It has been one week since the Aave Horizon launch. LlamaRisk collaborated with the Horizon team on pre-launch due diligence for assets, creating an RWA risk framework and establishing parameterization, including bounded NAV feeds. Our ongoing scope includes recommending operational parameters, monitoring the system, and providing advisory services. The following is a summary of the first week of operations.

Highlights

-

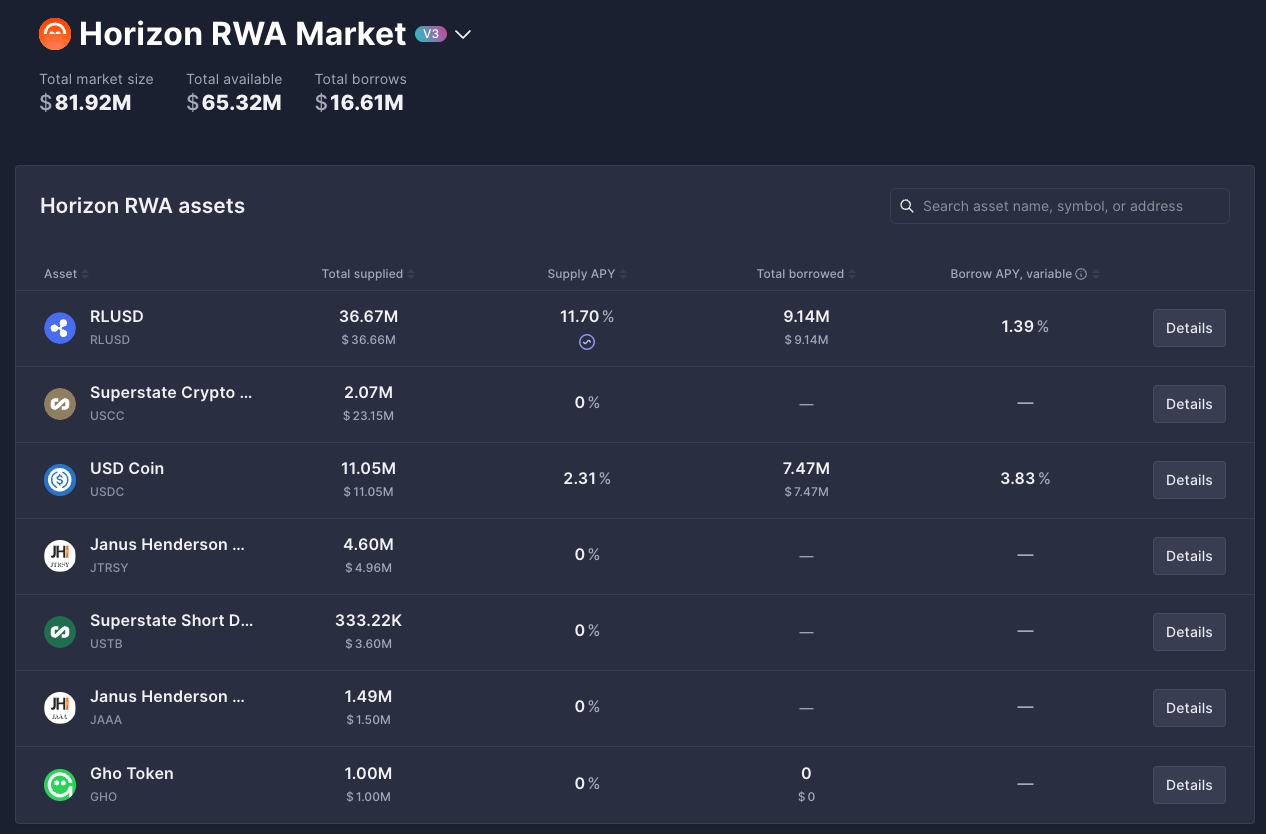

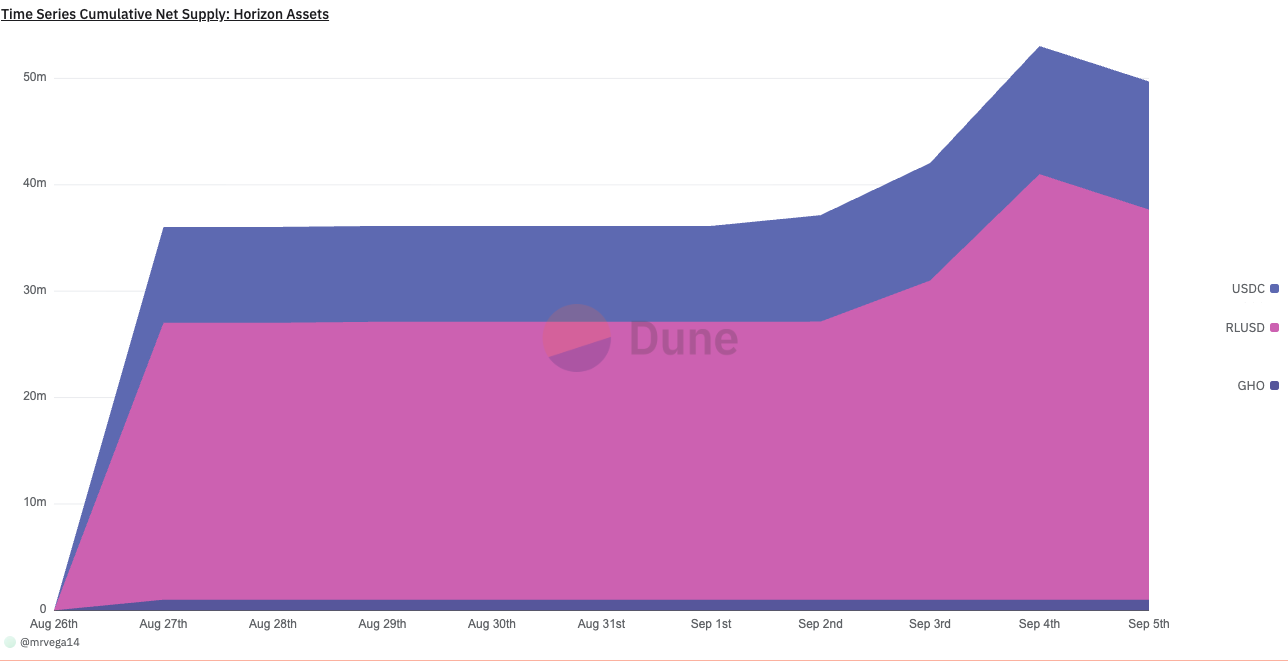

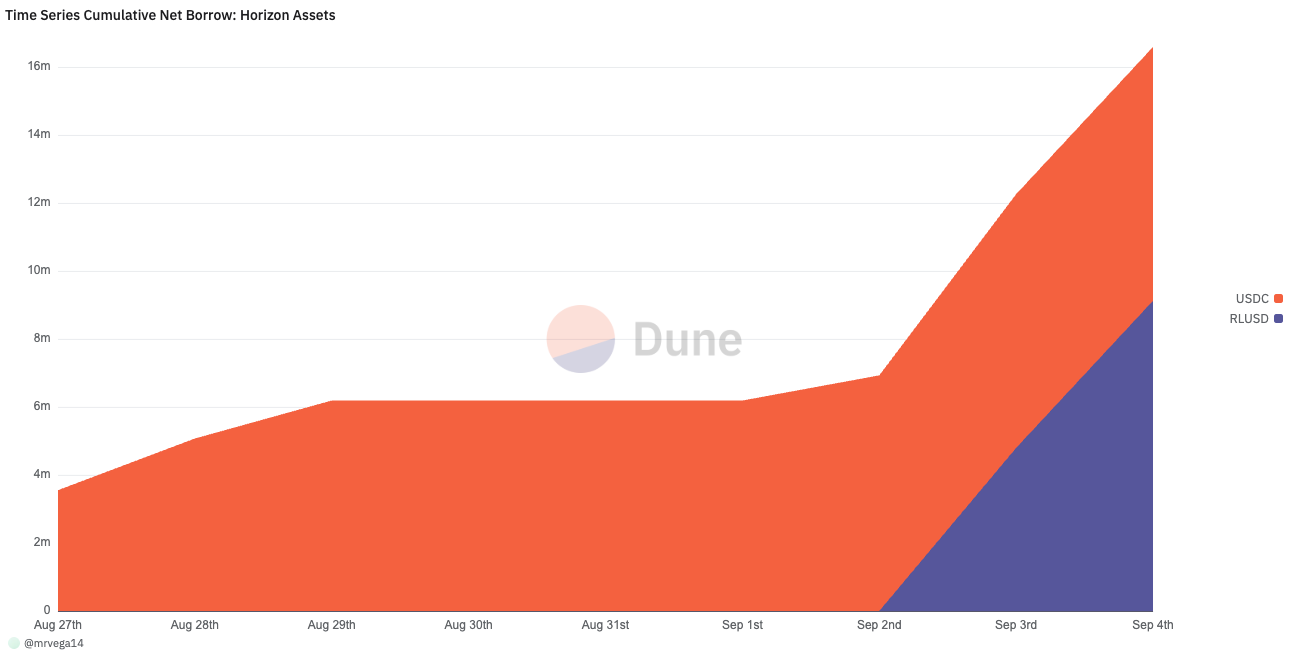

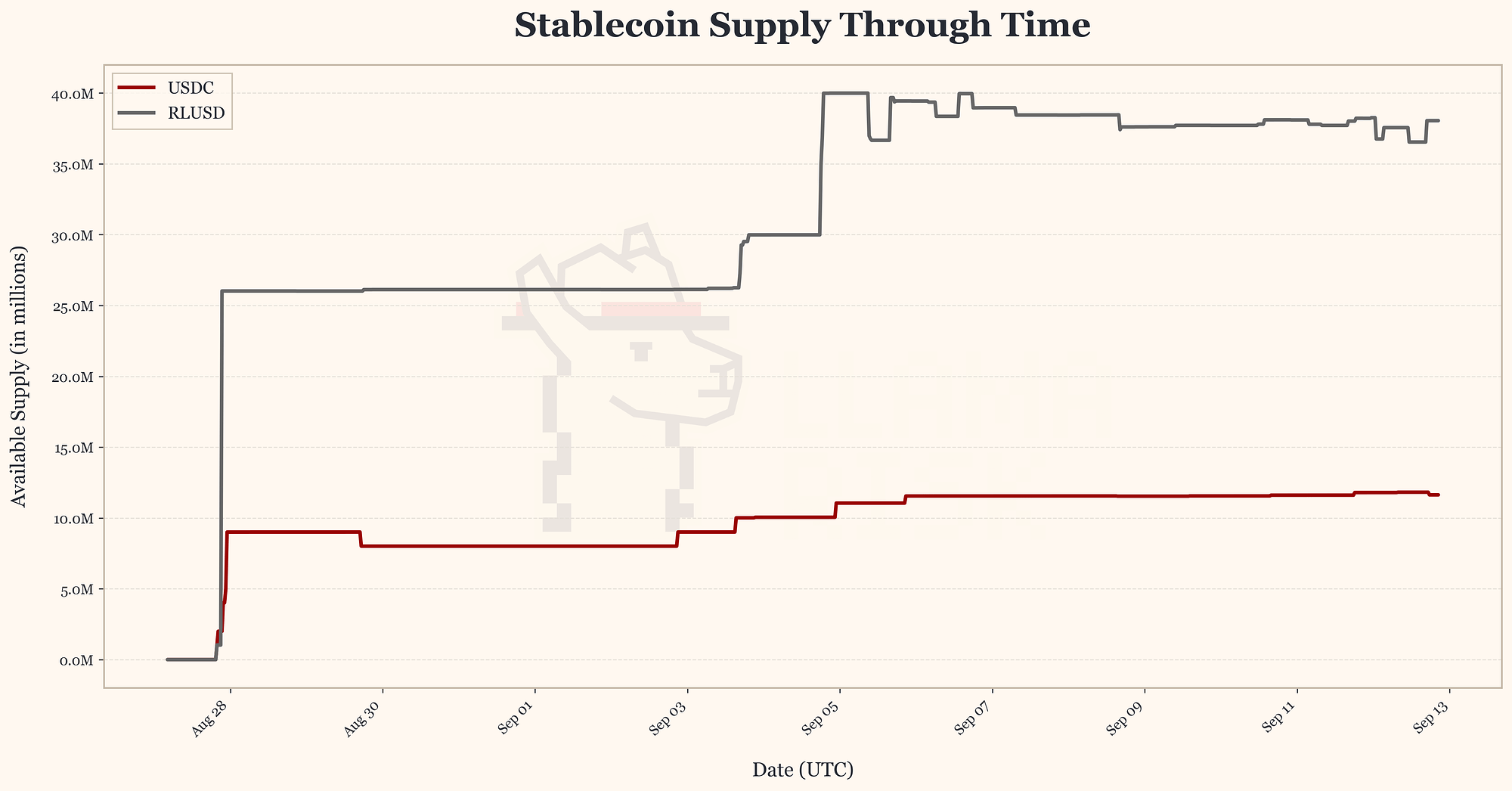

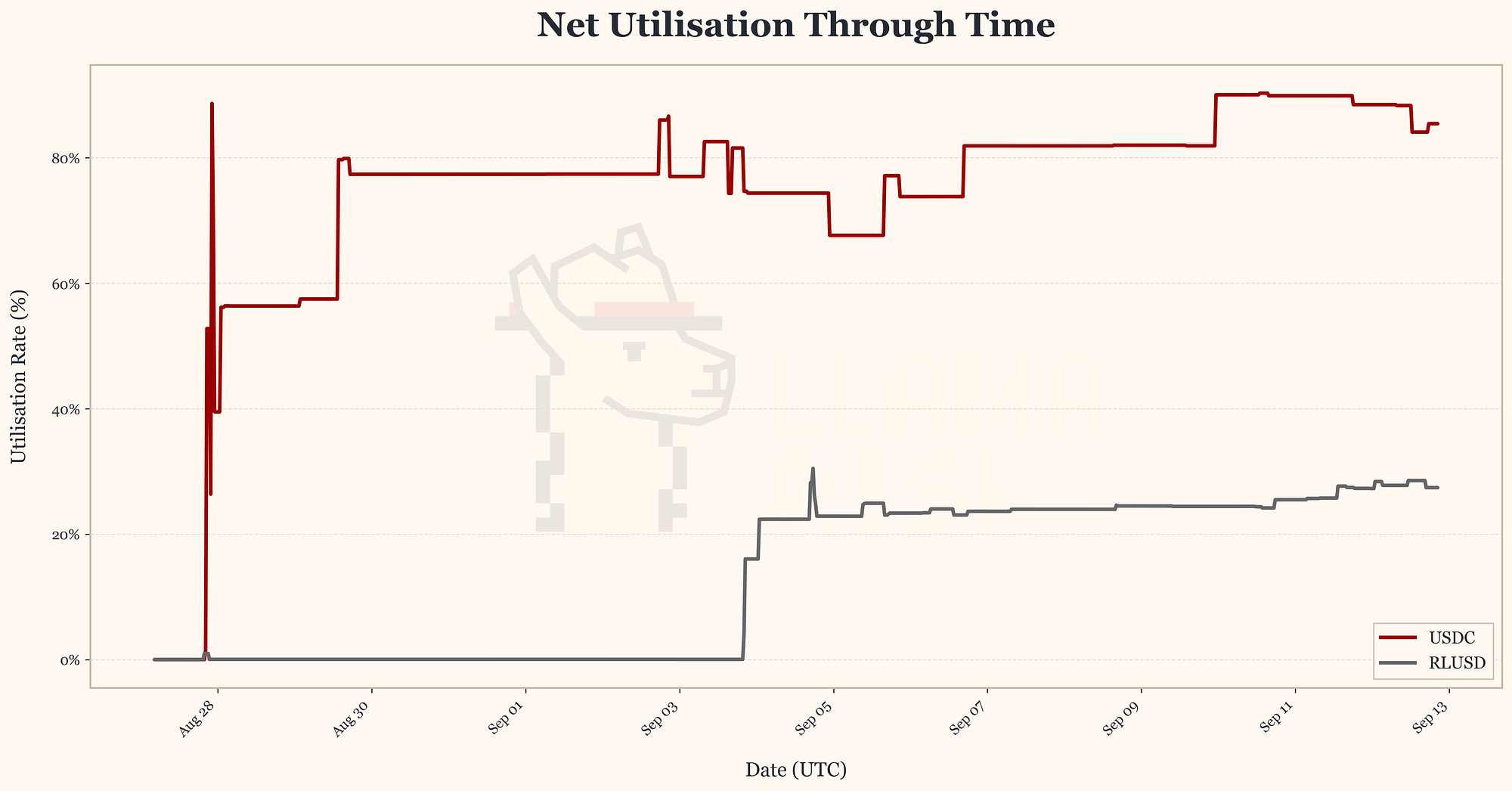

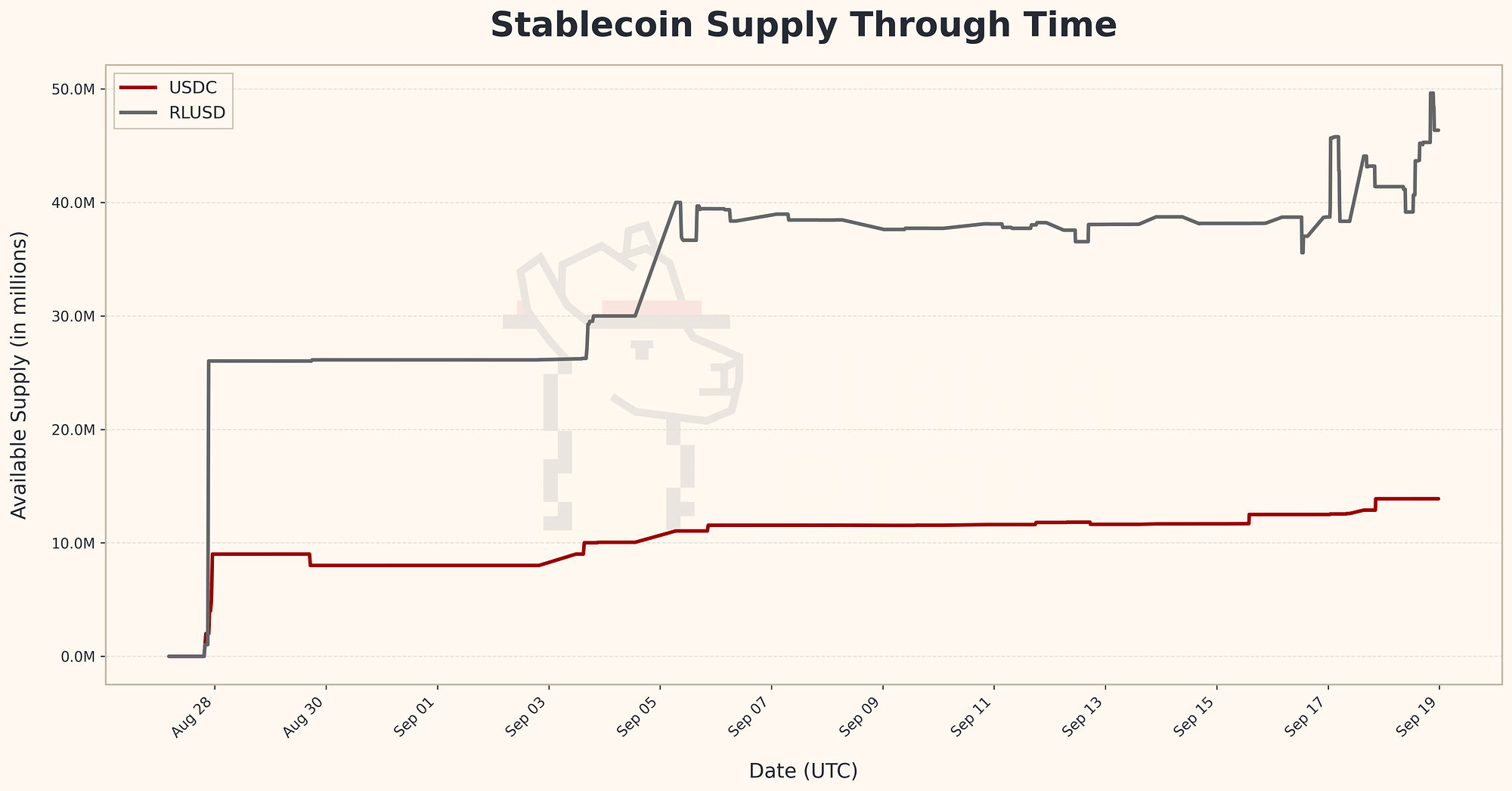

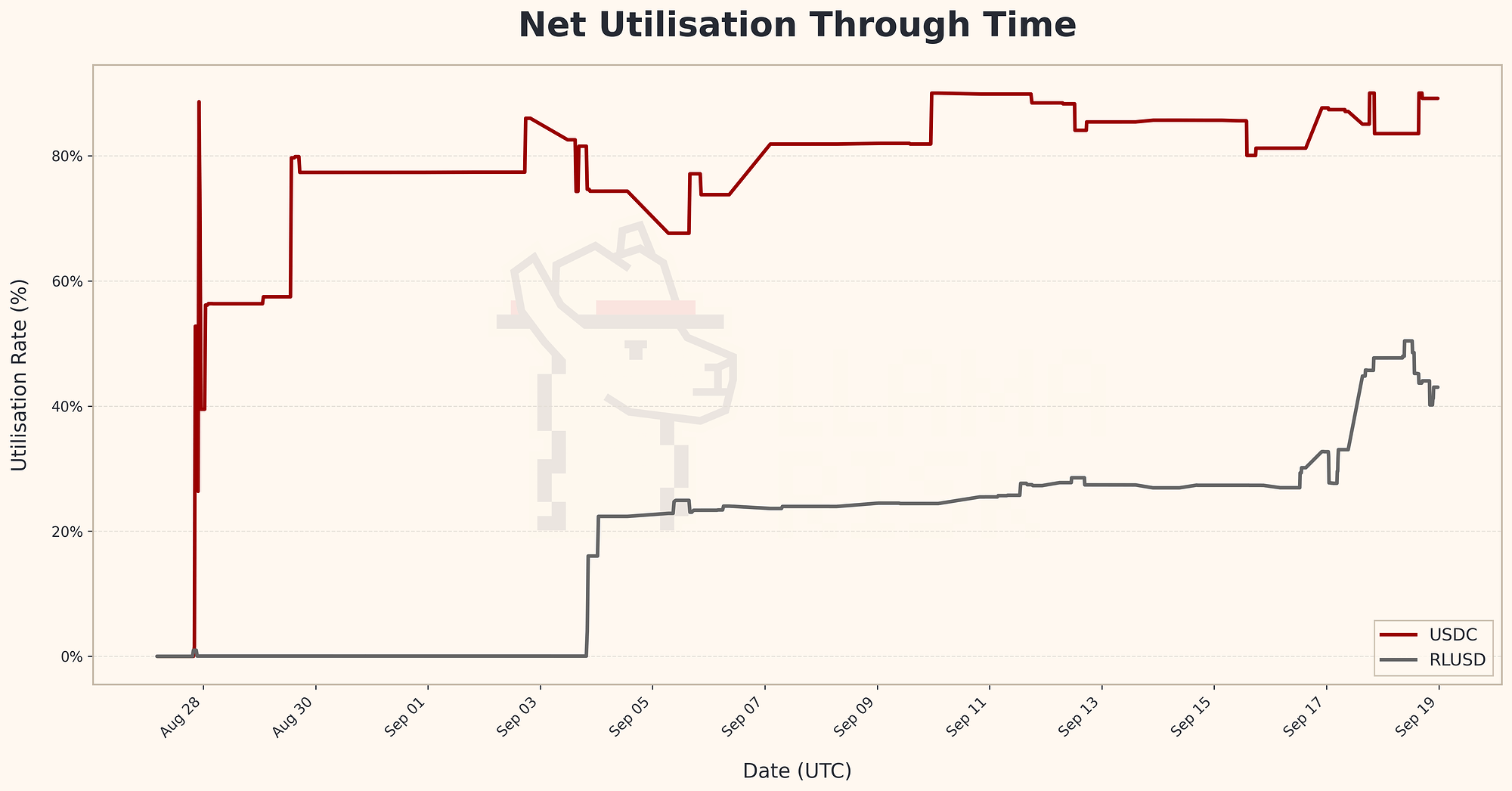

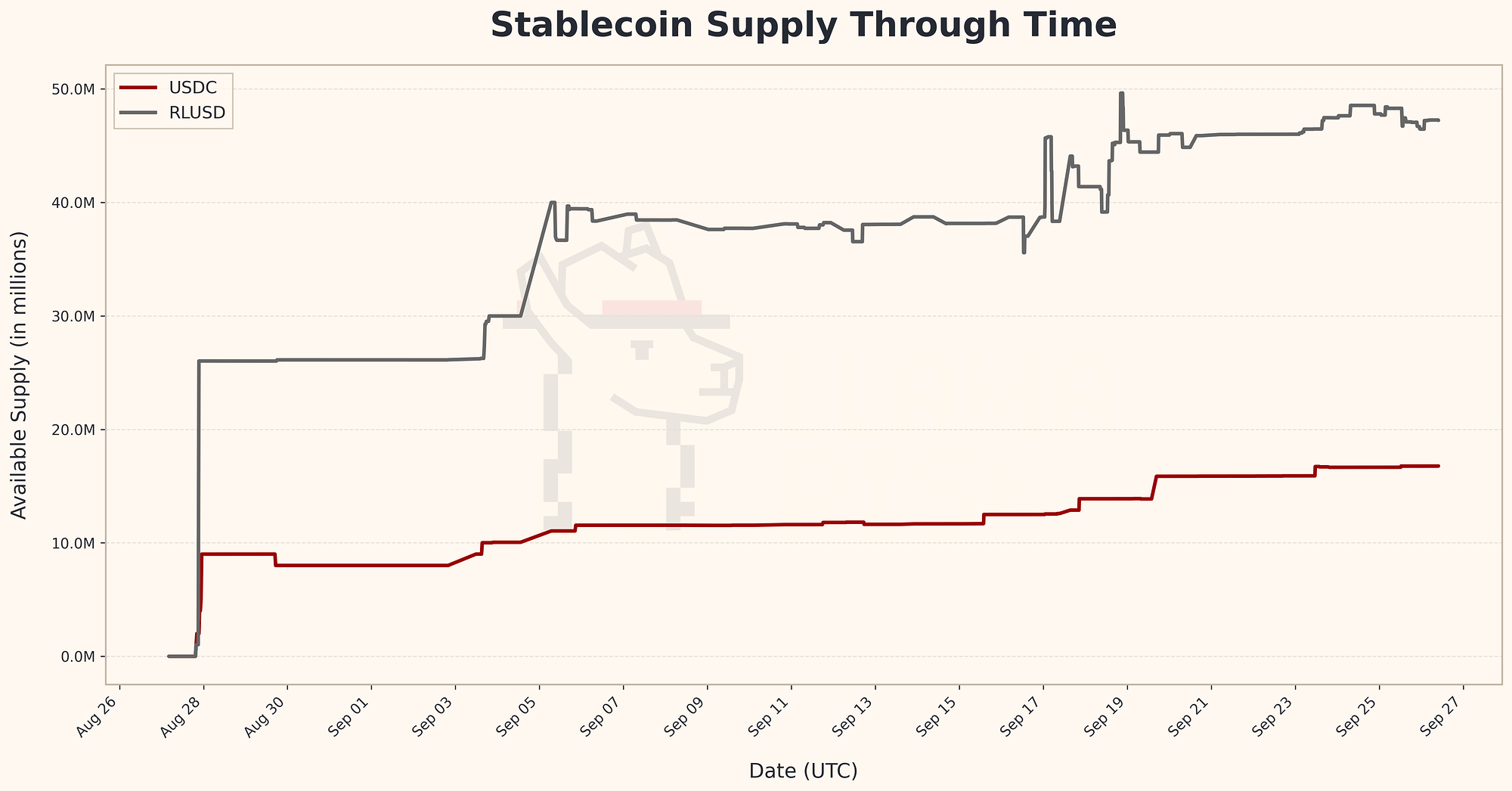

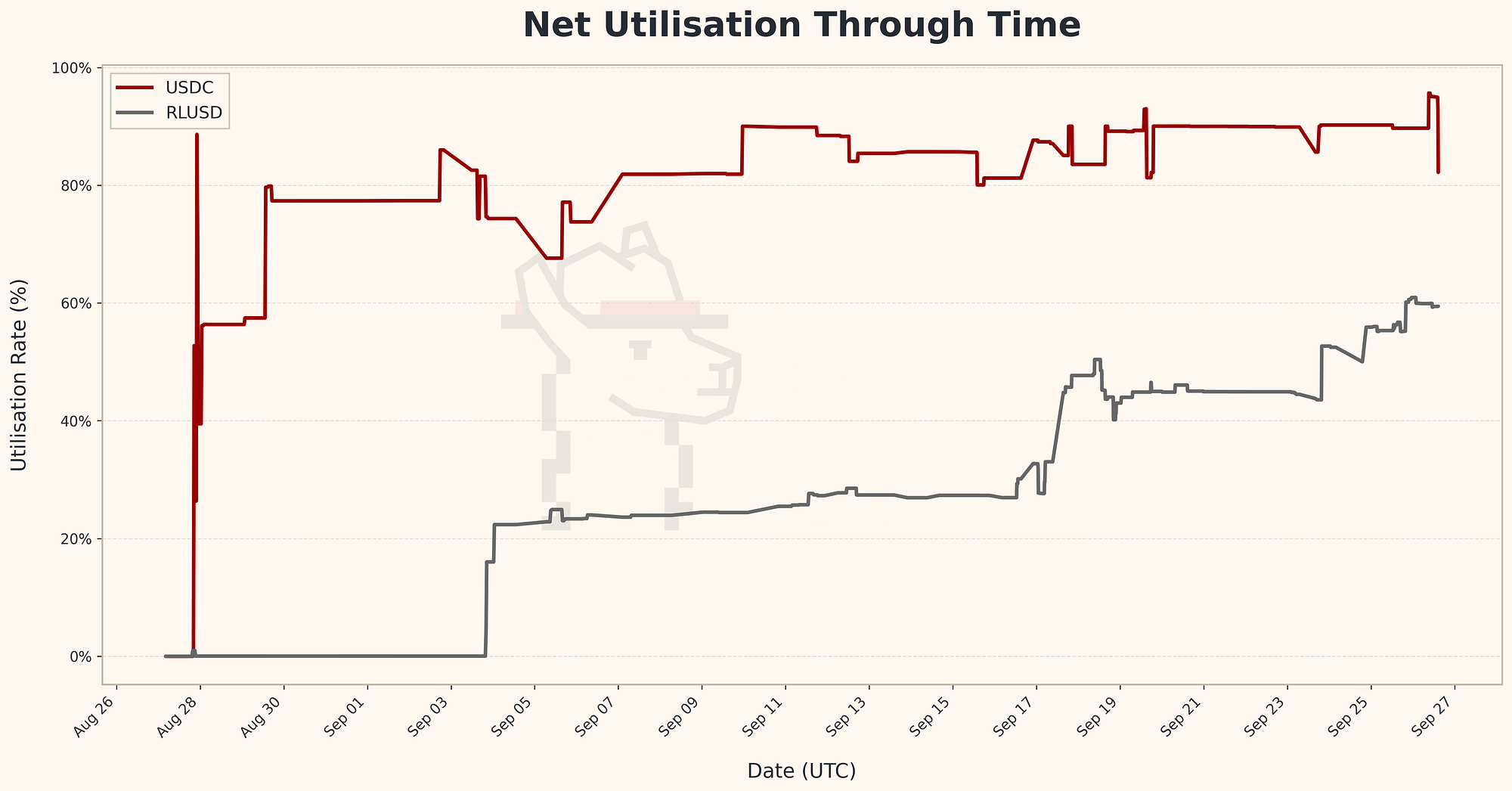

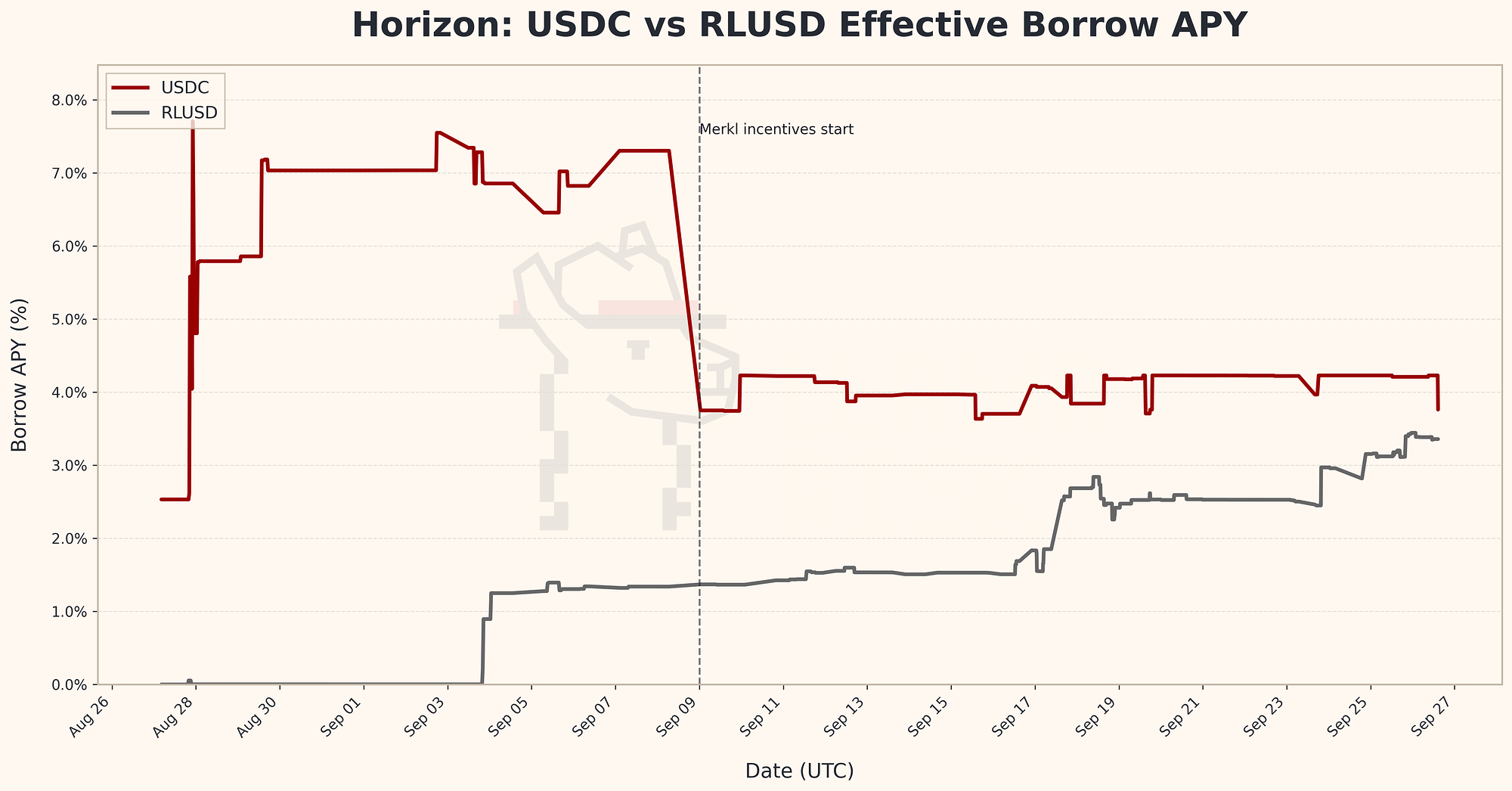

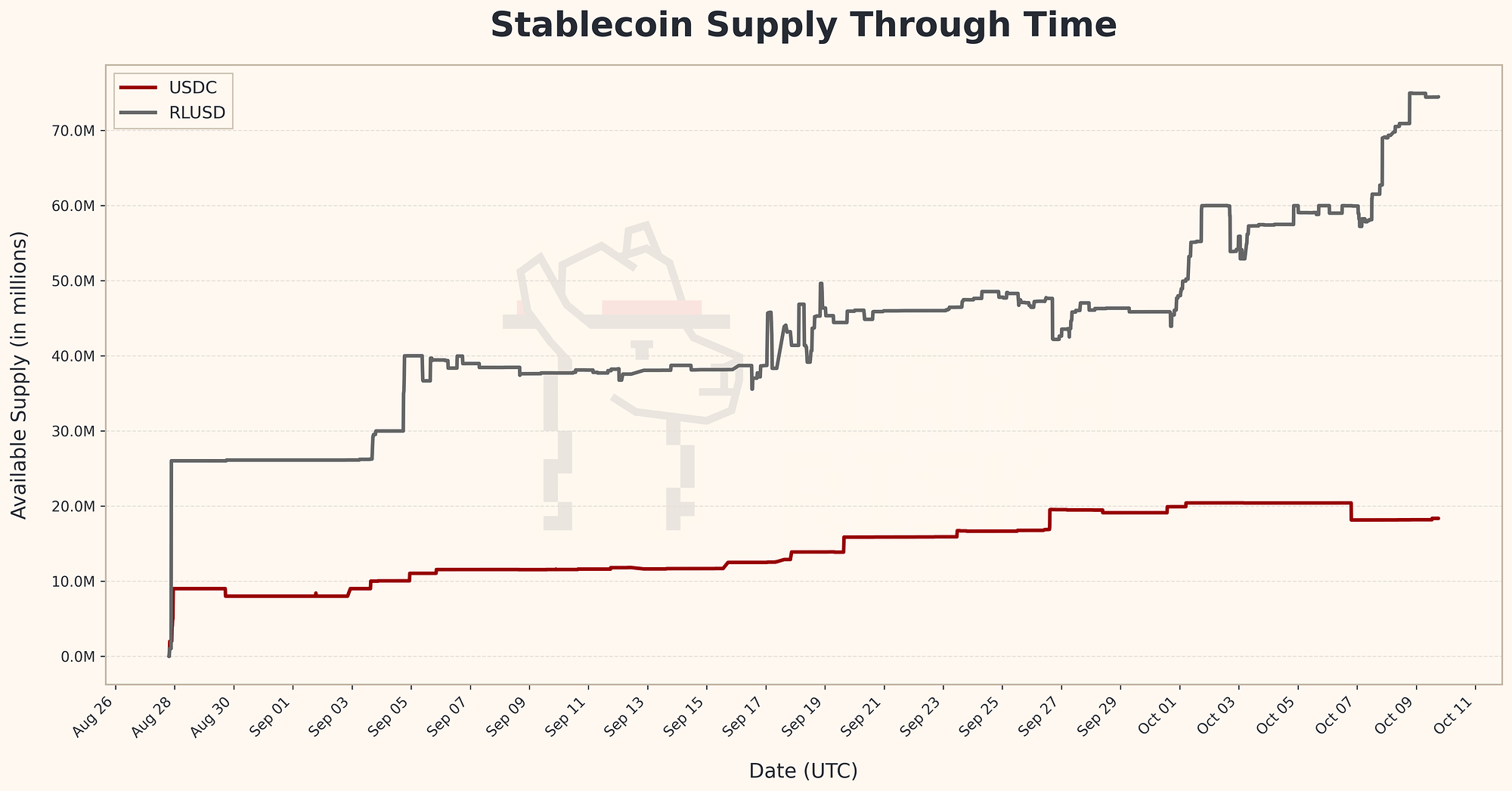

