Overview

In alignment with our Principal Token Risk Oracle framework, outlined in detail here, we present our risk parameter recommendations for the proposed listing of PT-USDe-25SEP2025.

Leveraging the dynamic linear discount rate oracle implementation, we also provide our recommended values for initialDiscountRatePerYear and maxDiscountRatePerYear, derived from the extended methodology detailed here.

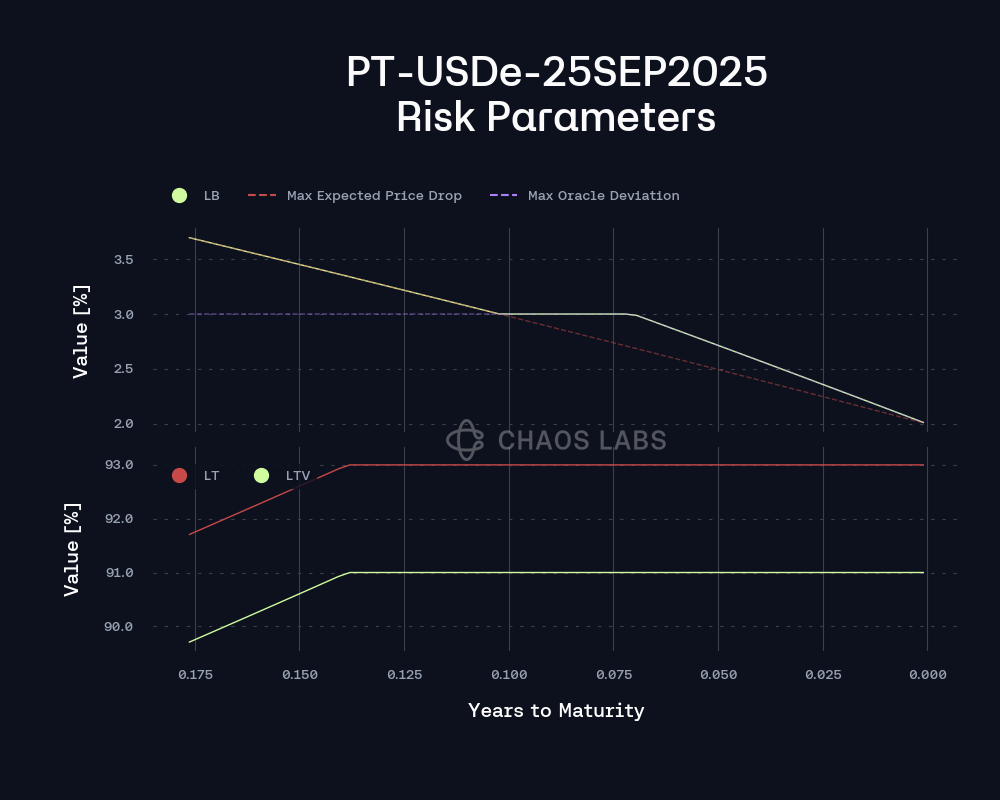

Risk Oracle Parameter Evolution

Stablecoin E-mode

Through our rigorous quantification of the algorithm, we find that the integration risk decays as the PT approaches maturity. This justifies the use of progressively less conservative risk parameters over time. Taking into account the underlying configuration of USDe E-mode within Aave, we outline the projected evolution of the LT, LTV and LB, with the initial parameterization approximately as follows:

LTV: 90.3%

LT: 92.3%

LB: 3.5%

The collateral parameters will continue to become more permissive, evolving in accordance with the plot above. This set of parameters explicitly refers to E-mode, and we recommend setting non-E Mode parameters such that the asset is effectively prohibited from borrowing uncorrelated assets.

The underlying configuration will be derived in accordance with a minimum liquidation bonus of 2% and a maximum liquidation threshold of 93%, per our previous listings of related PT assets.

