LlamaRisk supports the proposed parameter changes, judging that they do not introduce incremental risks to the Aave protocol and will help stabilize the markets after the incentives are enacted.

The proposed increase to the Slope1 parameter is an important preventative measure. As various incentive campaigns target borrow rates, this adjustment will help ensure that market utilization does not exceed its optimal point. This will help preserve sufficient liquidity, allowing the markets to function in a more balanced setup.

Proposed Slope1 Parameter Updates

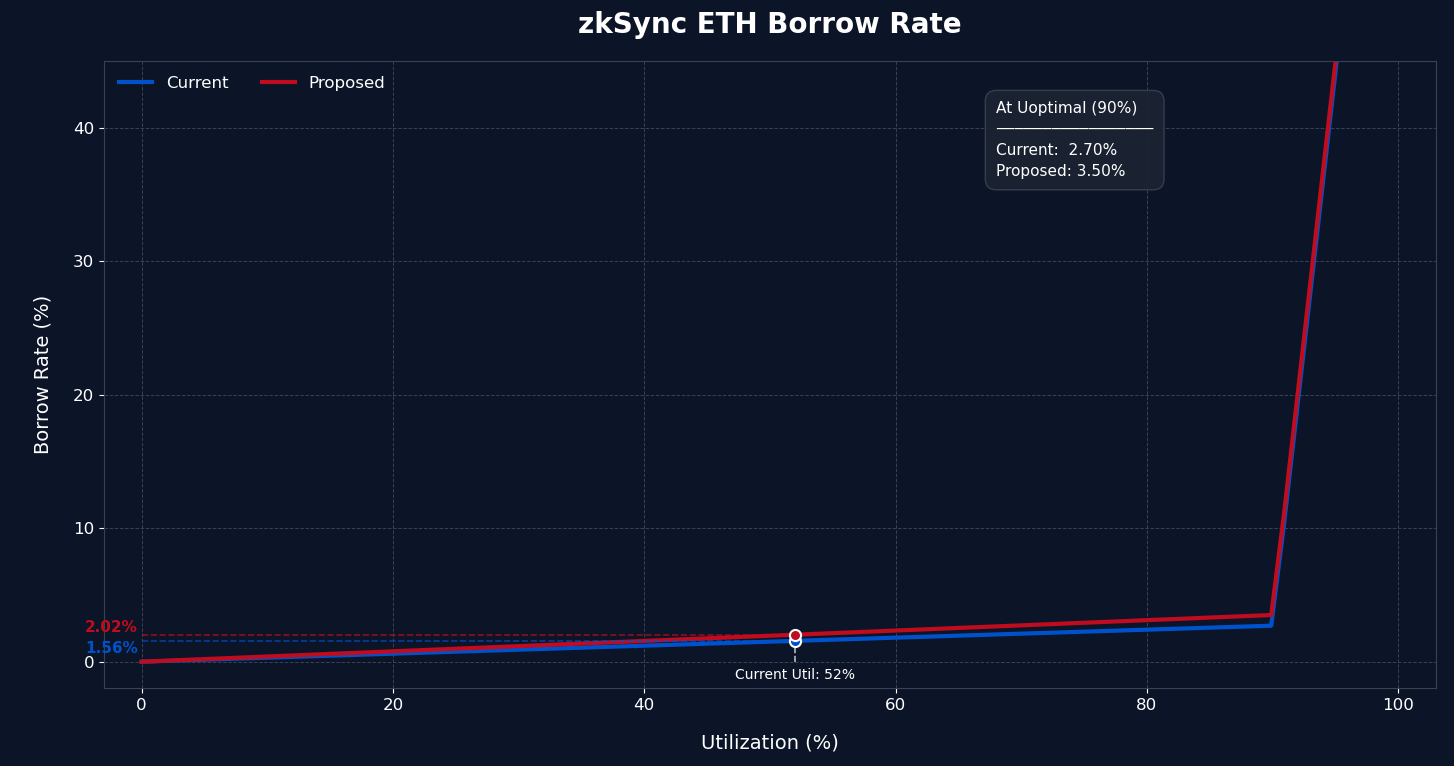

The proposed change for ETH on zkSync increases the borrow rate at 90% utilization from 2.70% to 3.50%, an absolute increase of 0.80 percentage points. With a current utilization of 52%, the borrow rate would increase from 1.56% to 2.02%. This represents an immediate absolute increase of 0.46 percentage points for current borrowers.