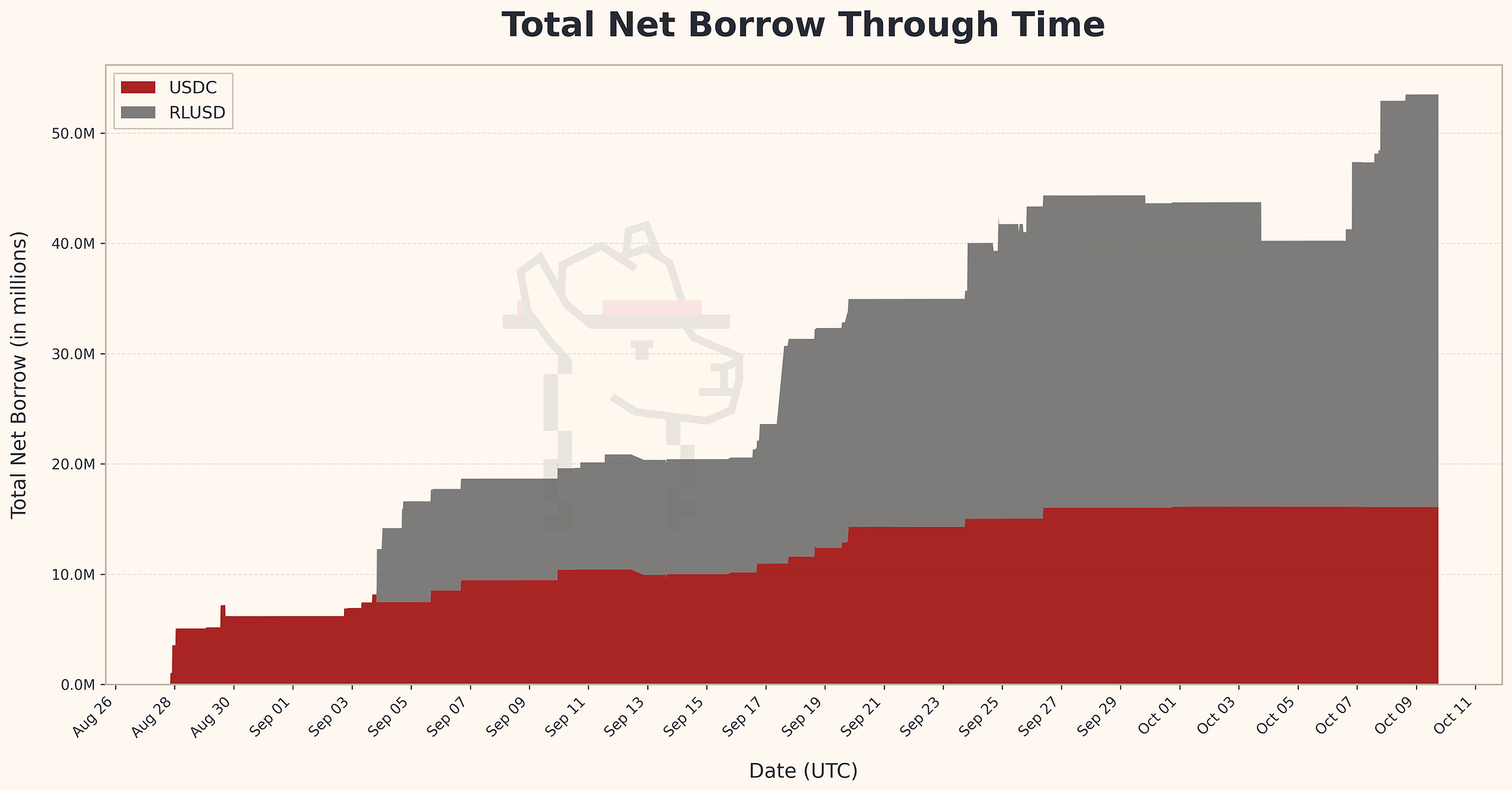

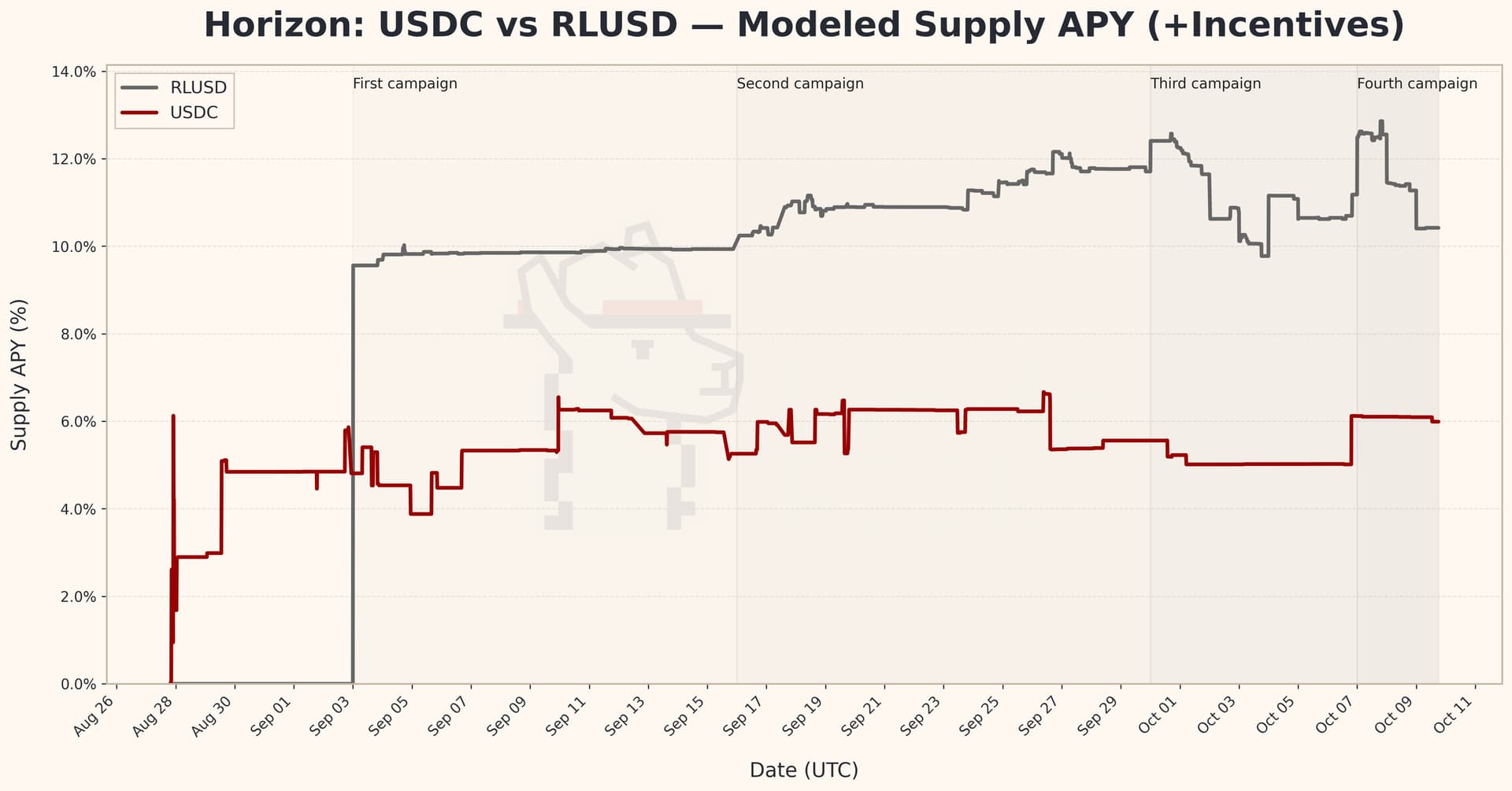

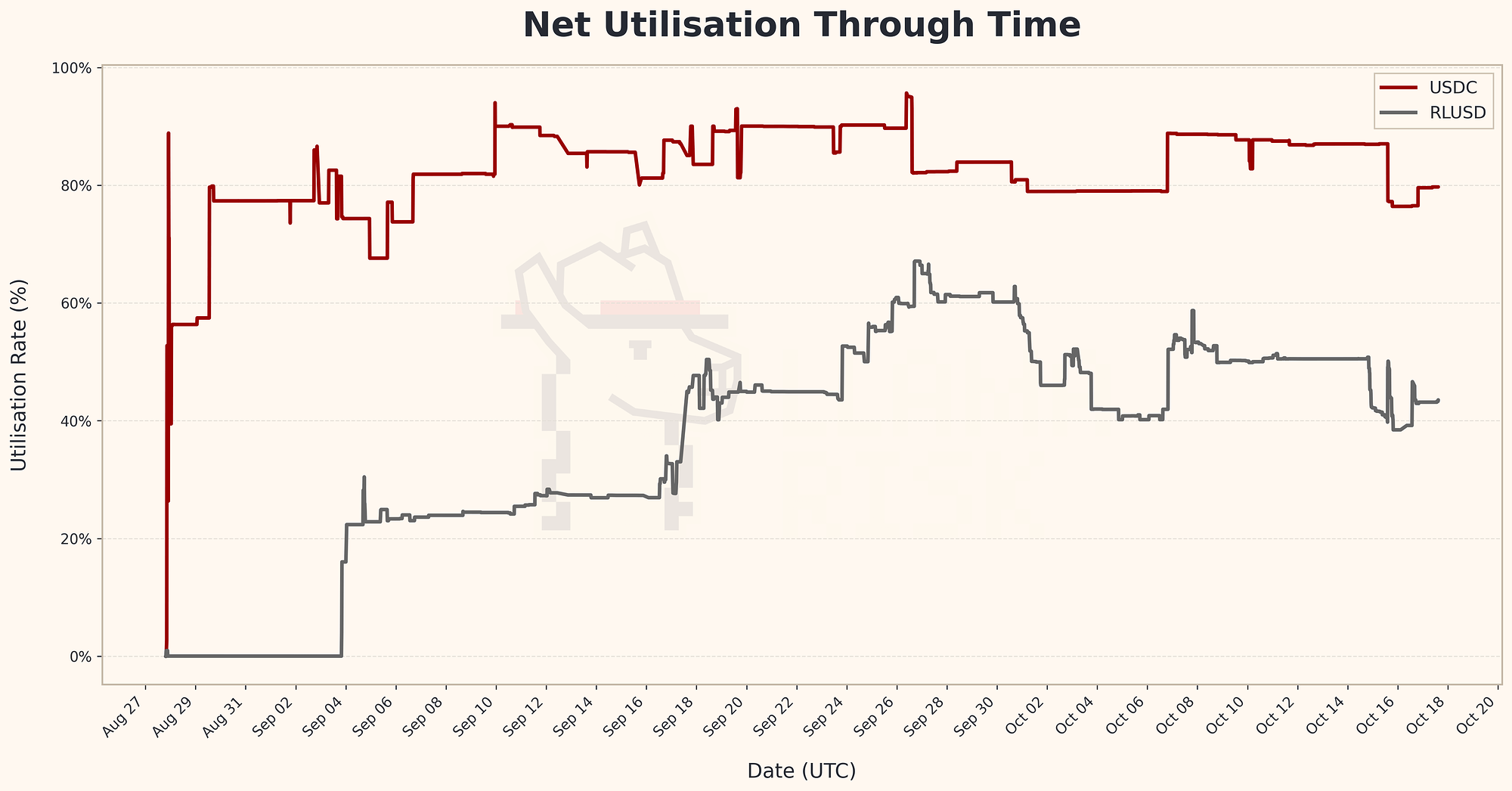

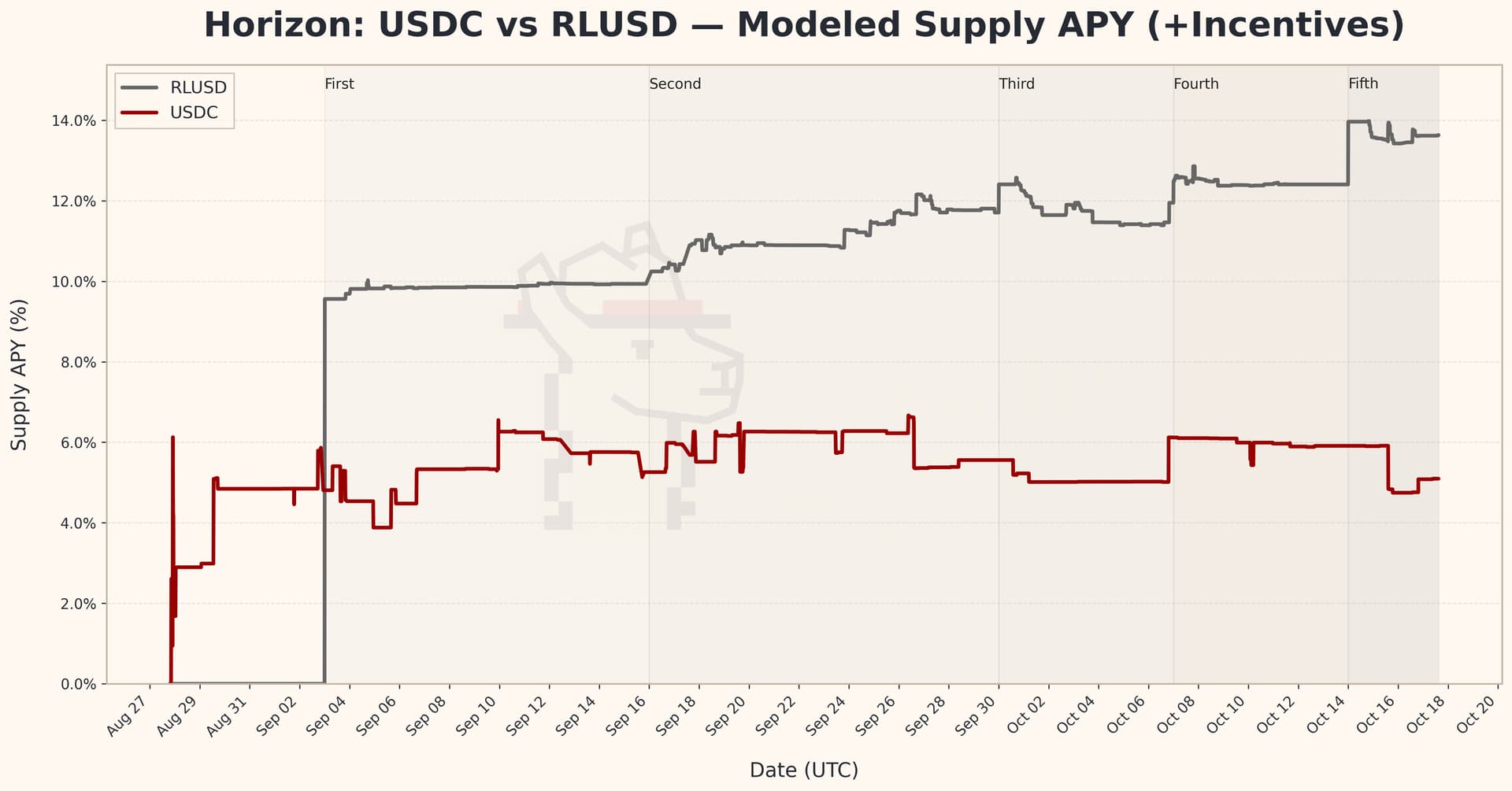

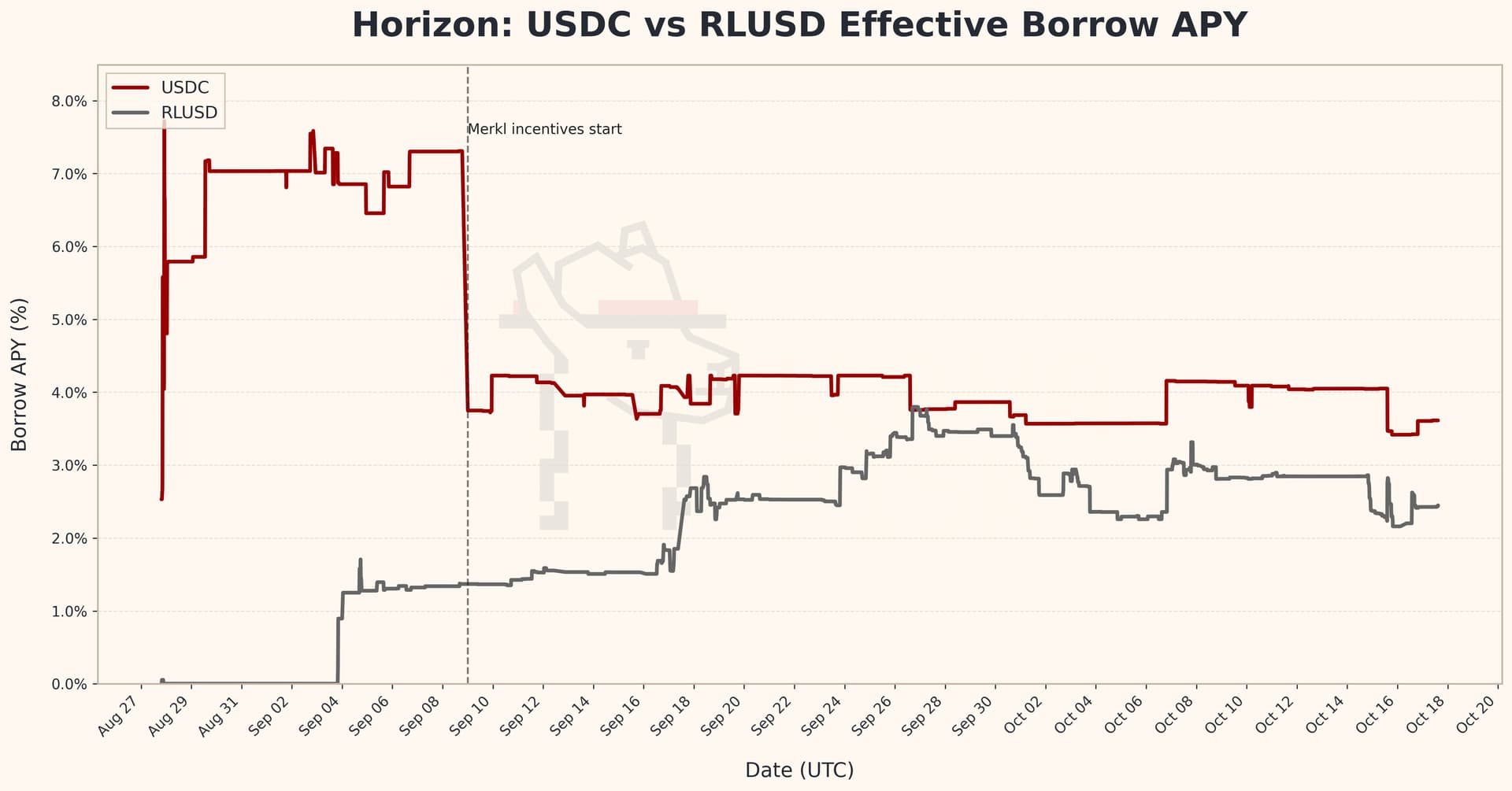

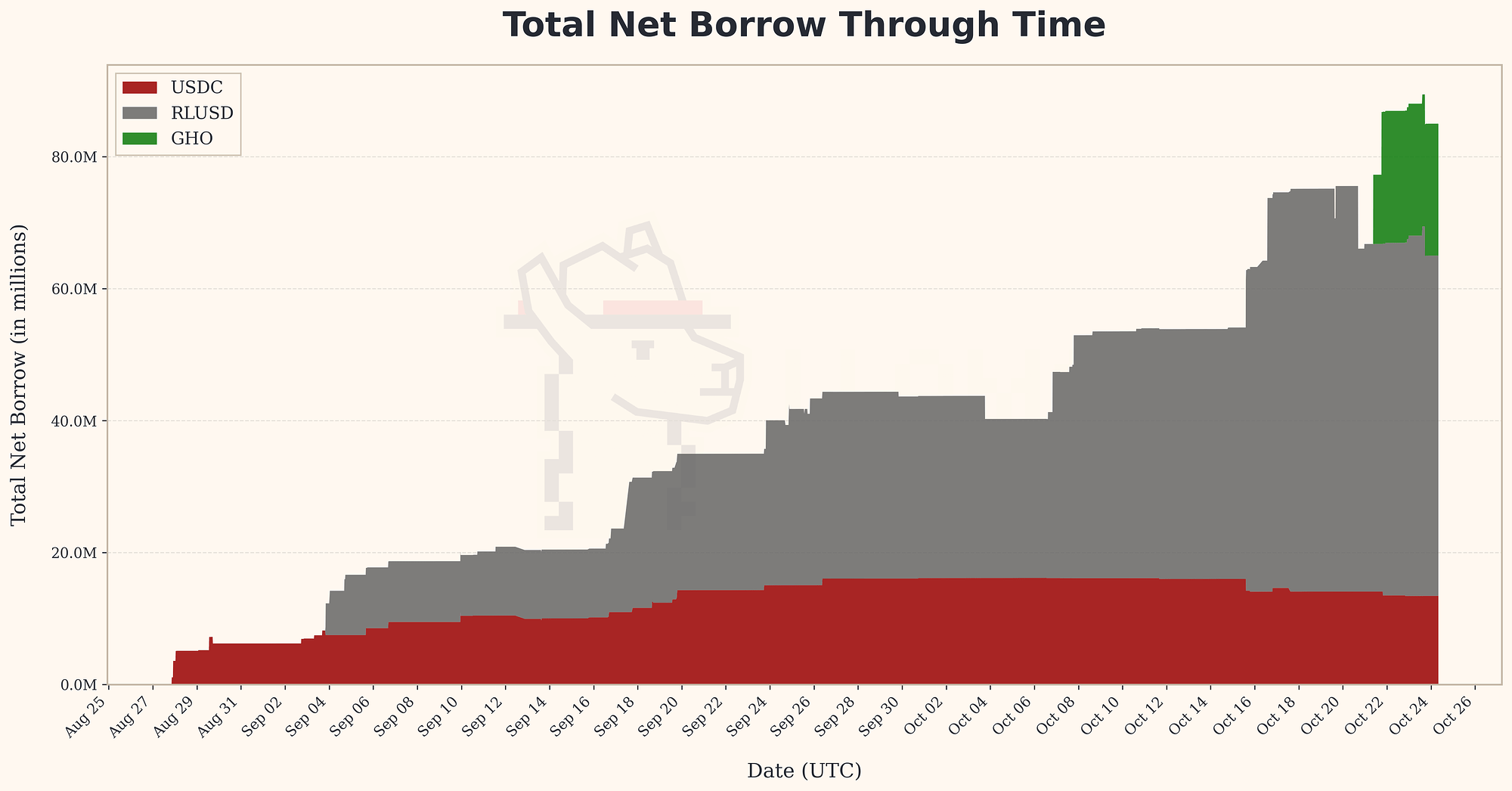

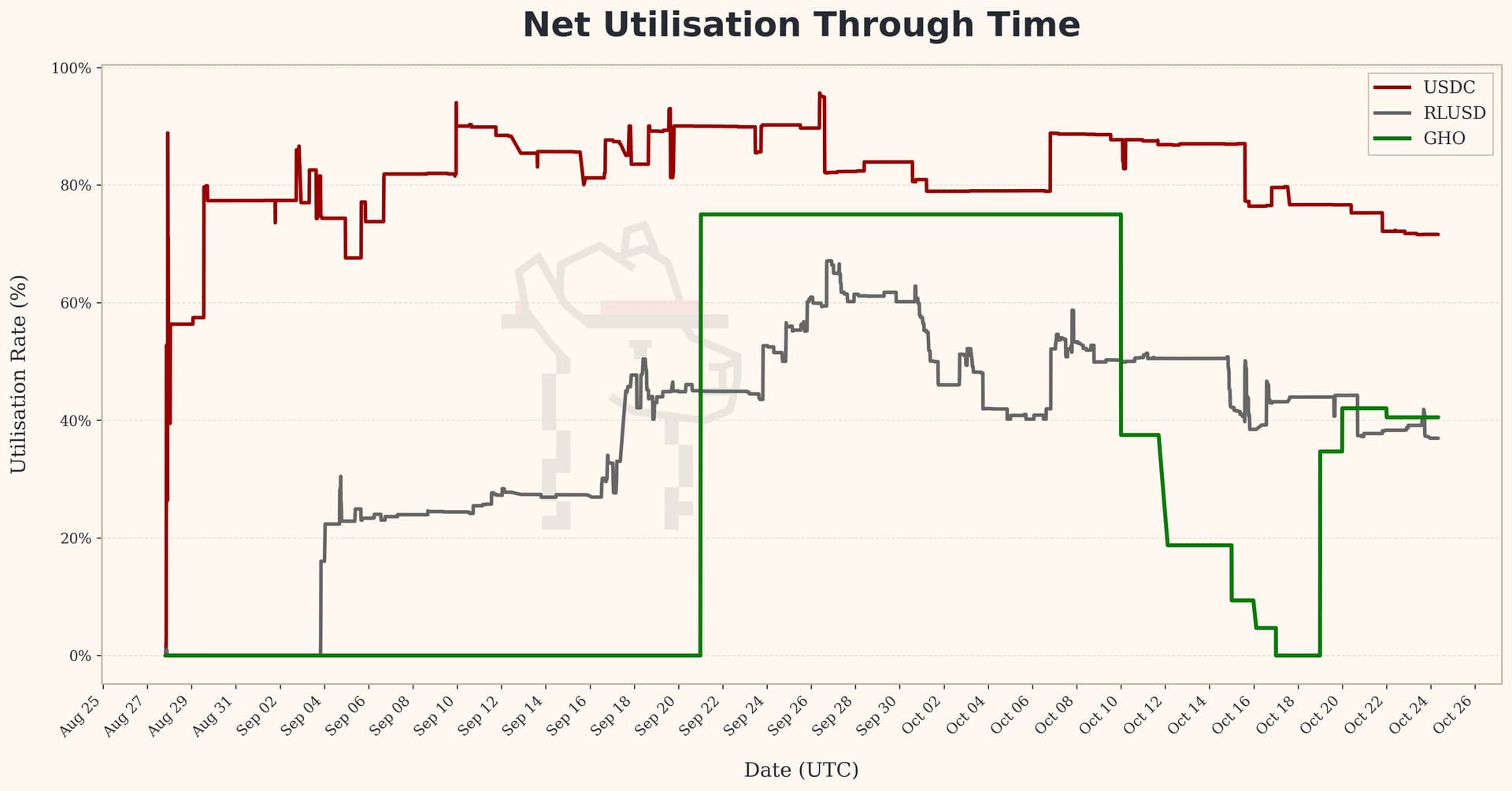

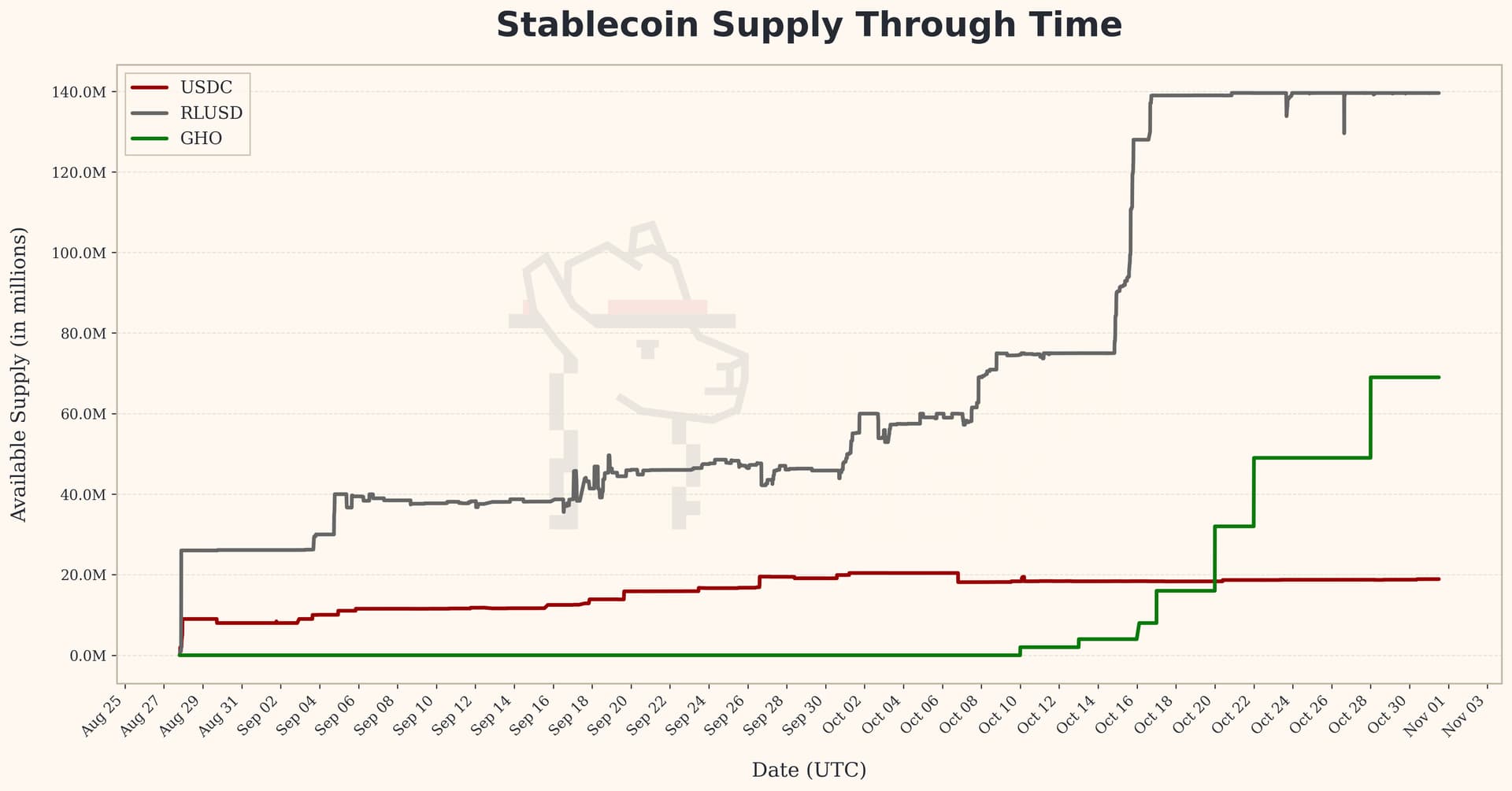

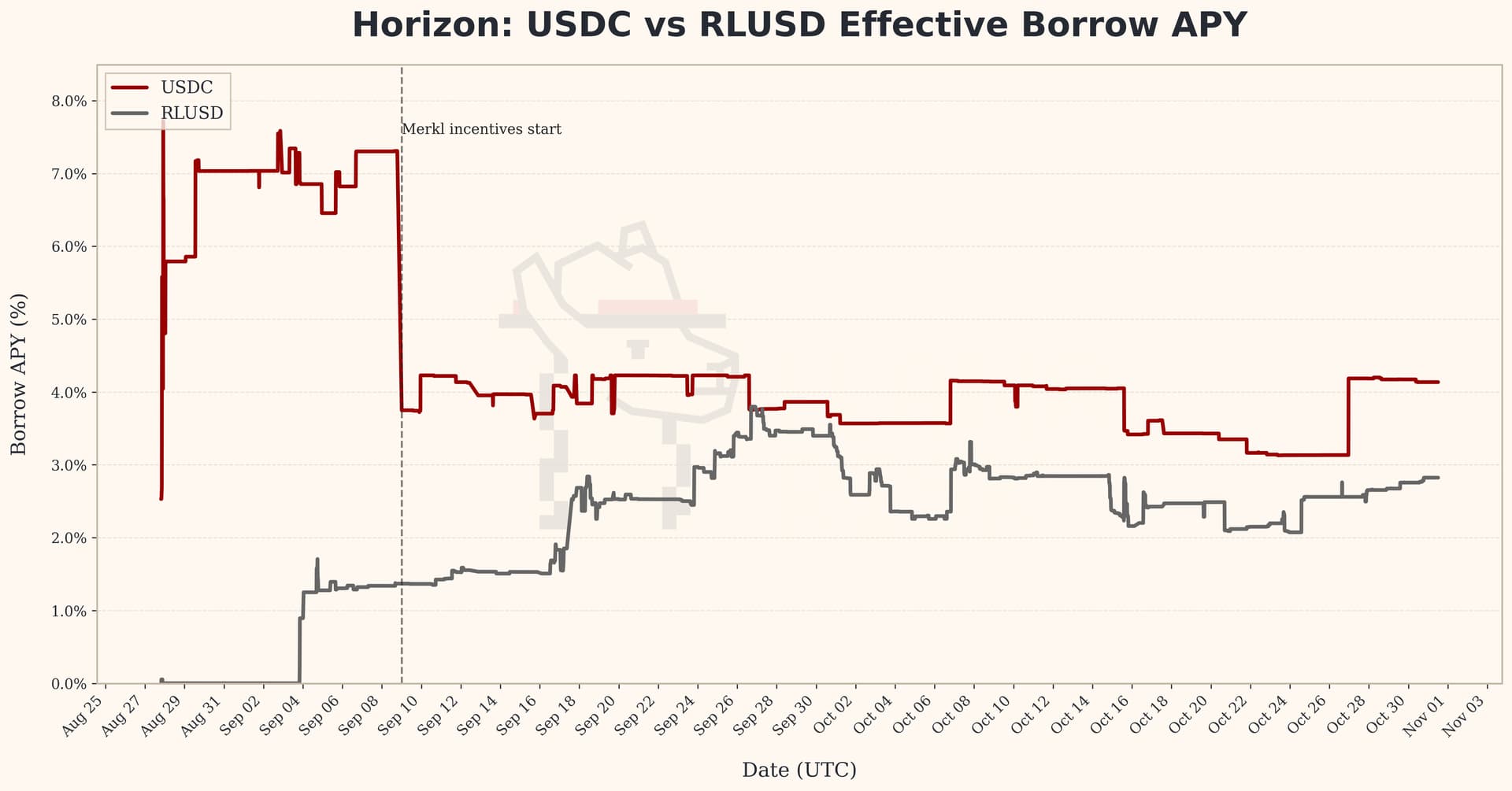

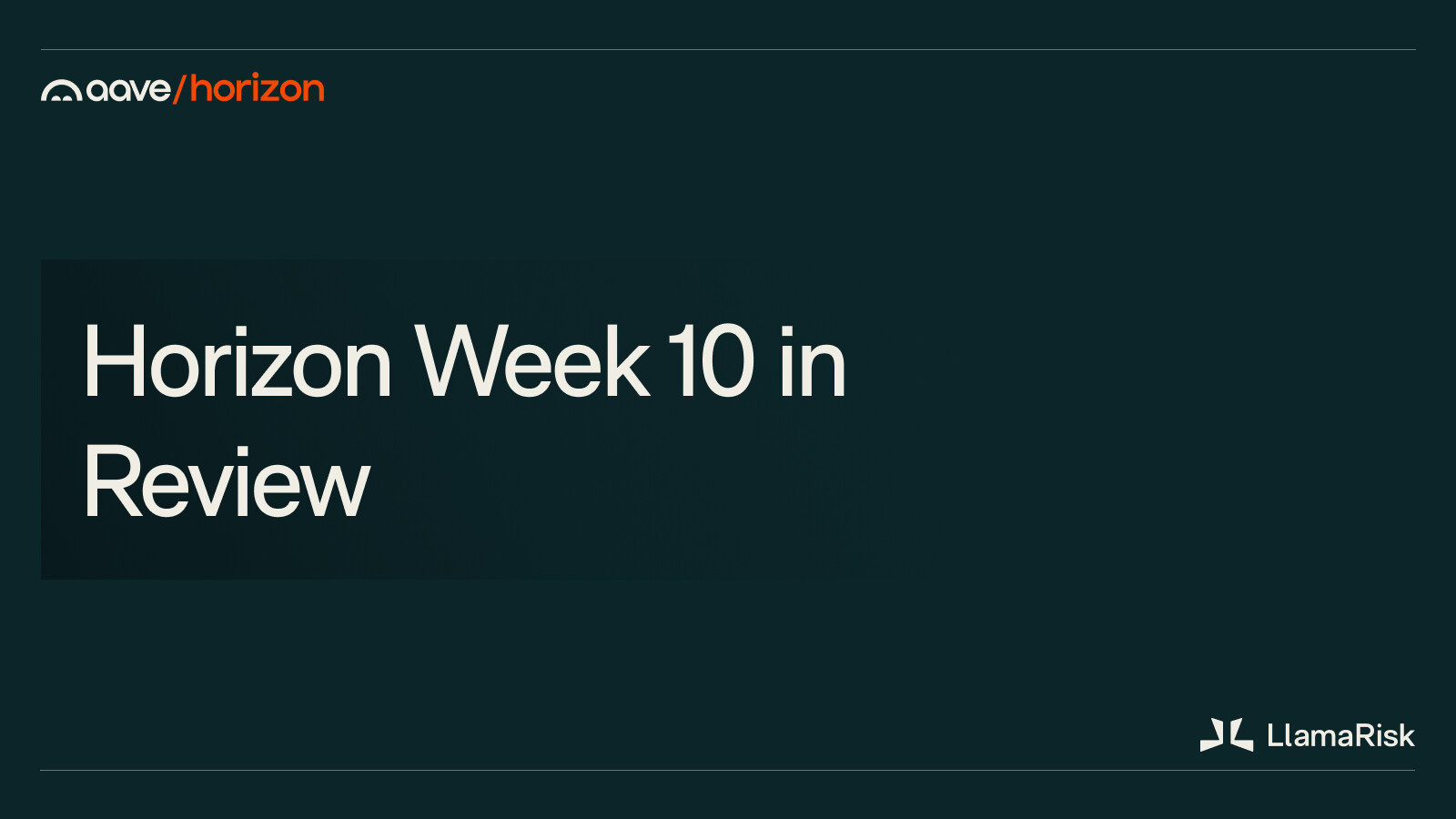

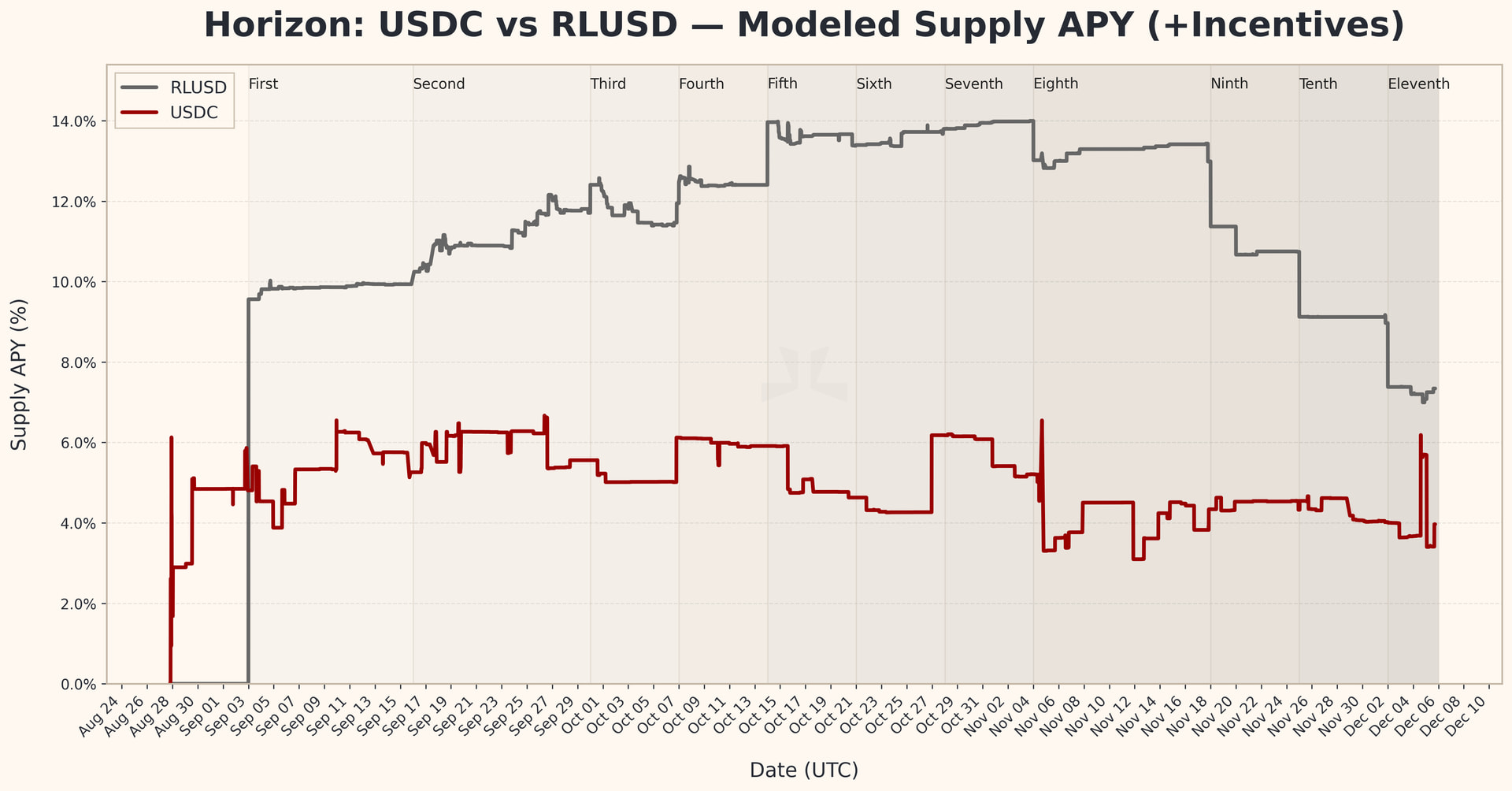

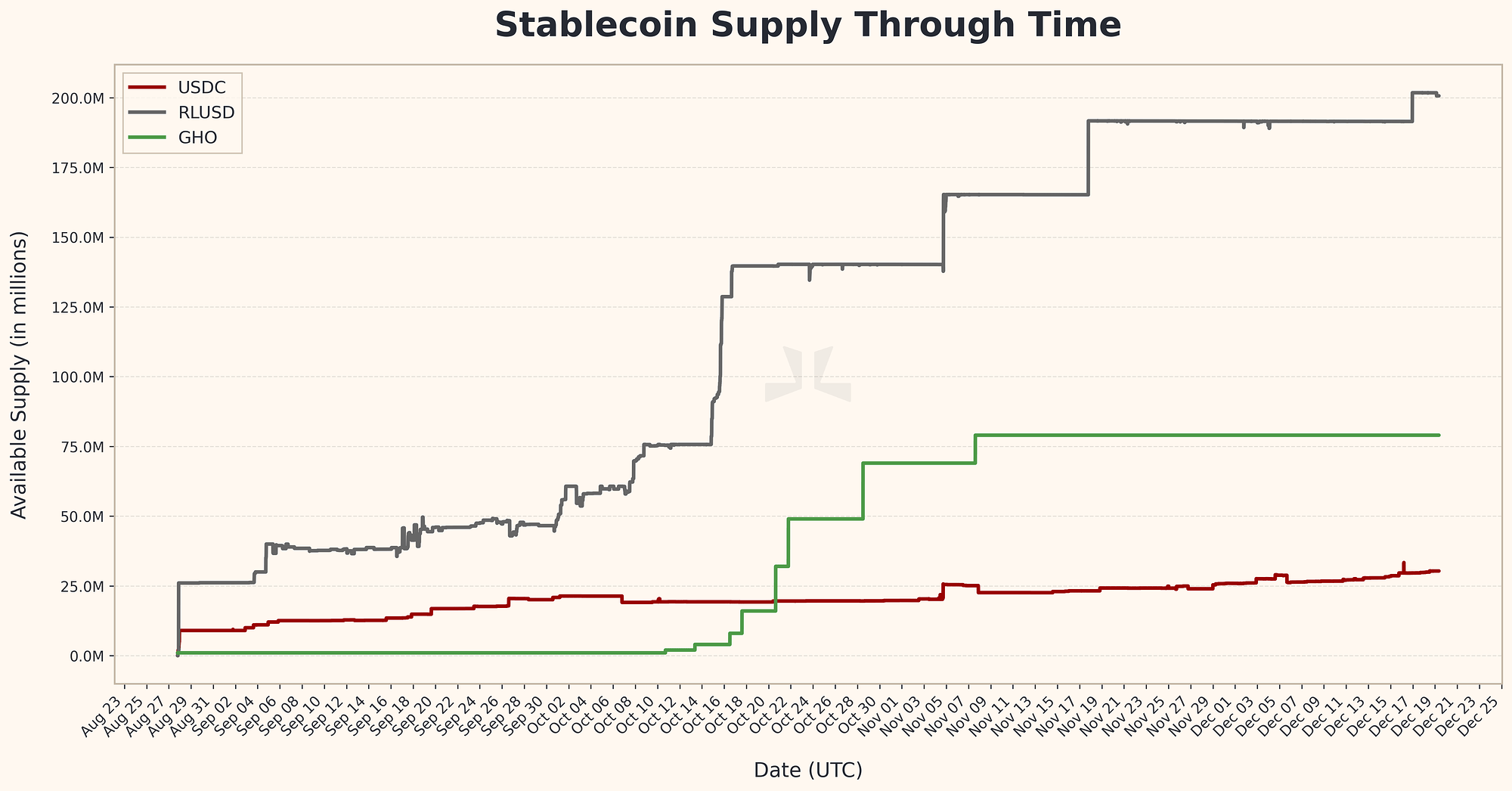

TVL has surpassed $80 million, with stablecoin deposits accounting for approximately $50 million. RLUSD is the largest supplied asset, reaching its $40 million cap at one point—a limit raised twice (from $25M to $30M, then to $40M) to meet strong demand fueled by a rewards campaign managed through Merkl. In contrast, USDC supply appears to be driven by bootstrap capital and organic demand.