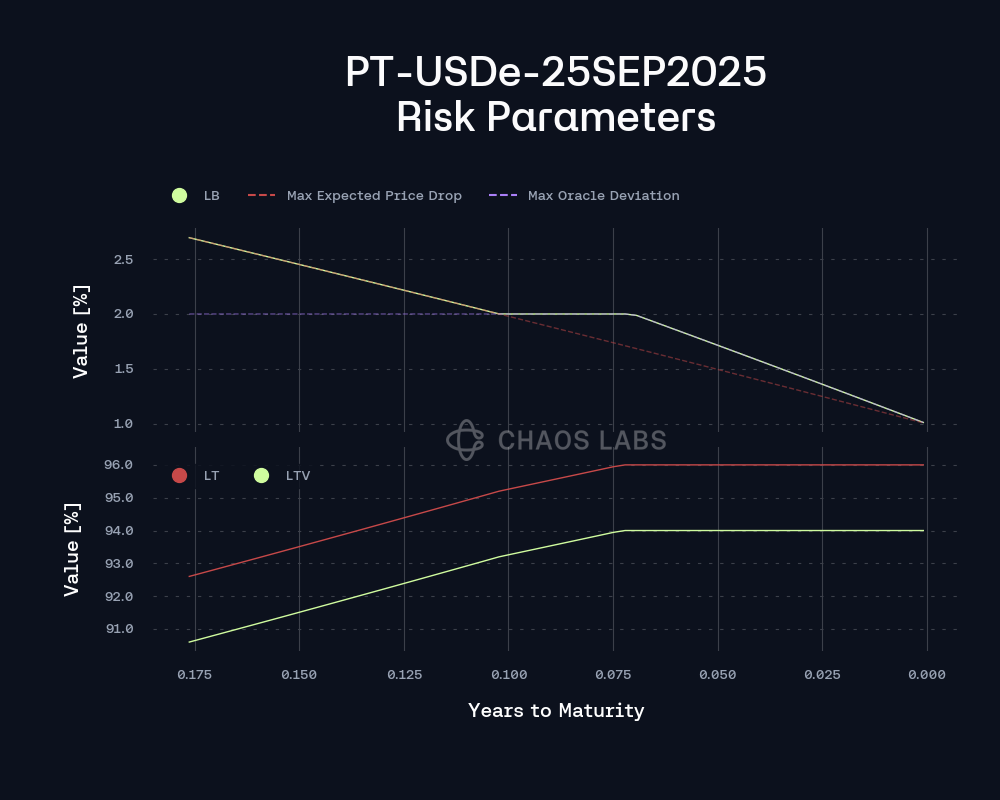

USDe E-mode

Additionally, we propose the introduction of a USDe E-Mode for the asset. Given that both the PT token’s underlying asset (USDe) and the debt asset are the same, the parameters need not be constrained by typical underlying asset considerations. Instead, the parameterization should be driven by the Pendle AMM’s liquidity dynamics, aligning more closely with the PT’s inherent pricing structure. We outline the projected evolution of the LT, LTV, and LB, with the initial parameterization approximately as follows:

LTV: 91.2%

LT: 93.2%

LB: 2.5%

This approach is justified by the correlation between the PT’s underlying and the debt asset, as both are effectively anchored to the same stable asset, USDe. As a result, this E-mode would allow for more efficient capital utilization.

The underlying configuration is based upon a minimum liquidation bonus of 1% and a maximum liquidation threshold of 96%. This configuration aligns with our broader Principal Token Risk Oracle framework, which emphasizes parameter flexibility for pairs where the PT’s underlying asset is also the debt asset, ultimately supporting deeper liquidity and optimized capital efficiency.

