Thank you ACI for initiating this refocus of the Aave multichain strategy.

TokenLogic supports the intent of the proposal and the below provides financial insights into the performance of each respective Aave deployment.

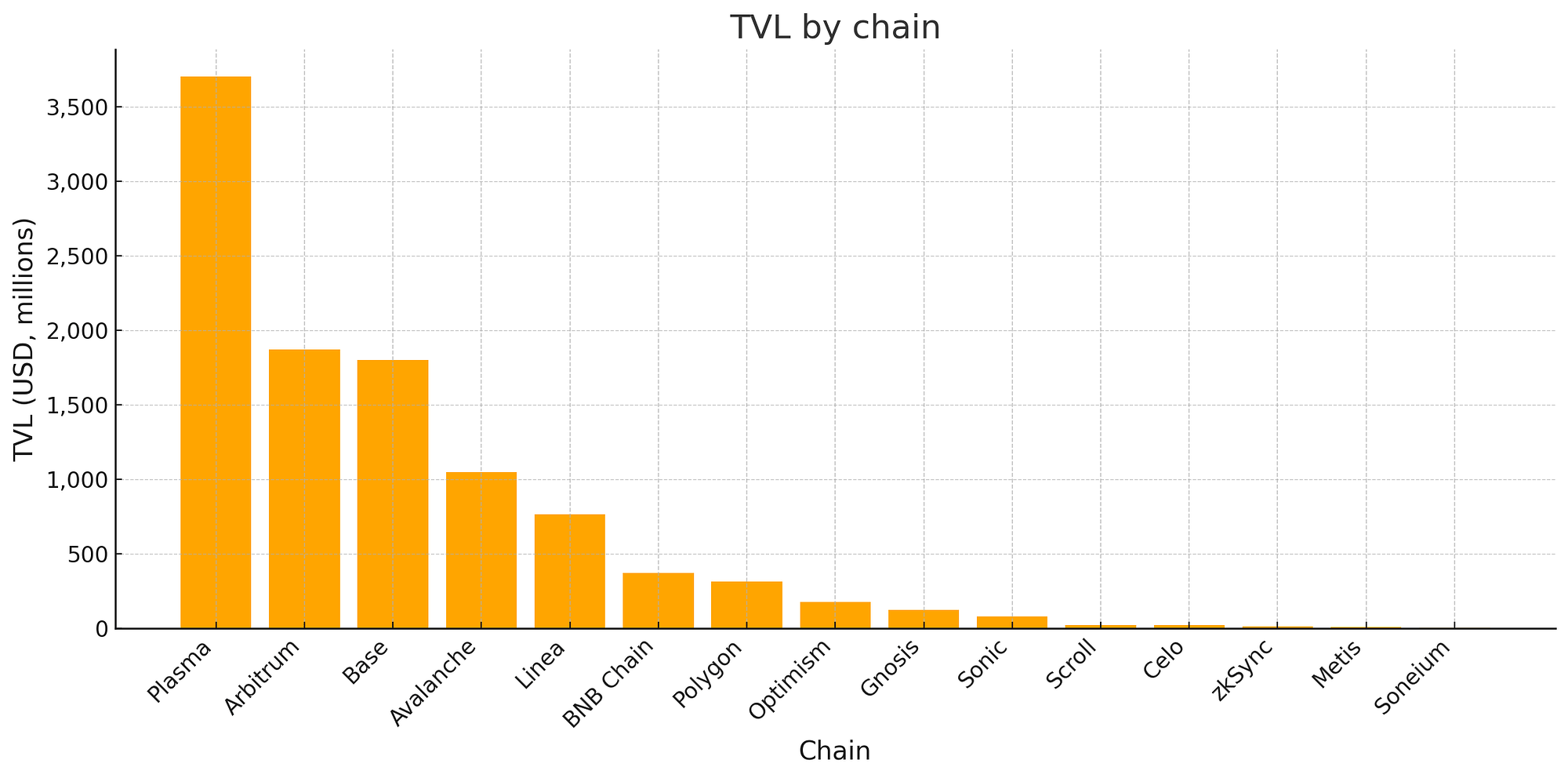

Aave currently operates on 18 chains, supporting 21 instances of which the 9 worst performing instances generated roughly $2M revenue for the DAO year to date.

This table represents the cumulative revenue of the 7 instances mentioned above accounting for less than $2M revenue YTD.

Our analysis indicates that a significant share of these deployments are structurally non-viable and collectively represent only ~1.5% of total protocol revenue.

At the same time, they consume meaningful monitoring bandwidth, risk assessment capacity, and security surface that the DAO must ultimately absorb.

Below we present our view about each of the instances.

1. Structural Non-Viability: zkSync, Metis, Soneium

We agree with ACI about those three instances, they can be deprecated.

Across each instance the borrow demand has been persistently very low for the last year. The chart below shows the borrow activity of zkSync spiked during the very short incentive campaign from the chain.

