Summary :

Add support for Polygon (ticker MATIC) in AAVE V2.

I’m a Polygon community member helping with ecosystem development and integrations.

References

- Project - Website

- Whitepaper - Whitepaper

- document portal - Official documentation

- Matic Asset codebase - Github

- Ethereum addresses - Etherscan

- ChainLink Oracle - latest supported price feeds

- Audits - Quantstamp audits

- Communities - Discord, Reddit, Official forum

MATIC - overview

MATIC is the ecosystem token of Polygon Network (previously Matic) - a 100% EVM compatible L2 scaling solution with current TVL of more than $500M and 200+ dapps deployed across DeFi, NFT, Gaming and DAO space. With the recent rebranding Matic has now expanded in scope and vision and have transformed into Polygon with the aim of becoming an L2 aggregator - thereby providing a developer with all L2 solutions - POS/Plasma chain (mainnet launched April 2020), zk and Optimistic Rollups and Validum chains (part of the roadmap - as seen on website).

The MATIC token lies at the heart of the Polygon ecosystem with multiple use-cases. Primarily the MATIC token is used for paying gas fees on the Polygon network. It runs the ecosystem, supporting top Dapps. Additionally you can participate in the Proof-of-Stake consensus of the blockchain as a validator node and earn 12-14% APY in MATIC tokens.

MATIC token’s emission schedule - courtesy Binance

Positioning of MATIC token within the AAVE ecosystem

Matic token is currently one of the most liquid altcoins on CEXs with daily spot volumes over 100M. The recent Coinbase listing was another achievement - further positioning MATIC as one of the premier altcoins.

Secondly, the whole NFT/Gaming boom has definitely made dapps like Decentraland, Decentral Games, Aavegotchi, Cometh, Polymarket, Quickswap household names in the space.

MATIC can play a unique role in the AAVE ecosystem in following ways -

- Lending MATIC

Since MATIC is primarily a CEX traded coin, most of the speculation and activity remains confined there. Holders don’t have an additional source of revenue other than price speculation. With MATIC as a collateral on AAVE, holders will rush to seek yields, in turn boosting AAVE’s liquidity. - Borrow MATIC

In today’s high gas fees environment Ether is becoming scarcer by the day. DEX traders can depost Ether on Aave and can borrow Matic on lucrative interest rates. The borrowed Matic can be then provided in single pool dexes like Bancor on L1 and QuickSwap/ComethSwap on L2 to capture liquidity pools of a growing DeFi ecosystem on Polygon.

In addition to the above present incentives, Polygon aims to become a L2 solutions aggregator. Heavy R&D is being done on Polygon SDK that will support Optimistic and ZK rollups and also give the ability for developers to spawn stand-alone or shared-security chains.

Benefits for AAVE

AAVE would be the first platform on L1 to support MATIC tokens as collateral → attracting CEX liquidity into DeFi. The Aave community would be supporting an Ethereum scaling solution, that’s building on the best features of L1 combined with UX ease of L2 to onboard the next 200M users to the blockchain world.

Also with the recent push by Aave in moving their liquidity to Polygon (Matic) as their preferred L2 scaling platform, users will benefit from mutual synergies.

History

Matic team has been making valuable contributions to the Ethereum ecosystem for a long time, even before it’s public surfacing as Matic Network. This includes working on implementations of Plasma MVP, developing the WalletConnect protocol and the Ethereum event notification engine Dagger.

MATIC token has now been listed over 30 exchanges globally (most recently Coinbase), and is trading against more than 50 base pairs. In terms of market cap MATIC is valued at $1.63B and FDV of $3.26B. 24H trading volumes of >$250M make it one of top 30 traded coins across DEXs and CEXs..

Polygon POS/Plasma hybrid chain is a production ready L2 scaling solution that is 100% EVM compatible, decentralized with 88 validators and battle-tested with 200+ dapps building on it. Average txn/day around 200k and 260k+ wallet addresses. These numbers are increasing at a faster rate than competitors owing to the NFT craze and DeFi initiatives launched by dapps on Polygon.

