Summary

A proposal to increase stablecoin Interest Rate parameters across all Aave deployments.

Motivation

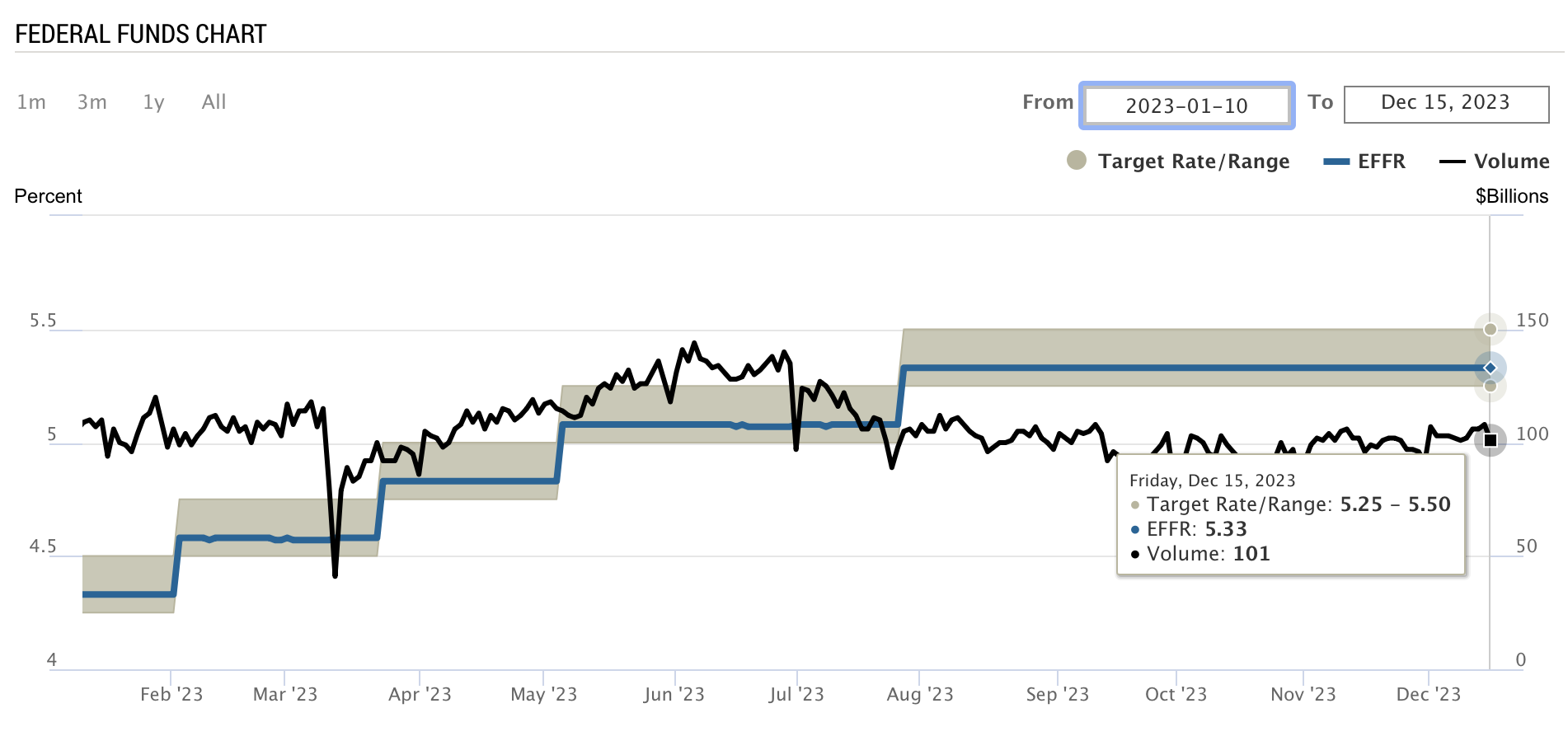

Following the implementation of AIP-375 to increase stablecoin borrow rates across Aave V2 and V3 deployments, we continue to observe volatility in borrow rates across Aave deployments. As we highlighted in the recent proposal, we recommend a more aggressive increase of the Slope1 parameter to stabilize borrows under the UOptimal point.

