title: [Direct-to-AIP] Parameter Updates - zkSync, Scroll and Sonic

author: @TokenLogic

created: 2025-08-02

Summary

This publication proposes updates several parameters on the zkSync, Scroll and Sonic instances of Aave v3.

Motivation

With the introduction of incentives on Scroll, zkSync and Sonic, this publication proposes adjusting the Slope1 and Reserve Factor (RF) parameters on some of the affect reserves.

We recommend increasing the RF on zkSync and Scroll deployments to generate additional revenue, strengthening overal protocol sustainability on these networks. Whilst Sonic provides better revenue generation for the DAO, the RFs on this instance are to remain as is.

With upcoming incentive campaigns expected to significantly enhance user yields. These campaigns will more than offset any reduction in supply APYs caused by this proposal. Therefore, adjustmentin the RF allows the DAO to capture more revenue without materially impacting user experience.

Borrow Rate Updates

For context, the following incentive campaigns are planned for each respective network. Do note, specific details will be provided at time of launch and the below provides some preliminary insights to support Borrow Rate adjustments.

| Network | Asset | Deposit | Borrow |

|---|---|---|---|

| zkSync | USDC | - | 3.00% |

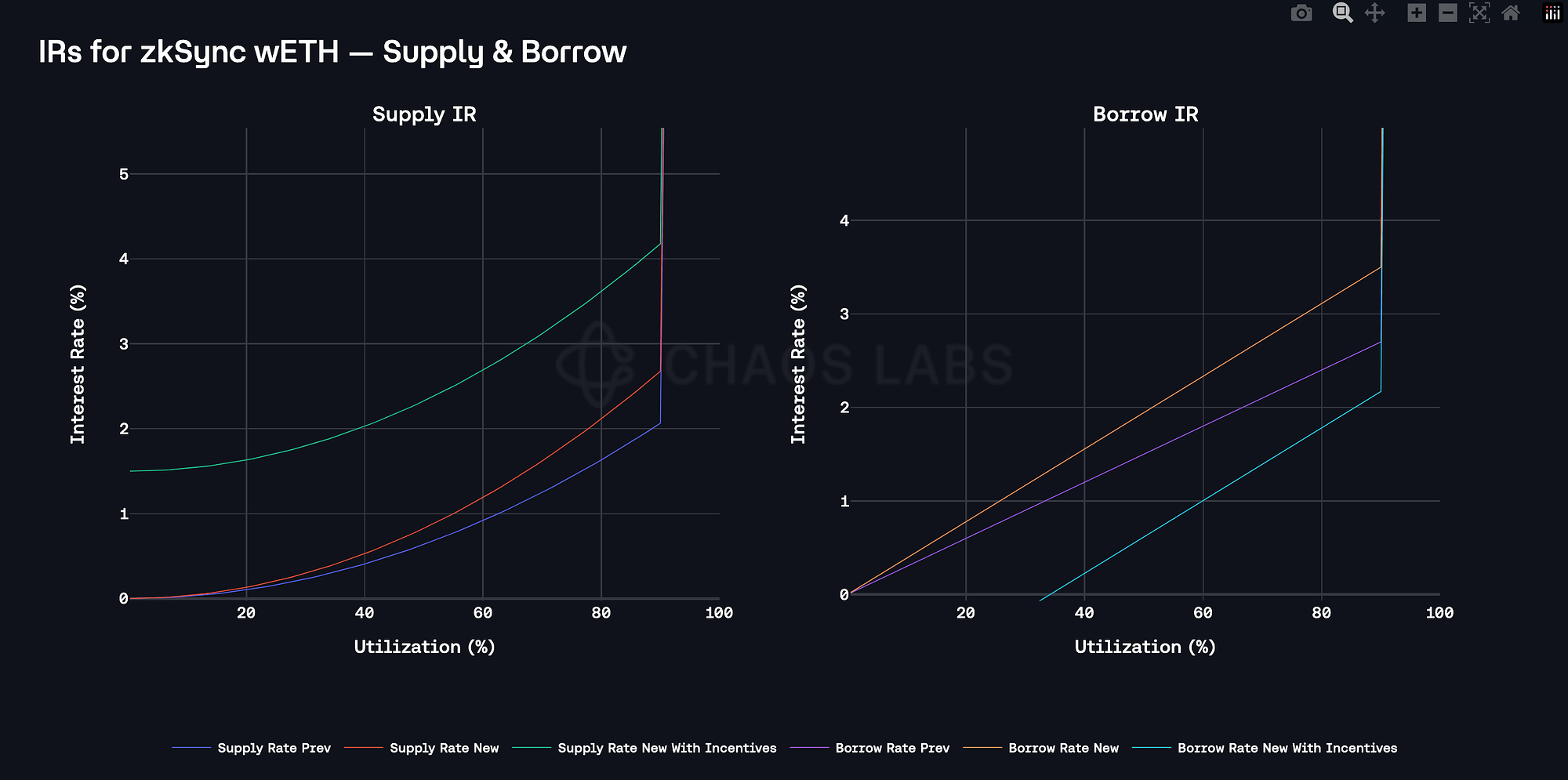

| zkSync | wETH | 1.50% | 1.33% |

| zkSync | wstETH | - | 1.00% |

| Scroll | USDC | - | 2.00% |

| Scroll | wETH | 1.00% | - |

| Sonic | USDC | - | 2.00% |

| Sonic | S | - | 1.00% |

The rewards are to be distributed in this manner until depleted.

To balance the introduction of incentives on the Slope1 for USDC, wETH and wstETH across zkSync and Scroll instances of Aave v3 are to be increased. Based upon current conditions, with the introduction of incentive rewards, users will experience a Net Borrow Cost lower than current. The Slope1 for USDC on Sonic is 8.50%, which is significantly higher than other instances of Aave v3 and the introduction of incentives is likely to lead to renewed interest in borrowing USDC.

Specification

The following paramater updates are proposed:

| Deployment | Asset | Parameter | Current RF | Proposed RF |

|---|---|---|---|---|

| zkSync | USDC | RF | 10% | 15% |

| zkSync | wstETH | RF | 5% | 35% |

| Scroll | USDC | RF | 10% | 15% |

| zkSync | USDC | Slope1 | 5.5% | 7.50% |

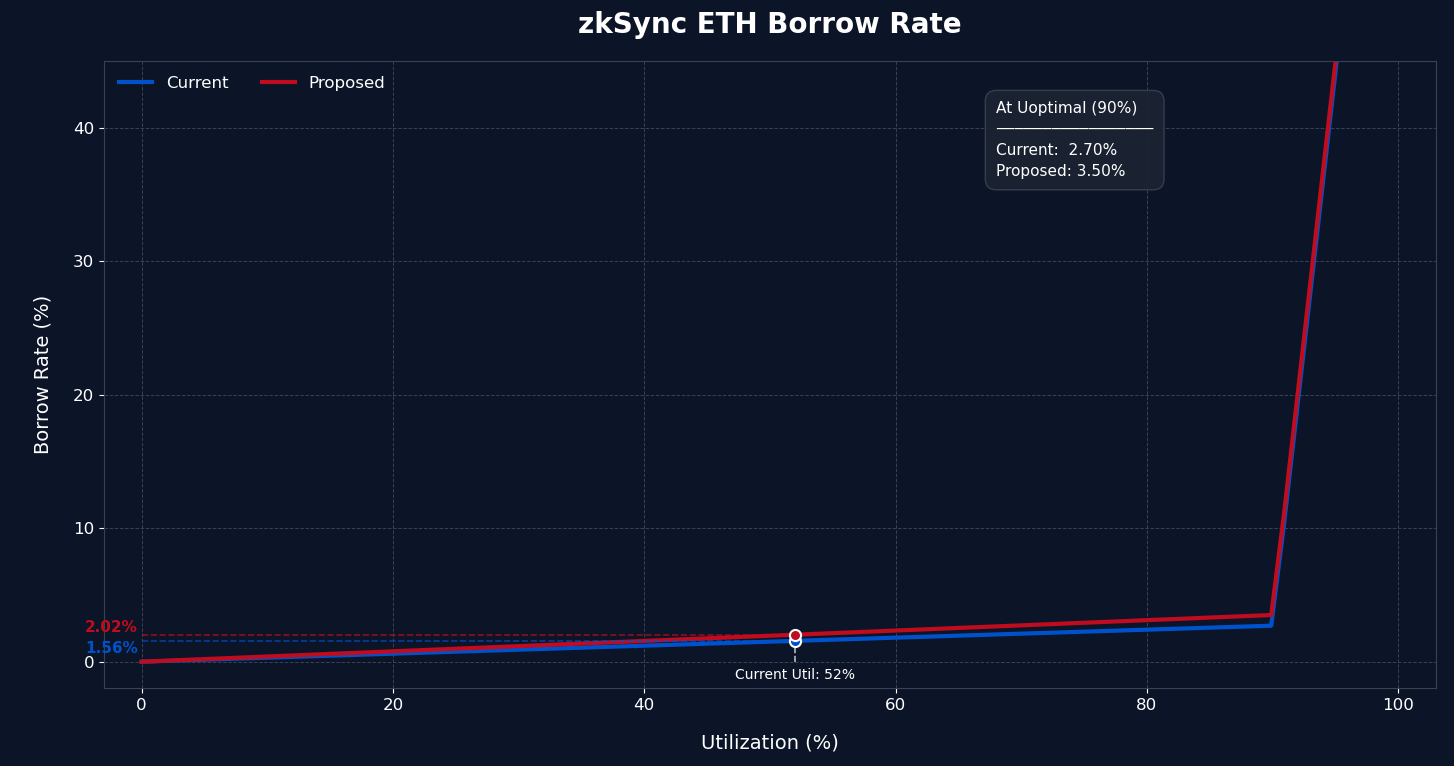