You can check all the dapps building on Polygon here on awesomepolygon.com.

Polygon chain statistics at 7000 tps. courtesy - BlockExplorer

Market Data for MATIC token (Market Cap, 24h Volume, Volatility, Exchanges, Maturity)

https://www.coingecko.com/en/coins/polygon#markets

Risk Assessment and Parameter suggestions

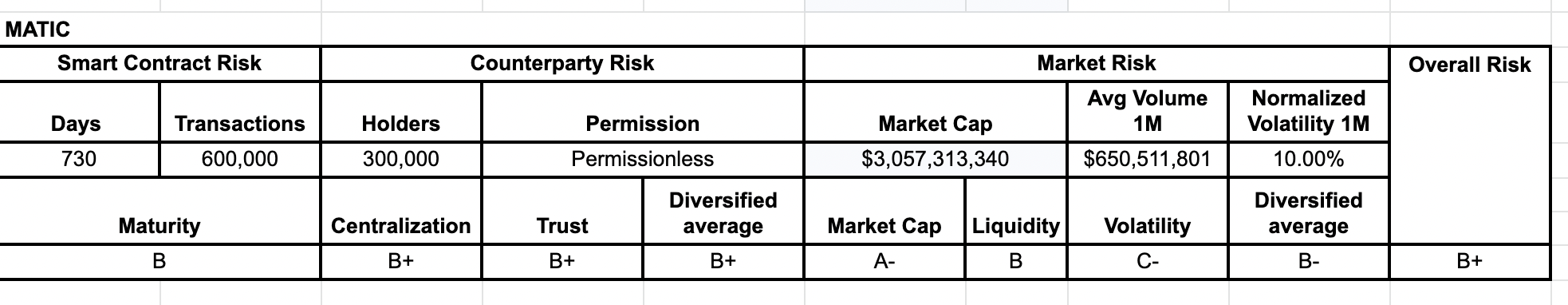

Matic token has undergone extensive security audits by Quantstamp. Here is an analysis based on Aave’s Asset Risk Framework 3 to quantify MATIC’s risks and the resulting model parameters suggestions.

MATIC’s Overall Risk is B+

Matic token was introduced in 2019 as a governance and utility token for Matic blockchain. The code has audits from Quantstamp which can be found above. The token plays a central role in the Polygon (previously Matic ecosystem) as it is used to pay gas fees. Currently MATIC fuels gas fees of around 600,000 transactions daily, more than 24M transactions and 380,000 wallets till date.

MATIC Counterparty Risk: B+

MATIC as a governance token for Polygon PoS network is used to pay 95+ validators today for securing the network. $700M MATIC tokens are staked on the Polygon PoS network ensuring security and decentralization. In addition to this, MATIC holders amount to more than 300,000 on chain across Polygon and Ethereum.

MATIC Market Risk: C

MATIC is one of the leading altcoins and ecosystem projects. Token is heavily traded across all top-exchanges with more then $5B market cap and 24Hr volumes nearing PoS chain’s TVL. MATIC has experienced up-side volatility, similar to most L1/L2 ecosystem tokens.

Risk Parameters

LTV 25%

Liquidation Threshold 45%

Liquidation Bonus 10%

Reserve Factor 20%

Variable Interest Rate Model ~ Collaterals

UOptimal 45%

R_0 0%

R_s1 7%

R_s2 300%

Communities

Twitter 190k followers

Discord 6.7k members

Reddit 12.3k members

Github

Official forum

Contracts date of deployments - 20 April 2019

Number of transactions - 531,046

Number of holders for tokens - 63,483 (on-chain)

Specifications

Author is a community member of the Polygon ecosystem.

Note Community members participating in lending/borrowing on AAVE-MATIC market who are also involved as delegators/stakers on Polygon PoS chain will be rewarded special incentives in our DeFi ecosystem.

I appreciate you taking the time to review. Please let me know if you have any questions or concerns.

- Add MATIC

- Don’t add MATIC