Previous IR Curve modification impact analysis

Stablecoins Total Supply and Borrow: The data from the charts reflects an overall increase in both the supply and borrowing of stablecoins on the Ethereum V3 platform. From November 25th to December 12th we observed the following increases in supply and borrow across USDC, USDT, and DAI:

| Asset | Total Supply (M) - Nov 25 | Total Supply (M) - Dec 12 | Total Supply Increase (M) | Supply Increase (%) | Total Borrow (M) - Nov 25 | Total Borrow (M) - Dec 12 | Total Borrow Increase (M) | Borrow Increase (%) |

|---|---|---|---|---|---|---|---|---|

| USDC | 423 | 445 | 22 | 5.20% | 378 | 406 | 28 | 7.40% |

| USDT | 347 | 366 | 19 | 5.40% | 265 | 332 | 67 | 25.20% |

| DAI | 78 | 86 | 8 | 10.20% | 70 | 79 | 9 | 12.80% |

| Total | 848 | 897 | 49 | 20.80% | 713 | 817 | 104 | 45.40% |

We’ve observed an overall $49M increase (20.8%) in supply across USDC, USDT and DAI on Ethereum V3, and a $104M increase (45.4%) in borrows.

This general uptrend suggests that the AIP’s changes were well received, with higher utilization for the assets following the parameter updates.