Borrow Demand on zkSync since launch

Under the ongoing risk update from @chaoslabs, core assets of these instances such as ZK and METIS will be deprecated. Future revenue potential is therefore structurally zero, not likely to be a cyclically low and therefore, this instance should be sunset.

Conclusion:

Without a forward path to improving the economic outlook it is unlikely Aave DAO will recover the deployment costs. Current revenue generation is insufficient to support these instances on a standalone basis and therefore, we support deprecating these instances.

2. Celo, Chain With User Value

Celo is a unique case within the multichain strategy. It brings many small, real users to Aave and is currently supported by an incentive program designed to boost liquidity and adoption. This user base provides community value, but from a financial and risk-adjusted perspective the situation is more complex. Borrow demand on Celo has remained minimal for months, and TVL has plateaued at levels that do not appear capable of scaling into sustainable revenue.

Borrow volume on Celo since the launch of the instance

With the stricter risk parameters being introduced for CELO, Celo is also set to lose a bit of its little borrowing activity. Compounding this, the chain currently lacks high-quality, large-scale native assets that could redefine its market or generate significant new demand. cUSD and cEUR need to make a big push growth wise.

For these reasons, our view is that Celo should not be removed abruptly, but it requires a time-boxed runway with explicit performance expectations. This should include measurable KPIs around borrow activity, the continuation and scale of incentives from the Celo ecosystem, and potentially the listing of safe, yield-bearing collateral if viable options exist. Without demonstrable progress against such metrics, continued support for the instance becomes economically unjustifiable.

3. Sonic, Potentially Revivable

Sonic has faced challenges in recent months, particularly following the conclusion of its airdrop campaign and the ecosystem-wide impact of the Balancer/Beets exploit. These events temporarily reduced activity and liquidity across the chain, but they do not alter the underlying potential of the ecosystem or its capacity to rebound. Importantly, the Sonic team has remained fully engaged throughout this period and has demonstrated a clear willingness to deploy incentives and work collaboratively to restore momentum.

Borrow volume on Sonic instance since launch

Aave itself was one of the largest beneficiaries of Sonic’s recent incentive programs, and the additional support directed toward our markets reflects a strong commitment from the Sonic community. For this reason, we do not believe that too aggressive measures would be constructive or aligned with the spirit of partnership that both sides have shown so far. Instead, this is a moment to coordinate more closely, refine the strategy, and accelerate efforts to rebuild sustainable borrower activity.

Our view is that the Sonic instance remains fully recoverable and can return to profitability with targeted support. To ensure progress, we recommend structuring the next phase around explicit, funded commitments that reinforce liquidity, improve incentives, and enable the listing of strategic collateral where appropriate.

4. Scroll, Revenue Supported by Aggressive RF Settings

Scroll had a lot of traction and a great run up until its TGE, Aave was the best place to get exposure to the airdrop. But on the back of that, everything has been going down and very fast. There hasn’t been any activity from the ecosystem to try to bootstrap and grow some native projects nor to be proactive in the listing of new assets on the protocol.

borrowing volume on the Scroll instance

Scroll’s recent uptick in revenue is entirely the result of exceptionally high reserve factors (50%) applied across ETH, wstETH, and USDC, levels far above the adjustments being proposed in this temp check.

2025 Revenue from the Scroll instance, we can see the result of the High RF proposal in the chart

This configuration is not indicative of organic growth or borrower demand; rather, it resembles the soft-shutdown mechanism previously used on Aave v2, where extreme RF settings were applied to encourage migration and reduce activity.

In practical terms, the revenue improvement on Scroll is manufactured. It is the predictable outcome of imposing unusually high RF rather than the result of meaningful market traction. And in resulted in outflows at the start of November. Under normal reserve factor conditions, Scroll’s revenue profile would place it alongside zkSync, Metis, and Soneium, chains that are structurally unable to support sustainable lending markets.

Our view is that Scroll’s fundamentals do not justify maintaining the instance in its current form and should be deprecated with zkSync, Metis and Soneium.

5. Optimism: Limited Differentiation, Strong Strategic Importance

Compared to Base or Arbitrum, the Optimism instance currently does not display strong differentiation in terms of collateral, leverage opportunities, or market behaviour. The assets and user profiles largely mirror those found on the larger L2s, but with lower liquidity and more modest borrow activity. As a result, the instance has not yet generated the depth of usage that would naturally justify operating a standalone deployment from a purely financial or liquidity-efficiency perspective.

Borrow volume on Optimism has been quite consistent since its inception

That said, Optimism occupies a unique and strategically important position within the broader Ethereum ecosystem. As the foundational chain of the Superchain, it has played a central role in distributing grants and supporting ecosystem growth for the past few years. Navigating this landscape has not always been straightforward for Aave, particularly given that several prominent actors within the Superchain alliance are closely aligned with competing lending protocols. These dynamics have made it more challenging for Aave to expand its footprint and capture meaningful borrow demand on OP Mainnet.

