Introduction

It has been nearly three months since the launch of the Aave Umbrella Safety Module, deployed by BGD Labs as part of Aave’s ongoing effort to enhance protocol safety and resilience. Designed to serve as a decentralized backstop in the event of shortfalls, the Umbrella Safety Module introduced a new staked safety buffer for key asset reserves of Aave V3 Core pools, starting with GHO, USDC, USDT, and WETH.

This report reviews the initial three-month growth of the Umbrella Safety Module, analyzes user distribution and staking patterns across each module, DAO cost impacts, and highlights emerging dynamics that may influence the module’s future trajectory.

Key takeaways

-

Successful launch: In their first three months, the Umbrella modules collectively attracted $554M in cumulative deposits. The performance against liquidity targets varies by module. The GHO, USDC, and WETH modules have all exceeded their targets. In contrast, the USDT module is the only one that has not yet reached its $104M target. The WETH module is the most over-capitalized, suggesting potential for future optimization.

-

Significant cost reduction: The transition to the Umbrella Safety Modules has led to a major decrease in costs for the Aave DAO. The annual cost per dollar of coverage has fallen by 43%, from $0.21 to $0.12. A complete shift to the Umbrella model could further reduce this cost to just $0.028, a substantial improvement in capital efficiency.

-

Capital inflows: Capital flowed in from various parts of the crypto ecosystem. While Aave itself was a primary source, $164M in new capital came from external protocols, including centralized exchanges like Binance and other DeFi platforms such as Sky Protocol, Fluid, and Morpho.

-

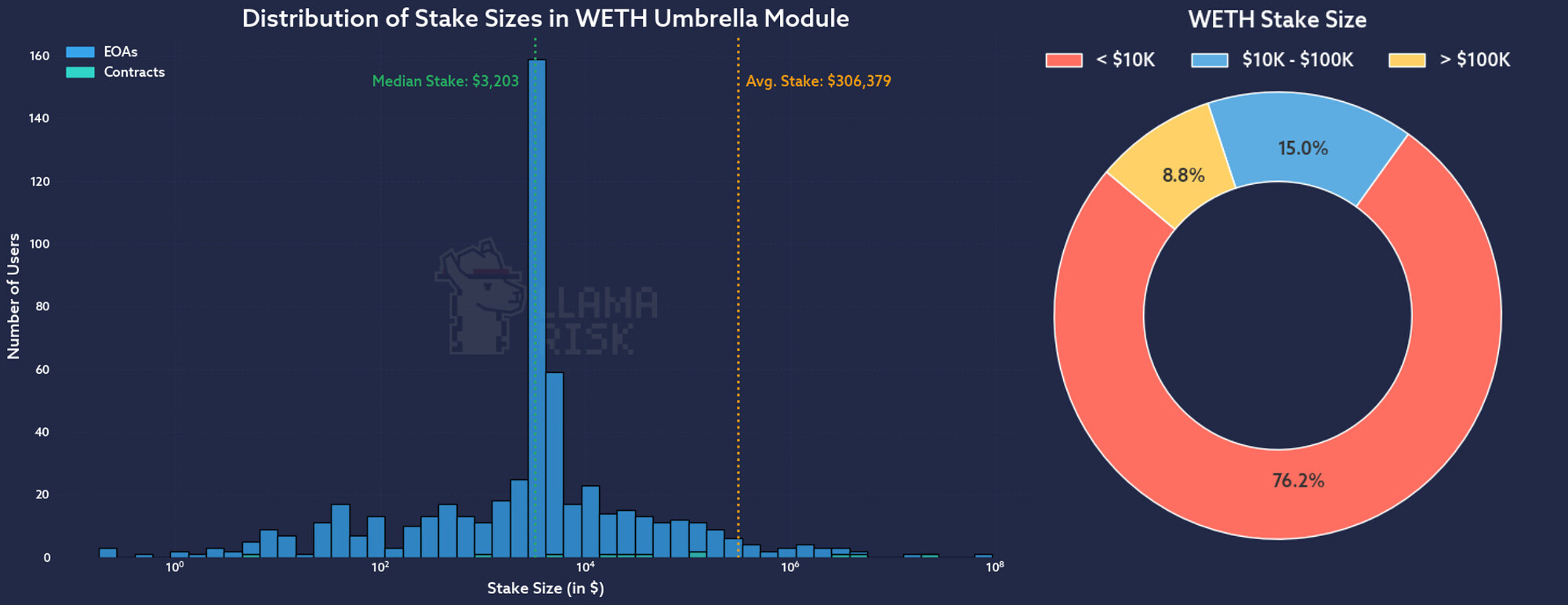

Whale influence: The WETH and GHO modules are significantly influenced by large holders, as shown by the large gap between their average and median stake sizes. The WETH module is the most extreme example of this concentration, with one whale group accounting for approximately 54% of the module’s total value.

-

Cooldown behavior: Although a significant percentage of funds are often in the 20-day withdrawal cooldown period (45% for USDC, 37% for GHO, 17% for USDT, and 13% for WETH), the actual withdrawal rates are low (around 38-40%). Users appear to be in “perpetual” cooldown to maintain withdrawal flexibility while continuing to earn rewards.

