Summary

Chaos Labs supports the proposal to optimize pyUSD parameters on Aave v3 Ethereum which includes reducing the Reserve Factor (RF) from 20% to 10% and increasing UOptimal from 80% to 90%. We recommend adopting both changes, and we will continue to closely monitor the market during the anticipated growth period for PYUSD.

In addition, we recommend removing pyUSD’s collateral eligibility to minimize oracle-related risks and reduce non-productive demand, effectively improving the efficiency of any incentives directed at the asset, and we recommend alligning pyUSD’s Slope 1 to the other stablecoins within the Aave V3 Ethereum Core instance.

Motivation

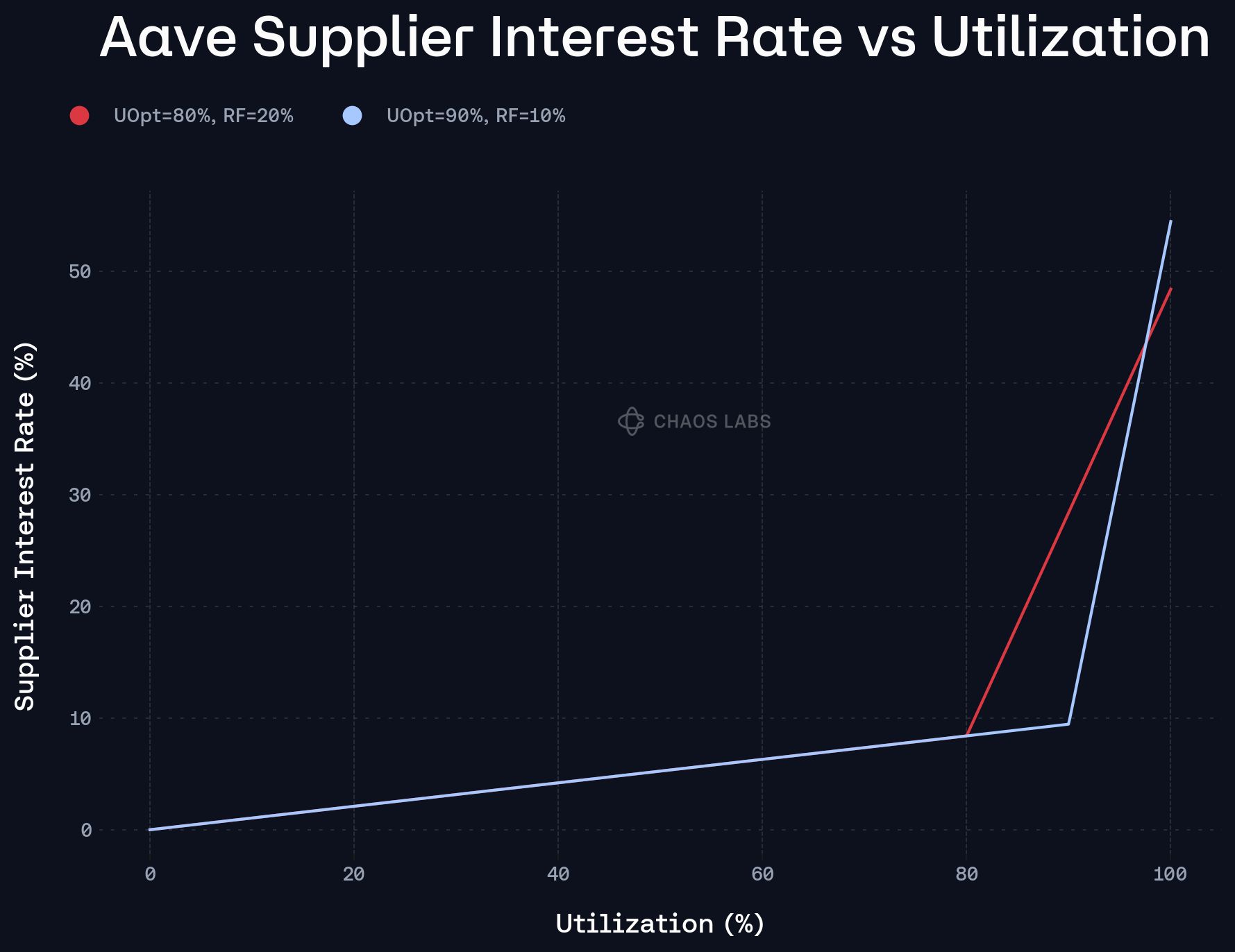

Reducing the Reserve Factor to 10% improves supplier yields at any given utilization by increasing the share of interest routed to liquidity providers. This change is expected to make pyUSD deposits more competitive while leaving protocol risk essentially unchanged, as RF strictly affects revenue distribution. However, this change will lower protocol revenue from the pyUSD reserve, effectively halving Aave’s take on the same borrow flows.

Increasing UOptimal to 90% allows the market to operate at a higher efficiency, thanks to being able to reach higher utilization prior to Interest Rate volatility. While at identical utilization below the new kink, instantaneous borrow rates may be marginally lower, the configuration encourages utilization to grow further to the Uoptimal under Slope1, which in practice can increase average supplier APRs if demand expands as expected during incentive periods.

These two changes effectively balance each other prior to reaching the prior Uoptimal of 80%, as it can be observed from the following plot that outlines the expected PYUSD supplier’s rate.

Importantly, higher UOptimal is safest when market size is sufficient and the market’s suppliers are highly distributed, and while the current size of PYUSD is fairly limited, and its suppliers are fairly concentrated, Chaos Labs expects the case to change as we expect near-term growth of PYUSD, following the implementation of market incentives. As such, we view the 90% UOptimal as safe for the protocol while providing material improvement to PYUSD suppliers.

Collateral Status

