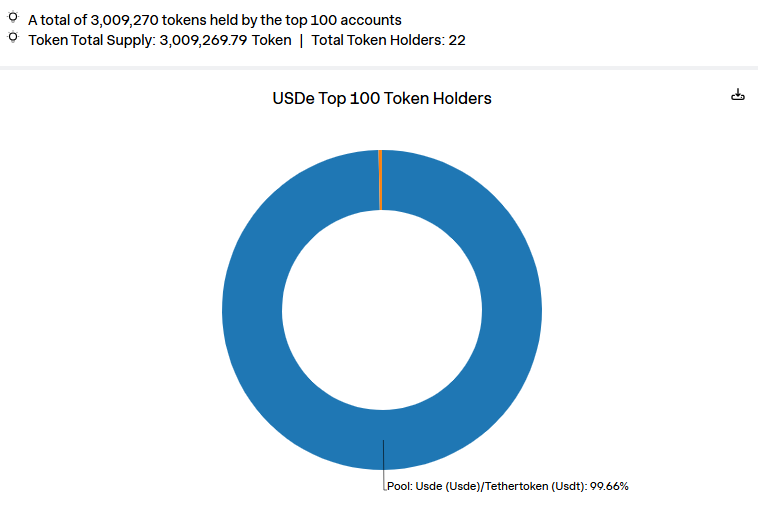

Source: USDe token holders, Snowtrace, September 9th, 2025

3M USDe has been bridged to date, with 99% held in a Uniswap USDe/USDT pool.

2. Market Risk

2.1 Liquidity

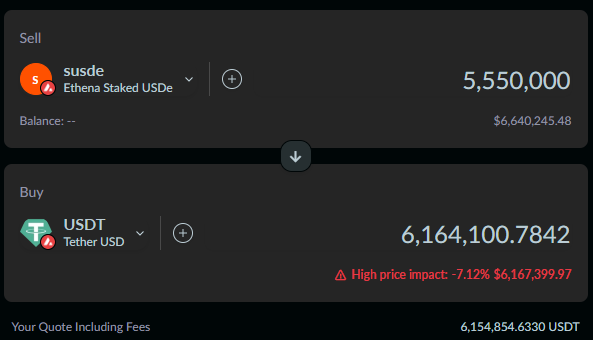

Source: sUSDe to USDT swap, Odos, September 10th, 2025

Swap Approximately 5.6M sUSDe worth $6.6M can be swapped for USDT within a 7.5% price impact (~$6.2M).

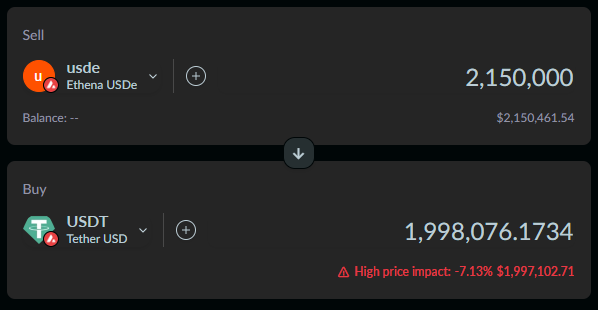

Source: USDe to USDT swap, Odos, September 10th, 2025

Approximately 2.15M sUSDe can be swapped for USDT within a 7.5% price impact.

2.1.1 Liquidity Venue Concentration

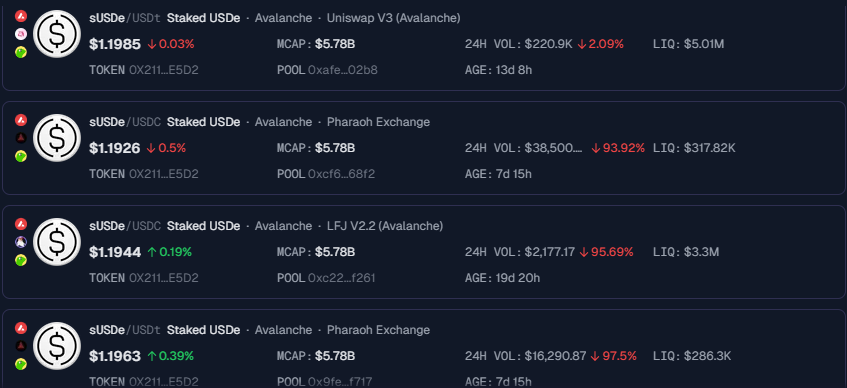

Source: sUSDe Pool Pairs, GeckoTerminal, September 10th, 2025

Notable sUSDe liquidity on Avalanche is distributed across 3 DEX venues, Uniswap (~$5M TVL in a sUSDe/USDT pool), LFJ (~$3.3M TVL in a sUSDe/USDC pool), and Pharoah (~$520K TVL across 3 pools).