Source: LlamaRisk, 5 August 2025

For USDC on zkSync, the borrow rate at the optimal utilization point is set to increase from 5.50% to 7.50%, an absolute increase of 2.0 percentage points. This market currently has a high utilization of 82%. The rate would rise from 5.06% to 6.91% at this level. This is an absolute increase of 1.85 percentage points at the current utilization.

Source: LlamaRisk, 5 August 2025

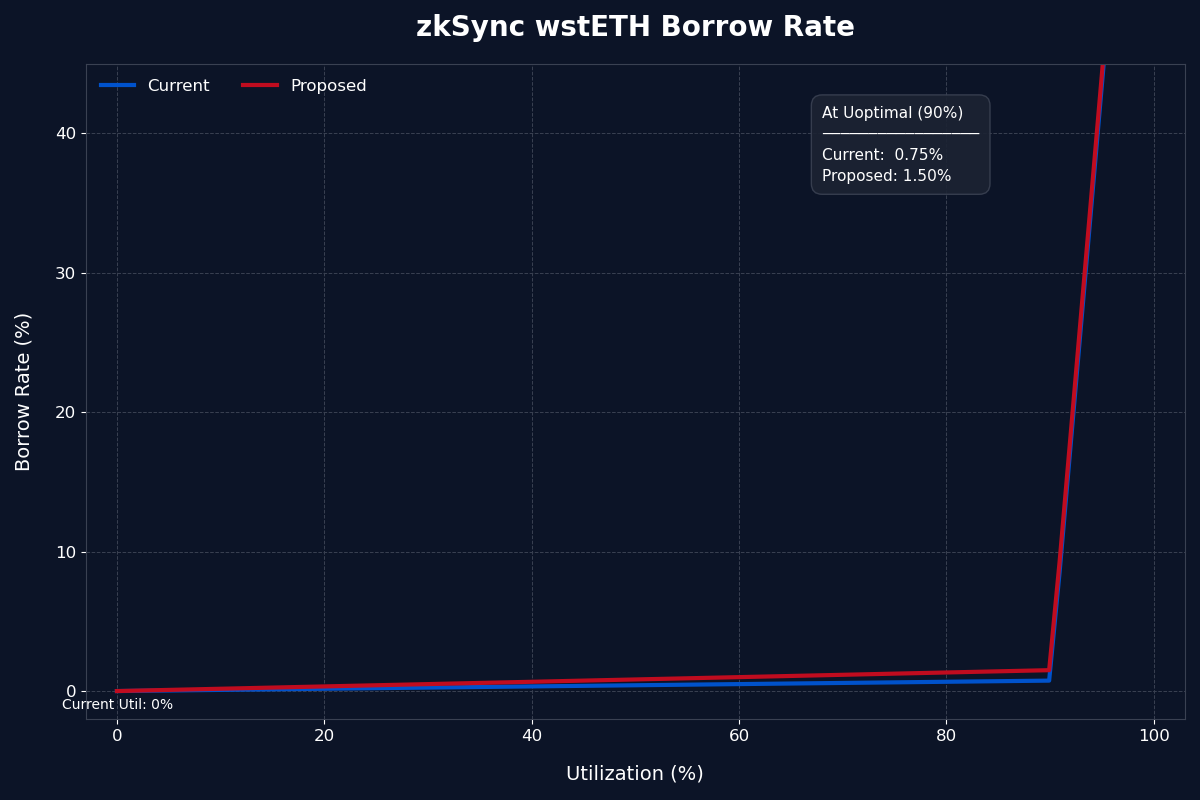

The borrow rate for wstETH on zkSync at 90% utilization will double, moving from 0.75% to 1.50%. However, the current utilization for this asset is 0%. The borrow rate is 0% at this level and will remain 0% after the parameter change. Therefore, there is no immediate impact on the borrow rate.