From our perspective, fully shutting down the Optimism market would be counterproductive and would likely strengthen competitors rather than benefiting the DAO. Maintaining a presence within the Superchain is strategically valuable, both to preserve optionality and to ensure Aave remains part of an ecosystem that continues to grow in influence.

We remain committed to supporting and developing activity on Optimism and within the broader Superchain. The DAO has already deployed significant resources across Superchain-linked environments(particularly through Base, and more recently through the Ink network) and we believe continued engagement is the right approach.

6. Gnosis, Valuable Ecosystem, Weak Activation

The Gnosis ecosystem has been a consistent source of innovation, producing novel primitives such as EUR-denominated stablecoin markets. Aave has historically supported this ecosystem, even going so far as to redirect revenue to help bootstrap adoption and stimulate early activity. Despite these collective efforts, borrow demand on Gnosis is scaling very slowly and revenue generated for the DAO remains low.

Gnosis borrowing activity since inception, worth noting that it remained close to ATH even after the last few weeks’ crash

There are, however, recent indications within Gnosis governance that the ecosystem is seeking to re-energise growth and expand its economic footprint. It would be interesting to set clear KPIs around borrowing activity, liquidity depth, and the level of ecosystem commitment. To reassess the state of that instance.

Gnosis instance revenue, growing but still very small

7. Polygon, Revenue-Positive but Declining

Polygon remains one of the few long-tail chains that continues to deliver more than respectable revenue for the DAO, and for this reason we do not believe it should be included in the scope of this proposal. When considering both the v3 and v2 deployments together, Polygon contributes more than $3.7M in YTD revenue.

YTD revenue from both Polygon instances

While it is true that Polygon v2’s revenue is driven only by highly aggressive reserve factor settings, this still represents tangible income for the DAO. Moreover, a significant share of the capital remaining on v2 is either effectively immobile due to key loss or expected to migrate naturally to v3 over time.

In this context, Polygon stands apart from the other chains discussed in the proposal. It already clears the $2M revenue floor comfortably and is better positioned than most ecosystems to meet a potential $2.5M threshold, even without substantial structural changes. The instance continues to demonstrate meaningful user activity, and we believe there is still room for growth, particularly as liquidity consolidates and assets transition to v3.

Polygon borrowing volume is holding decently

Our view is that Polygon should remain fully supported and not be grouped with the underperforming or structurally challenged chains referenced elsewhere in this proposal. While ongoing monitoring is always appropriate, Polygon does not exhibit the same economic or strategic concerns and continues to justify its place within the Aave multichain footprint.

8. BNB Chain, Capable of Strong Performance with Foundation Support

BNB Chain benefits from a very large user base, substantial liquidity, and strong trading activity. In theory, these characteristics should create a fertile environment for a lending protocol like Aave. However, none of this potential is currently translating into meaningful revenue for the DAO.

YTD revenue on BNB chain instance

The core issue is the absence of meaningful ecosystem or foundation support: there are no liquidity incentives, no coordinated integrations, and no active collaboration to make Aave a relevant component of the chain’s financial infrastructure. Without such partnership, Aave remains strategically peripheral on BNB Chain despite the chain’s scale.

We want to see that market revived with one of the BNB LST listed and some activity on the back of that. Some other lending markets on the chain are doing pretty well and reached a size we should be aiming to overtake. It would also strengthen Aave’s relationship with Binance and develop that.

9. The “Last Chance Collateral” Pathway

For any chain seeking an opportunity to grow back up, we propose a clear and standardized condition. The chain should list a high-quality, yield-bearing asset (subject to risk approval) and complement this listing with ecosystem-funded incentives, liquidity guarantees, and well-defined KPIs. For the moment, only Ethena, Maple and LRTs/LSTs assets meet the required security and risk thresholds. These are the assets we consider appropriate for listing across chains, provided there is meaningful demand and trading activity to support them. It is important to emphasise that such listings are service-provider intensive; they should only be considered if there is genuine, pent-up demand, as adding them without a clear usage path results in wasted operational bandwidth.

For assets not yet listed on Aave, the threshold would be even higher. New listings require significantly more work from service providers and cannot be justified without strong ecosystem commitment and demonstrable utility.

Even with high-quality collateral, these markets will still face liquidity and risk-premium challenges unless accompanied by sustained incentives. If foundations are unwilling to support these efforts financially, Aave cannot reasonably absorb the cost, risk, or opportunity cost of testing the chain’s viability on their behalf.

10. Revenue Floor Guarantees for New Deployments

TokenLogic agrees with the overall direction of the proposed revenue floors, $2M is a good threshold. However, for this requirement to function effectively, we agree with @ezreal that commitments from prospective chains must be enforceable rather than aspirational. A clear mutual understanding is necessary to ensure accountability and protect the DAO from unfunded promises or underperforming markets.