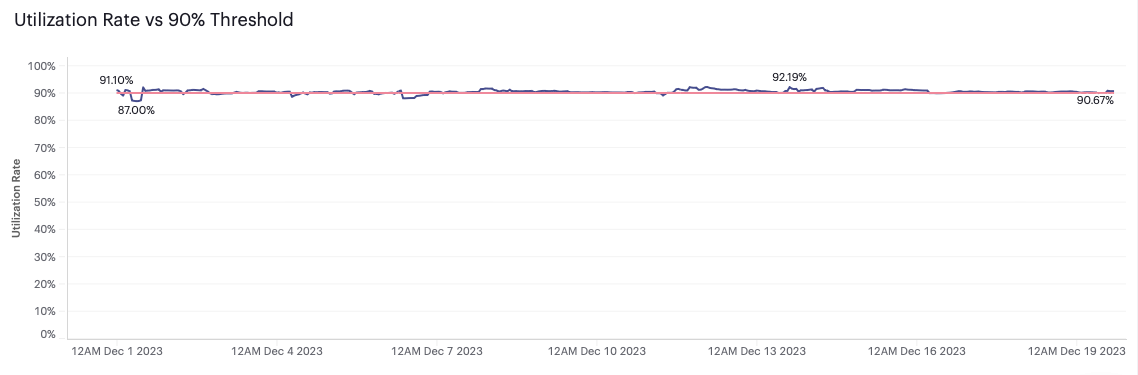

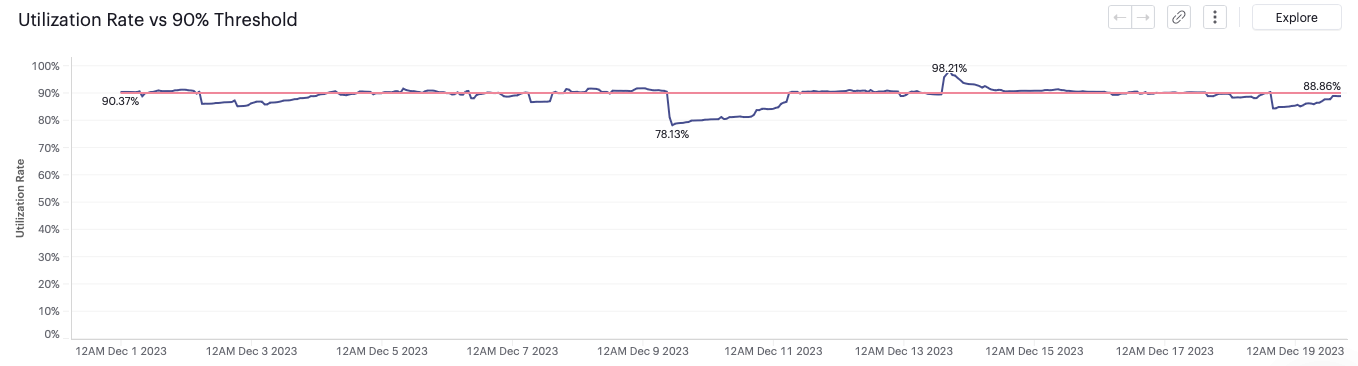

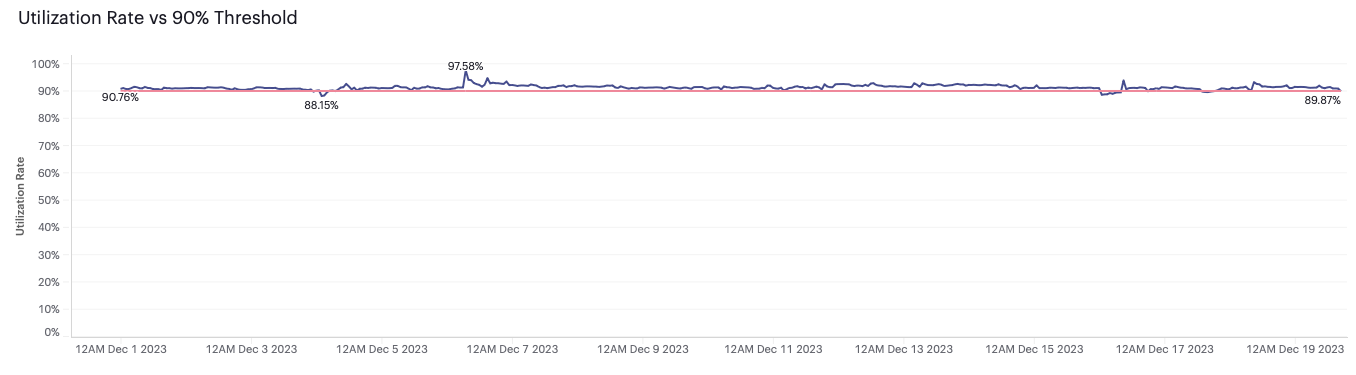

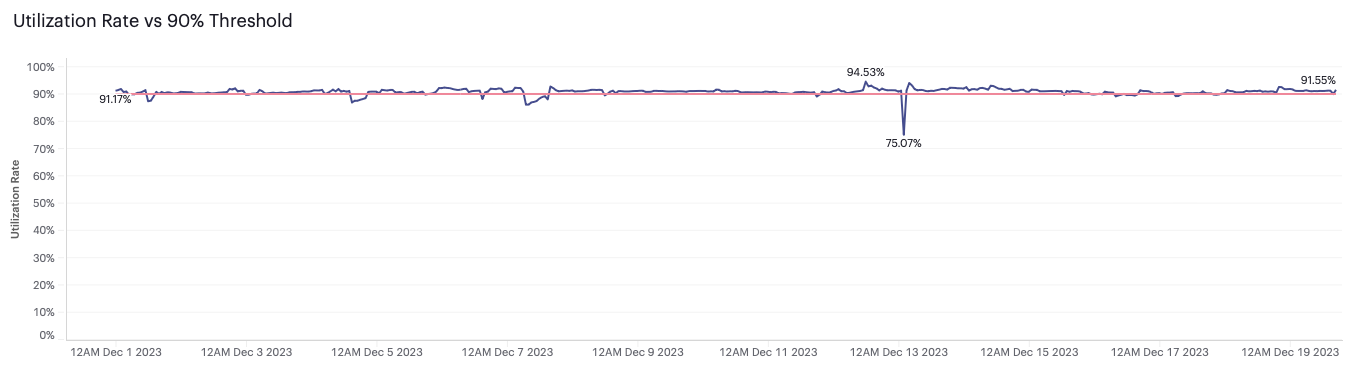

Utilization Rate Analysis: Our continuous monitoring of the utilization rates post AIP-375, setting Slope1 at 5%, shows sustained demand. When looking at the percentage of times in which utilization was above UOptimal, we can see that the AIP-375 increase didn’t stabilize the utilization at or below the UOptimal. This could also be due to changing market dynamics with the recent increase in crypto asset prices.