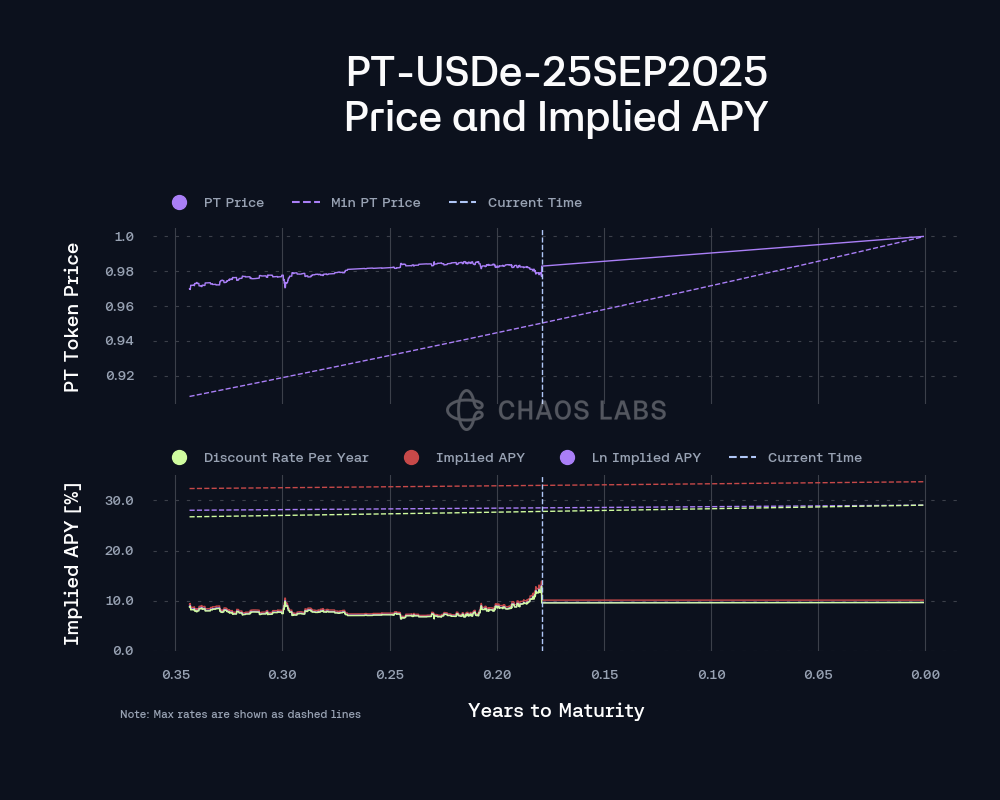

Initial Discount Rate Per Year and Maximum Discount Rate Per Year

Based on historical observed data and the pricing configuration of the market, our initial recommendations for the discountRatePerYear and maxDiscountRatePerYear are as follows:

Initial discountRatePerYear: 9.65%

maxDiscountRatePerYear: 29.1%

If pricing dynamics change until its listing, such that discountRatePerYear will require a refresh, we will institute such a change accordingly upon listing.

