REALT tokens are now vailable on Uniswap, Airswap and Catswap, has considerable liqudity, so there are market price feed, AAVE can take a lead on this space, bring RWA into crypto lending and borrowing (DeFI). We can certainly starting at with 300-400 collaterisation to minimise the risk and test the market demand. - just think about first mover advantage.

Hey there, here’s a little update on what has been happening since we posted the initial proposal to add RWA to Aave.

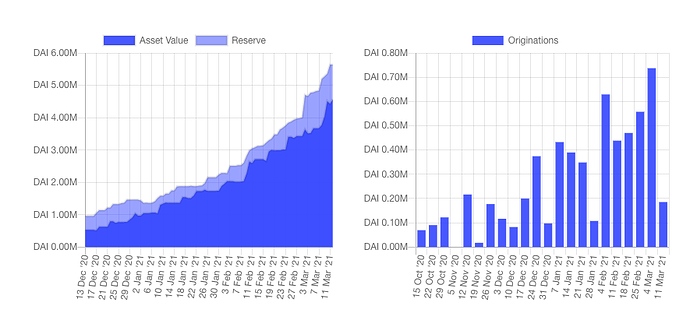

We’ve had steady growth on Tinlake, meaning (1) the size of the individual pools has grown and (2) the number of pools on Tinlake has increased to 7 active pools financing different types of RWA collateral. The current TVL on Tinlake passed 5,6MM and is steadily increasing. https://tinlake.info/

The asset originators we work with are building their track record with full on-chain transparency regarding their origination and financing performance. You can find the details on https://tinlake.centrifuge.io/ under the “Asset” tab of each individual pool. (See New Silver as an example below)

If you want to get a better understanding of who our partners are and the different asset types being financed on Tinlake check out our Centrifuge forum: Asset Originator Intros - Centrifuge

Structure

All investors on Tinlake go through KYC checks and sign a subscription document before being able to deposit their funds into a Tinlake pool (find more info on our legal setup here: https://developer.centrifuge.io/tinlake/further-information/offering-structure/ ).

When making Tinlake RWA available on Aave we are launching a pool of Tinlake pools where investors are able to get exposure not only to one single RWA pool but across several pools we will deploy a similar setup. Besides specifying the legal setup we’ve also started working on a first integration which we can hopefully share on Kovan soon.

Compute and storage of Tinlake is going to migrate to centrifuge chain eventually right?

How is this going to work with the integration with Aave? I know centrifuge is bridged with ethereum, but for example does interacting with Tinlake from Aave require (wrapped) Centrifuge tokens?

That’s a great question! Indeed, we want to move Tinlake to Centrifuge Chain at some point, although this won’t happen in the next few months. When this does happen, I think there would be a few potential options:

- The contracts for the market are deployed on Ethereum and we use a bridge to move wrapped DROP tokens onto Ethereum, and then deposit these as collateral into the market.

- If Centrifuge Chain becomes a parachain, it would also be possible to deploy the Aave market contracts to an EVM compatible parachain (like Moonbeam). Then, we could use Polkadot’s cross-chain communication layer to interact with the market.

- In theory, we could even make Centrifuge Chain EVM compatible, and deploy the Aave market contracts directly on the chain. This would remove any need for cross-chain communication.

All of this is still in an early state and changing rapidly, so we’ll have to wait and see what becomes the best choice for users.

Can you guys drop an update on how far the progress is made for AAVE partnership and AMM?

They are probably enjoying some well deserved time off! ;)

(but I am also very very curious towards an update)

Having as little steps in between seems the best solution to me, isnt it supposed to be plug and play with the EVM pallet?

Or is it possible to borrow Moonbeam’s code?

Hey @Pats nice to see you here too! :) Have you checked this post here: ARC: Aave Centrifuge Permissioned "RWA" Market Proposal - #7 by thedoctor_j ? We’re preparing an Aave snapshot vote as a next step :)

Thanks @lea for an update.