Summary

LlamaRisk supports listing PT-sUSDe-25SEP2025 on the Aave V3 Core instance. At the time of this analysis, the asset has a long time to maturity of 103 days. Ultimately, this integration is warranted by demonstrated user demand for USDe and sUSDe-based yield products. Based on the analysis presented below and supporting PT tokens exposure research, we deem that the addition of this PT asset would result in minor incremental risk for Aave’s Core market.

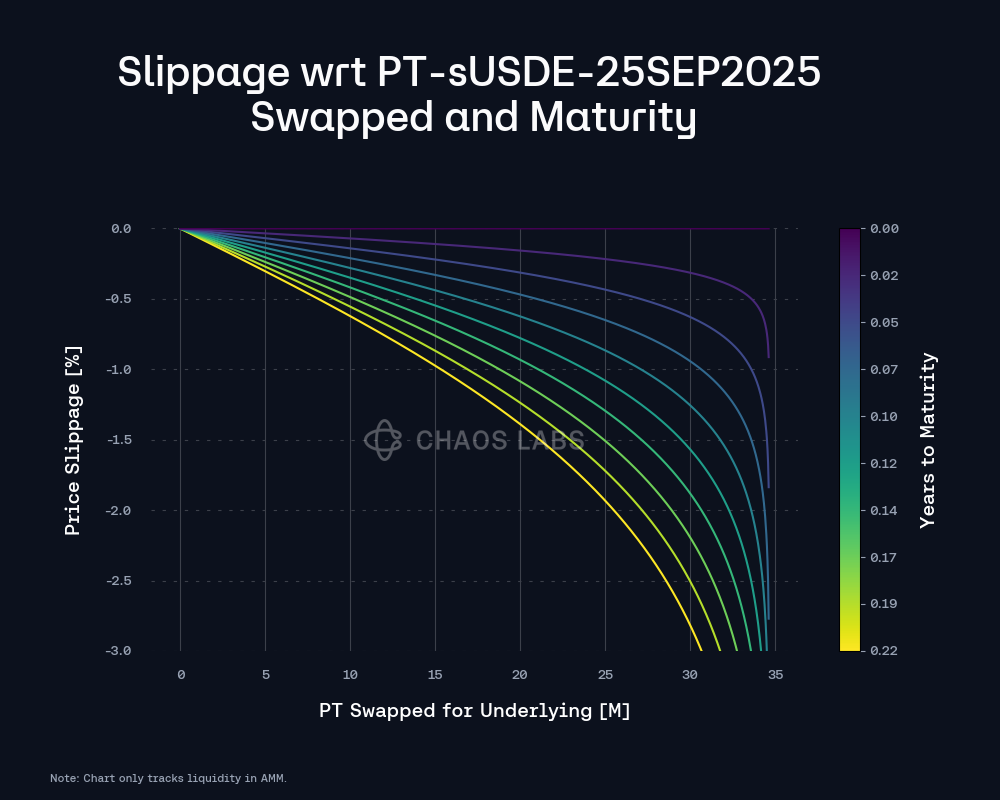

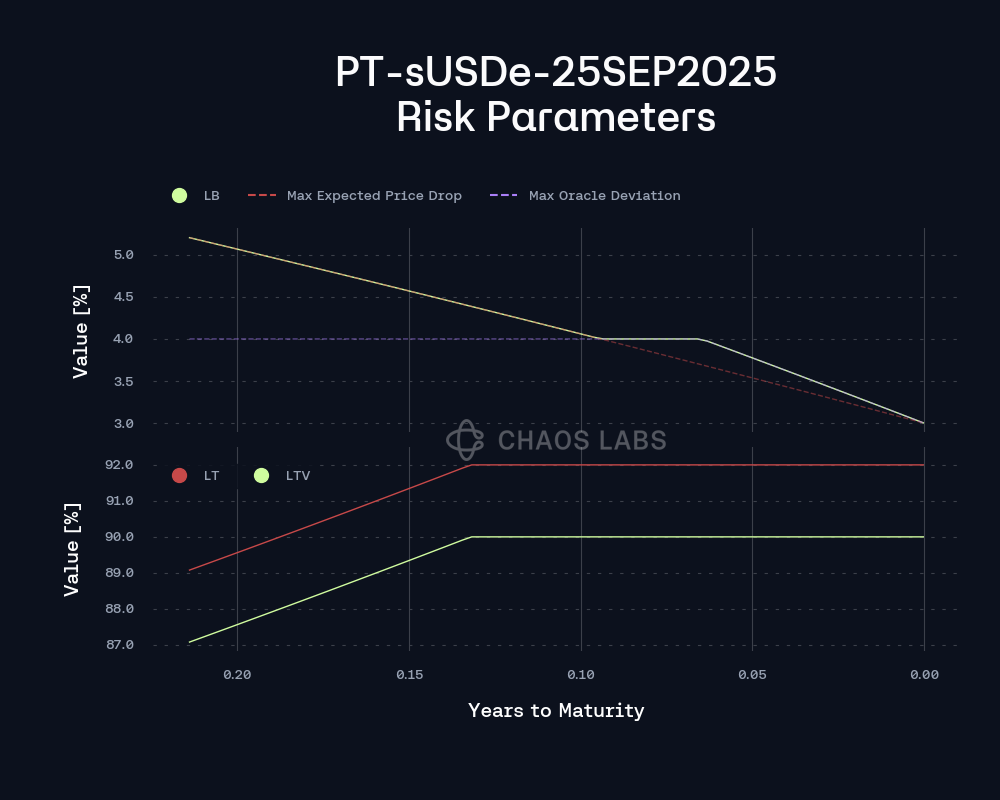

Given the longer time to maturity during onboarding, cautious management of the asset’s supply caps and discount parameters is required. The maximum discount parameter should be aligned with the liquidity yield range to account for unexpected longer-term market fluctuations. Recommended parameters will be presented jointly with @ChaosLabs.

Assessment of PT base asset: Link

Considered PT asset maturities: PT-sUSDe-25SEP2025

Asset State

Underlying Yield Source

The yield mechanism for sUSDe is derived from Ethena’s delta-neutral strategy. In this model, USDe is backed by a portfolio of stablecoins (USDT, USDC, etc.) and paired with short perpetual futures positions. This structure enables sUSDe to capture revenue from market funding rates and the yield from its underlying stablecoin collateral, which is then distributed to sUSDe holders. The yield’s sustainability is contingent on consistently positive funding rates and the robust performance of Ethena’s risk management framework. Although designed to be market-neutral, the yield can fluctuate with funding rate dynamics and the performance of the collateral assets.

Underlying utility

The primary driver for sUSDe demand is the delta-neutral yield generated by the Ethena strategy. While some secondary speculative interest is related to potential future Ethena incentives, it is not the core source of demand. sUSDe functions as a synthetic stablecoin with an embedded yield mechanism, appealing to users who want delta-neutral market exposure combined with an additional source of yield. Multiple sUSDe PT maturities on Pendle indicate sustained user interest and utility.

The sUSDe peg’s stability is subject to prevailing market conditions. A 7-day cooldown period for unstaking sUSDe means that during periods of high market stress, secondary markets may experience discounts, potentially impacting a user’s ability to realize the expected yield at maturity. Historically, significant de-pegs in the sUSDe secondary market have been short-lived, with arbitrage opportunities quickly restoring the peg.

Source: LlamaRisk, June 13, 2025

In recent months, the sUSDe secondary market price has shown a resilient peg to the sUSDe/USDe internal exchange rate, typically trading at a minor discount of 10-40 bps, though larger deviations have occurred during market volatility. More aggressive temporary de-pegs have nonetheless been observed within a longer timeframe, prompting the need for a larger asset liquidation bonus parameter.