Simultaneously, we recommend disabling PYUSD as collateral on the Aave V3 Core Instance. The majority of stablecoins on Aave are currently priced via market feeds with the addition of a CAPO limiter at 1.04. This, combined with thinner dex liquidity for less-utilized stables, makes for a poor collateral asset, as well as less optimal borrow assets. Temporary market deviations and oracle dislocations, even if capped, are a material risk that could lead to unwarranted liquidations. This behavior is exacerbated when such assets are used as collateral to back loans.

While a proof-of-reserve or attestation-based feed would be preventing oracle dislocations, enabling collateral would introduce maningfull attestation risks, as observed during periods of temporary uncertainty like USDC depeg.

Furthermore, empirically, stablecoin collateral demand is often incentive-driven and facilitates self-referential looping, and the disabling of it is expected to significantly improve the efficency of the rewards distribution, prioritizing genuine users, and the asset’s growth and demand rather than looping positions diluting the rewards.

Removing PYUSD as collateral will further minimize the effects driven by the increase in UOptimal, as it prevents rehypotecation and hence increases the flexibility of suppliers.

Slope 1 Adjustment

While the current Slope 1 was previously set due to running incentives, and was highly effective in preventing major rate volatility during the incentive programs, we recommend aligning the pyUSD target rate to the other stablecoins in the Core market by setting its Slope 1 at 6.50%.

Improvements

If the incentive campaign succeeds in significantly improving the attractiveness of PYUSD deposits on Aave V3, additional improvements can be performed to enhance PYUSD positioning within the Aave Core market. Such improvements can be considered and performed in the future, and would include the addition of PYUSD to the Ethena E-Modes, such as November PTs or Liquid Leverage, which could create a valuable opportunity to drive both considerable demand to PYUSD borrows, as well as provide an important addition of borrow liquidity for Ethena assets.

Specification & Recommendation

| Parameters | Current Value | Recommended Value |

|---|---|---|

| Asset | PYUSD | PYUSD |

| UOptimal | 80% | 90% |

| Reserve Factor | 20% | 10% |

| Slope 1 | 10.5% | 6.5% |

| LTV | 75% | 0% |

Disclosure

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0.