-

Emergence of secondary markets: DeFi protocols like YoProtocol and Pendle have started building secondary market products on top of the Umbrella staked tokens, adding another layer of utility and liquidity for stakers.

Resources

Methodology

All data in this report was obtained directly from the Ethereum blockchain. Vault balances, transaction history, and user distribution metrics were extracted from the relevant Umbrella Safety Module contracts. Data collection focused on the first three months following deployment, capturing the period from June 5, 2025 (block 22638170) to August 29, 2025. For this report, we define Umbrella users in two categories:

-

All-time users – any address that has ever deposited, withdrawn, or received Umbrella tokens (including via transfers) and at any point held a positive balance in any Umbrella module since contract deployment.

-

Active users – addresses maintaining an active stake in any Umbrella module at the analysis cutoff date.

This categorization enables longitudinal tracking of Umbrella’s user base and focused analysis of current participation levels.

Umbrella Mechanics

The Umbrella Safety Module functions as a first-loss capital layer designed to protect the Aave Protocol in the event of a shortfall. Participants stake designated assets into Umbrella modules, creating a readily available liquidity buffer that can be used to absorb losses. If losses exceed this first-loss layer, additional safeguards may be used to maintain protocol solvency and user confidence, including legacy stkAAVE/stkABPT coverage and the Aave DAO reserves.

Umbrella also includes a parametrizable deficit offset of $100K per module, which the DAO covers before stakers are subject to slashing. Since launch, no Umbrella user slashing events have been recorded. Deposits into the Umbrella module are instantaneous, while withdrawals trigger a 20-day cooldown period, during which users continue to earn rewards and remain eligible for slashing. This mechanism is intended to discourage capital exit during adverse market conditions, as funds in cooldown remain subject to slashing. Slashing can be triggered as soon as the deficit exceeds the offset, making the system more responsive than the legacy safety module, which relied on a formal governance process. The underlying aTokens fund each Umbrella module.

We determined liquidity targets for each Umbrella module using our Value at Risk (VaR) methodology. The recommended targets were: USDC ($66M), USDT ($104M), GHO ($12M), and WETH (25K WETH). These parameters were recommended based on a simulation run made on May 15, 2025. This methodology simulates extreme market stress using historical price data to generate synthetic shock scenarios. It models user liquidations under these shocks to estimate each asset’s Liquidity Capacity, the maximum debt that can be profitably liquidated before losses occur. The Target Liquidity for each Umbrella module is set to cover the gap between this capacity and a governance-defined Safety Target, ensuring robust risk coverage without overcapitalization.

