This week, Horizon Total Value Locked (TVL) surpassed $591m, with over $187.9m in net borrows, and $293.5m in stablecoin supply.

Highlights

- TVL has surpassed $590 million, with a total stablecoin supply of $294 million and net borrowings standing at $193 million. RLUSD and USCC remain the dominant supplied assets, mostly by active user demand for looping strategies and an ongoing incentive campaign.

- The incentivization programs for RLUSD supply and USDC borrow markets continue to be active.

Incentivize Program

Incentive programs on Horizon stimulate liquidity supply and borrowing activity, with active campaigns for USDC and RLUSD.

- USDC: A new borrowing campaign has been started, offering daily rewards of $1,667, effectively reducing the borrowing cost by approximately 3.5%.

- RLUSD: The new lending-focused campaign has been active since November 18, distributing $40,712 in daily rewards, capped at a 15% APY.

Utilization Report

In the twelve weeks following Horizon’s market activation, total borrowed balances expanded sharply to $194.3 million, fueled mostly by ongoing users adjusting and reallocating their positions and new borrowing demand against the newly launched VBILL token.

Source: LlamaRisk, November 21, 2025

Parameter changes during this period

- RLUSD: The supply cap and borrow cap were raised to 191.2m and 172m on 17 November.

- USCC: The supply cap was increased to 29m on 17 November.

Supply (stablecoins)

The total supply of stablecoins increased by 9.6% to $293.6m, driven by continued growth in both RLUSD and USDC, while the GHO market remained unchanged.

- RLUSD: Supply increase by 16% from $164.7 to 191.2m.

- USDC: Supply increase by 7.3% from $21.8m to $23.4m.

- GHO: The supply hasn’t changed and currently stands at $79m.

Source: LlamaRisk, November 21, 2025

Supply (RWAs)

The total supply of Real-World Assets (RWAs) grew by 6.2%, reaching $301.2 million. This week’s increase came entirely from USCC, which posted a modest uplift, while all other segments remained effectively unchanged.

The changes in individual RWA supplies were as follows:

- USCC: Supply increased by 3.2%, from $246.2m to $256m.

- JTRSY: Supply hasn’t changed and currently stands at $33.2m.

- USTB: Supply hasn’t changed and currently stands at $389k.

- JAAA: Supply hasn’t changed and currently sits at $2.5m.

- USYC: Supply remained at zero with no assets supplied.

- VBILL: Supply hasn’t changed and currently stands at $9.17m.

Source: LlamaRisk, November 21, 2025

Borrow

Total net borrowing on Horizon increased by 3.7% to $194.2m. This growth was due to increased borrowing in the USDC and RLUSD markets.

- USDC: Net borrow increase by 12.3%, from $15.5m to $17.4m.

- RLUSD: Net borrow increase by 5.4%, from $94.6m to $99.7m.

- GHO: Net borrow hasn’t changed and currently sits at $77.2m.