Source: LlamaRisk, 5 August 2025

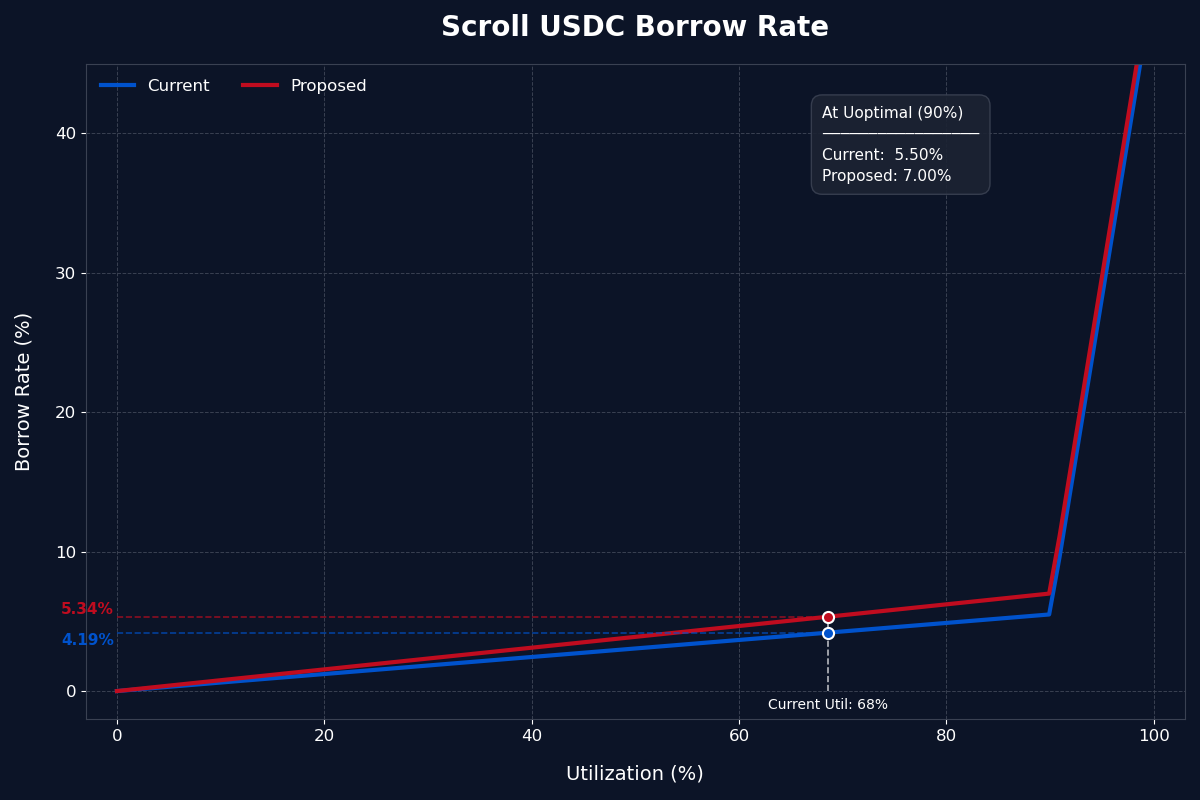

For USDC on Scroll, the proposal raises the borrow rate at 90% utilization from 5.50% to 7.00%. The current utilization for this market is 68%. The borrow rate will increase at this level from 4.19% to 5.34%. This change amounts to an absolute increase of 1.15 percentage points at current utilization.

Source: LlamaRisk, 5 August 2025

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk did not receive compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.