-

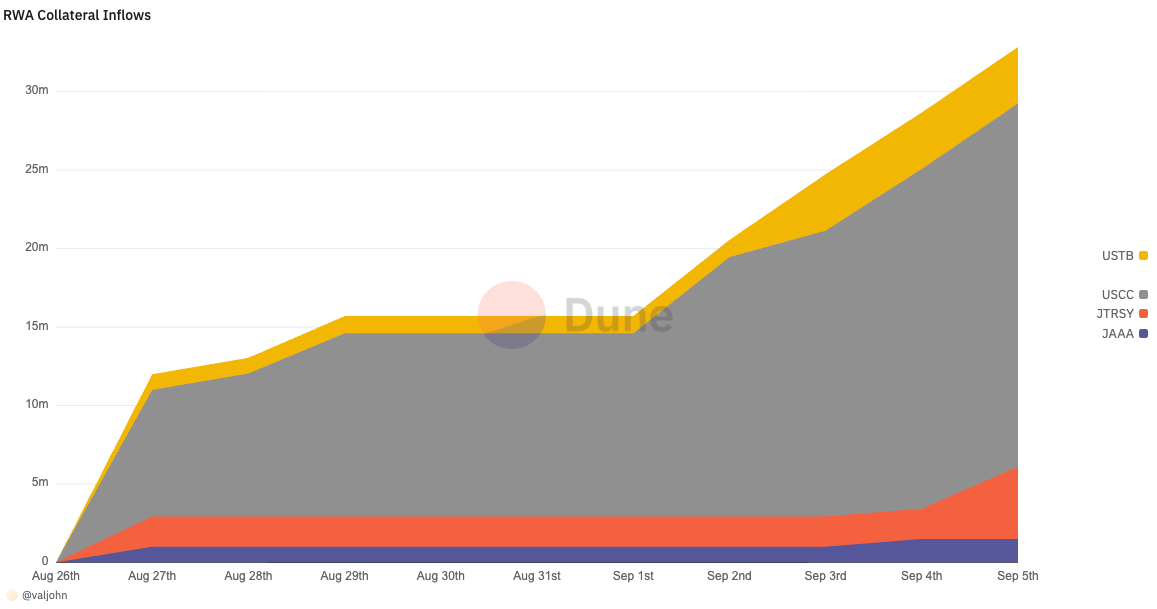

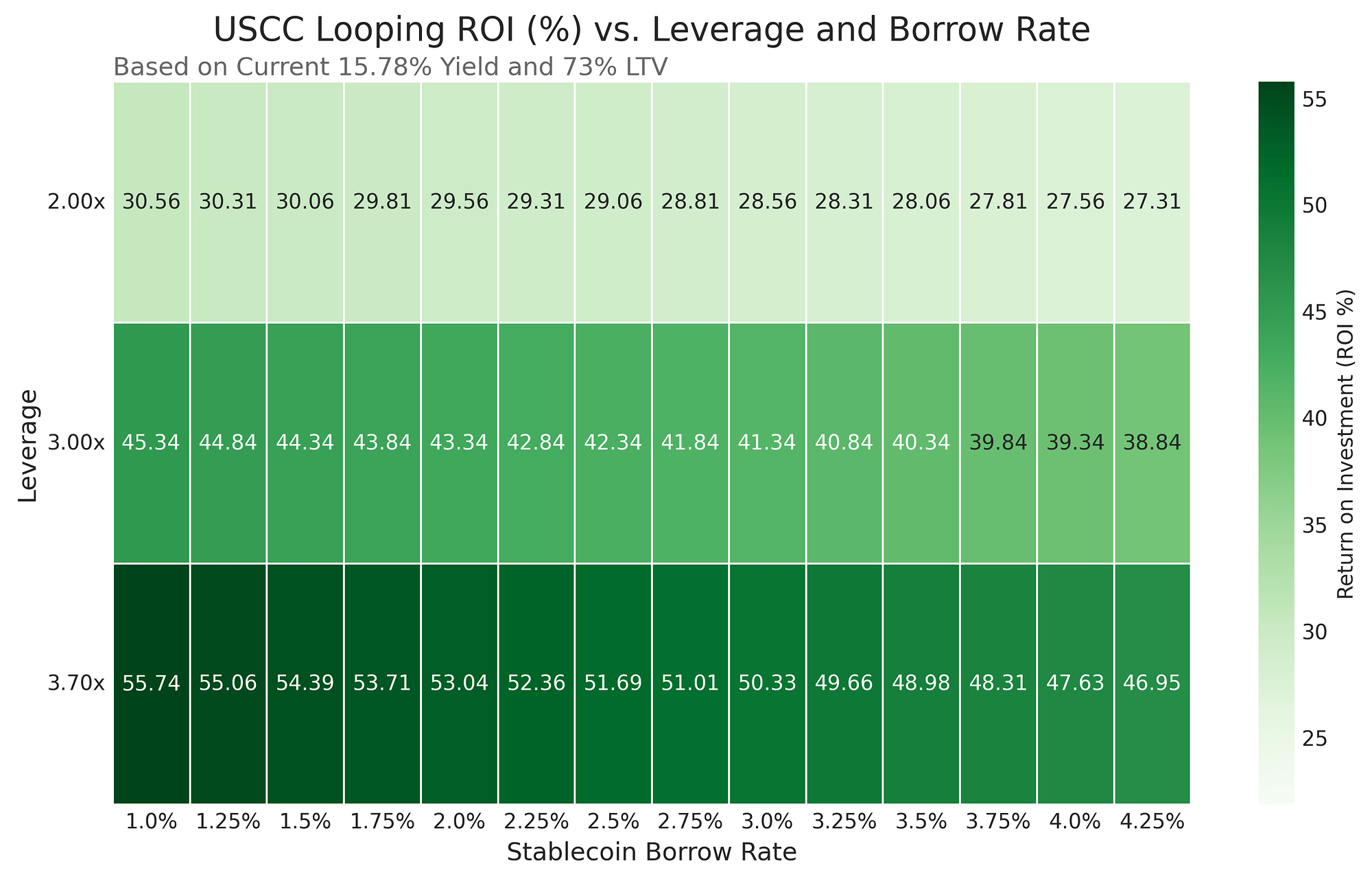

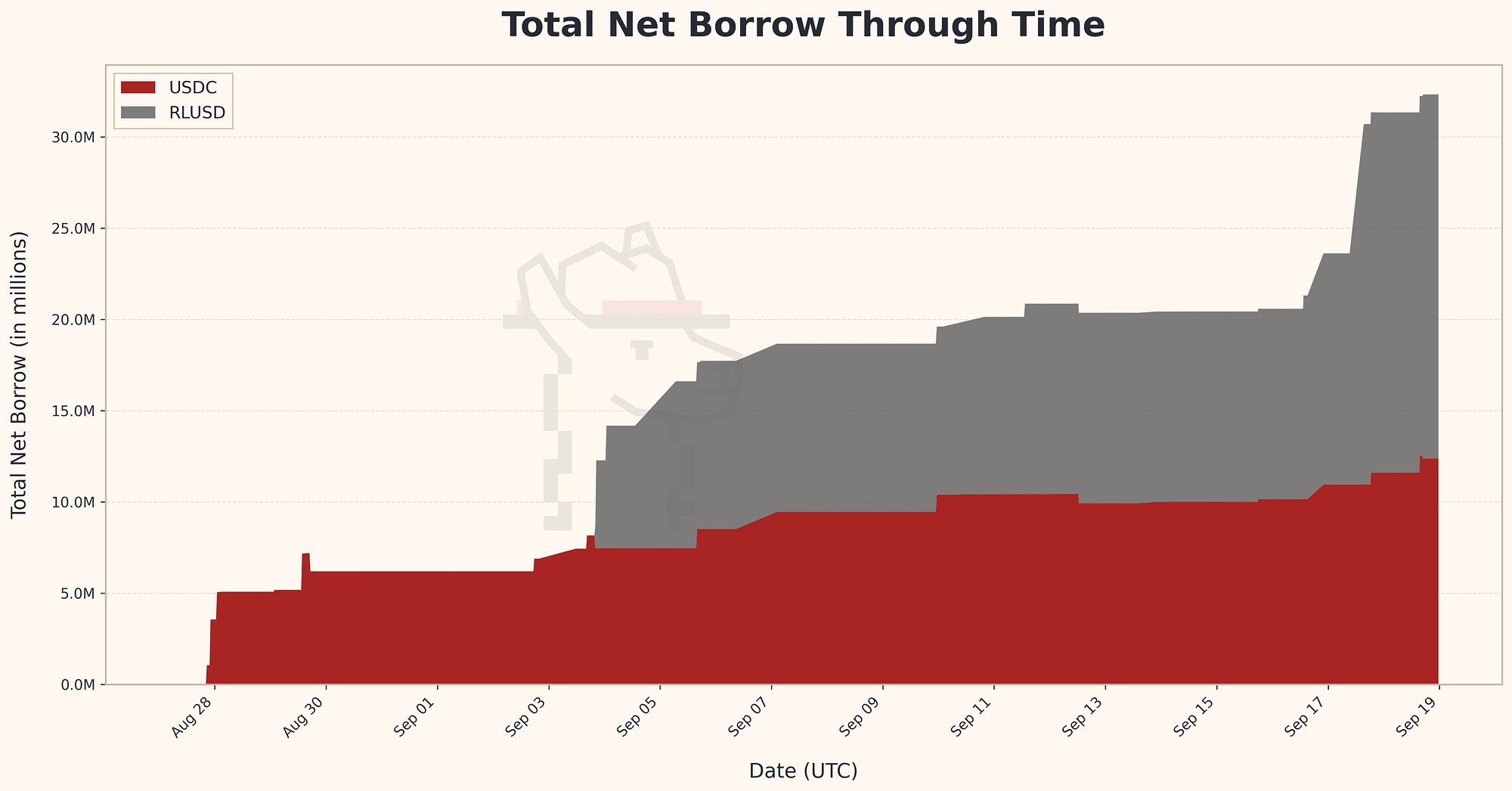

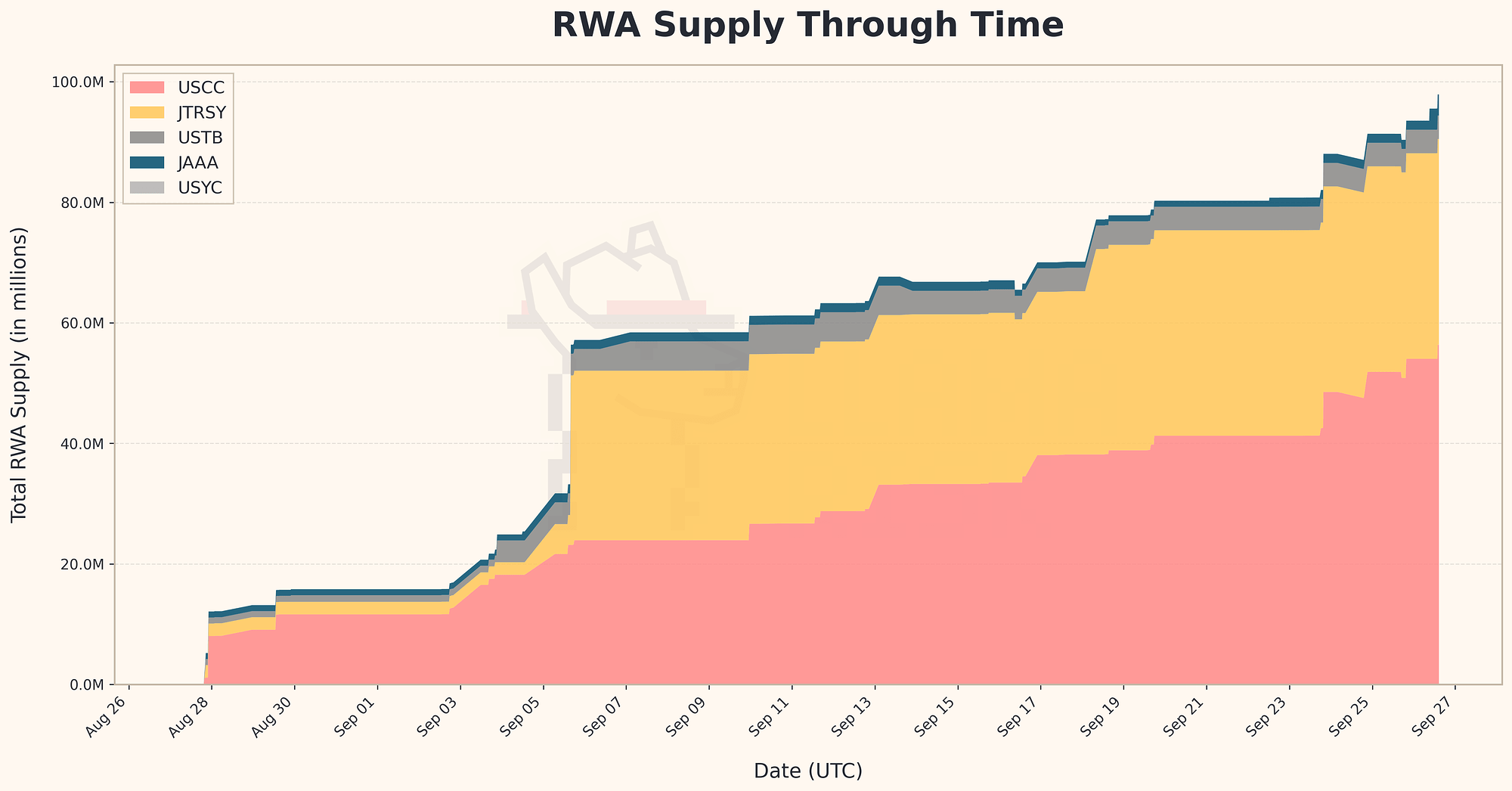

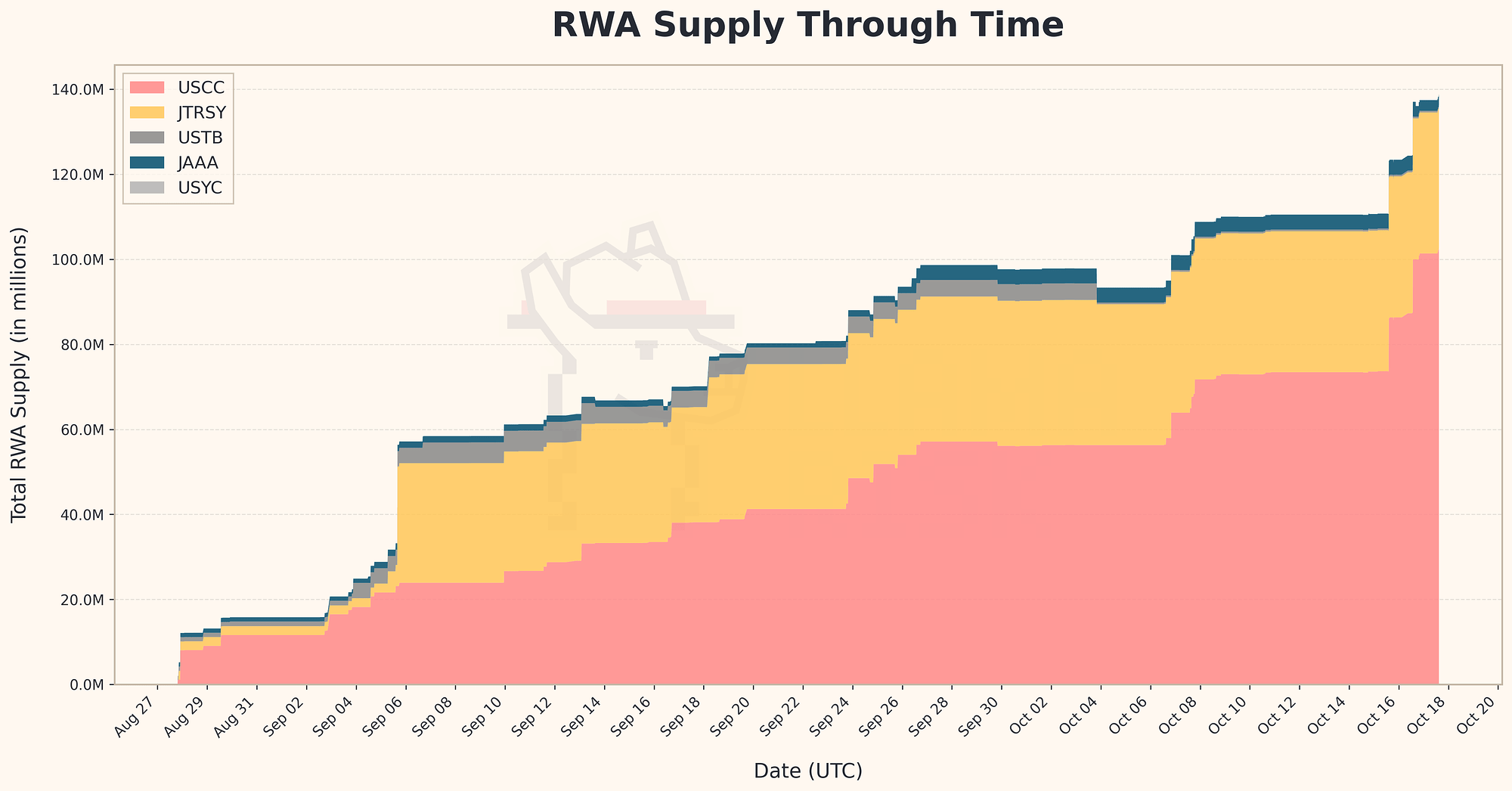

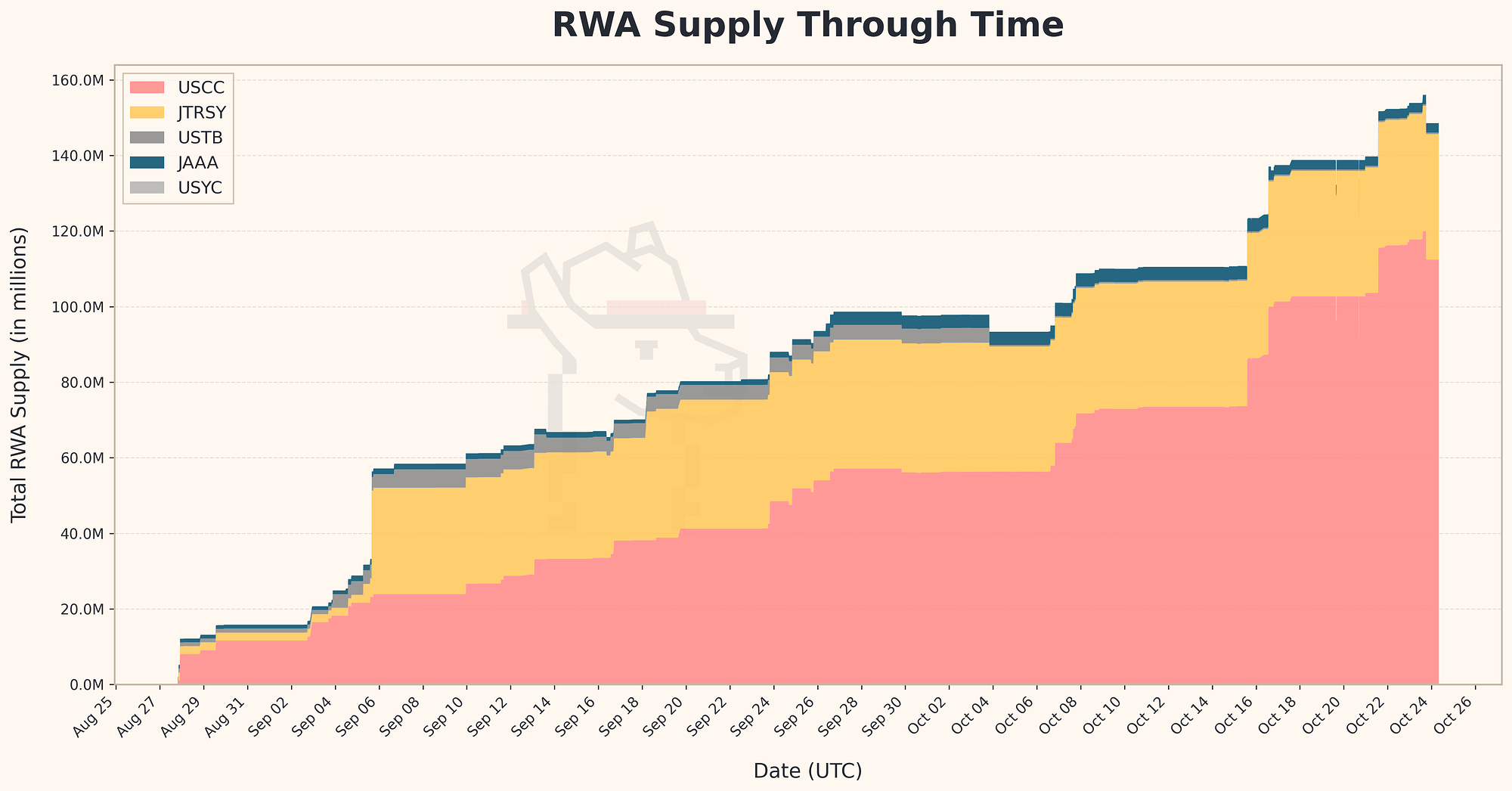

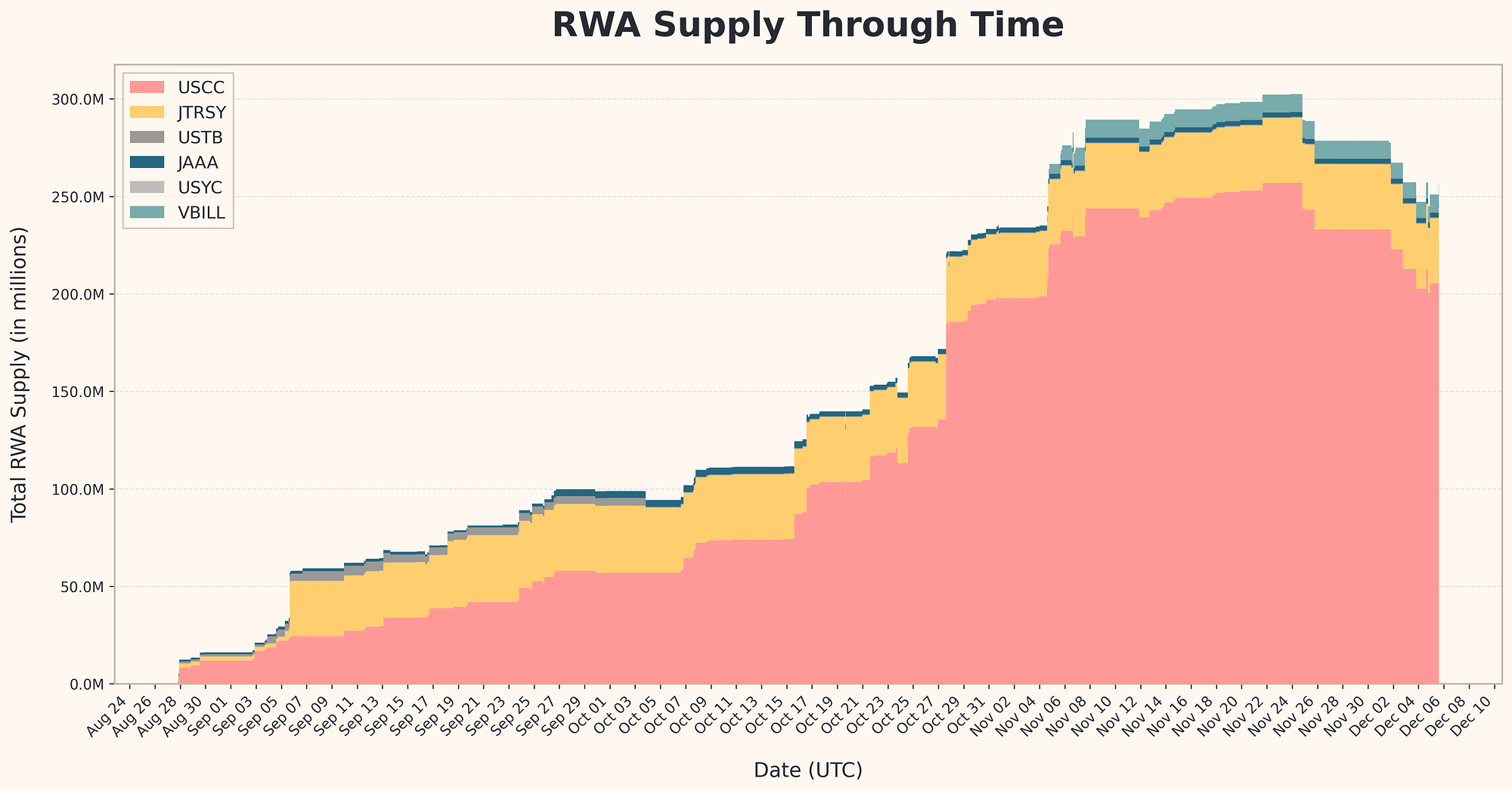

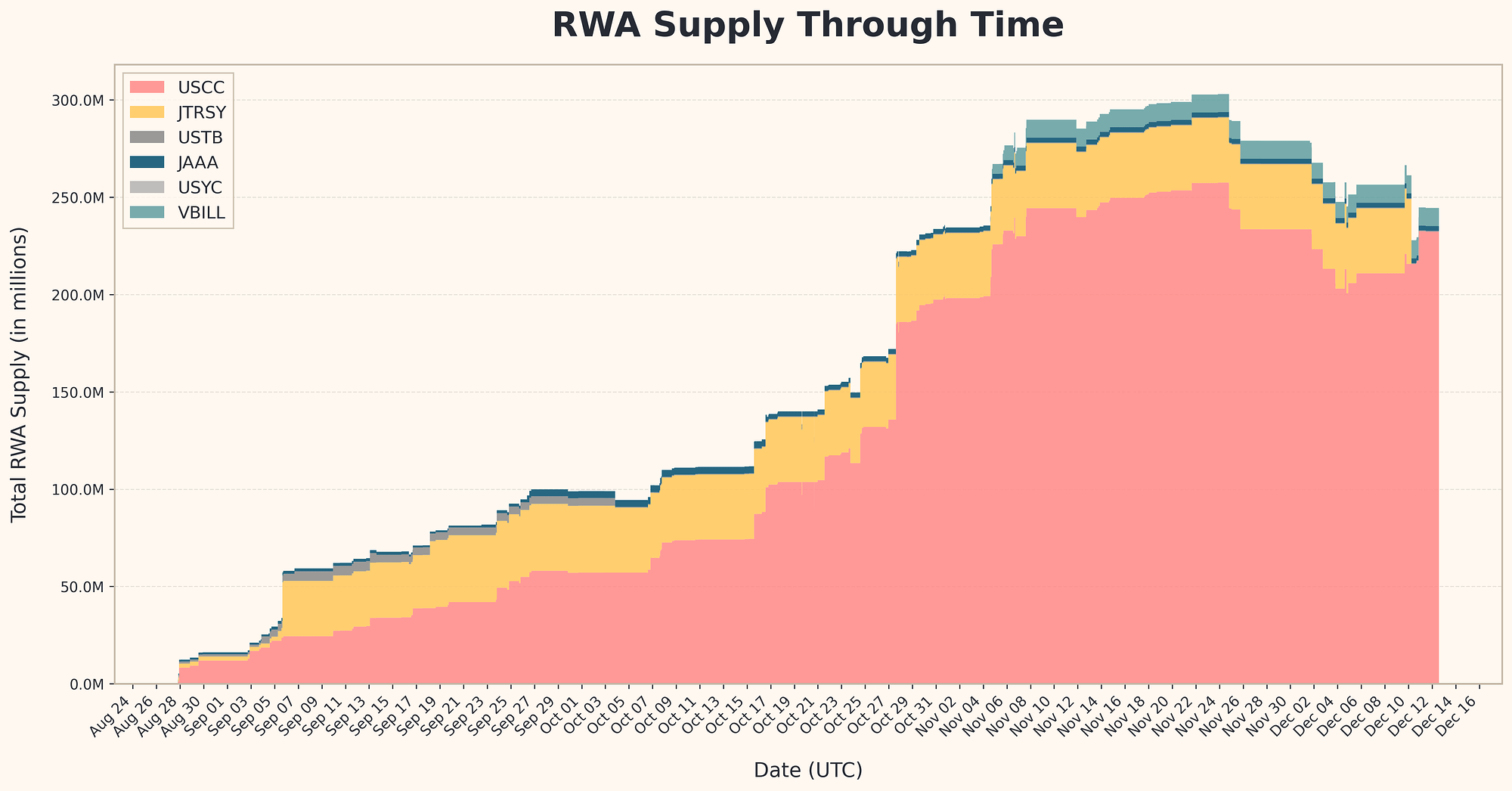

Total borrows have exceeded $16.5 million, primarily driven by Superstate’s Crypto Carry Fund (USCC). To accommodate significant deposits into USCC, the Horizon Operation Multisig increased its supply cap twice. Horizon now holds approximately 7.5% of all USCC onchain supply. As projected, market growth is currently constrained by the RWA supply side, which is limited to a select, whitelisted group of institutional and accredited investors.

-

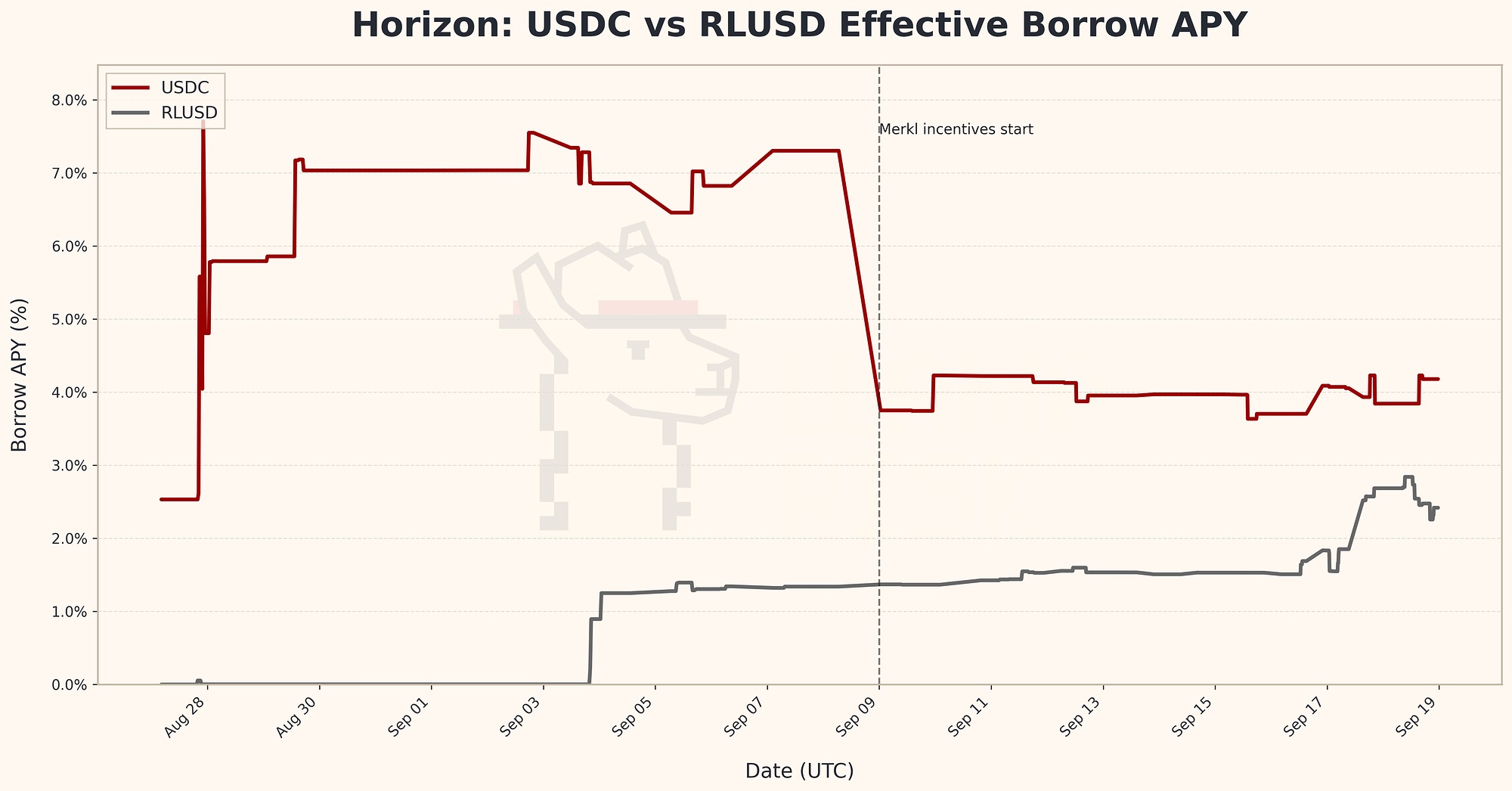

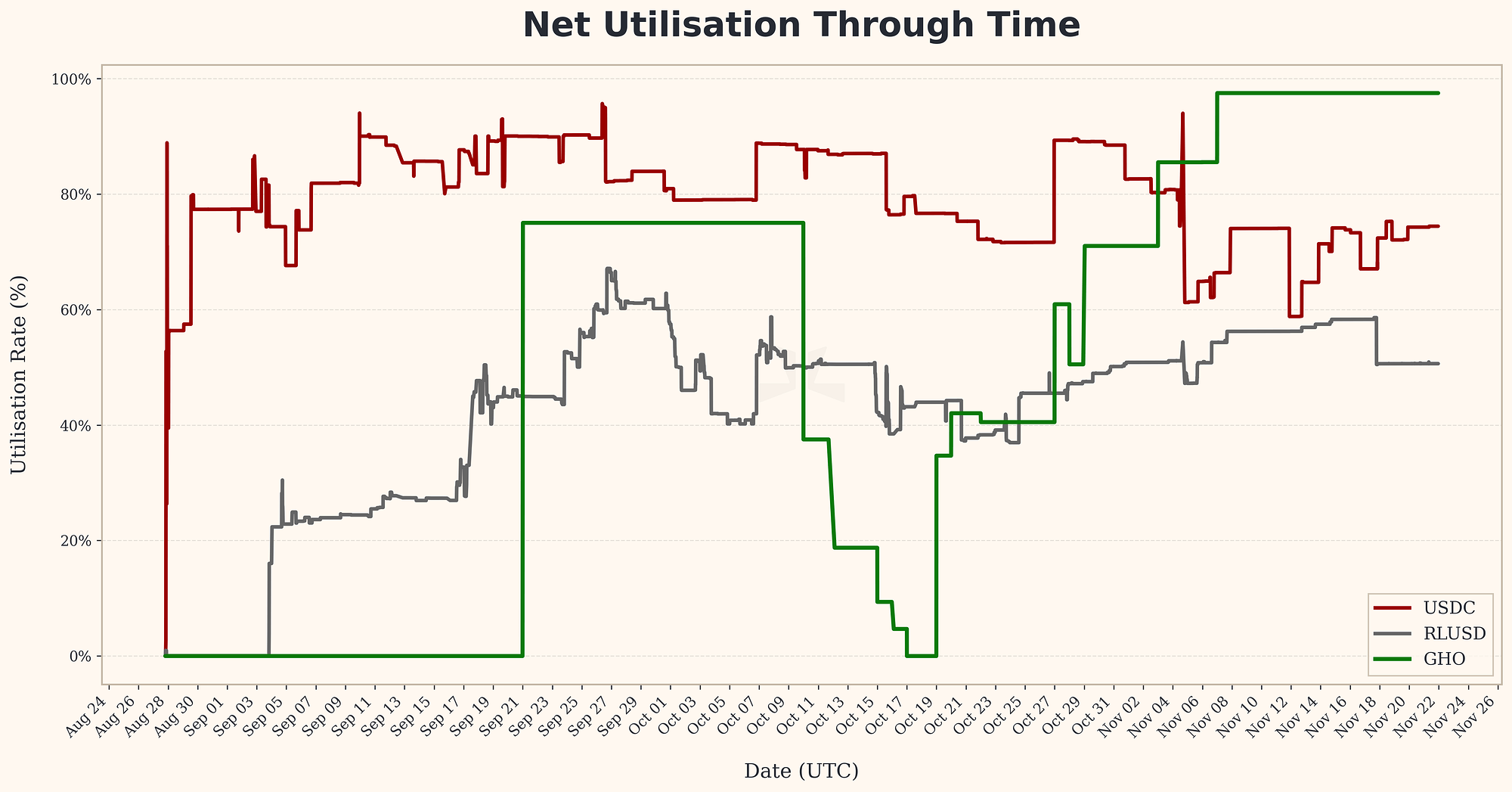

The GHO facilitator, which is capped at $1 million and does not permit external GHO deposits, has seen no utilization so far. This lack of activity is attributed to its comparatively high borrow rate relative to other available stablecoins on the platform. We expect usage to change as the bootstrapping period continues and some users elect to mint GHO to benefit from yield farming strategies (e.g., sGHO yielding over 8% APY).

-

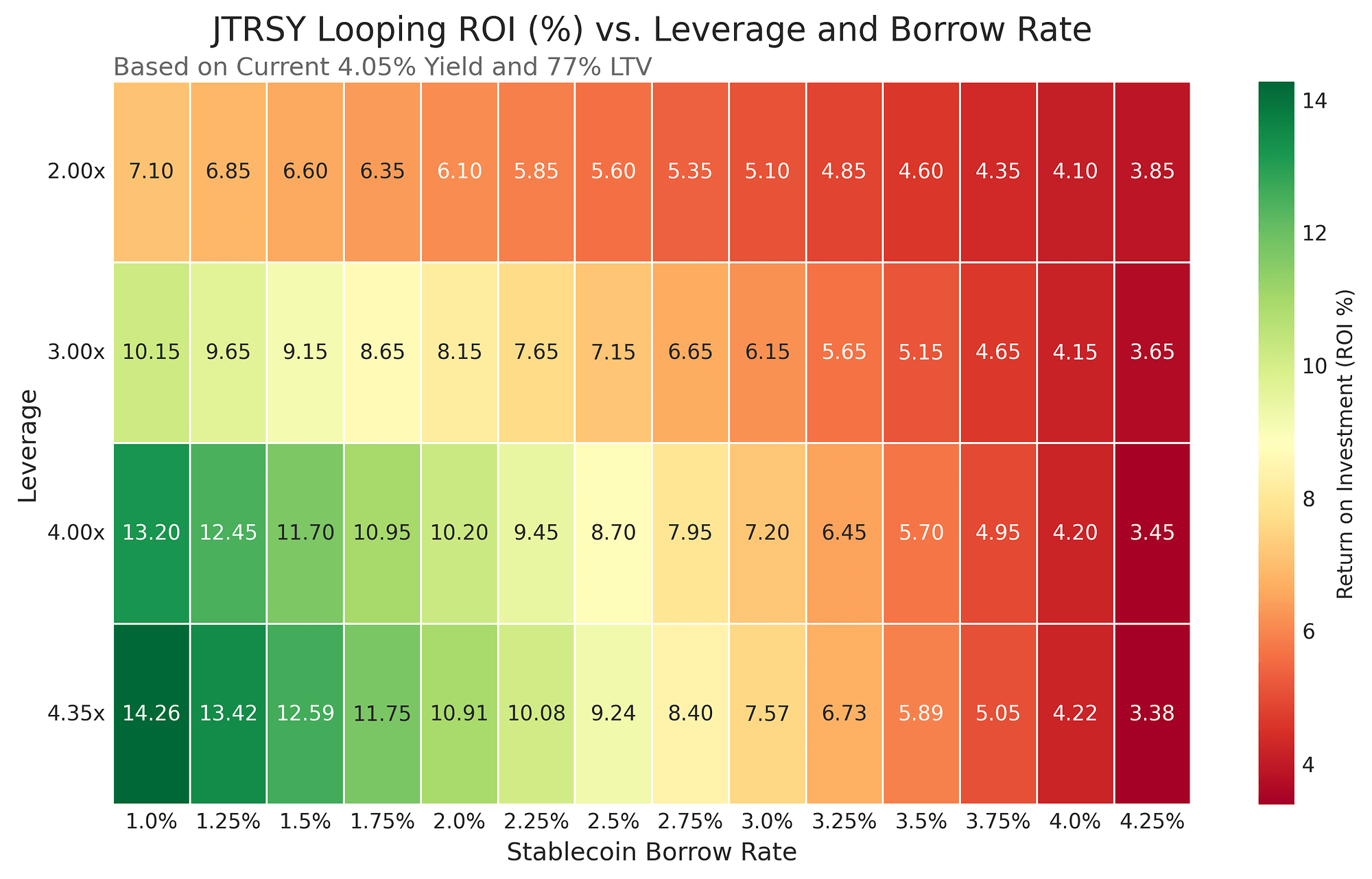

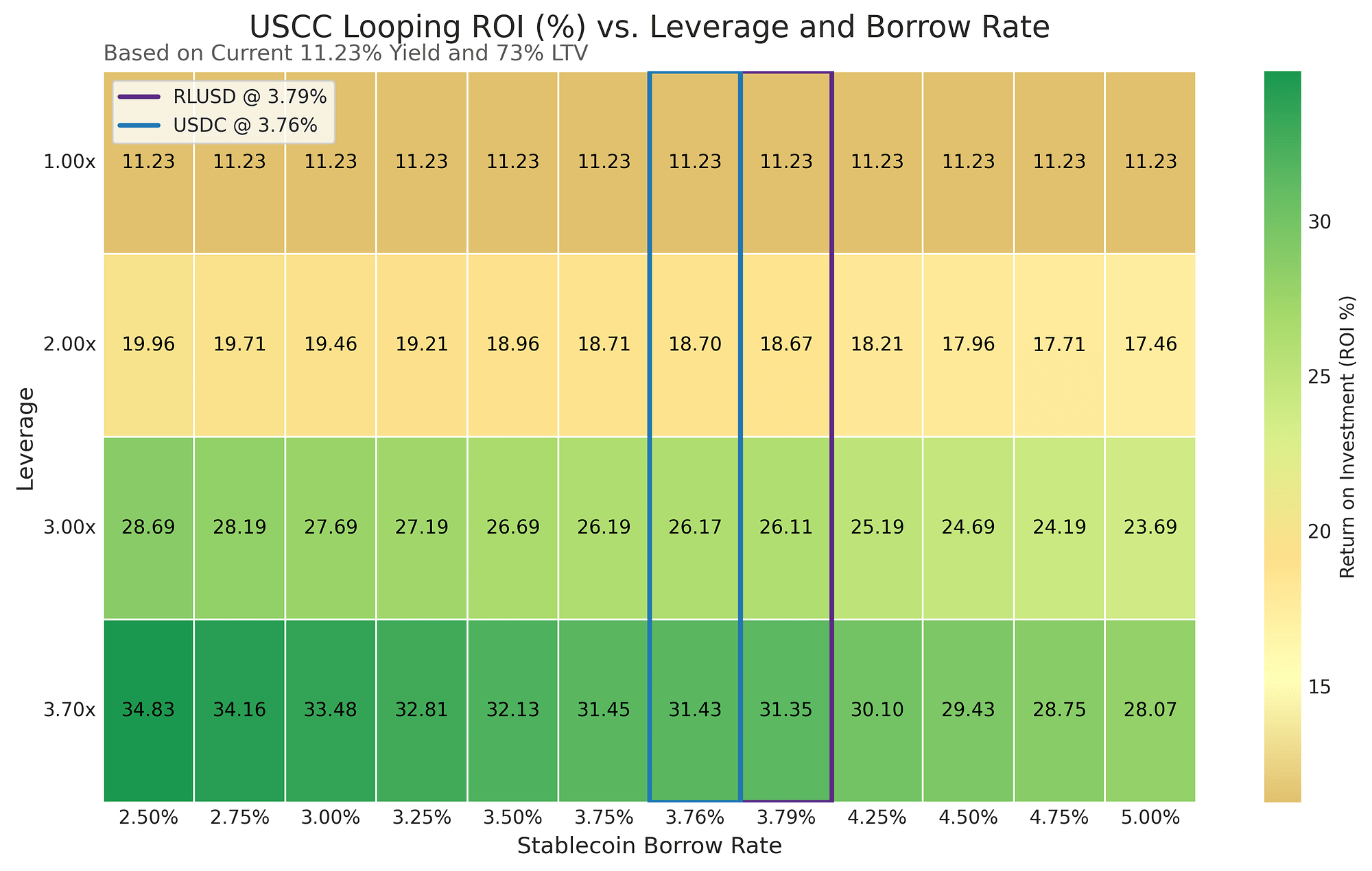

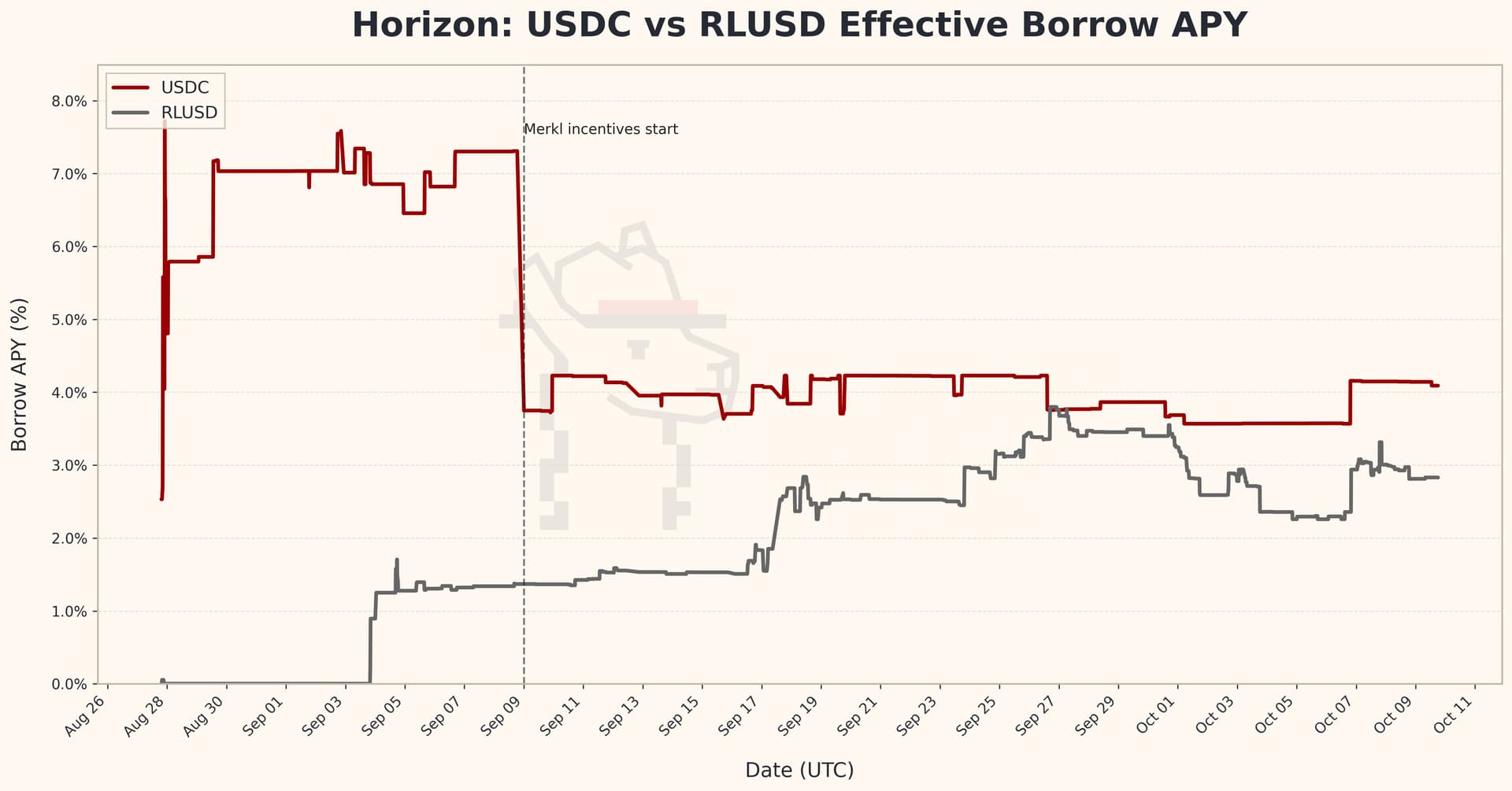

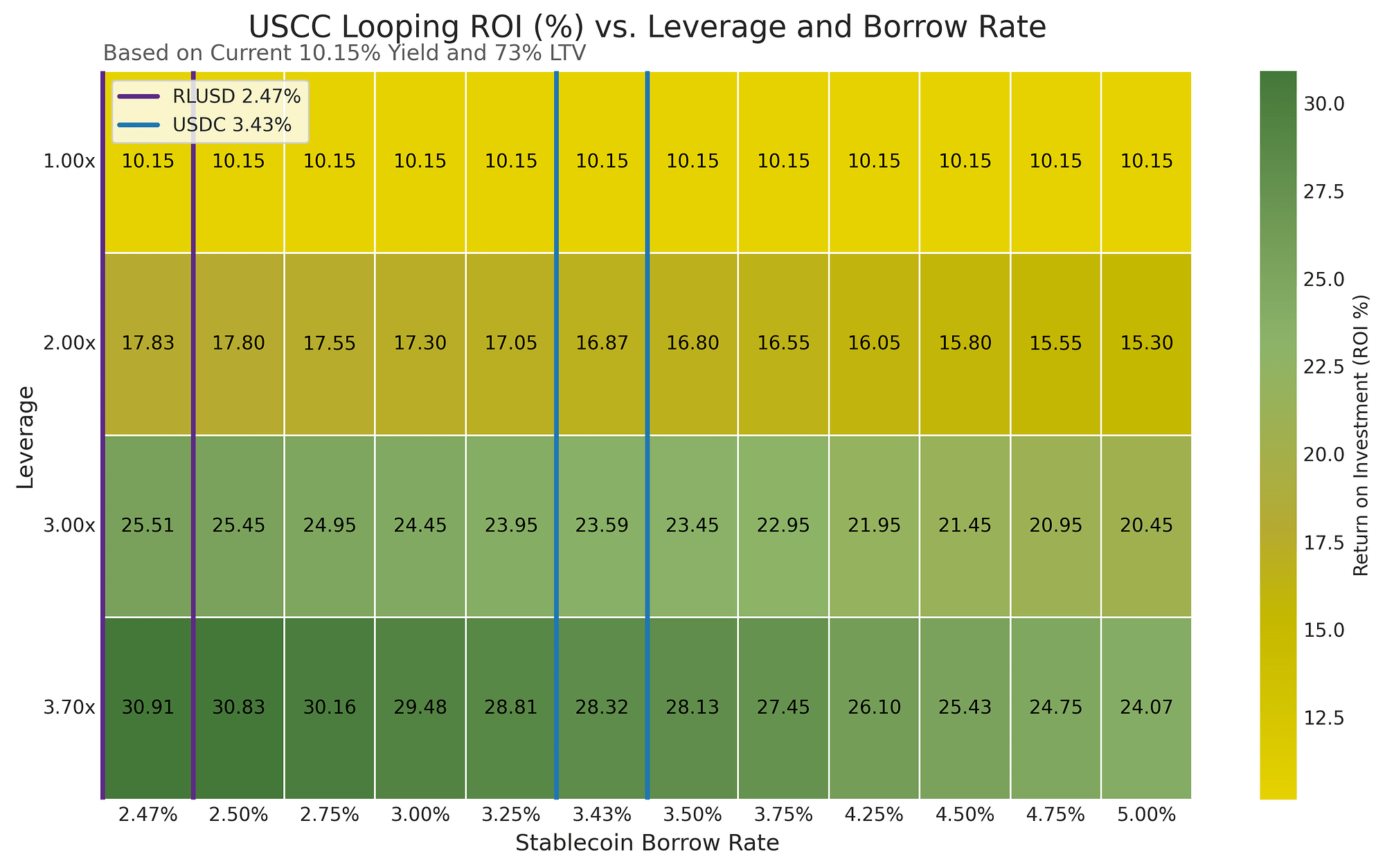

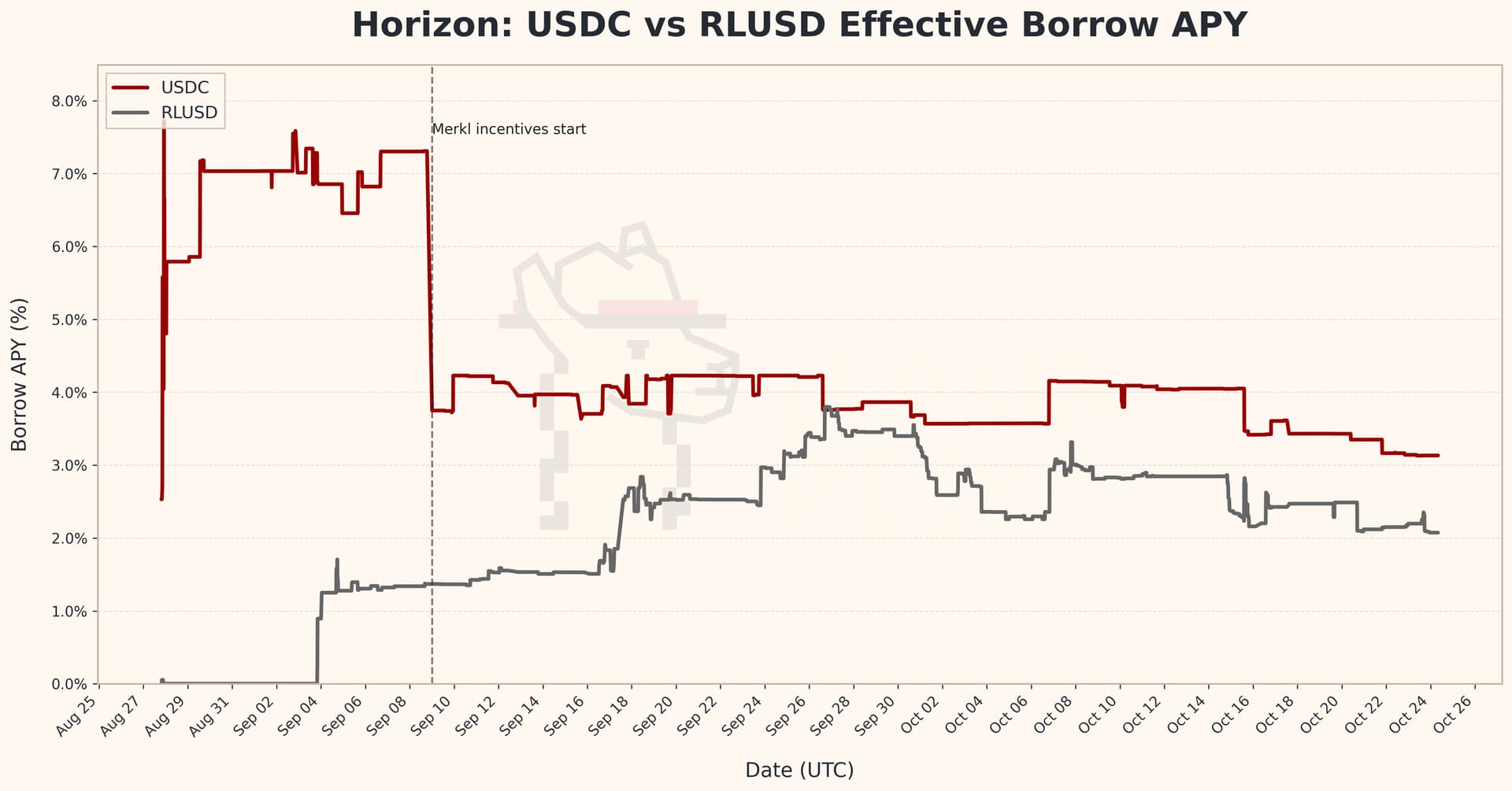

Despite attractive liquidity and low stablecoin borrowing costs, no significant leverage looping or yield farming has been observed. This is expected as users acclimate to the protocol. A key technical factor limiting such strategies is that not all RWA assets onboarded support instant minting and redemption, which prevents one-click leverage via flashloans. An ecosystem of tools and integrators (e.g., vaults, helper contracts) will develop around this use case as profitability increases and the protocol matures beyond its initial phase of conservative LTVs and supply caps.