Source: LlamaRisk, November 21, 2025

Stablecoin Utilization

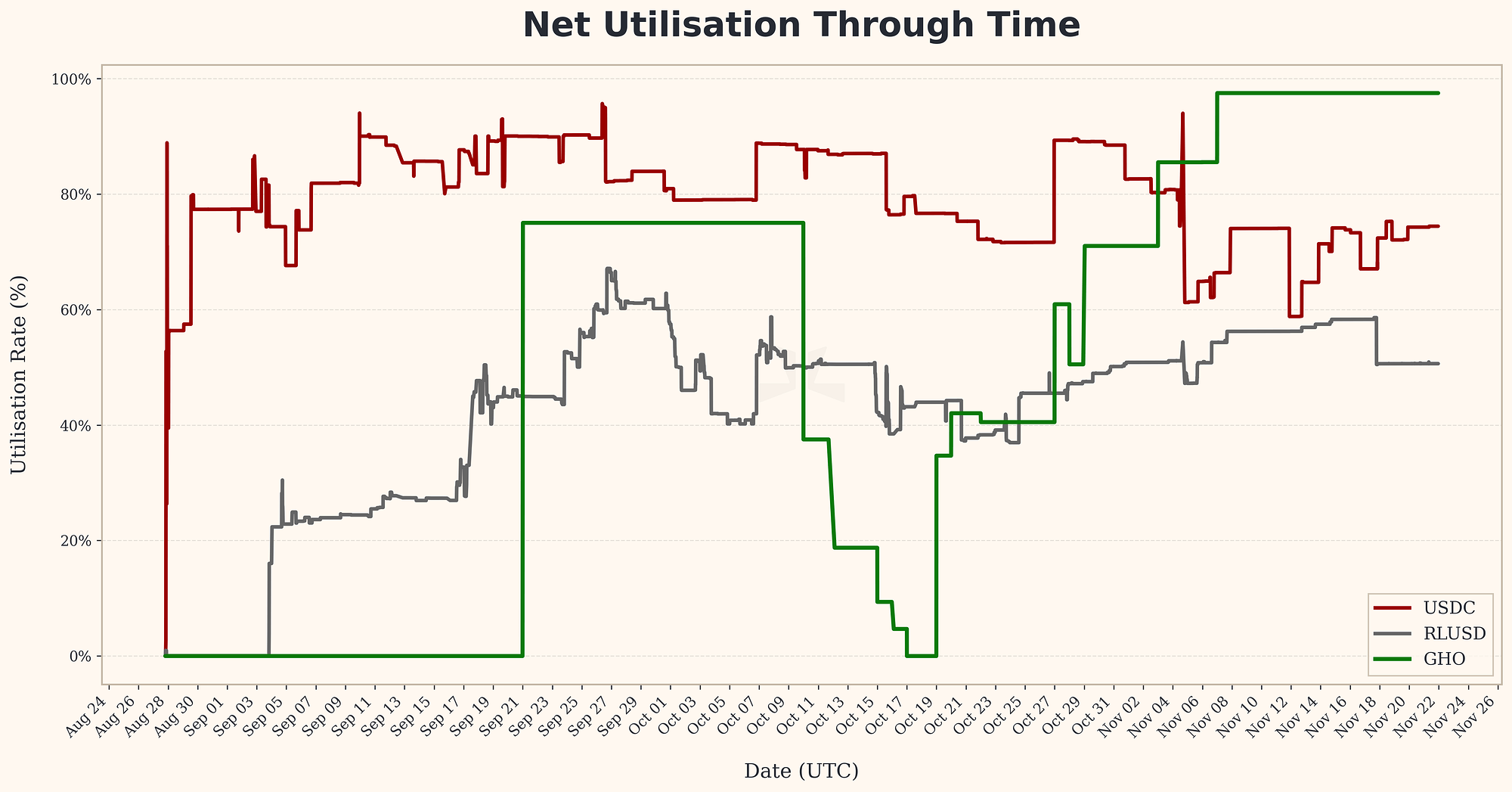

For this week, RLUSD and USDC utilisation levels held steady, as did GHO utilisation, which remained unchanged at 97.47%.