During two distinct 16-day intervals, we observed the following:

- Pre-AIP-375 Period (11.09.23 - 11.25.23)

- Post-AIP-375 Period (11.25.23 - 12.12.23)

Percentage of Time of Utilization Above UOptimal:

| Asset | Before AIP-375 | After AIP-375 |

|---|---|---|

| USDC | 69.53% | 77.34% |

| USDT | 63.02% | 33.09% |

| DAI | 48.70% | 63.24% |

The data demonstrates strong borrowing activity persisting after the interest rate curve adjustments, supporting a move towards higher interest rates. This pattern reflects a consistent, resilient demand among the top stablecoins on Ethereum V3.

Borrow Rate Analysis: After executing the previous proposal, we continue to observe fluctuations in borrow rates, suggesting the previous increase did not achieve the anticipated stabilization. This situation suggests that further adjustments of the interest rate parameters are necessary to achieve more consistent and stable borrowing rates.

Recommendation

Adjust Slope1 of stablecoins to 6%

The analysis indicates a necessity for further refinement of stablecoin interest rates, to achieve a more predictable and stable borrowing rate with an equilibrium utilization under the UOptimal point.

Therefore, we propose increasing Slope1 to 6% for stablecoins across all Aave deployments, in this iteration. Following this increase, we will continue monitoring the usage and equilibrium rate and make additional recommendations as necessary.

Specification

| Market | Asset | Current Slope1 | Rec Slope1 |

|---|---|---|---|

| Ethereum V2 | USDC | 5% | 6% |

| Ethereum V2 | USDT | 5% | 6% |

| Ethereum V2 | DAI | 5% | 6% |

| Ethereum V2 | FRAX | 5% | 6% |

| Ethereum V2 | sUSD | 5% | 6% |

| Ethereum V2 | GUSD | 5% | 6% |

| Ethereum V2 | LUSD | 5% | 6% |

| Ethereum V2 | USDP | 5% | 6% |

| Ethereum V3 | USDC | 5% | 6% |

| Ethereum V3 | USDT | 5% | 6% |

| Ethereum V3 | DAI | 5% | 6% |

| Ethereum V3 | FRAX | 5% | 6% |

| Ethereum V3 | LUSD | 5% | 6% |

| Avalanche V2 | USDC | 5% | 6% |

| Avalanche V2 | USDT | 5% | 6% |

| Avalanche V2 | DAI | 5% | 6% |

| Avalanche V3 | USDC | 5% | 6% |

| Avalanche V3 | USDT | 5% | 6% |

| Avalanche V3 | DAI | 5% | 6% |

| Avalanche V3 | MAI | 5% | 6% |

| Avalanche V3 | FRAX | 5% | 6% |

| Polygon V2 | USDC | 5% | 6% |

| Polygon V2 | USDT | 5% | 6% |

| Polygon V2 | DAI | 5% | 6% |

| Polygon V3 | USDC.e | 7% | No Change |

| Polygon V3 | USDC | 5% | 6% |

| Polygon V3 | USDT | 5% | 6% |

| Polygon V3 | DAI | 5% | 6% |

| Polygon V3 | MAI | 5% | 6% |

| Optimism V3 | USDC.e | 7% | No Change |

| Optimism V3 | USDC | 5% | 6% |

| Optimism V3 | USDT | 5% | 6% |

| Optimism V3 | DAI | 5% | 6% |

| Optimism V3 | sUSD | 5% | 6% |

| Optimism V3 | LUSD | 5% | 6% |

| Optimism V3 | MAI | 5% | 6% |

| Arbitrum V3 | USDC | 5% | 6% |

| Arbitrum V3 | USDC.e | 7% | No Change |

| Arbitrum V3 | USDT | 5% | 6% |

| Arbitrum V3 | DAI | 5% | 6% |

| Arbitrum V3 | LUSD | 5% | 6% |

| Arbitrum V3 | FRAX | 5% | 6% |

| Arbitrum V3 | MAI | 5% | 6% |

| Base V3 | USDC | 5% | 6% |

| Base V3 | USDbC | 7% | No Change |

| Metis V3 | USDC | 5% | 6% |

| Metis V3 | USDT | 5% | 6% |

| Gnosis V3 | USDC | 5% | 6% |

| Gnosis V3 | xDAI | 5% | 6% |

Next Steps

- Following community feedback, submit the ARFC for a snapshot vote for final approval.

- If consensus is reached, submit an Aave Improvement Proposal (AIP) to implement the proposed updates.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0