DAO Emissions

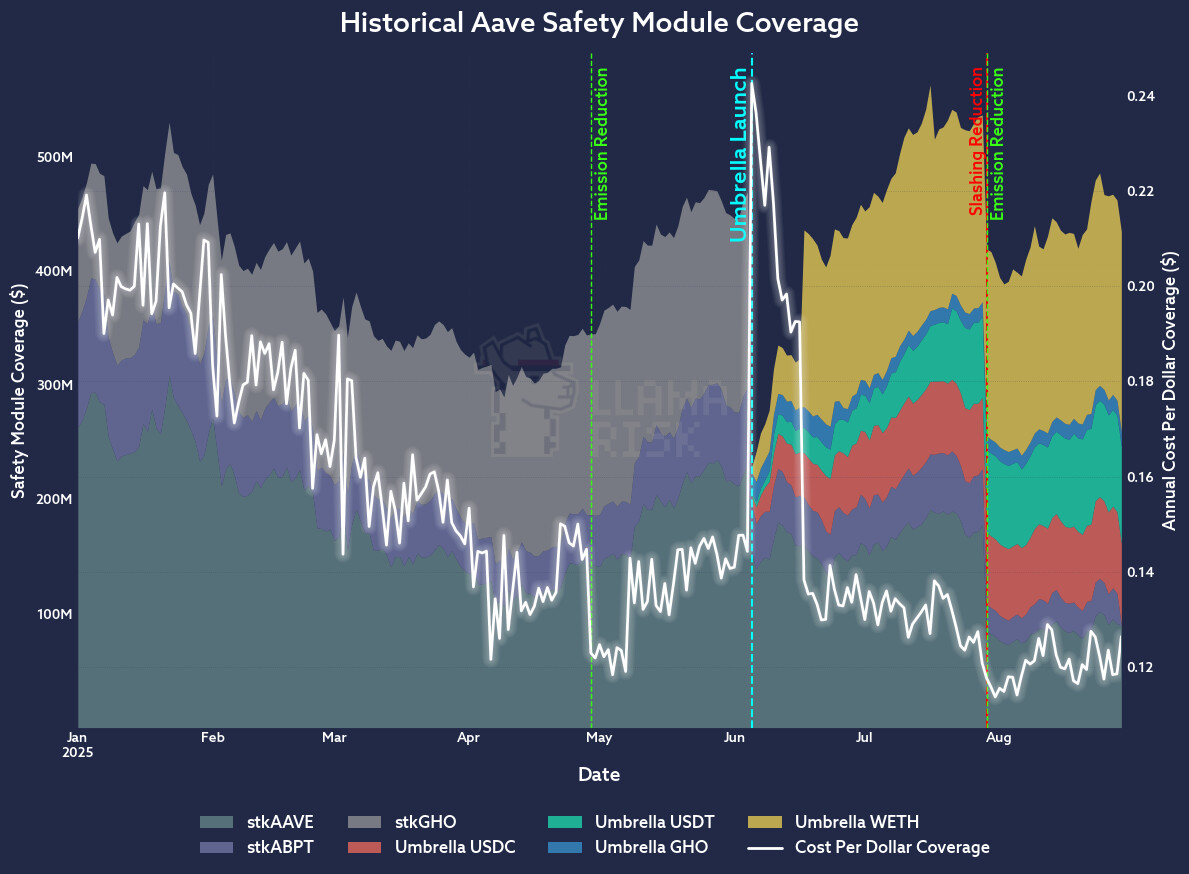

The transition from Legacy Staking Modules (stkAAVE, stkABPT, stkGHO) to Umbrella has resulted in significant cost reductions for the DAO. Previously, the Aave DAO distributed 255K AAVE per year, which has now been reduced to 142K AAVE per year for legacy staking modules. Emissions were progressively reduced to support the transition to the new, more efficient Umbrella Safety Modules, alongside slashing reductions: stkAAVE decreased from 30% to 10%, stkABPT from 30% to 10%, and stkGHO was fully transitioned to Savings GHO (sGHO) with zero slashing and separate emissions.

These measures have caused a progressive decrease in coverage from the Legacy Modules. However, TVL in stkAAVE and stkABPT has not declined. Instead, the reduction in coverage, as shown in the chart above, is a result of the slashing reductions.

Since the Umbrella Safety Modules launch, historical safety module coverage peaked at $550M in July 2025, within weeks of launch. Currently, the Safety Module cover is similar to the level at the beginning of the year. At the same time, the annual cost per dollar of coverage has decreased from $0.21 to $0.12, representing a 43% reduction in costs.

At max emissions, the Umbrella Safety Modules have a budget of 7.2M stablecoins and 550 WETH, totaling $9.7M at $4,500 per WETH, significantly lower than previous spending, as reflected in the reduced cost per dollar of coverage. If the DAO were to transition to the Umbrella Safety Modules fully, the cost per dollar of coverage at current liquidity levels (~$350M) would fall to just $0.028 from the current $0.12.

User Insights

Since the launch of Umbrella, all modules have recorded $554M in cumulative deposits and $217M in withdrawals. To better understand the nature and type of users interacting with Umbrella, we mapped these inflows and outflows to the other protocol venues they originated from or were directed to, as shown in the figure below.

Aave (current Protocol depositors) was the largest overall source of inflows, contributing $133.7M. In the WETH and GHO modules, more than 50% of deposits came from users previously supplying to the Aave WETH market. In contrast, inflows into the USDT and USDC modules were more diverse, coming from a wider range of protocol venues. Across all modules, Umbrella attracted $164M in new capital from protocols outside Aave and retained about 60.8% of its total inflows. Of the $44M in outflows traced to identified protocols, $14Mwas returned to Aave ork into an Umbrella module. This raised the overall retention of new users to approximately 82%.

It is important to note that these figures only account for identified protocols. They do not include inflows and outflows where assets were held in multisigs, transferred by another user, left idle in wallets, or deposited into unknown protocols. When including these users, who contributed $427M in inflows and $203M in outflows, the retention value adjusts to roughly 52%.

The illustration shows that first-order inflows, the last protocol where users deposited before supplying to Umbrella, are concentrated in a small set of venues. The largest shares came from Aave, Binance, and swaps conducted through DEXs and aggregators, accounting for most deposit activity across Umbrella modules. Focusing only on DeFi protocols, excluding CEXs, DEXs, and bridges, Sky Protocol was the largest contributor of USDC deposits. For other modules, aside from Aave, Fluid was the second-largest source of inflows for USDT and GHO, while Morpho played that role for WETH inflows.

Similarly, when looking at pure DeFi venues for first-order outflows from Umbrella, USDC outflows were led by Sky Protocol, followed by Morpho and Aave. For USDT, most users redeposited directly back into the USDT Umbrella module, with Aave and Pendle as the following largest destinations. In the case of WETH, Aave was the primary outflow venue, followed by Morpho. For GHO, most outflows also went to Aave, mirroring the inflow pattern. Here, an interesting two-way movement can be seen with the sGHO vault. The next biggest outflow destinations for GHO were Pendle and the GHO Umbrella module.