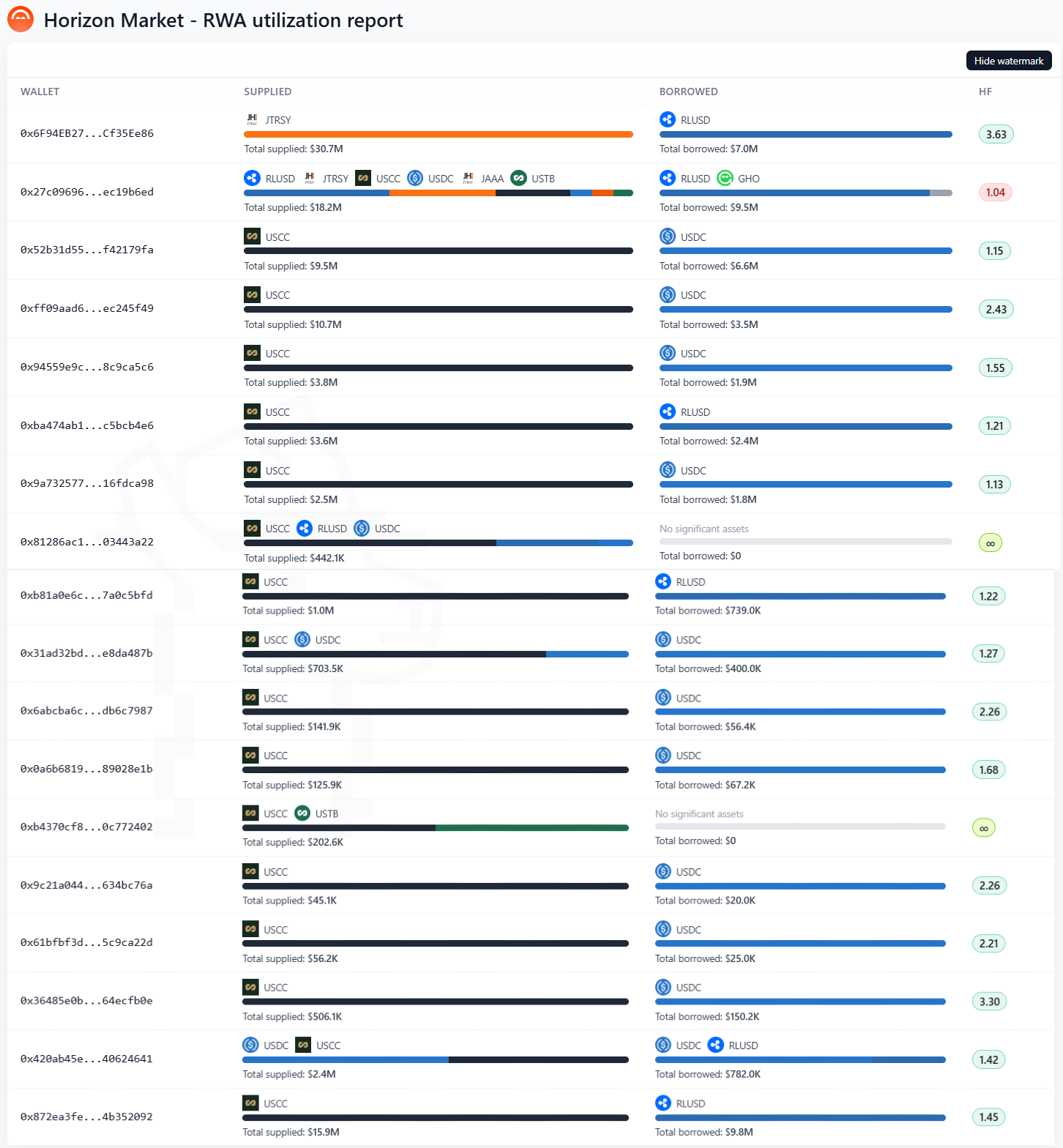

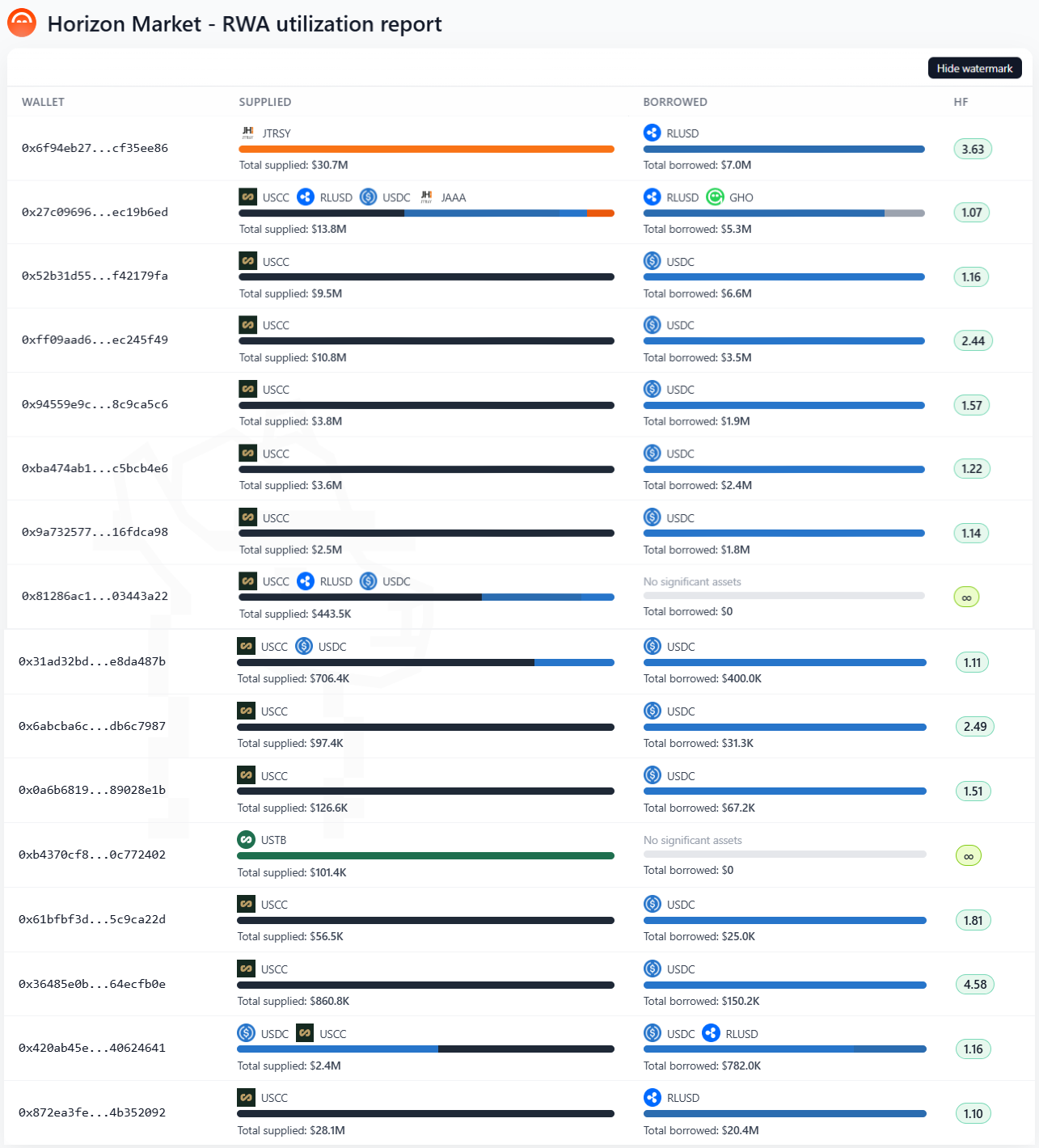

Source: Horizon RWA Market - 14:00 UTC, September 5, 2025

Utilization report

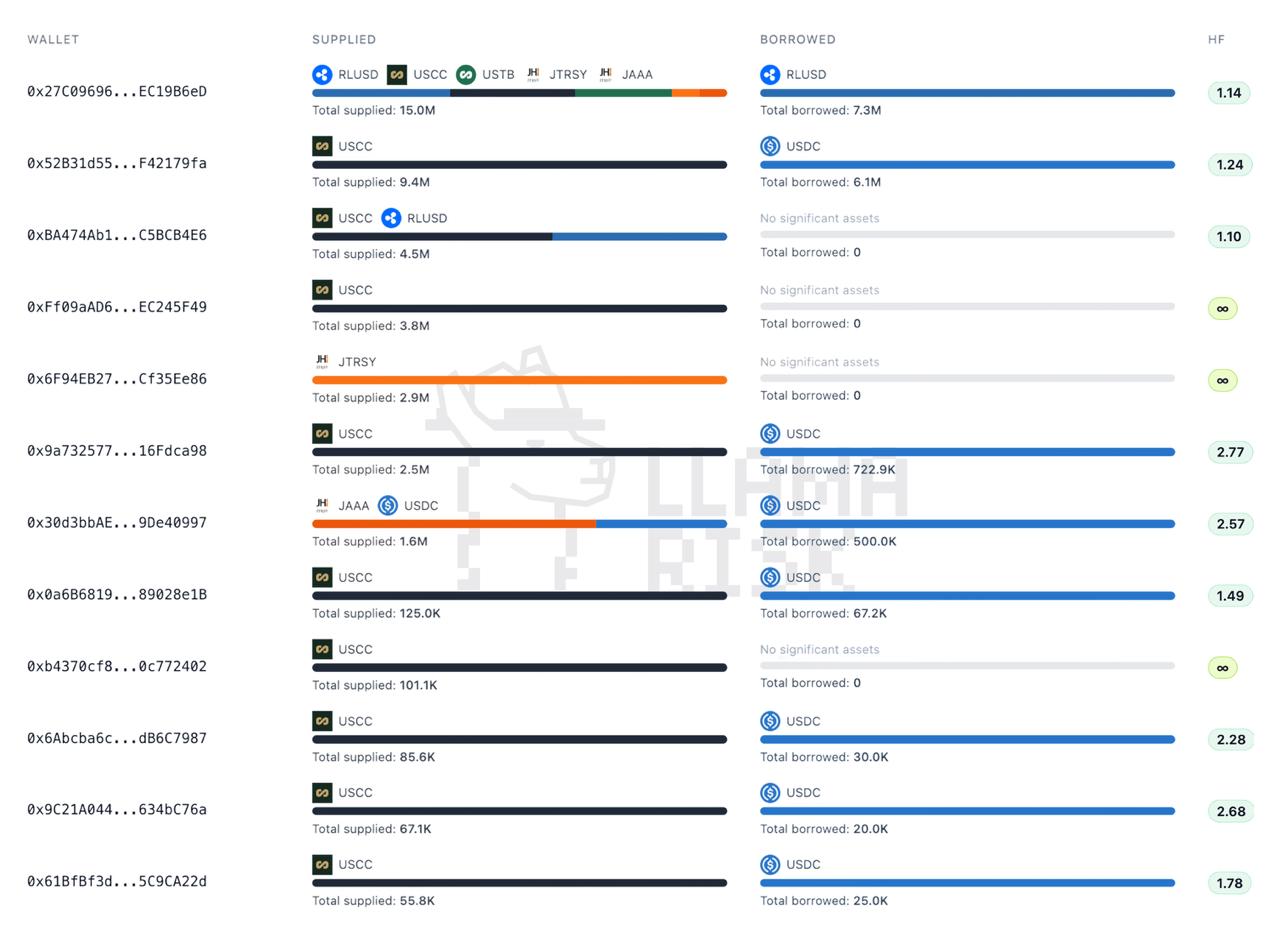

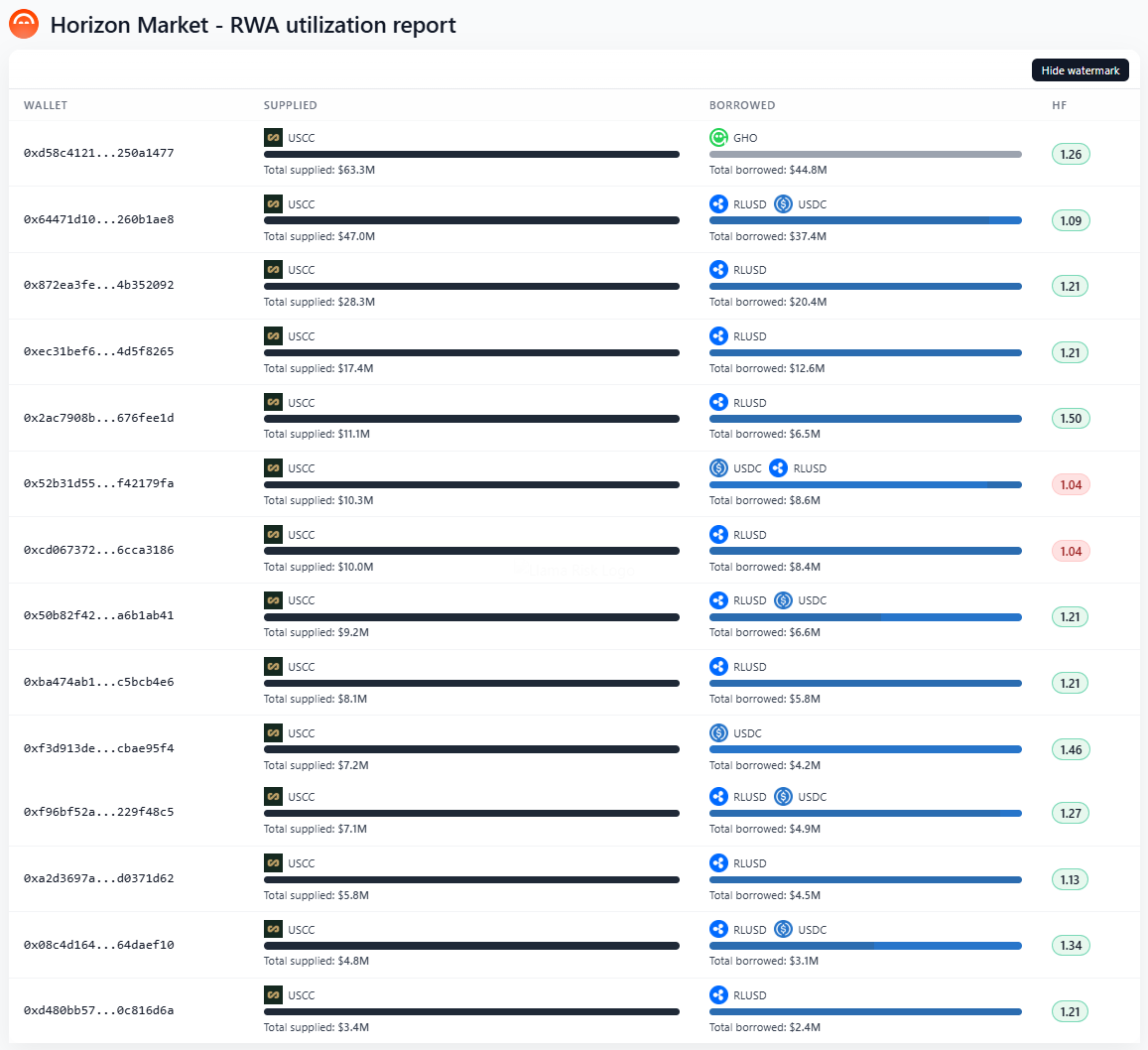

Current RWA suppliers (13 wallets) choose to maintain relatively high health factors, despite a conservative buffer between LTV and liquidation thresholds and a bounded NAV oracle that safeguards against faulty price updates. This is expected as users take some time to acclimate to the protocol.

In our research, we note 3 primary use cases for the Horizon market:

-

Instant Institutional Credit: Access immediate working capital by borrowing against tokenized assets, avoiding issuer redemption delays and fees.

-

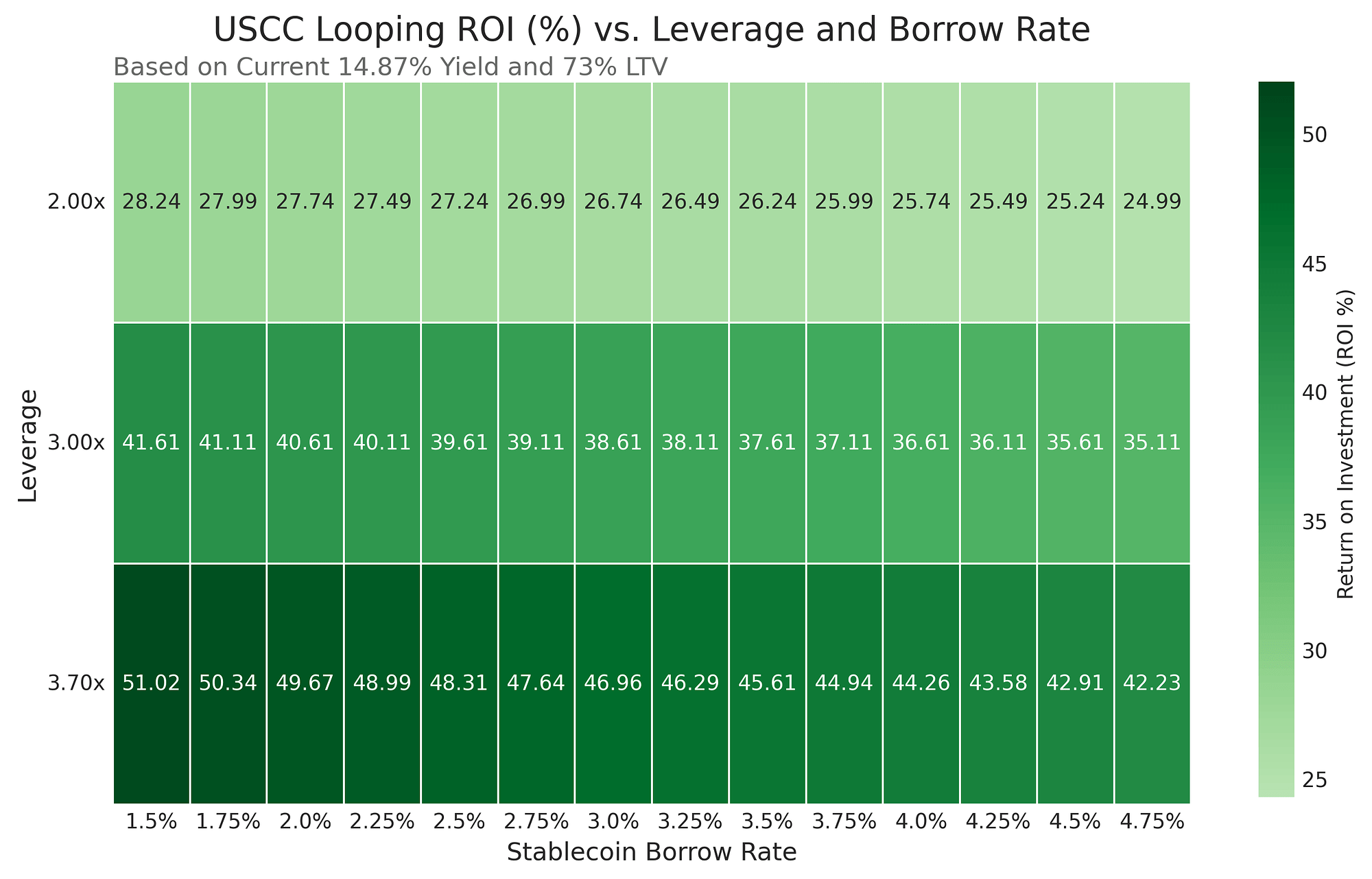

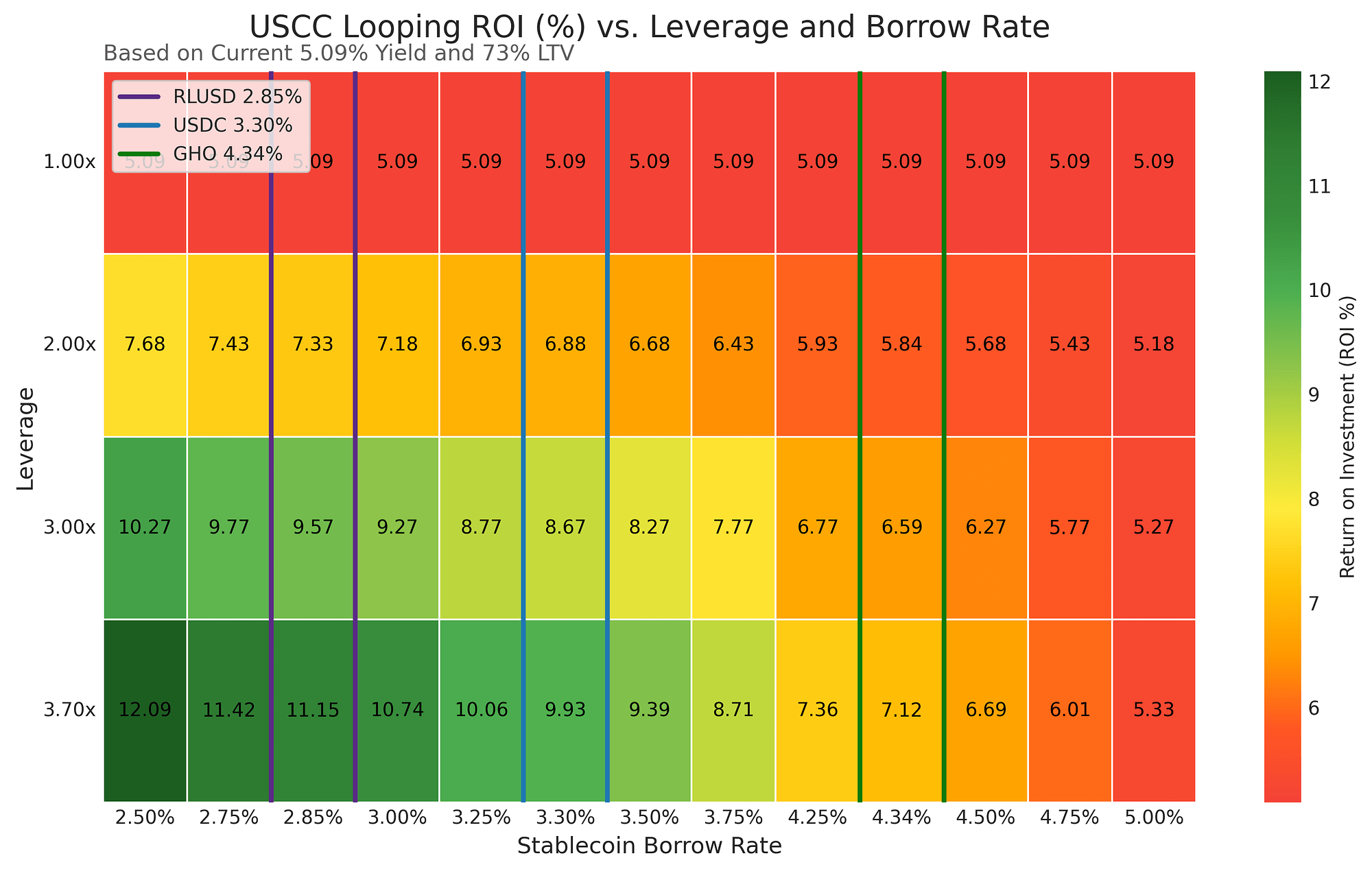

Leveraged Carry Trades: Execute a carry trade by borrowing stablecoins against yield-bearing RWAs, using recursive looping to scale the position and capture the basis between the borrow rate and asset yield.

-

DeFi Yield Generation: Generate yield through two primary avenues: passively supply stablecoins to earn interest from institutional borrowing, or actively execute farming strategies like supplying an RWA to mint and stake GHO.

Source: LlamaRisk - 14:00 UTC, September 5, 2025

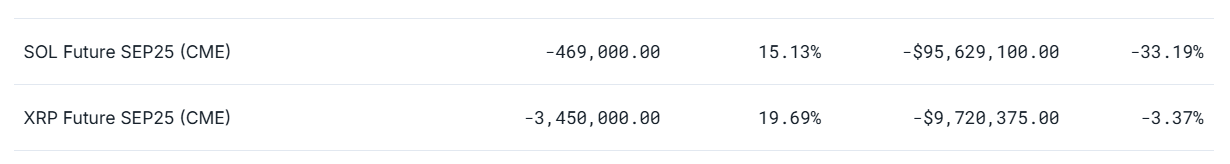

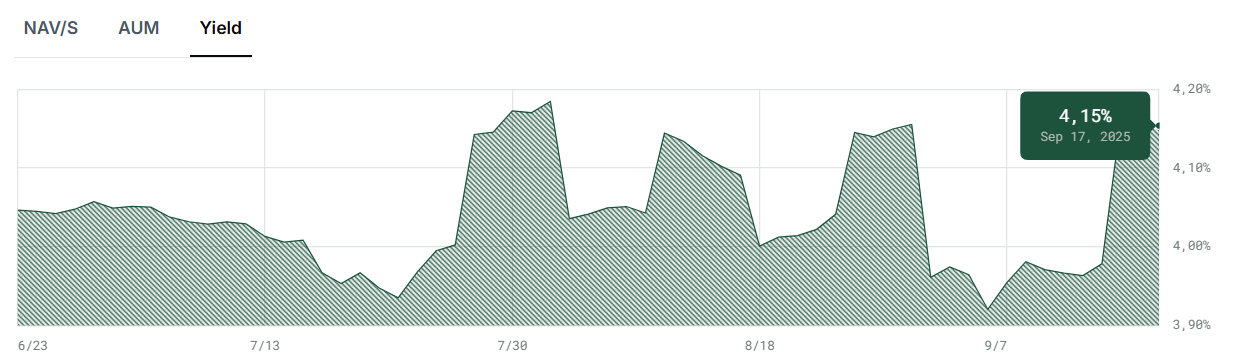

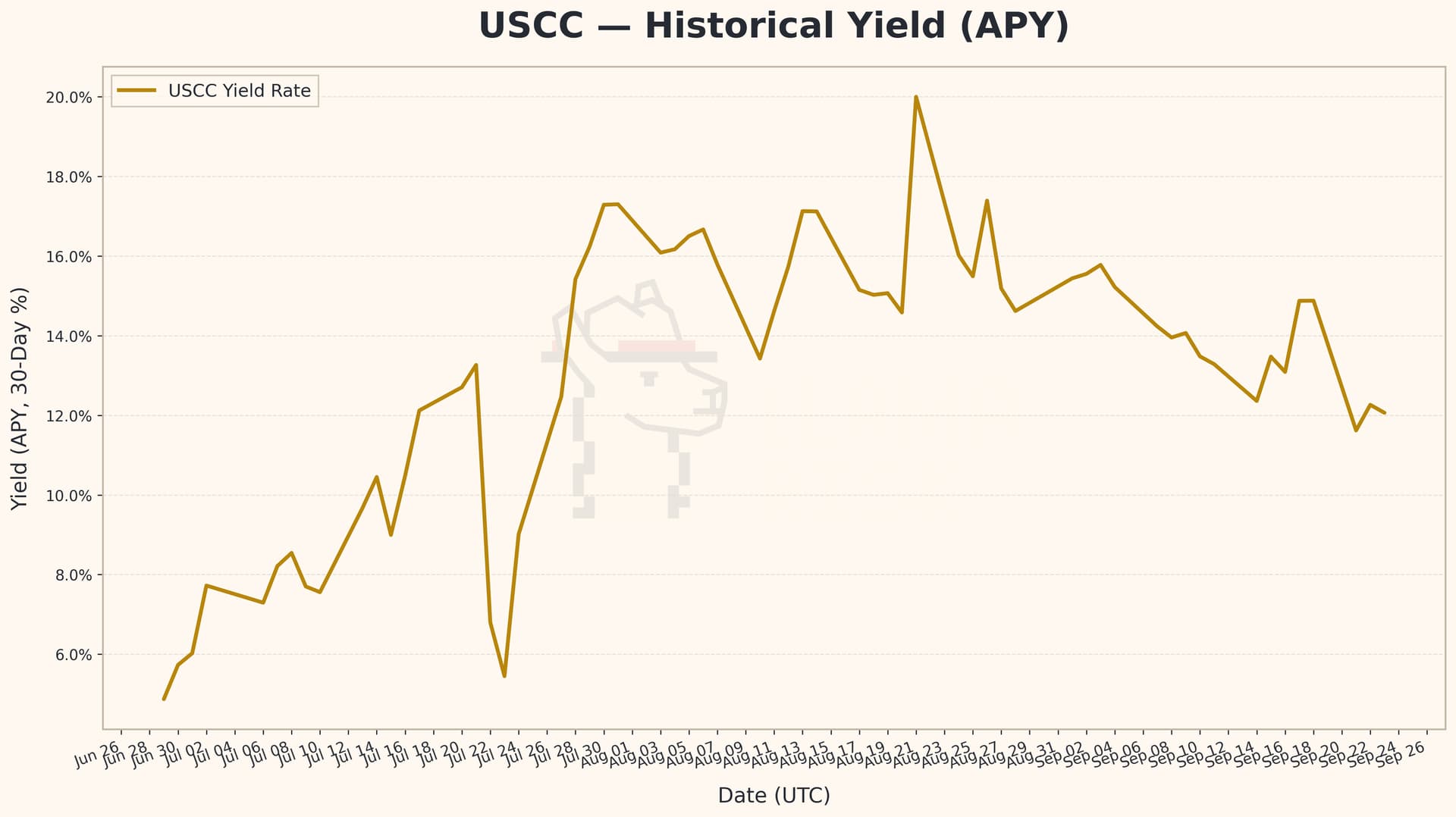

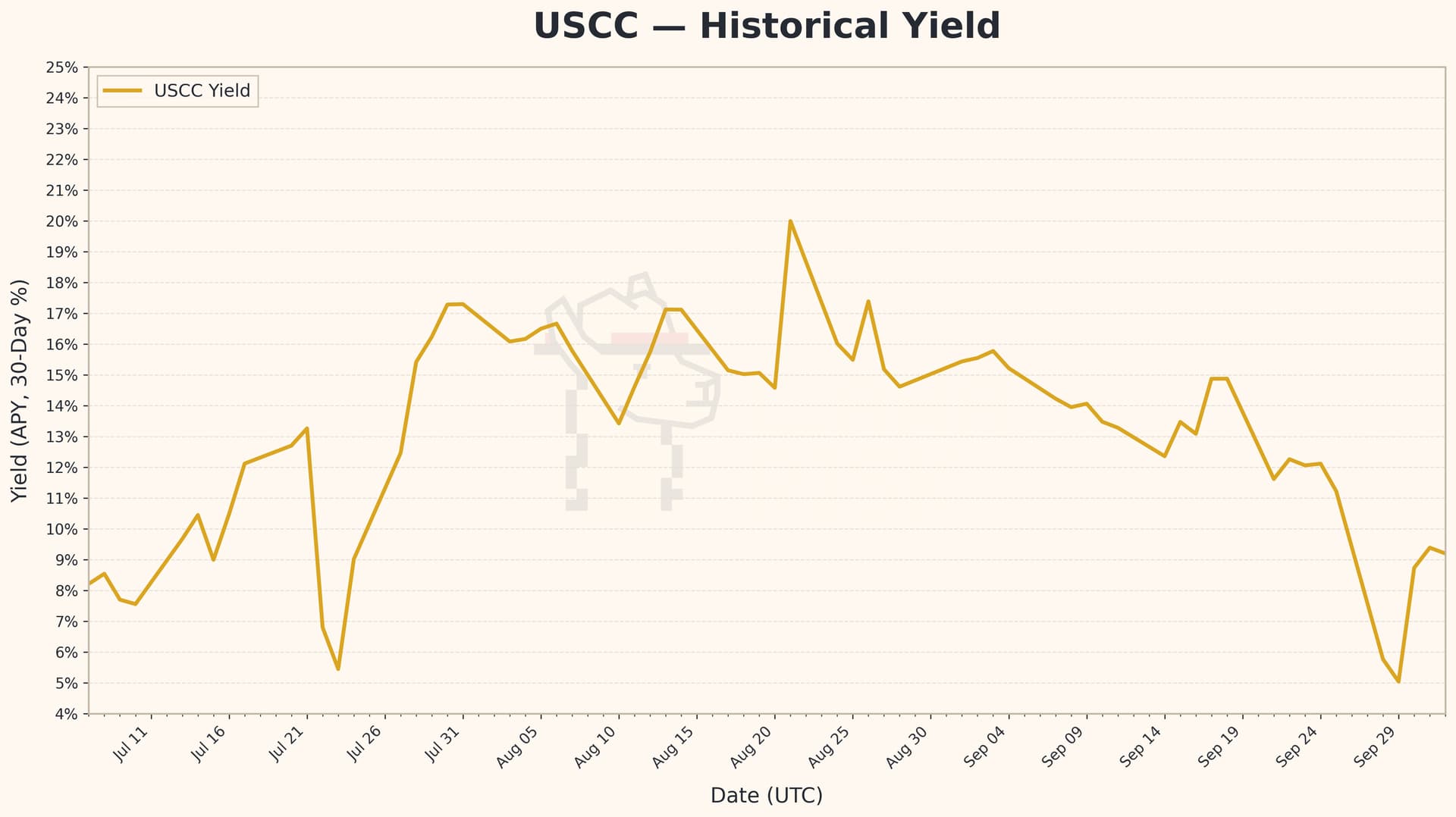

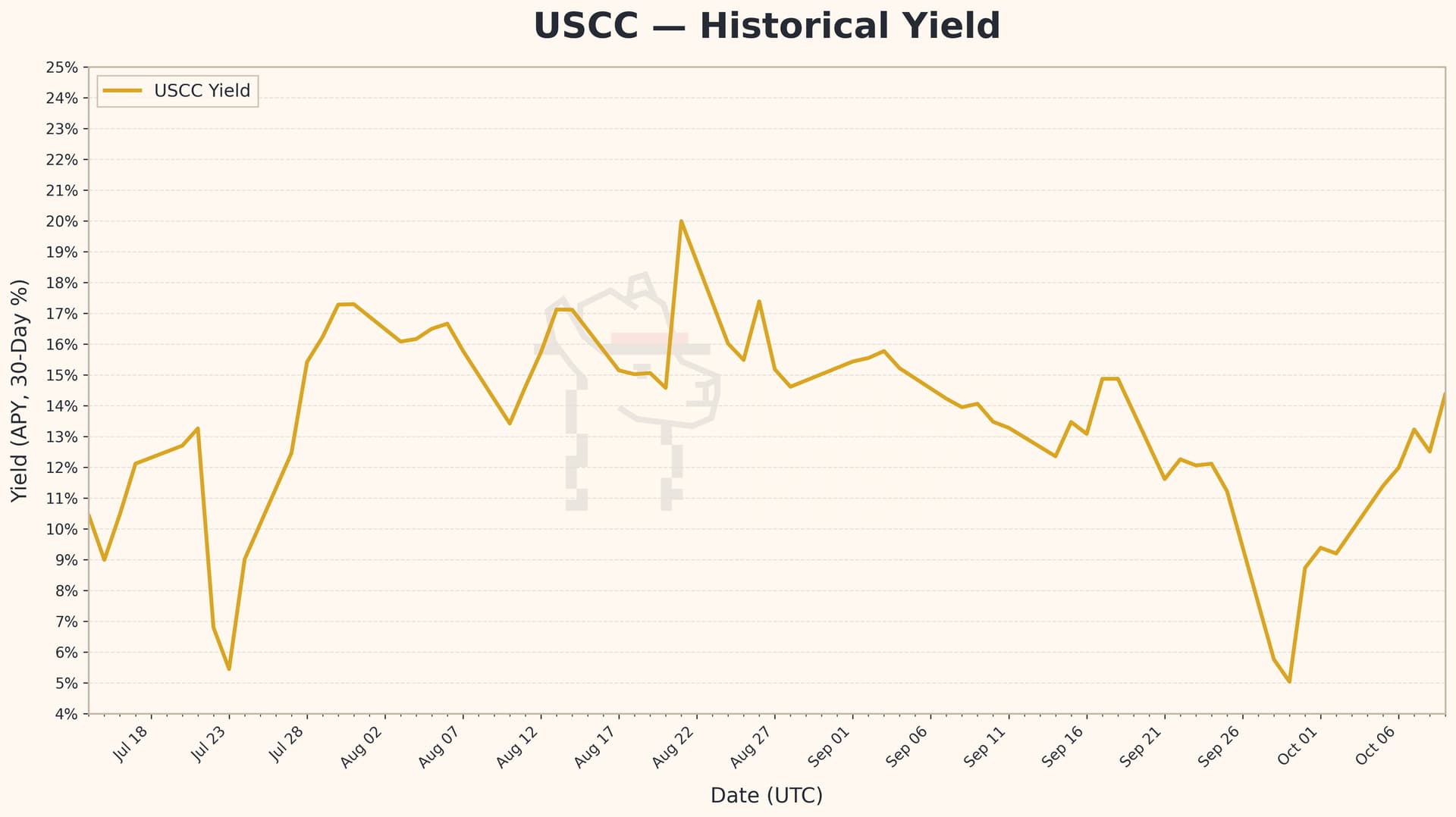

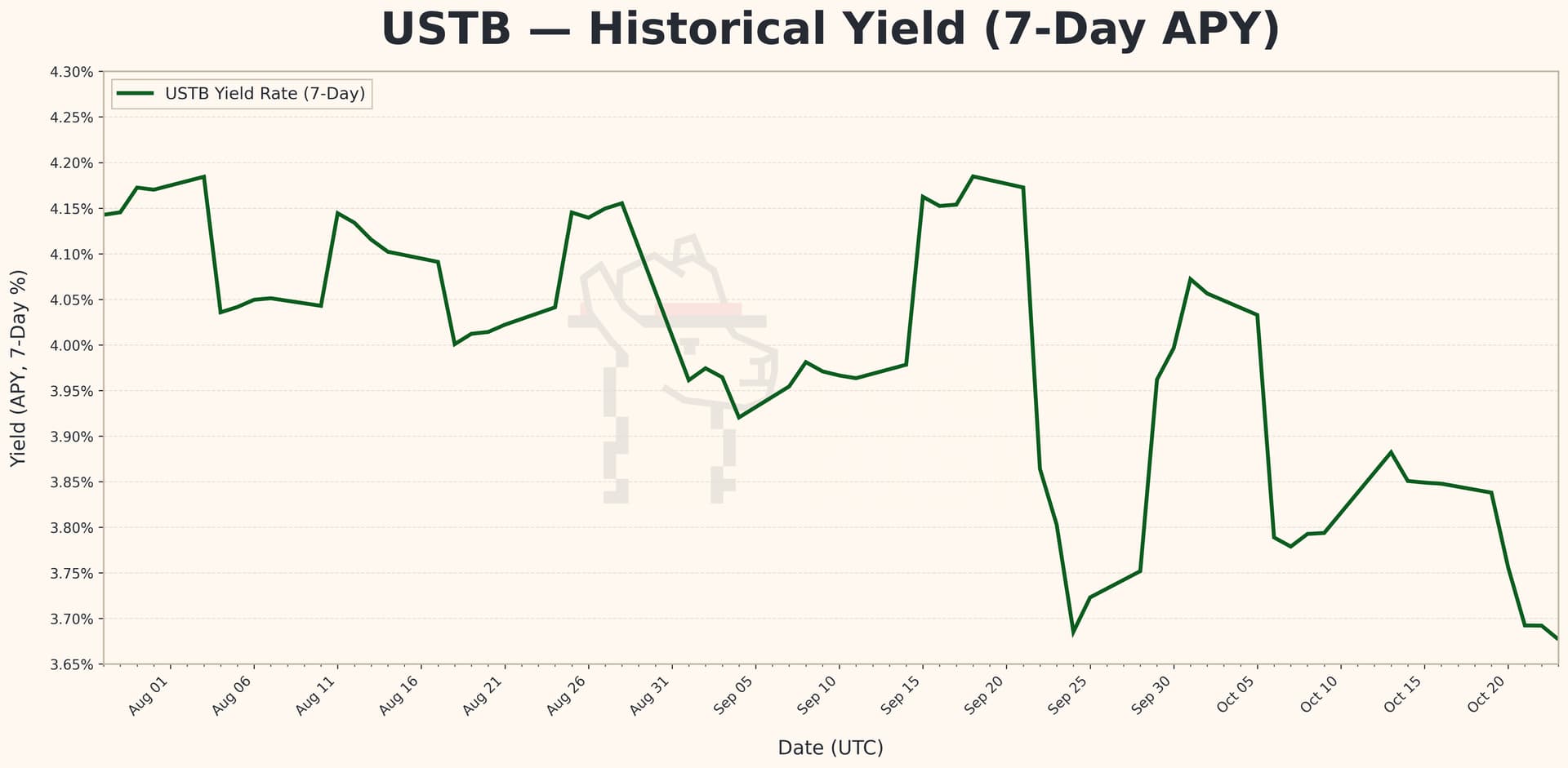

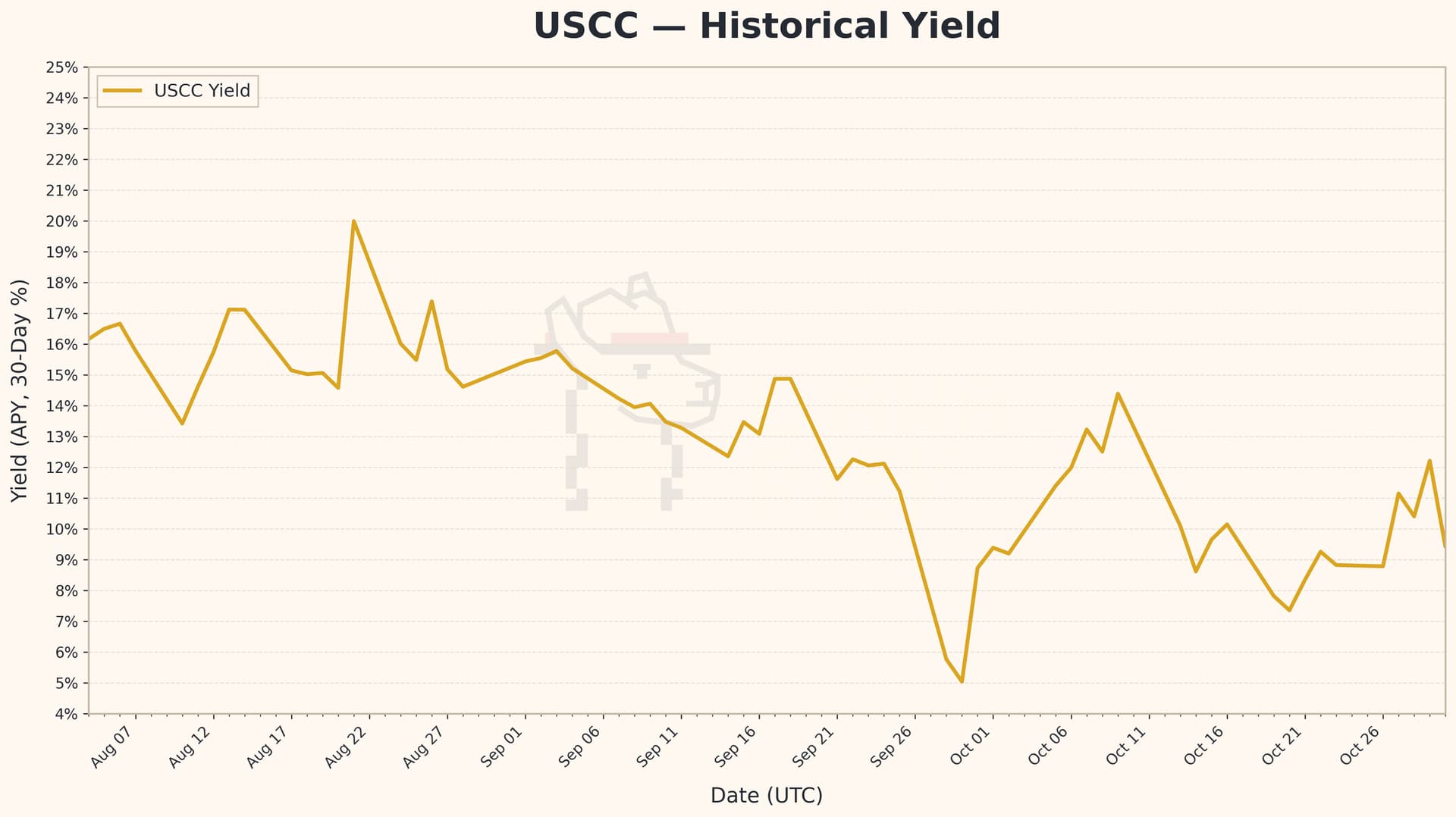

Driven by a compelling APY of ~15.78%, USCC is the dominant RWA supplied to Horizon, with the market attracting 7.5% of its total supply in the first week. The fund generates this return via a market-neutral strategy that captures basis by shorting CME-listed futures contracts, such as SOL Future SEP25 and XRP Future SEP25, while hedging price exposure. Because this yield significantly exceeds the Treasury rates that benchmark stablecoin returns, it is a primary incentive for suppliers.