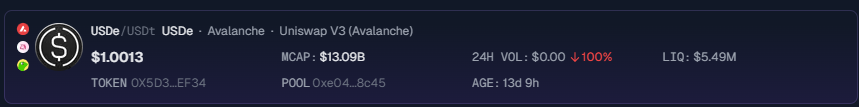

Source: USDe Pool Pair, GeckoTerminal, September 10th, 2025

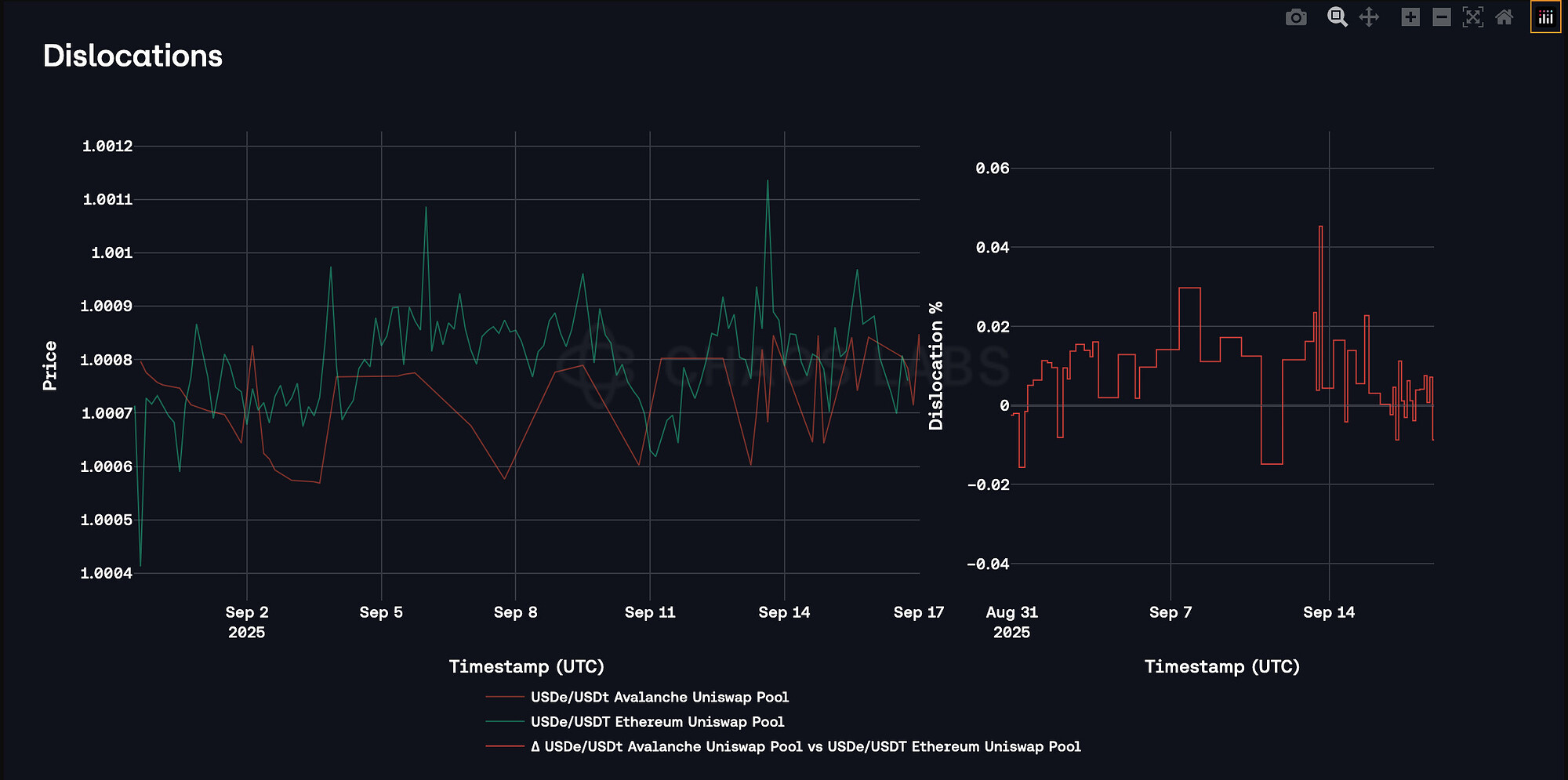

USDe liquidity is limited to a single USDe/USDT Uniswap pool, as shown by token holder distribution. This pool is relatively new, having been created on August 28th.

Liquidity is more pronounced for sUSDe relative to USDe, as shown by the swap price impact and liquidity venue options.

2.1.2 DEX LP Concentration

sUSDe LP providers in the most significant DEX pools are distributed as follows:

-

Uniswap sUSDe/USDT pool is currently limited to 1 EOA

-

LFJ sUSDe/USDC pool is currently supplied by 7 LPs with a single EOA, supplying over 60% of the pool’s TVL

Visibility for LPs for the sole USDe/USDT pool is low; however, given its recent creation, a limited number of suppliers may be present. While low LP distribution would be of concern in most instances, given both assets’ recent bridging to Avalanche, one should expect the distribution of LPs to widen as the assets grow over time.