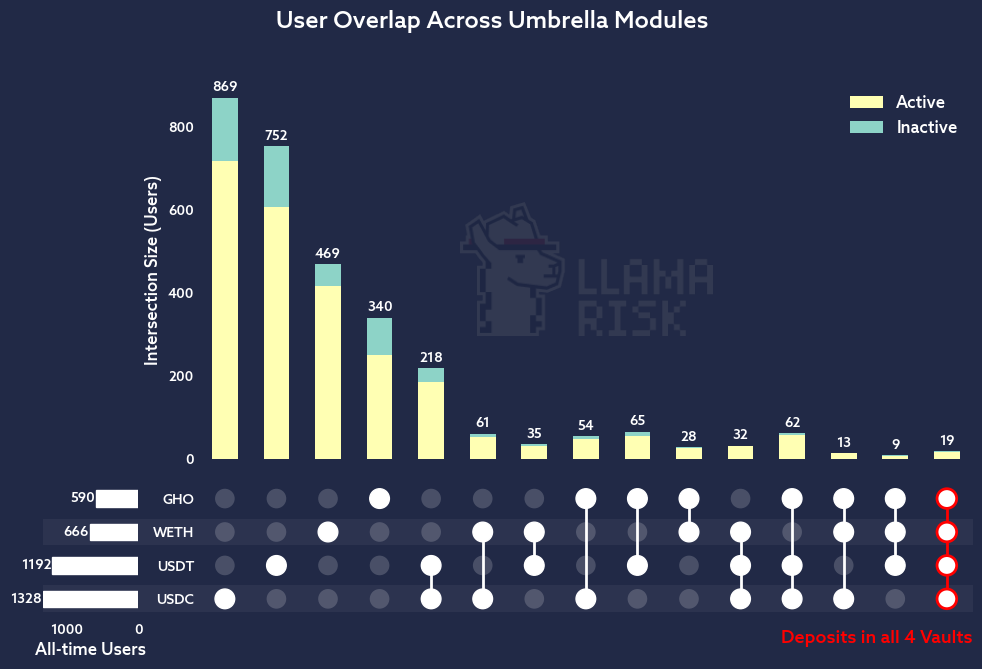

The chart illustrates user participation and overlap across Aave’s Umbrella Safety Modules for USDC, USDT, WETH, and GHO. A total of 3,026 unique users deposited into the modules, most of whom remain active with non-zero balances. Among the modules, USDC has the highest number of all-time depositors at 1,328, followed by USDT with 1,192, WETH with 666, and GHO with 590.

While 80.3% of users deposited into only a single module, overlaps in the UpsetPlot show that some users participated in multiple modules. The largest overlap occurred between USDT and USDC, with 218 common depositors. Additionally, 19 users deposited across all four modules. These overlaps highlight a subset of users who pursued a diversified approach, although mostly concentrated their deposits within a single module.

State of Umbrella Modules

Umbrella USDC

Growth

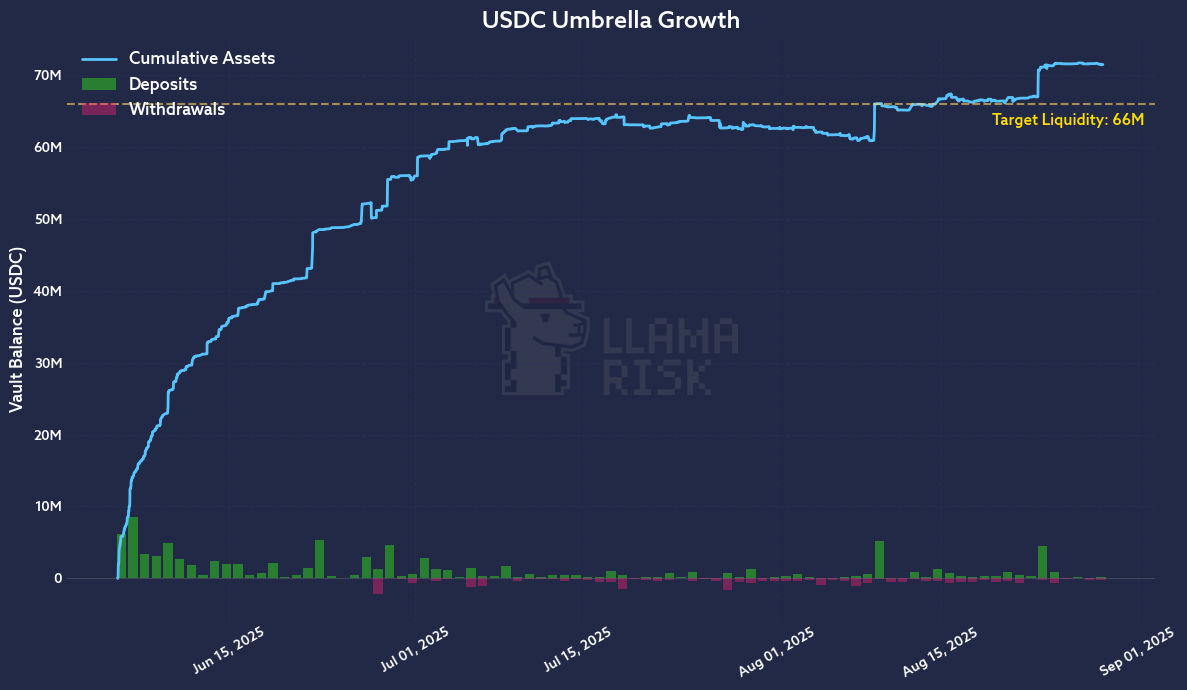

The USDC Umbrella module experienced rapid initial growth in early June, surpassing 30M USDC in deposits within the first week. Growth then continued at a slower but steady pace, reaching 71.4M USDC, just shy of its target liquidity cap of 66M. The largest single deposit occurred on June 28, 2025, when user 0xD56…687 contributed 3.7M USDC to the module.