Source: LlamaRisk, November 21, 2025

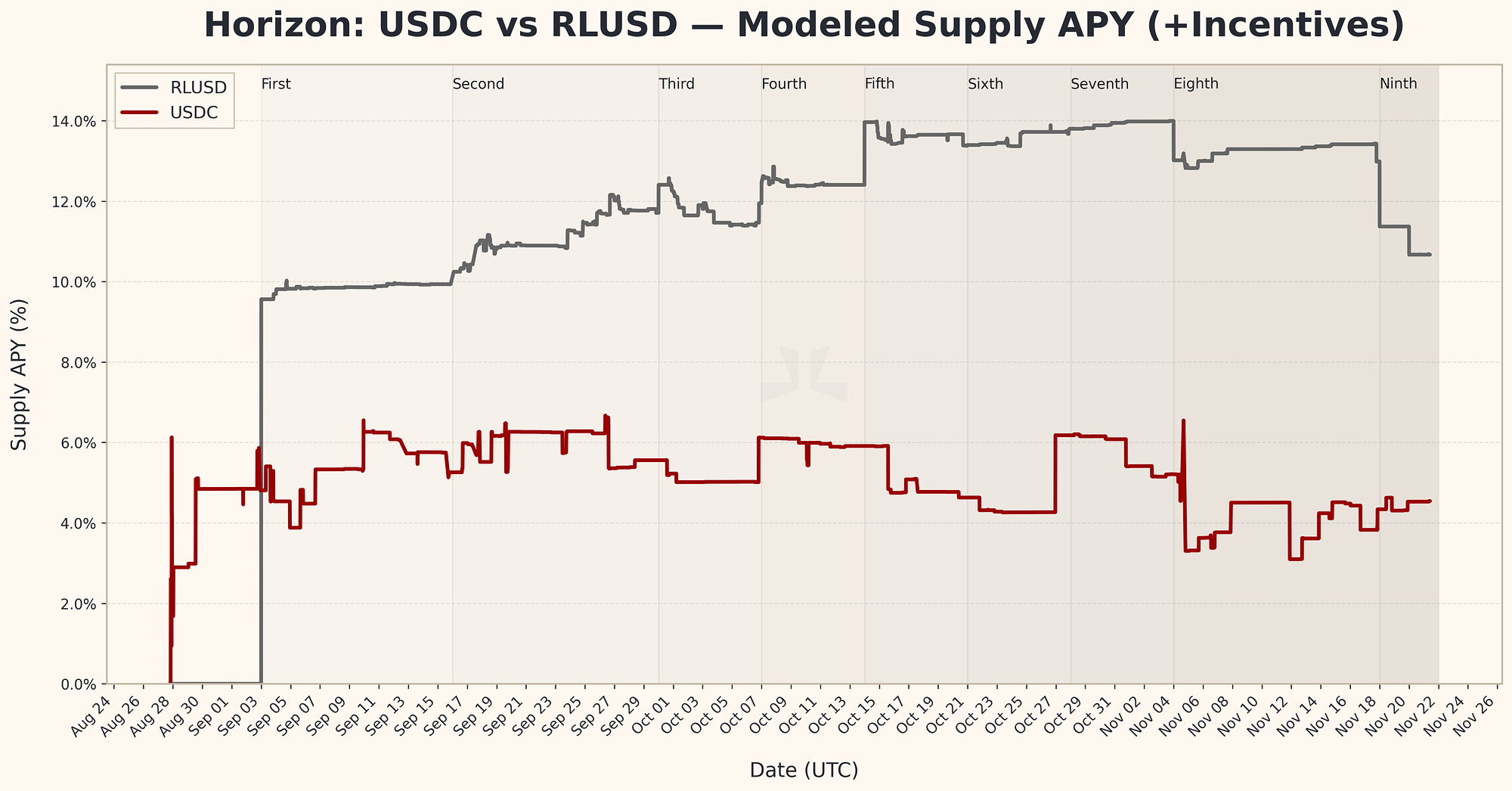

Stablecoin Supply Rates

The ninth RLUSD incentive program has now begun, effectively reducing RLUSD supply yields, while USDC yields remain stable as market utilisation holds steady.

Source: LlamaRisk, November 21, 2025

Stablecoin Borrow Rates

Borrow rates for both USDC and RLUSD remained steady throughout the week, exhibiting no significant shifts in pricing or utilization-driven pressure.

