There are two ways to recapitalize the Reserve for rewards, either the protocol fees or activating issuance that is not too high but compensates the LPs and stakers after the Aave Reserve is utilized. I think the AAVE safety module could be also utilized to things being build on top of the Aave Ecosystem, thus allowing projects to boos-trap liquidity and utilization in exchange of protocol fees for safety.

I think this is a great point. One thing to account for is that LPs and stakers have different models for discounting their cash flows. LPs have variable cash flows — fees that depend on events — whereas stakers are receiving more steady, continuous income. As such, the discounted cash flows that LPs attribute need a correction for volatility whereas staking pools can discount directly based on inflation. As such, the safety module should ensure that if there is a price crash after a shortfall event (SE), e.g. AAVE/ETH falls 90%, then LPs are over-incentivized relative to stakers.

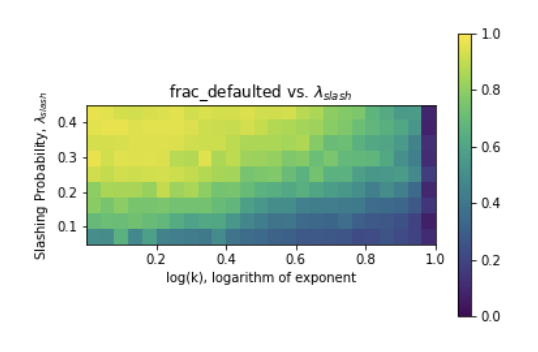

One of the things that Gauntlet will provide is some numerical evidence for how much is necessary to incentivize LPs vs. stakers post price shocks (even when there aren’t fees). It is likely that there will be some stable regions and unstable region in the space of inflation curves and compensation, but numerical plots like the one below (which is for a staking derivative that is similar to what Aave is doing with an insurance fund) will help improve confidence in recovery during such an event. Note that in the plot, the correct analogue of slashing probability for Aavenomics is the probability of an SE.