| zkSync | wETH | Slope1 | 2.7% | 3.50% |

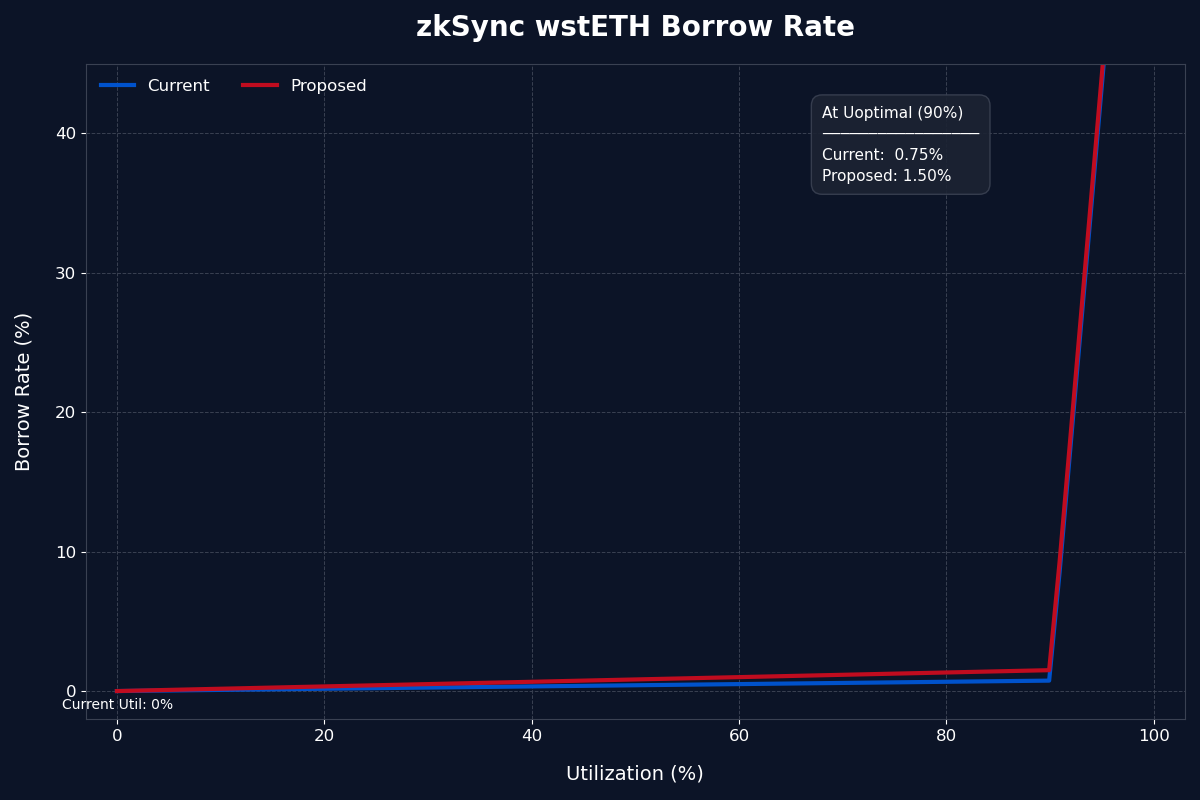

| zkSync | wstETH | Slope1 | 0.75% | 1.50% |

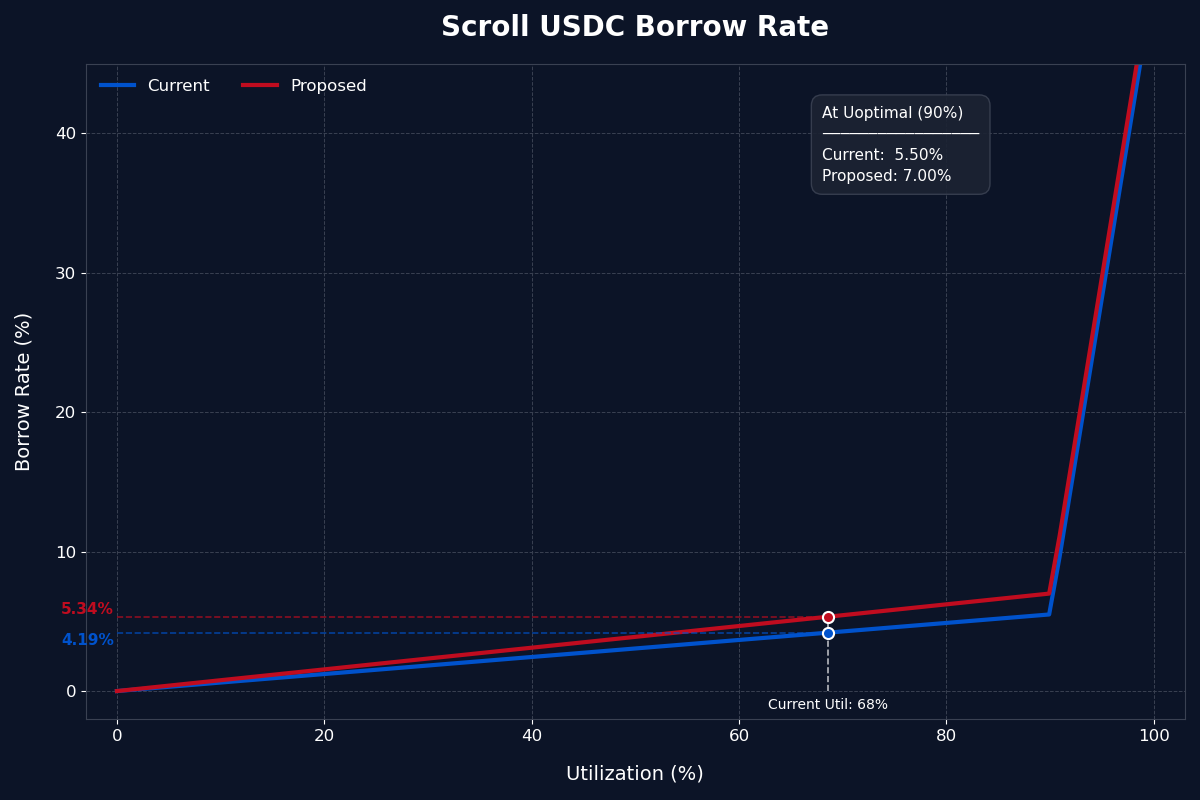

| Scroll | USDC | Slope1 | 5.5% | 7.00% |

Implementation is to be performed by the Risk Steward where practical with the remaining parameters to be implemented via an AIP.

Disclaimer

TokenLogic is not compensated for the creation or coordination of this proposal.

Next Steps

- Gather feedback from the community.

- Using the Direct-to-AIP process, submit AIP(s) for vote.

Copyright

Copyright and related rights waived via CC0