This week, Horizon Total Value Locked (TVL) surpassed $459.7m, with over $91.8m in net borrows, and $227.4m in stablecoin supply.

Highlights

- TVL has surpassed $460 million, with total stablecoin supply reaching $227.4 million and net borrows standing at $135.7 million. RLUSD and USCC remain the dominant supplied assets, mostly by active user demand for looping strategies.

- Stablecoin markets recorded a sharp rise in net borrows, largely driven by a major GHO borrowing position against USCC collateral.

- The incentivization programs for RLUSD supply and USDC borrow markets were renewed.

Incentivize Program

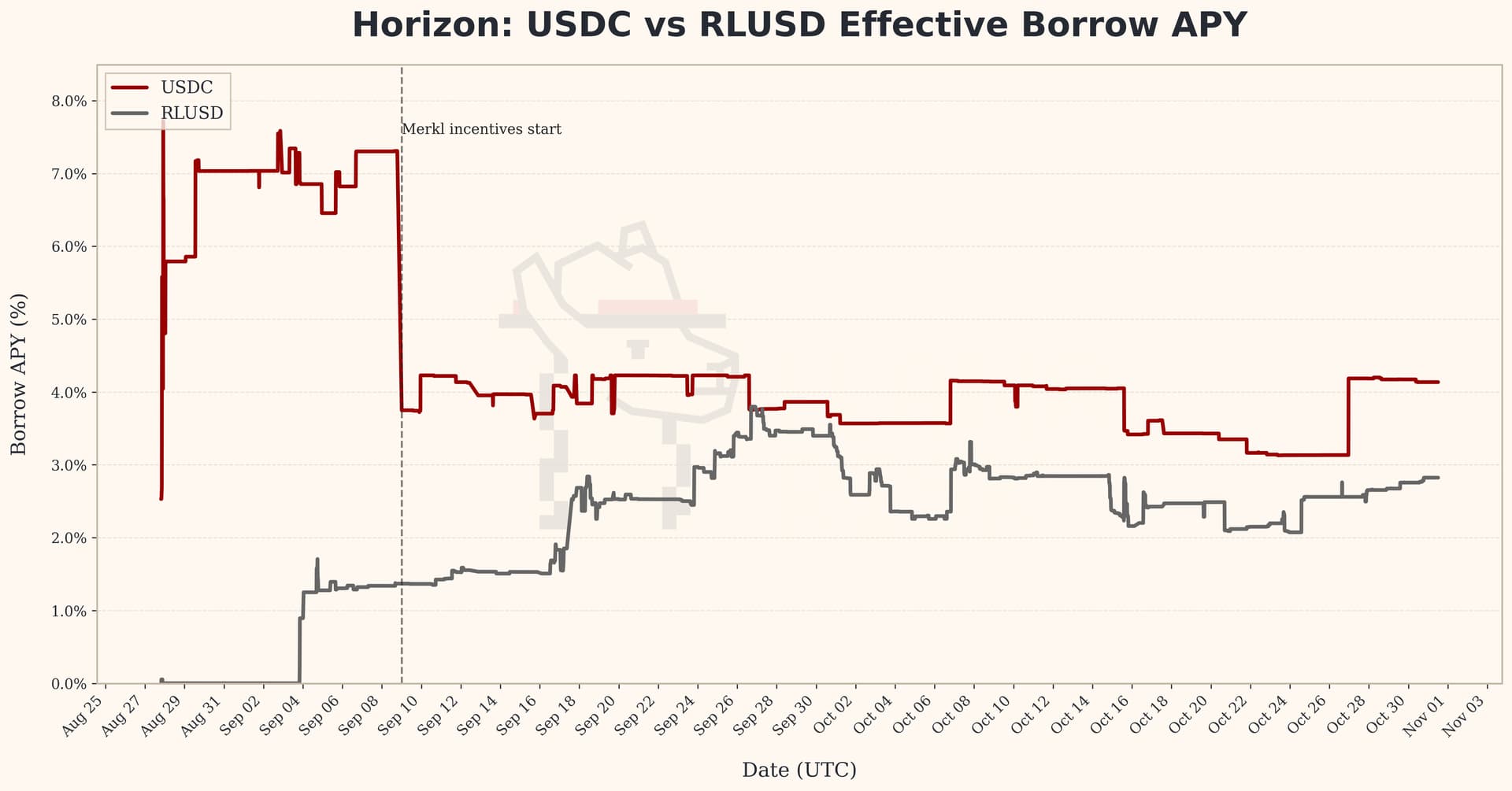

Incentive programs on Horizon stimulate liquidity supply and borrowing activity, with active campaigns for USDC and RLUSD.

- USDC: A borrowing campaign continues to be active, offering daily rewards of $1,603, effectively reducing the borrowing cost by around 3.5%.

- RLUSD: The new lending-focused campaign has been active since October 28, distributing $37,333 in daily rewards, capped at 15% APY.

Utilization Report

In the nine weeks following Horizon’s market activation, total borrowed balances expanded sharply to $135.7 million, fueled by sustained inflows of new users who began actively supplying and borrowing GHO against USCC collateral. A single address accounted for roughly half of the total GHO net borrow.

Source: LlamaRisk, October 31, 2025

Parameter changes during this period

- GHO: The supply and borrow caps were increased to 70m and 50m, respectively, on October 28.

- USCC: The supply cap was increased to 18.5m on October 24.