The USDC Umbrella module exclusively provides bad debt cover for the Aave V3 Core USDC pool. The total USDC debt currently stands at 4.9B, and with the existing vault liquidity, the module offers a debt coverage of 1.46%, down from its historical peak of 2.5%. Since the target liquidity has already been reached, this coverage will likely decline further as USDC debt grows.

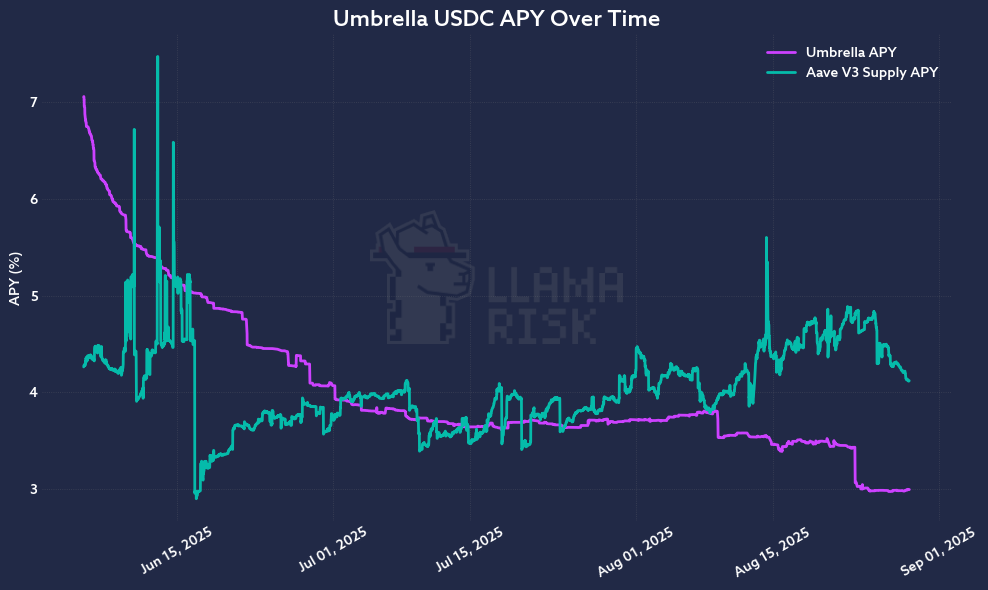

The Umbrella APY for the USDC module launched at a high of 7.06% and has gradually declined over time due to increasing deposits, currently at 2.99%. Since launch, the time-weighted average Umbrella APY stands at 4.03%. In addition, users earn the underlying Aave V3 supply APY, which has averaged 4.05%, bringing the total average APY from this module to 8.08%.

Upcoming Withdrawals

The upcoming withdrawal chart shows a concentrated wave of activity between August 29 and September 1, with nearly 16.5M USDC scheduled to exit the module. The largest withdrawal comes from the top staker, 0xD56…687, unlocking their 6.88M USDC position. Currently, 32.36M USDC, or 45.29% of the module’s deposits, is in cooldown.

It is important to note that most of these withdrawals are provisional, as users do not actually exit the module. The Umbrella mechanics allow users to accrue yield during the 20-day cooldown, and some users exploit this by perpetually remaining in cooldown to shorten their effective exit period. The cooldown can be reset via the StakerCooldownUpdated event, which overwrites the previous cooldown. The actual withdrawal rate for the USDC module is only 38.47%. If these substantial outflows were to occur, they would increase the Umbrella APY significantly, creating an opportunity for new depositors to capture higher yields.