Source: Superstate, September 5, 2025

Parameter changes during this period

Horizon supply caps were raised twice during the launch week to manage significant inflows. The key adjustments were:

-

RLUSD: The supply cap was raised from $30m to $40m on September 4th. This cap was rapidly reached due to the current incentive campaign, but supply has since contracted slightly.

-

USCC: The supply cap was raised in two stages. On August 28th, it was raised from $10,6m to $14.4m, then to $40m on September 4th. Supply cap is currently sitting at 58%.

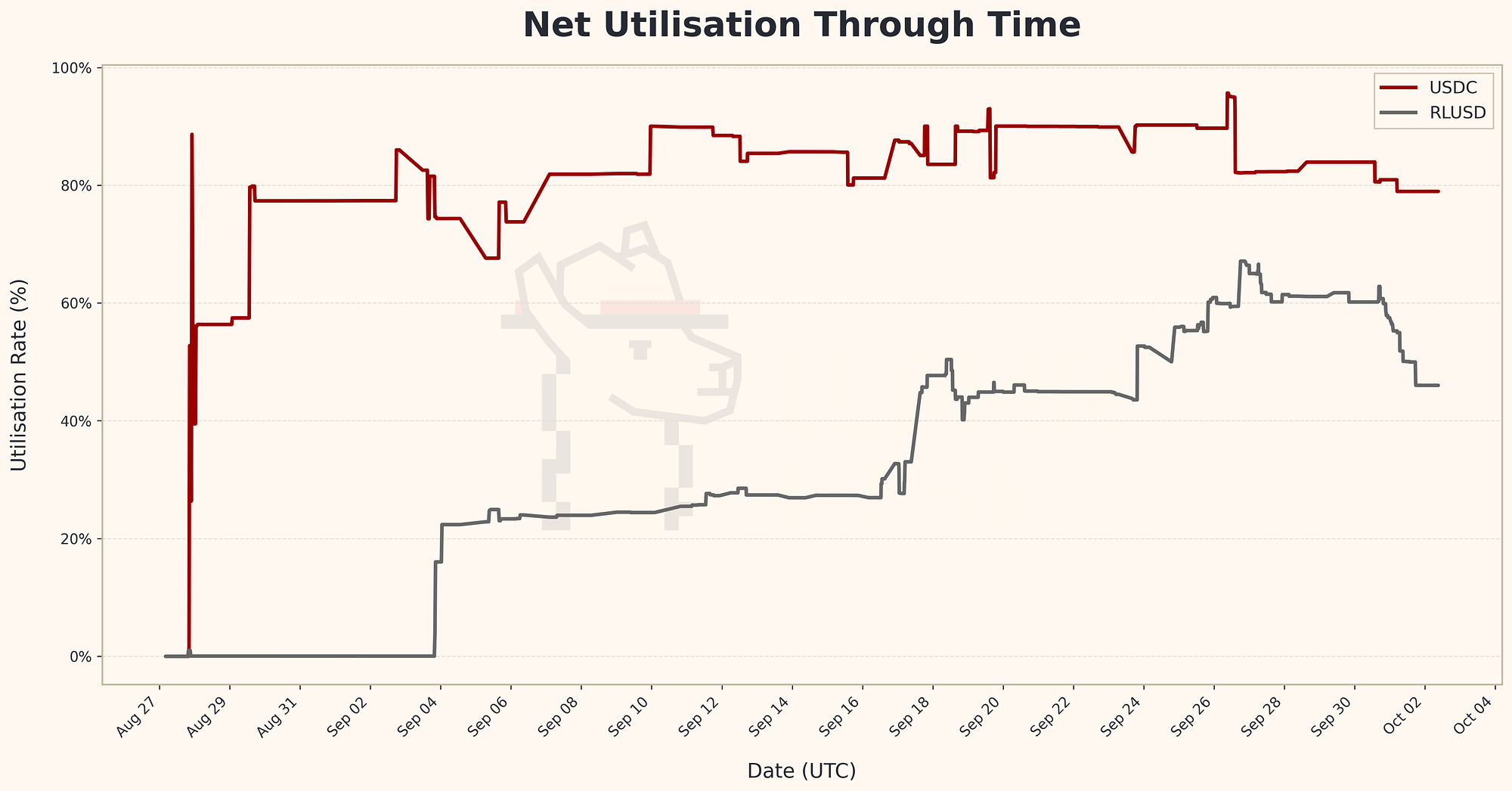

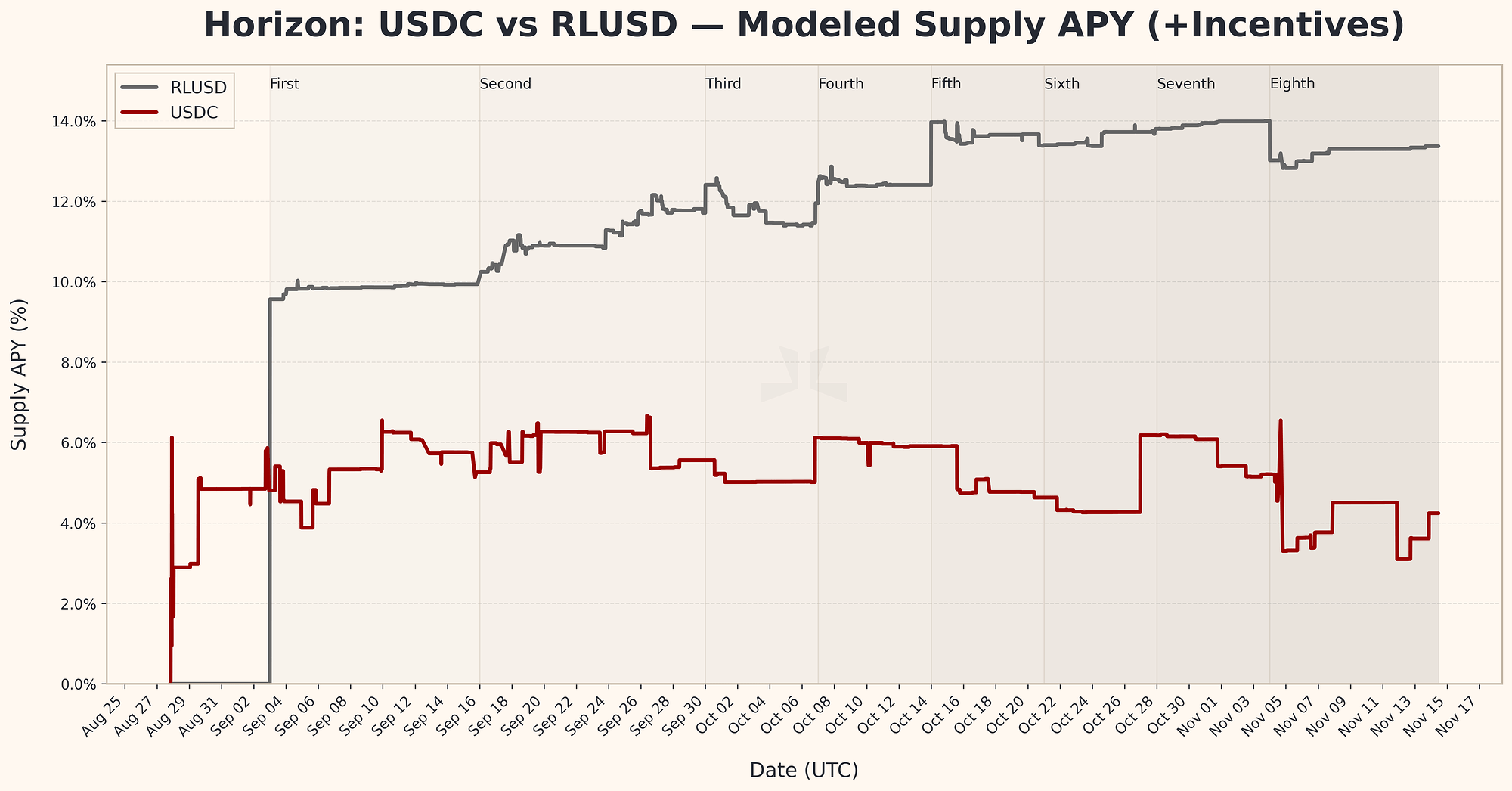

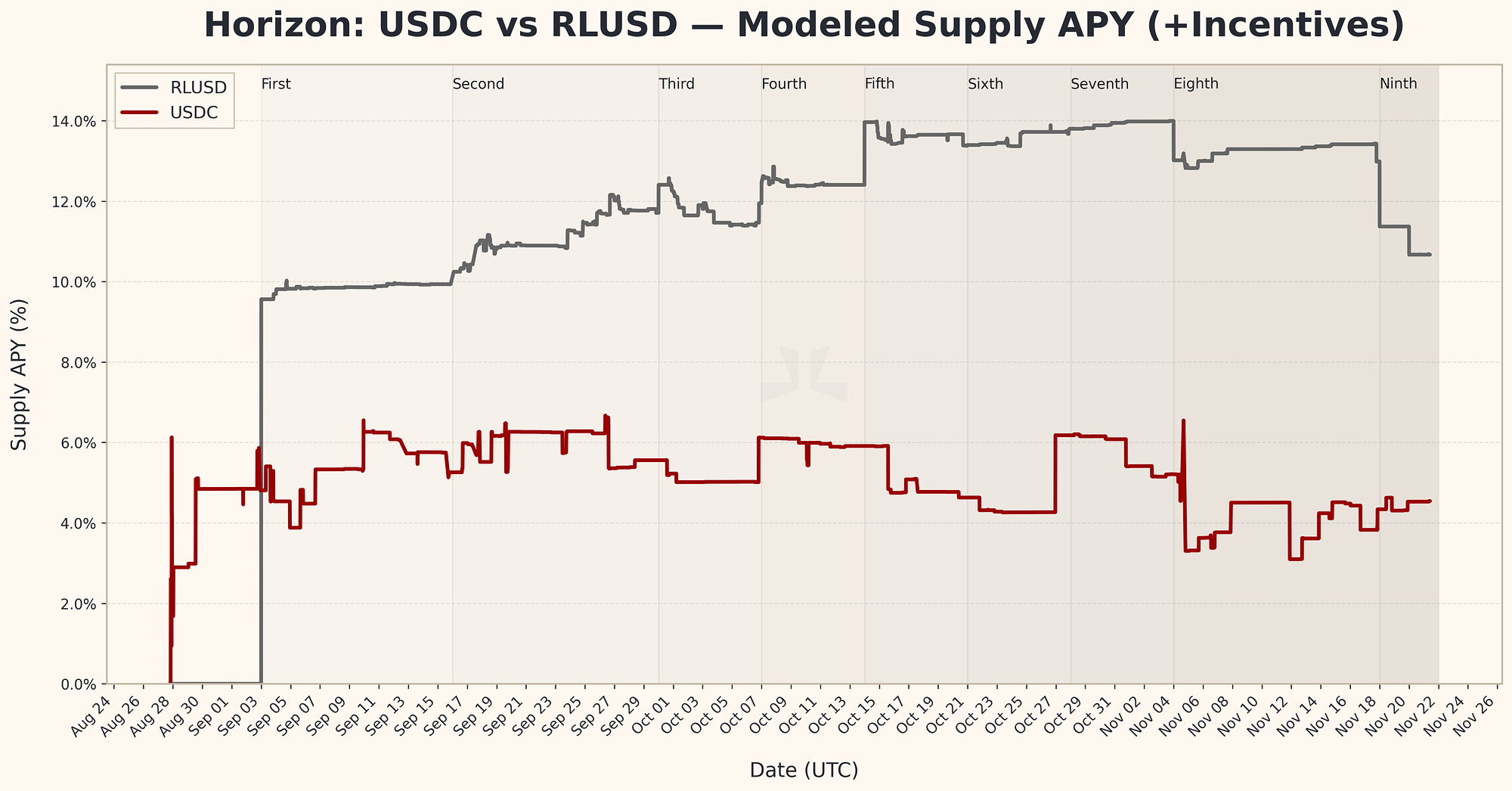

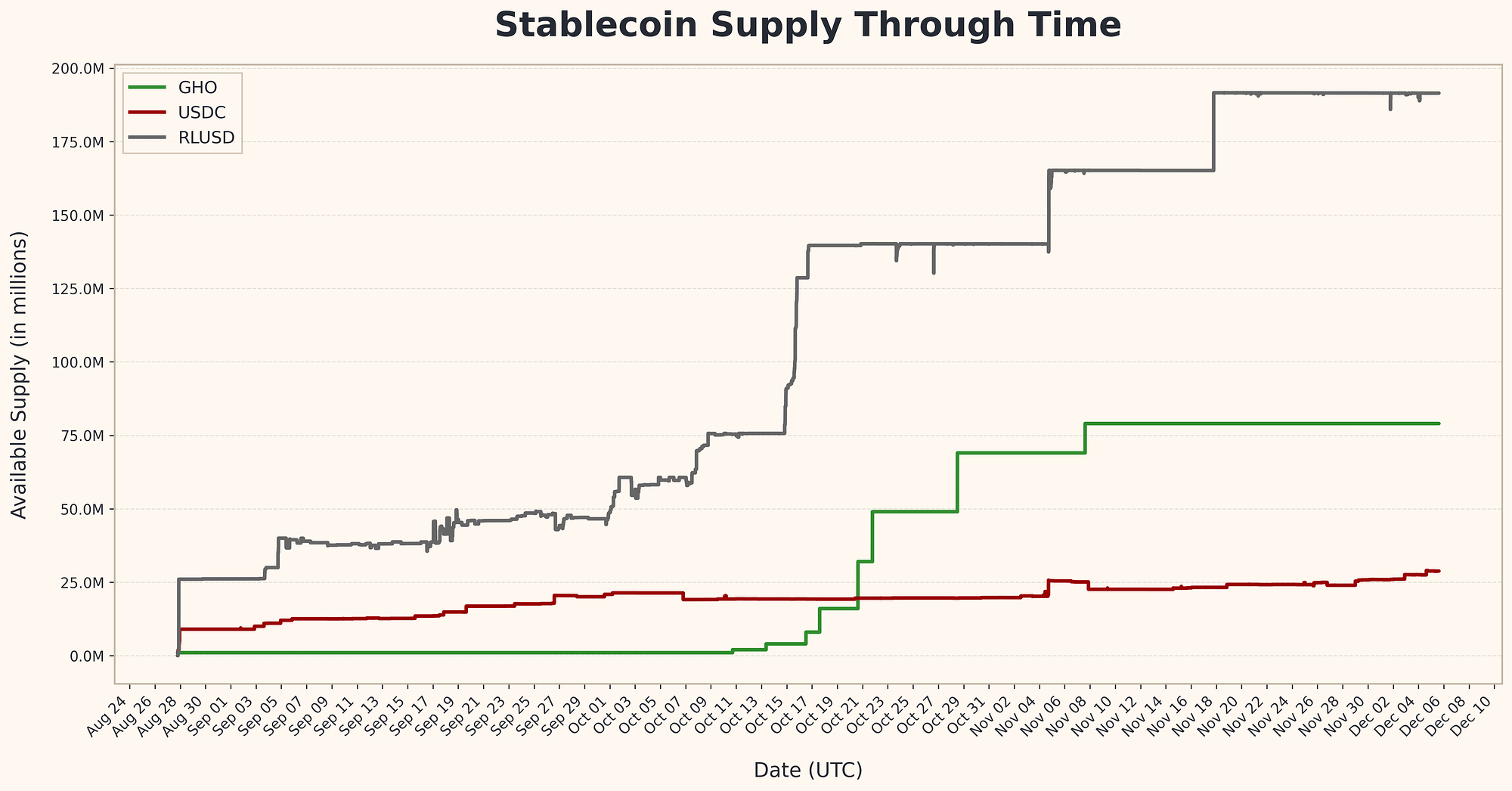

Supply Side (Stablecoins)

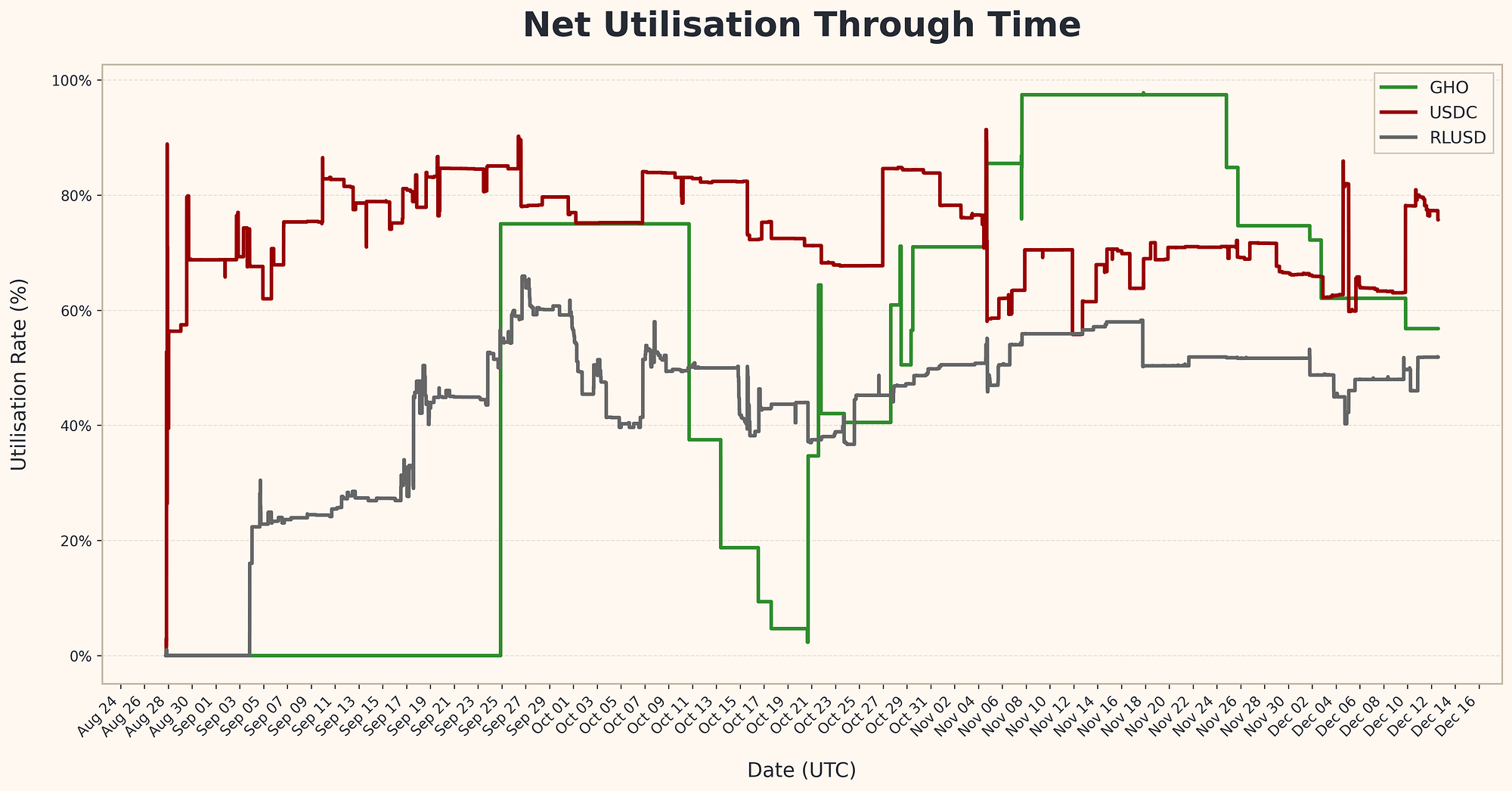

Large influxes of RLUSD and USDC mark the stablecoin supply. GHO is capped at 1m$ via a facilitator, with no room to deposit external GHO. Its comparatively high borrowing rate compared to the other stablecoins explains its lack of current usage.

Source: Dune (@mrvega14), September 5, 2025

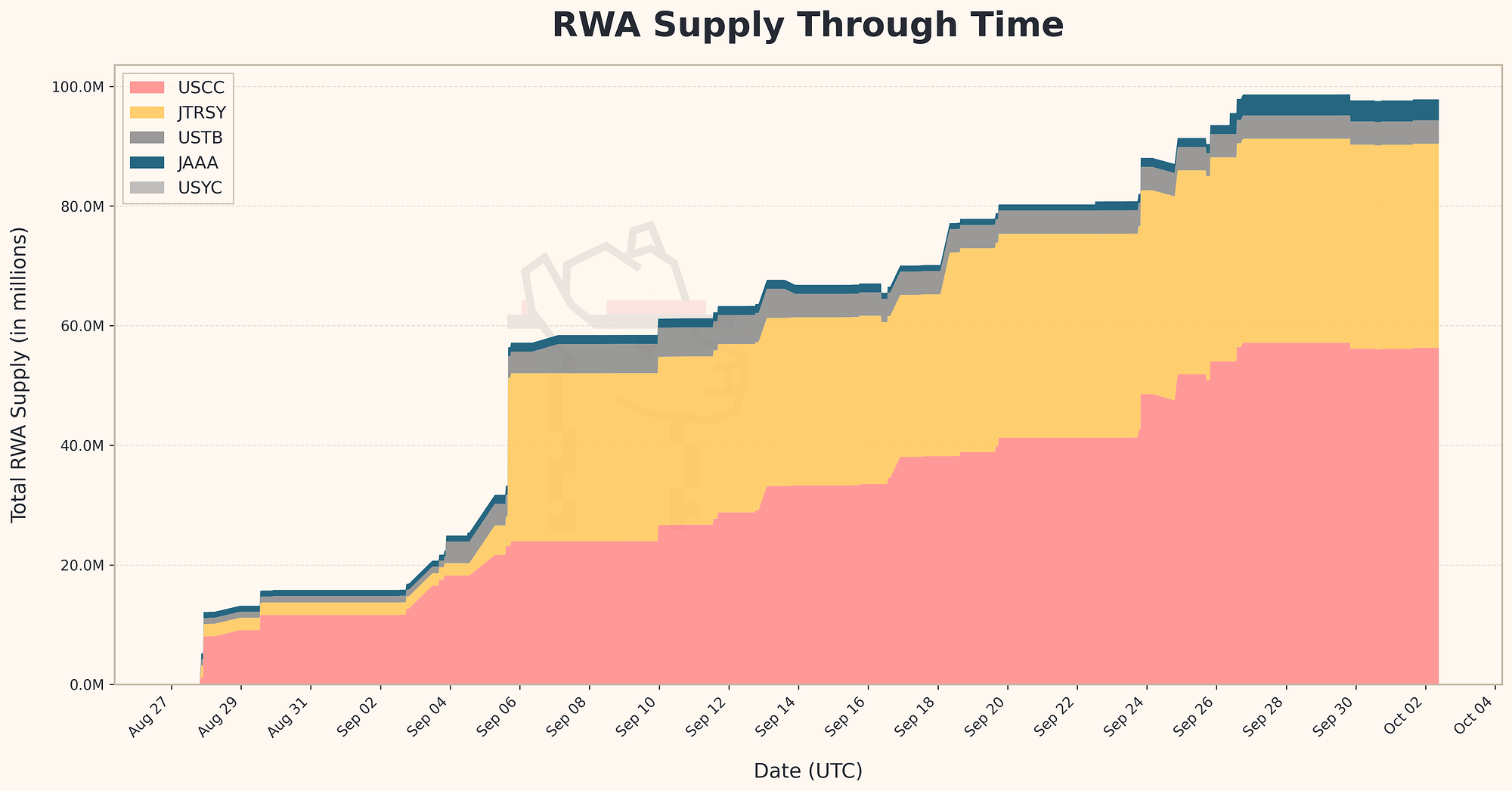

Supply Side (RWAs)

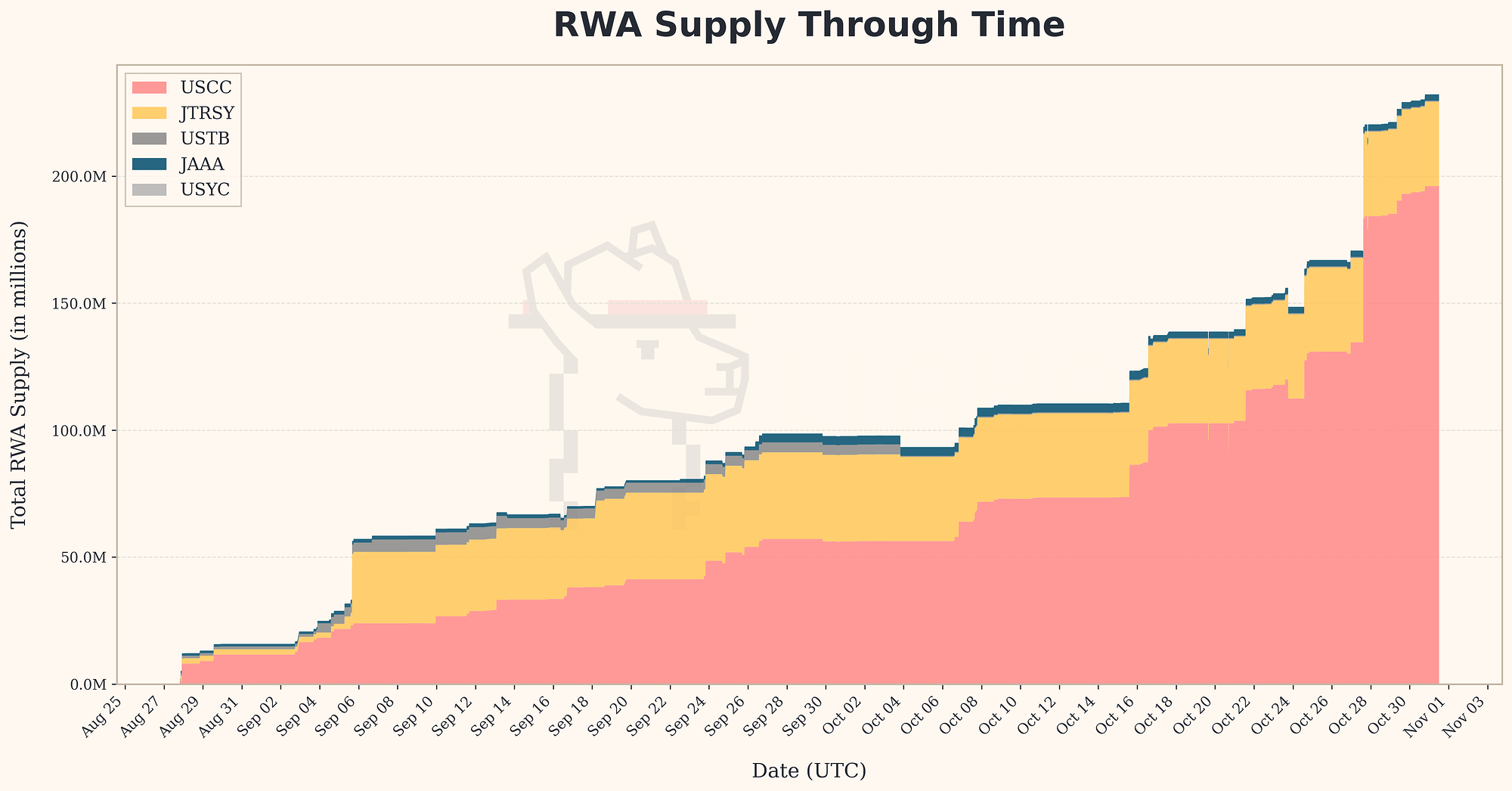

Supply growth is primarily concentrated in USCC, JAAA, and JTRSY.