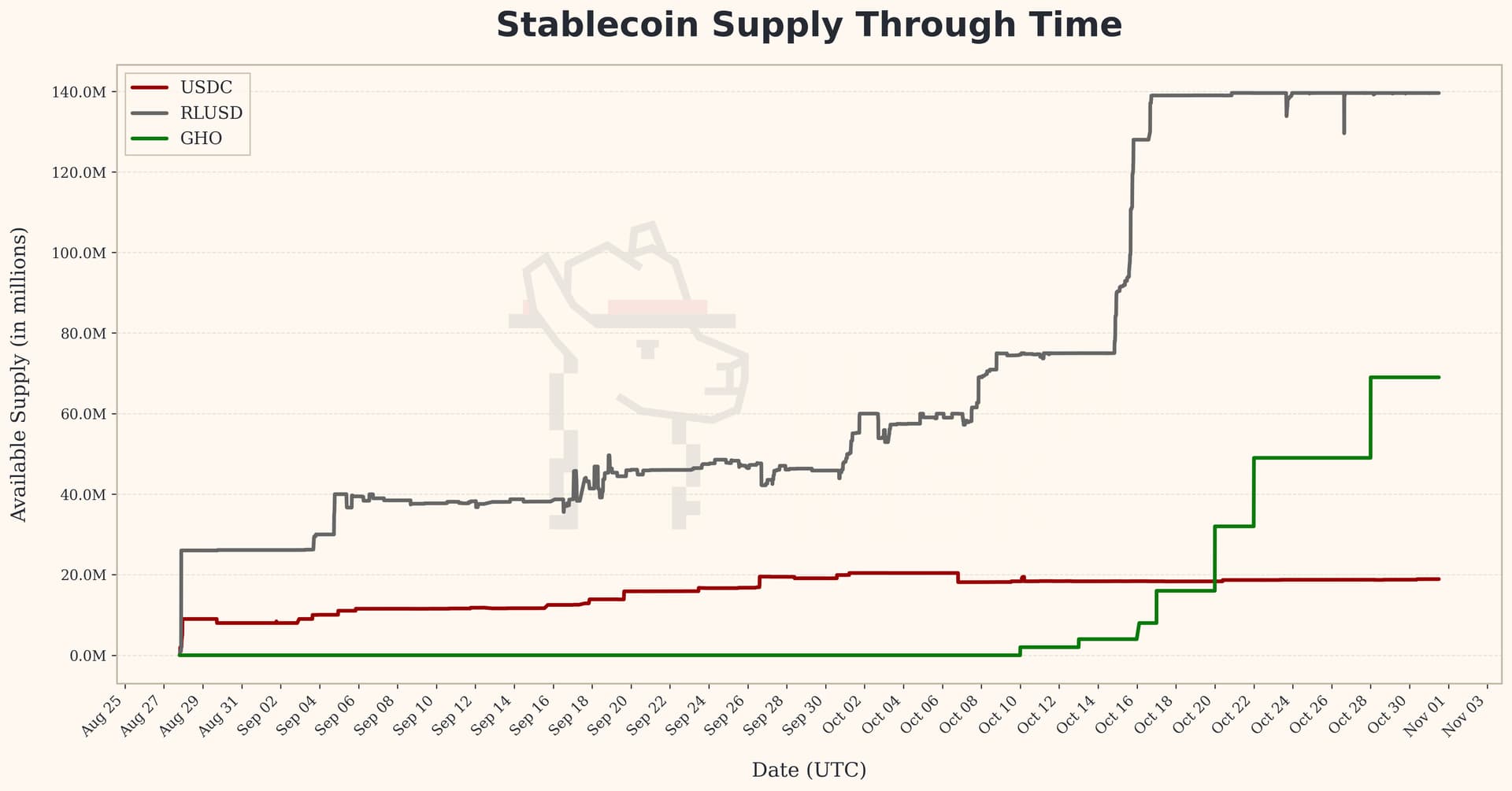

Supply (stablecoins)

The total supply of stablecoins increased by 10% to $227.4m. RLUSD accounts for the largest portion of this total supply.

- RLUSD: Supply hasn’t changed and currently sits at $139m.

- USDC: Supply increase by 1.9% from $18.4m to $18.9m.

- GHO: Supply increase by 38.8% from $50m to $69.4m, solely driven by liquidity from GHO Facilitator.