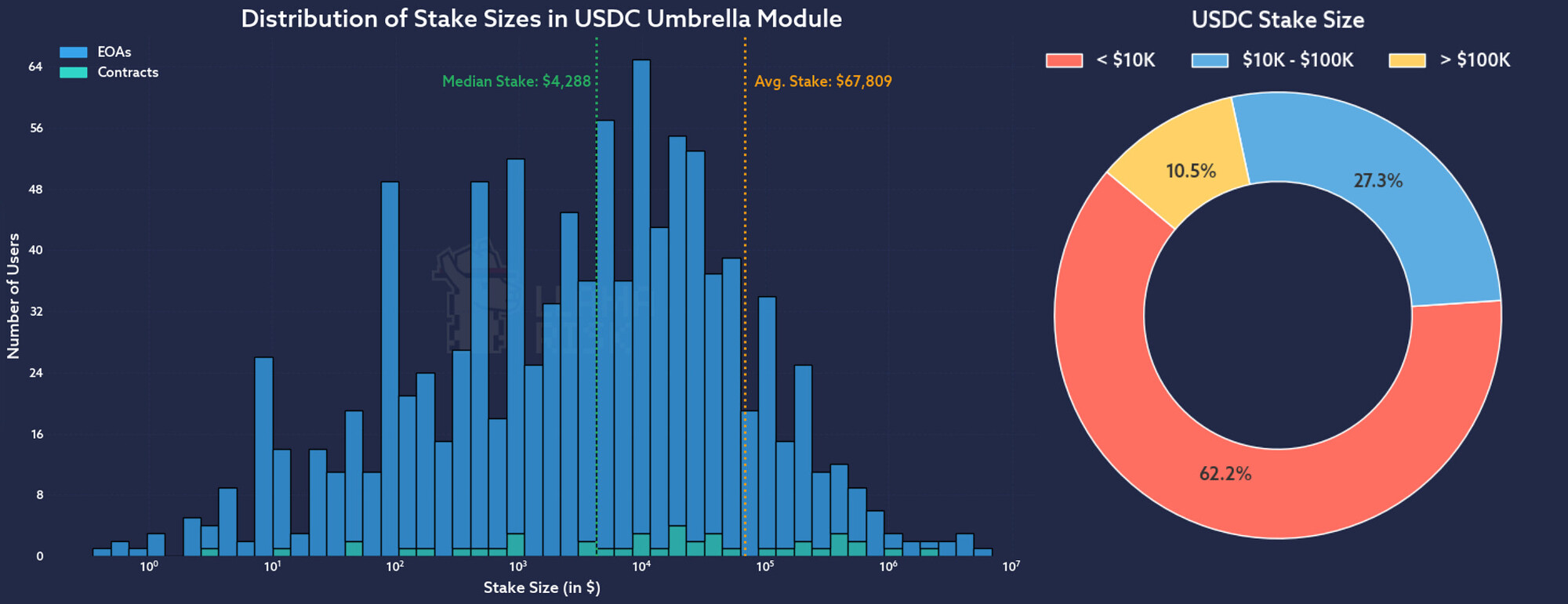

User Distribution

The current median stake size in the USDC Umbrella module is $4,288, while the average stands significantly higher at $67,809, indicating the presence of whales skewing the average. Since launch, 1328 unique users have deposited into the module, with 1055 still actively staked, and their respective stake size distribution can be seen in the pie chart above. Meanwhile, some notable secondary market integrations include YoProtocol’s yoUSD vault and Pendle’s SY-STKUSDC.V1 pool, which hold 0.54M and 0.29M Umbrella USDC, respectively.

Umbrella USDT

Growth

The USDT Umbrella module has demonstrated consistent and healthy growth throughout June and July, rising from just a few million USDT at launch to over 84.6M. It is the only module yet to hit the target liquidity cap of 104M. It may simply be a combination of a relatively higher target liquidity cap (compared to USDC) and general liquidity constraints in USDT. While early deposits laid a strong foundation, momentum accelerated notably in mid-July with several large inflows. The most significant came on July 21, 2025, when 7 Siblings, a whale group, deposited 10M USDT in a single transaction.

The USDT Umbrella module exclusively provides bad debt cover for the Aave V3 Core USDT pool. The total USDT debt currently stands at 5.8B, and with the existing vault liquidity, the module offers a debt coverage of 1.46%, identical to the USDC module. Unlike USDC, however, this coverage has the potential to increase, as the target liquidity for USDT has not yet been reached.

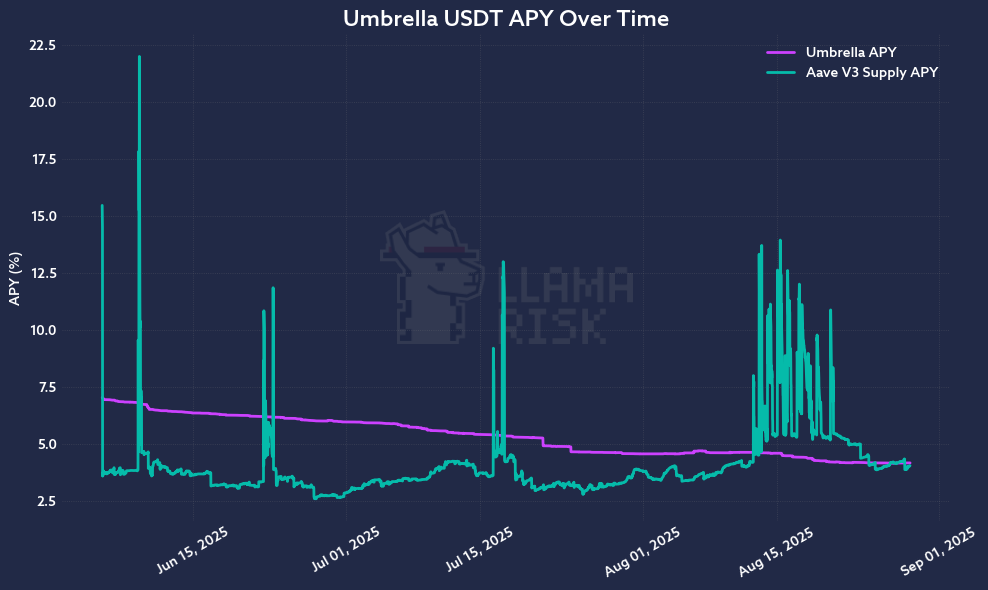

Since its launch, the USDT Umbrella module has delivered a time-weighted average APY of 5.35%, significantly outperforming Aave V3’s average of 4.08% over the same period, which brings the total APY in the same period to 9.43% higher than the USDC module. The current Umbrella APY has tapered to 4.19% with the growing vault deposits and is expected to stabilize around 3.5% once the target coverage is reached.