Source: LlamaRisk, November 21, 2025

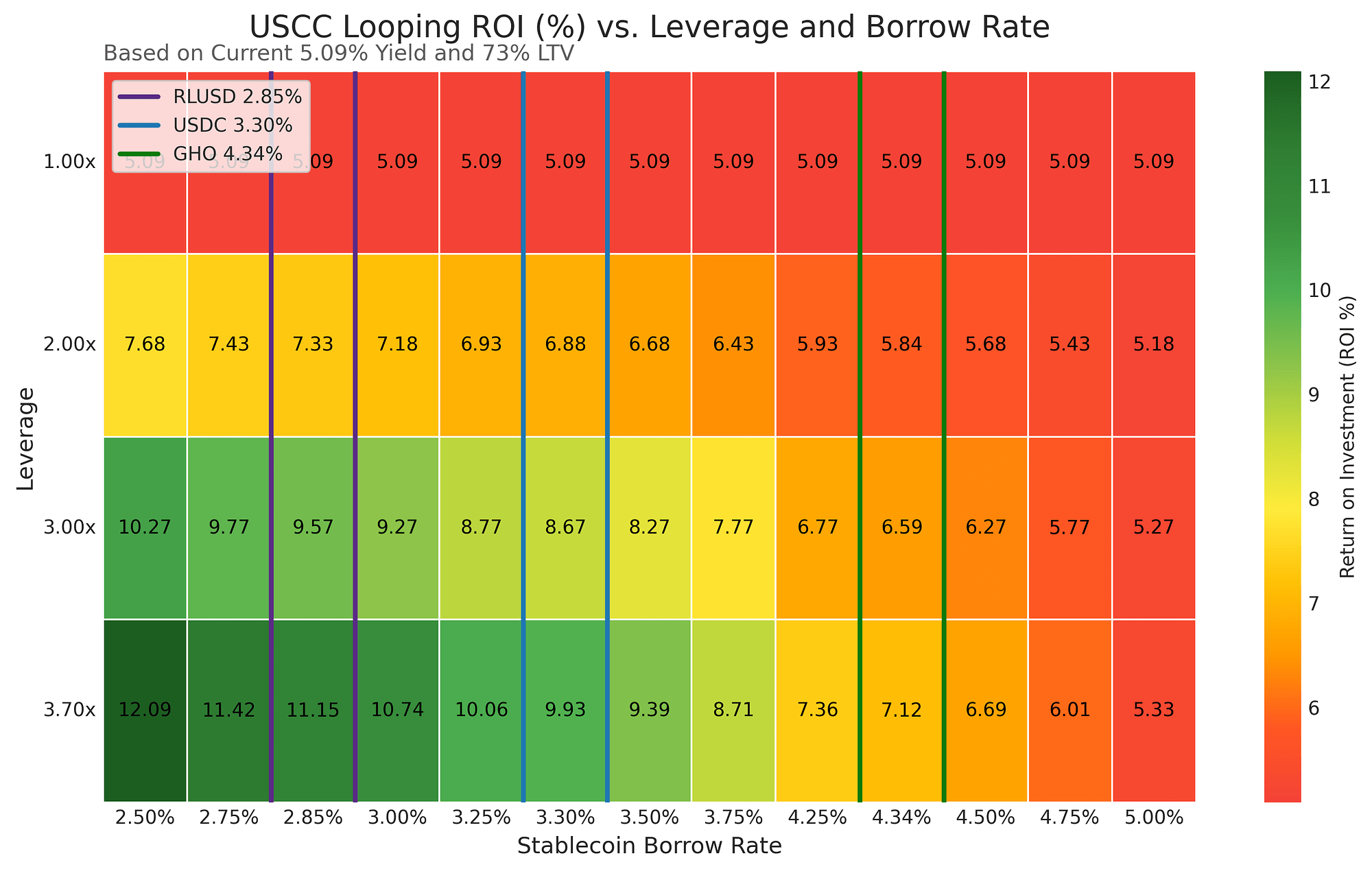

Profitability heatmaps for leverage looping

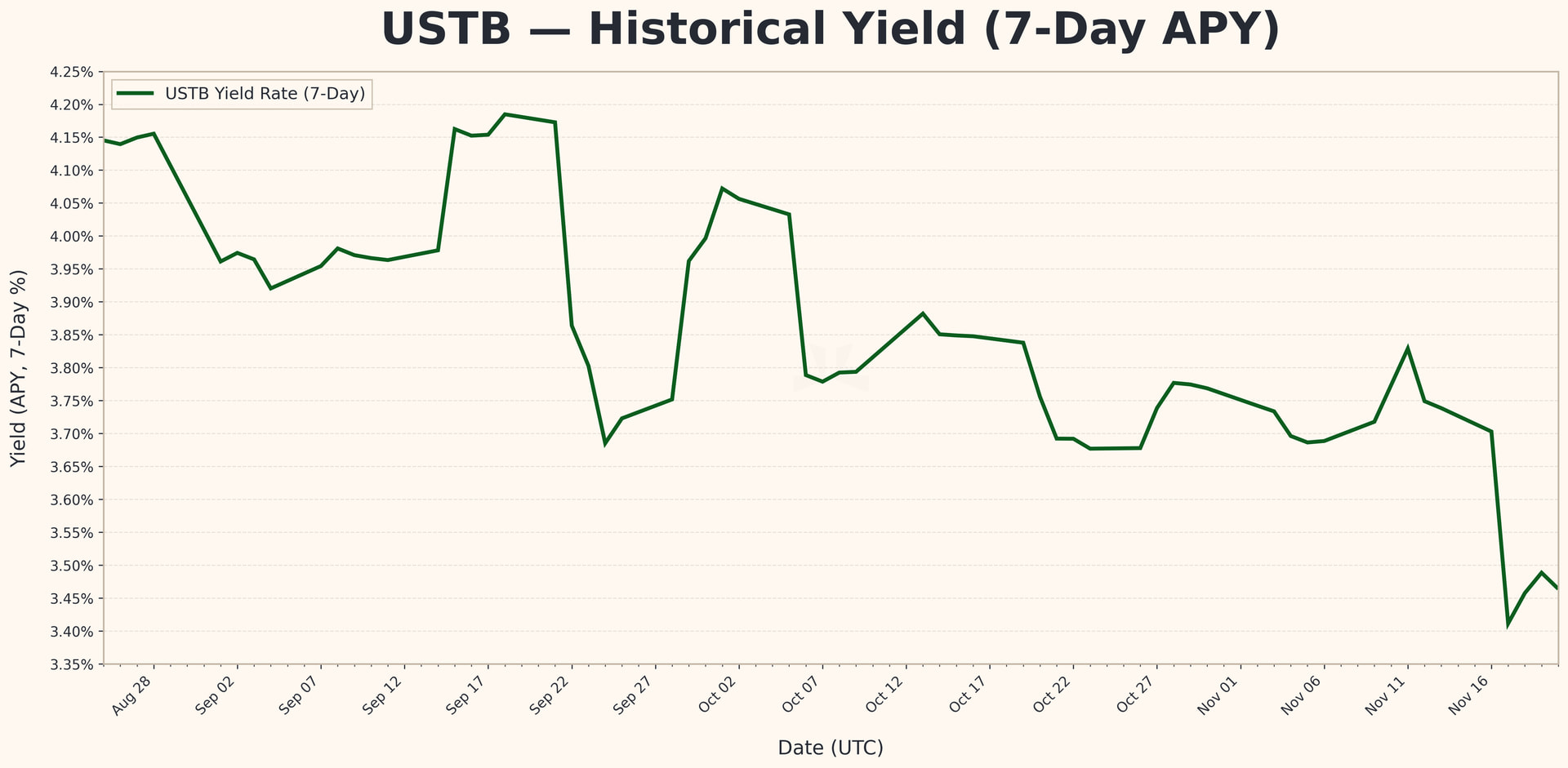

RWA yields moved lower over the week, with USCC slipping to 5.09% and USTB easing to 3.67%. The decline in USCC was driven primarily by weaker CME SOL futures yields, which represent its largest underlying exposure.

USCC

Source: LlamaRisk, November 21, 2025

Source: LlamaRisk, November 21, 2025

USTB

Source: LlamaRisk, November 21, 2025

Source: LlamaRisk, November 21, 2025