Summary

LlamaRisk supports the proposal to phase out legacy staking modules by reducing slashing for stkAAVE and stkABPT. While this would lower overall Safety Module coverage by $98.9M once both modules are fully deprecated, capital efficiency would improve significantly, with the cost per dollar of coverage expected to decline by 75%. We also support reducing maximum emissions for the oversubscribed WETH Umbrella module from 550 to 500 aWETH, while recommending that user outflows be closely monitored before considering any further reductions.

Safety Module Emissions

Source: LlamaRisk, September 15, 2025

As of September 15, 2025, the Aave Safety Modules provide $460.5M in coverage, with legacy staking modules stkAAVE and stkABPT contributing $82.6M and $16.3M, respectively. Under the proposed change to reduce slashing to zero for stkAAVE and stkABPT, total coverage would decline to $351.6M, fully supported by the Umbrella Safety Modules. This adjustment improves capital efficiency: the cost per dollar of coverage has already decreased to $0.103 since the launch of Umbrella. It is projected to fall further to $0.025 once the legacy modules are fully deprecated, assuming no outflows from Umbrella.

WETH Umbrella Module

Source: LlamaRisk, September 15, 2025

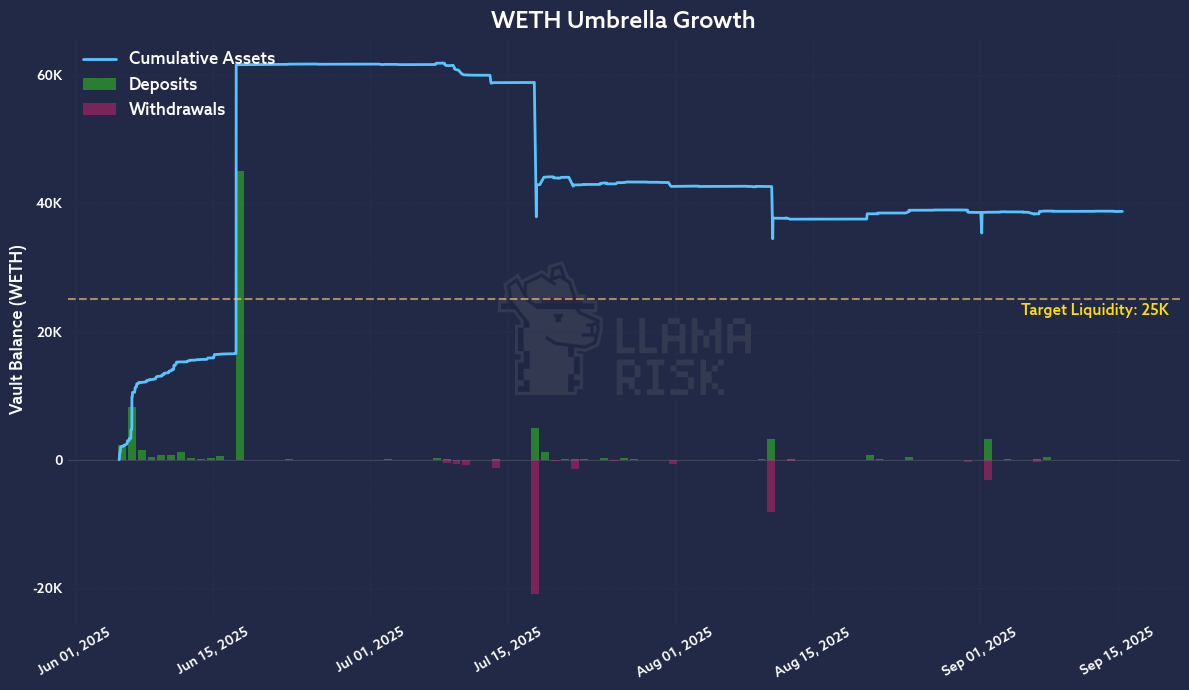

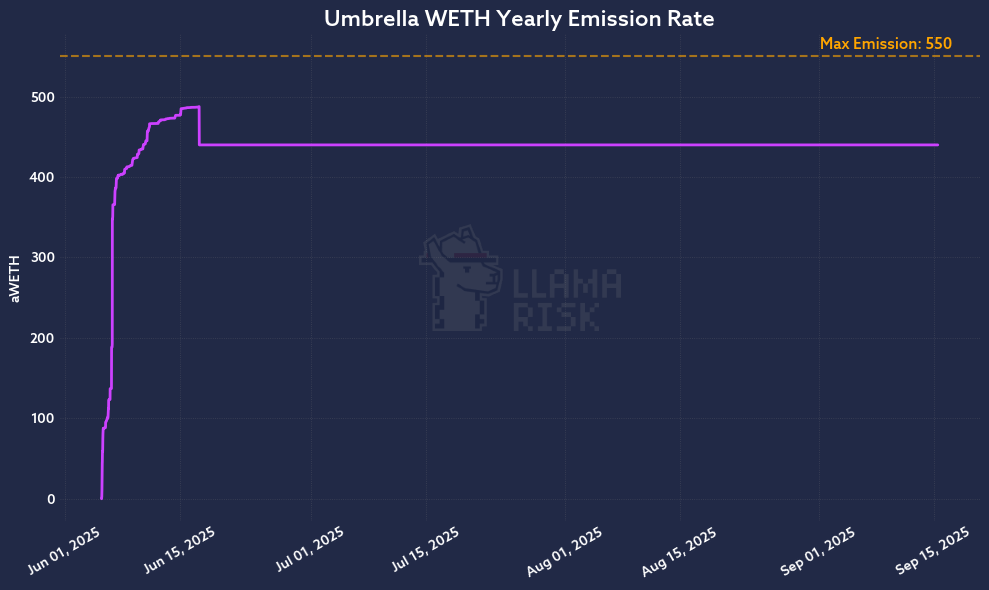

Since our last update, the WETH Umbrella Safety Module has experienced net-zero outflows, supporting our hypothesis that users remain in a ‘perpetual’ cooldown state to preserve withdrawal flexibility while still earning rewards. Deposits have consistently remained above 150% of target liquidity for nearly three months, indicating persistent oversubscription and justifying a reduction in emissions for this module.

Source: LlamaRisk, September 15, 2025

Deposits in the WETH Umbrella module have remained well above the target excess threshold (120% of target liquidity). Under the Emission Curve, this results in a proportional 20% reduction in emissions to avoid attracting additional deposits. Since June 17, 2025, the DAO has been spending an annualized rate of 440 aWETH. If the maximum emission were reduced from 550 to 500 aWETH, spending at current deposit levels would likely fall to around 400 aWETH. The corresponding Umbrella APR would decline marginally, from 1.14% to 1.04%, a change unlikely to drive significant outflows. We support @TokenLogic’s precautionary two-step approach to reduce emissions to 440 aWETH gradually, monitoring depositor behavior along the way.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.