2.2 Volatility

Source: sUSDe Price Chart Dexsceener, September 10th, 2025

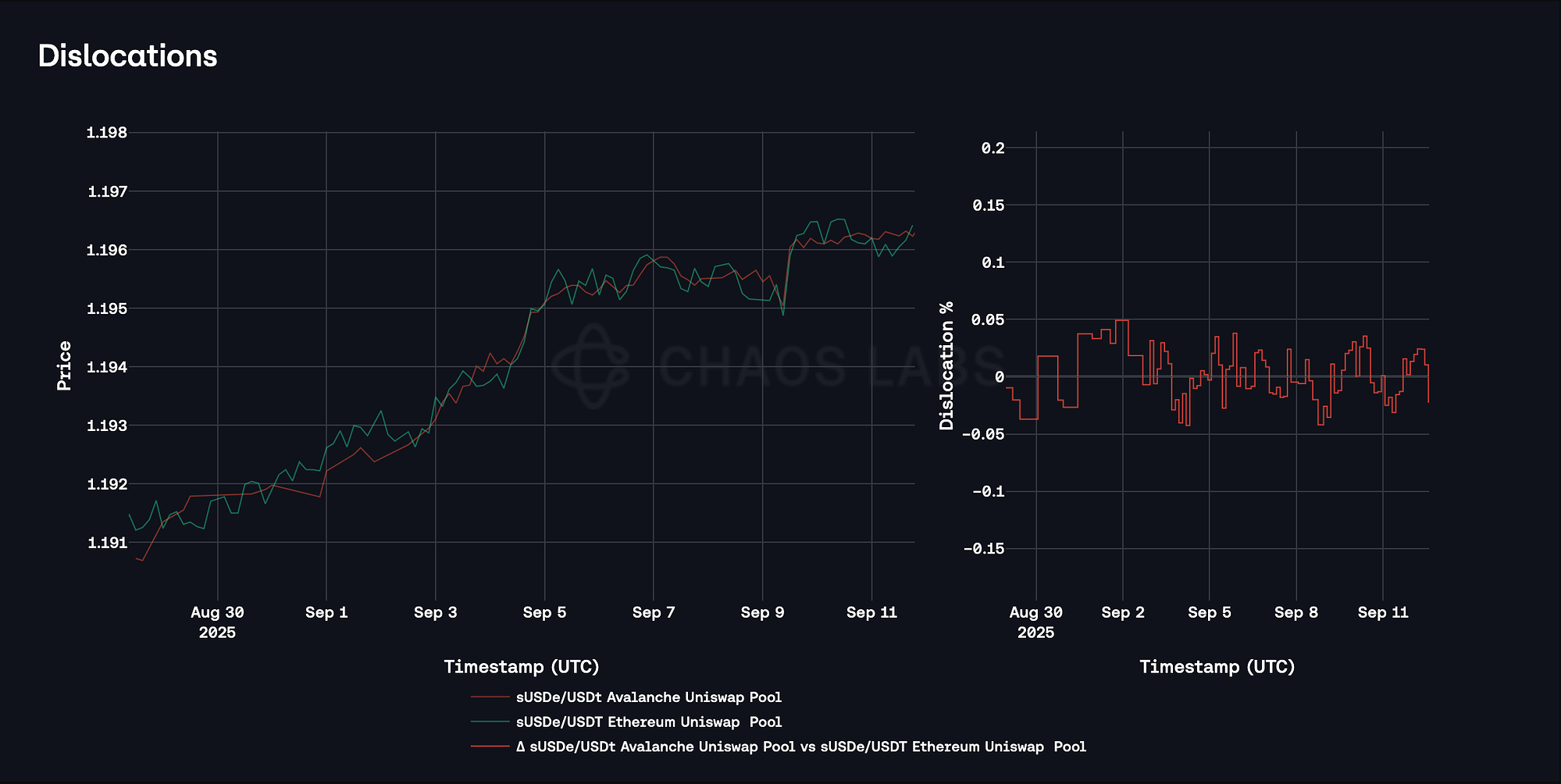

sUSDe price history on Avalanche is limited; however, it has shown incremental growth in line with its yield-bearing characteristics, with no significant negative price deviation.

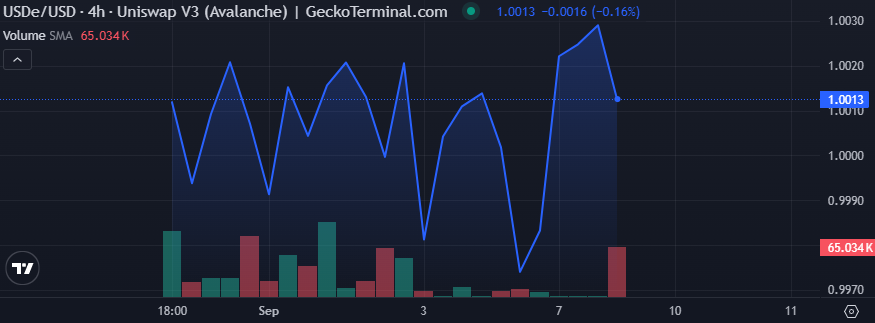

Source: USDe Price Chart, GeckoTerminal, September 10th, 2025

At the time of writing, the USDe price history is limited, with the price chart based on the recently deployed Uniswap pool.

2.3 Exchanges

USDe is listed on multiple exchanges, including Binance, Bybit, MEXC, Bitunix, and Kucoin, among others.

sUSDe is not listed on exchanges.

3. Technological Risk

3.1 Smart Contract Risk

An audit was performed on the Ethena OFT code on January 16th, 2025, by Zellic. This audit on the Layerzero codebase specific to Ethena found no issues of any level.

3.2 Bug Bounty

Layerzero and Ethena both have bug bounties, with max bounties worth $15.5M and $3M, respectively. OFT, USDe, and StakedUSDe smart contracts are explicitly stated in the program’s scopes.

4. Counterparty Risk

4.1 Access Control Risk

OFTs inherit the OpenZeppelin Ownable Standard, with sUSDe and USDe implementing a 2-step ownership process through OFTOwnable2Step. The owner of the contract has admin rights (transfer or renounce ownership) and the ability to set the address of the rateLimiter contract, which enables the owner or the rate limiter contract to modify the rate limits for transfers between chains.

Loss of ownership or a malicious rate limiter address being set would relinquish control of sUSDe and USDe contracts, risking interruption or halts of transfers back to the canonical chain or onto Avalanche.

4.2.1 Timelock Duration and Function

No timelock is present in either contract.

4.2.2 Multisig Threshold / Signer identity

sUSDe and USDe are owned by a 5/10 Safe Multisig.

Note: This assessment follows the LLR-Aave Framework, a comprehensive methodology for asset onboarding and parameterization in Aave V3. This framework is continuously updated and [u]available here[/u].

[/details]

Aave V3 Specific Parameters

Will be presented jointly with @ChaosLabs

Price feed Recommendation

We recommend the utilization of a sUSDe/USDe exchange rate feed, with underlying USDe priced using the Chainink USDT/USD feed, as used by other USDe-denominated assets within the Aave ecosystem.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.