Source: LlamaRisk, October 31, 2025

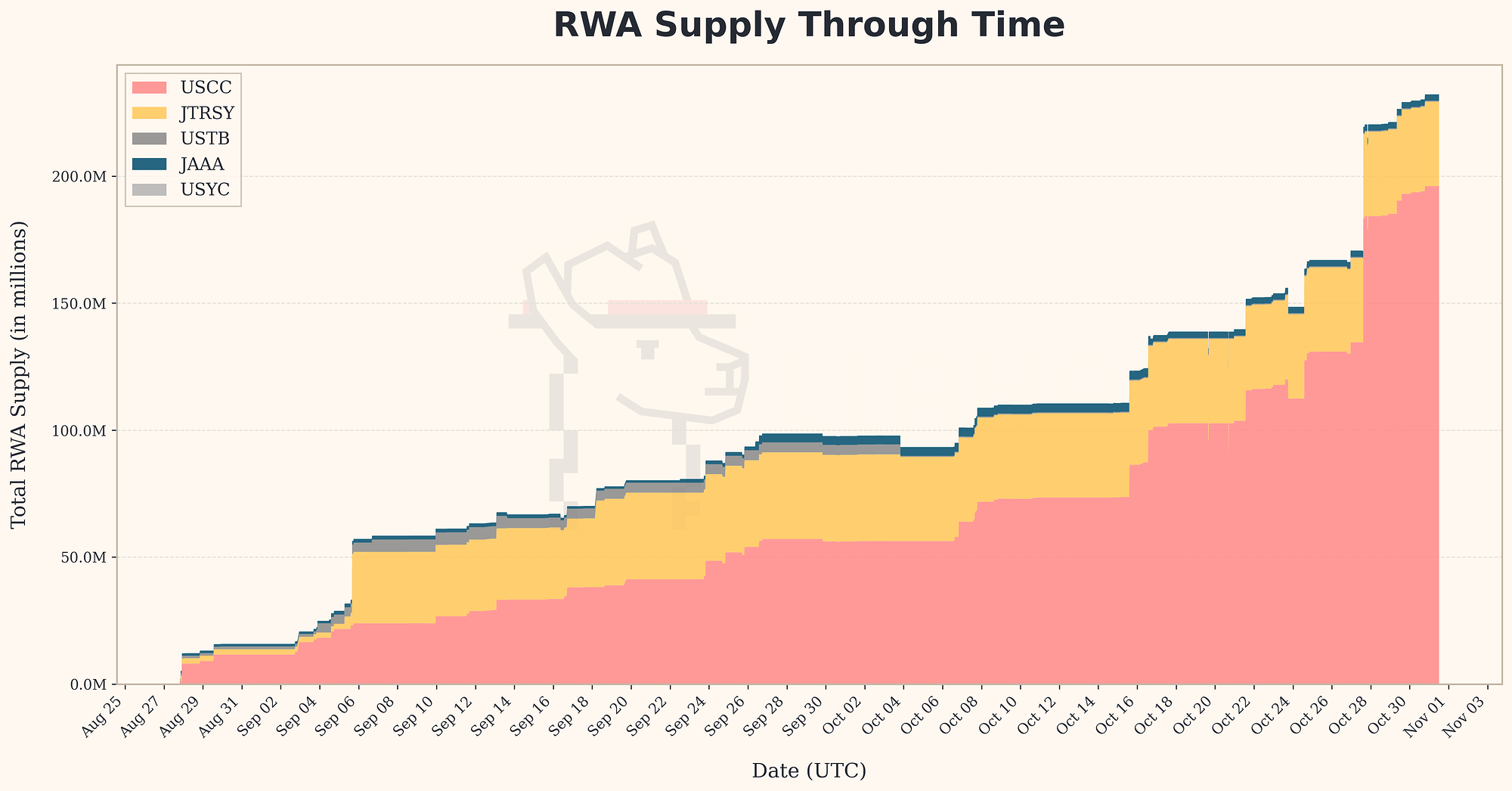

Supply (RWAs)

The total supply of Real World Assets (RWAs) grew by 40.5%, reaching $232m. The USCC remained the sole contributor to overall platform growth, reflecting enduring institutional demand for yield-generating collateral within the Horizon ecosystem.

The changes in individual RWA supplies were as follows:

- USCC: Supply increased by 51.8%, from $129.2m to $196m.

- JTRSY: Supply hasn’t changed and currently sits at $33.2m.

- USTB: Supply hasn’t changed and currently sits at $389k.

- JAAA: Supply hasn’t changed and currently sits at $2.5m.

- USYC: Supply remained at zero with no assets supplied.

Source: LlamaRisk, October 31, 2025

Borrow

Total net borrowing on Horizon increased by 78.9% to $135.9m. This growth was due to increased borrowing in the GHO market.

- USDC: Net borrow increase by 19.4%, from $14m to $16.72m.

- RLUSD: Net borrow increase by 14.7%, from $61m to $69.97m.

- GHO: Net borrow increased by 146.3% from $19.9m to $49.2m.

Source: LlamaRisk, October 31, 2025

Stablecoin Utilization

USDC and RLUSD market dynamics remained largely unchanged over the week, reflecting stable utilization and steady user activity. In contrast, the GHO market experienced a pronounced increase in engagement, with utilization climbing to 71%, signaling a strong acceleration in borrowing demand and active market adoption.

Source: LlamaRisk, October 31, 2025

Stablecoin Supply Rates

The seventh RLUSD incentive program commenced this week, maintaining a supply yield of 12.68%, as the market remains capped and fully utilized. This stability reflects constrained capacity rather than new inflows, with participants continuing to capture elevated returns within a saturated RLUSD market. In contrast, USDC supply rates have trended lower, consistent with softer utilization and moderating demand conditions.

Source: LlamaRisk, October 31, 2025

Stablecoin Borrow Rates

For the new week, borrowing rates across stablecoin markets held steady, with a spread of just over 1.5% between RLUSD and USDC. The GHO borrow rate remained anchored at 4.34%, reflecting consistent market pricing and liquidity conditions.