Source: Dune (@mrvega14) - September 5th, 2025

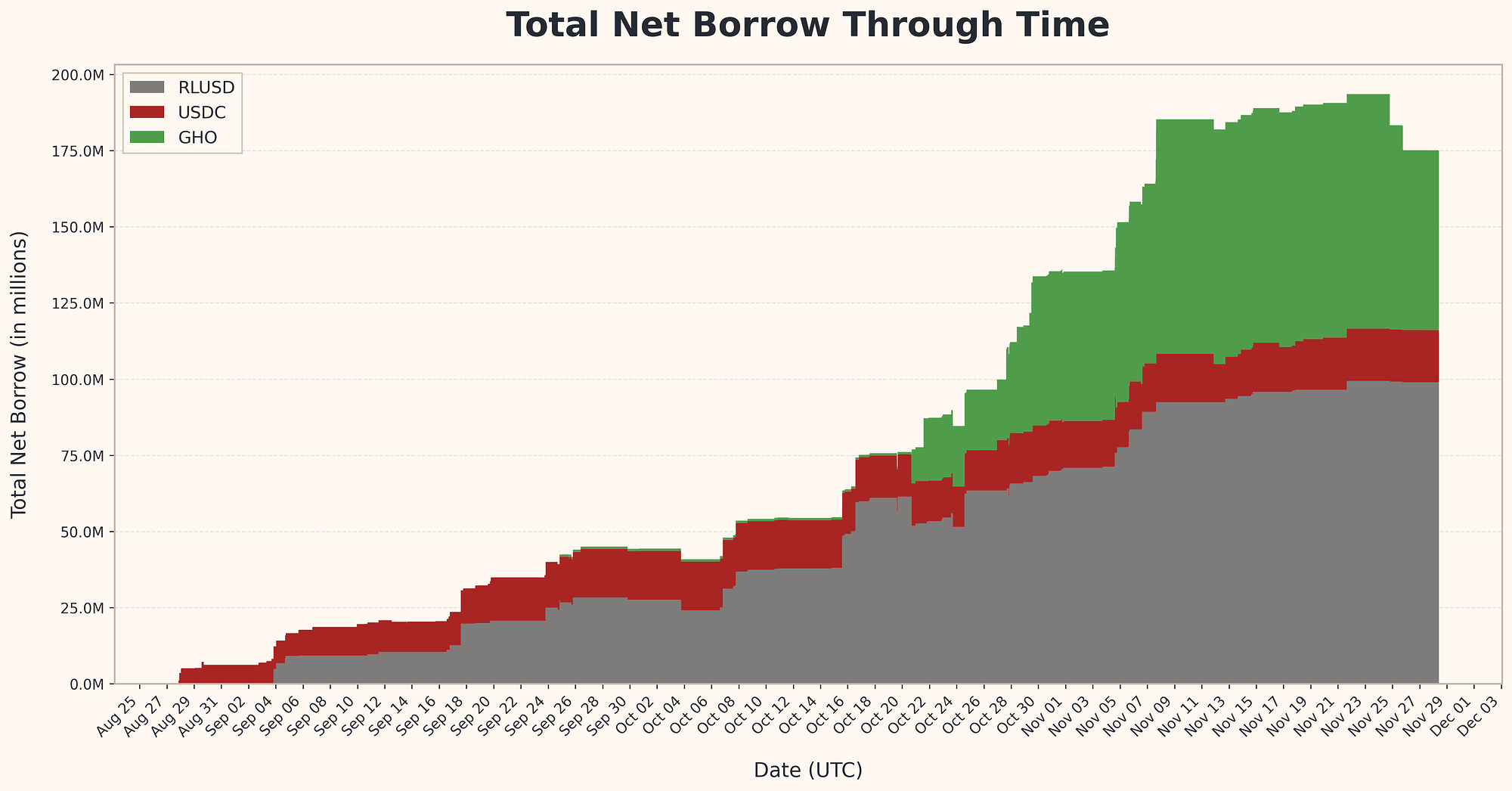

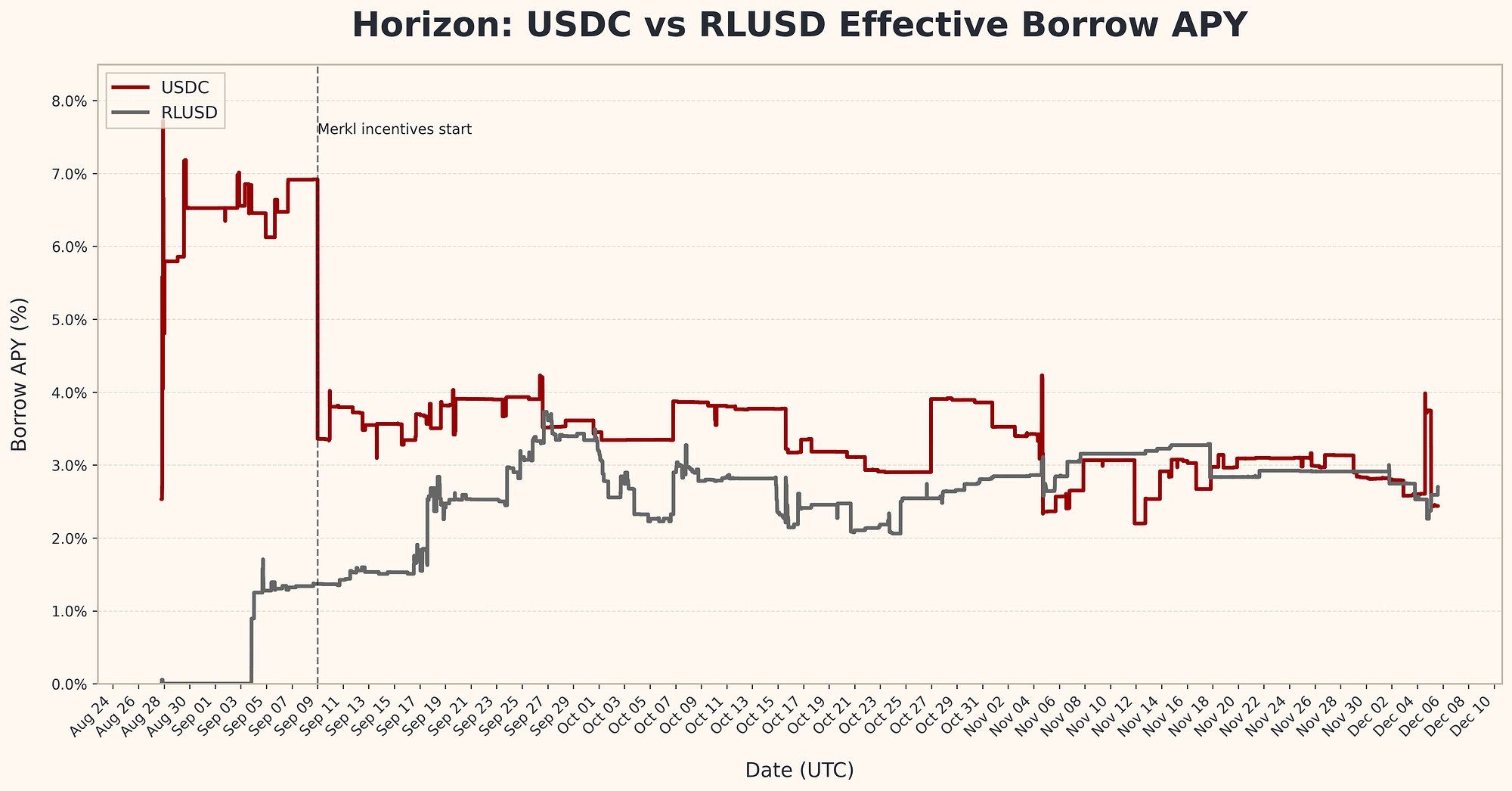

Borrow Side

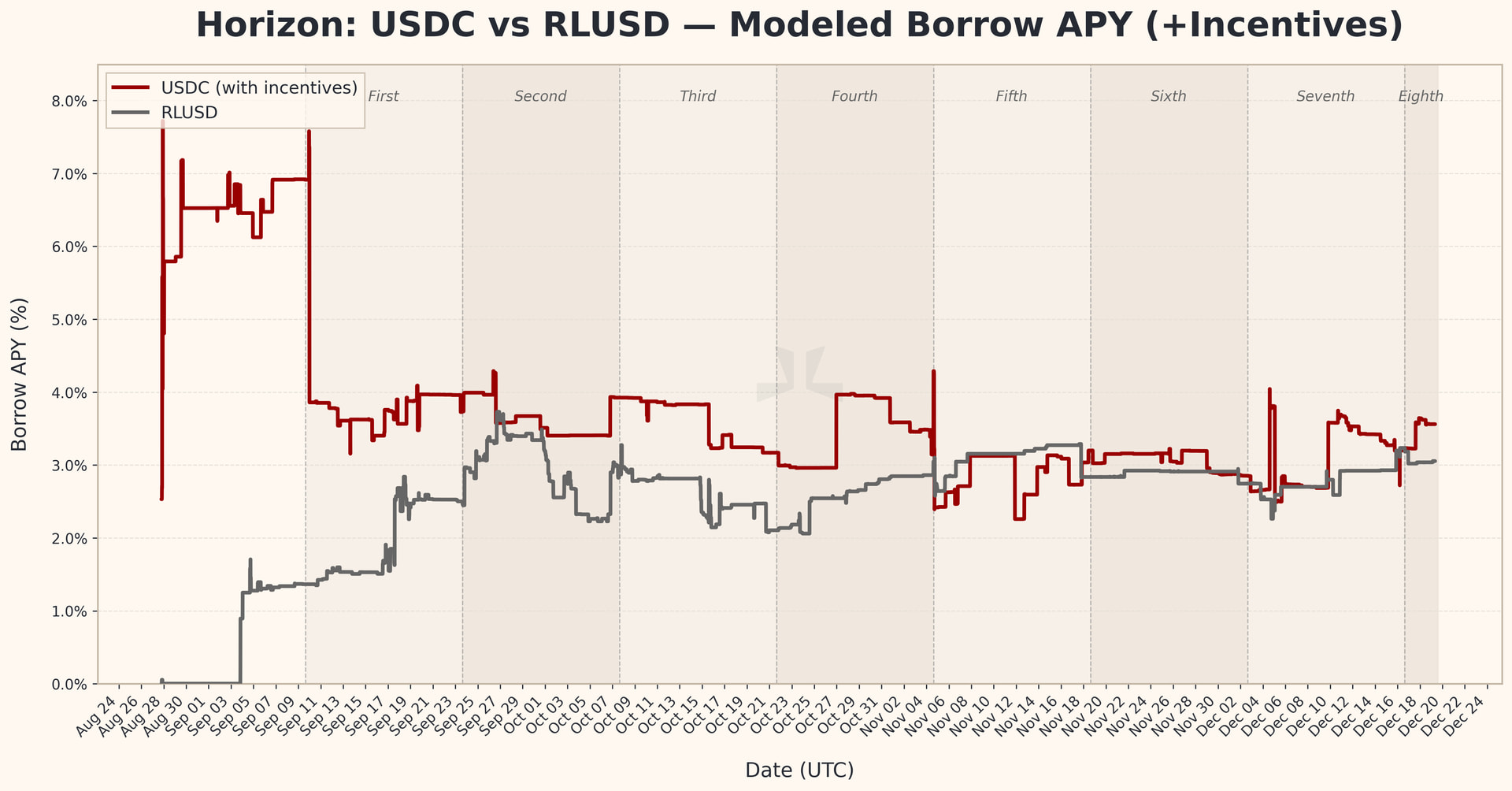

USDC and RLUSD are borrowed in similar amounts, mainly driven by USCC-backed loans.