Supply Cap

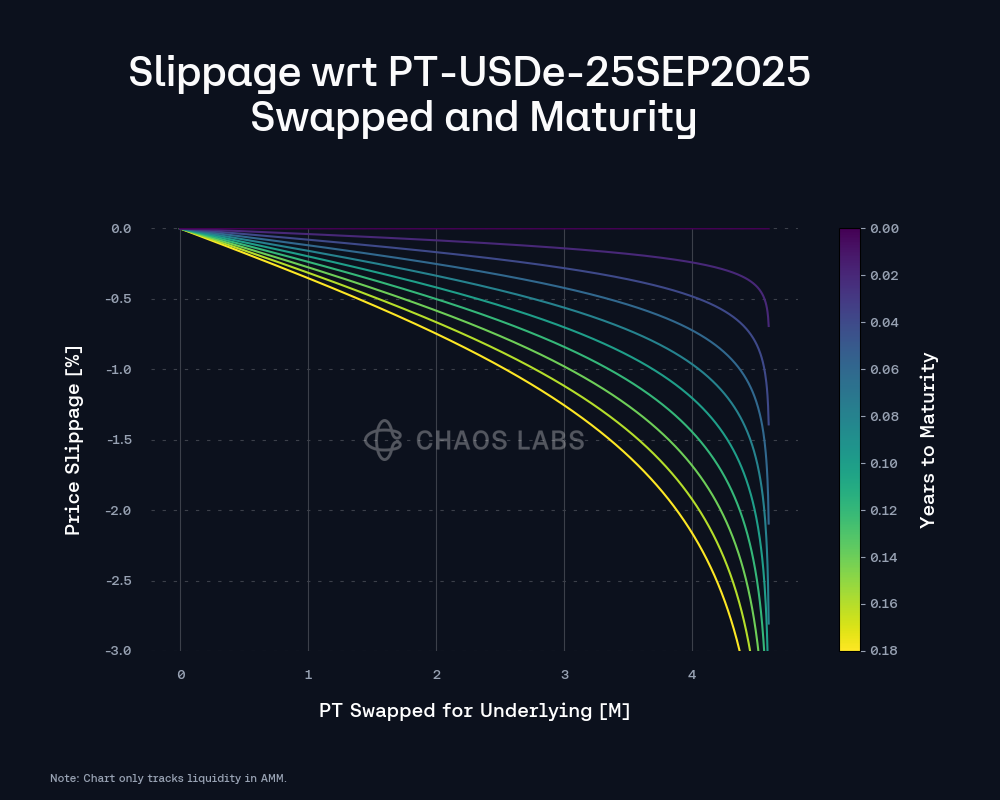

In the somewhat unlikely case of liquidations of this asset, liquidators would swap through Pendle’s AMM or order book. Crucially, PT-USDe’s on-chain liquidity has improved significantly in recent days, with its SY liquidity more than doubling to over 5M. Additionally, the PT liquidity grew to almost 3M in this timeframe.

The plot below represents the amount of liquidity available under 3% slippage as the market approaches expiry, given the current liquidity distribution in the AMM. As the market matures and moves closer to expiry, the slippage associated with swapping PT becomes less extreme.

At the current time to maturity, this liquidity supports trades of up to 4.5M PT tokens with less than 3% slippage.

Finally, there is somewhat limited buy liquidity on the order book as of this writing, with just under 1M of interest up to 15% implied yield.

Migration of Existing PTs

In order to support a seamless migration between PT-USDe and PT-eUSDe assets currently listed on Aave, with an expiry prior to the September expiration, we recommend including PT-USDe-31JUL2025, PT-eUSDe-14AUG2025 and USDe within the newly created E-Modes.

Underlying Oracle

As the underlying PT-USDe is anchored to USDe, we recommend leveraging the Capped USDT/USD feed as the underlying ASSET_TO_USD_AGGREGATOR within the PT-USDe PendlePriceCapAdapter.

Specification

| Parameter | Value |

|---|---|

| Asset | PT-USDe-25SEP2025 |

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 50,000,000 |

| Borrow Cap | - |

| Debt Ceiling | - |

| LTV | 0.05% |

| LT | 0.1% |

| Liquidation Penalty | 7.50% |

| Liquidation Protocol Fee | 10.00% |

PT-USDe Stablecoins E-mode

| Asset | PT-USDe-25SEP2025 | PT-eUSDE-14AUG2025 | PT-USDe-31JUL2025 | USDC | USDT | USDS | USDe |

|---|---|---|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | No | No | No | Yes |

| Borrowable | No | No | No | Yes | Yes | Yes | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | Subject to Risk Oracle |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | Subject to Risk Oracle |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | Subject to Risk Oracle |

PT-USDe USDe E-mode

| Asset | PT-USDe-25SEP2025 | PT-eUSDE-14AUG2025 | PT-USDe-31JUL2025 | USDe |

|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | Yes |

| Borrowable | No | No | No | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle |

Initial E-mode Risk Oracle

| Parameter | Value | Value |

|---|---|---|

| E-Mode | Stablecoins | USDe |

| LTV | 90.3% | 91.2% |

| LT | 92.3% | 93.2% |

| LB | 3.5% | 2.5% |

Linear Discount Rate Oracle

| Parameter | Value |

|---|---|

| discountRatePerYear (Initial) | 9.65% |

| maxDiscountRatePerYear | 29.1% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0