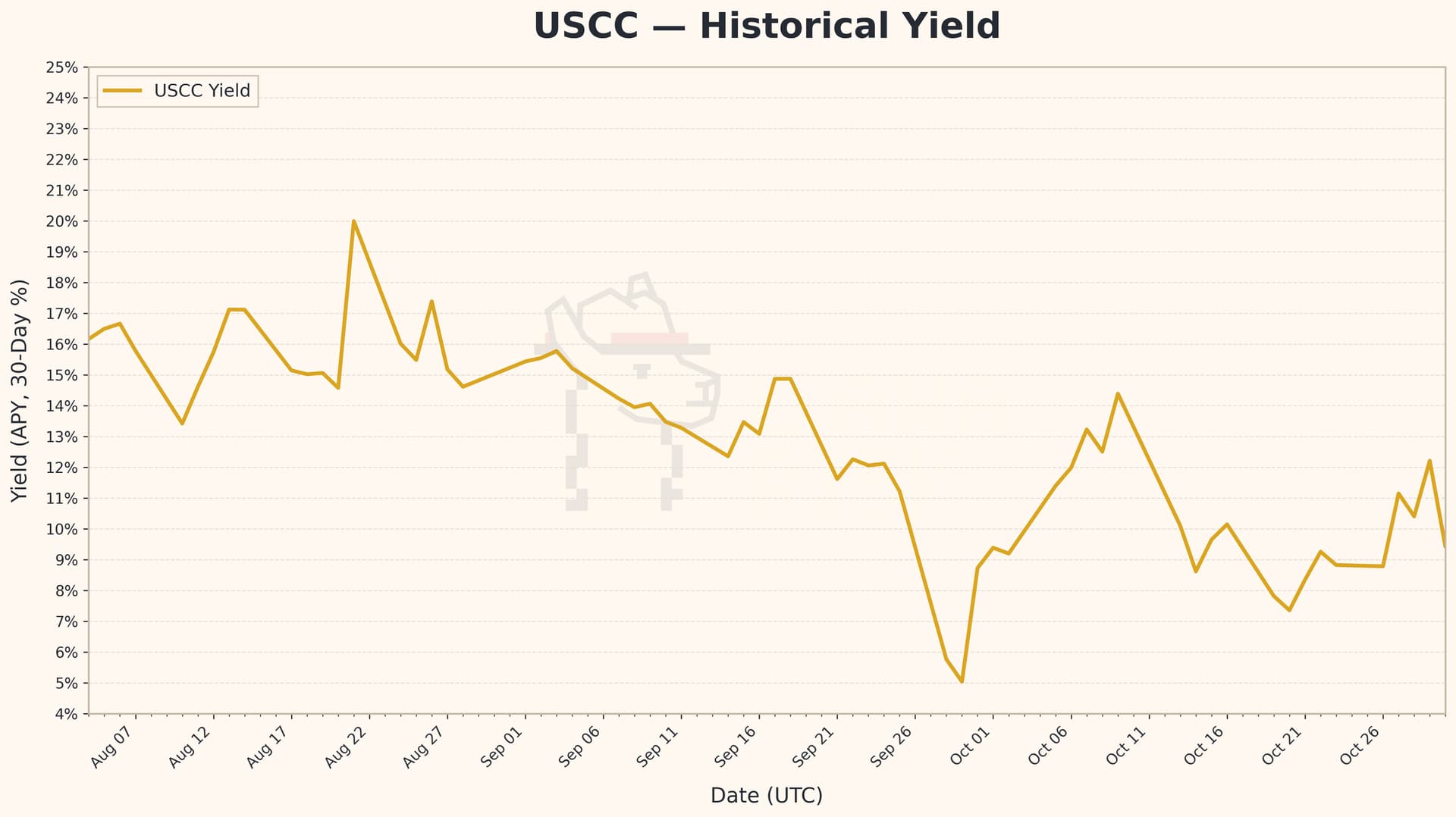

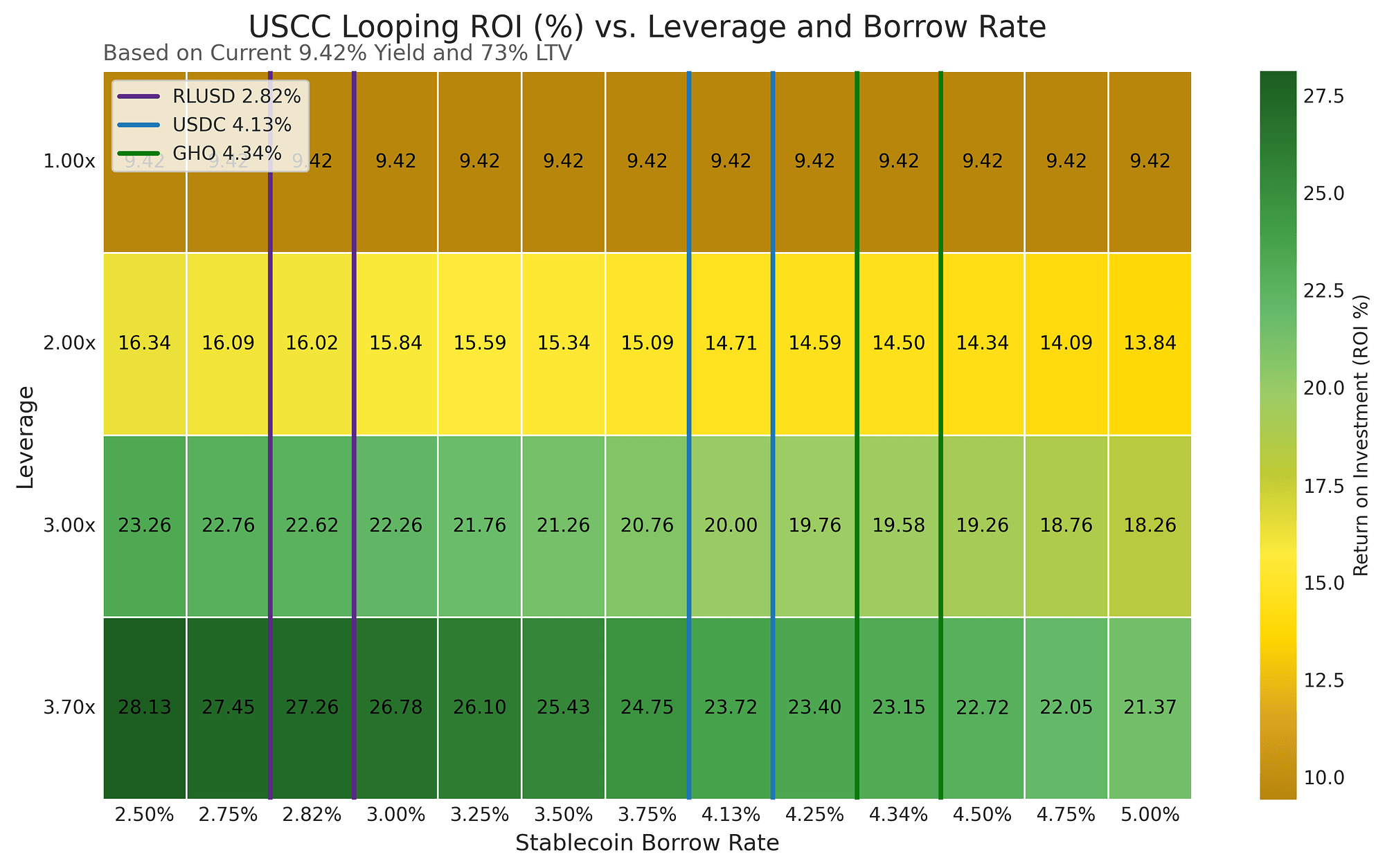

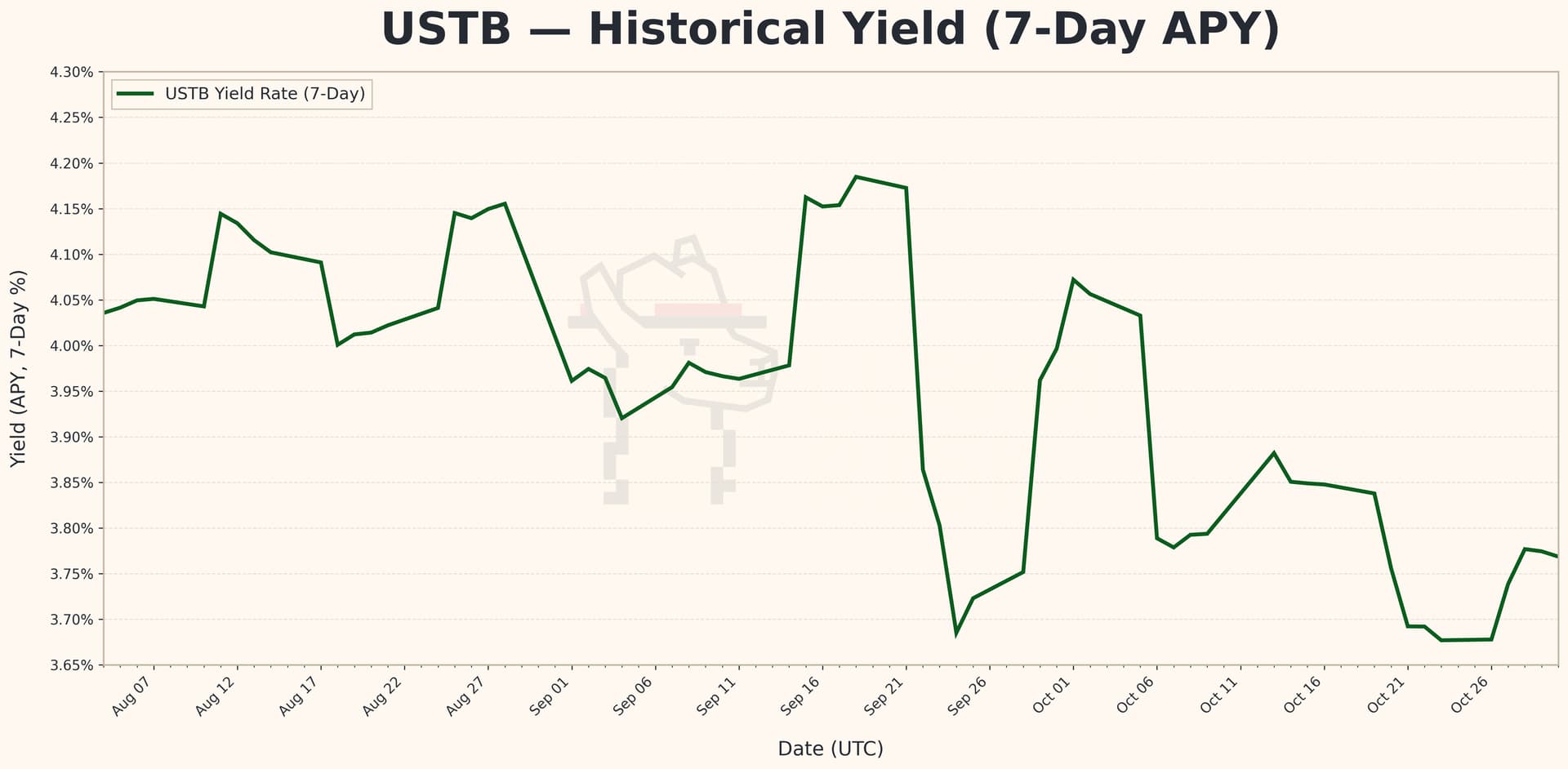

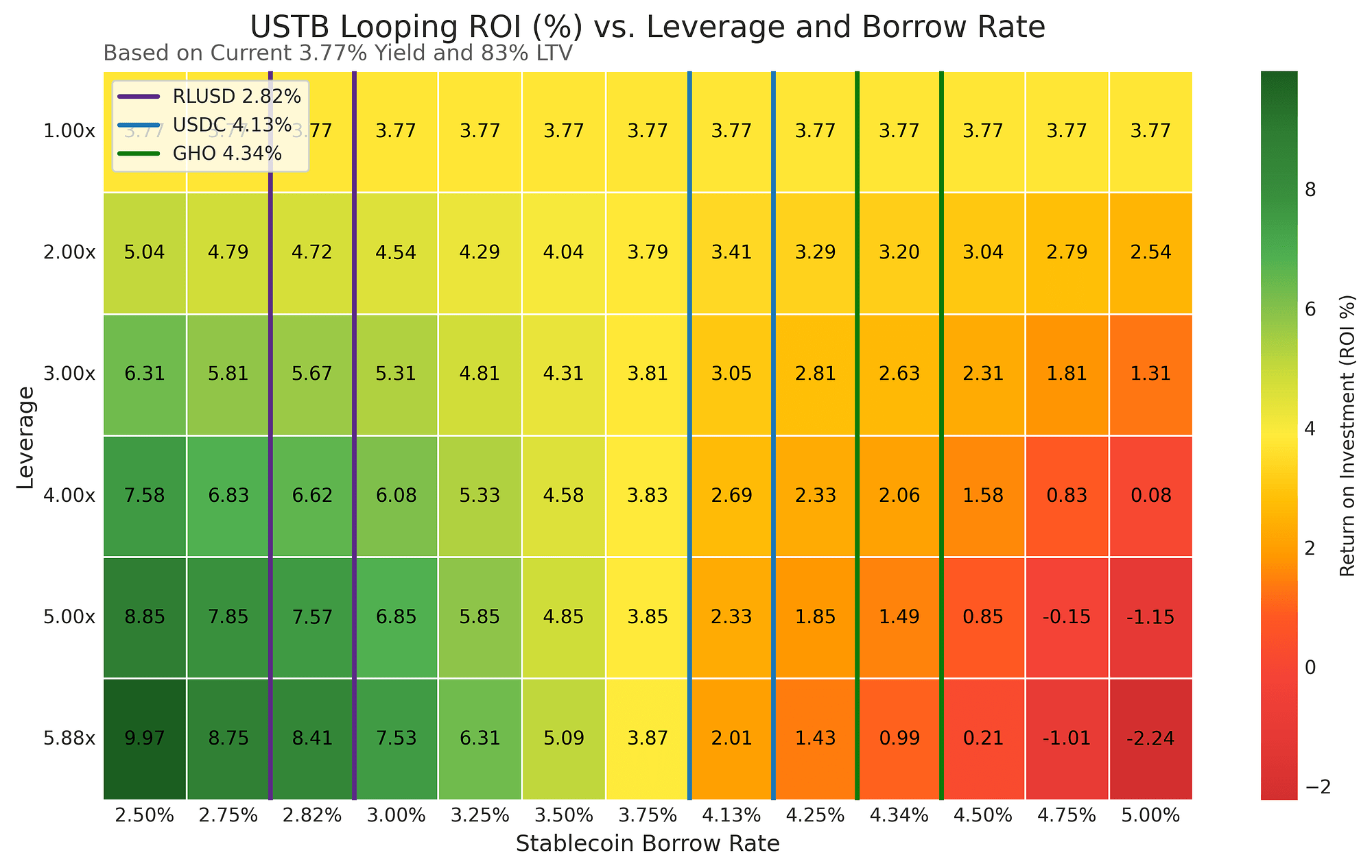

Profitability heatmaps for leverage looping

RWA yields remained largely unchanged over the week, with only marginal adjustments across assets. USCC now offers 9.42%, while USTB yields 3.77%, reflecting a modest upward shift in returns amid broadly stable RWA market conditions.

USCC

Source: LlamaRisk, October 31, 2025

Source: LlamaRisk, October 31, 2025

USTB

Source: LlamaRisk, October 31, 2025

Source: LlamaRisk, October 31, 2025