Source: Dune (@mrvega14) - September 5th, 2025

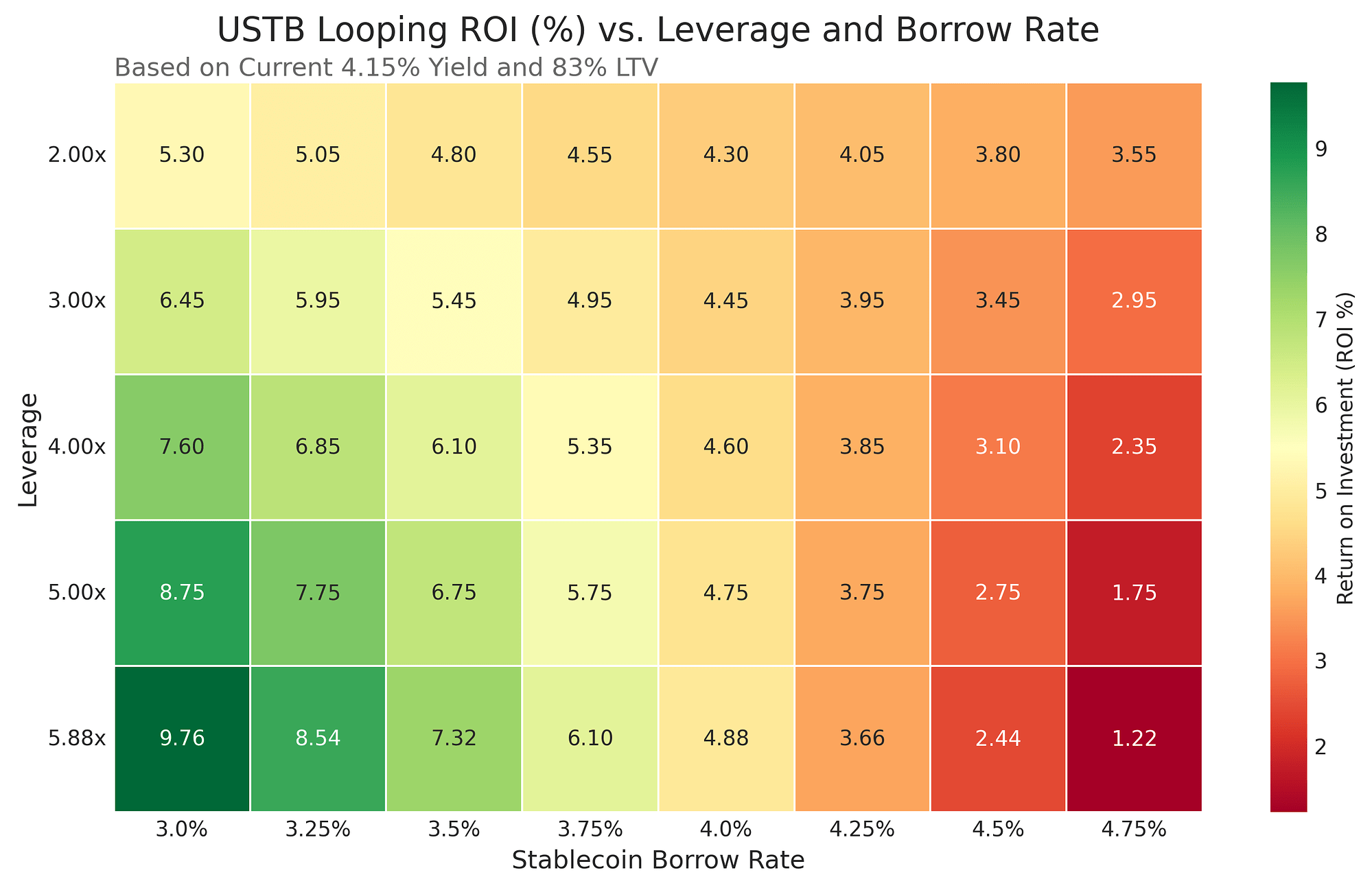

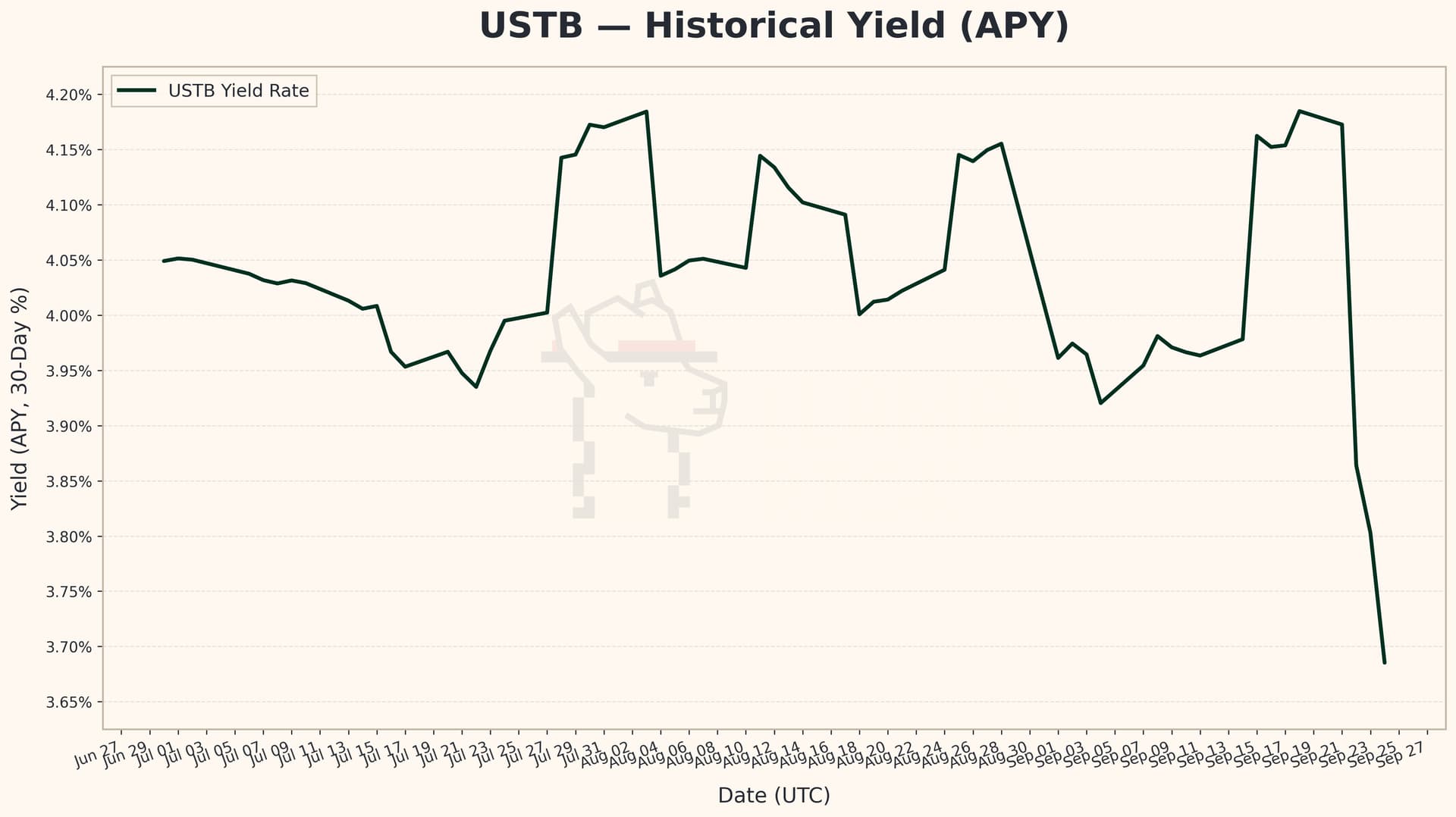

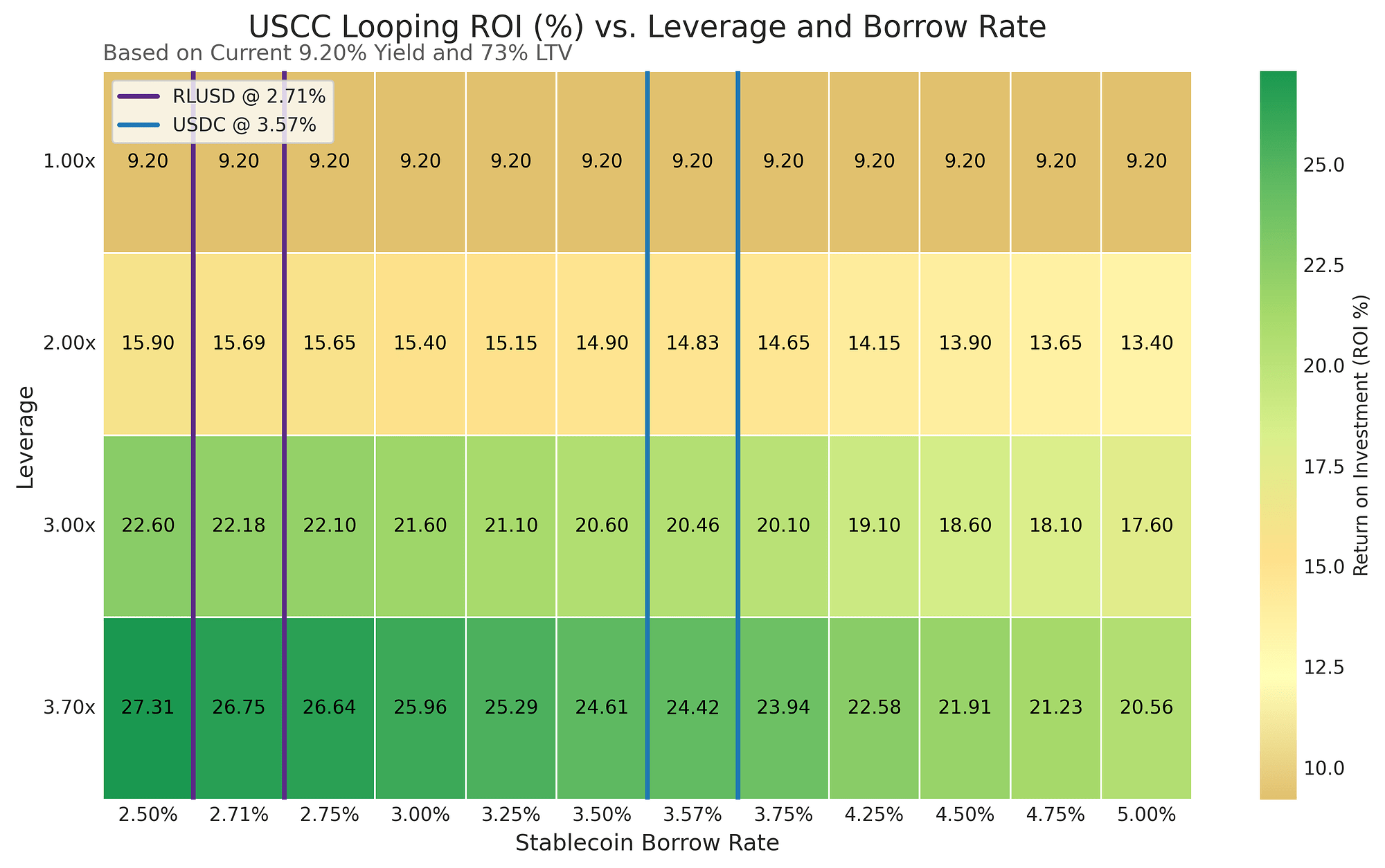

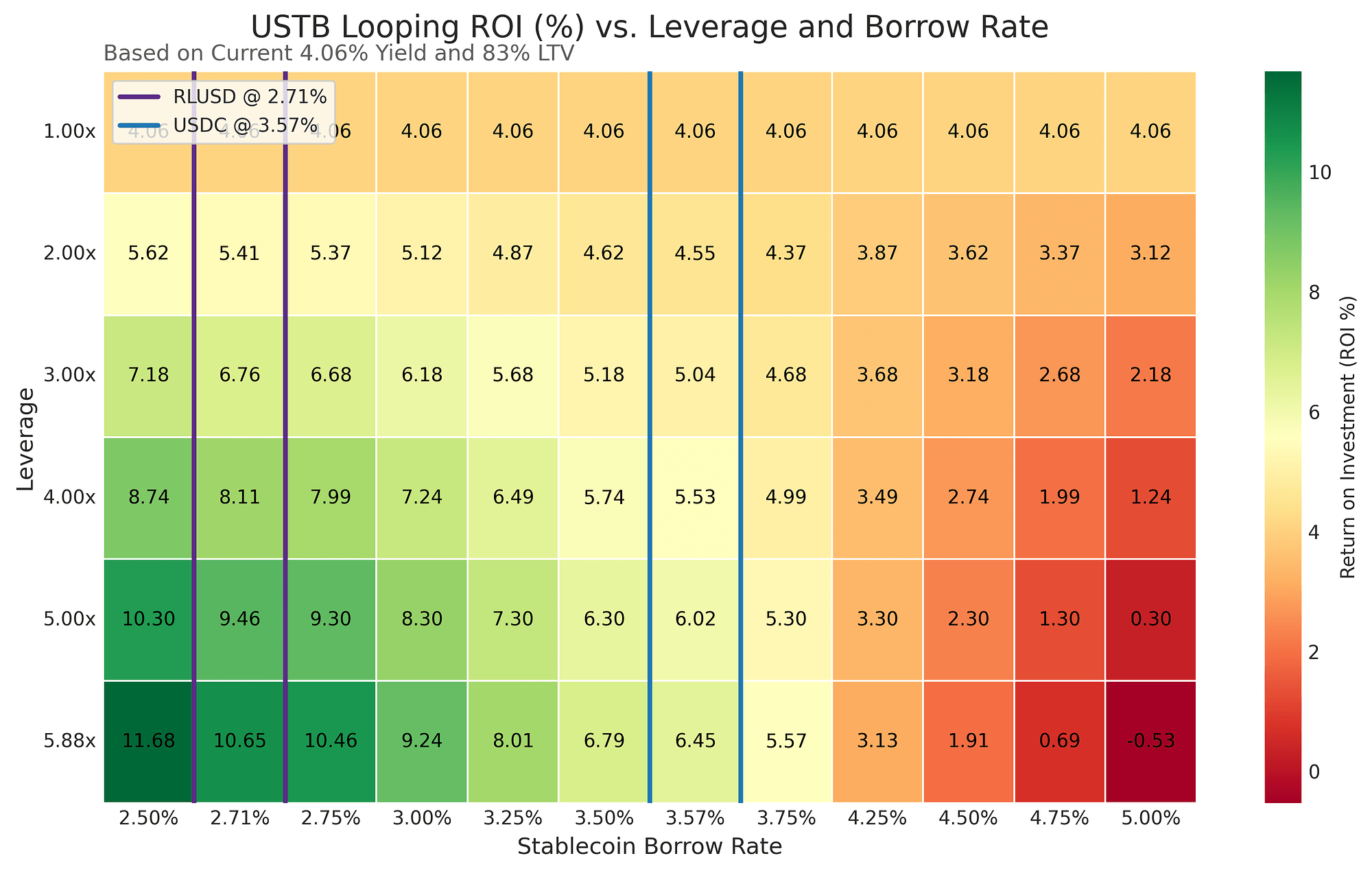

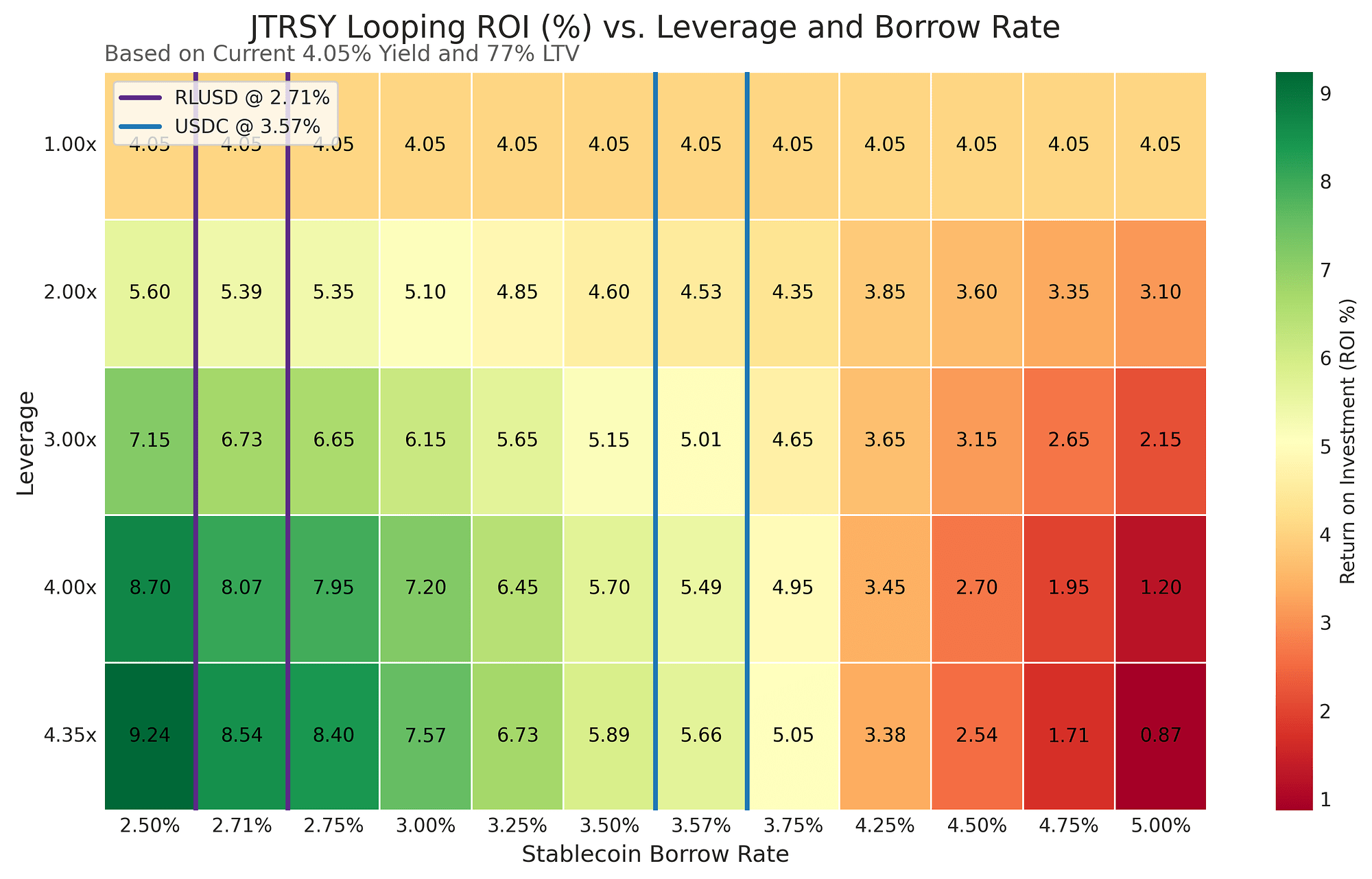

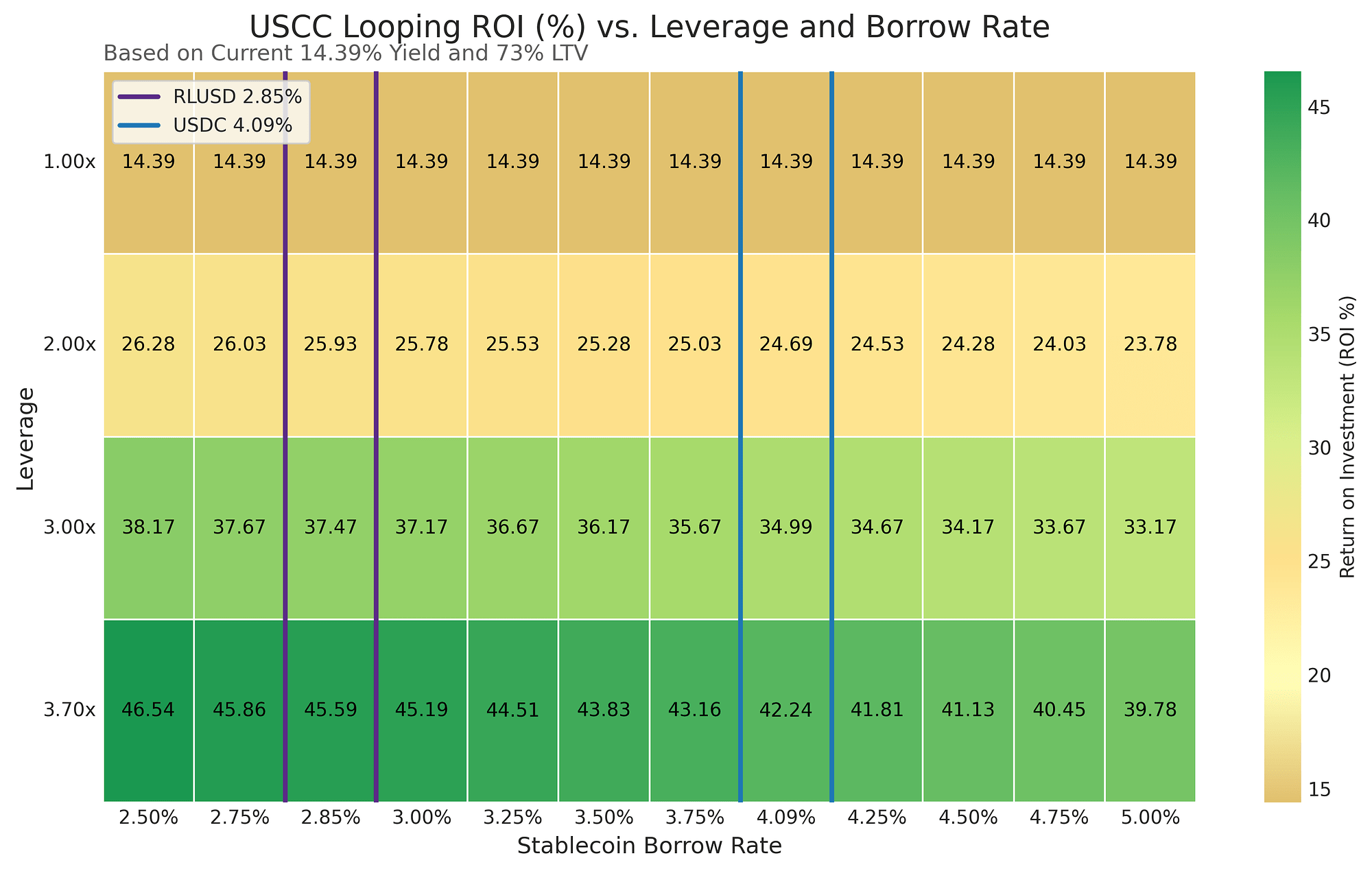

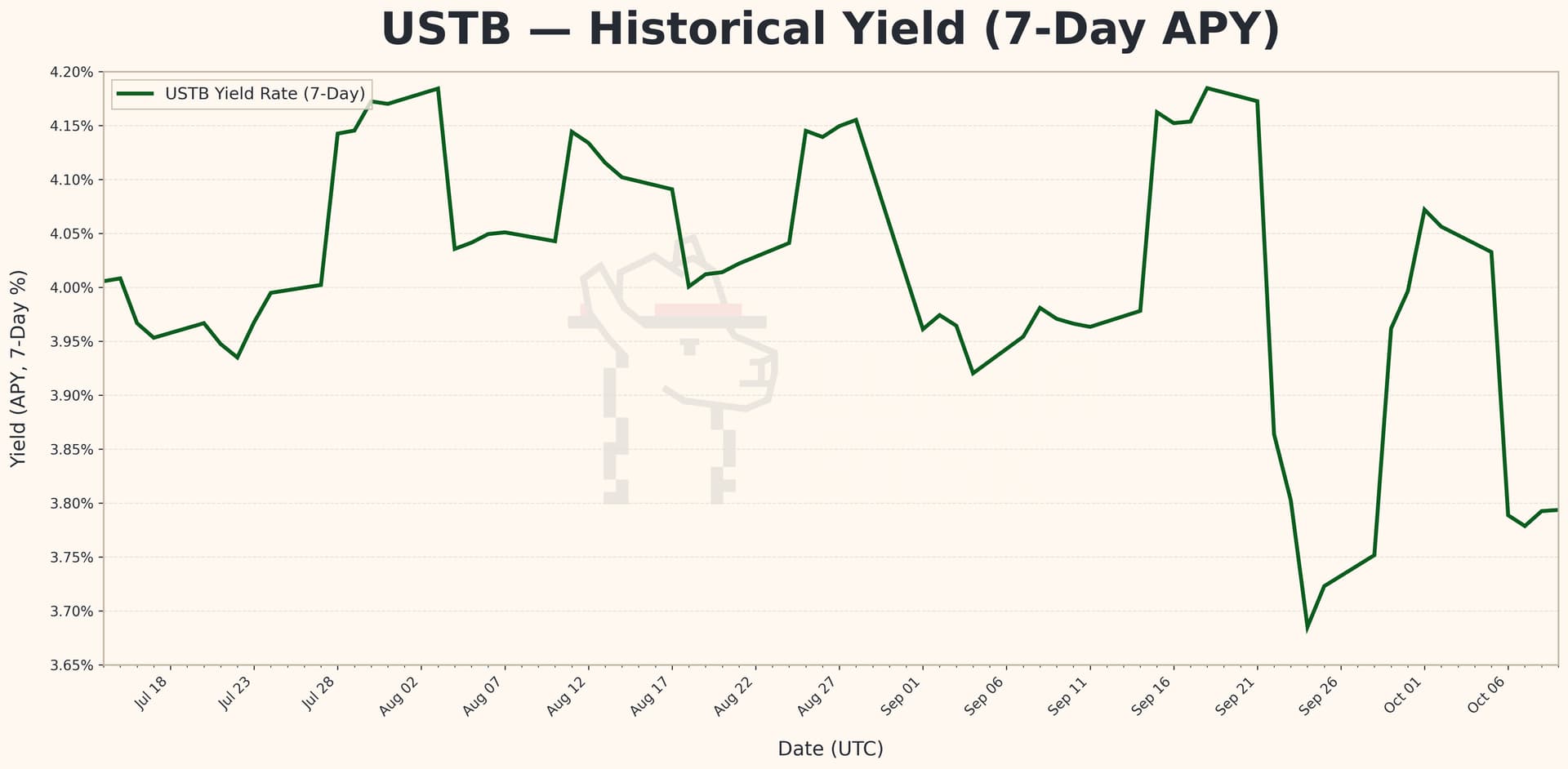

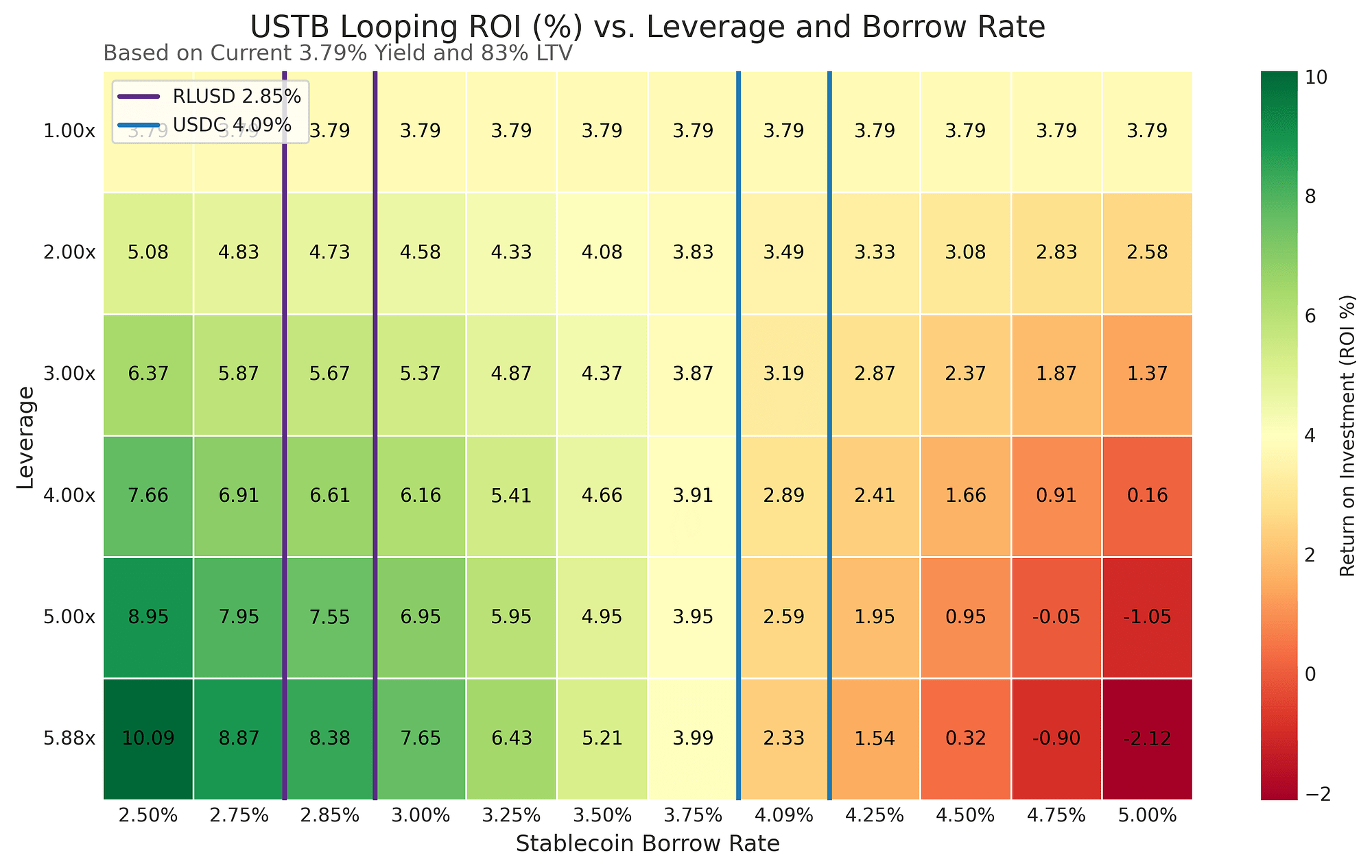

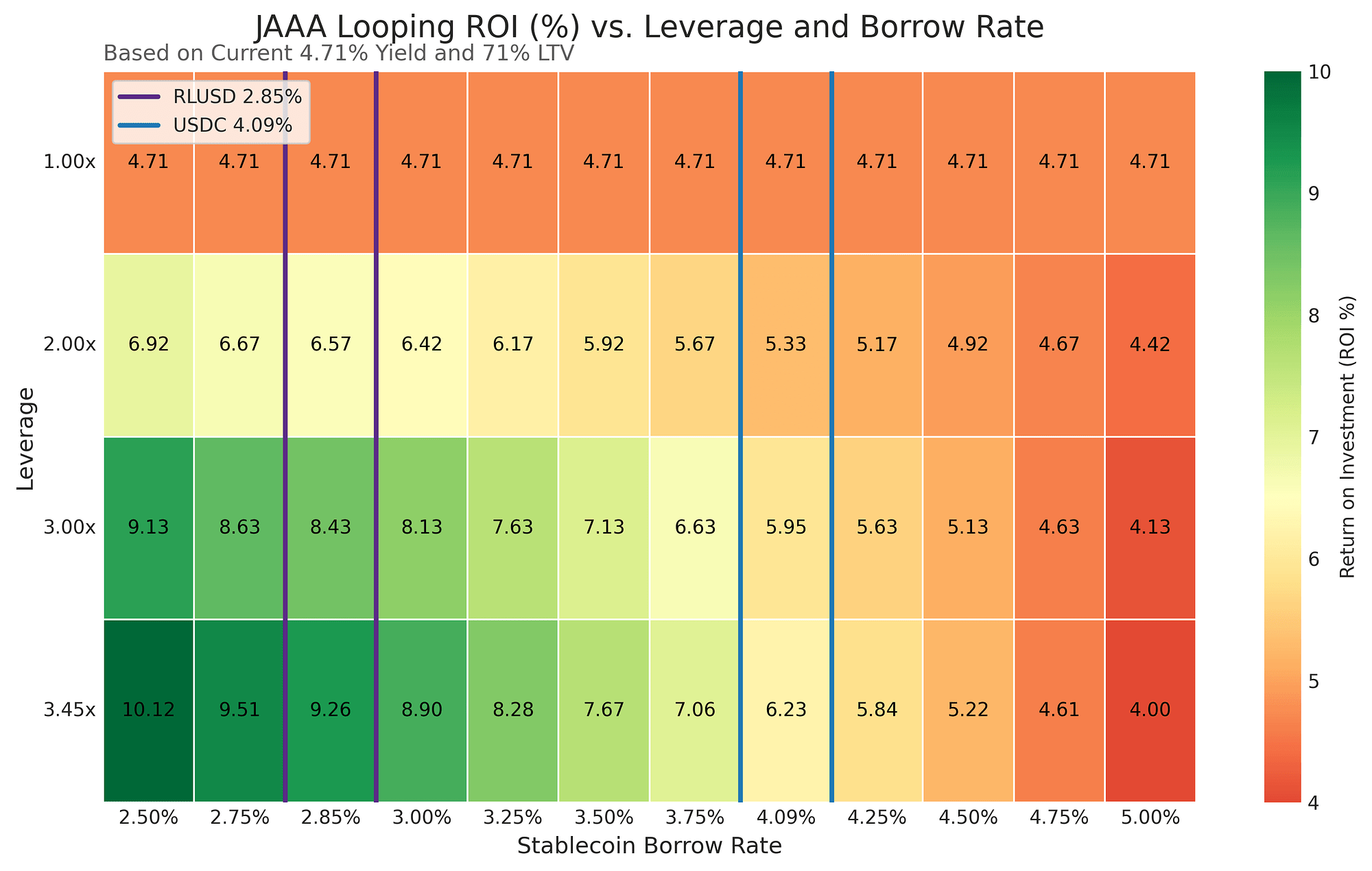

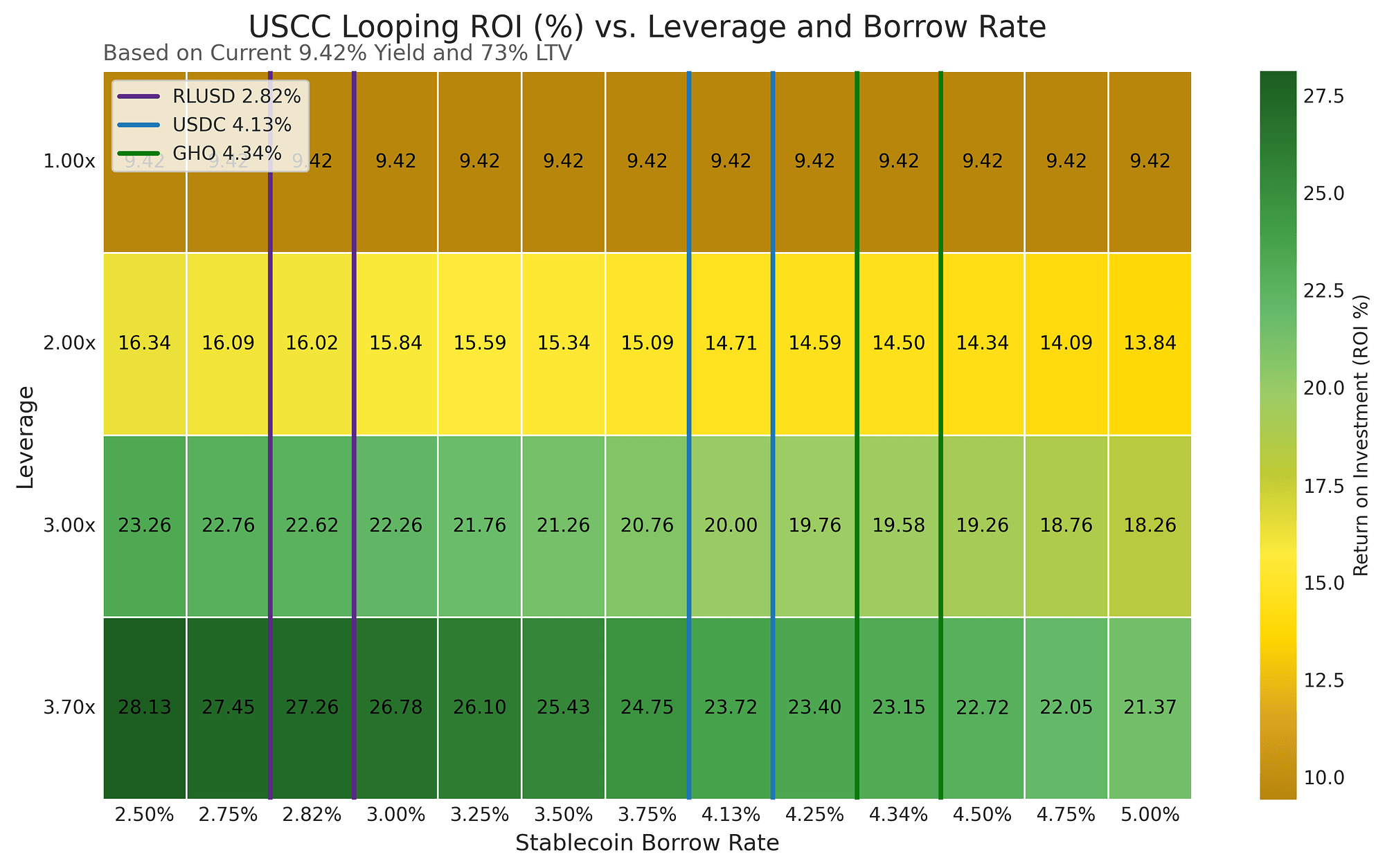

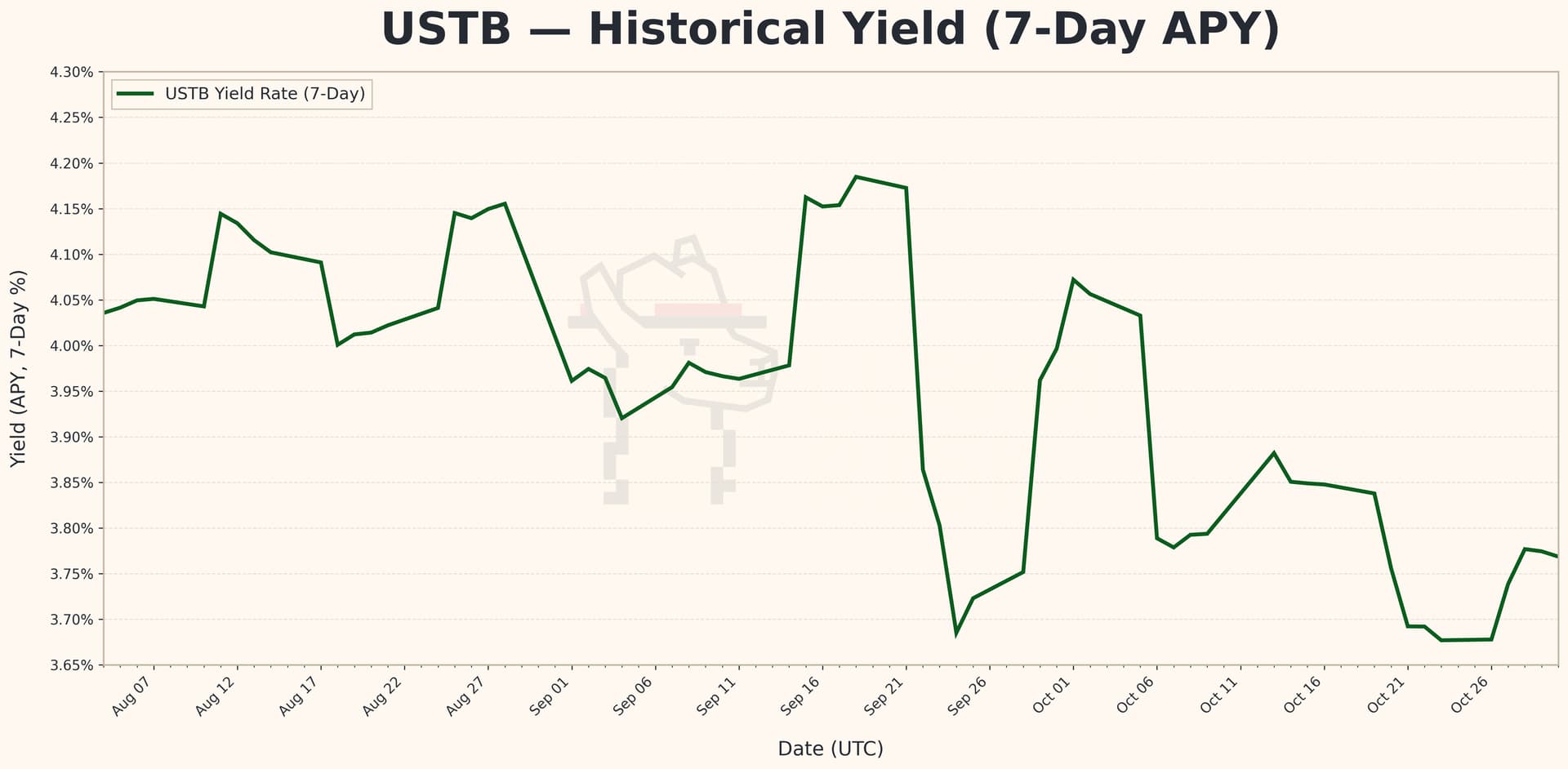

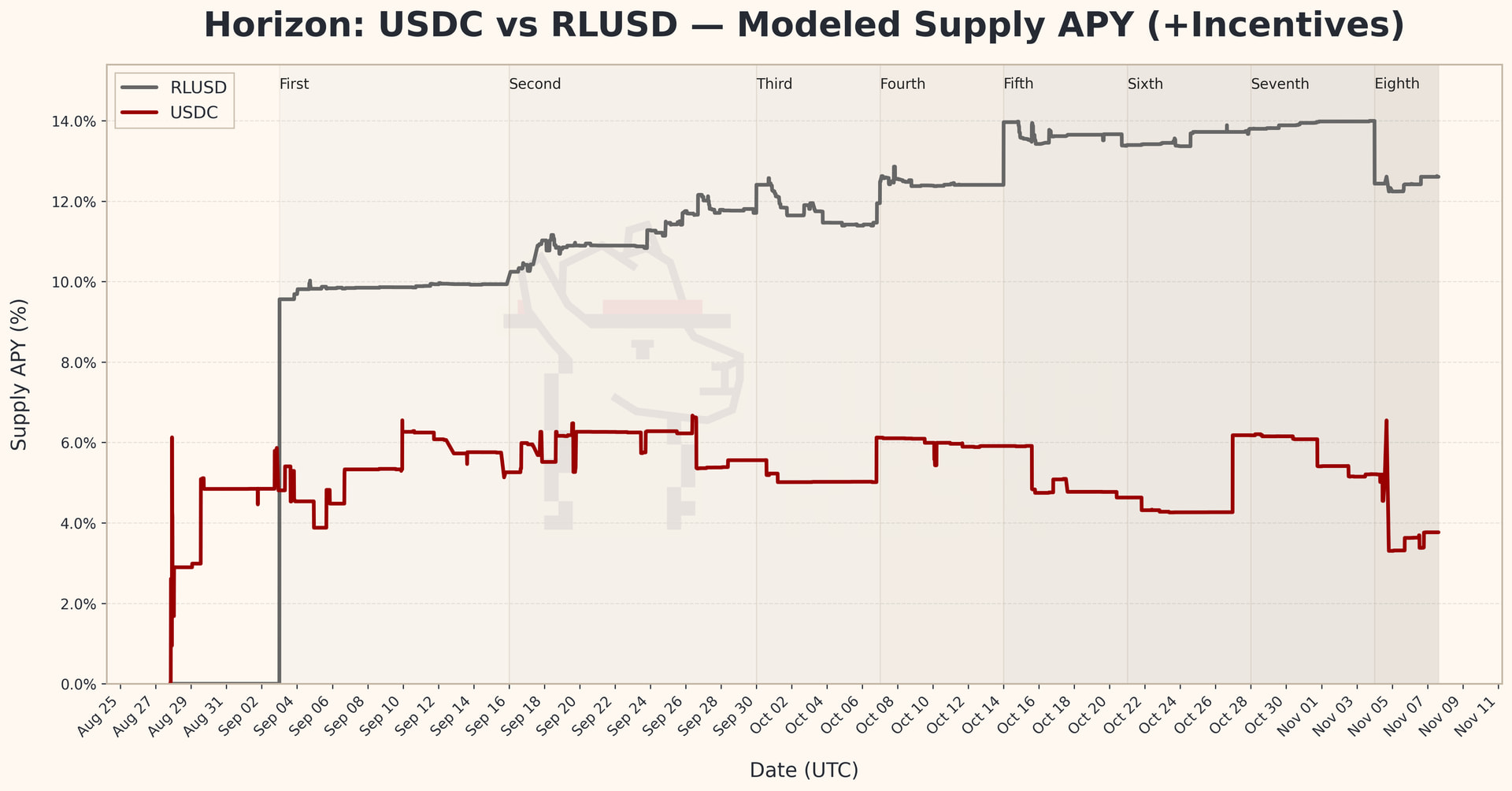

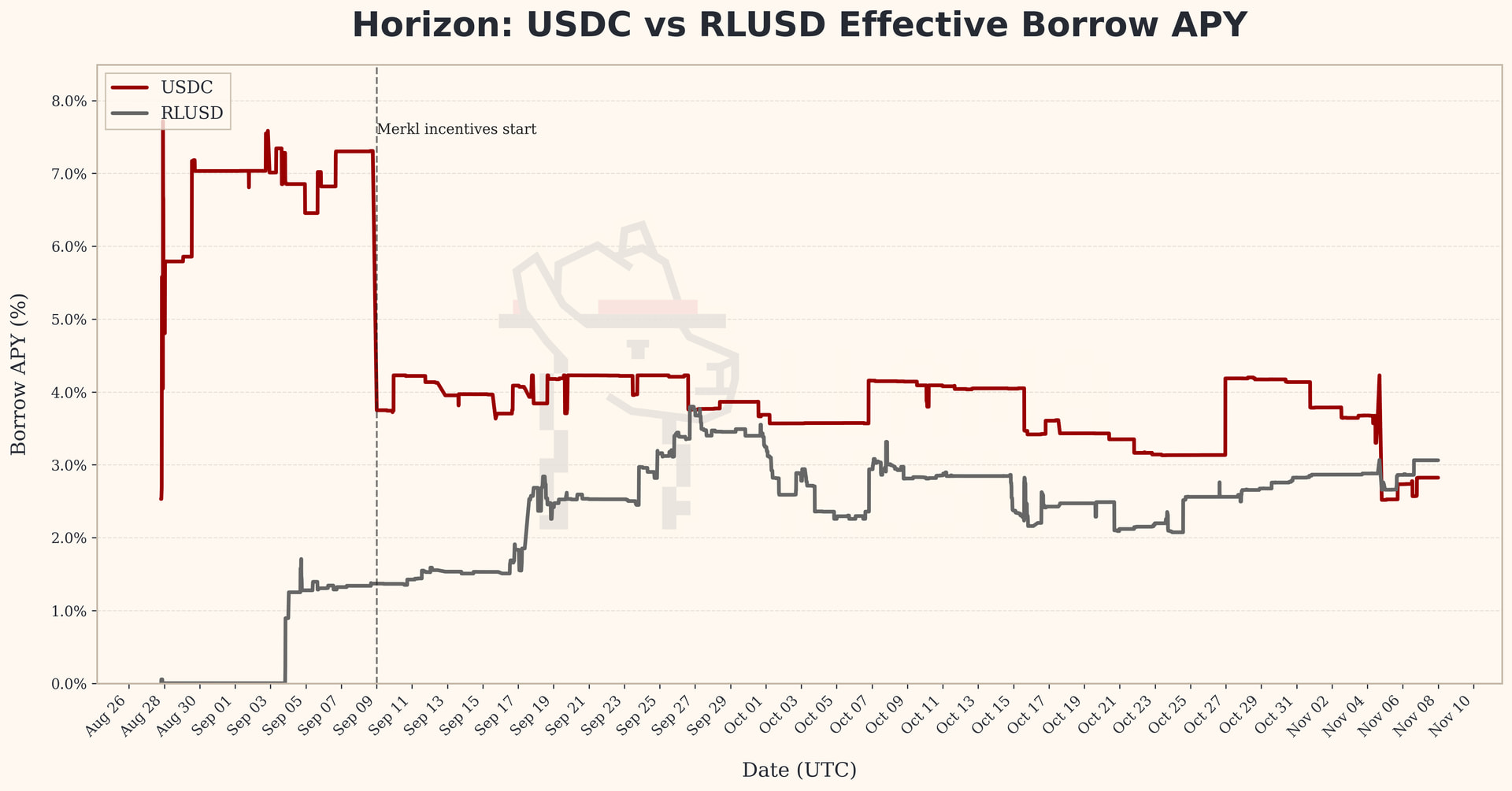

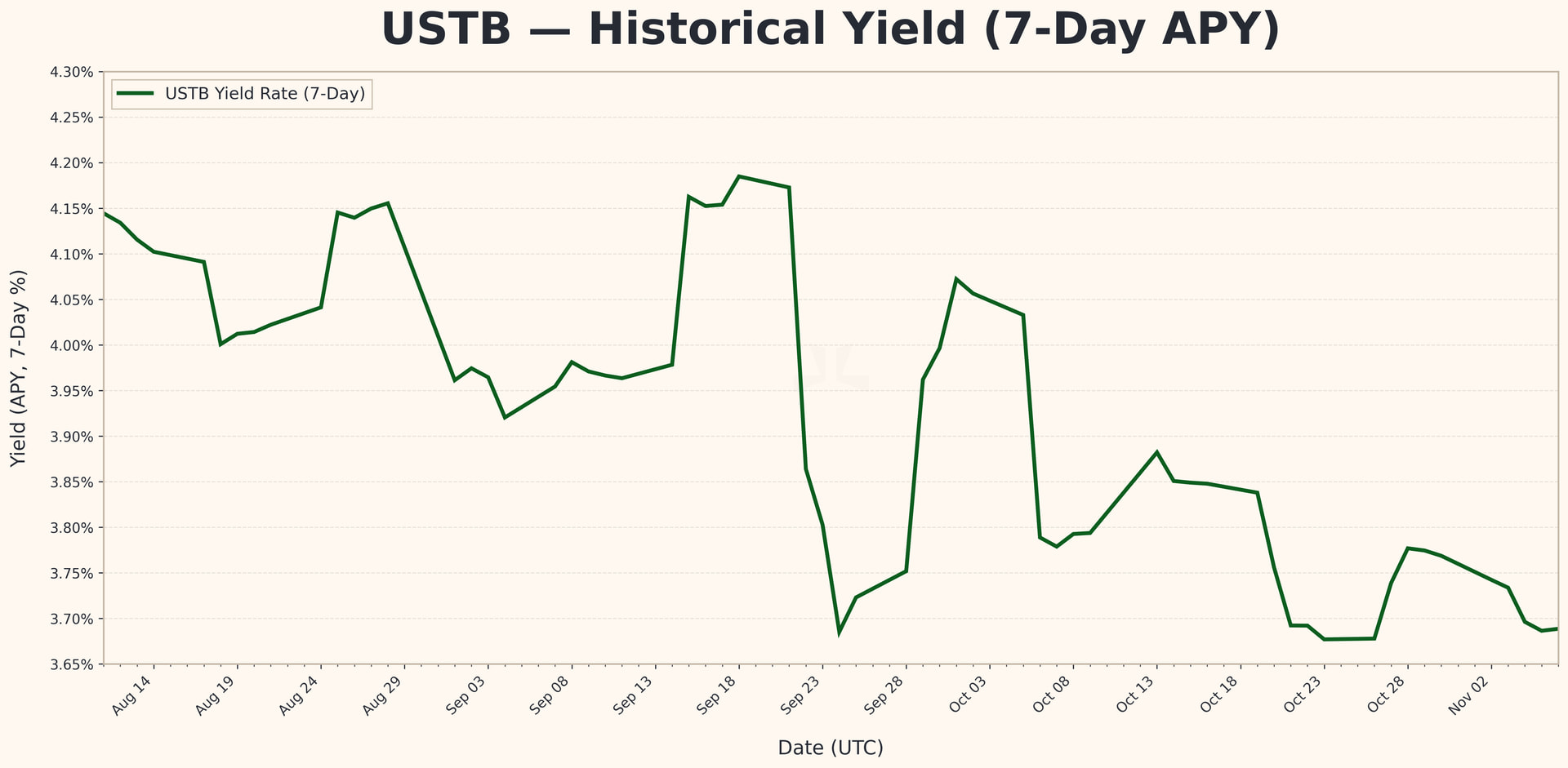

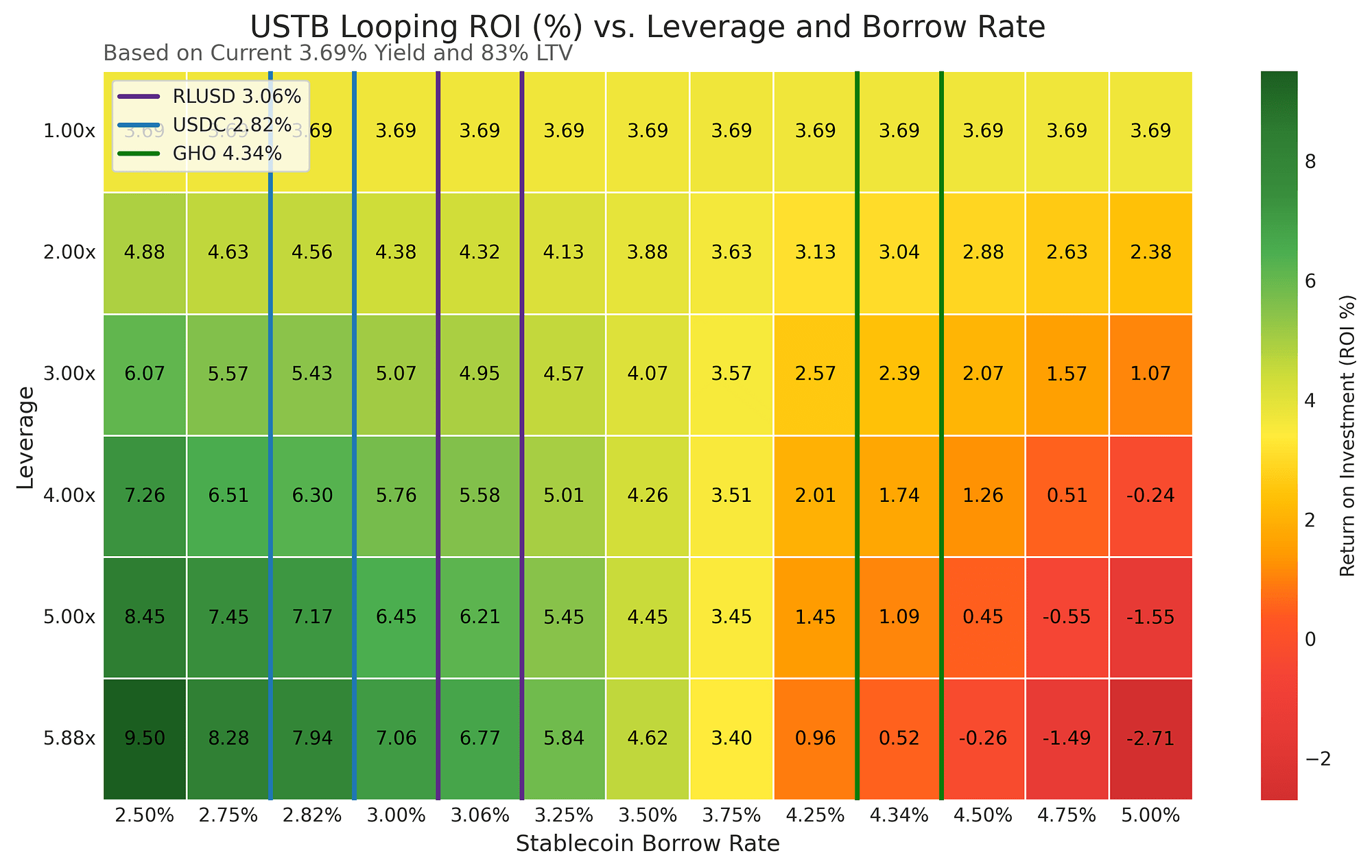

Profitability heatmaps for leverage looping