Upcoming Withdrawals

Over 14.77M USDT is currently in the cooldown period, representing approximately 17.45% of the total module balance. The withdrawal events appear staggered, with the largest coming from the top staker, 0xD33…f0D, withdrawing their entire 1.8M USDT stake on September 7, 2025. The actual withdrawal rate for the USDT module is only 37.82%. If these withdrawals were to occur, they would increase the USDT Umbrella APY, creating renewed incentives for new deposits.

User Distribution

Since launch, 1192 unique users have deposited in the USDT Umbrella module, with 953 still active. The big difference between the median stake of $5,000 and the average stake of $88,854 suggests meaningful institutional or whale participation. There are some secondary markets available for the Umbrella Stake USDT token, the largest being YoProtocol’s yoUSD vault, followed by Pendle’s SY-STKUSDT.V1 pool, with $1.66M and $0.95M TVL, respectively.

Umbrella GHO

Growth

The GHO Umbrella module experienced the fastest growth among its peers, hitting its 12M target liquidity cap on the very first day of launch. The largest single deposit came from user 0x329…4fB, contributing $4.79M. Deposits in the GHO staking module peaked at an all-time high of 20.14M GHO on June 21, 2025, but have since declined to 13.14M GHO as of August 29, 2025.

The GHO Umbrella module provides bad debt cover specifically for the Aave V3 Core GHO pool, which does not have collateral enabled, meaning GHO can only be borrowed. The total GHO debt currently stands at 152M, and with the existing vault liquidity, the module offers a debt coverage of 8.64%, significantly higher than that of the USDC and USDT modules.

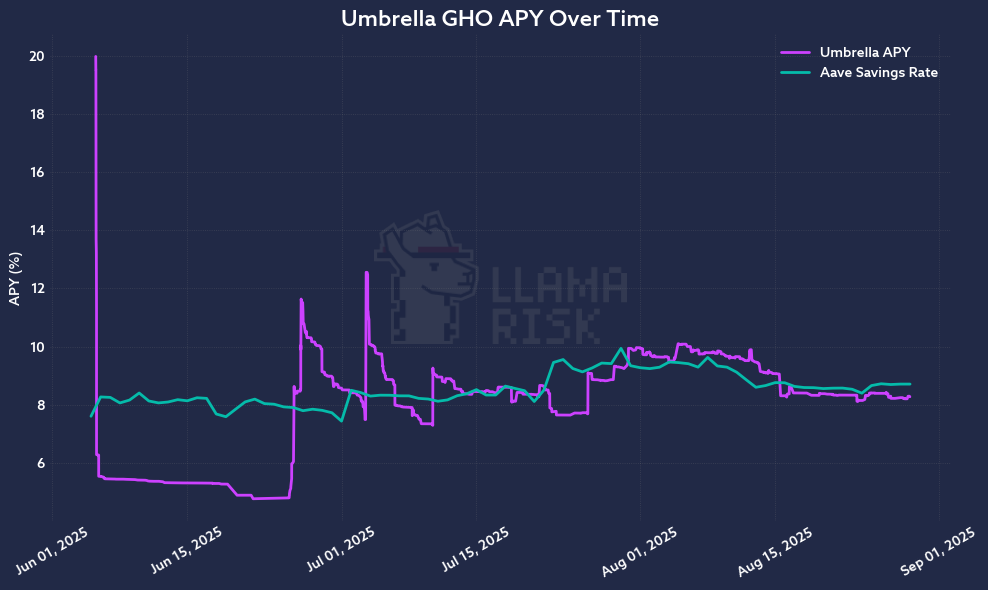

The GHO Umbrella module is the only module with a single APY source for depositors, derived solely from Umbrella Emissions, as the V3 supply APY is unavailable. Since launch, the time-weighted average APY for GHO has been 7.95%, stabilizing around 8.27%.

GHO’s Umbrella APY can be compared with the Aave Savings Rate (ASR) offered to sGHO users, representing a risk-free rate. Over the same period, the time-weighted average ASR was 8.53%, slightly outperforming the Umbrella GHO APY. As seen in the user asset flow chart, Aave accounted for a significant portion of GHO inflows and outflows from the Umbrella module, with depositors frequently moving between the two modules to capture higher APY for their GHO deposits.

Upcoming Withdrawals

Currently, 4.82M GHO, representing 36.7% of the total GHO Umbrella module balance, is in cooldown awaiting withdrawal. The largest pending withdrawal is 1.49M GHO from user 0xDD6…4E2, the module’s largest staker. The actual withdrawal rate for the GHO module is 40.27%. If these withdrawals occur, they would push the APY higher, often prompting other users, likely including sGHO holders, to deposit quickly to capture the elevated yield, which drives the APY back down.

User Distribution

The current median stake size in the GHO Umbrella module is $1,862, while the average stake is significantly higher at $29,188, indicating a concentration of large deposits. Since launch, 590 unique users have deposited into the module, with 450 still maintaining active positions. The secondary market integrations for this module include Pendle’s SY-STKGHO.V1 pool, which currently holds 0.47M GHO staked through the Umbrella module.