Total Supply

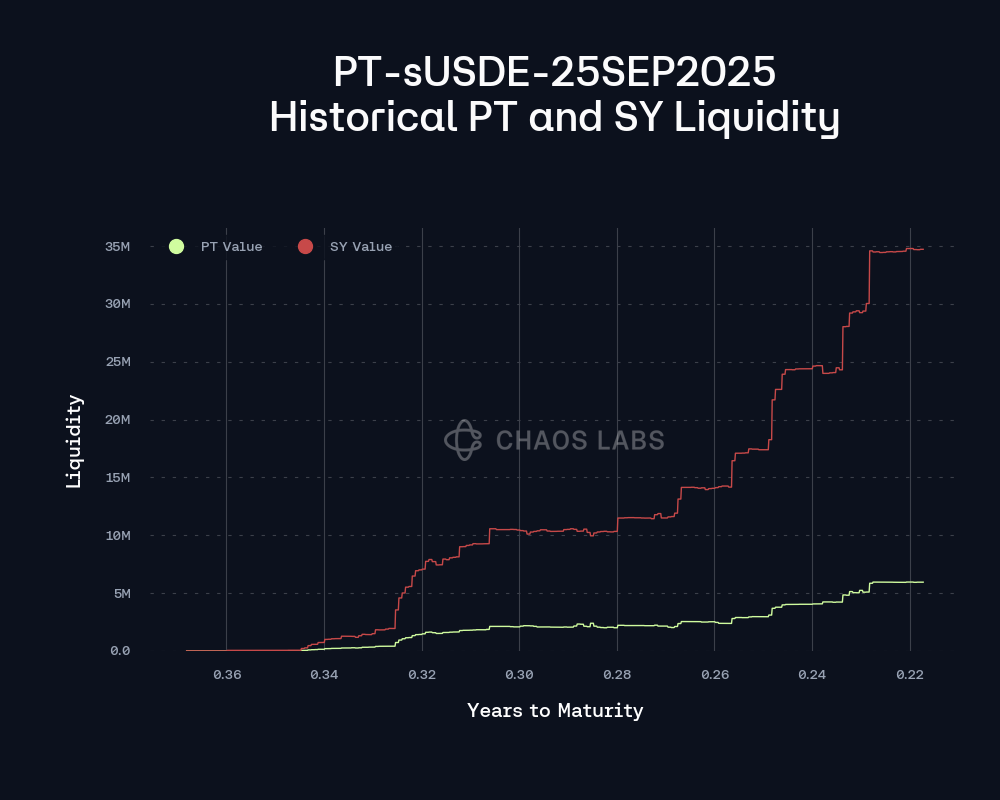

This specific maturity pool was launched on June 6th, 2025, and with over 3 months remaining until maturity, it has already attracted significant liquidity. The SY-sUSDe (Standardized Yield token) supply has grown to $1.6B, most of which stems from the July PT maturity pool. The available liquidity in the PT-sUSDe-25SEP2025 pool is now at 12M. With the total PT sUSDe supply of 15M tokens, the current supply-to-liquidity ratio remains large, although it is expected to decrease sharply as Aave integrates this asset into the Core market.

Source: LlamaRisk, June 13, 2025

Holders

An analysis of the PT-sUSDe-25-Sep-2025 holder base reveals a diversified distribution. The largest single holder is 0x5555551f.., controlling 16.9% of the total supply. The second-largest holder is the Pendle liquidity pool, which accounts for 13.4% of the PT supply.

Source: Etherscan, June 13, 2025

Market State

As noted, the sUSDe pool has an estimated liquidity of 12M. Of this total, 84.08% (10.34M) is held as SY sUSDe, with the remaining 15.92% (1.96M) held as PT sUSDe tokens.

Source: Pendle, June 13, 2025

The market’s order book reflects healthy trading activity. The bid-ask spread on the implied yield is approximately 0.5%. Liquidity on the bid side appears somewhat thinner, with a total of 3.4M PT tokens available.

Source: Pendle, June 13, 2025

The PT-sUSDe-25-Sep-2025 pool has the following parameters:

| Parameter |

Value |

| Liquidity Yield Range |

5% - 29% |

| Fee Tier |

0.1015% |

| Input Tokens |

USDe, sUSDe |

| Output Tokens |

sUSDe |

| Reward Tokens |

PENDLE |

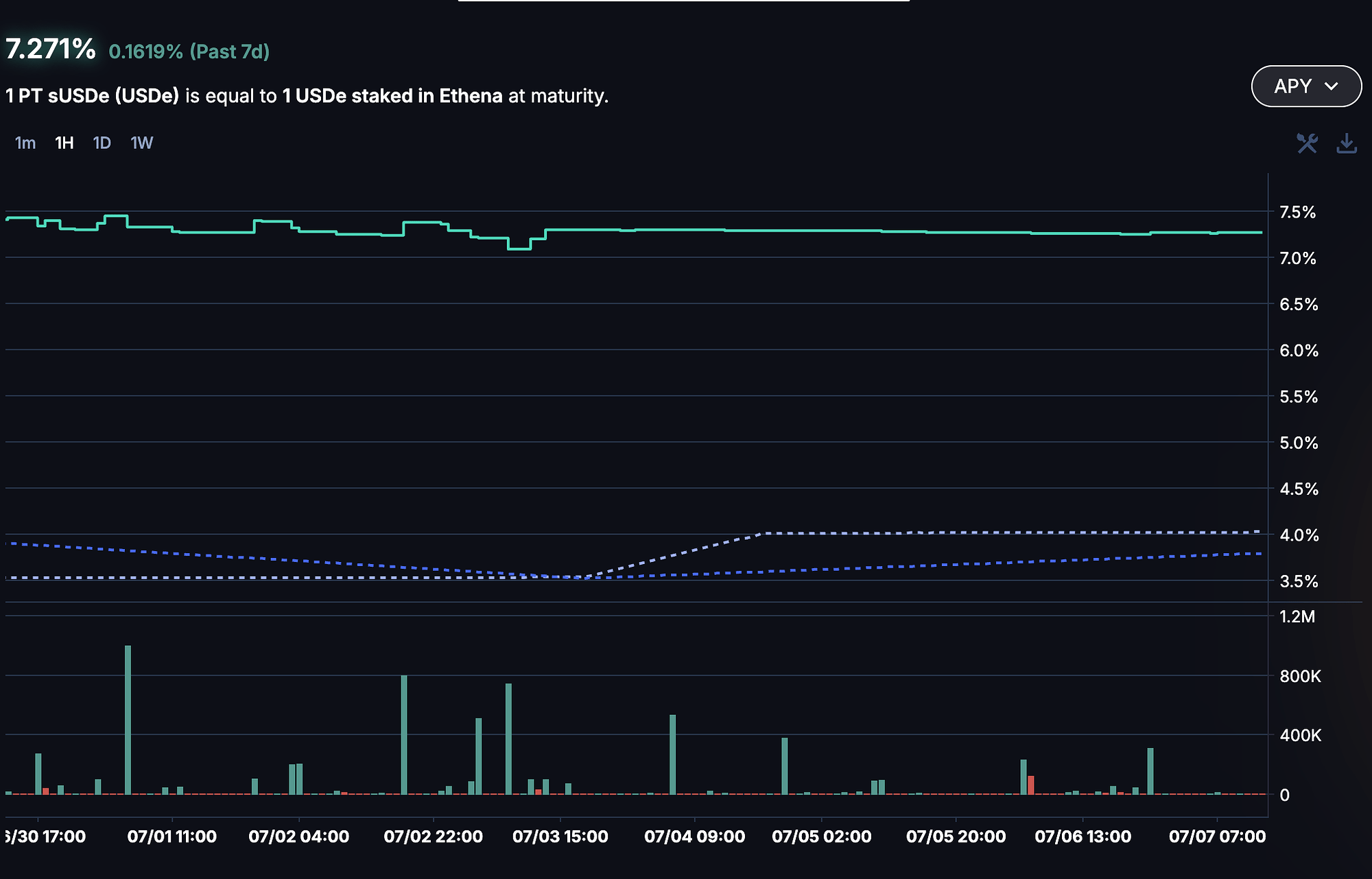

Price and Yield

At the time of this review, 103 days remain until the pool’s maturity. The implied yield for the PT is 7.8% APY, with the PT priced at 0.978 sUSDe. Both the implied PT and LP yields have shown stability since the pool’s launch, indicating consistent user interest and stable yield expectations.

Source: LlamaRisk, June 13, 2025

Maturities

In addition to the PT-sUSDe-25-Sep-2025 pool, other maturities are available on Pendle, including pools with shorter durations. The availability of a range of maturities across different chains and with varying liquidity levels signals strong and persistent user interest in the product, which is expected to remain stable and currently represents $2B of attracted TVL.

Source: Pendle, June 13, 2025

Integrated Venues

PT sUSDe-25-Sep-2025 is not yet integrated into other lending venues due to the recency of the pool and, therefore, represents a significant first-mover advantage to Aave.

Recommendations

We will present the risk parameter recommendations for the PT-sUSDe-25SEP2025 listing together with @ChaosLabs, which will follow up shortly.

Price Feed Recommendation

We recommend using the exchange rate of sUSDe/USDe with the PT linear discount rate Oracle implementation. The price of USDe will be derived from the USDT/USD feed, which is consistent with the pricing of other USDe-denominated assets within the Aave ecosystem.

Furthermore, we recommend implementing a CAPO on the oracle to mitigate the risk of upward price manipulation of the underlying exchange rate.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk serves as Ethena’s Risk Committee member and an independent attestor of Ethena’s PoR solution. LlamaRisk did not receive compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.