We calculate the profitability of looping strategies for RWA tokens by comparing their underlying yields against different stablecoin borrow rates. The heatmaps illustrate how leverage alters returns: when funding costs are low, each additional loop lifts returns meaningfully, but as borrow rates rise, the benefit fades quickly and margins get squeezed.

JAAA

JTRSY

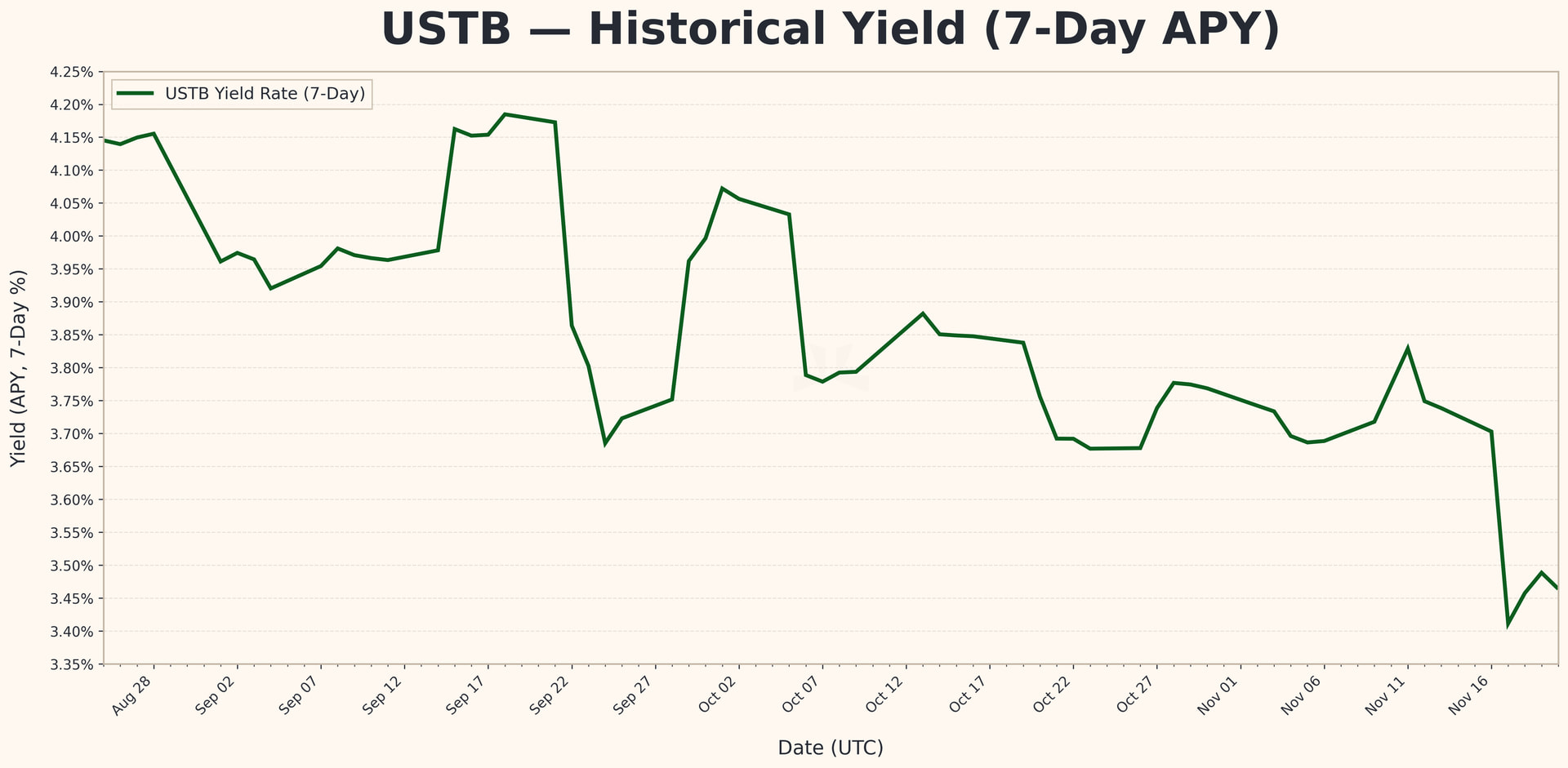

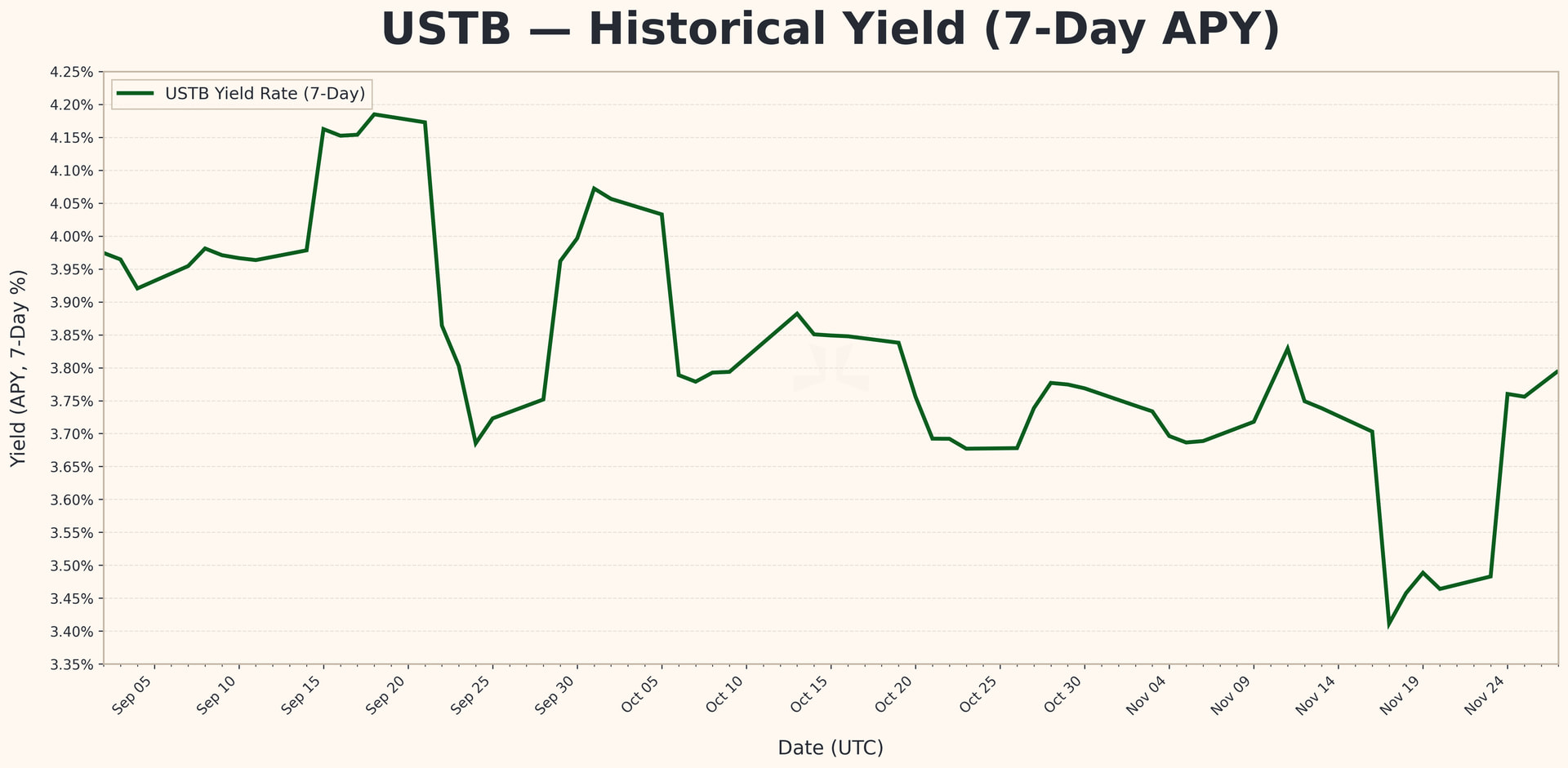

USTB

USCC

Disclosure

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk serves the Horizon protocol and has been engaged to conduct due diligence, parametrisation, and ongoing risk services.

The information provided should not be construed as legal, financial, tax, or professional advice.