Umbrella WETH

Growth

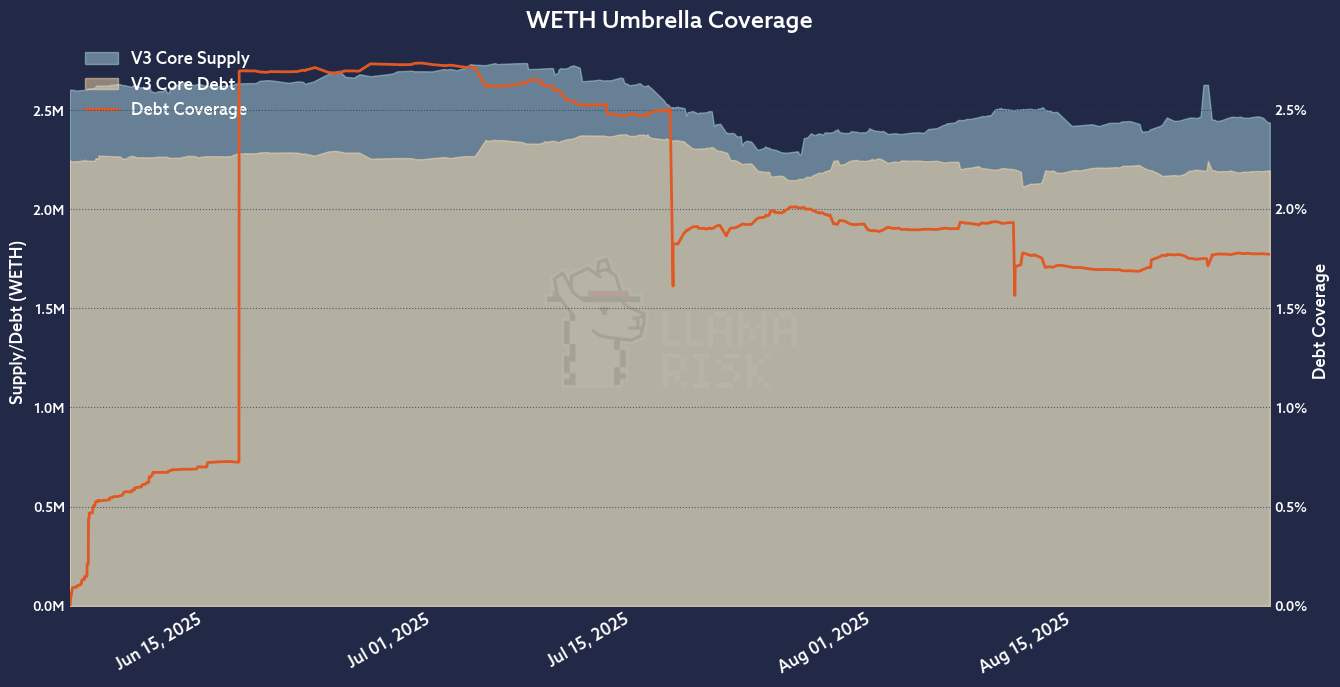

The WETH Umbrella module has seen one of the fastest growth trajectories, second only to the GHO module. From the outset, steady deposits in the first week helped build early momentum. Still, the most notable inflow occurred on June 17, 2025, when the whale group “7 Siblings” staked 45K ETH, currently valued at ~$200M, pushed the module’s total deposits to an all-time high of 61.9K ETH and well beyond its target coverage of 25K ETH. Despite a significant withdrawal of 21K ETH on July 17, 2025, and 8.1K ETH on August 10, 2025, by the same group, they remain the largest staker, accounting for approximately 54% of the module’s total TVL.

The WETH Umbrella module provides bad debt cover specifically for the Aave V3 Core WETH pool. The total WETH debt currently stands at 2.2M, and with the existing vault liquidity, the module offers a debt coverage of 1.77%. This coverage is likely to decrease, as deposits in the module already exceed the target liquidity.

At launch, the WETH Umbrella module offered a high APY of 4.4%, but a rapid influx of large deposits quickly pushed the yield below the Aave V3 Supply APY. Since then, the module has delivered a time-weighted average Umbrella APY of 1.25%, compared to 2.24% from the underlying Aave V3 market. This brings the total average APY for Umbrella stakers to 3.49%.

Upcoming Withdrawals

Currently, 5.24K ETH, representing 13.46% of the module’s total TVL, is in cooldown awaiting withdrawal. The “7 Siblings” whale group plans to withdraw 3.2K ETH on August 30, 2025. The actual withdrawal rate for the WETH module is just 38.49%.

User Distribution

The skew between the median and average stake in the WETH Umbrella module, $3,203 and $306K respectively, is the largest among all Umbrella modules, driven primarily by a significant whale deposit from the “7 Siblings” group currently worth $94M. Since its inception, the module has attracted 666 unique users, with 567 still actively staked. Secondary market integrations for this module include YoProtocol’s yoETH vault, which holds 813 Umbrella WETH deposits.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.